Vertex Pharmaceuticals Inc

Latest Vertex Pharmaceuticals Inc News and Updates

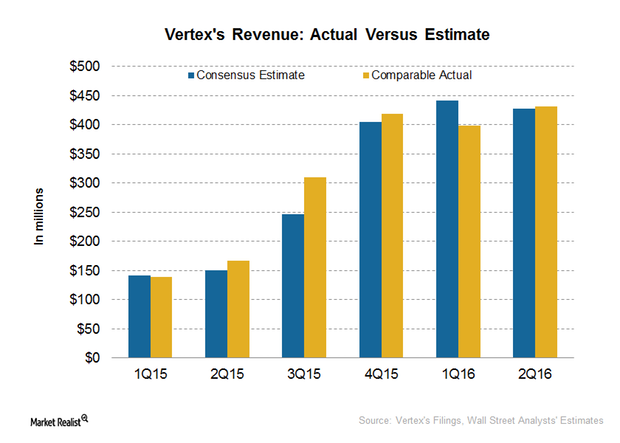

How Vertex’s Revenue and Earnings Surprised in 2Q16

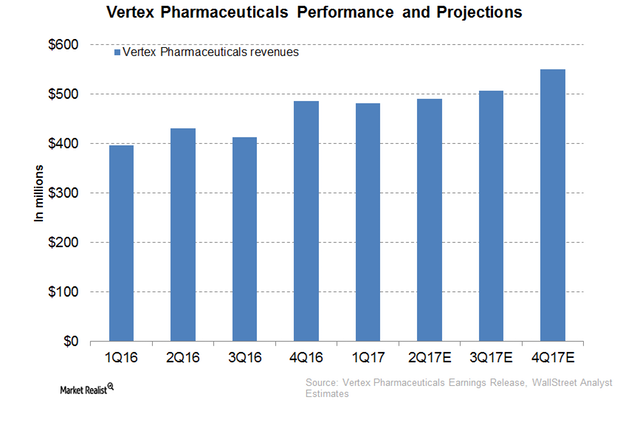

Vertex Pharmaceuticals (VRTX) reported its 2Q16 earnings on July 27, 2016. VRTX surpassed Wall Street analysts’ projections and reported revenue of $431.6 million.

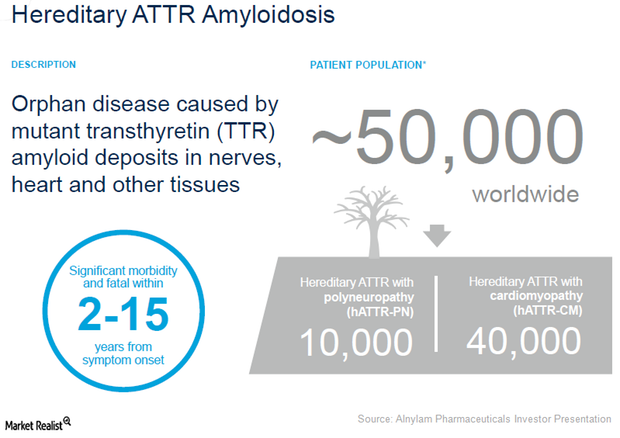

Alnylam Pharmaceuticals: Developing Therapies for Hereditary ATTR Amyloidosis

Alnylam Pharmaceuticals (ALNY) is currently developing three investigational therapies—Patisiran, Revusiran, and ALN-TTRsc02—for the treatment of patients with hereditary ATTR amyloidosis.

