Morgan Stanley

Latest Morgan Stanley News and Updates

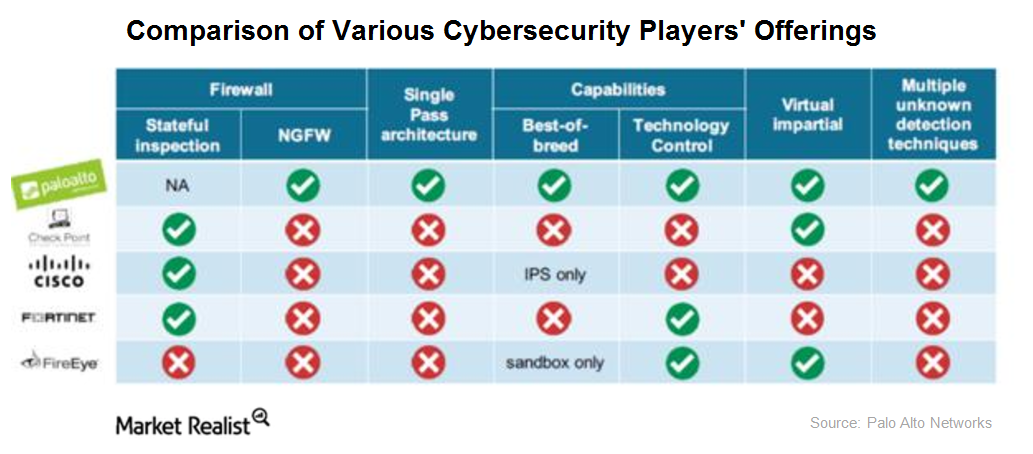

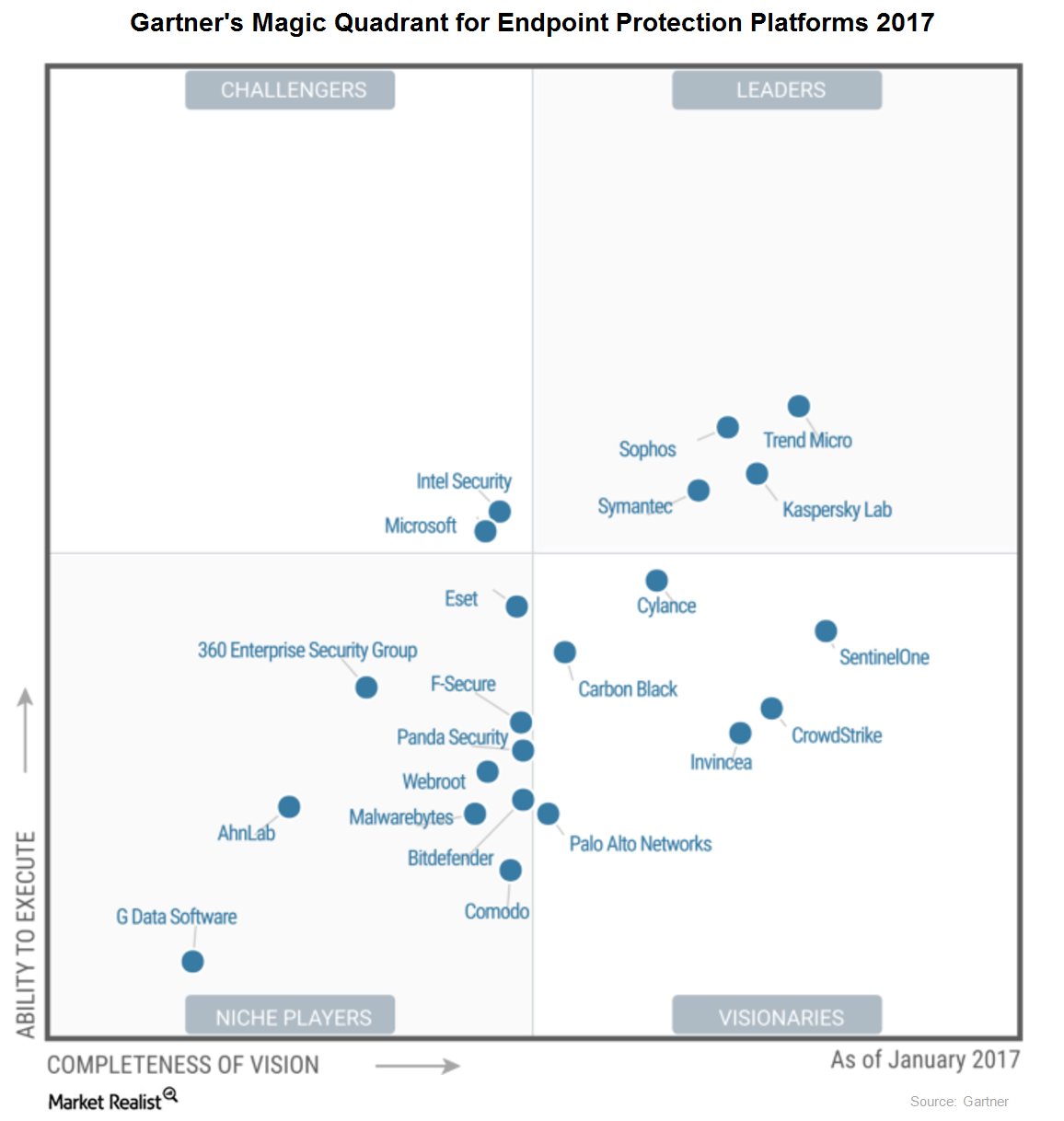

Does Palo Alto Pose a Real Competition to FireEye in Cybersecurity?

FireEye (FEYE) employs malware sandboxing technology to identify advanced security threats before they intrude and infect a network.

Morgan Stanley's Buyback Stock Picks in 2021

Since stock buybacks are expected to pick up the pace in 2021 after remaining muted in 2020, Morgan Stanley has made it picks.

Morgan Stanley’s (MS) Stock Forecast Before Q1 Earnings

