Financial Select Sector SPDR® ETF

Latest Financial Select Sector SPDR® ETF News and Updates

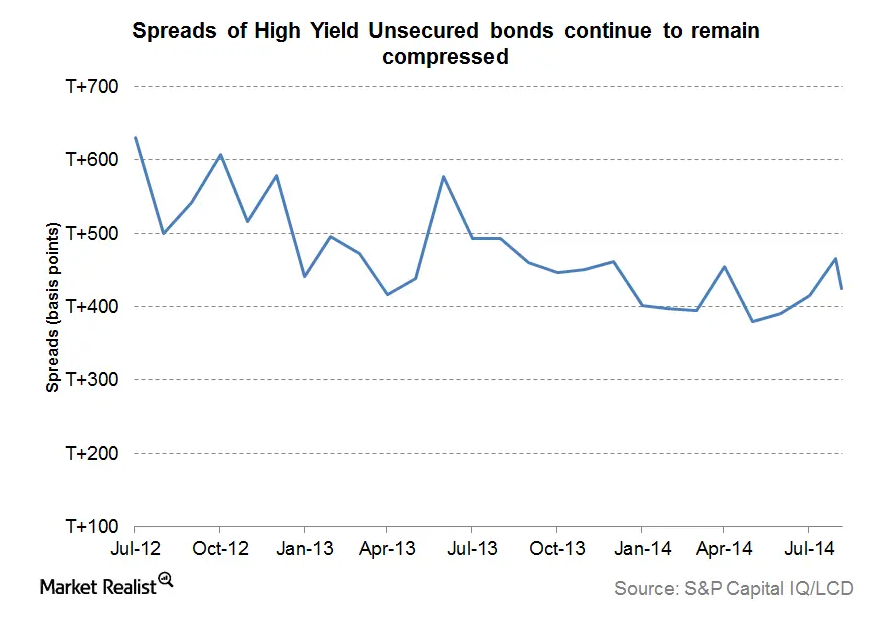

Why tight credit spreads usually mean a period of global expansion

Today, most measures of credit conditions are positive, with tight spreads across all of fixed income. Even high yield spreads have come in after a short scare last month.

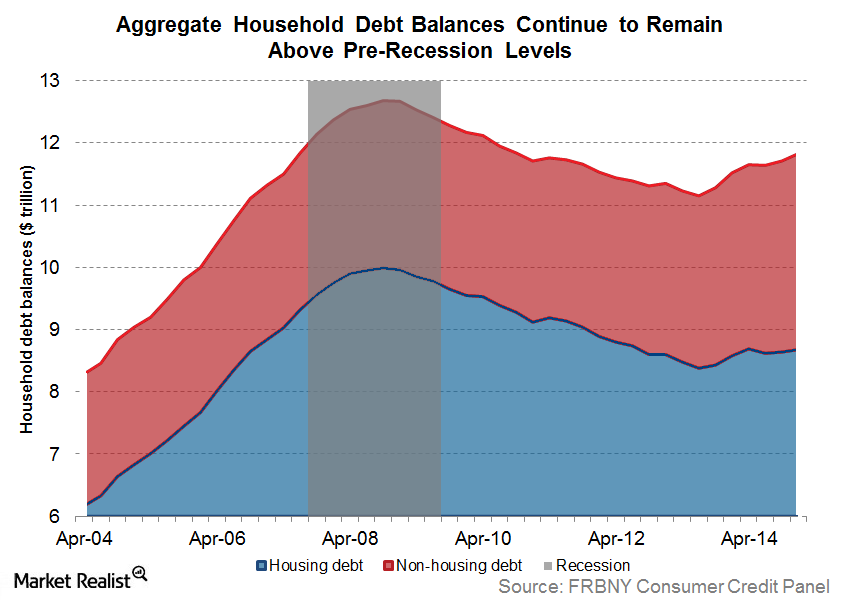

The Great American Deleveraging: Fact or Myth?

The great American deleveraging has largely been limited to the financial sector (XLF) (IYF). Non-financial debt is still much higher than historical averages.