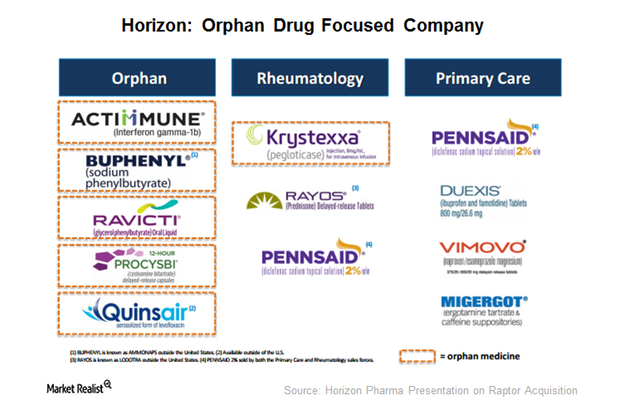

Buy Allows Horizon to Further Expand into Orphan Drug Space

Through the acquisition of Raptor Pharmaceuticals, Horizon Pharma (HZNP) will gain access to Procysbi and Quinsair and expand in the orphan drug space.

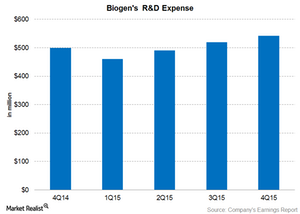

How Much Does Biogen Spend on Research and Development?

Biogen’s (BIIB) R&D expenses for 4Q15 were $542 million, or 19% of its total revenue, including a $60 million payment to Mitsubishi Tanabe.

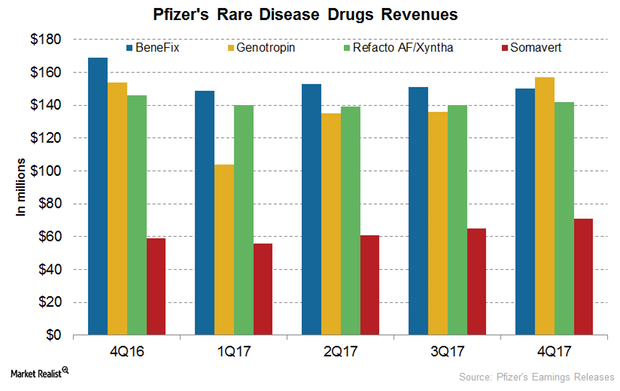

Inside Pfizer’s Rare Disease Segment Performance in 2017

In 4Q17, Pfizer’s BeneFix reported revenues of $150 million, which represents a ~11% decline YoY and a ~1% decline quarter-over-quarter.

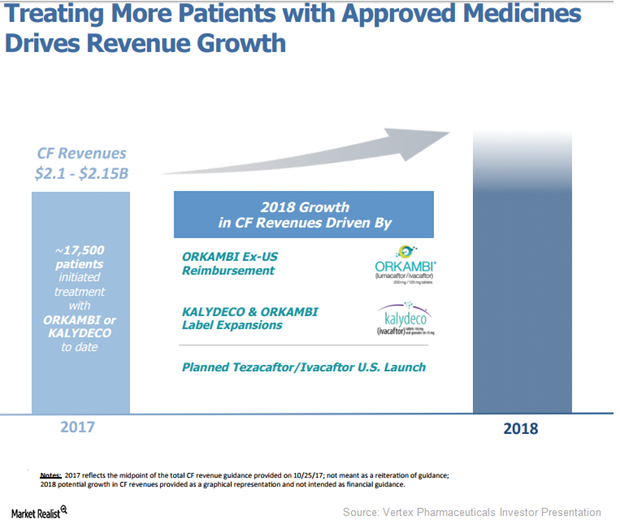

Vertex Pharmaceuticals Has Robust Late-Stage Research Pipeline

On January 10, 2018, Vertex Pharmaceuticals announced that Orkambi has secured regulatory approval from the European Commission to treat CF patients ages six to 11 years.

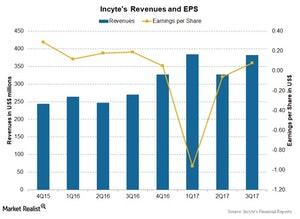

How’s Incyte’s Valuation in January 2018?

Analysts expect Incyte Corporation’s revenue to rise ~26.7% to $413.8 million in 4Q17 compared to $326.5 million in 4Q16.

