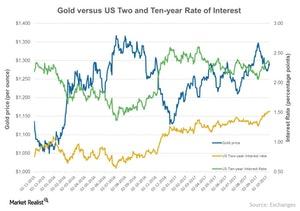

Interest Rate versus Gold: Interest Rate Wins Again

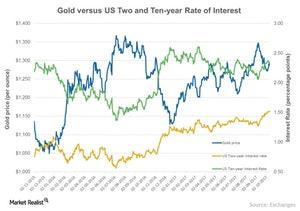

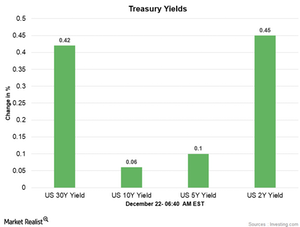

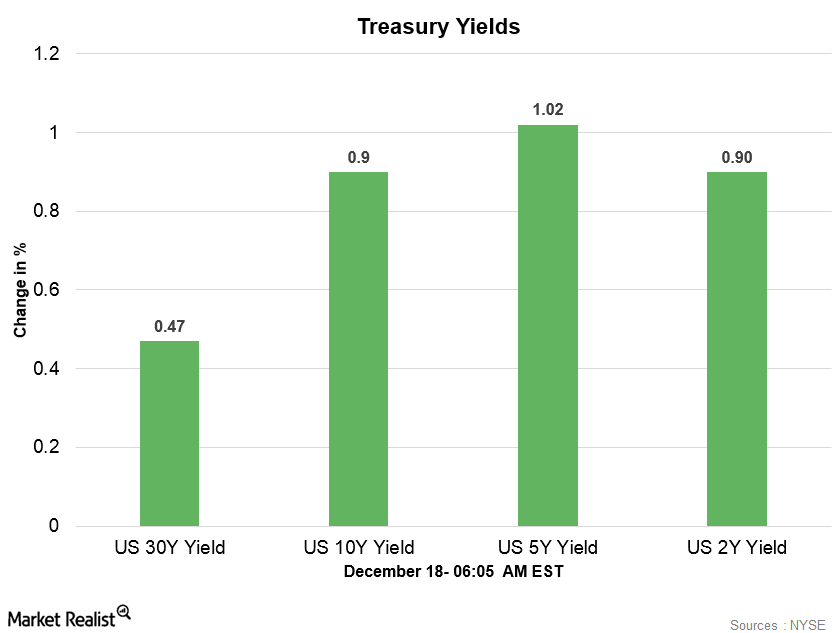

