Peter Neil

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Peter Neil

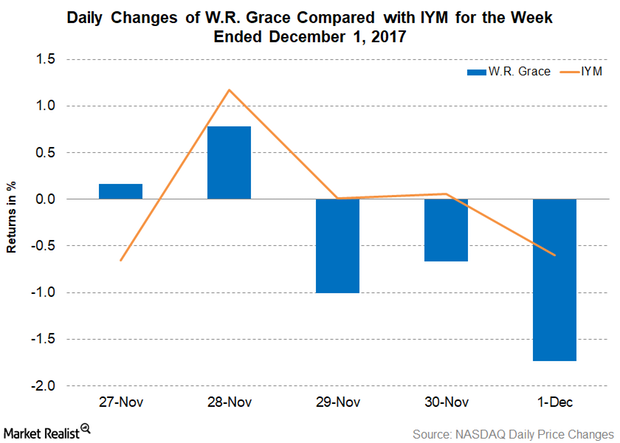

W.R. Grace Signs a Spree of New Contracts

On November 27 and 28, 2017, W.R. Grace (GRA) signed a spree of new contracts for its Unipol license.

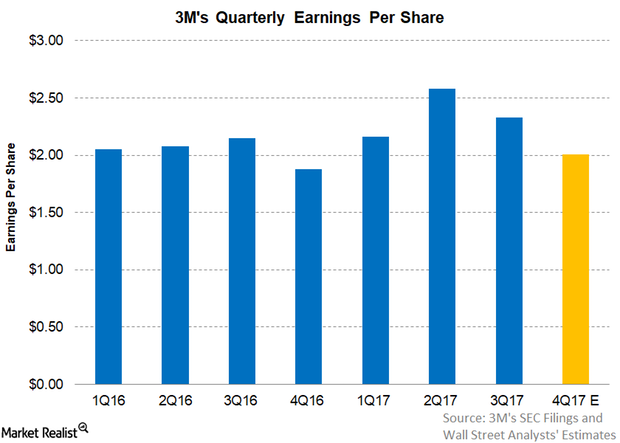

Can 3M Beat Analysts’ Earnings Estimates in 4Q17?

3M (MMM) is expected to post earnings per share (or EPS) of $2.01 in 4Q17, an increase of 6.9% over 4Q16.

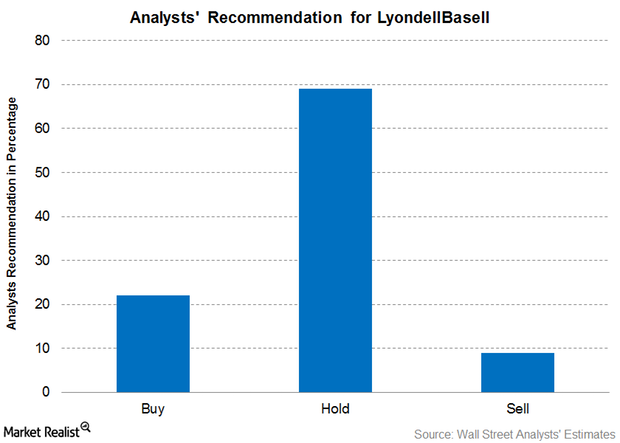

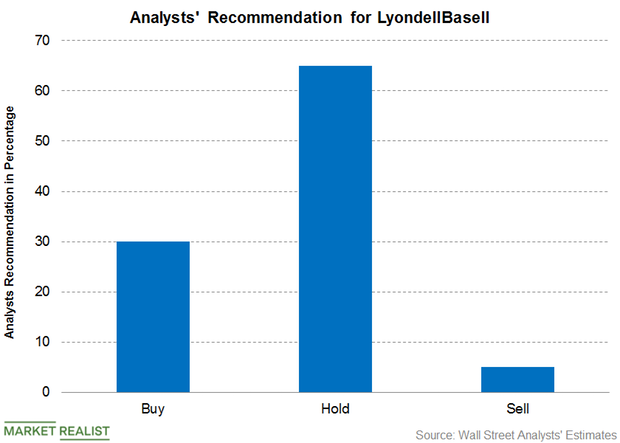

How Wall Street Analysts Rate LyondellBasell ahead of 1Q18 Earnings

The analyst consensus target price for LyondellBasell is $116.82, implying a return potential of 8.5% over the closing price of $107.68 as of April 20, 2018.

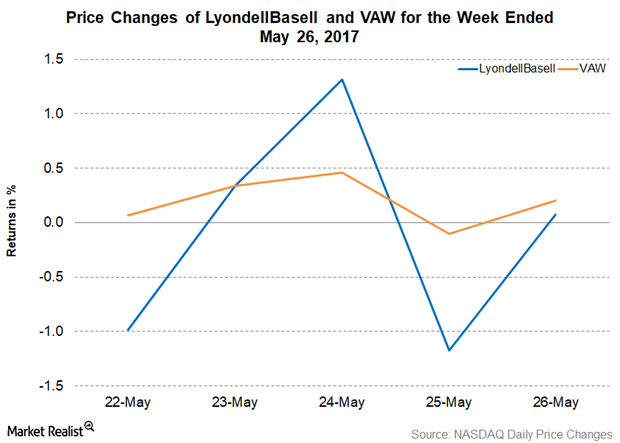

LyondellBasell Announces New Share Repurchase Program

On May 24, 2017, LyondellBasell’s (LYB) board authorized a new share repurchase program. It can repurchase up to 10% of its outstanding shares over the next 18 months.

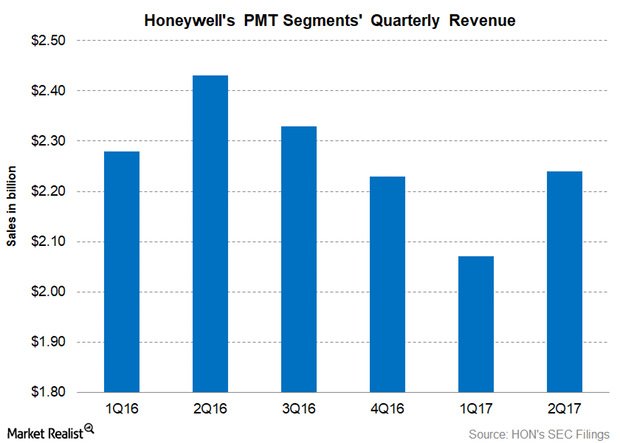

Honeywell’s Performance Materials and Technologies: Why It Fell

Honeywell’s (HON) Performance Materials and Technologies (or PMT) segment accounted for 22.2% of HON’s total revenue in 2Q17.