Morgan Stanley (MS) will release its earnings for the first quarter of 2021 on April 16. What’s the forecast for Morgan Stanley stock before its earnings?

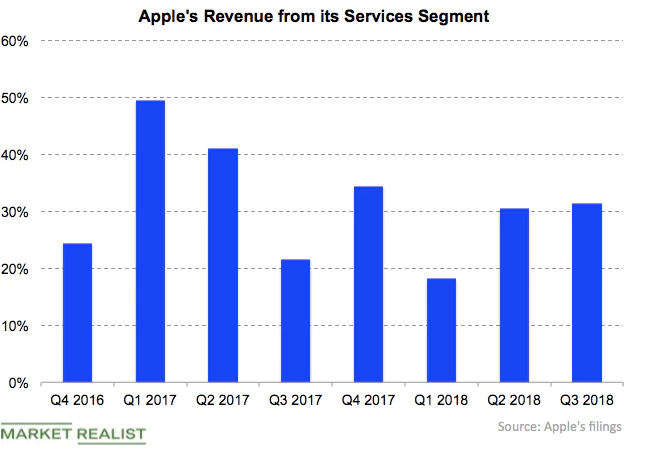

Why Is Morgan Stanley Optimistic about Apple?

According to a report from Apple Insider, Morgan Stanley expects Apple to offset the threat of longer replacement cycles with the iPhone Xs.

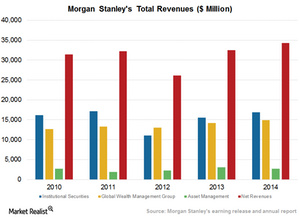

Morgan Stanley’s Strong Revenue Model

Morgan Stanley charges fixed fees and performance fees for asset management services, products and services, and administration of accounts.

