ONEOK Inc

Latest ONEOK Inc News and Updates

What is XLE? Exploring Midstream Energy Company Exposure

Companies in the midstream sector that are included in the XLE portfolio include Kinder Morgan, Oneok, the Williams Company, and Spectra Energy.

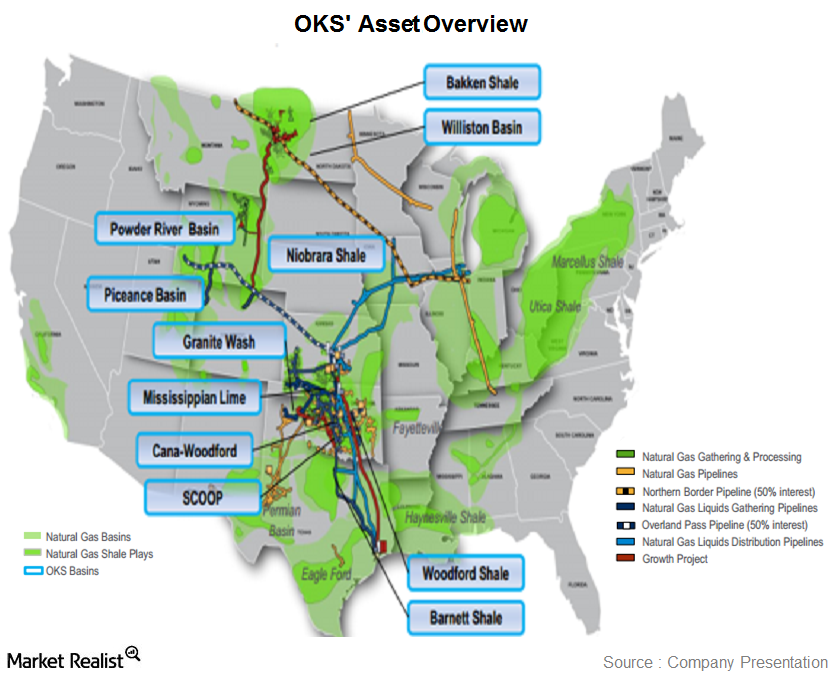

Overview: ONEOK Partners and its 3 operating segments

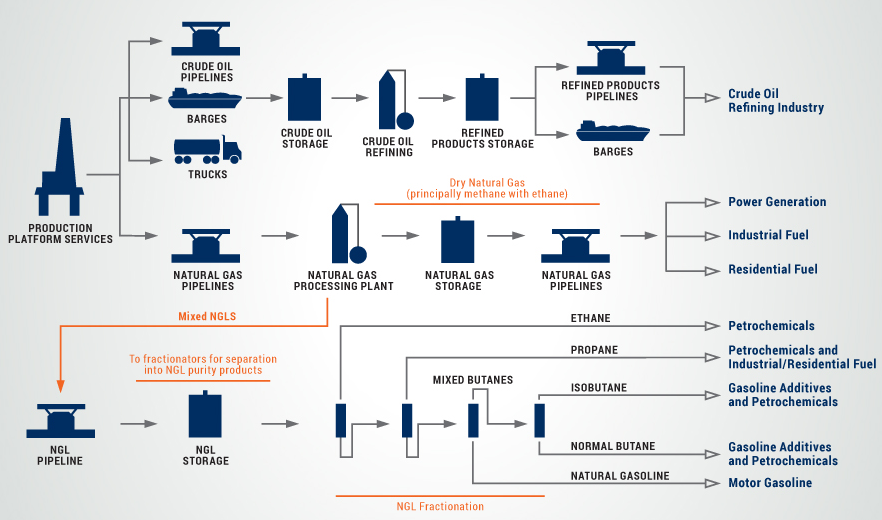

ONEOK Partners (OKS) is a master limited partnership (or MLP) engaged in gathering, processing, storing, and transporting natural gas and natural gas liquids (or NGLs) in the U.S.

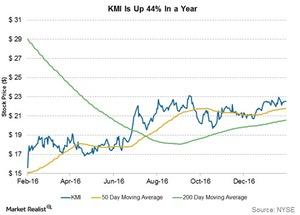

Will Kinder Morgan Stock Continue to Surge in 2017?

