Peter Neil

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Peter Neil

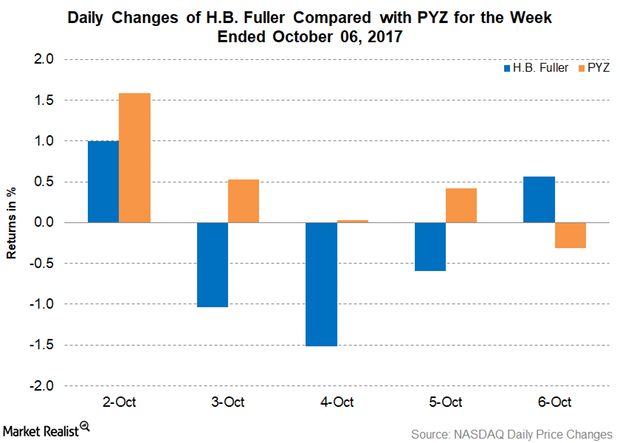

H.B. Fuller Inducts Ruth Kimmelshue to Its Board of Directors

On October 4, 2017, H.B. Fuller (FUL) announced that Ruth Kimmelshue had been appointed to the company’s board of directors, effective immediately.

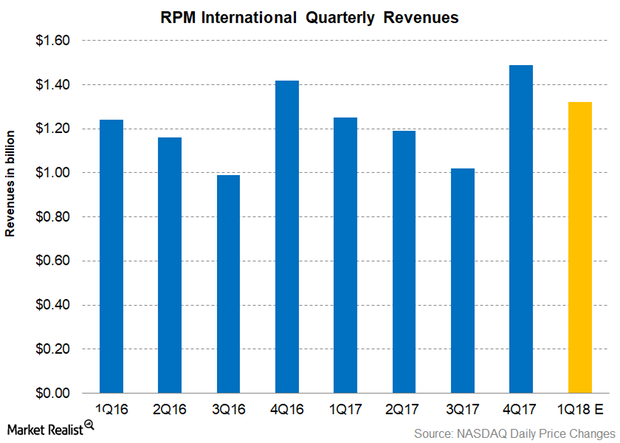

Can RPM International Outperform the Analysts’ Revenue Estimate for Fiscal 1Q18?

As of September 25, 2017, analysts have forecasted that RPM will report revenues of $1.32 billion for fiscal 1Q18, which would be a 5.5% rise over fiscal 1Q17.

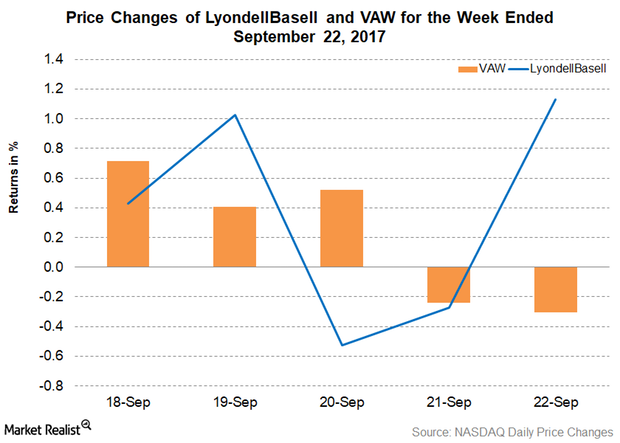

LyondellBasell Starts Polypropylene Production at Dalian, China

On September 21, 2017, LyondellBasell (LYB) announced that it has started manufacturing polypropylene (or PP) from its production facility in Dalian, China.