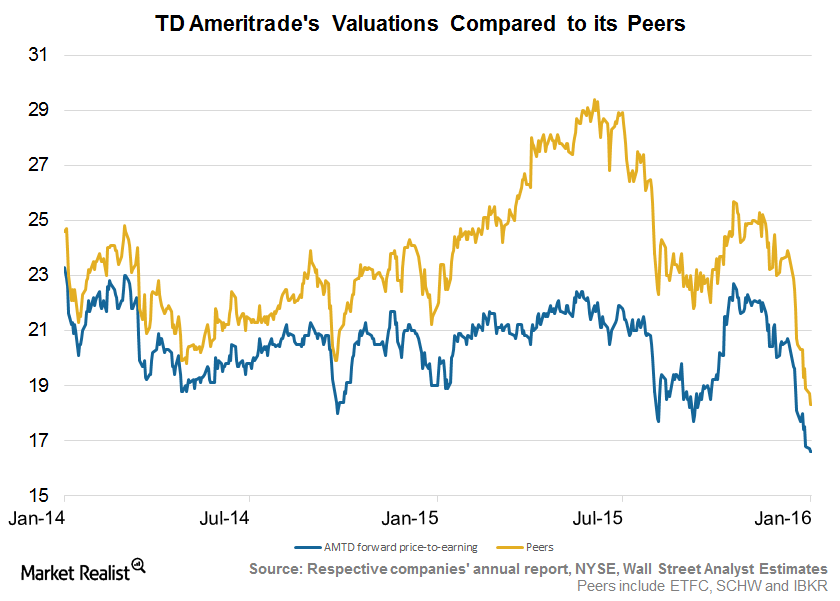

TD Ameritrade’s Valuation Falls alongside the Industry

Historically, TD Ameritrade traded at a discount to its peers because of average operating margins. The sector’s valuations fell in the recent past.

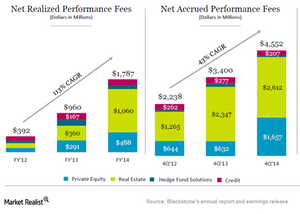

Blackstone Is Attracting New Capital

The launch of innovative ideas at the right time can help Blackstone attract a good amount of new capital through its dedicated network.

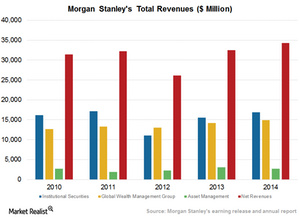

Morgan Stanley’s Strong Revenue Model

Morgan Stanley charges fixed fees and performance fees for asset management services, products and services, and administration of accounts.

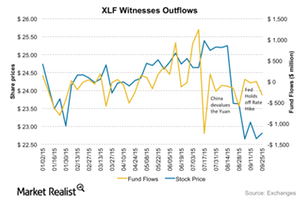

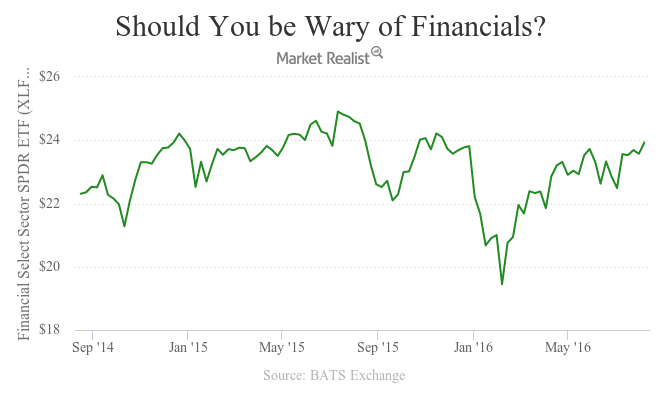

Fund Flows to XLF Have Been Declining

Exchange-traded fund investors added almost $552.6 million on average to the Financial Select Sector SPDR ETF (XLF) in the last quarter. During the week ending September 25, the ETF witnessed outflows of $318.3 million.

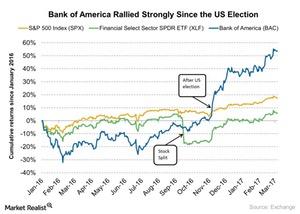

What Goldman Sachs Thinks about Bank of America

Bank of America (BAC) is currently trading at $25.26. Its 52-week high is $25.80 and 52-week low is $12.05.