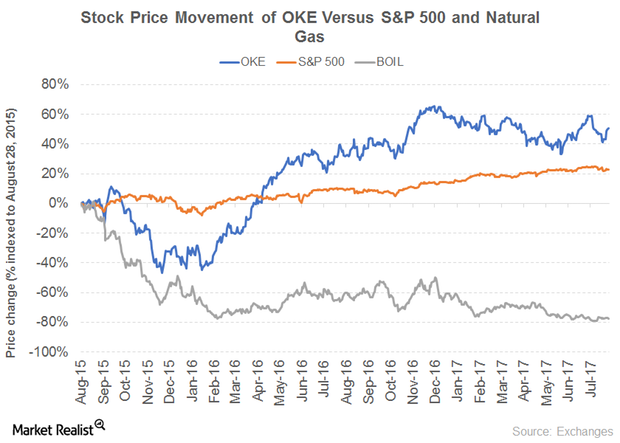

Kinder Morgan stock has risen 44% in the past year, as compared to Enterprise Products Partners’ 32% rise and ONEOK’s 162% rise.

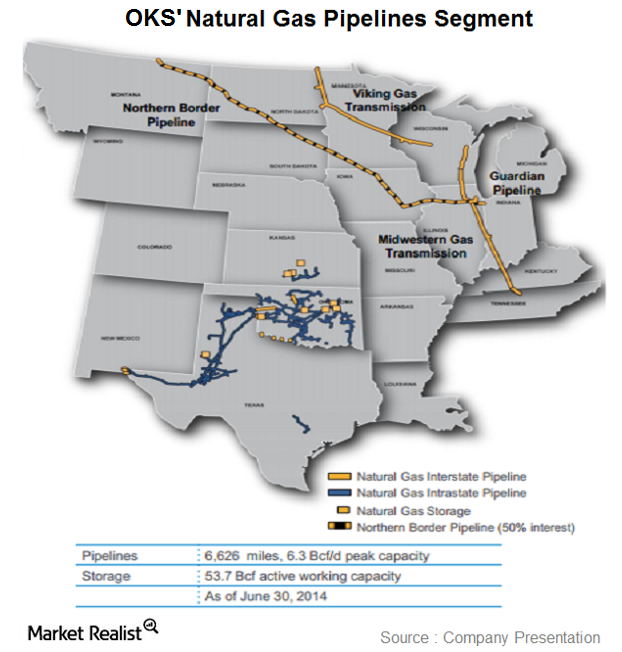

Overview: ONEOK Partners’ natural gas pipelines segment

ONEOK Partners’ (OKS) natural gas pipelines segment owns and operates regulated interstate and intrastate natural gas pipelines and natural gas storage facilities.