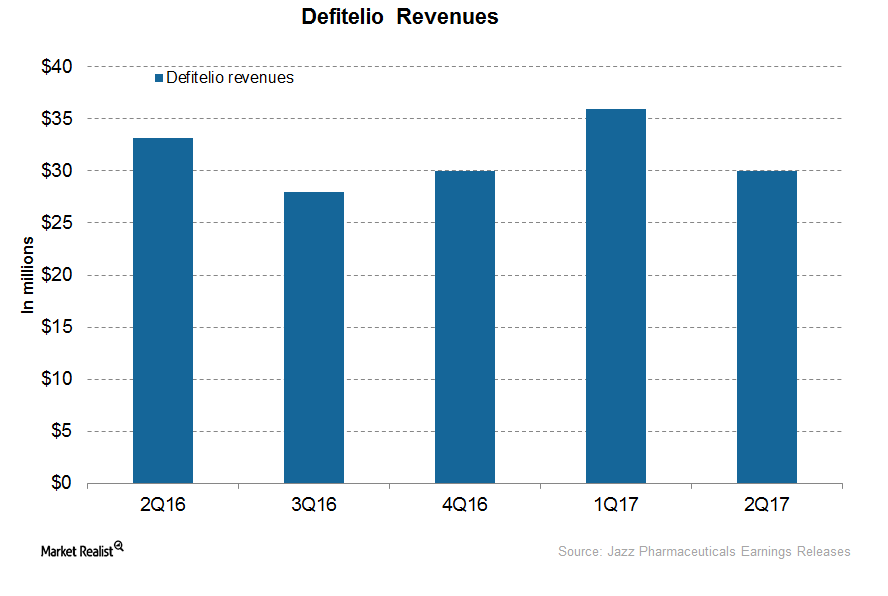

How Is Jazz’s Defitelio Positioned after 2Q17?

In 2Q17, Jazz Pharmaceuticals’ (JAZZ) Defitelio generated revenues of ~$30 million, which represents a ~10% fall YoY and a ~17% fall QoQ.

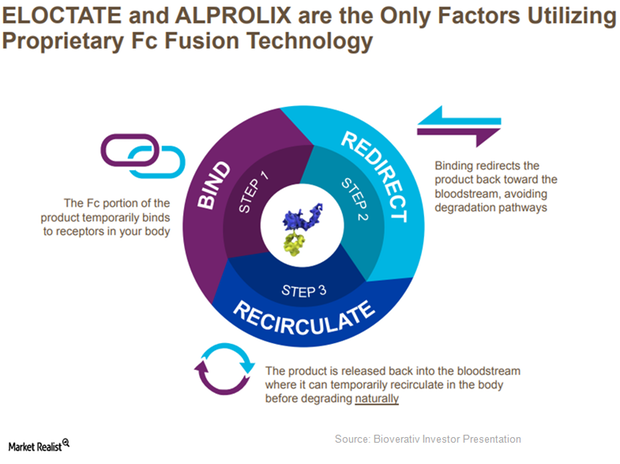

Alprolix and Eloctate Increasingly Used for Prophylaxis in 2017

Since demand from the target population for prophylaxis is rising rapidly, Bioverativ’s Alprolix and Eloctate are expected to see solid demand trends in 2017.

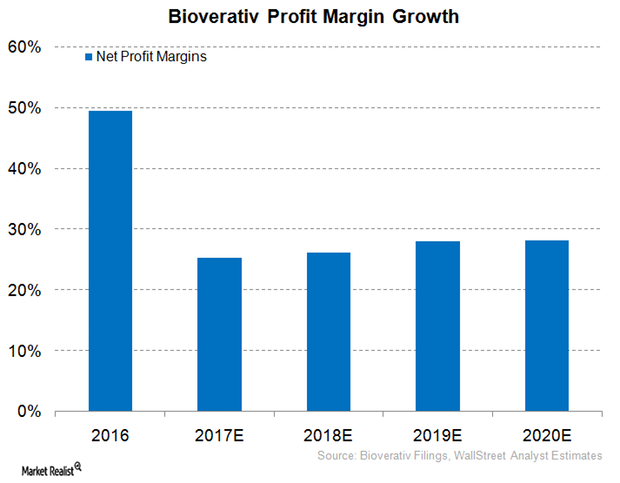

Bioverativ Expected to Report Healthy Profit Margins in 2017

Bioverativ (BIVV) expects its 2017 GAAP and non-GAAP operating margins to fall 38.0%–42.0% and 43.0%–47.0%, respectively.