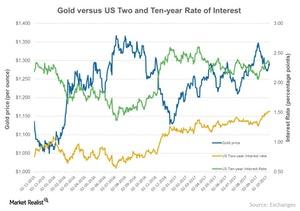

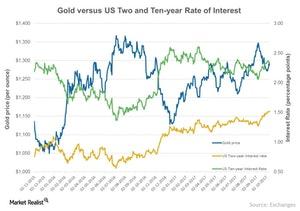

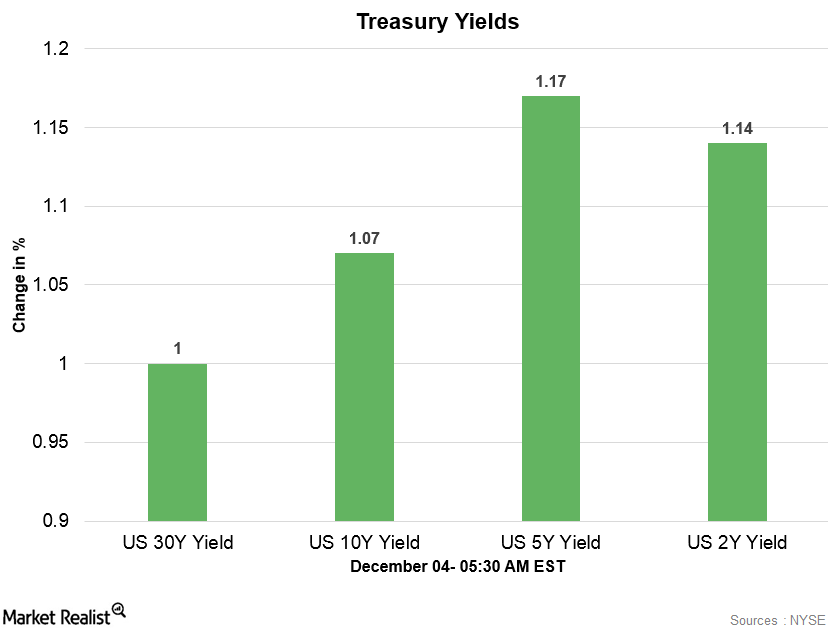

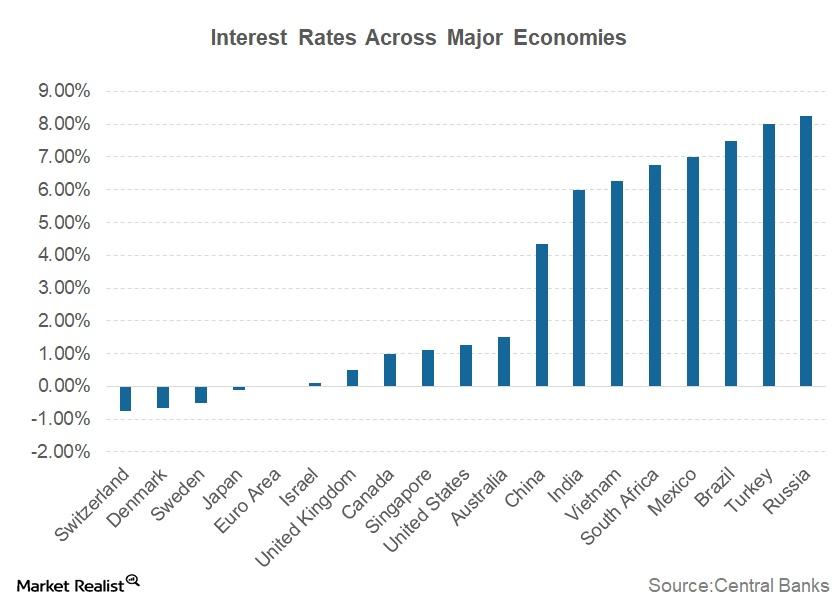

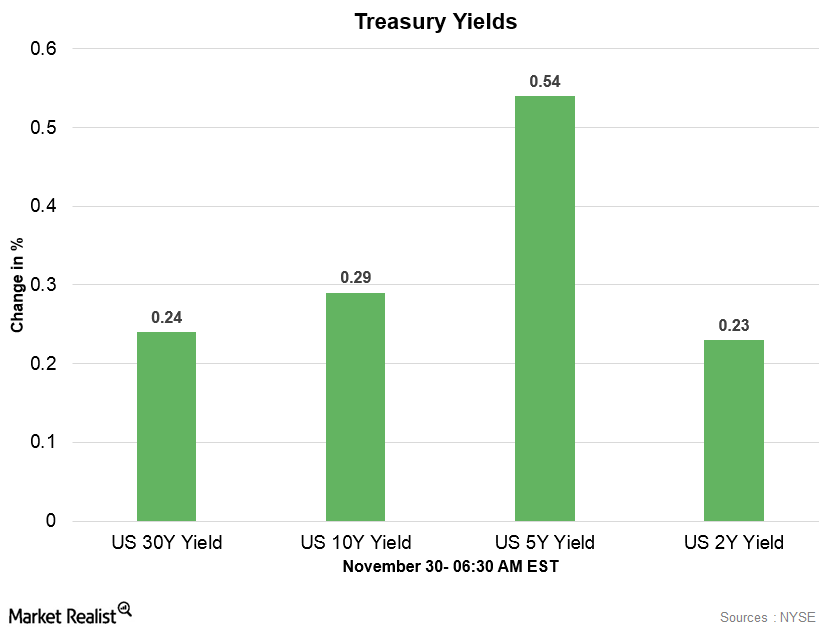

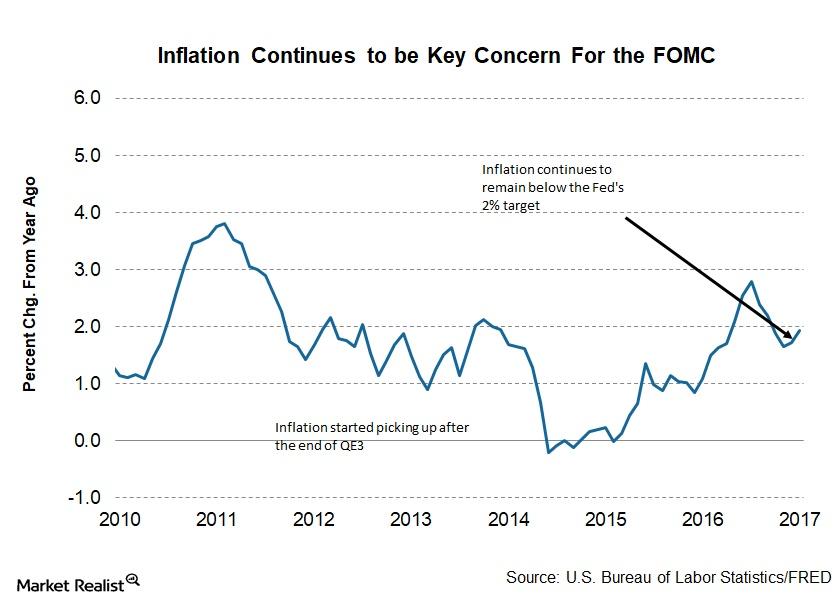

