SPDR EURO Stoxx 50 ETF

Latest SPDR EURO Stoxx 50 ETF News and Updates

What Does the UK Really Have to Gain from Exiting the EU?

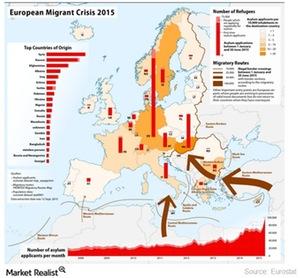

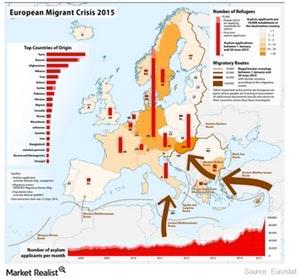

The EU’s light immigration laws allow young talent to work across the EU, but with more immigrants entering the UK, local citizens have less access to jobs.

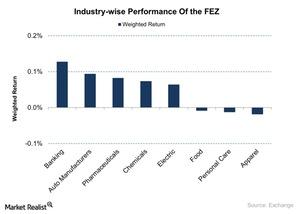

Positive Manufacturing Reports Drive the FEZ Up

The SPDR Euro Stoxx 50 ETF (FEZ) is a US exchange-traded ETF that tracks the performance of the 50 largest companies across the Eurozone.

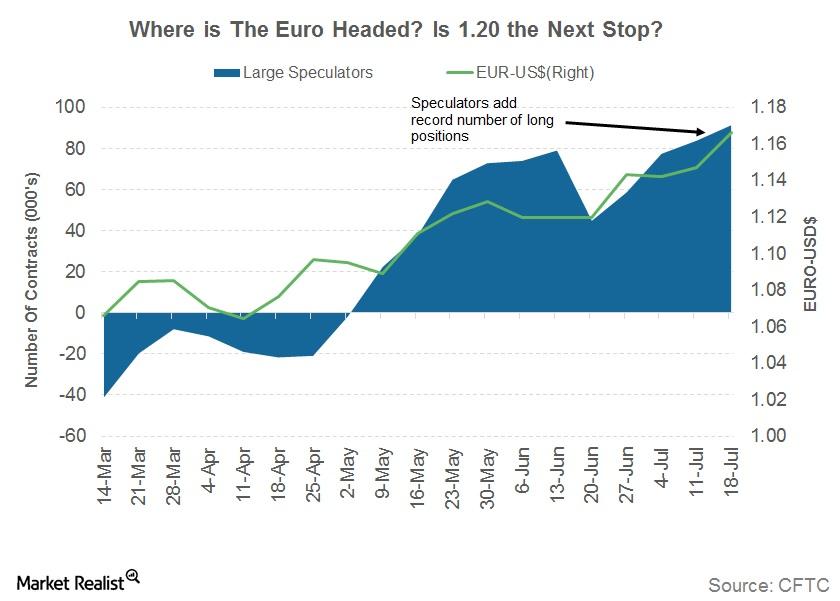

Euro Reaches 23-Month Peak: Could It Climb Higher?

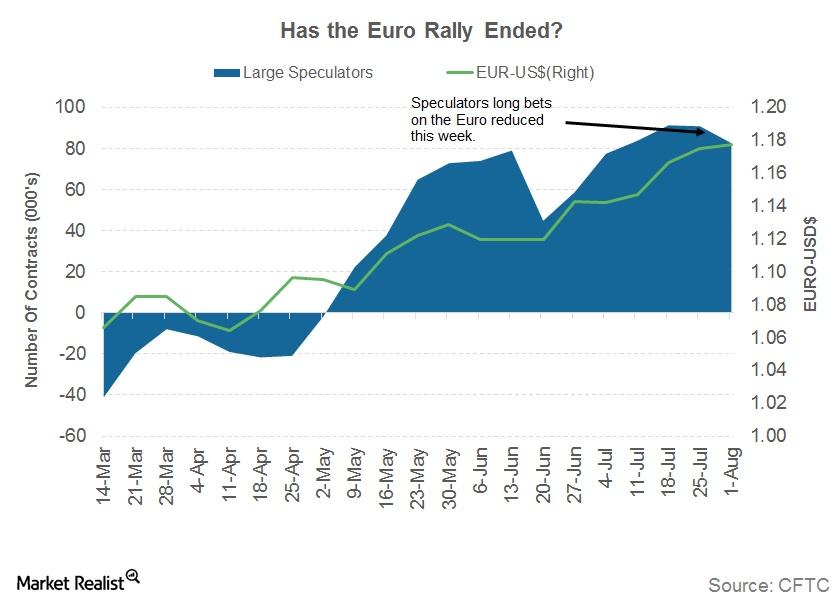

Euro rallies to a 23-month peak Last week, the euro (FXE) closed at 1.17, appreciating by 1.7% against the US dollar (UUP). The currency has appreciated by more than 10% against the US dollar this year, making it one of the strongest developed market currencies. Improving economic conditions and a stable political climate turned the […]

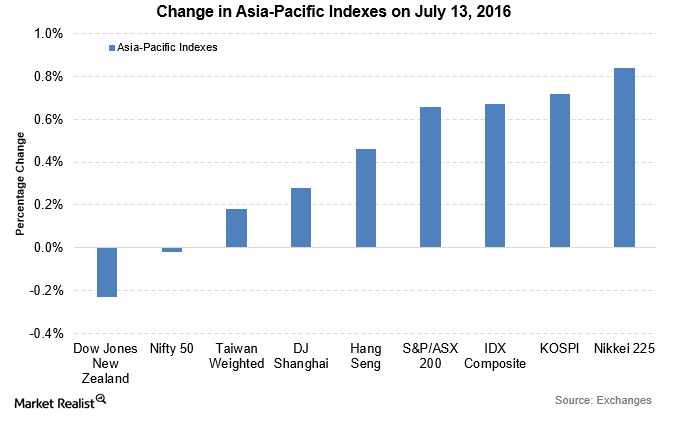

Why Are Global Markets Range Bound?

The contrasting movement among the global markets was primarily due to caution ahead of the Bank of England’s monetary policy release on July 14.

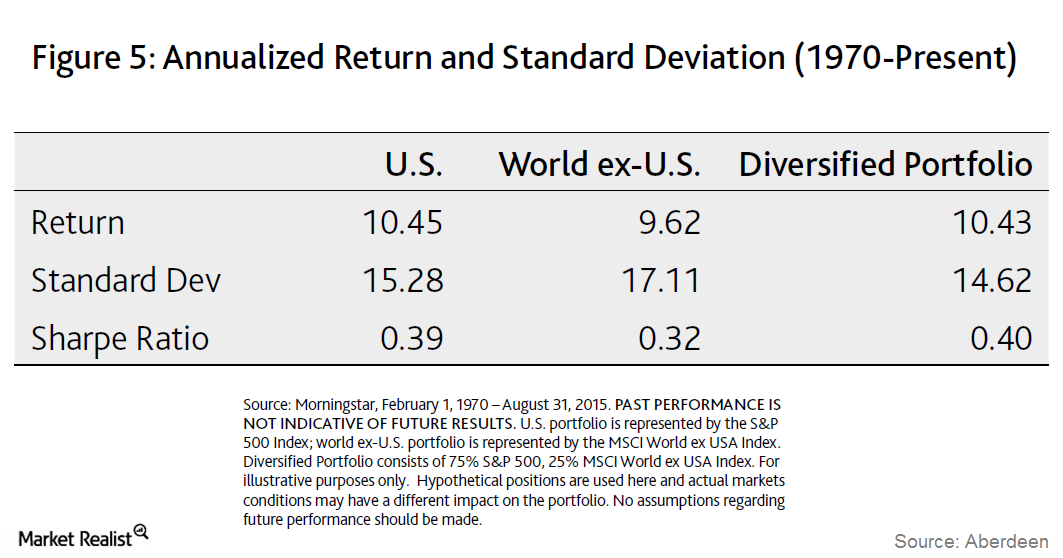

Risk and International Assets in a Portfolio

Although international investing does tend to mitigate risk and diversify portfolios, there are certain risks involved.Financials The key arguments of the Yes campaign of the Scottish referendum

The voting result of the Scottish Referendum, due September 18, will have a direct bearing on Scotland, the United Kingdom, and the 28-member European Union as a whole.