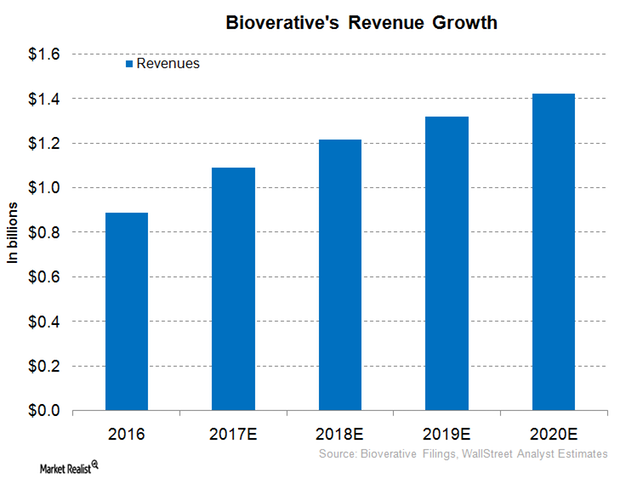

Bioverativ Expected to Report Robust Revenue Growth in 2017

In 1Q17, Bioverativ reported revenues close to $259.0 million, driven by its focus on a commercial strategy for its hemophilia products and optimal cost management.

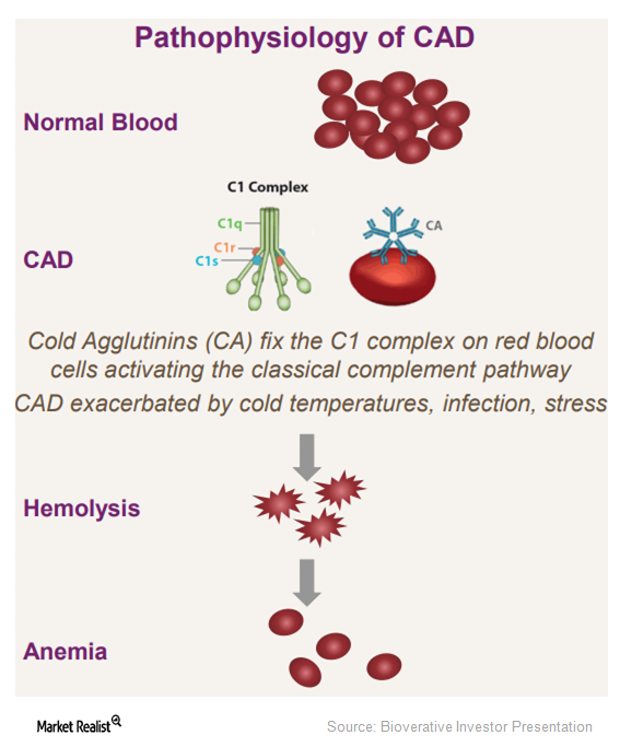

Bioverativ–True North Therapeutics: Stronger Research Pipeline

The acquisition of True North Therapeutics has paved the way for Bioverativ’s (BIVV) entry into cold agglutinin disease (or CAD).