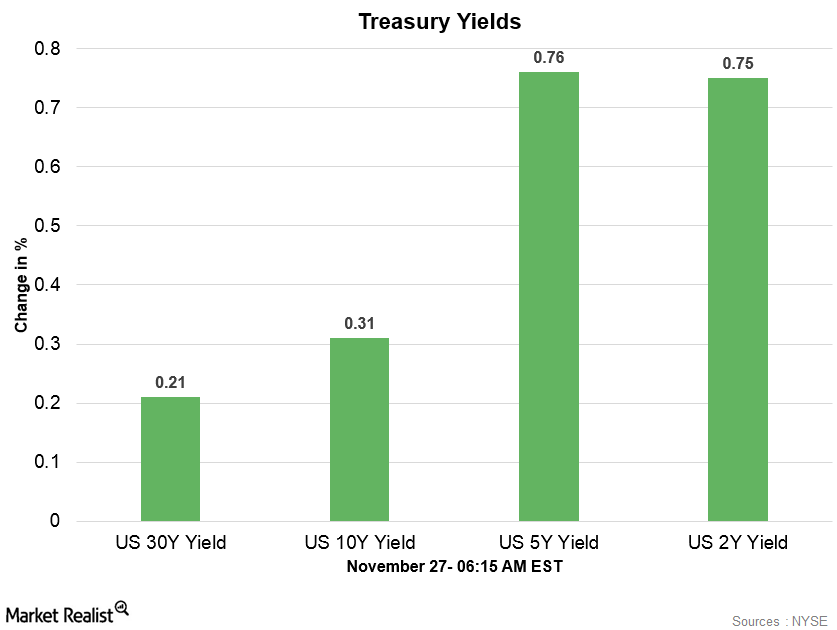

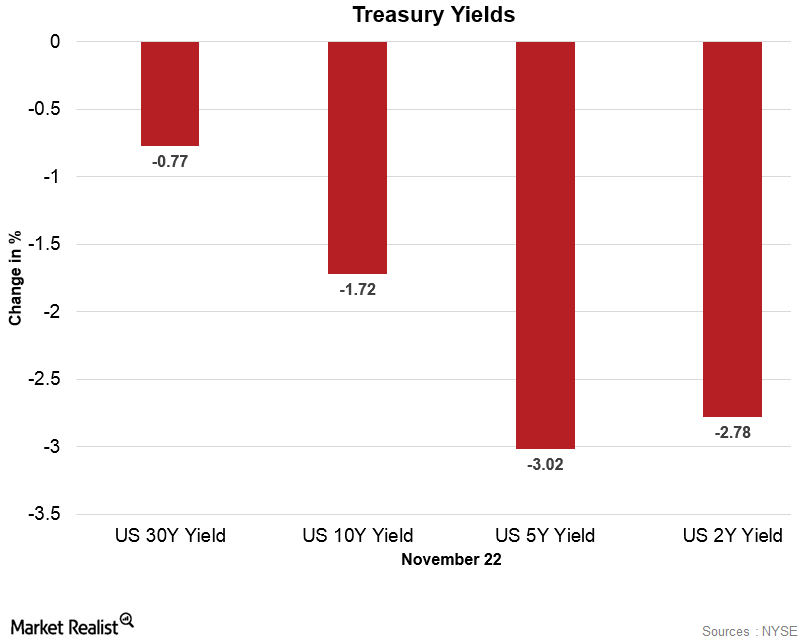

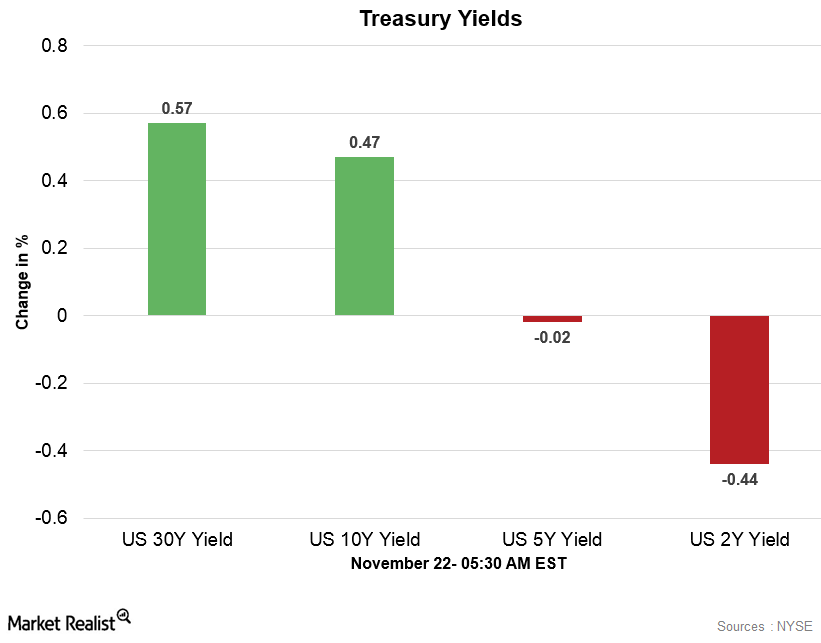

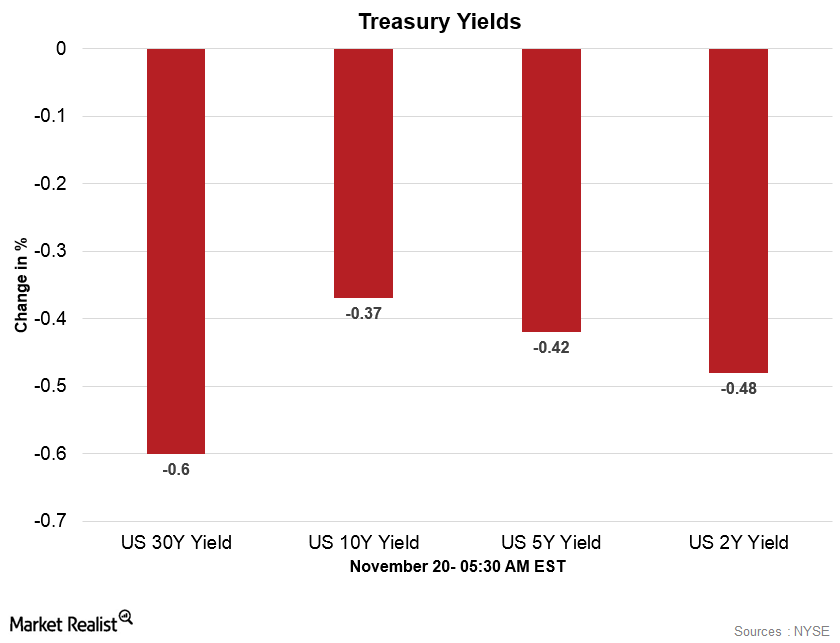

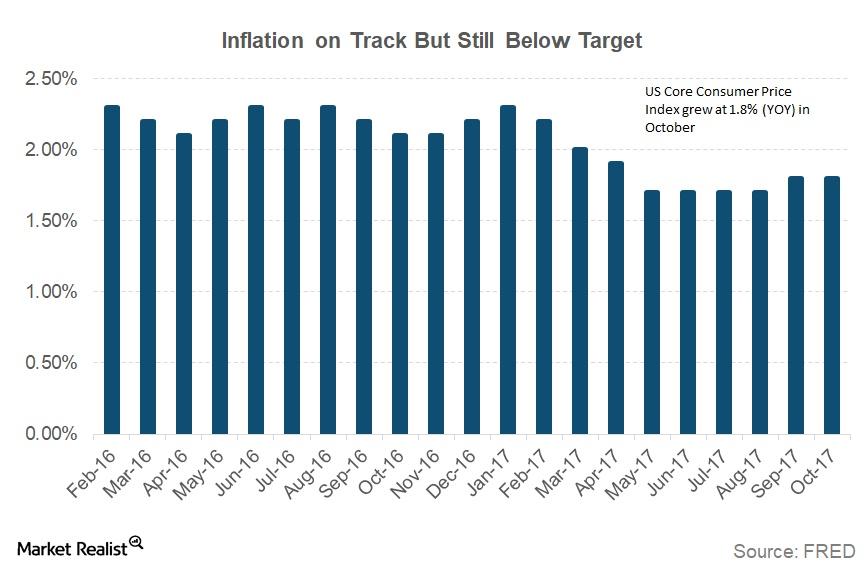

Gold is a non-yield bearing asset that reacts negatively to rises in the interest rate.

Market Realist has the latest news and analysis on debt securities, from bonds to exchange traded notes.

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.