Vanguard FTSE Emerging Markets ETF

Latest Vanguard FTSE Emerging Markets ETF News and Updates

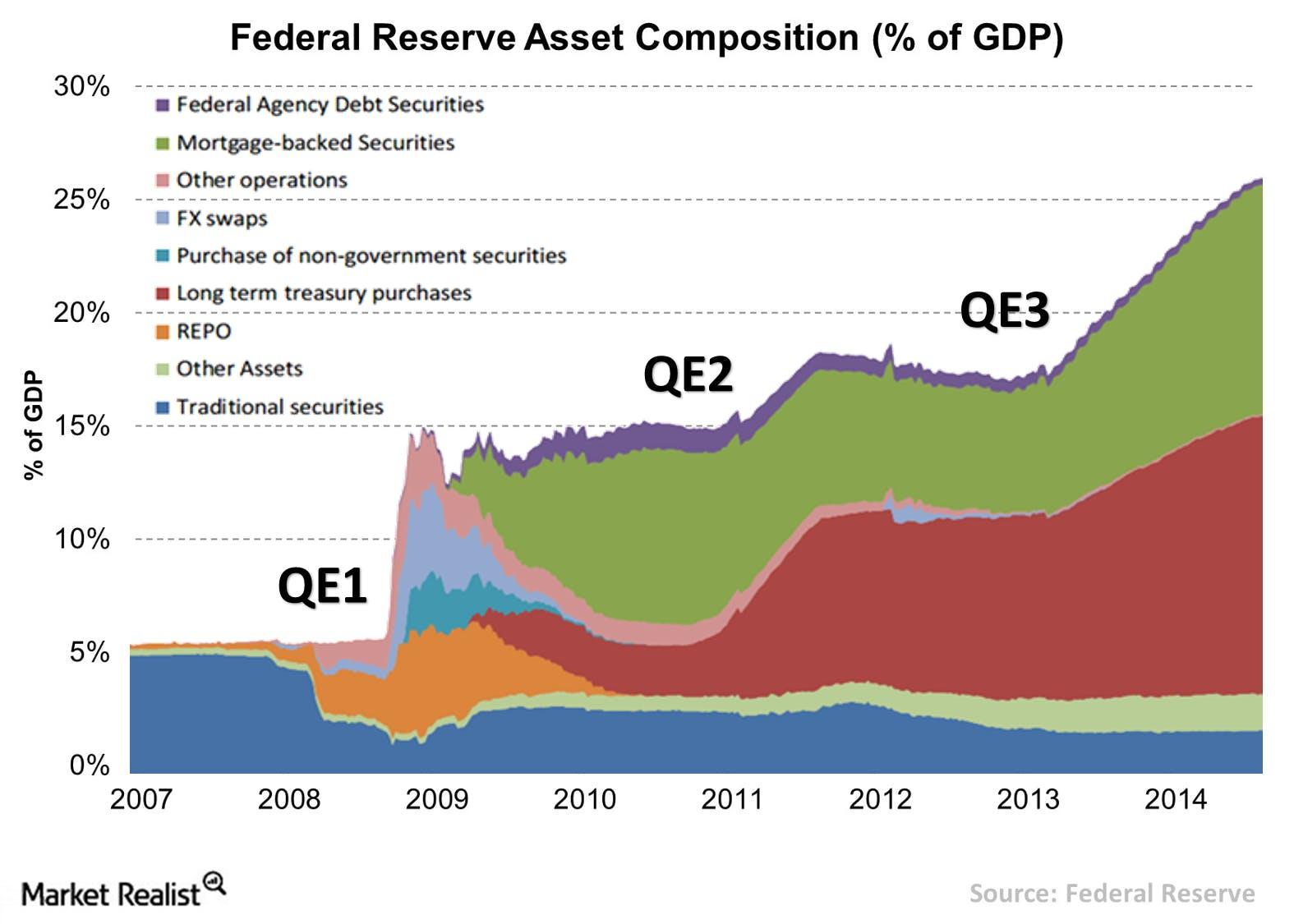

Must-know: Why the Fed drove up emerging market asset prices

Many economists, like the Nobel Prize–winning Paul Krugman, believe that the Fed acted as a “white knight” in 2008, saving the global economy in the dire aftermath of the financial crisis.