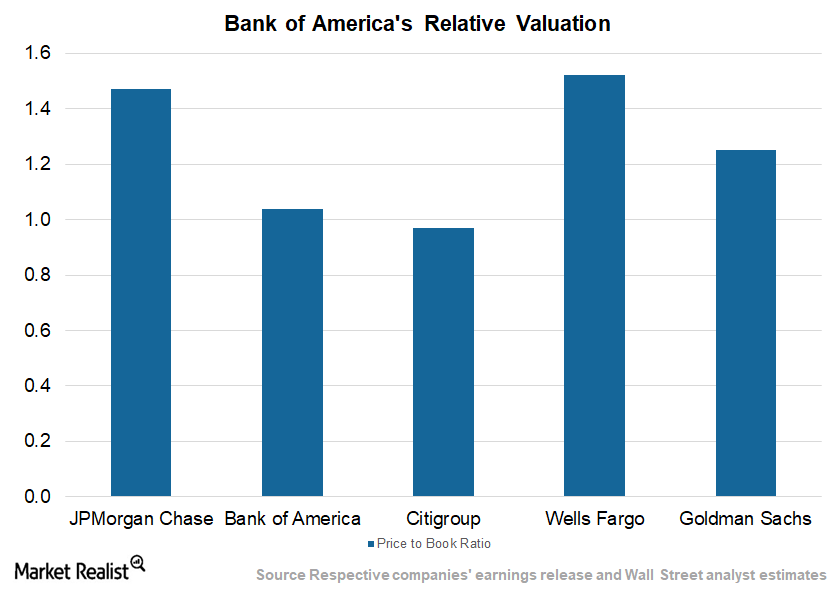

Why JPMorgan and Wells Fargo Are Trading at High Multiples

In spite of a rather weak performance, Wells Fargo (WFC) commands the highest premium due to its strong franchise, mortgage concentration, and high net interest margins.Financials Why Wells Fargo leads in loans

The bank has always focused on its bread and butter revenue-earning stream: loans. Over the years, Wells Fargo slowly realized its goal of achieving a strong market share in lending.

What Do Analysts Recommend for JPMorgan Chase and Wells Fargo?

In a Bloomberg survey of 37 analysts, 19 analysts (51%) have assigned a “buy” rating to Wells Fargo (WFC) while 13 (35%) have rated it as “hold.” The stock currently has five “sell” ratings.

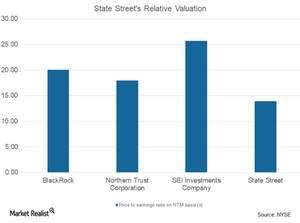

Can State Street Recover Its Discounted Valuations?

On a next 12-month basis, State Street Corporation (STT) has a PE (price-to-earnings) ratio of 13.9x. Its competitors’ average is 21.22x.

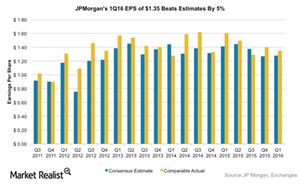

JPMorgan Chase Gained 4% after Its 1Q16 Earnings: Was It That Good?

On April 13, JPMorgan Chase reported 1Q16 earnings of $1.35 per share. It beat consensus estimates of $1.28. Its shares rallied 4.2% after the earnings beat.Financials Why Wells Fargo has the highest net interest margin

Maintaining a high net interest margin has always been part of Wells Fargo’s (WFC) strategy. Wells Fargo has consistently been better than the industry’s average net interest margin.Financials Must-know: Putting the price–to-book value ratio in perspective

We explored the most commonly used valuation metric for financial companies—the price-book value. We also understood the relation between price-book value and return on equity.

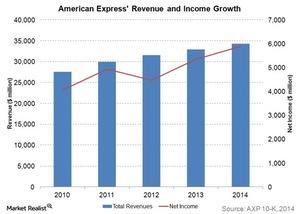

American Express: Opportunities Abound in a Challenging Market

Co-branding relationships are an important part of the American Express business model. The costs of renewing and extending these relationships is increasing.

General Electric’s Mission, Vision, and Strategy

General Electric’s strategy is to reshape its portfolio from a broad conglomerate to a more focused industrial leader.

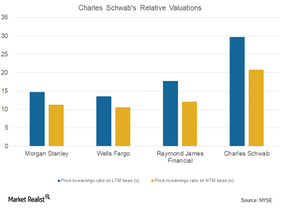

What’s Charles Schwab’s Valuation?

Charles Schwab (SCHW) has a price-to-earnings ratio of 20.80x on an NTM (next-12-month) basis.

Dimensional Fund Advisors’ Major Holdings in Q3

Dimensional Fund Advisors’ top buys are Apple (AAPL), AT&T (T), Microsoft (MSFT), L3Harris Technologies (LHX), and Verizon Communications (VZ).Financials Must-know: Is Wells Fargo making boring attractive for investors?

Wells Fargo’s (WFC) broad operation level strategy over the long run can be described by two words—slow and steady. It doesn’t take many risks. It’s stable and boring.

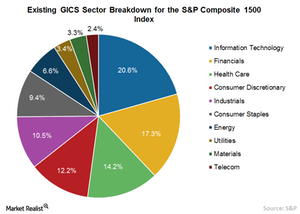

How REIT Classification Benefits Preferred Securities

S&P Dow Jones Indices and MSCI (MSCI) have decided to shift stock exchange-listed equity REITs and other listed real estate companies from the financial sector (XLF) to a new real estate sector.

