MasterCard Inc

Latest MasterCard Inc News and Updates

Why High-Margin Stocks Are a Good Buy Amid Economic Uncertainty

Goldman Sachs, which expects the S&P 500 to rise to 5,100 in 2022, is advising investors to look at high-margin stocks. Should you buy them?

Revisiting PayPal–Amazon Payment Partnership Talks

PayPal’s (PYPL) chief financial officer, John Rainey, mentioned partnering with Amazon (AMZN) during a recent Credit Suisse technology event. He didn’t clarify whether the companies were still in active talks.

Understanding PayPal’s Choice Transition

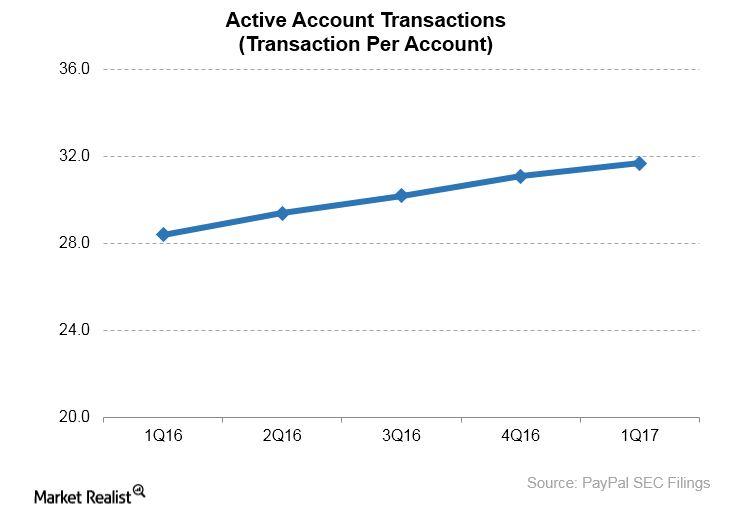

PayPal reported that its payment transaction per active account increased 12.0% year-over-year in 1Q17.

Why PayPal Stock Is an Attractive Pick for Investors

On Thursday, PayPal stock rose 2.6% and closed at $168.05 after an analyst upgrade. At the last closing price, PayPal’s market cap was $197.3 billion.

Is AXP Stock a ‘Sell’ after Its Q1 Earnings?

Today at 7:02 AM ET, AXP stock rose 1.1% to $84.10 in the pre-market session. The company reported its first-quarter earnings results on April 24.

Bitcoin Year in Review and 2020 Forecast

I wouldn’t call 2019 a sea of tranquility for Bitcoin. But at least it wasn’t as much of a roller-coaster ride as the two preceding years.

US GDP Shatters Expectations, Pessimists Run for Cover

The US GDP increased at an impressive rate of 1.9% for the third quarter. The growth beat the expectations of around 1.6% for the quarter.

Why Apple Services Are Overshadowing the iPhone

By 2020, Apple aims to double its Services revenue from 2016. Meanwhile, the iPhone is looking less and less important for the company.