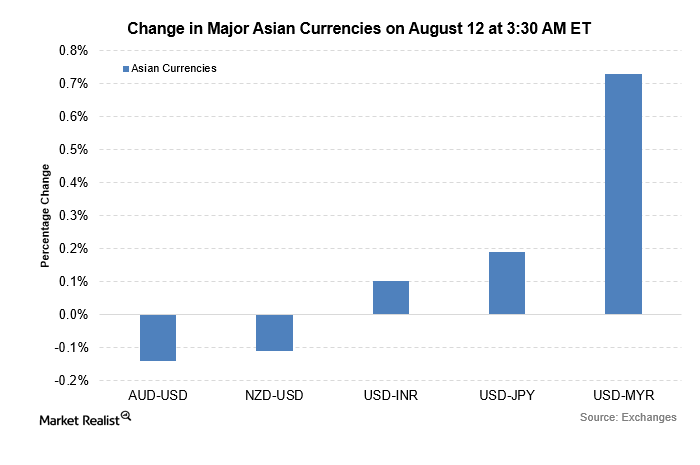

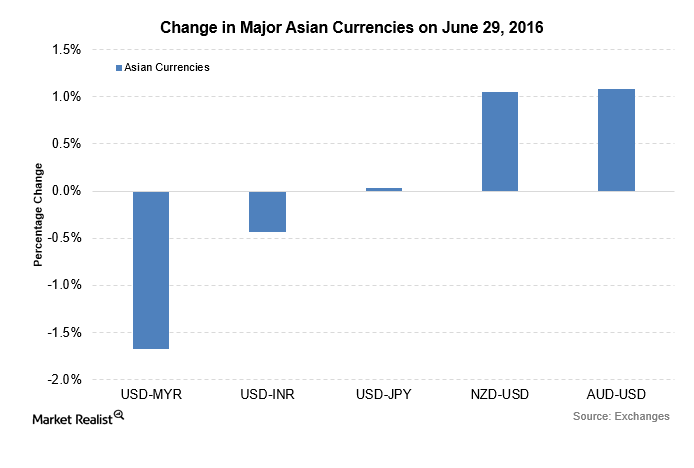

Notable Gainers and Losers among Major Currency Pairs

Major Asian currency pairs were trading on a negative bias against the US dollar on August 12, 2016. The US dollar broadly rose against the other currencies.

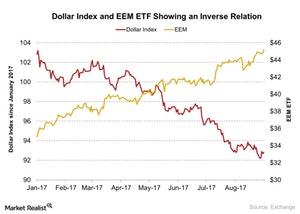

Stanley Druckenmiller Exited Position in EEM

Stanley Druckenmiller also sold his position in the iShares MSCI Emerging Markets ETF (EEM).