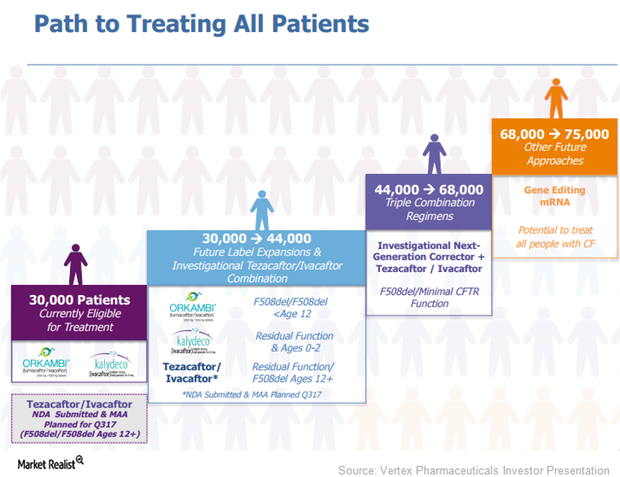

Vertex Pharmaceuticals Cystic Fibrosis Market Could Expand

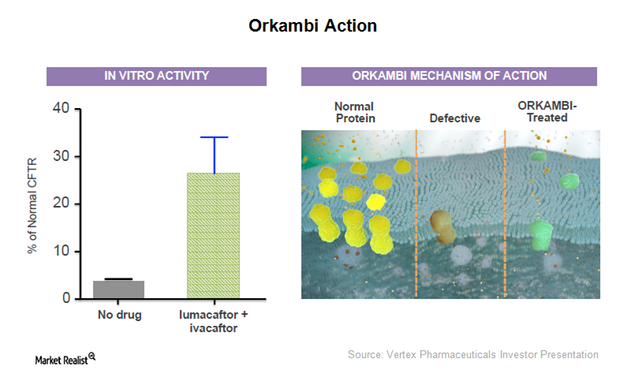

Vertex Pharmaceuticals’ (VRTX) drugs, Orkambi (lumacaftor/ivacaftor) and Kalydeco (ivacaftor), are capable of treating around 30,000 cystic fibrosis (or CF) patients.