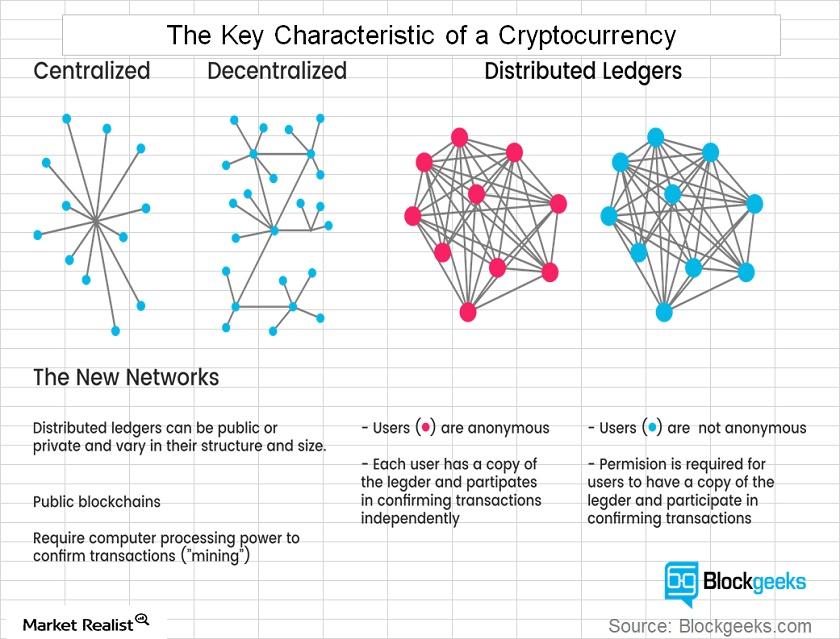

Verizon and Wells Fargo Are Getting on the Blockchain

Verizon (VZ) and Wells Fargo (WFC) are taking steps to integrate blockchain technology into their business models. Here’s why.

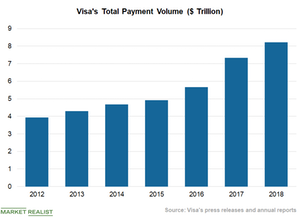

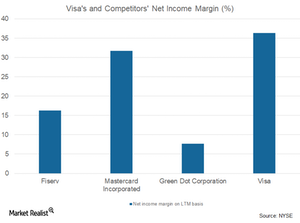

Digitization and Tech Investment Drove Visa’s Payment Volume

Visa’s (V) fourth-quarter results benefited from the growing global trend of cashless transactions.

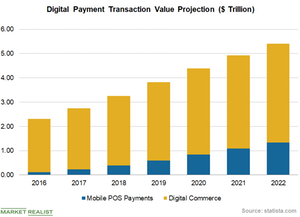

Rising Digital Payments to Support Mastercard’s Long-Term Growth

Statista projects that the total value of global digital payment transactions could increase to ~$5.41 trillion in 2022 from ~$2.75 trillion in 2017.

What Are Mastercard’s Growth Strategies?

Over the past few years, Mastercard’s (MA) revenues have remained consistent.

Inside Visa’s Operating Expenses

Visa (V) saw a rise of 13% in total operating expenses on a YoY (year-over-year) basis in fiscal 1Q18. It incurred $1.5 billion in expenses in fiscal 1Q18 compared to $1.4 billion a year earlier.

Breaking down Bitcoin and Cryptocurrencies: Key Characteristics

In the case of bitcoin, the safety of the system is linked with the bitcoin algorithm, which miners keep solving to generate new coins and maintain the system.

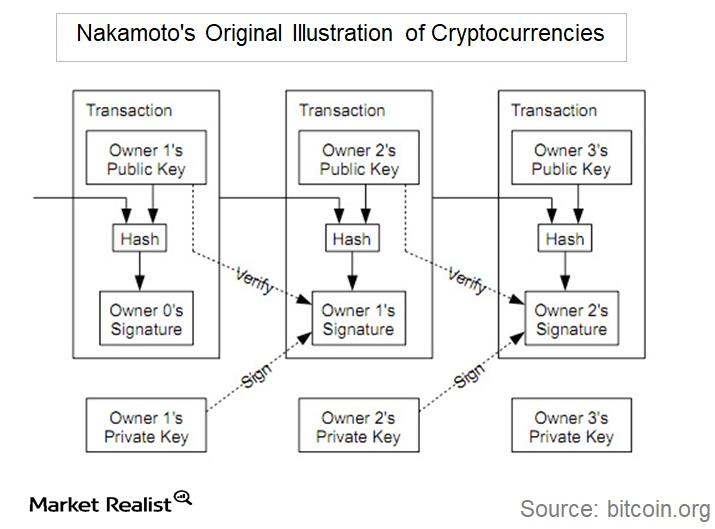

How the First Bitcoin Was Created

Satoshi Nakamoto is considered to be the founder of bitcoin, but the actual identity of Satoshi Nakamoto is not known.

Analyzing Visa’s Assets and Liabilities

As of September 30, 2016, Visa (V) has reported a total asset balance of $64.03 billion. As of June 30, 2017, the company managed to report a total asset balance of $64.00 billion.