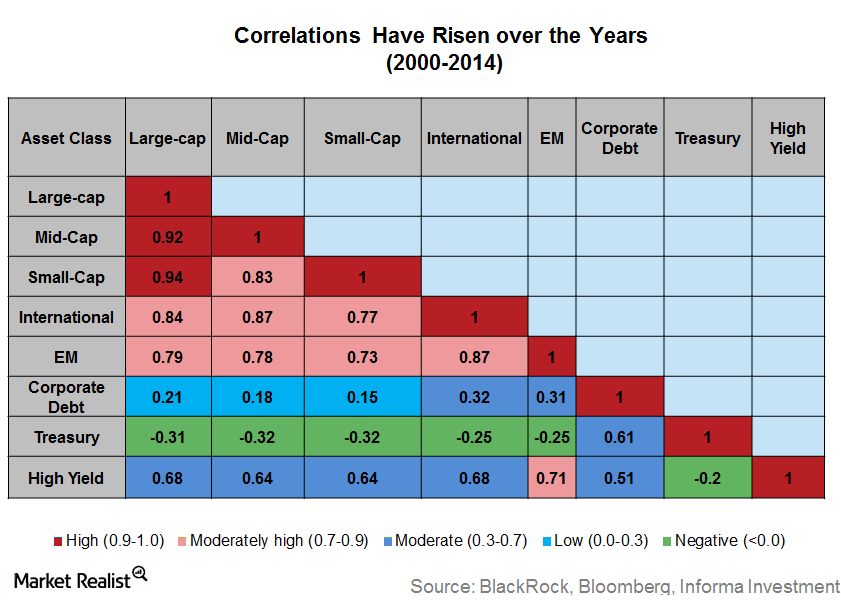

Diversify Broadly and Consider Alternative Investments

Rising correlation across asset classes is a sticky problem that investors face while investing in today’s markets.

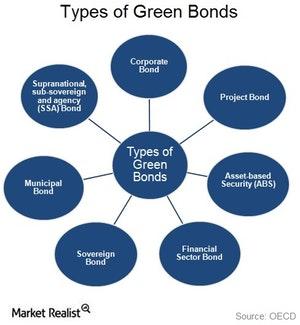

The Role of Emerging Markets in Global Green Bond Issuance

Over the last ten years, the green bonds (GRNB) universe has expanded and diversified, holding 600 bonds from 24 countries in 23 currencies.

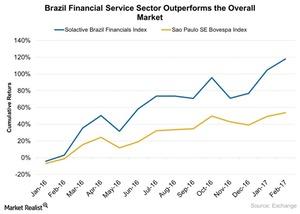

Why the Service Sector’s Contribution to Brazil Is Important

The service sector is the main contributor to Brazil’s GDP and job creation, but it’s currently suffering from structural weakness and poor international performance.Financials The big 3 ETF providers in the US—iShares, SPDR, and Vanguard

In the U.S., Blackrock (BLK), State Street GA (STT), and Vanguard are the top three ETF providers. They have a 40.1%, 22.3%, and 20.7% market share, respectively.