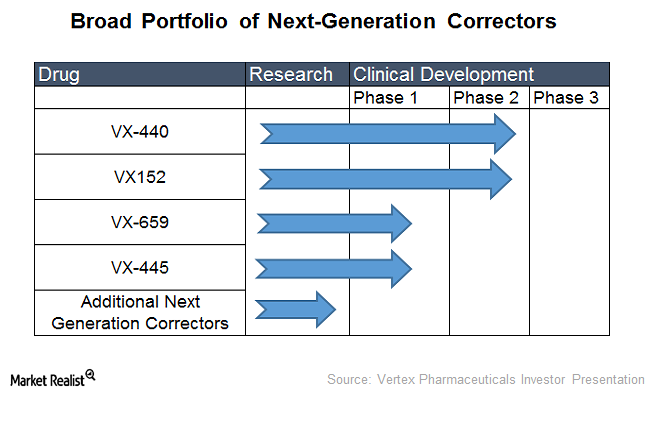

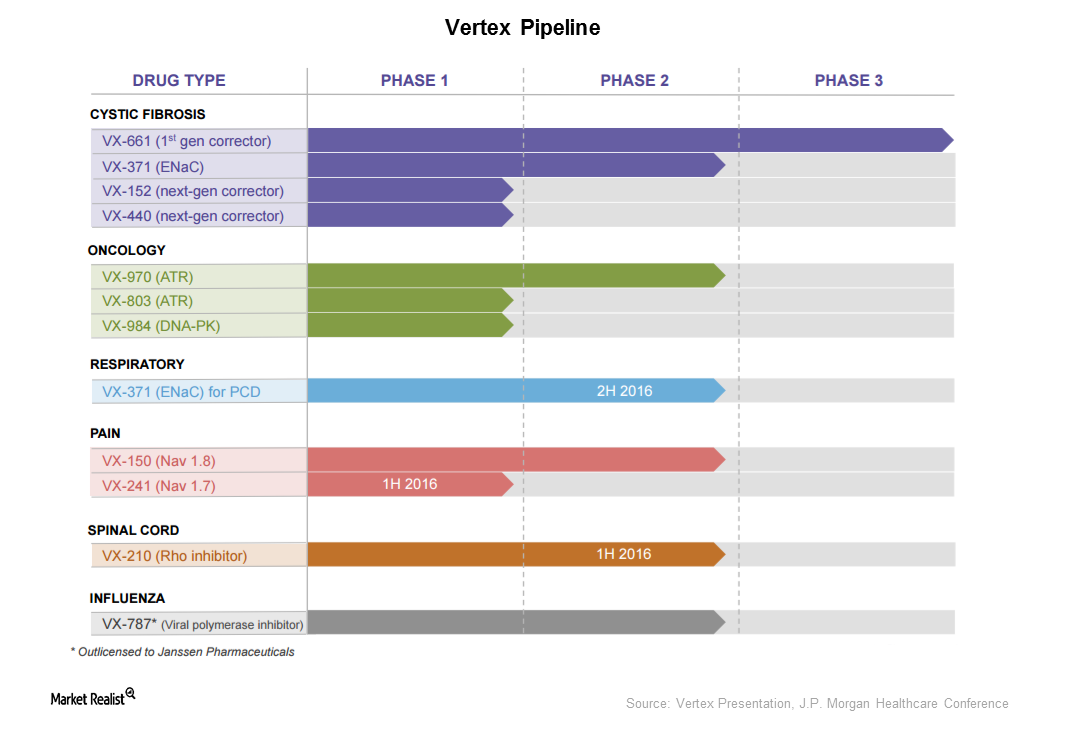

Inside Vertex Pharmaceuticals’ Clinical Pipeline

In March 2017, Vertex Pharmaceuticals (VRTX) announced promising results from two phase-3 clinical trials, Evolve and Expand.

Inside Vertex Pharmaceuticals’ Revenue Trend

In 2016, Vertex Pharmaceuticals (VRTX) reported revenues of around ~$1.7 billion, which reflected a whopping 65% YoY (year-over-year) growth.

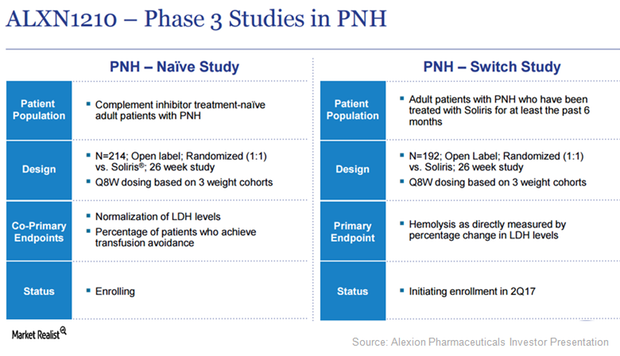

ALXN1210 Is Expected to Boost Alexion Pharmaceuticals’ Revenue

Alexion Pharmaceuticals has planned five clinical trials in 2017 to test the potential of investigational next-generation C5 antibody, ALXN1210, as a treatment option for complement-mediated diseases.

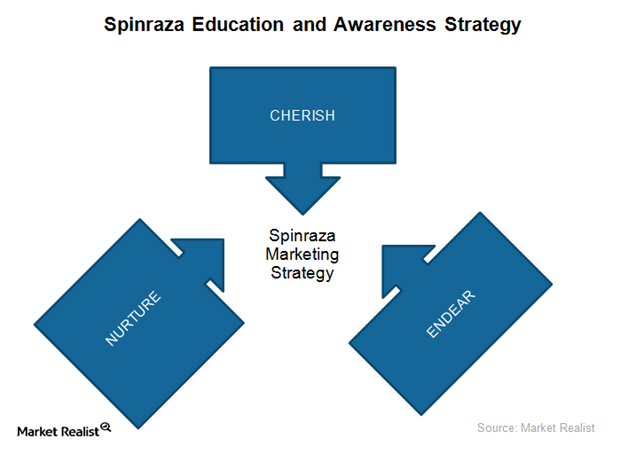

Biogen’s Targeted Marketing Strategy for Spinraza in 1Q17

To promote the use of Spinraza for SMA, Biogen (BIIB) has been actively educating and creating awareness for the drug among physician and patient communities.