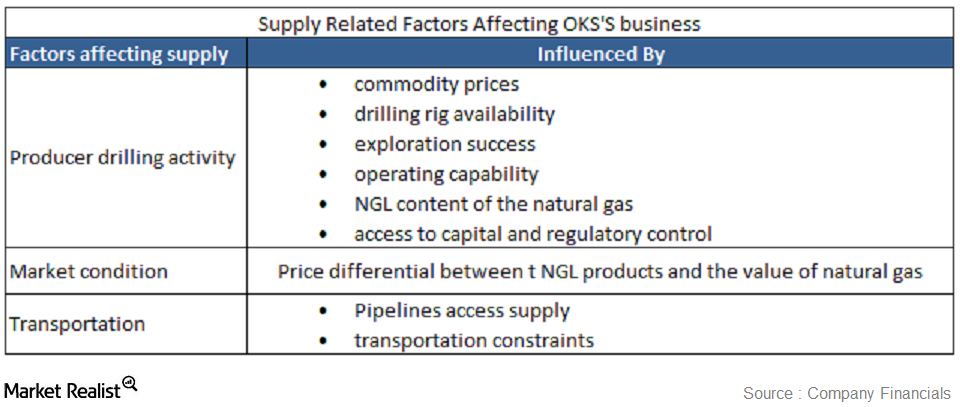

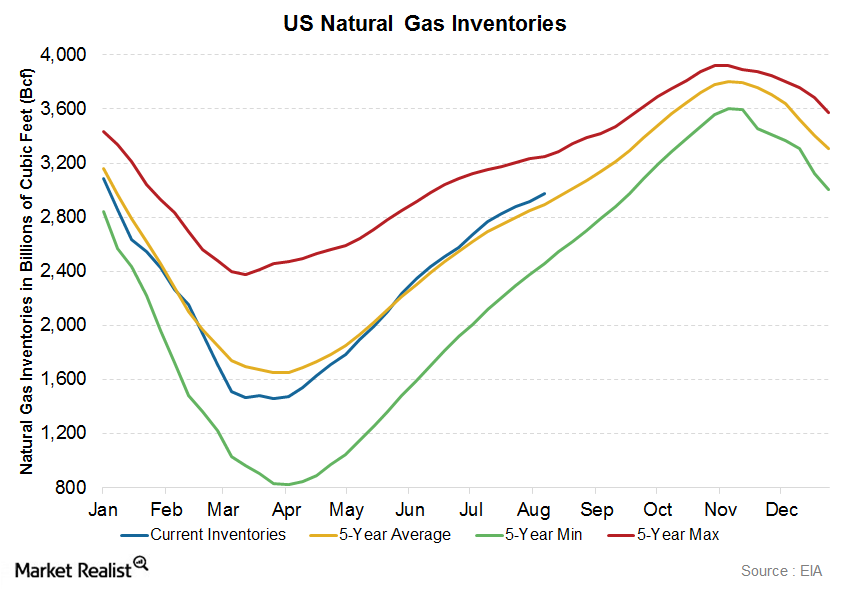

Must-know: Supply-related factors that affect ONEOK Partners

Natural gas, crude oil, and NGL (or natural gas liquid) supply is affected by several factors that could be supply related or demand related.

KMI, WMB, and OKE: Understanding Their Key Business Focus

Kinder Morgan transports natural gas, refined petroleum, crude oil, condensate, CO2, and other products through its network of pipelines.

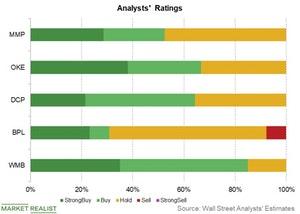

Are Analysts Bullish on Williams Companies?

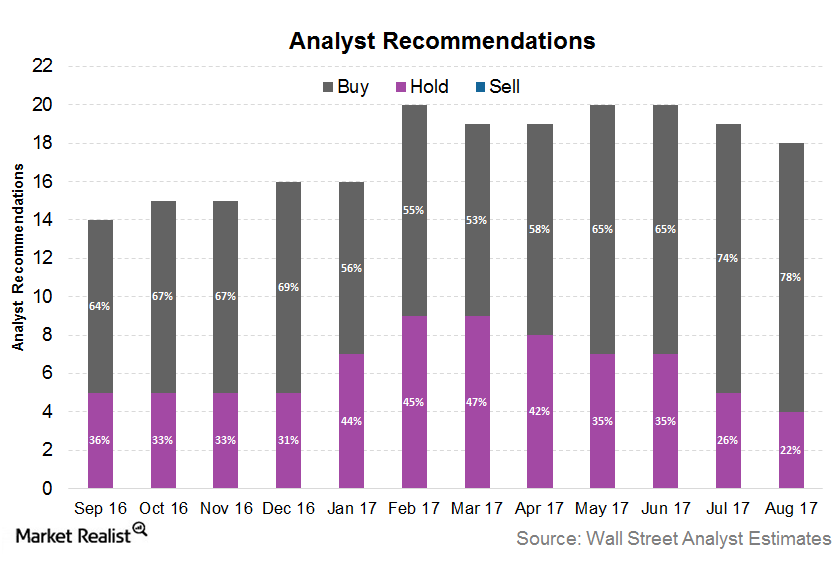

About 78.0% of analysts rate Williams Companies (WMB) a “buy,” while the remaining 22.0% rate it a “hold” as of August 21, 2017.

These Midstream Players Have Created Maximum Wealth for Investors

In this series, we’ll look at the historical outliers in midstream energy, which have generated massive wealth amid turbulent times.

Why ONEOK Has Outperformed Its Peers in 2018

ONEOK (OKE) stock has risen ~21% so far in 2018, outperforming its peers in the midstream sector.