Why PayPal Favors a 2-Sided Network

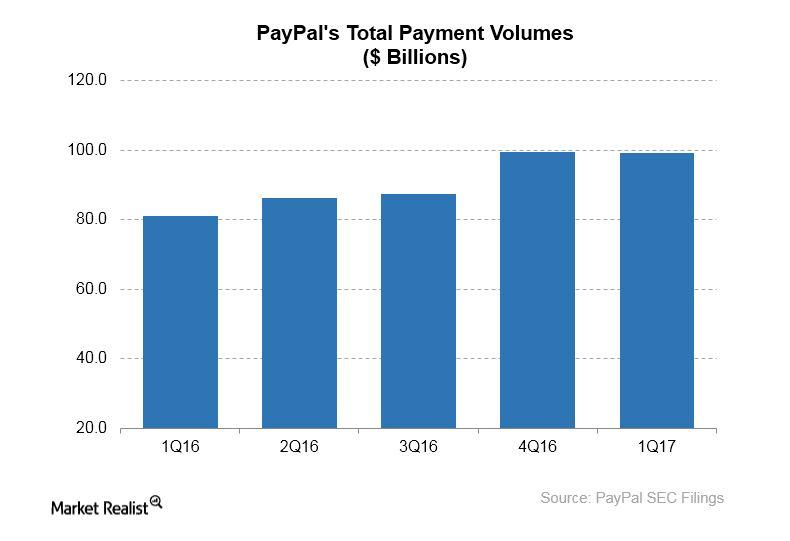

PayPal (PYPL) processed $99.3 billion in payment volumes in 1Q17, up 23% year-over-year.

A Look at PayPal’s Notable Achievements

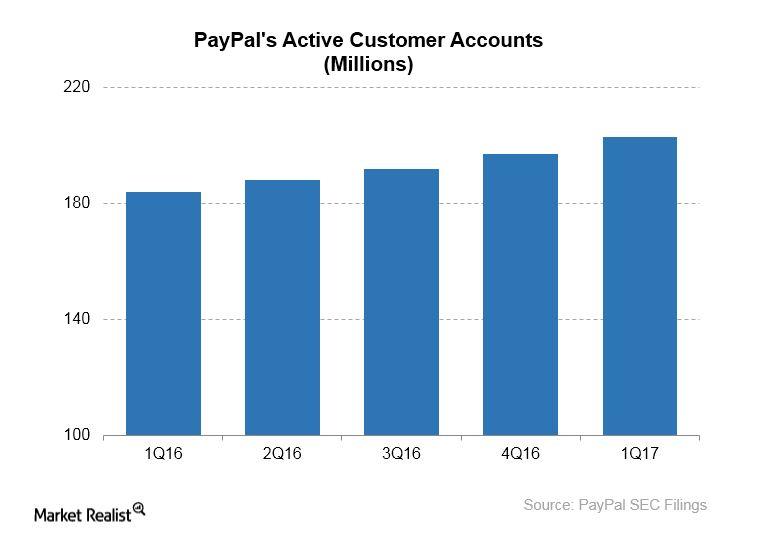

PayPal concluded 1Q17 with ~203 million active registered accounts, up from 197 million in 4Q16 and 184 million a year earlier.

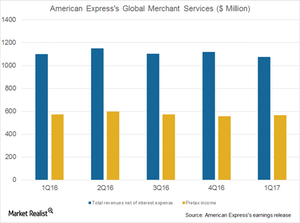

Inside American Express’s Global Merchant Services Segment

American Express’s (AXP) Global Merchant Services segment is expected to see a marginal increase in its net income in 2Q17.

American Express to Ride on Partnerships, Digitization

American Express (or Amex) (AXP) has entered into digital partnerships with Airbnb, Facebook (FB), and Uber in order to offset the revenue loss from Costco (COST).

How Visa Created a Network Effect

Visa (V) boasts a significant advantage in terms of its worldwide acceptance. This availability lent to the network effect’s being the source of the company’s moat.