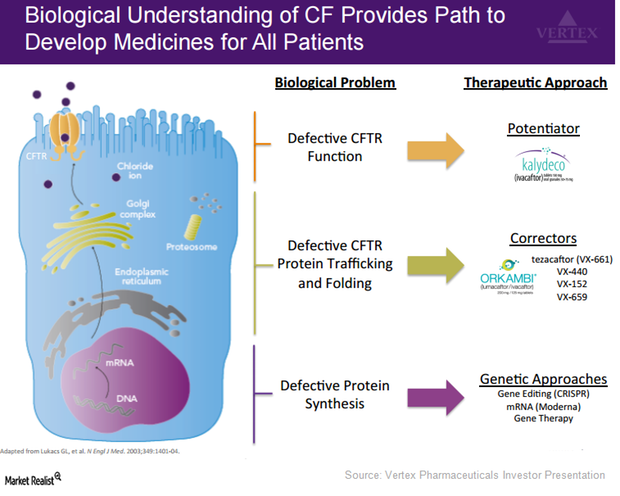

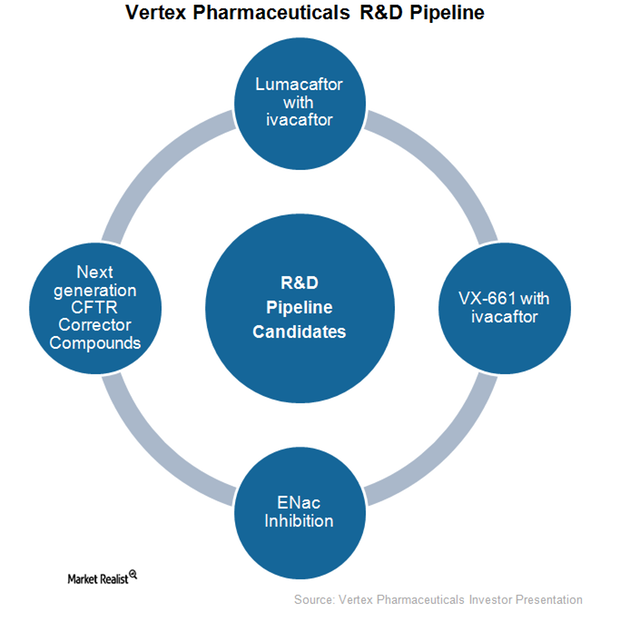

Vertex Has Adopted Multiple Approaches to Treat Cystic Fibrosis

Vertex Pharmaceuticals (VRTX) is aiming to increase the number of patients eligible to be treated with its drugs to include the entire CF patient population.

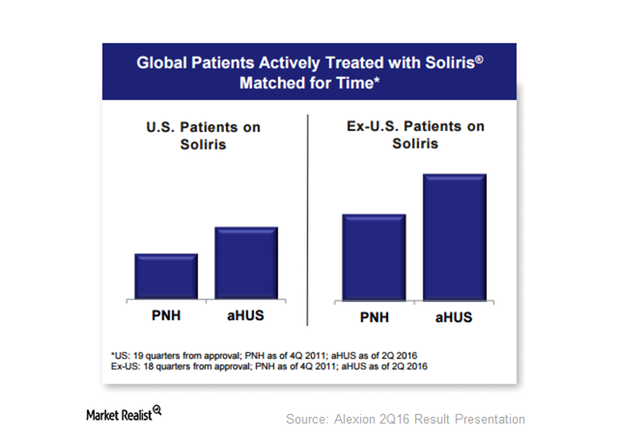

How Significant Is Alexion’s Opportunity with Soliris?

Alexion (ALXN) has been serving the atypical hemolytic uremic syndrome, or aHUS, market for the past five years.

How Does Vertex Plan to Expand Beyond Cystic Fibrosis?

Vertex is trying to expand its product base beyond cystic fibrosis. It holds molecules in the oncology, respiratory, pain, spinal cord, and influenza spaces.