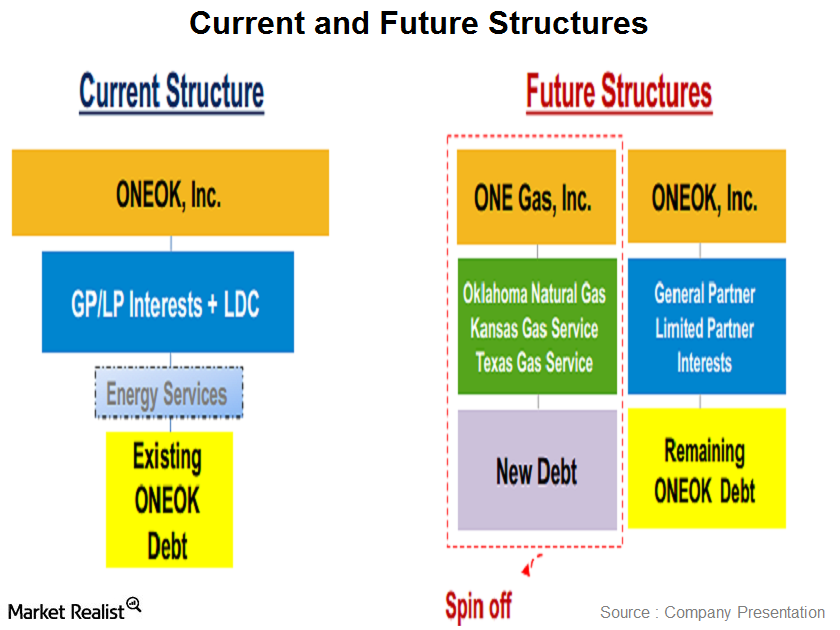

Must-know: Why ONEOK restructured its business, creating ONE Gas

Earlier this year, ONEOK (OKE) created a new stand-alone publicly traded company called ONE Gas (OGS), separating its natural gas distribution business into a separate dedicated company. The company believes that by having two separate companies, each of the companies will have a greater focus on its individual strategy, financial strength, and growth potential.

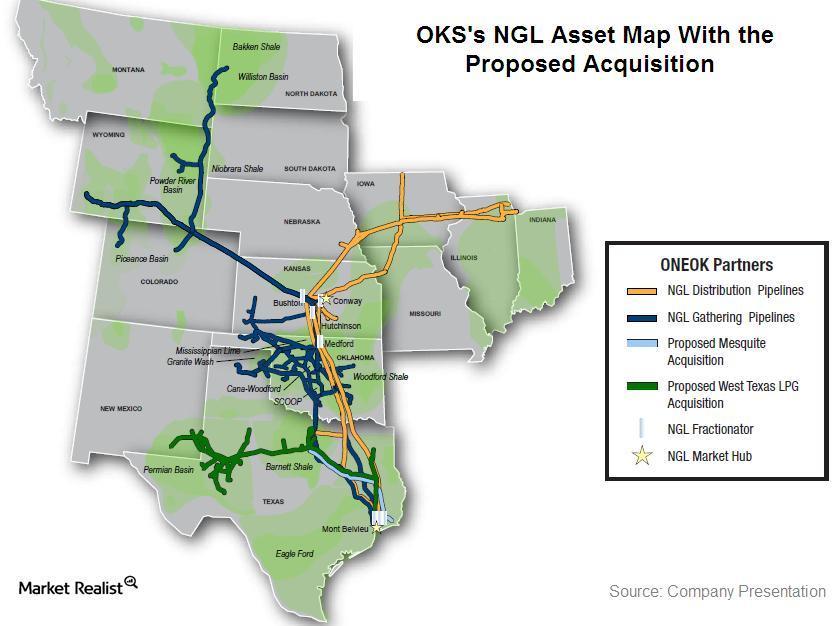

Why ONEOK Partners acquires Permian assets from Chevron

On October 27, ONEOK Partners (OKS) announced that it agreed to acquire Chevron Corporation’s (CVX) natural gas liquids (or NGLs) pipeline assets.