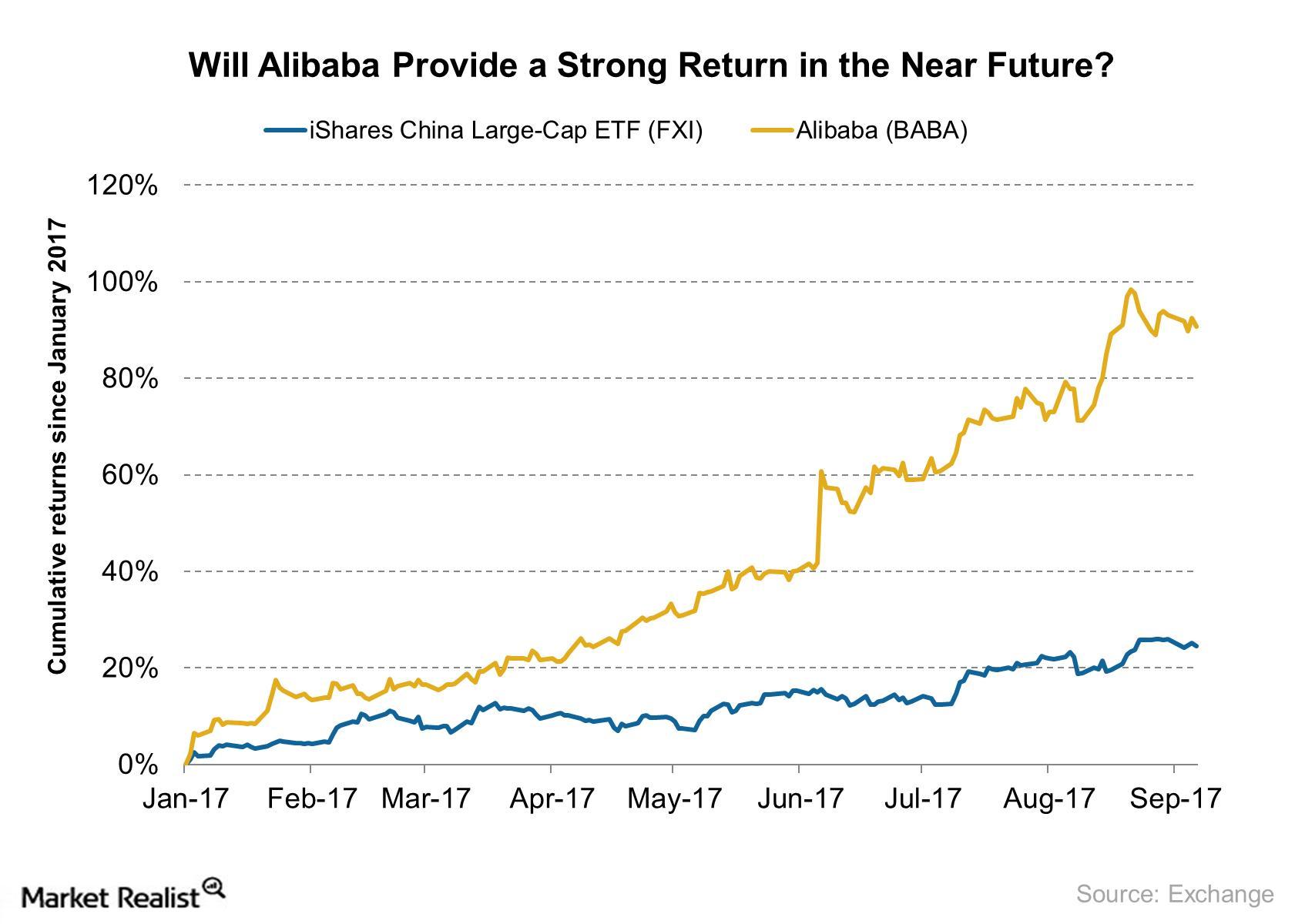

Why Goldman Sachs Is Optimistic about Alibaba

Alibaba was trading at $169 on September 8, 2017. Its 52-week high is $177 and its 52-week low is $86.01.

Labeled Green Bonds’ Significance to Investors

Global climate leaders have set a $1 trillion target for green finance by 2020, which would require a tenfold increase in global green bonds issuance.

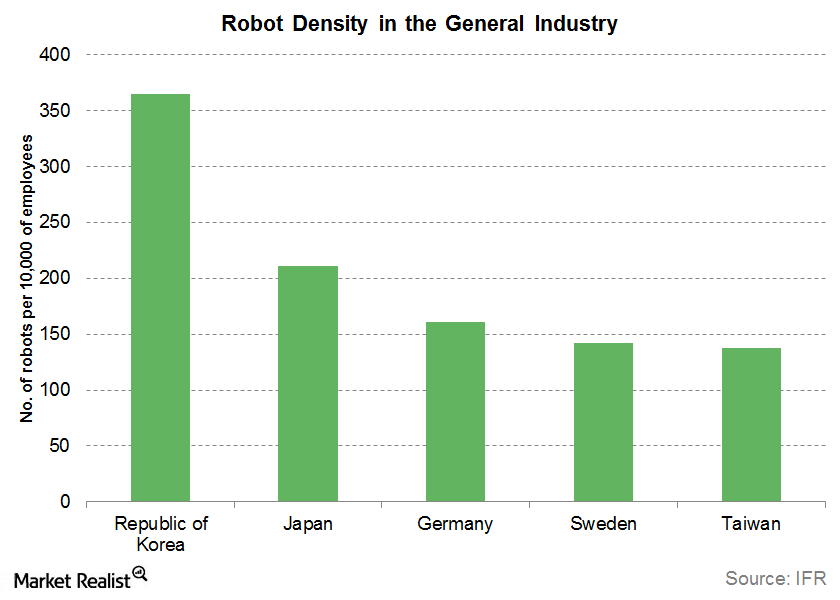

The Rise of Factory Automation in China

The rise of factory automation in China (GCH) has been rapid and unprecedented. China is the largest market for robots and automated parts.Materials Business overview: The cement industry

Cement is classified into various categories based on its composition and specific end uses. Cement is classified as either portland, blended, or specialty cement. Investors can access the cement industry through the Vanguard FTSE Emerging Markets ETF (VWO).Materials Must-know: Cement’s final manufacturing process

The blend is heated in a rotary kiln. Gas, oil, or pulverized coal are used to ignite the flame at one end of the kiln. The clinker from the kiln passes into a cooler, where convective airflow cools the clinker for subsequent handling and grinding.