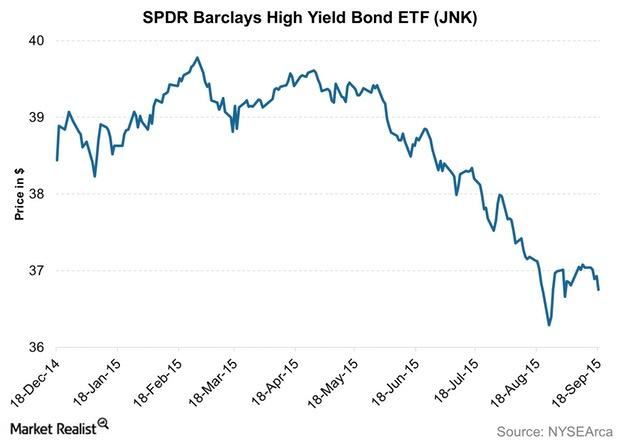

Lack of Rate Hike in September Leads US Stocks Down

The US Federal Reserve met on September 16 and 17 in one of the most anticipated monetary policy meetings in recent memory.

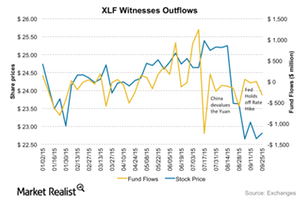

Fund Flows to XLF Have Been Declining

Exchange-traded fund investors added almost $552.6 million on average to the Financial Select Sector SPDR ETF (XLF) in the last quarter. During the week ending September 25, the ETF witnessed outflows of $318.3 million.

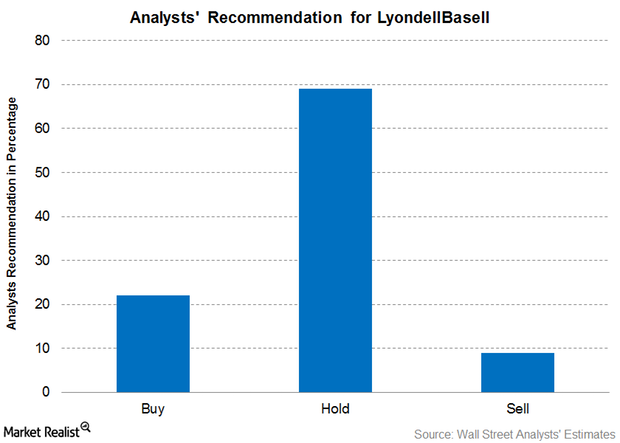

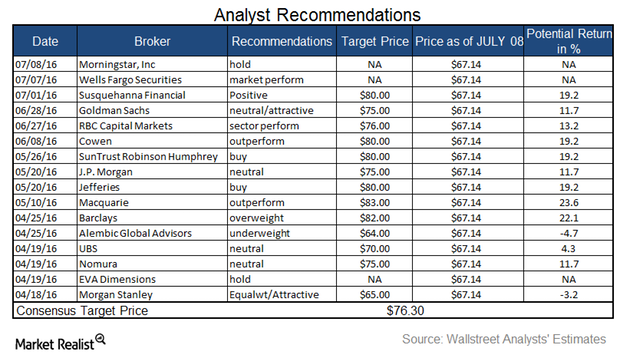

How Wall Street Analysts Rate LyondellBasell ahead of 1Q18 Earnings

The analyst consensus target price for LyondellBasell is $116.82, implying a return potential of 8.5% over the closing price of $107.68 as of April 20, 2018.Financials Must-know: Determining a bank’s value