PPG Launches Powercron 160 Electrocoat in North America

On March 12, PPG Industries (PPG) announced the launch of its Powercron 160 electrocoat in North America.

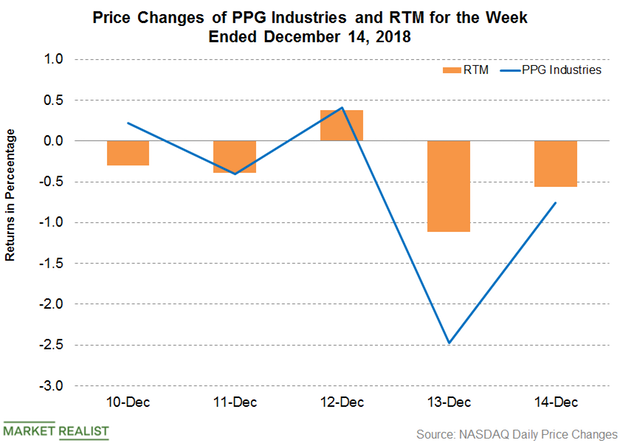

PPG Industries: Investment and Stock Price Update

Due to continued weakness in the market, PPG Industries stock fell 3.0% and closed at $100.14 for the week ending December 14.

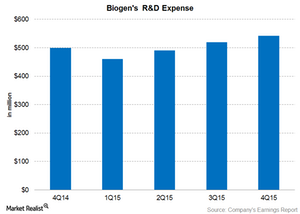

How Much Does Biogen Spend on Research and Development?

Biogen’s (BIIB) R&D expenses for 4Q15 were $542 million, or 19% of its total revenue, including a $60 million payment to Mitsubishi Tanabe.

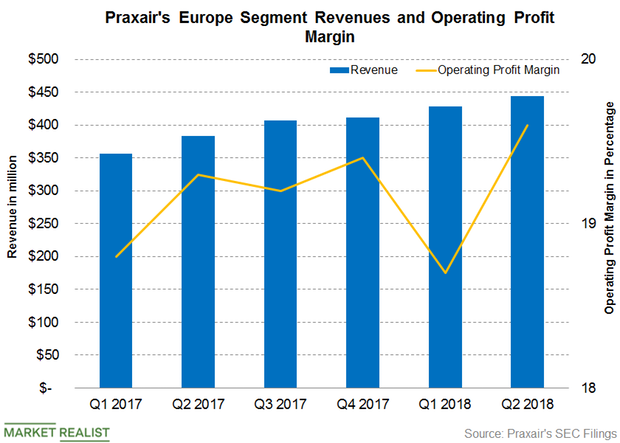

How Praxair’s European Revenue Is Trending

Praxair’s (PX) European segment contributed 14.5% of its total revenue in Q2 2018, compared with 13.5% in Q2 2017.

Air Products and Chemicals Completes Acquisition of ACP Europe SA

In a press release today, Air Products and Chemicals (APD) announced that it had completed its acquisition of ACP Europe SA.

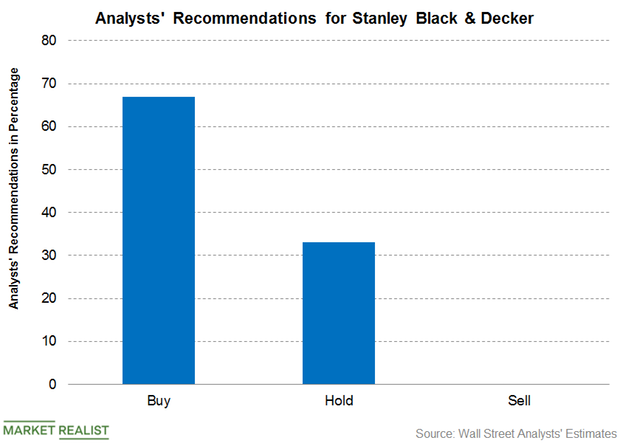

Stanley Black & Decker: Analysts’ Recommendations

Currently, 21 analysts are actively tracking Stanley Black & Decker. Among the analysts, 67% recommend a “buy,” while 33% recommend a “hold.”

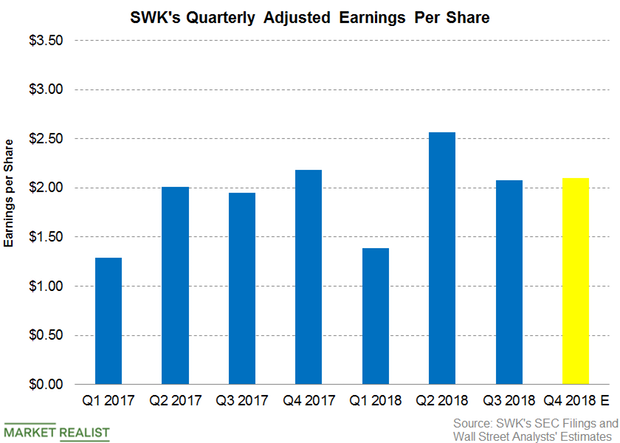

Can Stanley Black & Decker’s Q4 Earnings Beat the Estimates?

Stanley Black & Decker (SWK) is expected to post an adjusted EPS of $2.1 in the fourth quarter—a decrease of ~4.7% YoY (year-over-year).

LyondellBasell: Analysts’ Views and Recommendations

For LyondellBasell, 30% of the analysts recommended a “buy,” 65% recommended a “hold,” and 5% recommended a “sell.”

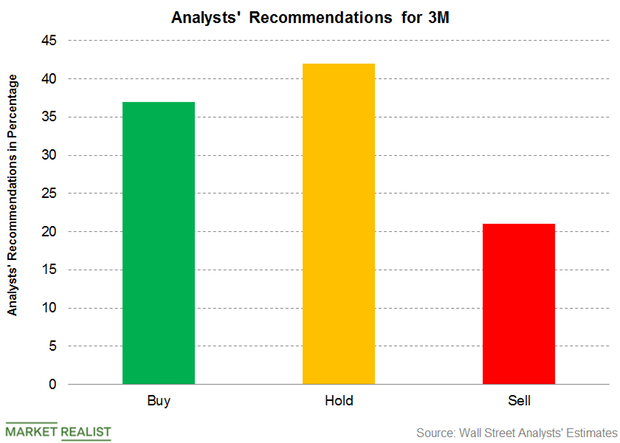

3M: Analysts Revised the Target Price

For 3M stock, 37% of the analysts recommended a “buy,” 42% recommended a “hold,” and 21% recommended a “sell.”