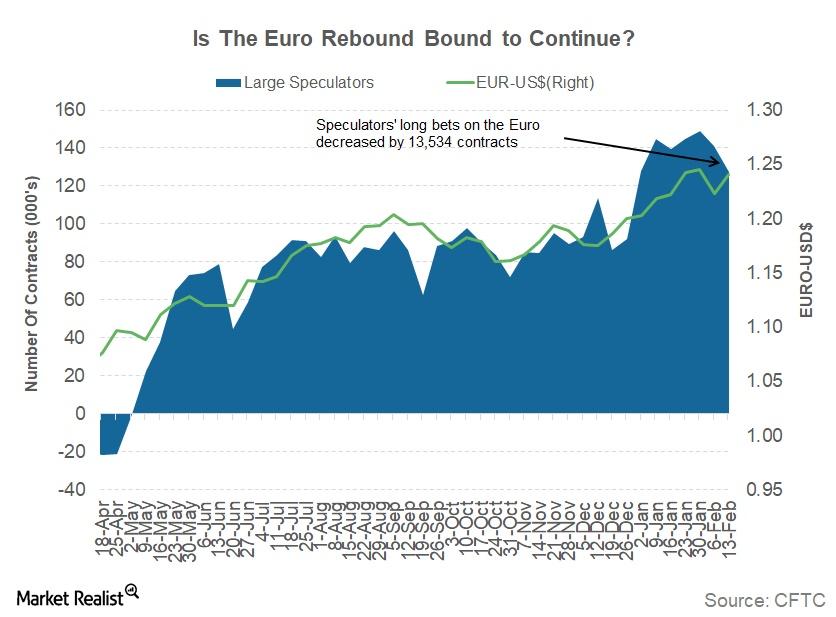

What to Expect from the Euro This Week

The euro-dollar (FXE) exchange rate closed the week ending February 16 at 1.24, an appreciation of 1.4% against the US dollar (UUP).

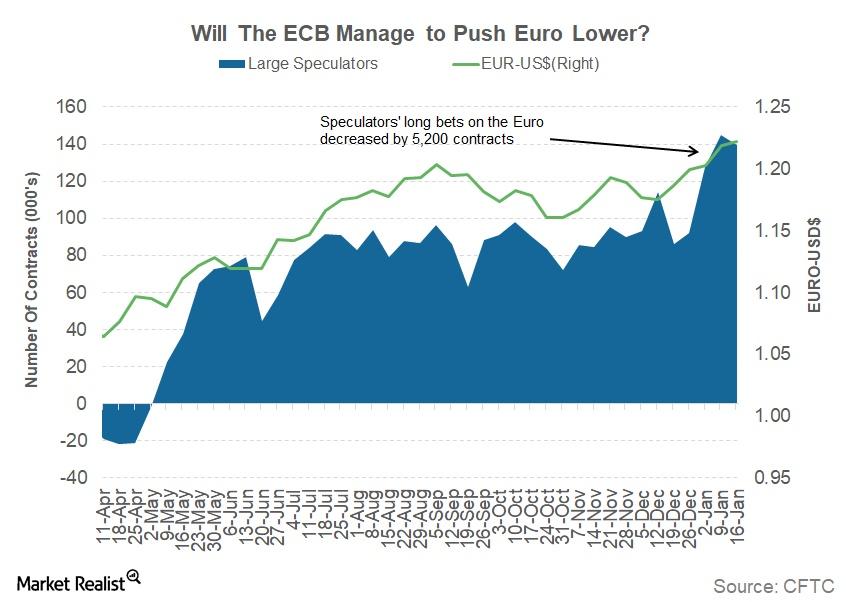

Politics and Central Bank Comments Could Drive the Euro Higher

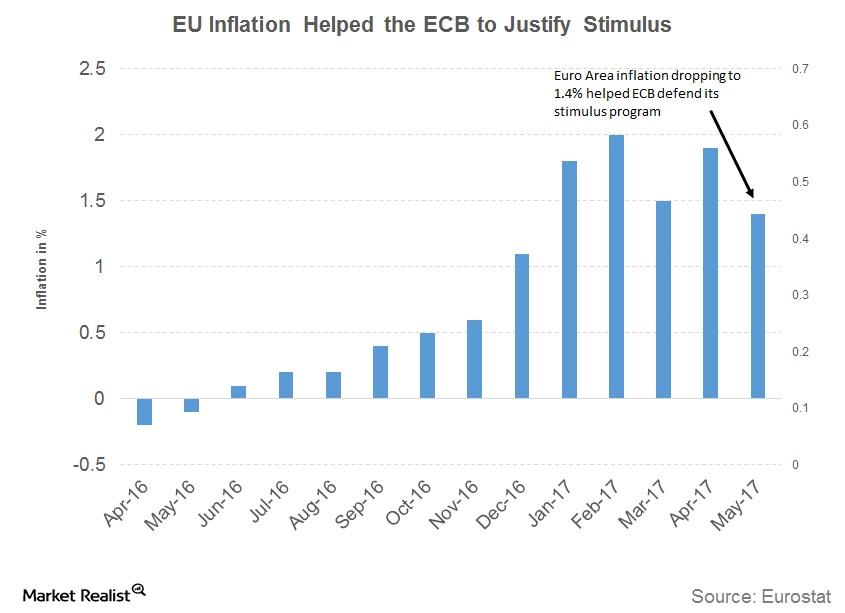

The Eurozone’s inflation data published on January 17 indicated that prices increased 1.4% in December 2017, which is still below the long-term average.

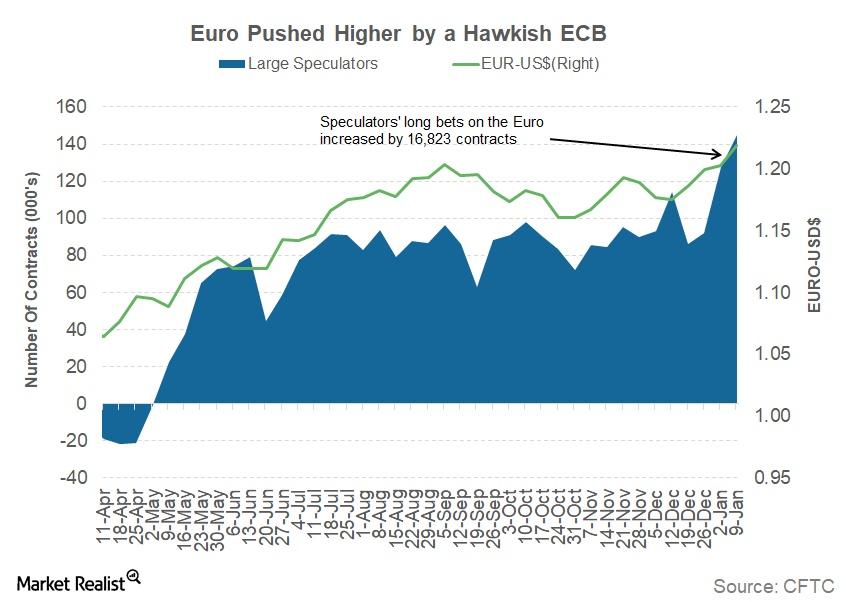

What Factors Are Driving the Euro Higher?