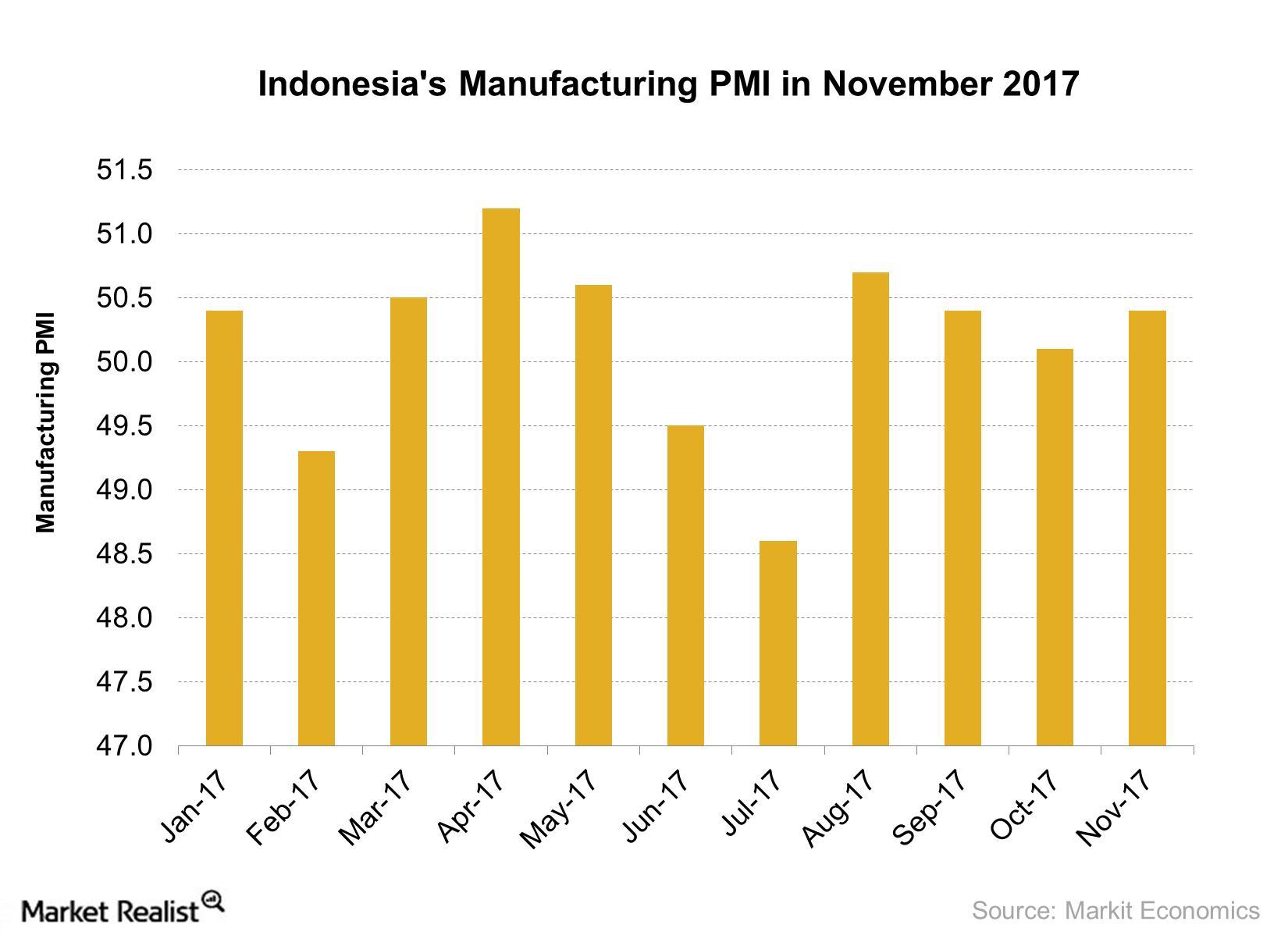

Analyzing Indonesia’s Manufacturing Activity in November 2017

Indonesia’s manufacturing activity in November According to a report by Markit Economics, Indonesia’s (IDX) (ASEA) manufacturing PMI (purchasing managers’ index) rose to 50.4 in November from 50.1 in October 2017, marking the fourth consecutive month of expansion. In November, Indonesia’s manufacturing PMI was driven by the following: production output and volume rose, marking a second consecutive month of expansion in […]

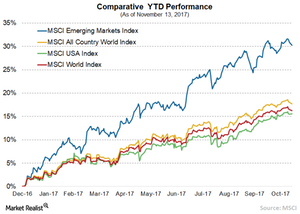

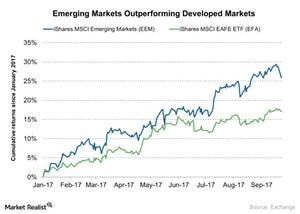

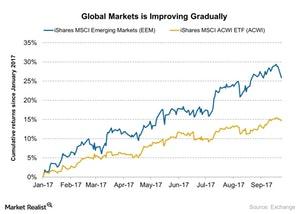

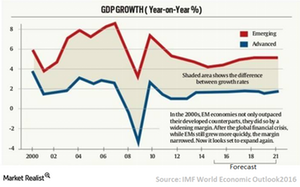

Why Emerging Markets Are Rallying