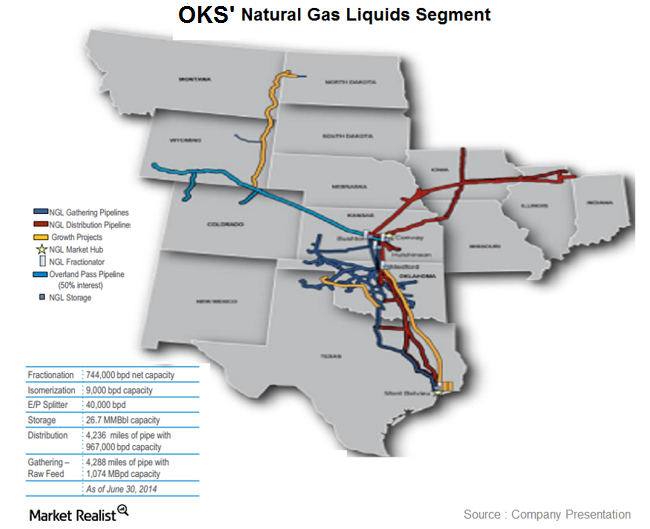

Overview: ONEOK Partners’ natural gas liquids segment

ONEOK Partners’ (OKS) natural gas liquids segment provides natural gas liquid gathering, fractionation, transportation, marketing, and storage services to its producers.

The US Energy Sector: An Overview

To understand the US energy sector, it’s essential first to understand the country’s energy needs. The US uses various energy sources to meet its energy needs.

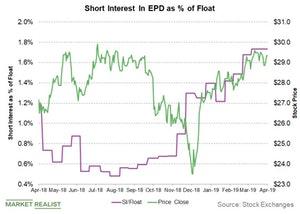

Recent Changes in Enterprise Products Partners’ Short Interest

The short interest in Enterprise Products Partners (EPD) stock rose from 24.9 million shares on March 15 to 25.7 million shares on March 29.

Key MLP and Midstream Rating Updates Last Week

On January 16, Barclays raised its rating for Williams Companies (WMB) from “equal weight” to “overweight.”

Richard Kinder: From Enron to Kinder Morgan

Currently, Richard Kinder owns nearly 11% of Kinder Morgan’s outstanding shares. The stock has underperformed the midstream sector.

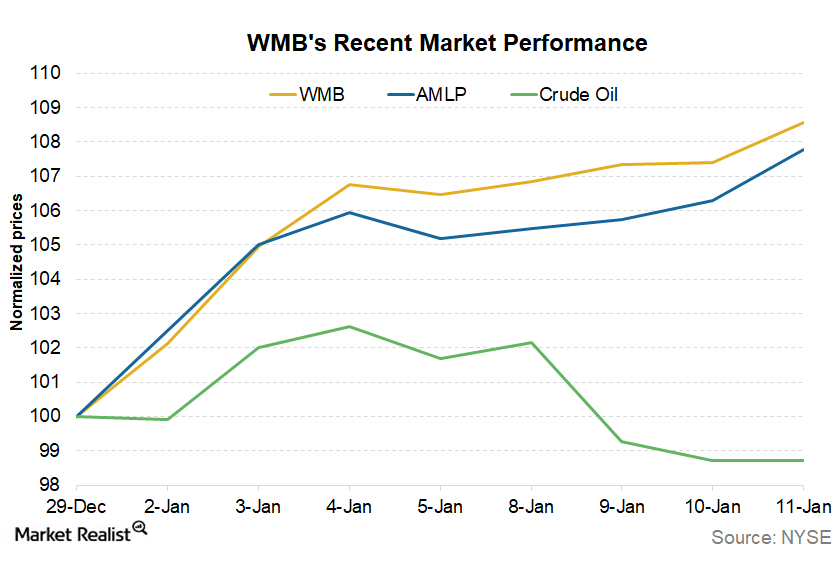

WMB Has Risen ~9% in 2018 So Far: Can the Gains Continue?

Williams Companies (WMB) has had a massive start to the year. It’s risen nearly 9% in seven trading sessions in 2018. Overall, the C corporation GP (general partner) has risen ~14% since the start of December 2017.

ONEOK’s Gas Gathering and Processing Fee Rates Increased

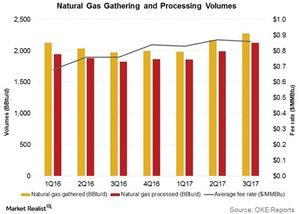

ONEOK’s Natural Gas Gathering and Processing segment’s gathered natural gas volumes rose to 2,278 BBtu/d in 3Q17—compared to 1,977 BBtu/d in 3Q16.