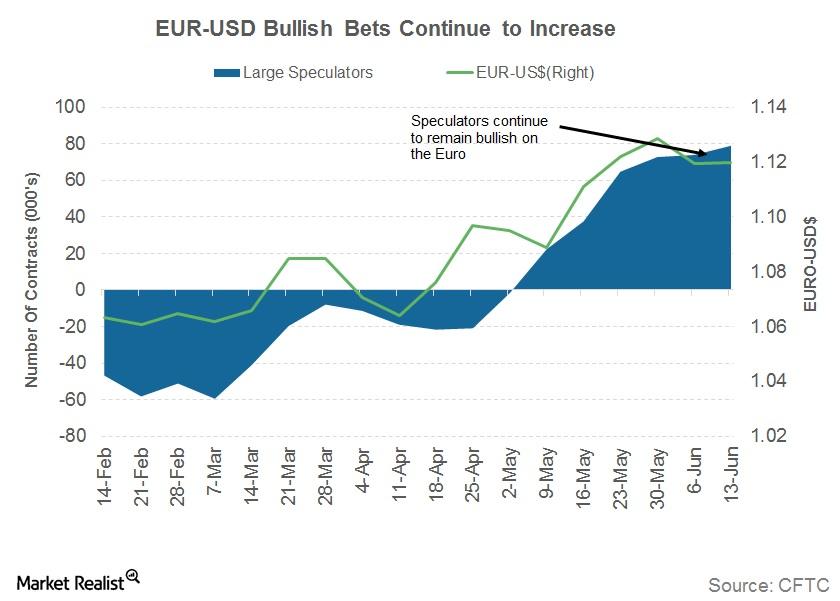

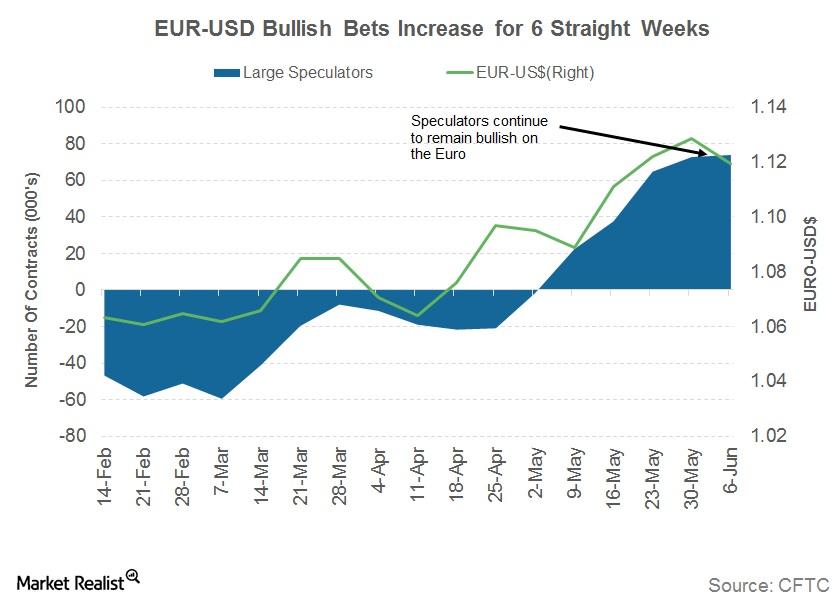

According to the January 12 Commitment of Traders report, speculators increased their long euro positions by 16,823 contracts last week.

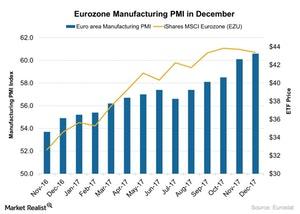

Eurozone Manufacturing Activity Reaches a High in December 2017

Eurozone manufacturing activity in December According to Markit Economics, the Eurozone’s manufacturing PMI (purchasing managers’ index) rose strongly in December 2017, to 60.6 from 60.1 in November 2017. It beat the market expectation of 60.4 and marked the strongest expansion in manufacturing activity since 1997. Major Eurozone members Germany (EWG) (DAX-INDEX), France (EWQ), Spain (EWP), and Italy […]

What France’s Manufacturing Activity Indicates

France’s manufacturing activity in December According to Markit Economics, France’s manufacturing PMI (purchasing managers’ index) rose strongly in December 2017, to 58.8 from 57.7 in November 2017. Whereas the index didn’t meet the market estimate of 59.3, it marked the strongest improvement in manufacturing activity since September 2000. France’s expansion in manufacturing activity suggests that business […]

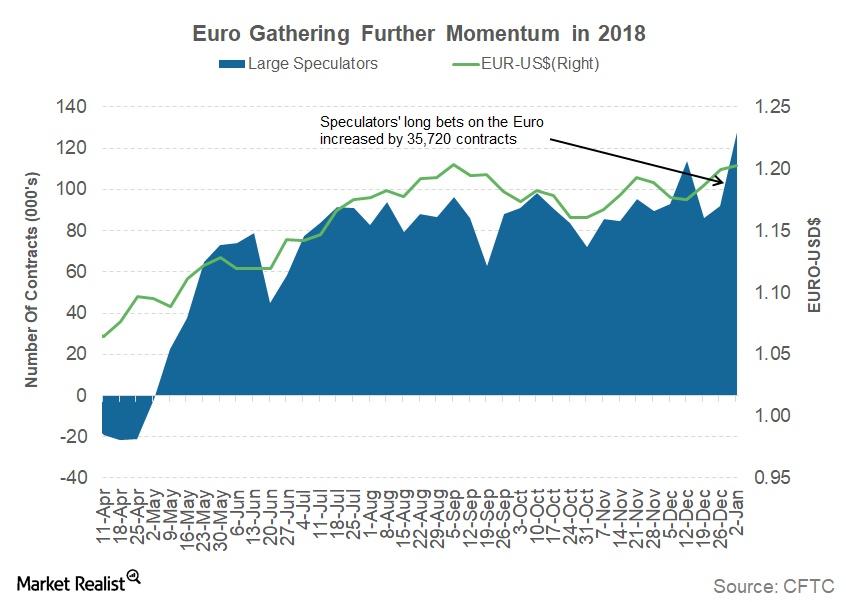

Factors That Are Driving the Euro Higher

The euro appreciated 0.27% against the US dollar (UUP) after posting double-digit gains against the US dollar in 2017.

What to Make of the Surprising Gains in the Euro in 2017

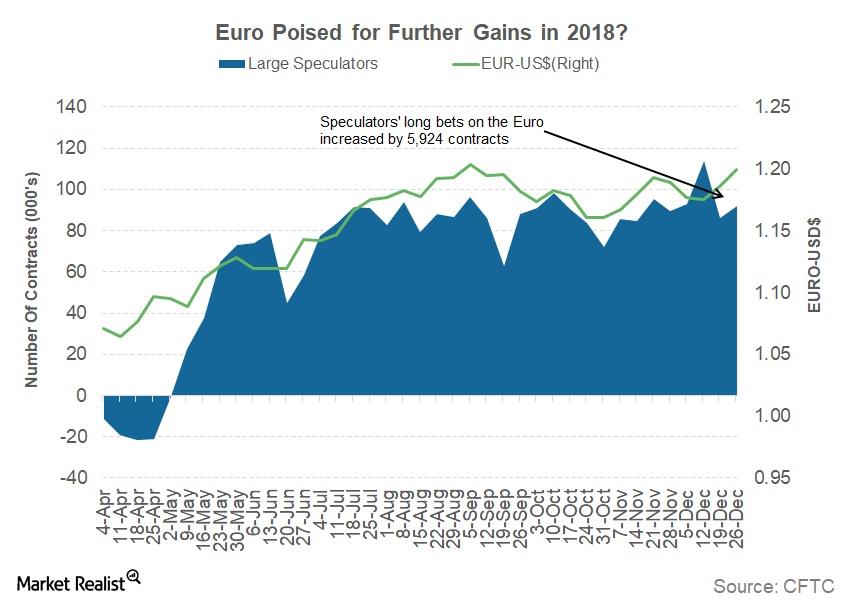

The euro–dollar (FXE) pair closed 2017 at 1.1998. It appreciated by 13% against the US dollar and posted close to 10% gains against the other major global currencies.

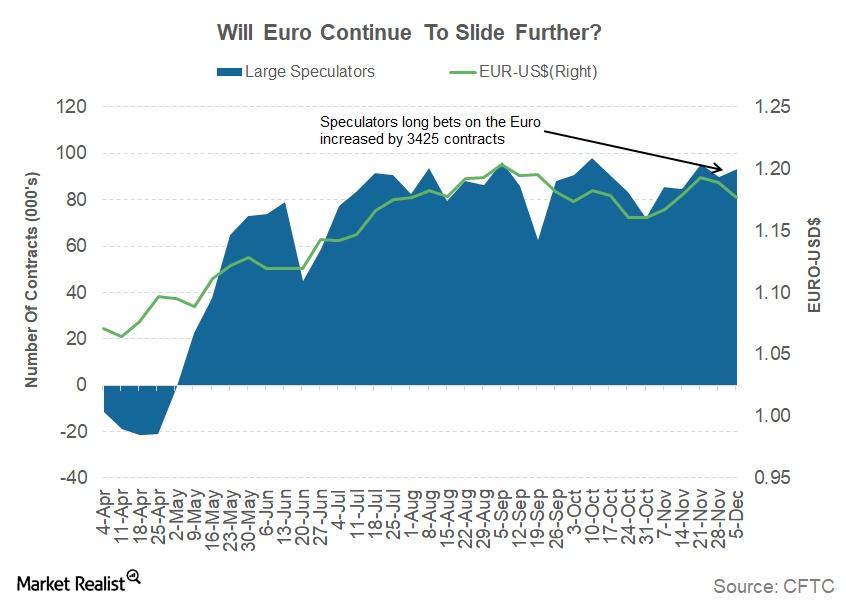

Here’s What Drove the Euro Higher Last Week

The euro (FXE) closed the week ended December 22, 2017, at 1.1864, appreciating 0.94% against the dollar (UUP).