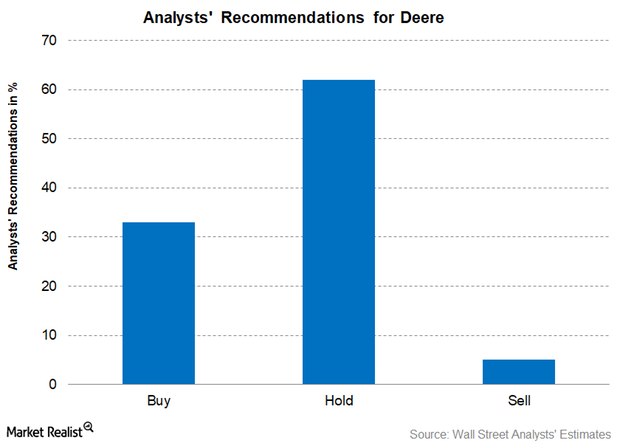

Deere: Analysts’ Recommendations and Target Prices

For Deere, 33% of the analysts recommended the stock as a “buy,” 62% recommended the stock as a “hold,” and 5% recommended the stock as a “sell.”

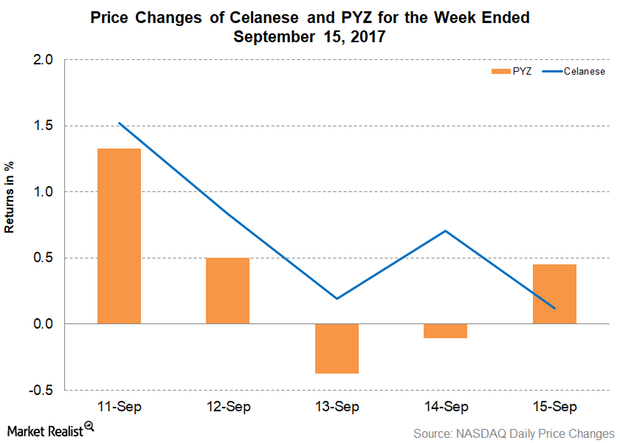

Celanese Continues to Hike Its Product Prices

On September 14, 2017, Celanese (CE) announced that it’s increasing the prices for several of its products across different regions.

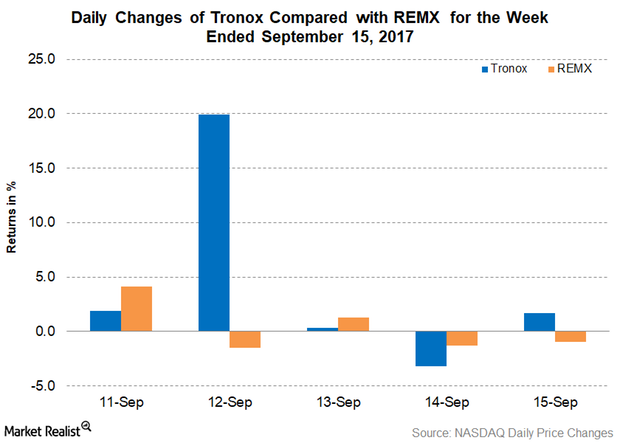

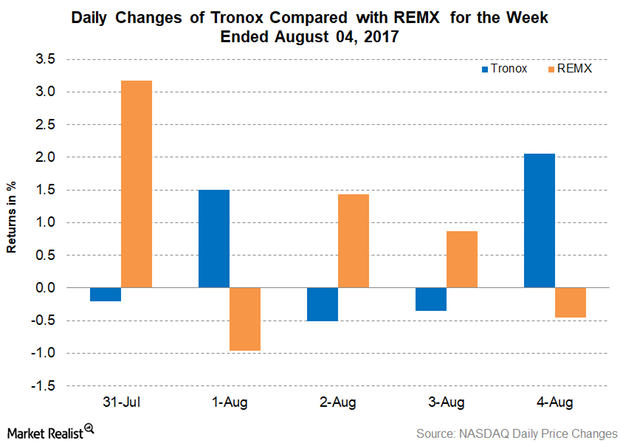

Tronox Will Raise $450 Million through Senior Notes

On September 14, 2017, Tronox (TROX) announced that it will raise $450 million through senior notes. The notes will mature in 2025.