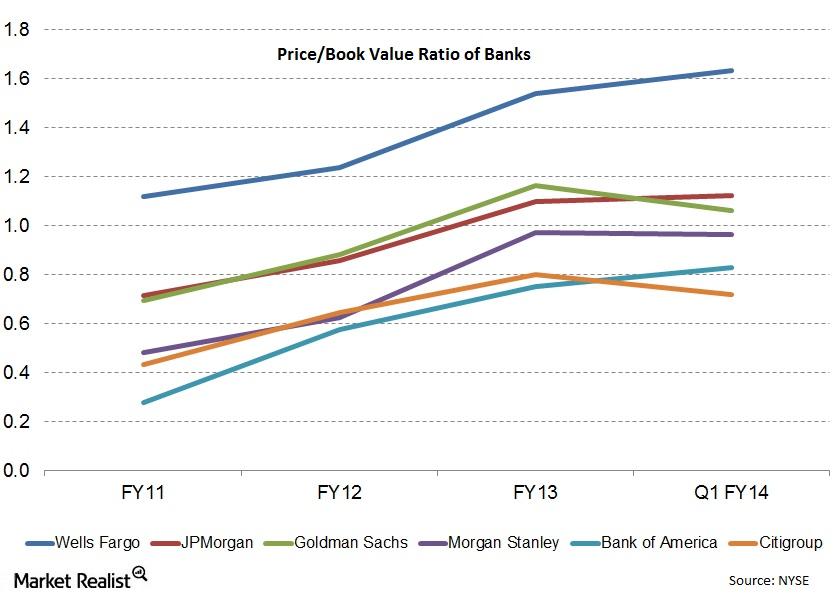

The first challenge is that banks are highly regulated and any change in regulations has a huge impact on the valuation of a bank—the second challenge is that it’s difficult to determine cash flow for a bank because both debt and reinvestment are difficult to calculate.Financials Must-know: Putting the price–to-book value ratio in perspective

We explored the most commonly used valuation metric for financial companies—the price-book value. We also understood the relation between price-book value and return on equity.

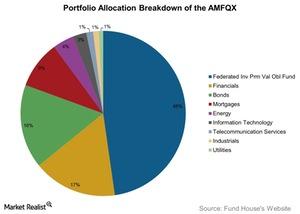

AMFQX: More Than 60% Exposure to Derivative Securities

AMFQX is an alternative mutual fund that seeks to generate positive absolute returns with a low correlation to the returns of broad stock and bond markets.

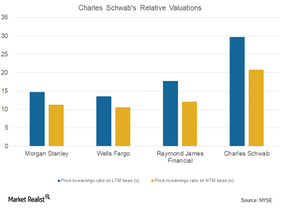

What’s Charles Schwab’s Valuation?

Charles Schwab (SCHW) has a price-to-earnings ratio of 20.80x on an NTM (next-12-month) basis.

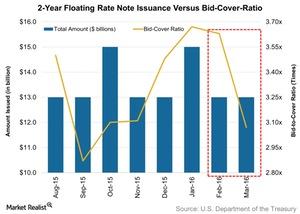

Why Overall Demand Tanked for 2-Year Floating-Rate Notes

Overall, $13 billion worth of floating-rate notes were auctioned, the same as in February’s auction.

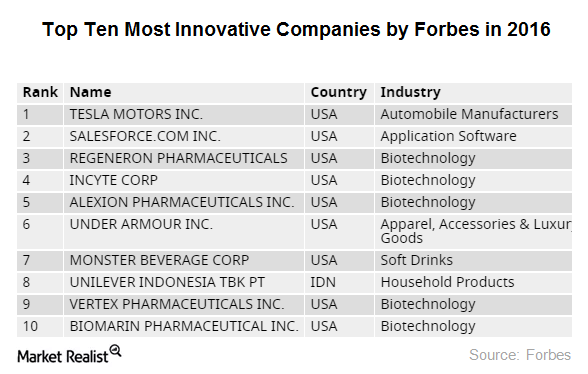

Why Salesforce Holds the Title of Most Innovative Company

In 2016, Salesforce has continued to report double-digit growth and was ranked as the most innovative company by Forbes for the sixth straight year.

Morgan Stanley and Goldman have bigger bond exposure than Bank of America and Citi

Bond underwriting exposure could be risky for investment banking departments, as interest rates begin to rise and refinancing slows.

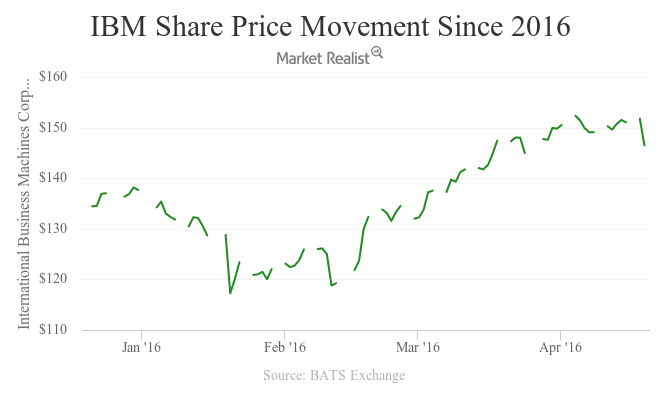

Why Did IBM Stock Fall after Its Fiscal 1Q16 Results?