Graphical Representation of General Electric’s Business Model

General Electric’s industrials and finance services are its two broader divisions, contributing 91% and 9%, respectively, to its consolidated 2015 earnings.

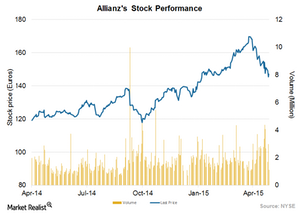

Allianz Reports 11% Revenue Growth Backed by Insurance Business

Allianz Group offer property casualty insurance, life and health insurance, and asset management products and services in over 70 countries. The company’s major operations are in Europe.

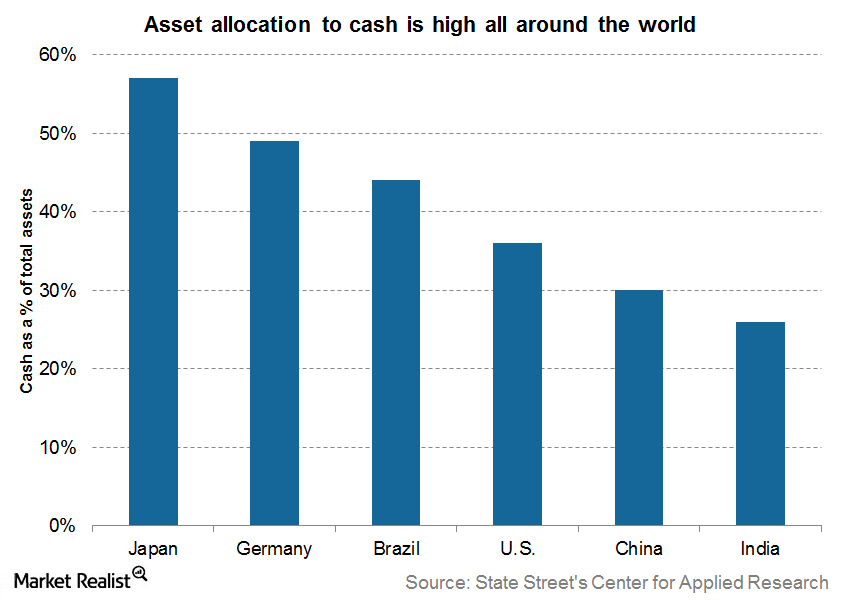

What Should Be The “Right Amount” of Cash Allocation?

If you’re preparing your portfolio for the short term, the allocation to cash should be high. As the horizon increases, allocation to cash should go down.