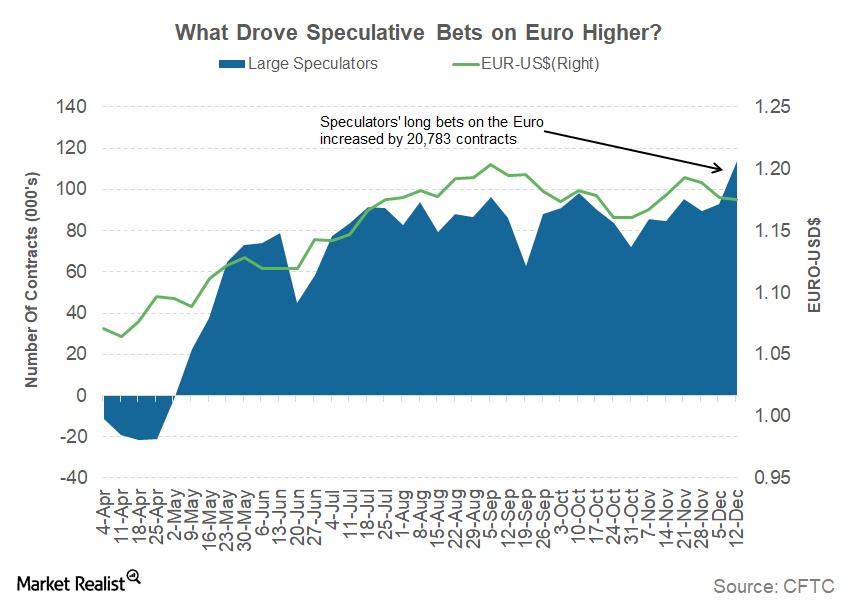

What Drove the Euro Higher Last Week?

The total net speculative bullish positions on the euro (EUFX) increased from 93,106 contracts to 113,889 contracts in the previous week.

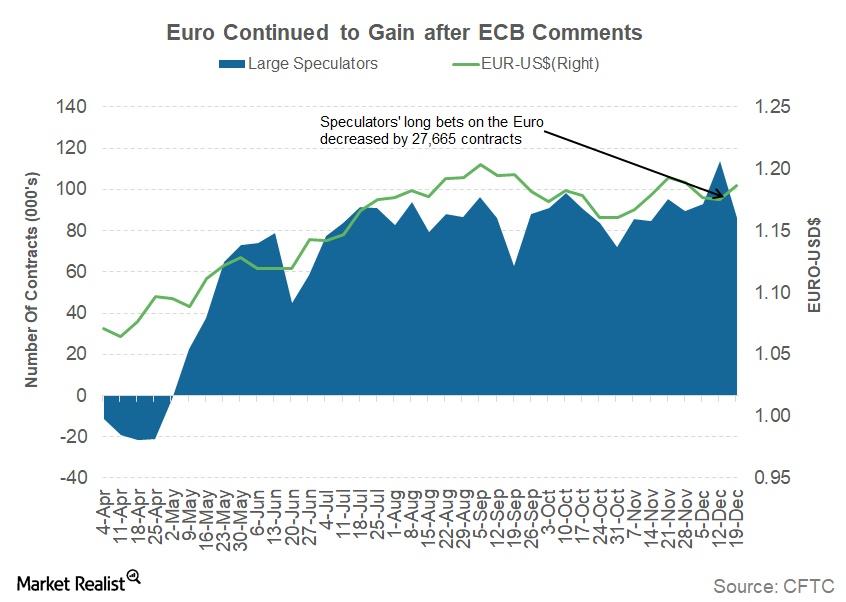

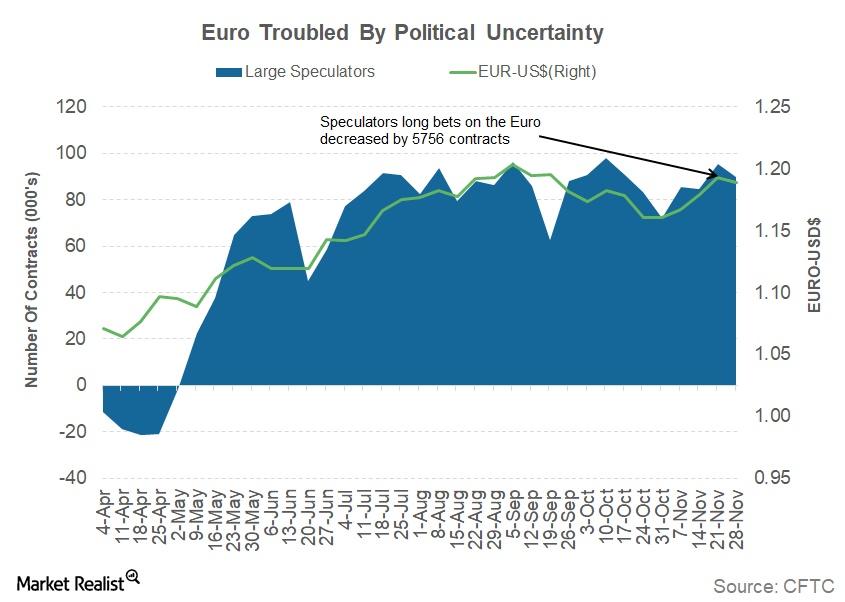

Why the Euro Continued to Fall Last Week

The euro-dollar (FXE) closed the week ending December 8 at 1.18, depreciating by 1.1% against the US dollar (UUP).

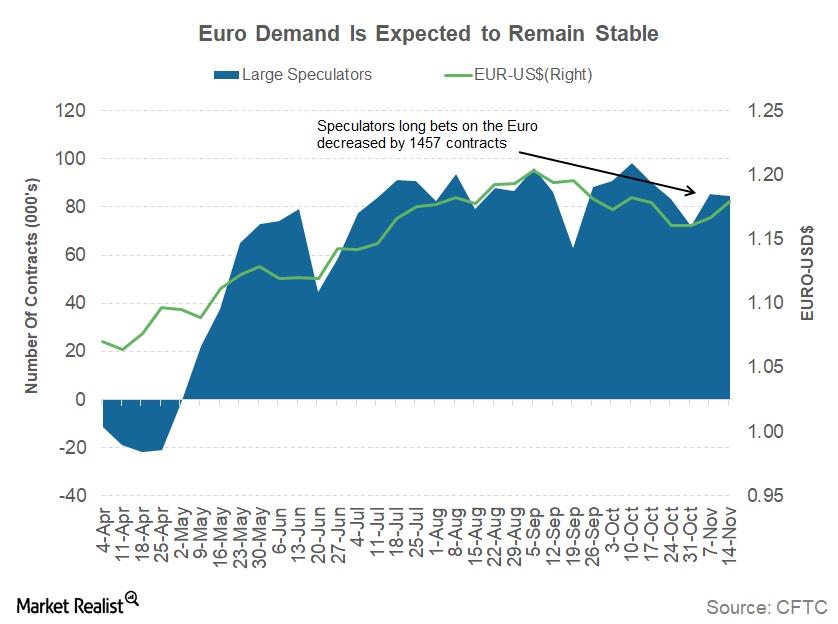

Are Politics Holding the Euro Back?

The euro-dollar (FXE) closed the week ending December 1 at 1.19, depreciating by 0.33% against the US dollar (UUP).

What Drove the Euro Higher against the Dollar Last Week?

The euro-dollar (FXE) closed the week ending November 17 at 1.2, appreciating by 1.1% against the US dollar (UUP).

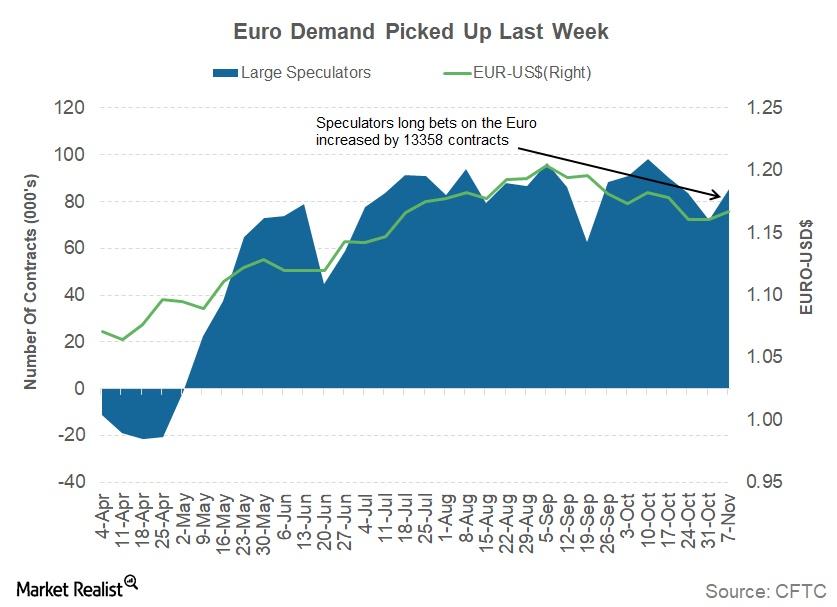

How Euro Managed to Bounce Back Last Week

The euro-dollar (FXE) pair closed the week ending November 10 at 1.2, appreciating 0.48% against the US dollar (UUP).

Why the Euro Is Likely to Remain Quiet this Week

The euro-dollar pair (FXE) closed the week ending November 3 at 1.1609 against the US dollar (UUP). Worries about a possible escalation of tensions in Spain’s Catalonia region proved futile.