Despite exceeding analysts’ estimates, IBM stock fell after the earnings announcement on April 18, 2016. It was IBM’s 16th consecutive quarter of revenue decline.

Understanding Banks’ Market and Reputational Risks

All banks face risks. Two key areas to understand are banks’ market risk and reputational risk. Here’s a summary of each type.

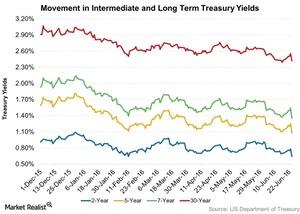

Brexit Vote: How Did US Treasury Auctions React?

The US Treasury auctioned 30-year TIPS (VIPSX)(LTPZ) worth $5 billion on June 22.

Understanding a Bank’s Operational and Business Risks

Banks experience operational risk in all daily bank activities, such as a check incorrectly cleared or a wrong order punched into a trading terminal.

Morgan Stanley Stock Falls Despite Strong Q3 Earnings Results

Morgan Stanley stock is trending downwards in the pre-market session on Oct. 15 after its third-quarter earnings results.

Bank of America: The second-largest US banking operation

Bank of America Corporation’s (BAC) banking operations are the second-largest in the United States by assets.

Tesla’s Real Competition: Automakers or Mega-Tech?

Tesla (TSLA) stock has been polarizing like no other. Analysts and investors have very strong views about the stock on either side.

Why the price-to-book value ratio’s the most used valuation

The price-book value ratio is the ratio of the market value of equity to the book value of equity. Price stands for the current market price of a stock. Book value is the total assets minus liabilities, or net worth, which is the accounting measure of shareholders’ equity in the balance sheet.

Must-Know: Credit and Liquidity Risks in Banking

The top risks that every bank faces are credit risk and liquidity risk. We’ll look at the banks that managed this risk safely, and those that didn’t.

Amazon: Analysts Revise Target Price, Earnings Are a Concern

Amazon (AMZN) shares are trading close to 4% in early-market today. The company announced its third-quarter results on Thursday.

Adobe, Workday, and ServiceNow Fall Due to Downgrades

Adobe (ADBE), Workday (WDAY), and ServiceNow shares have lost significant market value in early-market trading today. Adobe stock has fallen close to 4%.

An Overview of the US Banking Sector

The banking sector plays a pivotal role in our daily lives. This series explores the sector, its driving factors, and its key indicators and latest trends.

JPMorgan and Bank of America: Time to Buy Stocks

In August, JPMorgan Chase (JPM) and Bank of America Merrill Lynch (BAC) suggested that investors not buy just yet. Their opinions are now changing.

JPMorgan and BofA: Don’t Buy the Market Dip Just Yet

JPMorgan Chase suggests waiting until September before returning to stocks. The markets will likely make new all-time highs in the first half of 2020.

Morgan Stanley Sees Ford’s Dip as a ‘Buying Opportunity’

Yesterday, Morgan Stanley upgraded Ford Motor Company stock from “equal weight” to “overweight” and increased its target price.

Morgan Stanley Is Skeptical about the S&P 500’s Upside

Morgan Stanley doesn’t believe the S&P 500’s current breakout above 3,000 will last. It also doesn’t expect Fed rate cuts to rekindle growth.

Analysts Lower Target Price on FedEx after Its 2019 Outlook Cut

Most analysts reduced their target prices on FedEx after the delivery giant trimmed its fiscal 2019 earnings outlook.

Southwest Stock Rose on Speculation about Warren Buffett Takeover

Southwest Airlines (LUV) rose over 4% yesterday on social media speculation that Warren Buffett’s Berkshire Hathaway is considering a takeover bid.