APD’s Q4 2018 Earnings Beat Estimates, Revenues Missed

On November 6, Air Products and Chemicals reported revenues of $2.30 billion for the fourth quarter.

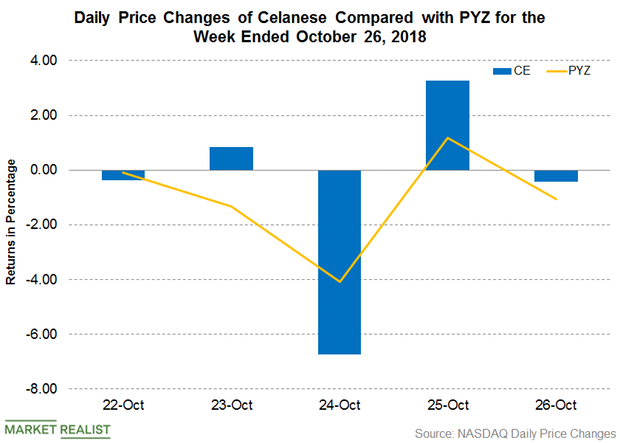

Celanese Increases Prices of Ethyl Acetate in the Americas

On October 22, Celanese (CE) announced that it would be increasing the prices of ethyl acetate in the Americas region.

3M’s Unfunded Pension Funds: Analyzing the Trend

3M offers pension and post-retirement benefit plans to its employees. The company has more than 75 defined benefit plans in 27 countries.

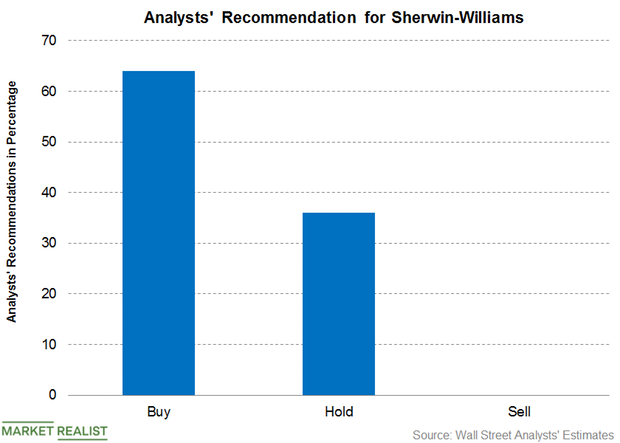

Sherwin-Williams: Analysts’ Recommendations

For Sherwin-Williams, 64% of the analysts recommended a “buy,” 36% recommended a “hold,” and none of the analysts recommended a “sell.”

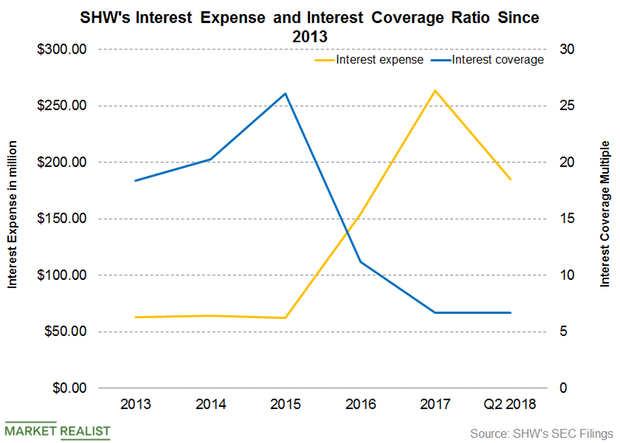

Analyzing Sherwin-Williams’s Ability to Service Its Debt

Sherwin-Williams’s (SHW) interest expense has increased significantly due to borrowings for the Valspar acquisition.

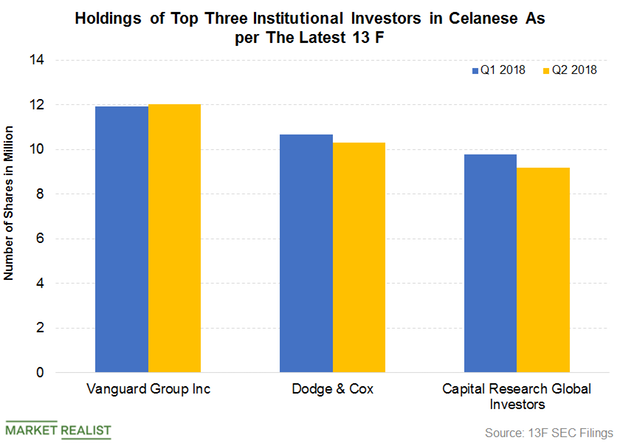

What Are Institutional Investors’ Positions on Celanese?

Second-quarter 13F SEC filings indicate that institutional investors own 95.3% of Celanese’s (CE) outstanding shares.

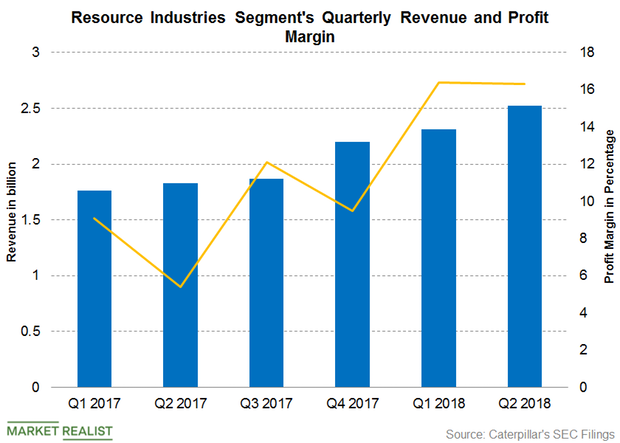

Analyzing Caterpillar’s Resource Industries Segment

Caterpillar’s Resource Industries segment is the company’s lowest revenue contributor. The segment had a revenue share of 18% in the second quarter.