Will Payment Processors Keep Seeing the US Dollar Impact in 2017?

Payment processors are now seeing improved performances on increased spending, new technologies, expansion into global markets, and the stable US dollar.

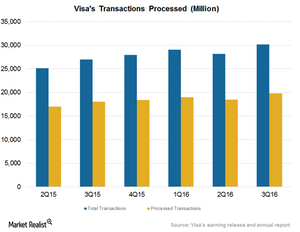

International Use to Boost Visa’s Fiscal 4Q16 Processed Transactions

Visa (V) reported total transactions of $30.2 billion in fiscal 3Q16, compared to $27 billion in fiscal 3Q15—a growth of 11.8% year-over-year.

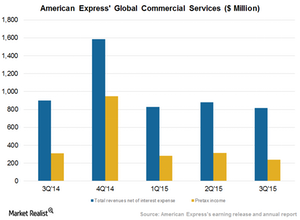

American Express Is Focusing on Its Global Commercial Services

American Express’s Global Commercial Services’ total revenues net of interest expense fell by 9% to $817 million in 3Q15, forming 10% of its total revenues.

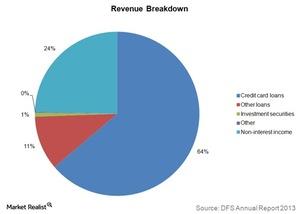

What investors should know about Discover Financial Services

Discover Financial Services (DFS) is a direct bank and electronic payment services company in the US. It offers an array of banking products.

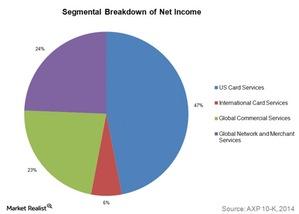

American Express and Its Four Operating Segments

Of the four American Express segments, the Global Network and Merchant Services segment has shown the highest growth over the last two years.

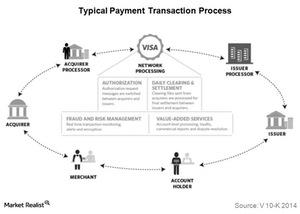

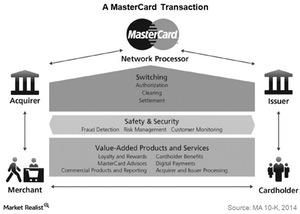

What Happens When You Swipe a Visa Card?

Visa’s open-loop payments network connects and manages the exchange of information between issuers and acquirers.