There are a lot of reasons behind the sharp rally in EMs (SCHE). The prominent reason is that the GDP growth in many of these nations has improved in the last few quarters partially on the back of the rise in commodity prices like copper and oil.

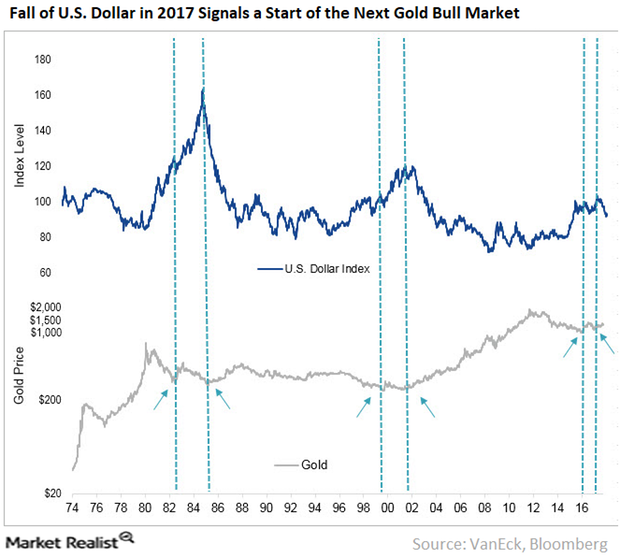

1 Technical Trend That Could Affect Gold Prices

Investor complacency doesn’t hide the fact that there are financial risks to QT. Forty percent of the Fed’s balance sheet unwind is in mortgage-backed securities at the same time that the housing market is showing signs of slowing.

What’s the IMF’s View on Tax Reform?

According to the IMF (International Monetary Fund), a moderate progressive tax system may not negatively impact economic growth in developed economies (SPY) (EZU).

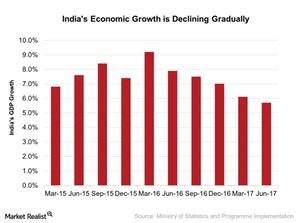

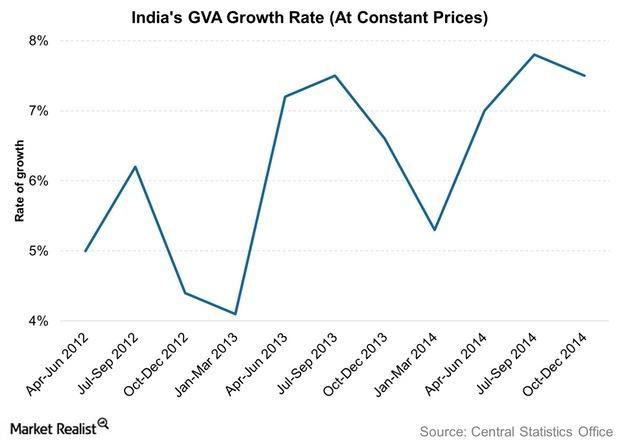

Could Indian Economy Grow Faster after GST Implementation?