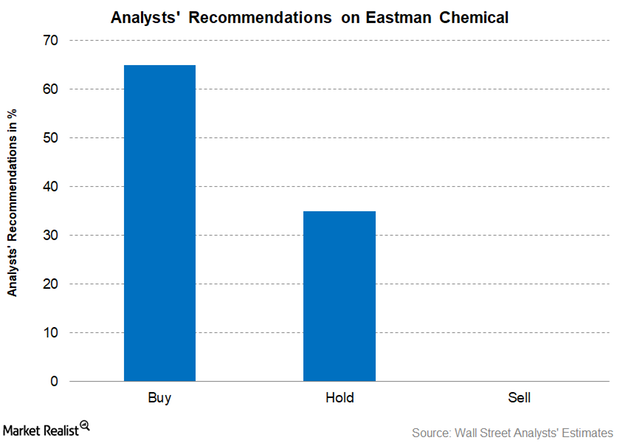

What Analysts Recommend for Eastman Chemical

Analysts’ consensus on EMN’s mean target price is on the rise from $89.92 in July to the current target price of $93.38 as of September 12, 2017.

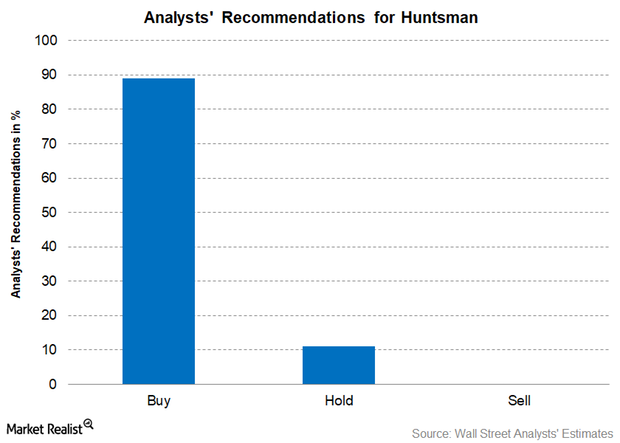

Why Most Analysts Recommend ‘Buy’ for Huntsman

Analysts’ consensus for Huntsman The number of analysts covering Huntsman (HUN) stock has increased from eight analysts to nine analysts in the last month. Among them, 89% of the analysts have recommended “buy,” and 11% have recommended “hold.” There were no “sell” recommendations. Analysts have raised Huntsman’s 12-month target price to $30.11 from $28.71, implying a potential […]

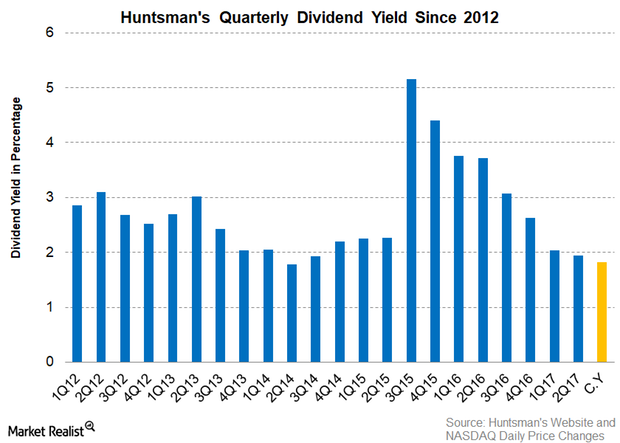

Huntsman’s Dividend Yield Falls as Its Stock Price Rises

Huntsman’s dividend yield Dividend yields are very important for long-term investors, as they fetch a steady income. Investors prefer companies with a strong dividend yield and growth. As Huntsman (HUN) has maintained its dividend rate, we can expect it to pay a fiscal 2017 dividend of $0.50 per share At this dividend rate, Huntsman’s dividend yield […]