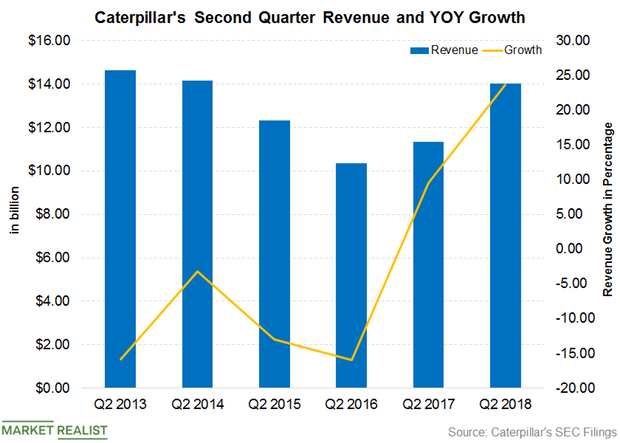

Caterpillar’s Revenues: Highest Growth in More than Six Years

Caterpillar (CAT) reported revenues of $14.01 billion in the second quarter—an increase of 23.7% on a YoY (year-over-year) basis.

PPG Industries Stock since Its Q1 2018 Earnings

PPG Industries (PPG) has announced that it will announce its second-quarter earnings on July 19 before the market opens.

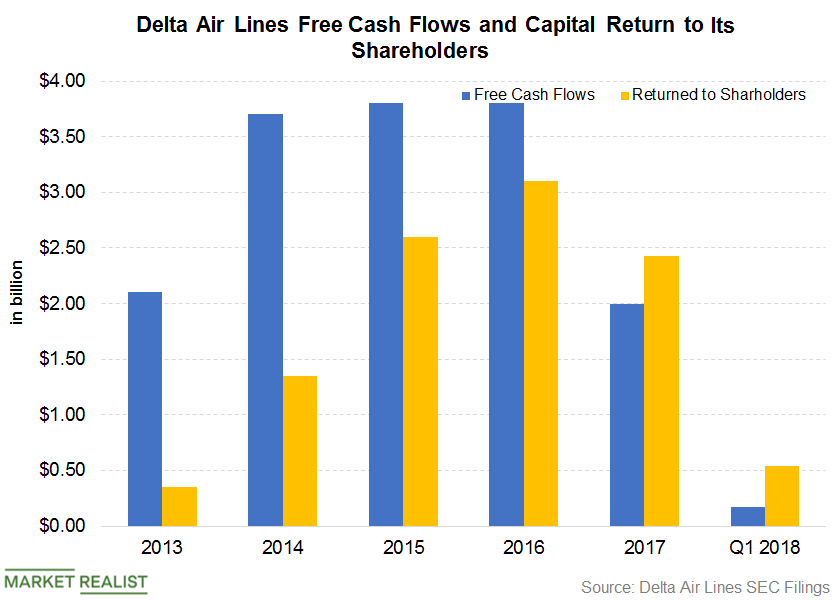

Analyzing Delta Air Lines’ Free Cash Flow

Considering the data in the past five years, Delta Air Lines (DAL) has been generating a strong FCF. Delta Air Lines’ five-year average FCF is $3.08 billion.

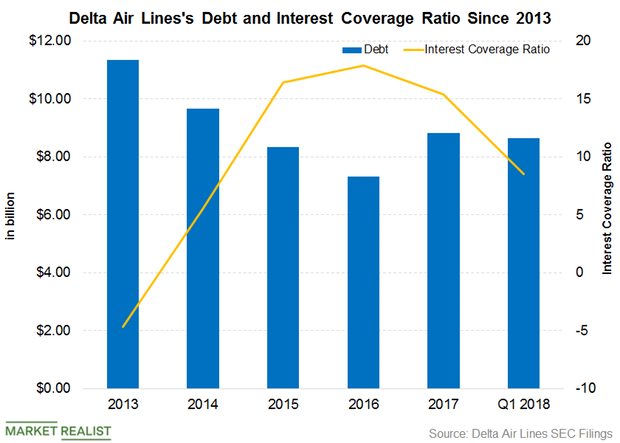

Delta Air Lines: Is Higher Debt a Concern?

Delta Air Lines’ higher debt means a higher interest expense and a higher DE (debt-to-equity) ratio. Delta Air Lines’ current DE ratio is 0.69x.

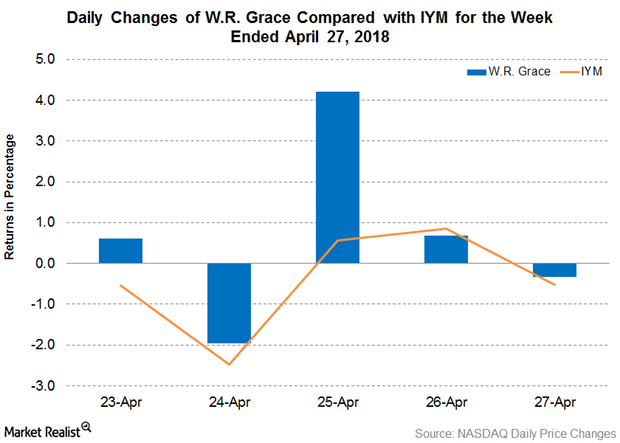

W. R. Grace Bags New UNIPOL Technology Client

On April 24, W. R. Grace (GRA) announced that it would be licensing its UNIPOL PP Process Technology to Inter Pipeline to be used in its Heartland Petrochemical complex in Alberta, Canada

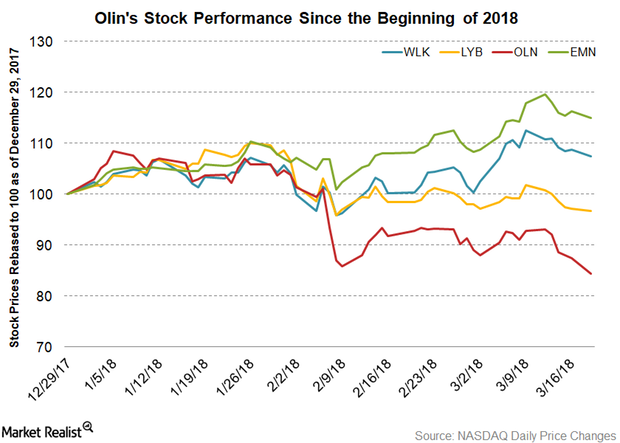

How Olin Stock Has Fared in 2018 Year-to-Date

On a year-to-date basis, until March 19, 2018, OLN stock has fallen 15.5%.

Reviewing Albemarle’s Stock Performance since 3Q17

Albemarle (ALB) is set to announce its 4Q17 results after the market closes on February 27, 2018.