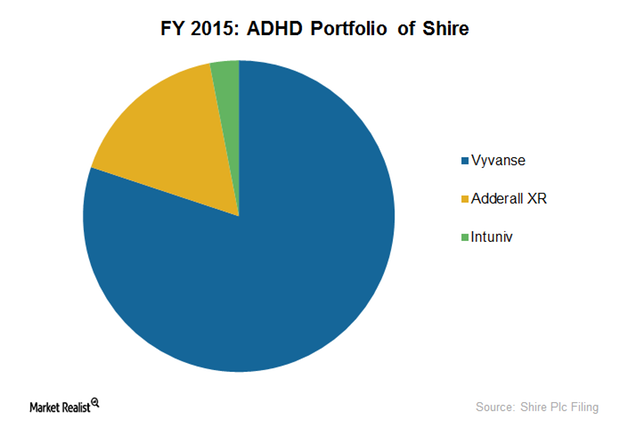

How Vyvanse Could Fuel Shire’s ADHD Portfolio Sales

Vyvanse is Shire’s leading ADHD drug, constituting 80% of the company’s ADHD portfolio. In fiscal 2015, Vyvanse earned the company $1.7 billion.

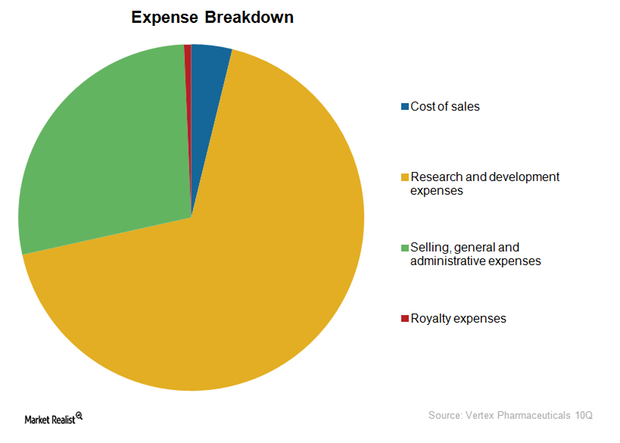

Vertex Pharmaceuticals’ Cost Structure and EBITDA Margins

While mature biotechnology companies with drugs in multiple disease segments earn an average of 30%–40% EBITDA, margins of companies targeting only rare diseases can vary due to unique business models.

Vertex Has Strong Research and Development Pipeline

As part of its research and development, Vertex Pharmaceuticals (VRTX) has been actively exploring new cystic fibrosis (or CF) drugs as well as other indications for its existing drug Kalydeco.

Vertex Pharmaceuticals’ New Drug Orkambi Receives FDA Approval

On July 2, 2015, the FDA (U.S. Food and Drug Administration) approved Orkambi, a combination drug of lumacaftor and ivacaftor, for treating cystic fibrosis (or CF) patients.

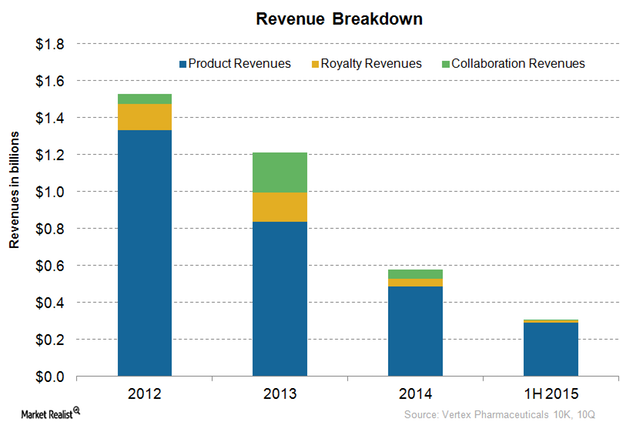

Vertex Pharmaceuticals’ 3-Pronged Business Model

Vertex Pharmaceuticals’ (VRTX) business model includes revenues in three areas: products, royalties, and collaboration. There’s significant variability in royalty and collaboration revenues.