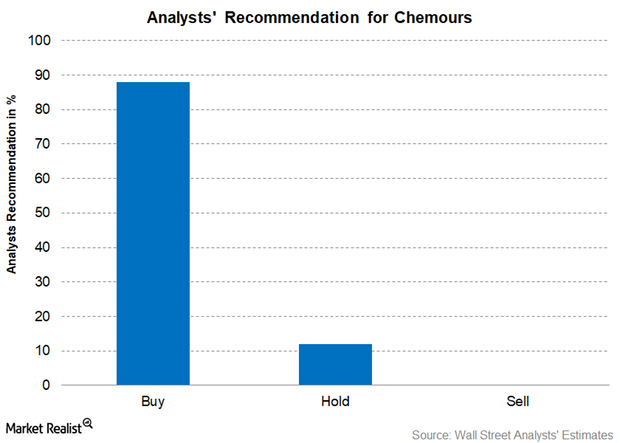

Chemours: Analysts’ Recommendations and More

For Chemours, 88% of the analysts recommended a “buy,” 12% of the analysts recommended a “hold,” and none of the analysts recommended a “sell.”

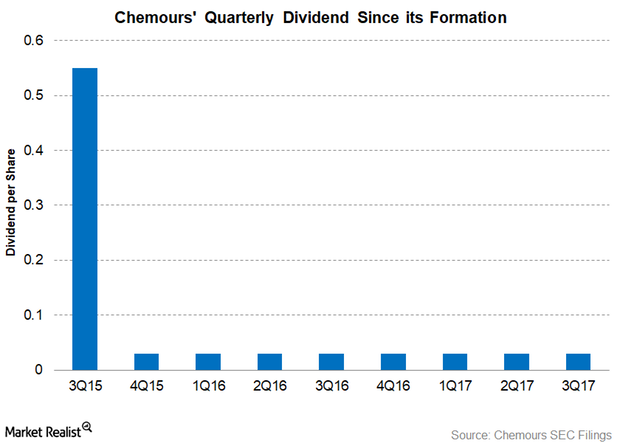

Chemours: Analyzing Its 3Q17 Dividend

On September 15, 2017, Chemours (CC) will pay the 3Q17 dividend on its outstanding common shares. It has declared a cash dividend of $0.03 per share.

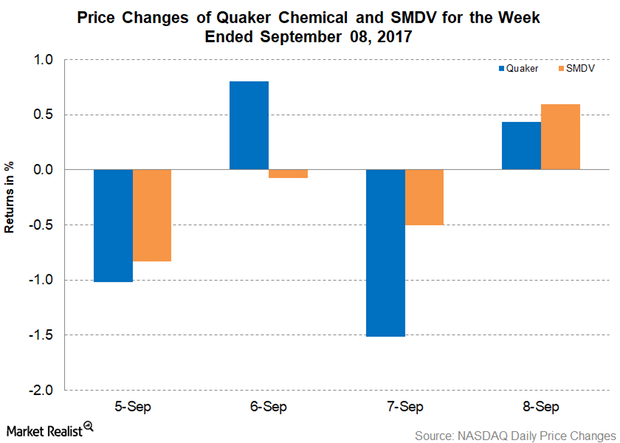

Shareholders Approve Quaker Chemical and Houghton Combination

On September 7, 2017, Quaker Chemical (KWR) shareholders approved the company’s combination with Houghton International.