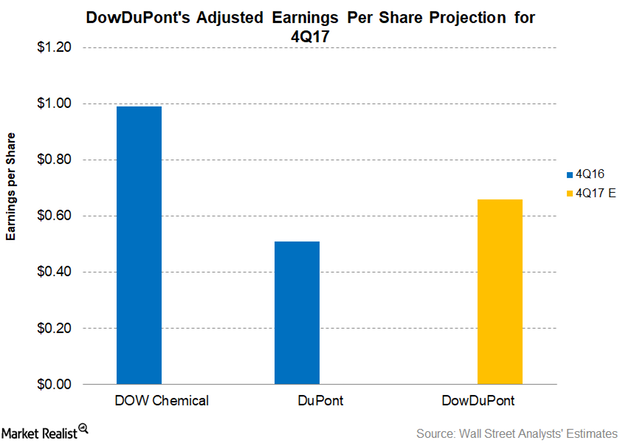

What Could Drive DowDuPont’s Adjusted Earnings in 4Q17?

DowDuPont (DWDP) is expected to post an adjusted EPS (earnings per share) of $0.66 in 4Q17. DowDuPont posted an adjusted EPS of $0.55 in 3Q17.

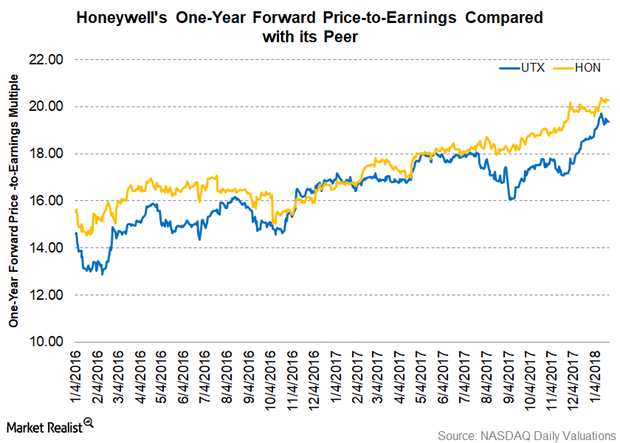

Where Does Honeywell’s Valuation Stand Compared to Peers?

The strong upward trend in the market has pushed Honeywell’s (HON) one-year forward PE (price-to-earnings) multiple to 20.30x as of January 22, 2018.

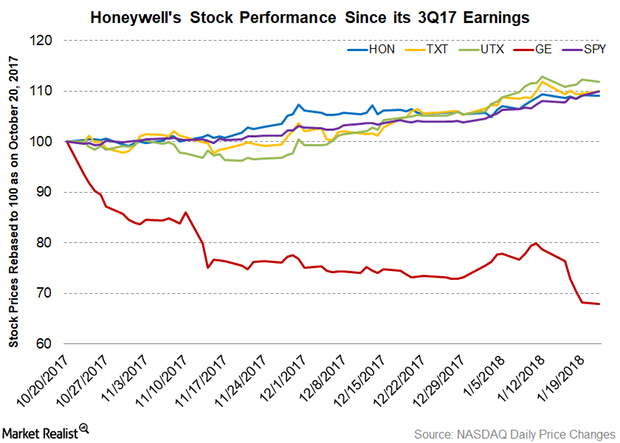

How Has Honeywell Stock Performed since 3Q17 Earnings?

Since Honeywell (HON) declared its 3Q17 earnings on October 20, 2017, HON stock has risen ~9.0% as of January 22, 2018.

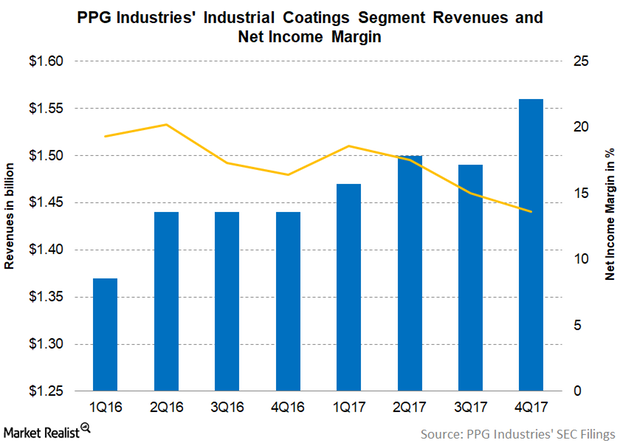

PPG’s Industrial Coatings Segment’s Margins Continue to Contract

PPG Industries’ (PPG) Industrial Coatings segment is its second reporting segment. The segment represented 42.3% of the company’s total revenue in 4Q17 compared to 42.0% in 4Q16.

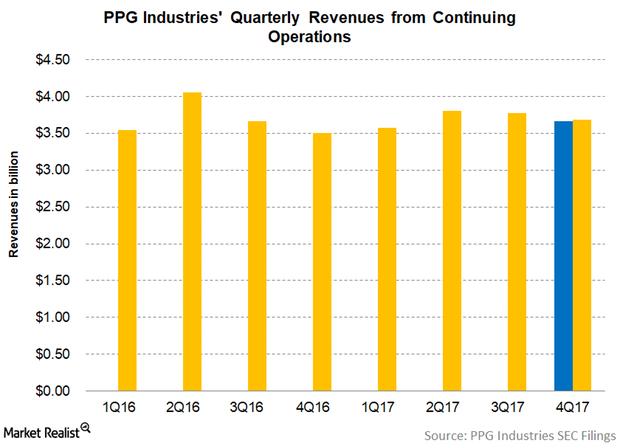

PPG Industries Stock Soars as 4Q17 Revenue Beats Estimates

PPG Industries (PPG) announced its 4Q17 earnings before the market opened on January 18, 2018. The company reported revenue of $3.68 billion, a rise of 7.9% year-over-year.

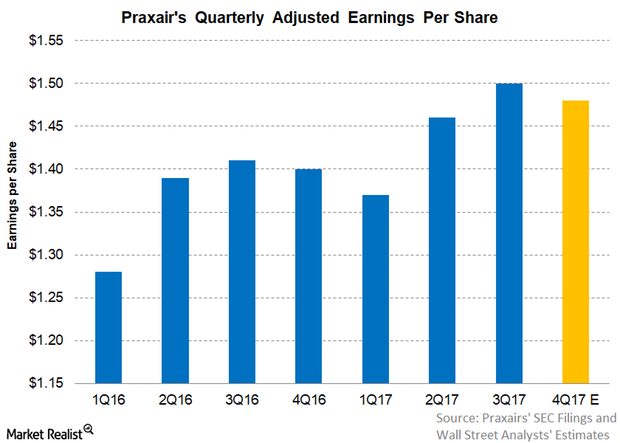

Can Praxair Meet Analysts’ Adjusted Earnings Per Share Estimate?