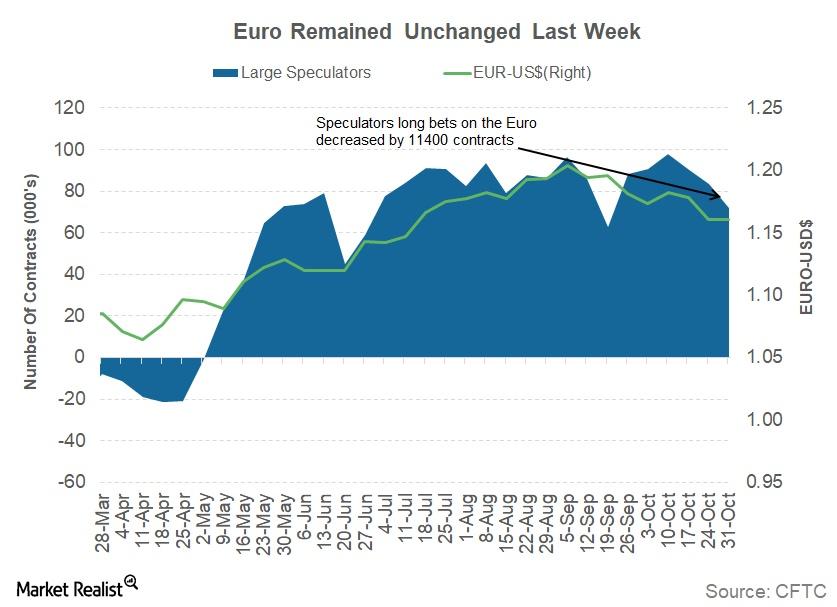

How Political Drama and ECB’s Dovish Statement Affected the Euro

The euro-dollar (FXE) pair closed the week ending October 27 at 1.16 against the US dollar (UUP).

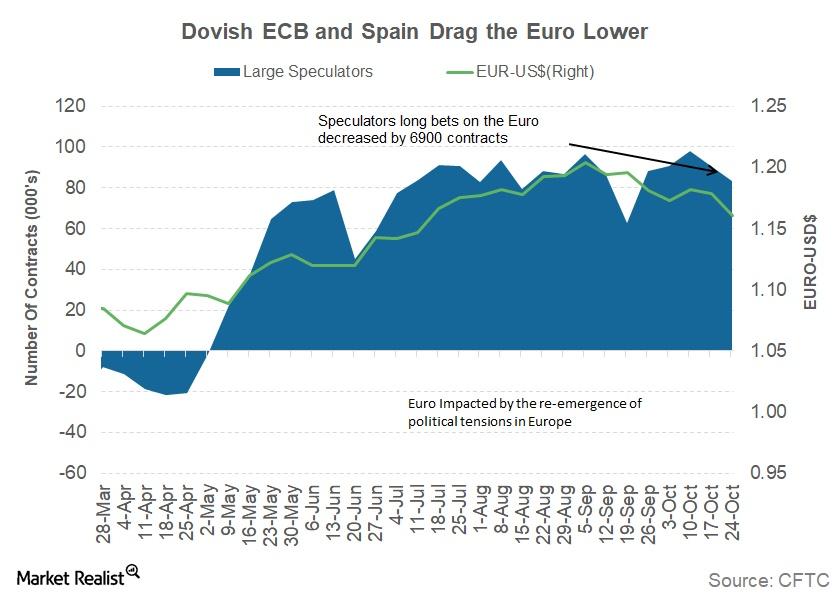

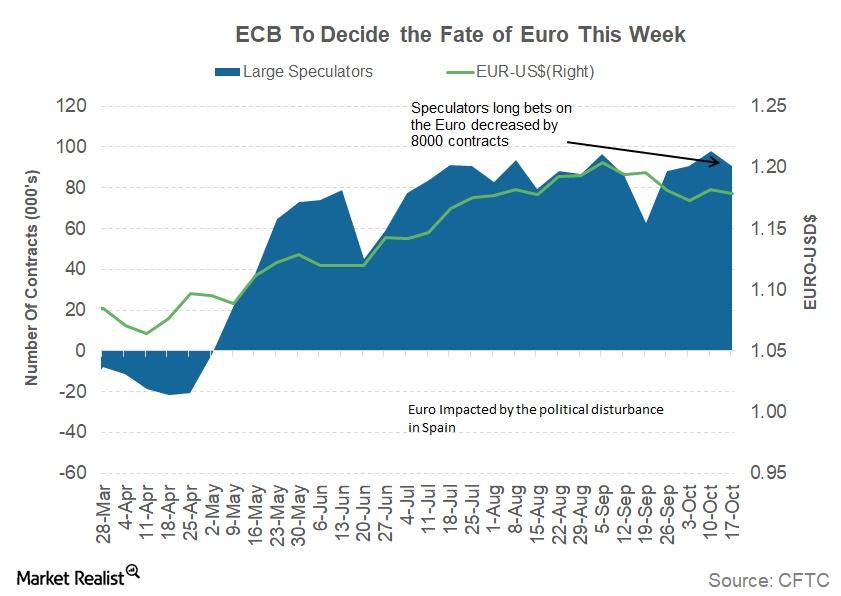

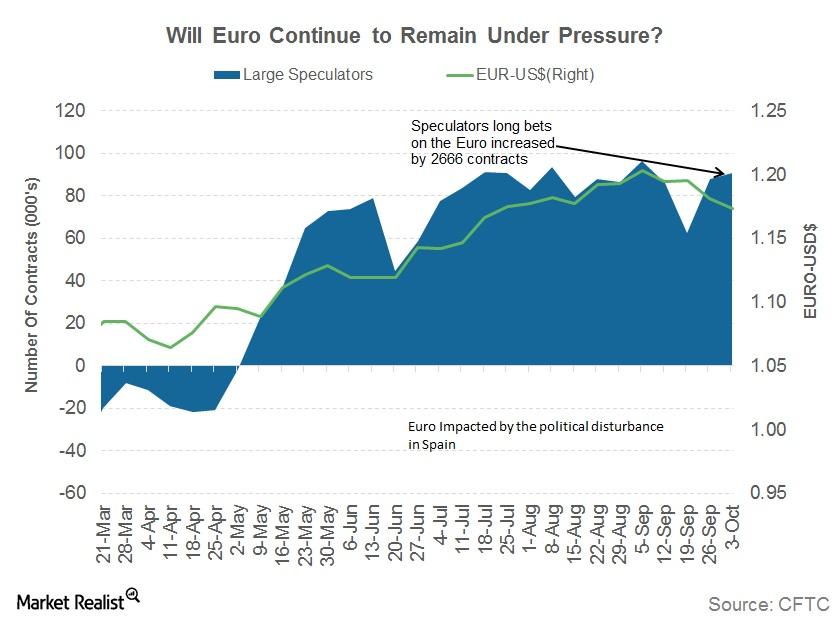

Why the Euro’s Troubles Could Continue This Week

The euro-dollar (FXE) closed the week ending October 20 at 1.179 against the US dollar (UUP).

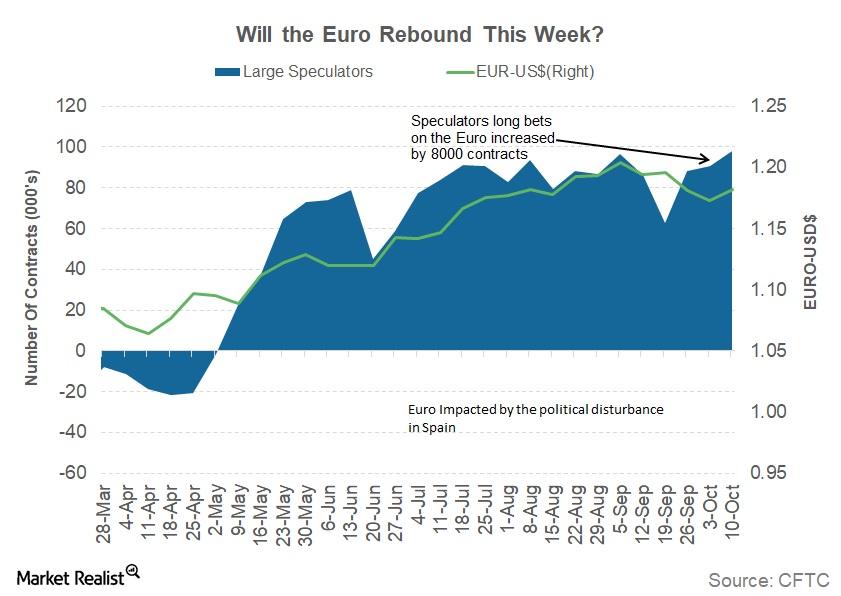

Will the Euro Regain Its Momentum this Week?