Celanese: Another Round of Price Hikes on Some Products

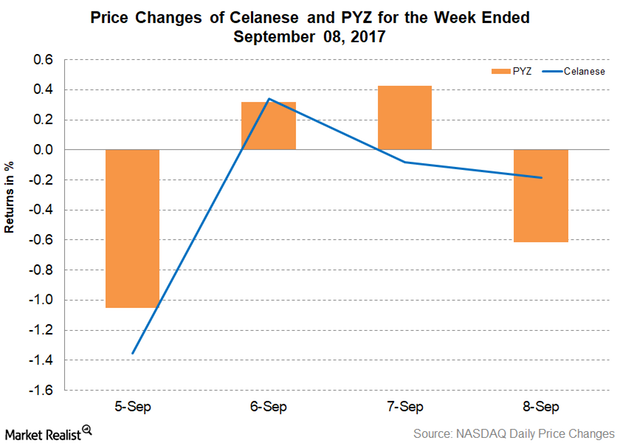

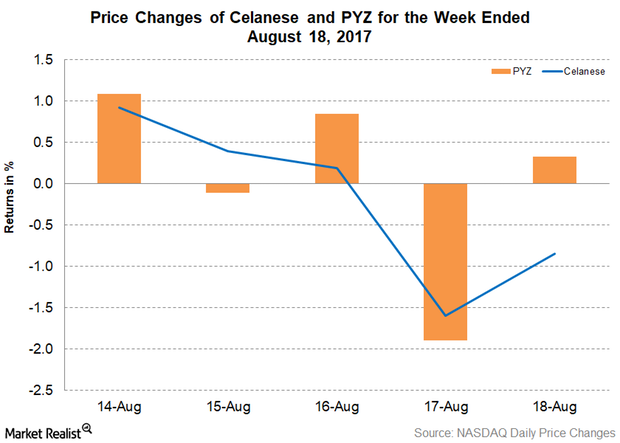

Celanese’s stock price fell 1.3% and closed at $96.78 for the week ending September 8, 2017. It traded 4.40% above the 100-day moving average price.

H.B. Fuller to Acquire Royal Adhesives and Sealants

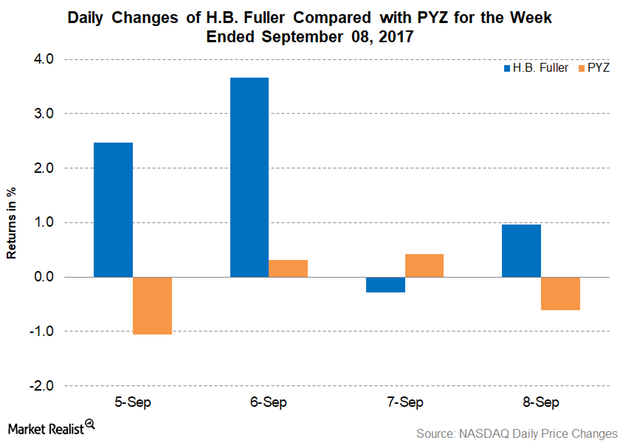

On September 4, 2017, H.B. Fuller (FUL) announced that it has entered into an agreement to acquire Royal Adhesives and Sealants.

Is LyondellBasell Stock Undervalued Compared to Its Peer?

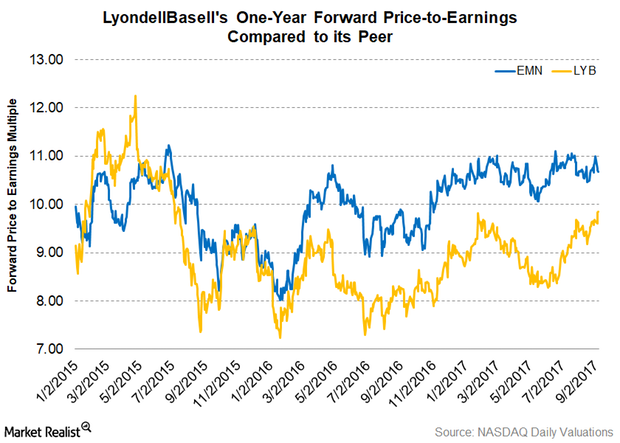

As of September 7, 2017, LyondellBasell’s one-year forward PE multiple stands at 9.80x, while Eastman Chemical has one-year forward PE multiple of 10.70x.