On a yearly basis, economic growth in India (INDA) showed a strong improvement of 9.2% in the first quarter of 2016.

How Emerging Economies Are Supporting Global Growth

According to the report provided by the World Bank in June 2017, global (ACWI) growth is expected to strengthen to 2.7% in 2017.

How Emerging Market Manufacturing Activity Is Trending

In this series, we’ll take a look at the manufacturing activity and service activity of major emerging economies (EEM) (VWO) in August 2017.

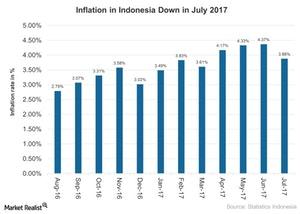

Inflation in Indonesia Fell in July: Is It a Correction or Trend?

Inflation in Indonesia (EEM) in July 2017 stayed in line with the market expectation of 3.9%.

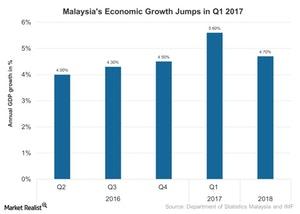

Can Improved Demand Help Malaysia’s Economy Expand in 2Q17?

The Malaysian economy gave us an impressive growth story in 1Q17, with its increased investments in infrastructure and private sector expansion.

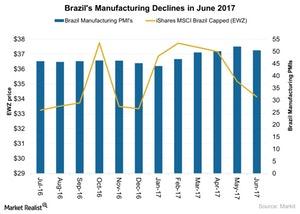

Why Brazil’s Manufacturing Activity Lost Momentum in June 2017

Brazilian (ILF) manufacturers remain firmly optimistic about the country’s output growth in the next 12 months.

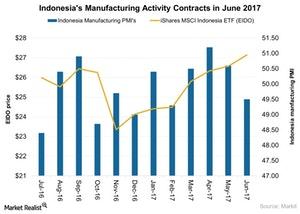

Indonesia’s Manufacturing Activity Fell in June 2017

The manufacturing PMI (purchasing managers’ index) in Indonesia (EIDO) fell to 49.5 in June 2017—compared to 50.6 in May 2017.

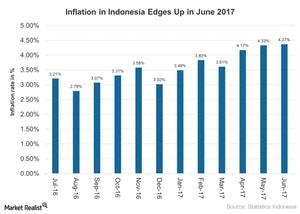

Indonesia Inflation Was Close to the Target in June 2017

Consumer prices in Indonesia (EEM) rose 4.4% on a YoY (year-over-year) basis in June 2017—compared to a 4.3% rise in May 2017.

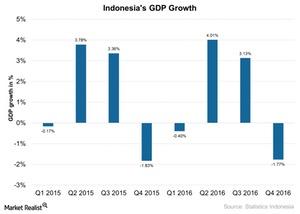

Indonesia Has High GDP Growth Expectations, but Will These Help Markets in 2017?

The World Bank is forecasting higher growth for Indonesia (IDX) at about 5.1% and 5.3% for 2017 and 2018, respectively.

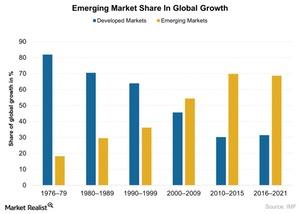

Emerging Market’s Increasing Share in Global Growth and Its Impact

The improved growth in emerging markets was led by a cyclical recovery in Brazil (EWZ) and Russia (ERUS).