The euro-dollar (FXE) pair closed the week ending October 13 at 1.1822 against the US dollar (UUP). The shared currency managed to rebound from an 11-week low the week before, affected by political turmoil in Spain.

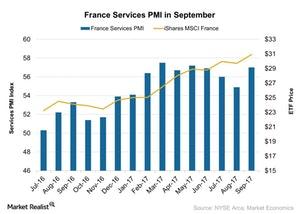

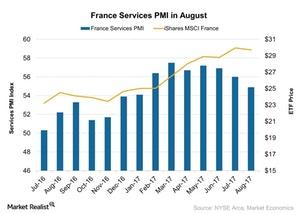

France’s Services PMI Strengthened in September after a Gradual Fall

The iShares MSCI France ETF (EWQ), which tracks France’s performance, rose 4% in September 2017.

A Look at the Catalonia-Troubled Euro This Week

It’s possible that political pressures could keep the euro under pressure as the economic calendar remains light in the Eurozone.

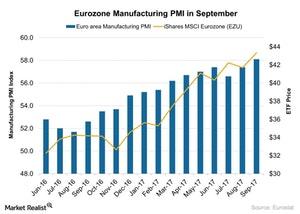

Does Eurozone Manufacturing Signal a Healthier Economy?

According to a report by Markit Economics, the final Eurozone manufacturing PMI (purchasing managers’ index) improved strongly in September 2017.

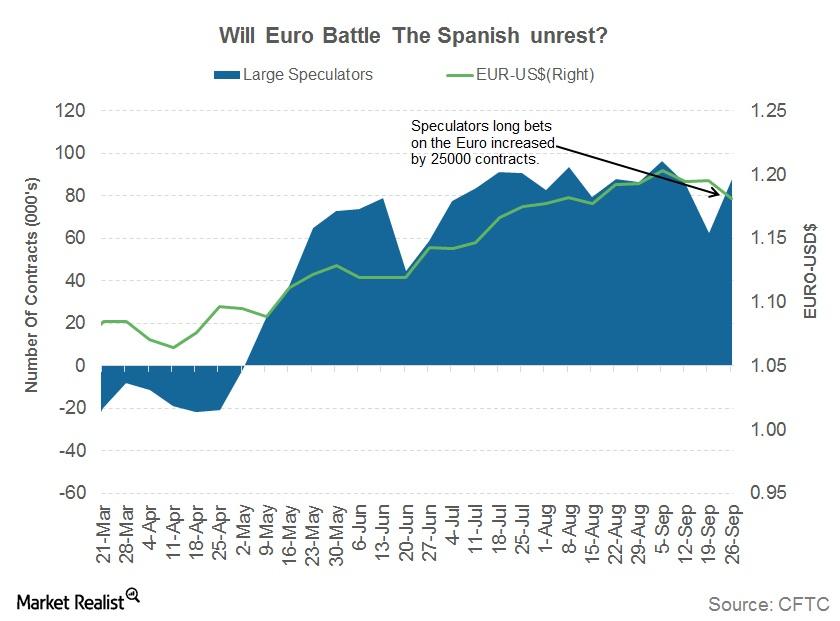

Will Spanish Unrest Drag the Euro Lower?

The euro-dollar (FXE) closed the week ending September 29 at 1.1814 against the US dollar (UUP). German election results had a minor negative impact on the shared currency.

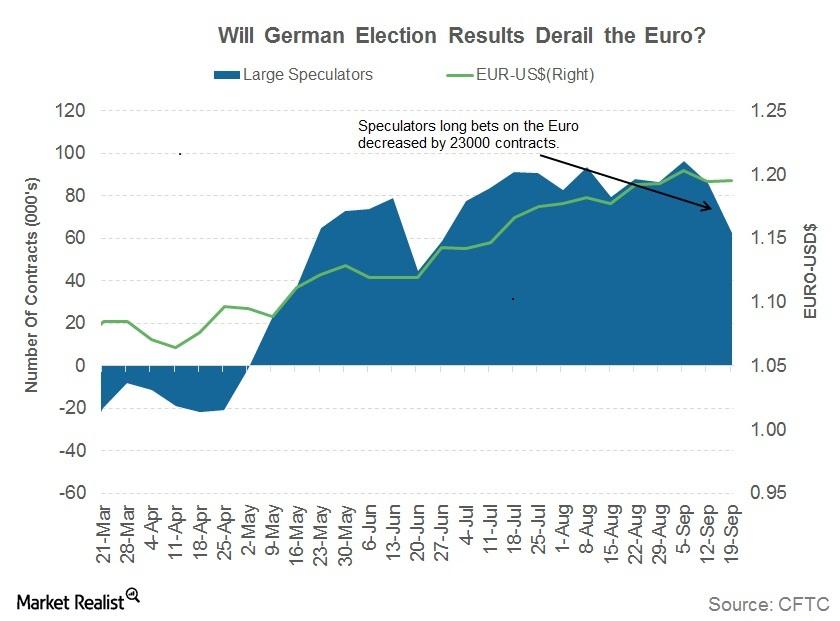

Will a Coalition Government in Germany Derail the Euro?

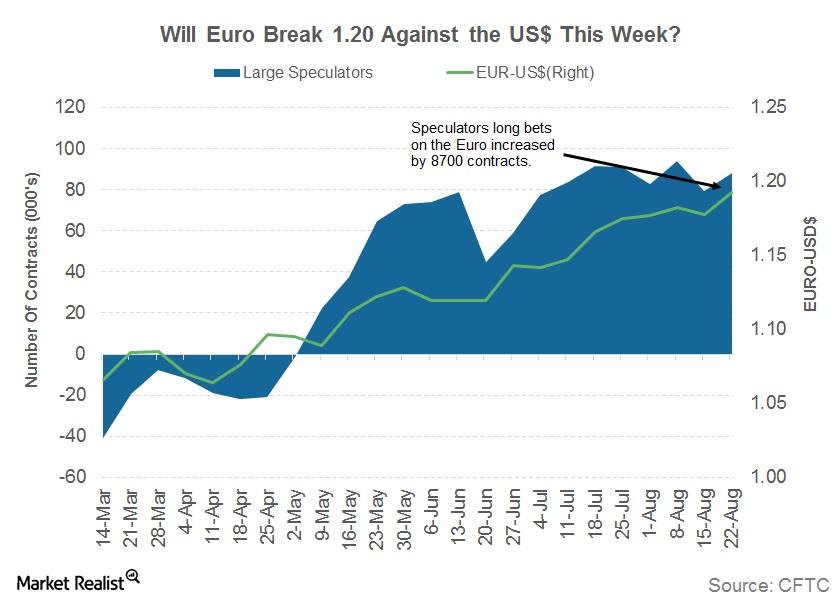

The euro-dollar (FXE) closed the week ending September 22 at 1.2 against the US dollar (UUP).

Why France’s Services PMI Fell in August

According to data provided by Markit Economics, the August France Services PMI (purchasing managers’ index) stood at 54.9 in August 2017 compared with 56 in July 2017.

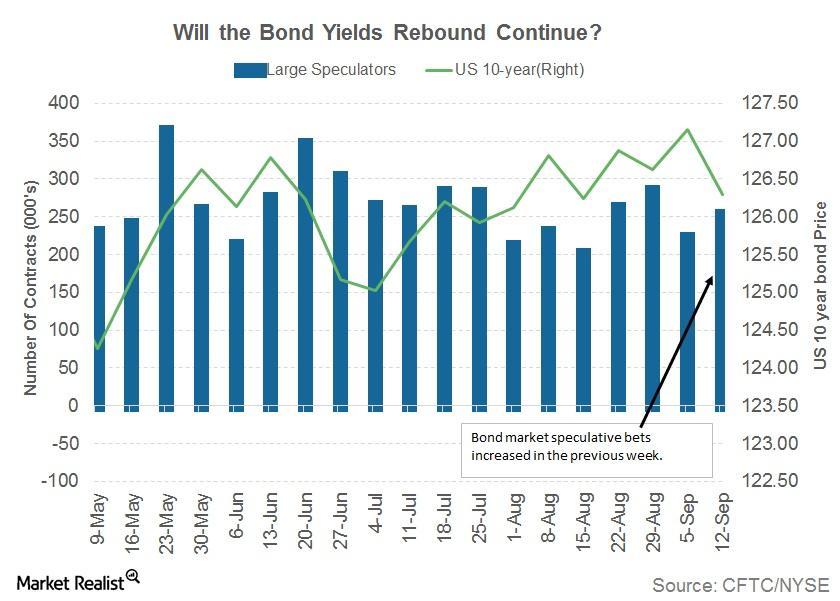

Why Was the Euro a Silent Spectator Last Week?