As of January 15, 2018, analysts are expecting Praxair (PX) to report adjusted EPS (earnings per share) of $1.48, an increase of 5.7% on a year-over-year basis.

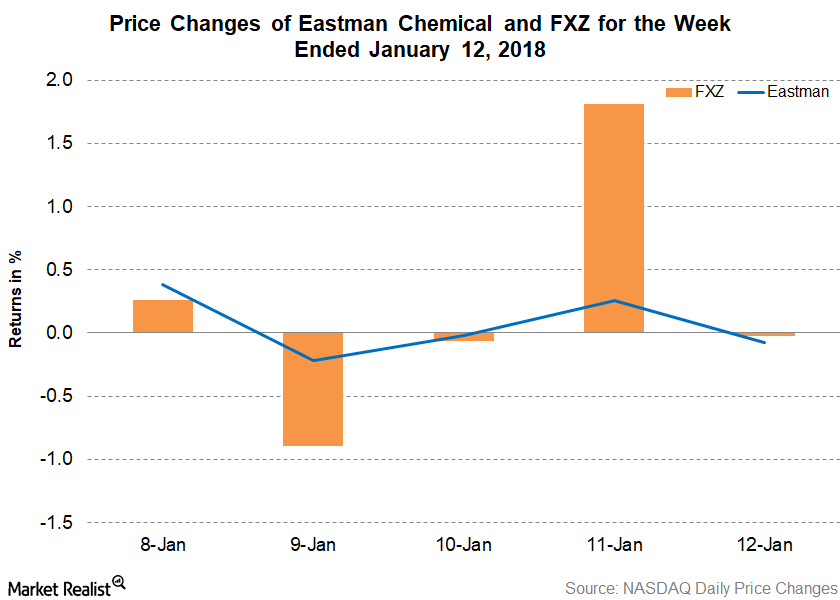

Eastman Chemical’s Demand for Tritan Continues to Grow in Asia

The demand for Eastman Chemical’s Tritan continues to grow.

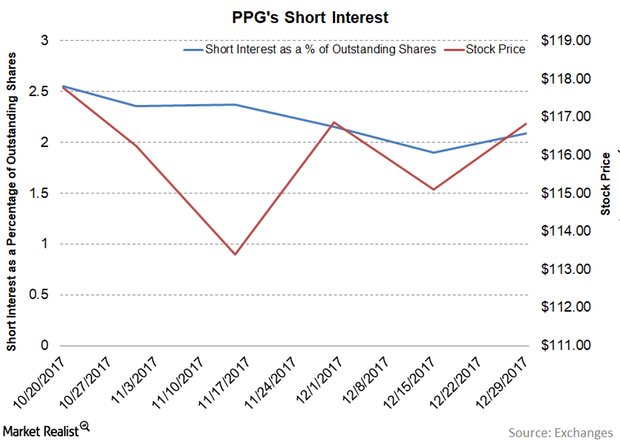

PPG Industries: Short Interest before Its 4Q17 Earnings

As of December 29, PPG Industries’ short interest as a percentage of outstanding shares stood at 2.10%. Its short interest fell from 2.55% as of October 20.

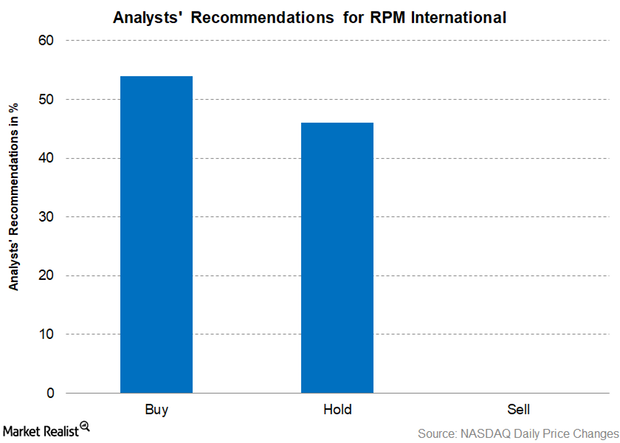

Analysts’ Consensus on RPM International

For RPM International, 54% of the analysts recommended a “buy,” 46% recommended a “hold,” and none of the analysts recommended a “sell.”

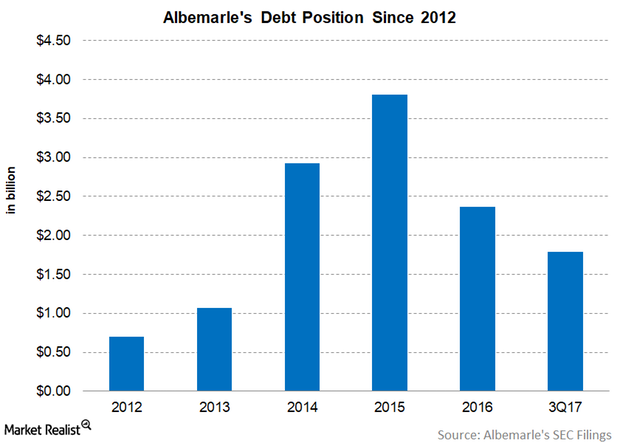

Albemarle Strengthens Its Leverage Position

At the end of 3Q17, Albemarle (ALB) reported debt of ~$1.8 billion, its lowest point since 2014.

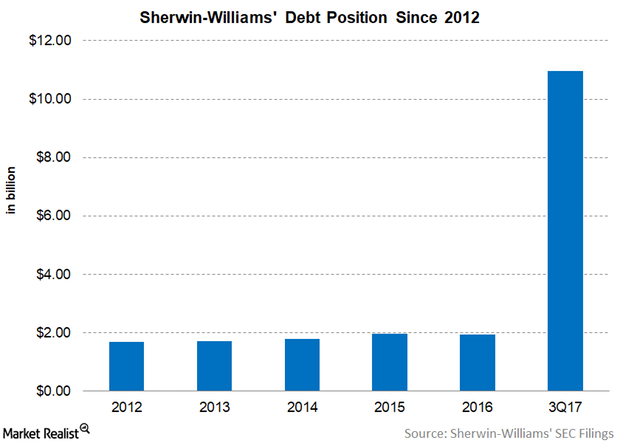

Sherwin-Williams’ Debt at All Time High: Should Investors Worry?