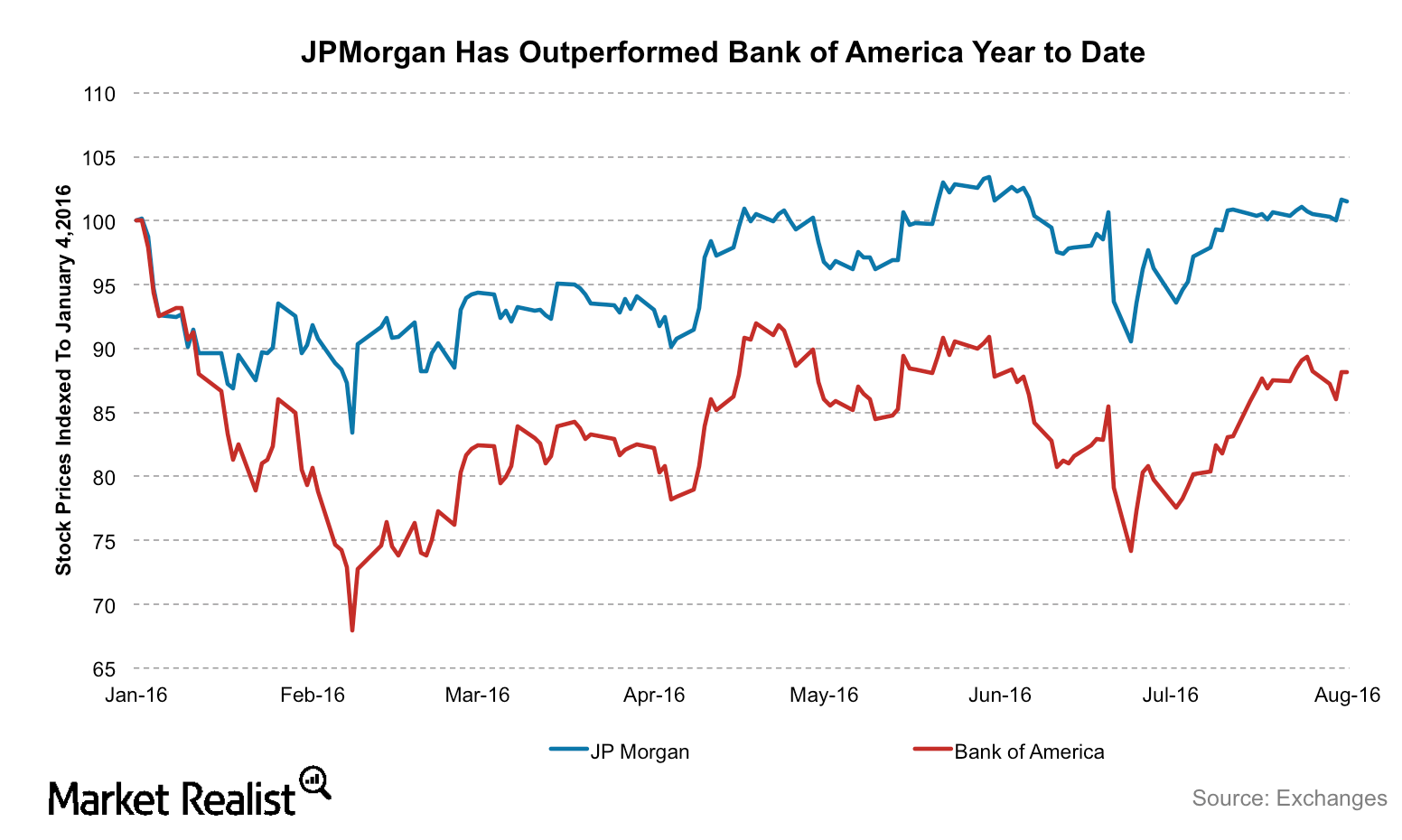

Why Deutsche Bank Prefers Bank of America over J.P. Morgan

In this series, we’ll compare Bank of America and J.P. Morgan on the basis of their 2Q earnings, profitability, cost-cutting initiatives, and interest rate sensitivities.Financials Why low funding cost is an advantage for Wells Fargo

If a bank is able to keep its cost of deposits low, it will have a competitive advantage. Wells Fargo has the lowest cost of deposits among its peers—despite having a very high deposit base.Financials Why Wells Fargo focuses on non-interest income

Wells Fargo wants to maintain a balance between its interest income from loans and non-interest income. Non-interest income accounts for nearly 49% of Wells Fargo’s revenues.Financials Why cross-selling is part of Wells Fargo’s strategy

Wells Fargo’s (WFC) first, and possibly the most important, operational strategy is focusing on cross-selling. It’s the most important pillar of its operational strategy.

Understanding Banks’ Market and Reputational Risks

All banks face risks. Two key areas to understand are banks’ market risk and reputational risk. Here’s a summary of each type.

Which Sectors to Avoid if Inflation Rises

Telecom services and utilities, the traditional dividend stars, have provided a fillip to US equities in 2016.

Understanding a Bank’s Operational and Business Risks

Banks experience operational risk in all daily bank activities, such as a check incorrectly cleared or a wrong order punched into a trading terminal.Financials Why Wells Fargo uses human resources as a strategic tool

Wells Fargo (WFC) believes that people are a competitive advantage source. Integrating sound human resource practices lies at the core of Wells Fargo’s strategy.