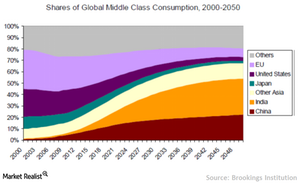

Rethink Your Emerging Market Story

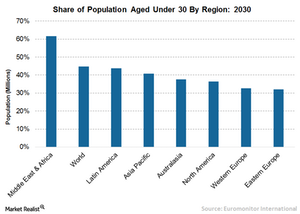

In the previous articles of this series, we discussed population and economic growth as the two major drivers leading to a rise in emerging markets (EMQQ).

Emerging Market Economic Growth Outpaced Developed Markets

In recent years, emerging markets have experienced rapid economic growth compared to developed markets.

Why Emerging Markets Have Better Demographics

Achieving higher returns amid the rising market volatility, record-low interest rates, and global uncertainties is a huge challenge for investors.

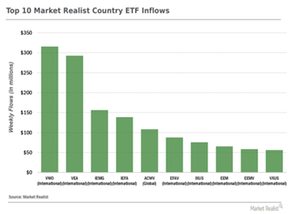

Country ETFs: Double Down on Emerging Markets?

The upside reversal in emerging market equity ETFs has become one of the most remarkable investment themes in 2016. Investors don’t want to miss out.

What Were the Best-Performing Currencies on June 29?

The Malaysian ringgit led the rise in Asian currencies as the US dollar-ringgit currency pair, which is inversely related to the ringgit, fell by 1.7%.

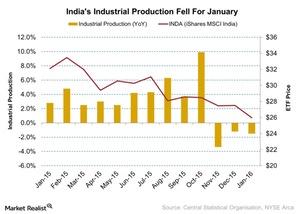

Why Did India’s Industrial Production Fall?

India’s industrial production fell by 1.5% in January, according to the Central Statistical Organization. In January 2015, the industrial production index rose to 2.8%.

India Now Uses Gross Value Added to Calculate Economic Output

The Indian economy has certainly seen a change since the new government took over. India now uses what is known as GVA (gross value added) to calculate economic output.

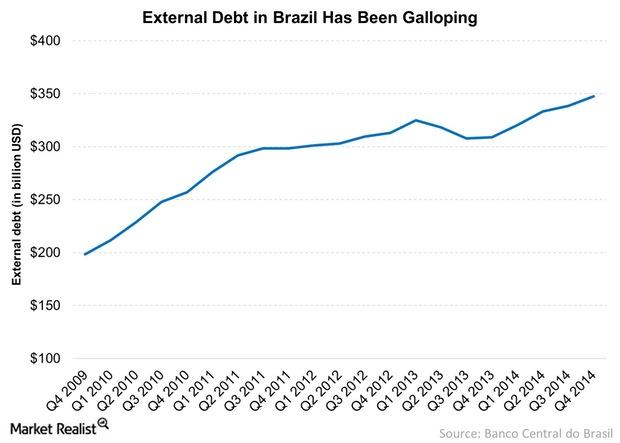

Why the Brazilian Government’s Debt Has Surged over the Years

The Brazilian government’s debt has surged over the last five years. The country’s internal debt has also increased.Macroeconomic Analysis Why India’s industrial production is important

In India, production changes are measured by the IIP. It’s released on a monthly basis. This is an important indicator for assessing the health of the industrials sector.Materials Must-know: Factors that influence the cement industry

The cement industry is highly affected by regulatory norms. This is prominent in developed countries where environmental issues are more stringent. This adds to the companies’ costs.Materials Must-know: Cement industry drivers and indicators

An increased focus on infrastructure development increases cement demand. This effect is prominent in emerging economies. A substantial portion of this demand comes from infrastructure projects. The projects are funded by the government.Materials Must-know: The cost elements of cement

The cement industry relies on power. Power and fuel costs account for ~30% of the price of cement when it’s sold. As a result, power and fuel have a major impact on the company’s operating expenditure.Materials Must-know: Cement preparation

The company takes a sample of the limestone at various levels in the form of steps. The steps are called benches. The benches determine the quality assurance. Since quality varies, the bench compares it with the standard that’s required. This is called limestone benching.