At the end of 3Q17, Sherwin-Williams (SHW) debt was at an all-time high of $11.0 billion.

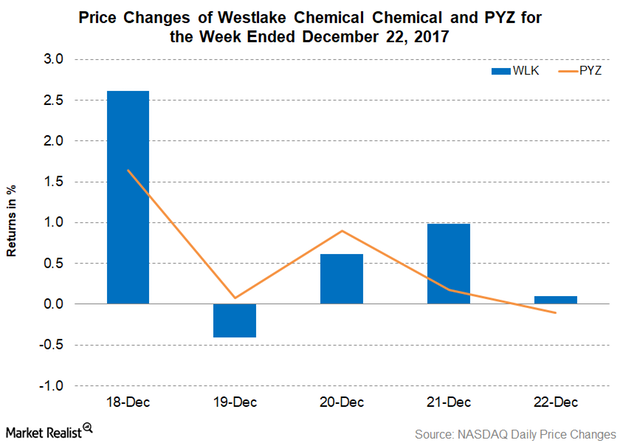

Westlake Announces Optional Redemption of Senior Notes

On December 18, 2017, Westlake Chemical (WLK) announced that it had sent notices about the optional redemption of $688 million in senior notes.

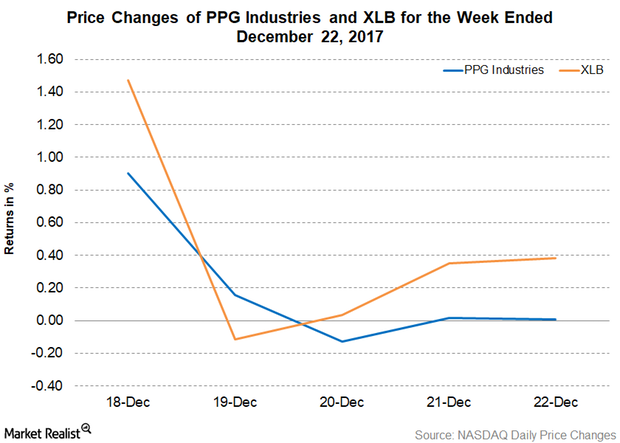

PPG Industries Increases Precipitated Silica Product Prices

On December 19, 2017, PPG Industries (PPG) announced that it’s increasing the prices of sodium silicate and all precipitated silica by up to 6%.

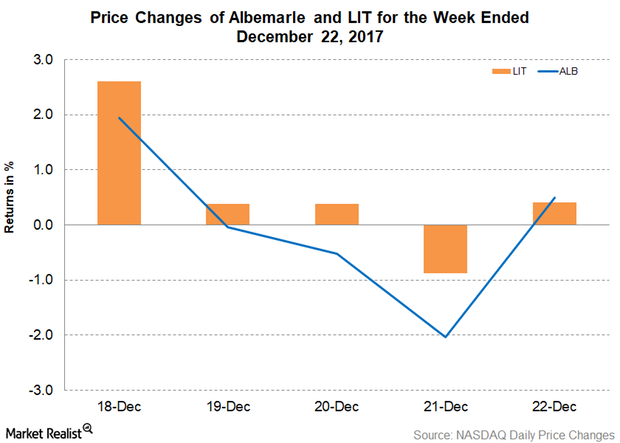

Albemarle Launches New Granite Technology

On December 19, 2017, Albemarle (ALB) announced the launch of its new Granite technology.

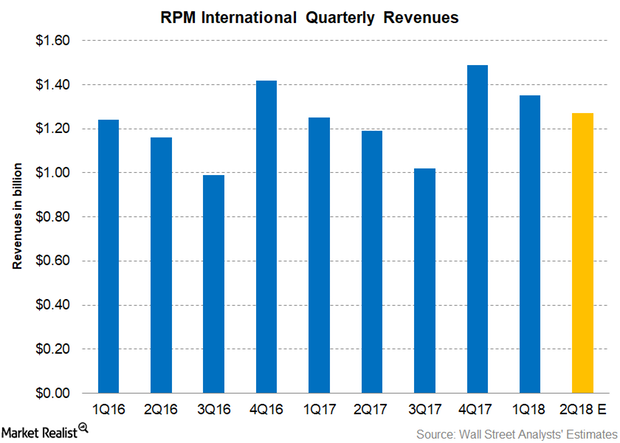

What Could Boost RPM International’s Fiscal 2Q18 Revenue

Analysts’ revenue expectations As of December 20, 2017, analysts expected RPM International (RPM) to report revenue of $1.3 billion in fiscal 2Q18. The expected revenue represents growth of 6.7% year-over-year. In fiscal 2Q17, RPM reported revenue of $1.2 billion. Between 2012 and 2017, RPM’s second-quarter revenue grew at a CAGR (compound annual growth rate) of […]

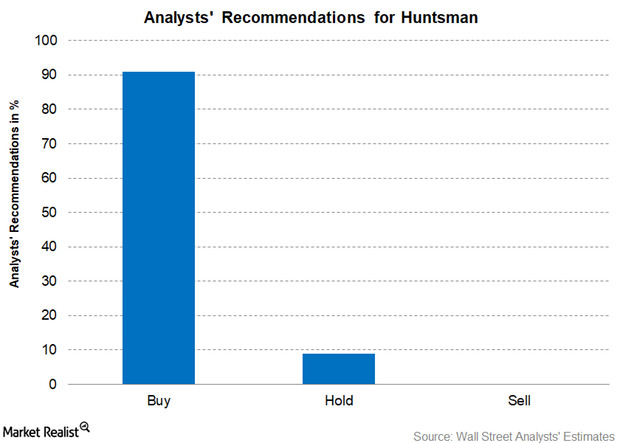

Why Analysts Are Quickly Raising Huntsman’s Target Prices

The analyst consensus target price for Huntsman is $37.55, which implies a return potential of 20.9%.