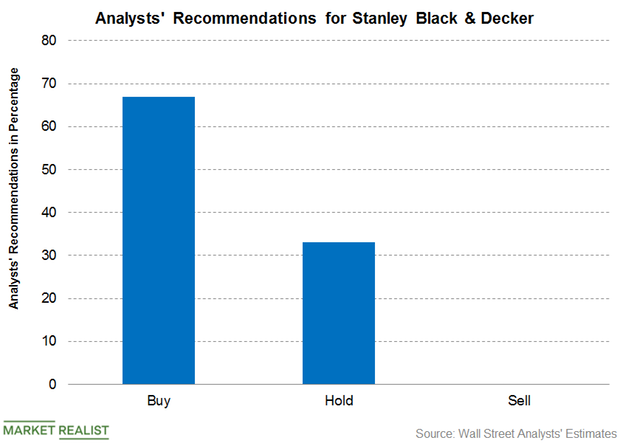

Stanley Black & Decker: Analysts’ Recommendations

Currently, 21 analysts are actively tracking Stanley Black & Decker. Among the analysts, 67% recommend a “buy,” while 33% recommend a “hold.”

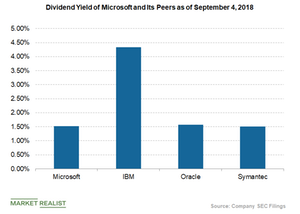

How Is Microsoft Returning Value to Shareholders?

Tech giant Microsoft (MSFT) has been rewarding its shareholders with dividend payments.

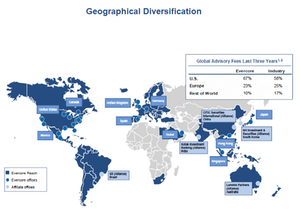

A Look at Evercore’s Business Model

Evercore generated 25% of its fees from its technology, media, and telecom sector, 20% from its energy sector, and 17% from its financials sector in 4Q17.

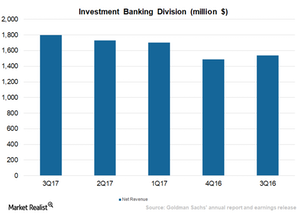

Goldman Sachs and Its Commanding Investment Banking Division

Goldman Sachs’s (GS) Investment Banking segment generated revenues of $1.8 billion in 3Q17, which was a 4% rise compared to 2Q17.

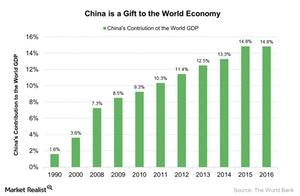

James Gorman Says China ‘Is a Gift to the World Economic Growth’

James Gorman, chair and CEO of Morgan Stanley (MS), shared his view on China (FXI) (YINN) in an interview with CNBC.

Why Symantec’s Enterprise Security Segment Is Inclined toward the Cloud

In late May 2017, Microsoft (MSFT) acquired Hexadite to strengthen its position in the cybersecurity space.

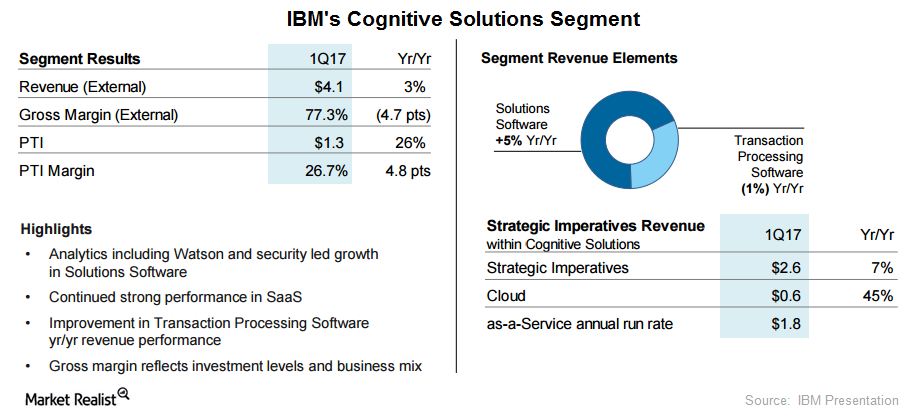

How Has IBM’s Cognitive Solutions Segment’s Performance Been?