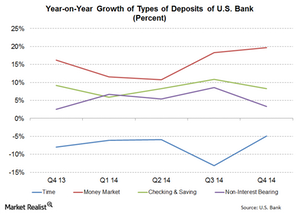

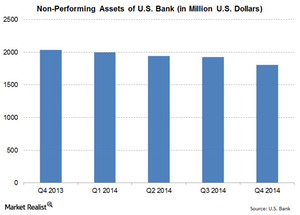

Low-cost deposit growth is a key strength for U.S. Bank

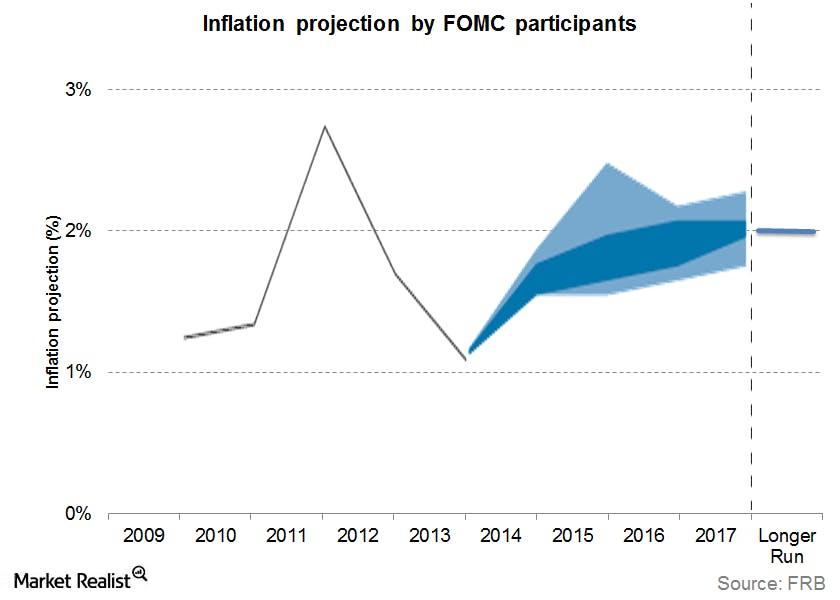

U.S. Bank does well in increasing its low-cost deposit base. In 4Q14, money market deposits grew the fastest at 19.7%—compared to 4Q13.Why US inflation data is important and how we measure it

U.S. inflation is not just a measure of growth and price pressure in the U.S. economy. It has more far-reaching consequences.

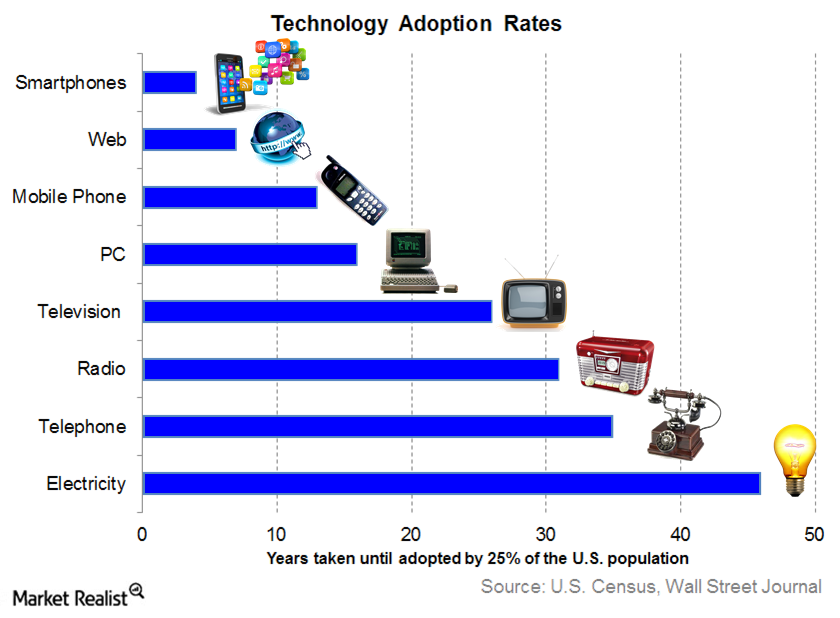

Tech Adoption Rates Have Reached Dizzying Heights

Technology (XLK) is advancing by leaps and bounds. The diffusion and adoption rates for new technologies have risen over the years as the population has become more tech-savvy.

Bank of America and Wells Fargo: Comparing Interest Rate Exposure

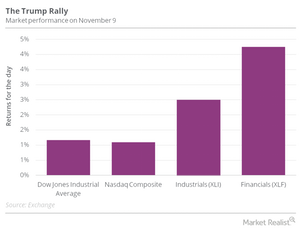

Since Donald Trump’s presidential victory, Wall Street analysts have raised their forecasts for the major banks’ (XLF) net interest margins as they anticipate rising interest rates and economic growth.

Ray Dalio, the Role of Credit, and the Economic Machine

Credit is the most important part of the economy, leading to increased spending, increased income levels, higher GDP, and faster productivity growth.

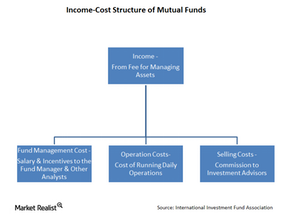

The salient features of mutual funds

There are investors who are willing to take on higher risk to generate above-average market returns. For these investors, active funds offer the optimal investment avenue.