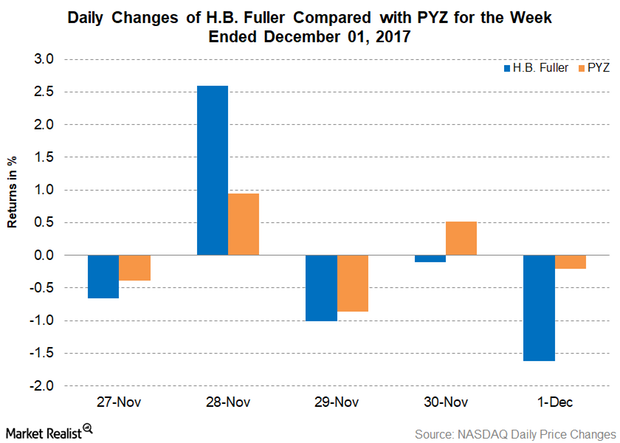

H.B. Fuller Opens a New Facility in Germany

On November 28, 2017, H.B. Fuller (FUL) announced that it has started a new Automotive Competency Center in Mannheim, Germany.

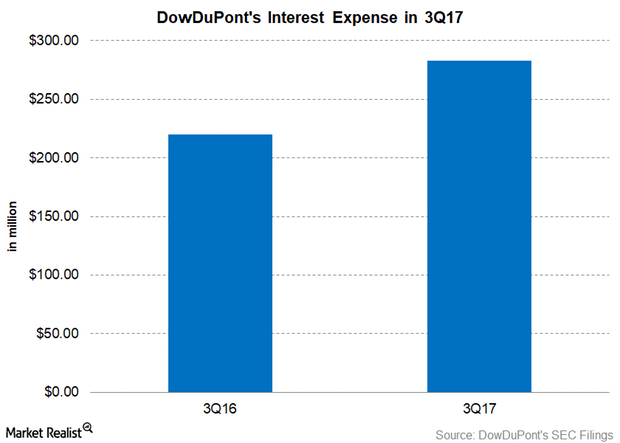

How Strong Is DowDuPont’s Interest Coverage?

In 3Q17, DWDP’s interest expense was reported at $283 million as compared to the $220 million in 3Q16 on a proforma basis.

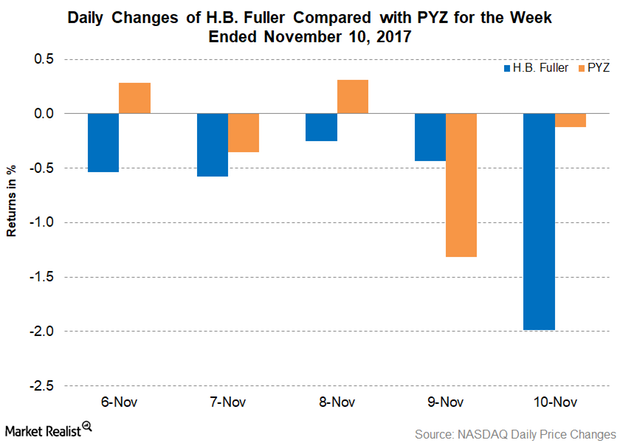

H.B. Fuller Finalizes Its Adecol Deal

On November 6, 2017, H.B. Fuller (FUL) provided its acquisition plans for Adecol Indústria Química, a Brazilian company.

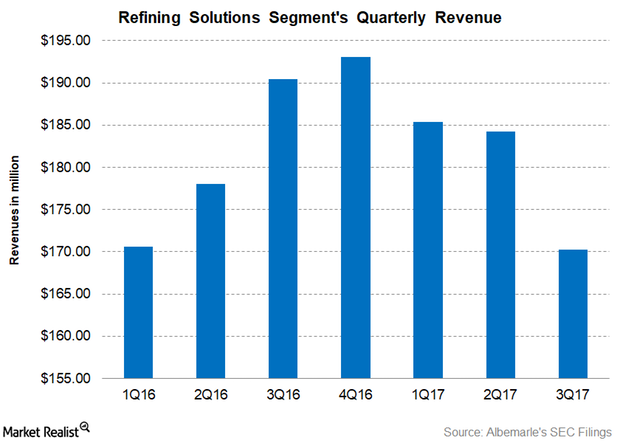

Why Albemarle’s Refining Solutions Segment Fell in 3Q17

Albemarle’s (ALB) Refining Solutions segment is the company’s lowest revenue generator, accounting for 22.6% of its total revenues in 3Q17 compared to 29.1% in 3Q16.

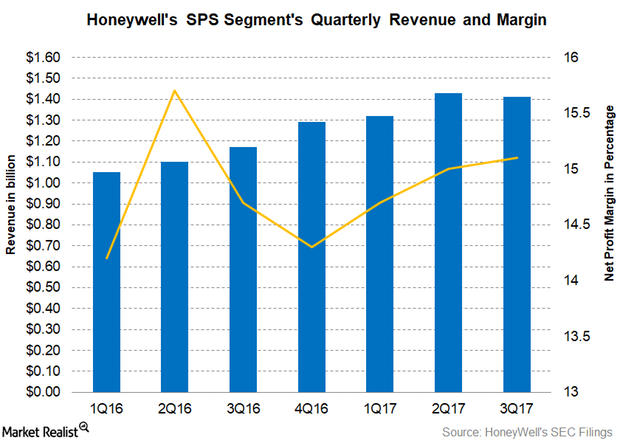

Honeywell’s Safety and Productivity Solutions: Acquisition Wave

Honeywell International’s (HON) Safety and Productivity Solutions segment is a fairly new segment and its lowest revenue contributor, accounting for 14.0% of total revenue.

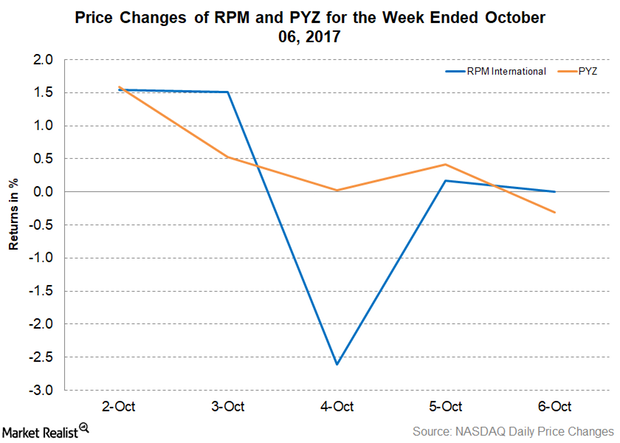

RPM International Increases Its Quarterly Dividend

On October 5, 2017, RPM International (RPM) announced an increase in its regular quarterly cash dividend of $0.32 per share—a YoY rise of 6.7%.