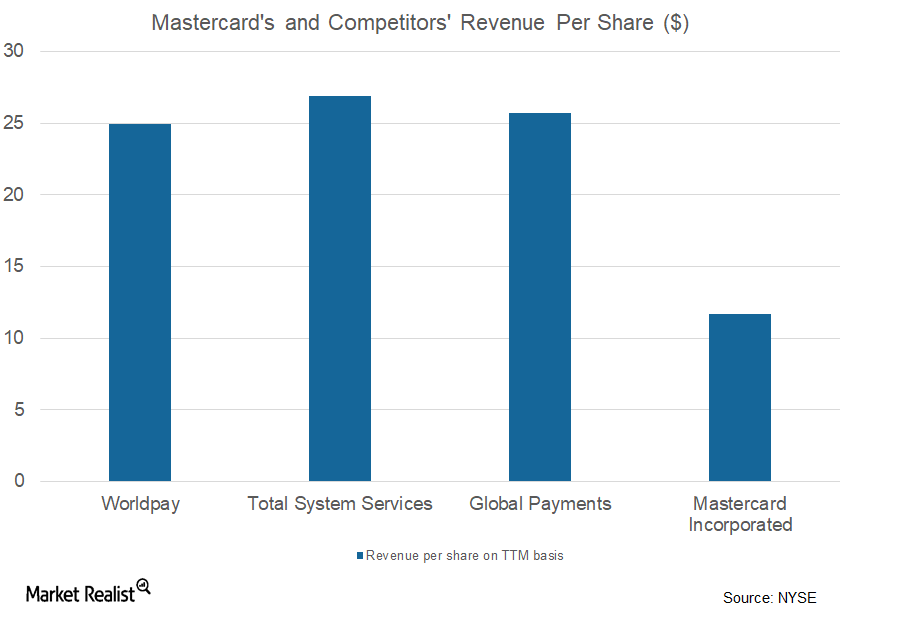

MasterCard: The World’s Second Largest Payment Processing Company

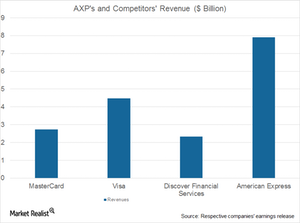

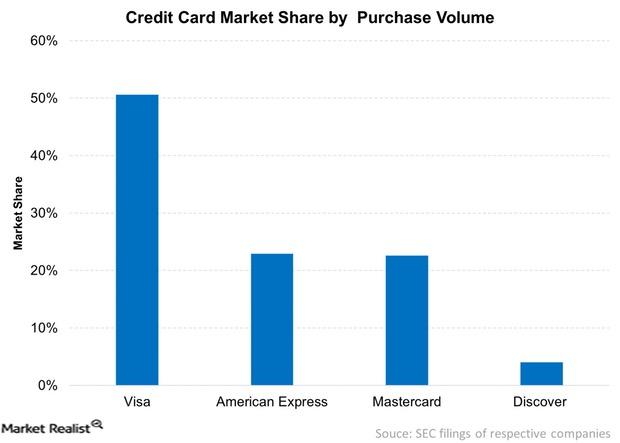

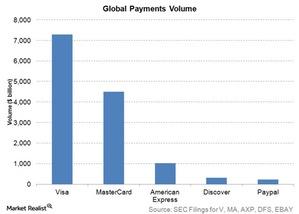

MasterCard enables consumers and businesses to use electronic modes of payment instead of cash and checks. MasterCard’s payment network is the second largest in the world, behind industry leader Visa.

Understanding MasterCard’s Credit and Debit Products

MasterCard’s digital platform MasterPass streamlines the retail sale and purchase process for the consumer and the merchant.

MasterCard Operates in an Intensely Competitive Payments Industry

Cash and checks constitute ~85% of the retail payment transactions worldwide. However, electronic payment methods are increasingly replacing cash and check payments globally.

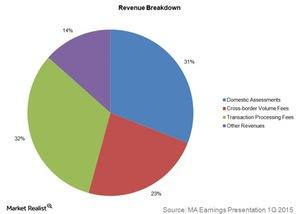

How MasterCard Generates Its Revenue

MasterCard’s revenue sources include transaction processing fees, as well as fees for fraud-prevention products and services.

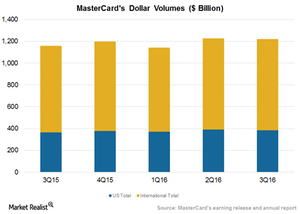

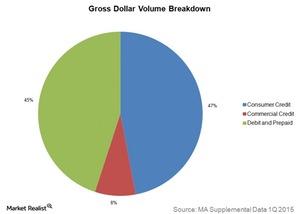

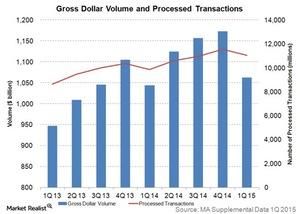

Why Growth in MasterCard’s Gross Dollar Volume is Important

The US accounts for 32% of MasterCard’s total gross dollar volume. The Asia-Pacific, Middle East, and Africa contribute 31%, and Europe accounts for 27% of the total volume.

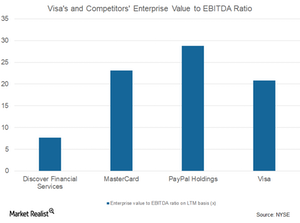

MasterCard Does Not Look Overvalued Compared to Historical Levels

MasterCard focuses on growth in its core business of credit, debit, prepaid offerings, and processed transactions. It seeks to diversify its customer base, including smaller merchants and consumers who still use cash and checks.