Citigroup globally established in emerging markets

Citigroup’s exposure in emerging markets is mainly to investment-grade global multinationals through its institutional businesses.Financials Why the yield curve impacts bank profitability

Historically, a flatter yield curve had an adverse impact on the financial institutions’ returns. It lowered their net interest margins. The Fed continues to stress an accommodative monetary policy. The policy and strong overseas demand have kept yields low at the long end of the curve. As a result, the difference between 30-year and five-year Treasury yields fell to 154 basis points on September 5, 2014.Financials Why the banking sector is better, but with room for improvement

Russ explains the good news behind his upgrade of the global financial sector as well as the bad news keeping his sector outlook somewhat subdued.

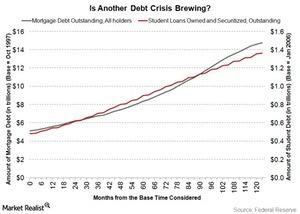

Is Student Debt the Next Bubble to Hit the US Economy?

Many are likening the current student debt situation in the United States to the mortgage debt situation that led to the 2009 financial meltdown in the US economy.

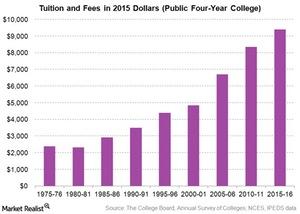

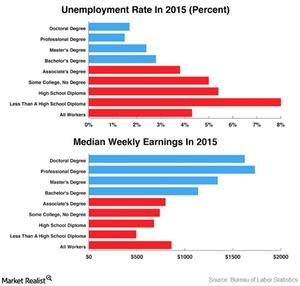

Why Is College Education So Expensive in the United States?

The rise in delinquencies on student loans in the United States (SPY) (IWM) (QQQ) can be partially attributed to the accelerated rise in college tuition and fees.

Why Student Debt May Not Affect the US Economy Like Sub-Prime

According to the White House Council of Economic Advisers, “Student debt is less likely to make a recession more severe or slow an expansion in the way that mortgage debt may have.”

Gundlach: Invest in Industrials, Materials, Financial Sectors

“Industrials, materials, and financials are the sectors. . .you want to be invested in,” said Jeffrey Gundlach recently in a CNBC interview.

Show it: How mutual funds make money

In return for investing a client’s money, mutual funds charge a fee, generally an annual fee set as a percentage of the client’s assets. This fee is the only source of income for a mutual fund-focused asset manager.

U.S. Bank’s non-performing assets declined in 4Q14

U.S. Bank’s (USB) non-performing assets were $1,808 million at the end of 4Q14. The ratio declined by 11.24%—compared to 4Q13.

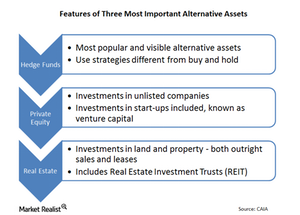

Private equity, hedge funds, and other alternative assets

Private equity is capital invested in companies that aren’t listed on stock exchanges. These alternative assets include venture capital.