How ONEOK Has Managed Its Impressive Dividend Yield

How ONEOK has maintained a 4% yield ONEOK (OKE), the general partner and 41% owner of ONEOK Partners, owns one of the country’s premier natural gas liquid systems. The company’s revenue grew 15% in 2016 after falling 36% in 2015. The growth was driven by its Natural Gas Gathering and Processing, Natural Gas Liquids, and […]

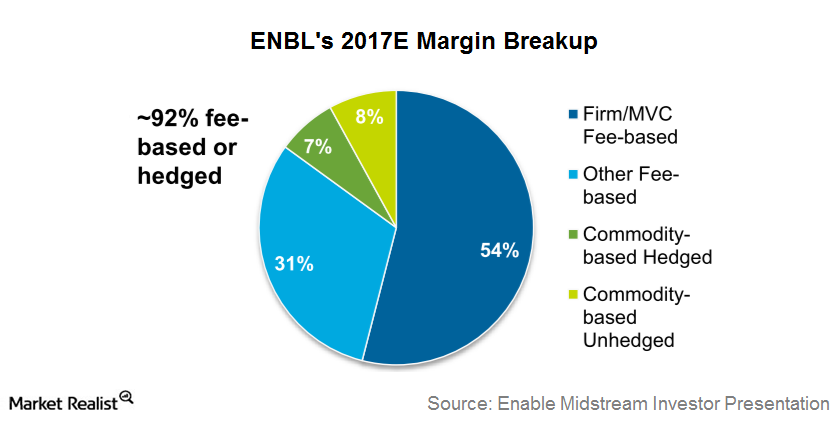

Getting Familiar with MLP Contracts

In this article, we’ll look at types of MLP contracts for midstream MLPs. Midstream MLPs generally have fixed-fee contracts.

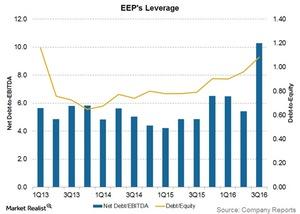

Is Enbridge Energy Partners’ Leverage a Concern?

Enbridge Energy Partners’ (EEP) debt-to-equity ratio is 1.1x. How do other midstream companies compare?

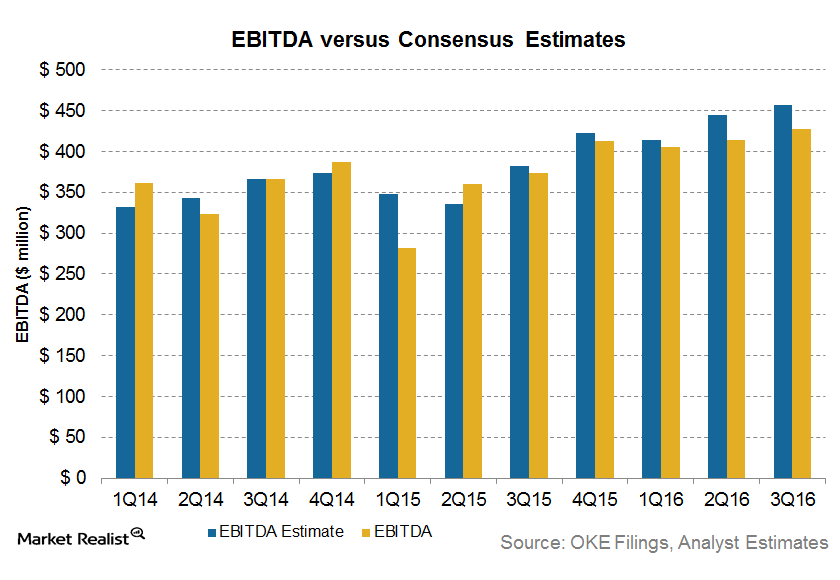

What Drove ONEOK’s 3Q16 Earnings Growth?

ONEOK (OKE) reported its 3Q16 results on November 1, 2016, after the market closed. Its 3Q16 analyst-adjusted earnings before interest, tax, depreciation, and amortization rose 14.4% from 3Q15.

ONEOK Is Expected to Post Higher 2Q16 Earnings

ONEOK (OKE) and ONEOK Partners (OKS) are scheduled to report their 2Q16 results on August 2. Here’s what you need to know.

ONEOK: Trading 57% below Its 50-Day Moving Average

ONEOK (OKE) is currently trading 57% below its 50-day moving average. It’s generally been trading below its 50-day moving average since mid-2014 when energy prices began falling.

