Can 3M Beat Analysts’ Earnings Estimates in 4Q17?

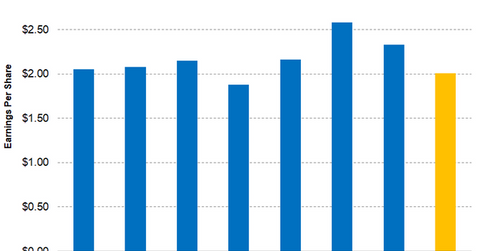

3M (MMM) is expected to post earnings per share (or EPS) of $2.01 in 4Q17, an increase of 6.9% over 4Q16.

Dec. 4 2020, Updated 10:52 a.m. ET

3M’s EPS estimation for 4Q17

3M (MMM) is expected to post earnings per share (or EPS) of $2.01 in 4Q17, an increase of 6.9% over 4Q16. In 4Q16, MMM reported EPS of $1.88. If 3M can meet Wall Street expectations, it would continue its upward trend for the fourth quarter since 2015.

3M’s continued integration of its business portfolio by way of divestitures and acquisitions is expected to bring down its operating expenses as a percentage of sales.

COGS

Analysts have projected 3M’s cost of goods sold (or COGS) in 4Q17 to be ~$3.8 billion, representing 49.0% of its expected sales. In 4Q16, MMM reported COGS of ~$3.7 billion, representing 50.7% of its sales. This trend implies a decline of 170 basis points on a year-over-year basis.

The company’s selling, general, and administrative (or SG&A) expenses are also set to decline as a percentage of sales. The company’s 4Q17 SG&A expenses are expected to be ~$1.4 billion, which comprises 18.4% of its expected sales.

In 4Q16, 3M’s (MMM) SG&A expenses as a percentage of sales totaled 20.8%, implying an improvement of 240 basis points on a year-over-year basis.

Share repurchases to improve earnings

MMM is expected to continue its share repurchases in 4Q17 as well. In 3Q17, 3M bought back nearly $380.0 million in common stock. At the end of 3Q17, 3M had 612.7 million shares outstanding.

By the end of 4Q17, analysts expect 3M’s outstanding shares to totaled ~608.8 million. Plus, 3M also guided that in 2018, it plans to buy back shares valued at $2.0 billion–$4.0 billion.

Investors can indirectly hold 3M by investing in the Industrial Select Sector SPDR ETF (XLI), which invest 5.7% of its portfolio in 3M. This fund also holds Boeing (BA), Honeywell (HON), and Caterpillar (CAT), which had weights of 7.6%, 4.8%, and 4.1%, respectively, on January 19, 2018.