Despite its aggressive measures to tap growth, top line growth continues to be elusive for IBM. The company’s 1Q17 results marked its 20th straight quarter without revenue growth.

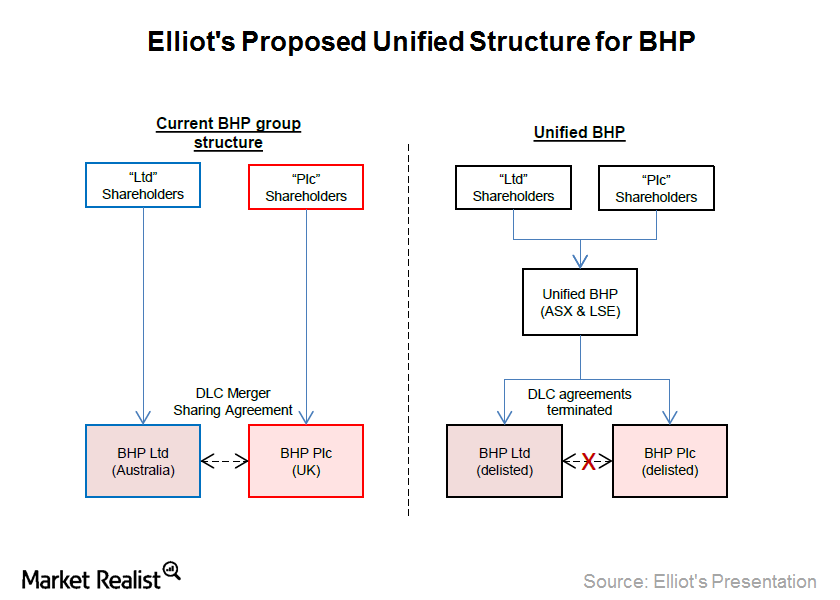

A Unified Structure for BHP: Do the Costs Outweigh the Benefits?

Elliott Funds has proposed unifying BHP Billiton’s (BHP) (BBL) dual-listing structure into a single Australian-headquartered and Australian tax resident–listed company.

Will Strategic Imperatives Again Rule IBM’s 4Q16 Results?

Despite a fall in overall revenue and no growth in any of its operating segments, IBM’s Strategic Imperatives segment managed to post growth in 3Q16.

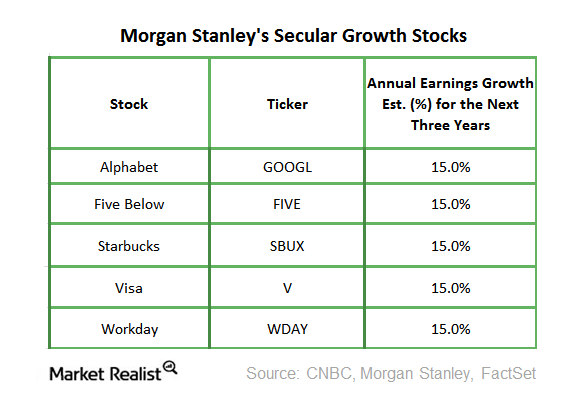

A Look at Morgan Stanley’s Top 5 ‘Secular Growth’ Stock Picks

On Friday, October 14, 2016, Morgan Stanley (MS) released a list of its favorite “secular growth” stock picks. It believes these stocks have long-term growth possibilities.

Analysts’ Ratings for Celanese before Its 2Q16 Earnings Release

On July 12, 2016, Celanese’s (CE) consensus 12-month target price was $76.30, indicating a return potential of 11.3% from that day’s closing price of $68.57.

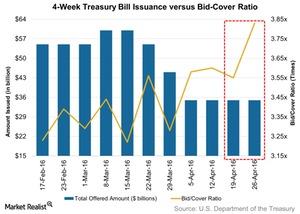

Fundamental Market Demand Rose for 4-Week Treasury Bills Auction

The US Department of the Treasury conducted the weekly auction of four-week Treasury bills (or T-bills) on April 26.