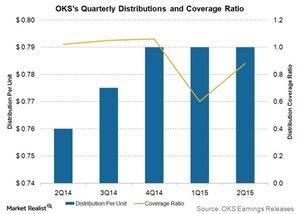

ONEOK Partners Reports Distribution Coverage Missed 2Q15 Target

Generally, MLPs with stable earnings target a distribution coverage ratio in the range of 1 to 1.1 times the distributable cash flow.

Natural Gas Inventories Beat Expectations: How Will Prices React?

On Thursday, August 13, the EIA (U.S. Energy Information Administration) published its “Natural Gas Weekly Update” for the week ended August 7.

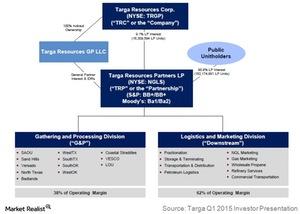

Targa Resources: A Midstream Energy MLP

Targa Resources Partners is a midstream energy MLP formed in 2006. The company is expanding its operations into gathering crude oil and transporting petroleum products.

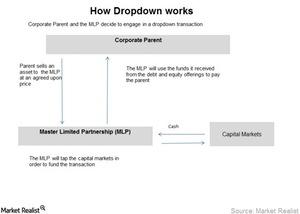

How Do Master Limited Partnerships Grow?

MLPs normally pay out all the available cash to the unit holders in the form of quarterly cash distribution. They hold only the maintenance capital expenditure.

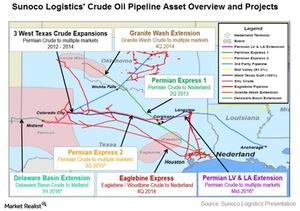

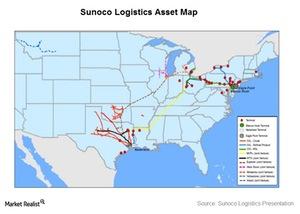

Crude Oil Pipeline Is a Major Segment for Sunoco Logistics

In the crude oil pipeline segment, Sunoco Logistics (SXL) runs 5,800 miles of crude oil pipelines and approximately 500 miles of crude oil gathering lines.

An Overview of Sunoco Logistics Partners

Sunoco Logistics Partners (SXL) is an energy midstream master limited partnership. It operates crude oil, natural gas, refined products, and natural gas liquids pipeline and terminal assets.

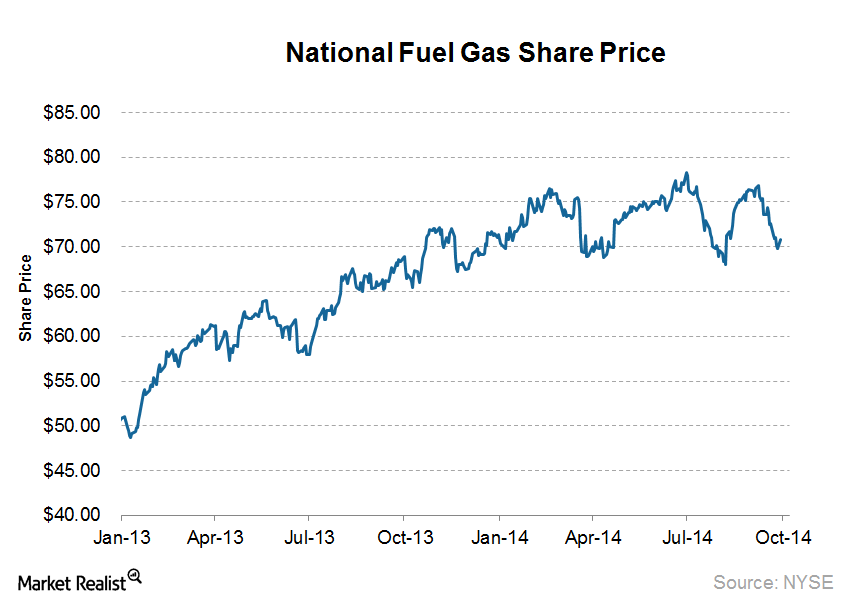

Mario Gabelli’s GAMCO Investors goes activist on National Fuel Gas

Activist investor Mario Gabelli’s GAMCO Investors, which owns a 9.1% in National Fuel Gas (NFG), is pressuring the company to spin off its gas utility segment from its natural gas exploration and midstream assets.