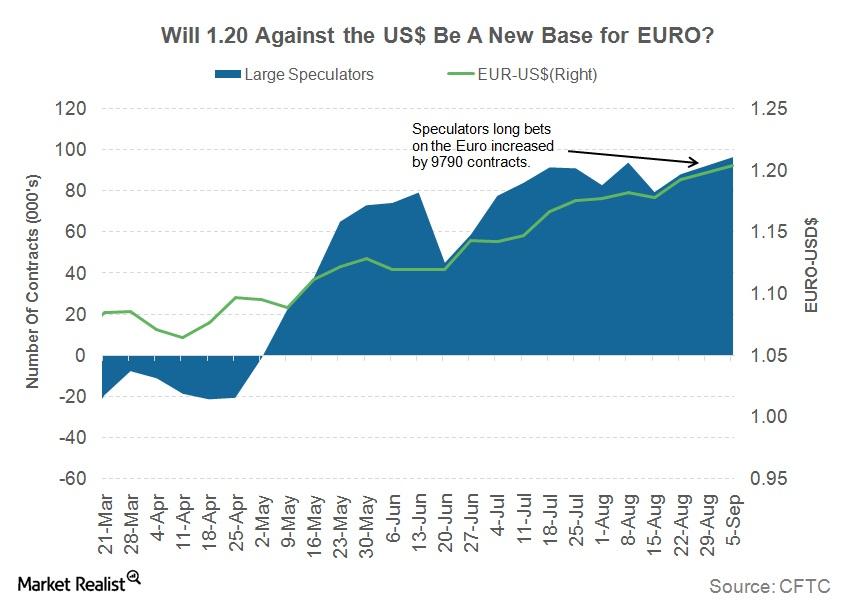

As per the latest Commitment of Traders (or COT) report, released on Friday, September 15 by the Chicago Futures Trading Commission (or CFTC), speculators turned bullish on the euro during the week.

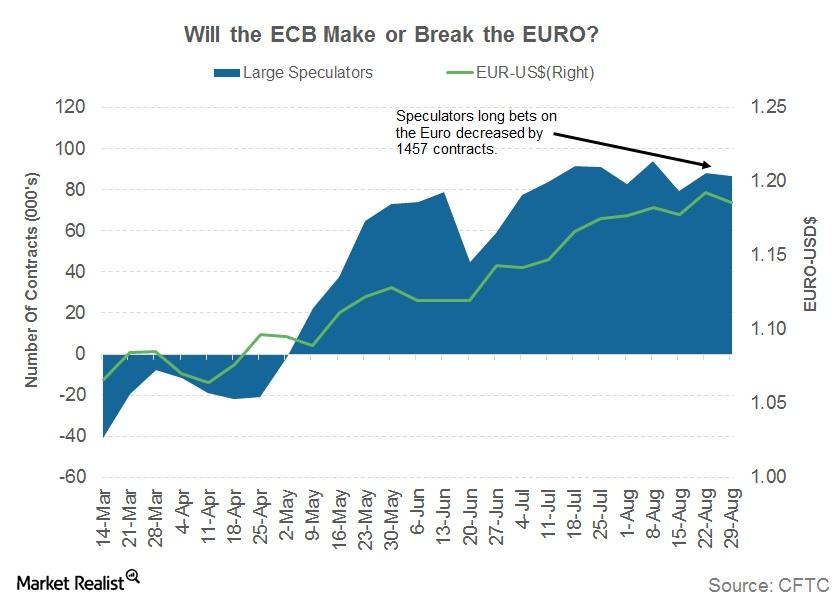

Why Did the ECB Downgrade Its Inflation Outlook?

In its September 7 policy meeting, the ECB (European Central Bank) downgraded the outlook for the EU economy’s inflation.

Why the Euro Rose to a 3-Year High Last Week

The euro closed the week ended September 8, 2017, at ~1.20 against the US dollar. It rose 1.48% against the US dollar as euro bulls took charge.

Why the Euro Could Remain Volatile This Week

The euro (FXE) closed the week ended September 1, 2017, at 1.19 against the US dollar (UUP). It lost 0.56% against the US dollar.

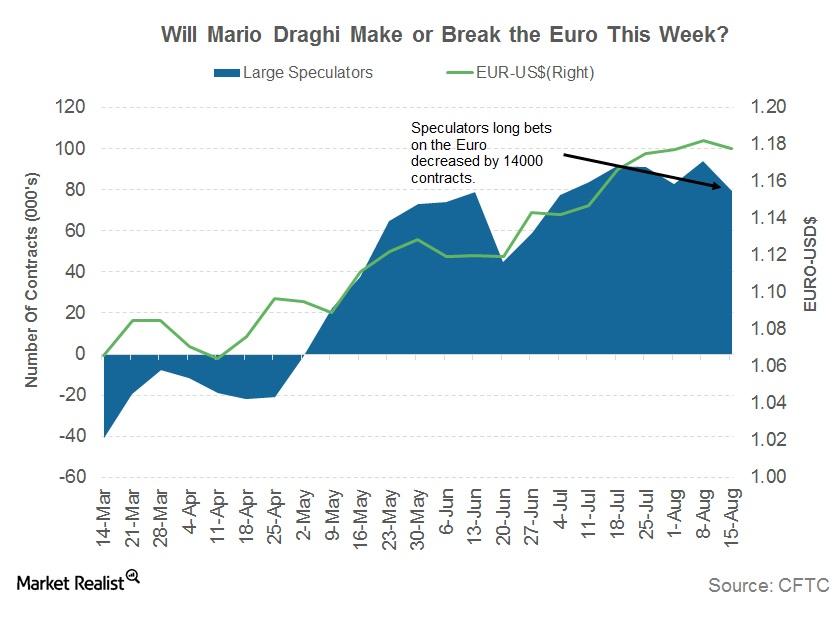

Mario Draghi Didn’t Stop the Appreciating Euro

European Central Bank President Mario Draghi gave didn’t comment about removing monetary stimulus in his speech at the Jackson Hole symposium.

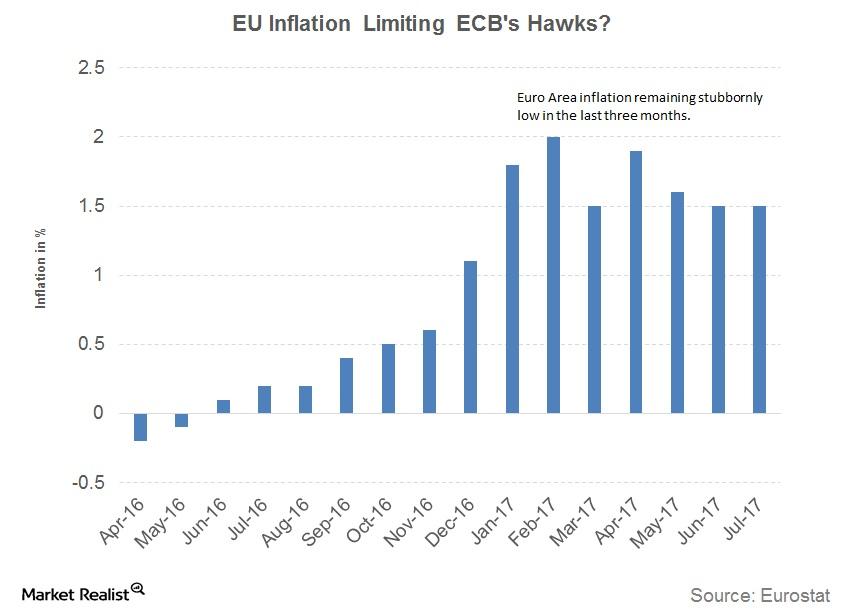

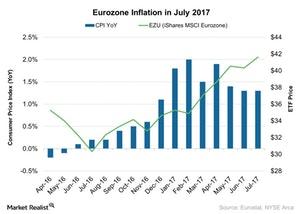

Analyzing the Eurozone’s Inflation in July 2017

On a year-over-year basis, the Eurozone Inflation Index was at 1.3% in July 2017—the same as in June, according to data provided by Eurostat.

Will Draghi Lift or Drown the Euro This Week?

The euro-dollar pair (FXE) closed the week ending August 18 at 1.18 against the US Dollar (UUP).

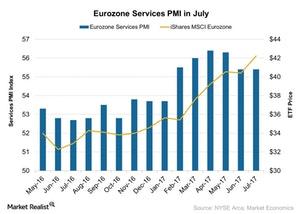

What Happened to the Eurozone Services PMI in July

The Eurozone Services PMI remained unchanged in July 2017, coming in at 55.4 but missing the preliminary market estimation.