What Are TIPS and How Do They Benefit Investors?

Treasury inflation-protected securities (or TIPS) protect the value of debt securities from eroding due to a rise in inflation.

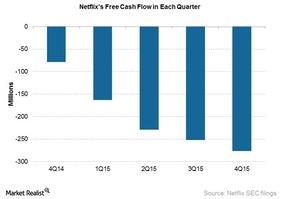

A Look at Netflix’s Capital Structure

At -$276 million, Netflix had negative free cash flow for the fourth straight quarter in 2015 as the company continued investing in original programming.

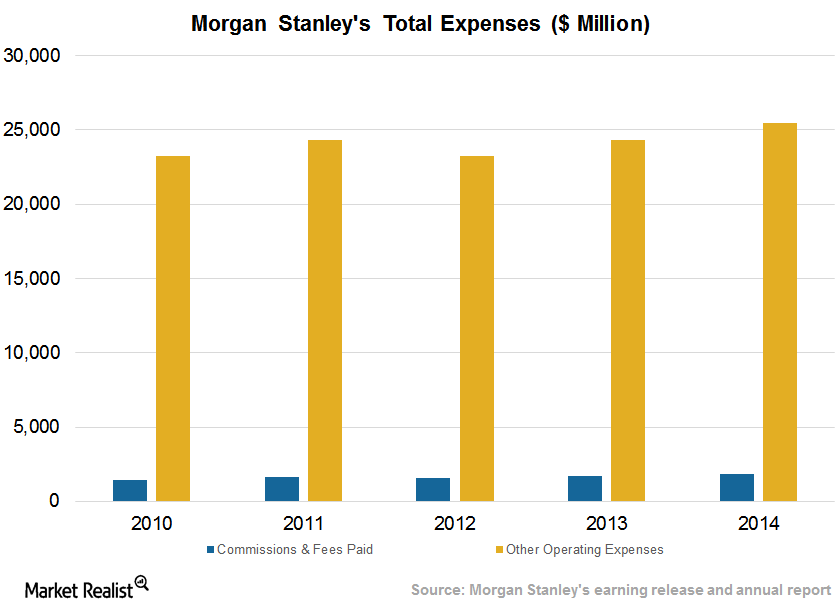

Morgan Stanley’s Careful Attention to Compensation Expenses

Morgan Stanley divides its non-interest expenses into compensation and non-compensation. It’s compensation expenses (and benefits) are ~80% of this class.

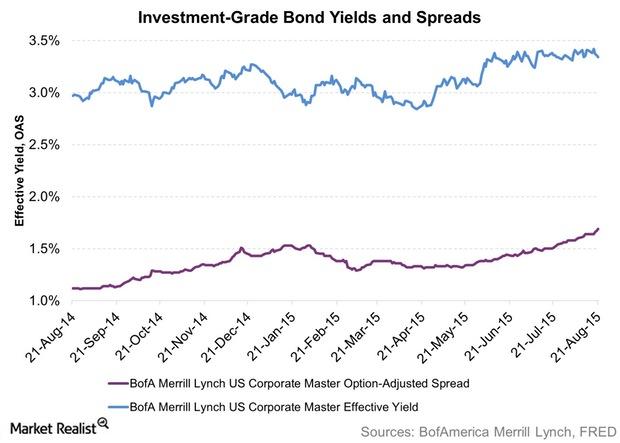

Spreads between High-Grade Bonds and Treasury Yields

If spreads widen further, high-grade bonds will become more attractive because yields and prices are inversely related. A rise in yields indicates falling prices.

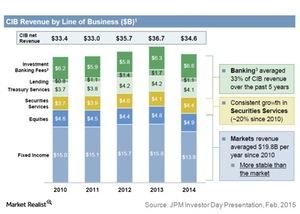

How J.P. Morgan Ranks in Corporate and Investment Banking

In the US, J.P. Morgan competes with Bank of America (BAC), Goldman Sachs (GS), and Morgan Stanley (MS), the leading players in investment banking.