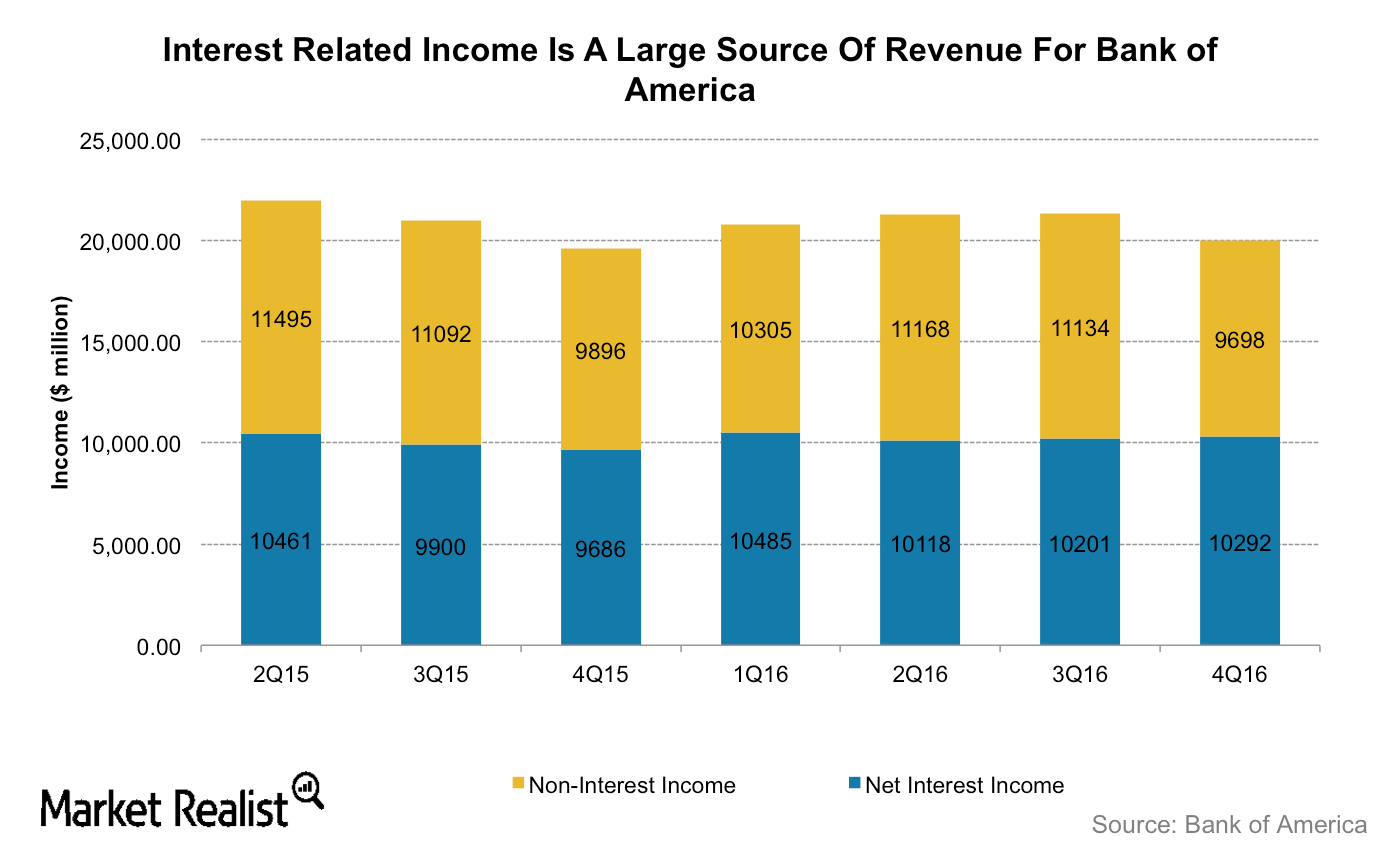

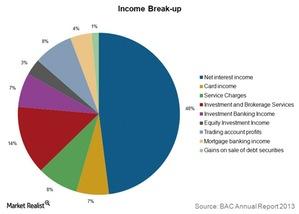

How does Bank of America make money?

Net interest income contributes about half of Bank of America’s total income. Investment and brokerage services contribute the most to noninterest income.

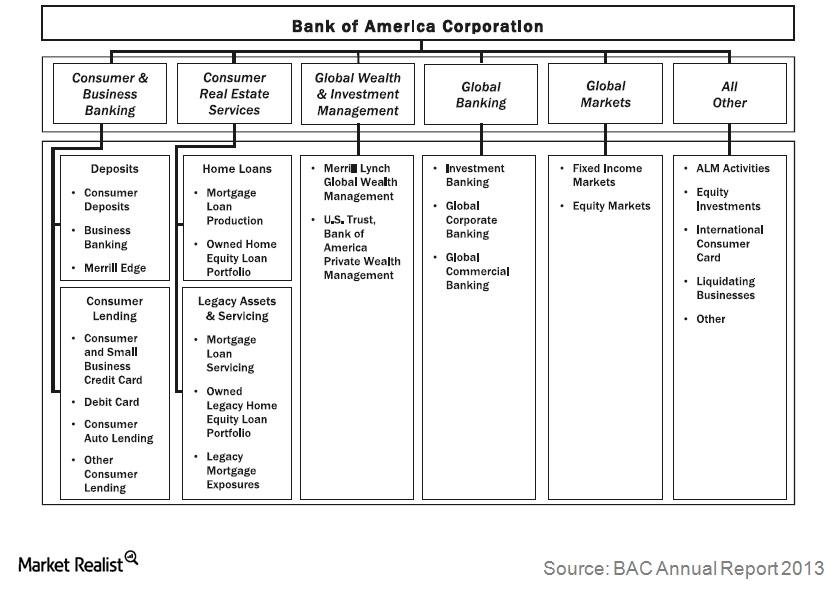

Bank of America’s six operating segments

Bank of America operates through five major segments. Its Consumer and Business Banking segment contributes a third of the bank’s total revenues.

Bank of America: The second-largest US banking operation

Bank of America Corporation’s (BAC) banking operations are the second-largest in the United States by assets.