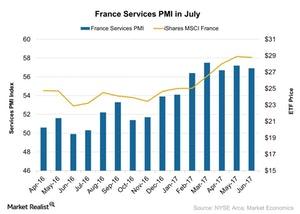

Behind the France Services PMI in July

The July France Services PMI (purchasing managers’ index) stood at 56.0 in July 2017, compared with 56.9 in June 2017, meeting the initial estimate of 55.9.

Is Strong Economic Expansion in the Eurozone Driving the ECB?

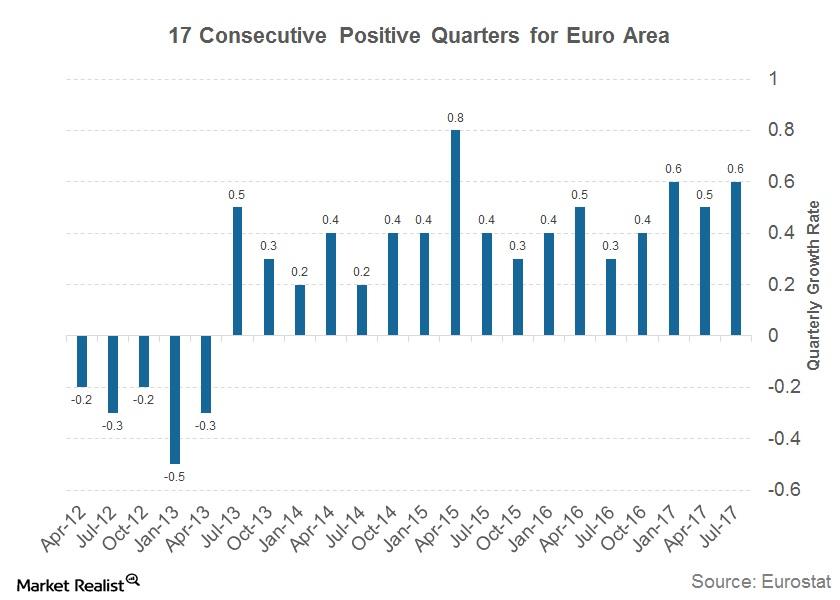

The European economy has expanded in the last 17 consecutive quarters. The Eurozone’s annual growth rate is 2.1%—the highest growth rate in the last six years.

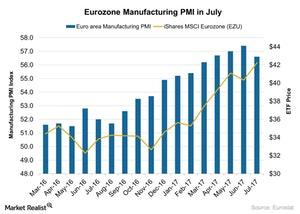

Why Eurozone Manufacturing PMI Dropped in July 2017

According to a report by Markit Economics, the final Eurozone manufacturing PMI (purchasing managers’ index) stood at 56.6 in July 2017 as compared to the 57.4 in June 2017.

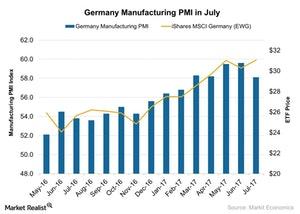

How Did Germany’s Manufacturing PMI Trend in July?

The final Markit Germany manufacturing PMI (purchasing managers’ index) stood at 58.1 in July 2017 compared to 59.6 in June 2017.

Is the Euro Running Out of Steam?

The German DAX (DAX) was up ~1.1%, Euro Stoxx (FEZ) was up ~1.1%, and France’s CAC was up ~1.4% in the week ended August 4, 2017.Macroeconomic Analysis Germany’s Rising Manufacturing: A Change in Sentiment

According to data provided by Markit Economics, the final Markit Germany manufacturing PMI (purchasing managers’ index) stood at 59.6 in June 2017 compared to 59.5 in May.

Will Weak Data from the EU Derail the Euro?

The euro (FXE) remained confined to a narrow range against the US dollar (UUP) in the previous week.

Soros: Why Brexit Could Lead to Lower Living Standards

Lower trade and investment flows could impact employment and wage growth, which might impact the standard of living in the United Kingdom.

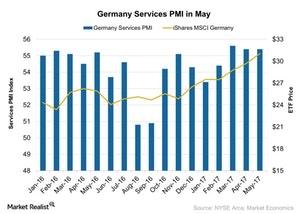

Why Germany’s Services PMI Didn’t Change in May

According to data provided by Markit Economics, the final Markit Germany services PMI (purchasing managers’ index) stood at 55.4 in May 2017.

Is Long Euro the Theme for Forex Markets?

The euro (FXE) remained in a narrow trading range against the US dollar (UUP) between the levels of 1.130 and 1.115 for the last five weeks.

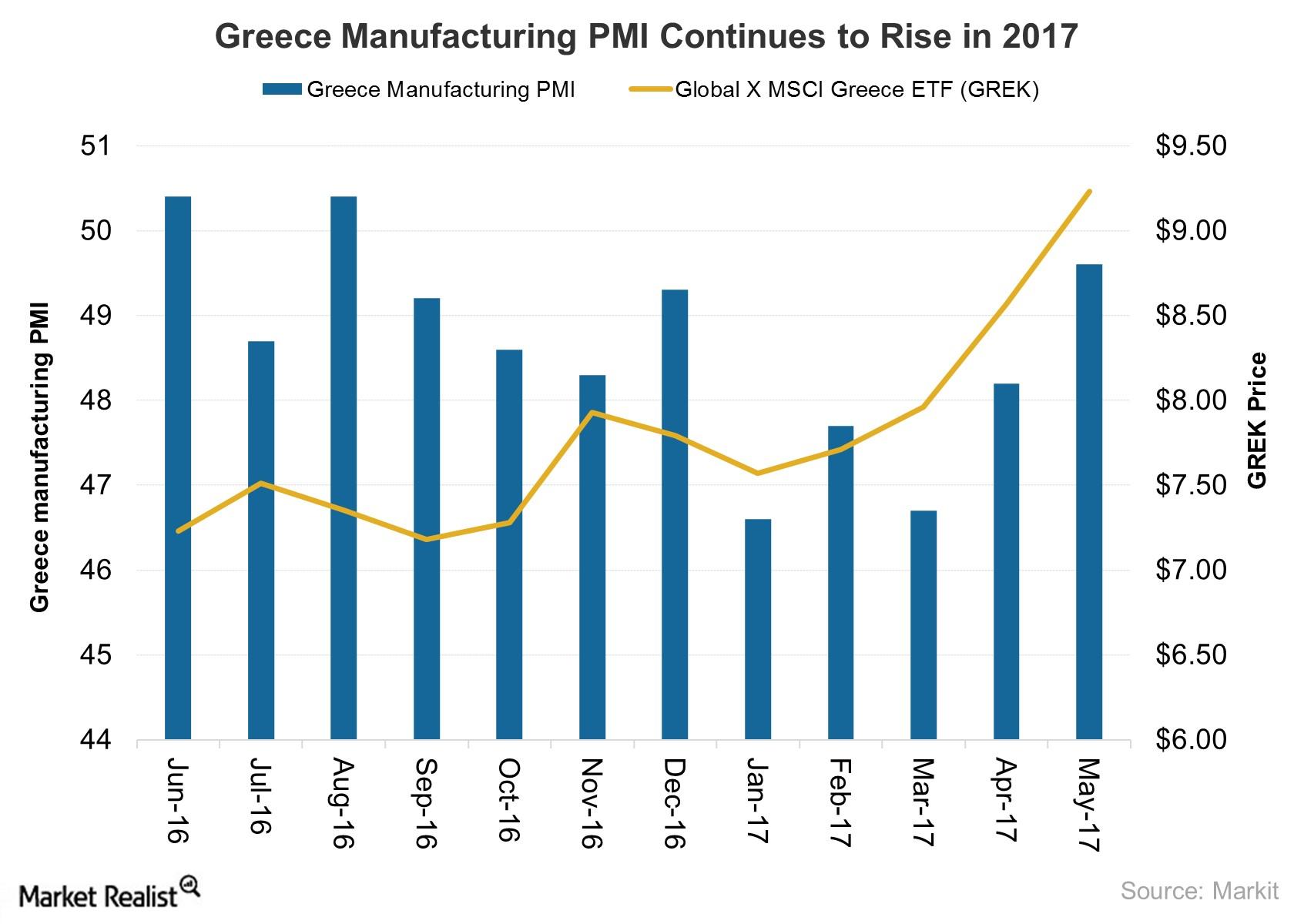

Did Greece’s Manufacturing Activity Improve amid Growth Expectations?

The Markit Greece Manufacturing PMI advanced to 49.6 in May 2017 compared to 48.2 in the previous month.

Has the ECB Been Successful in Taming the Euro?

The euro (FXE) closed the week at 1.1196 to the US dollar (UUP), posting a 0.76% loss compared to the previous week.

Why the ECB Closed the Door on Further Rate Cuts

The ECB (European Central Bank) left interest rates unchanged at 0% in the rate-setting meeting that was held on Thursday, June 8.