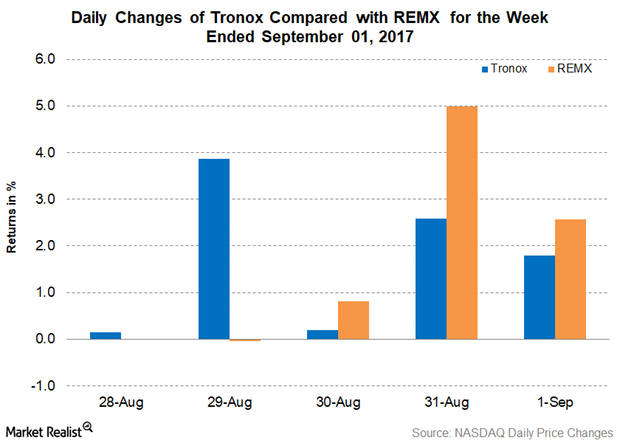

Tronox Completes the Sale of Alkali Chemicals Business

On September 1, 2017, Tronox (TROX) announced that it had completed the previously announced sale of its alkali chemicals business to Genesis Energy (GEL).

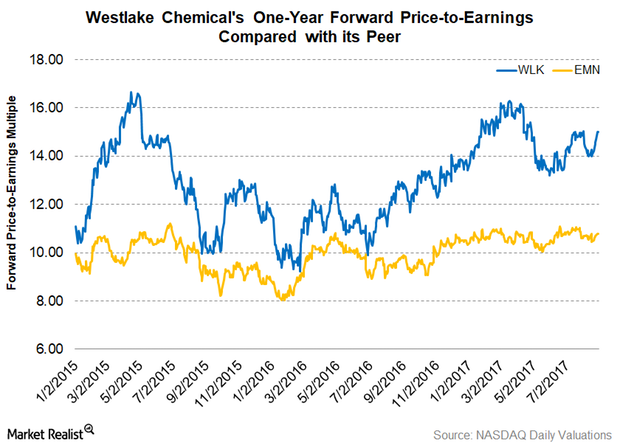

What Do Westlake Chemical’s Valuations Suggest?

Westlake Chemical is trading at a premium to its peer Eastman Chemical. After good earnings in 1H17, analysts expect Westlake Chemical to post EPS of $4.66.

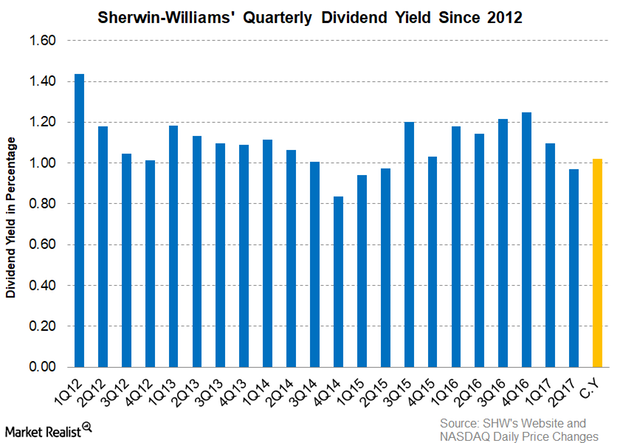

Sherwin-Williams’ Dividend Yield and Dividend Payout

Sherwin-Williams didn’t make any changes to its quarterly dividend rate. As a result, we can expect its fiscal 2017 dividend to be $3.40 per share.

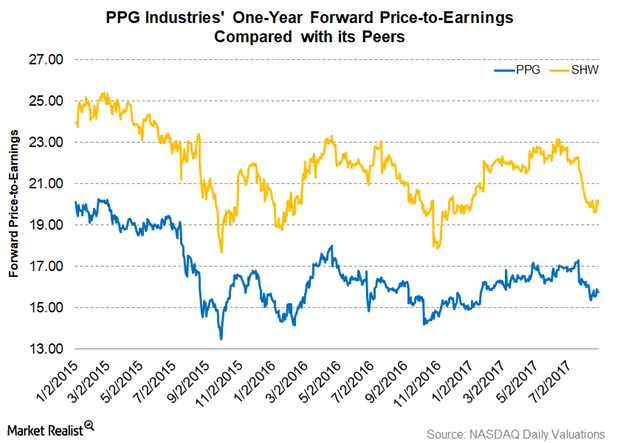

Why PPG Industries Is Trading at a Discount

As of August 25, 2017, PPG Industries’ one-year-forward PE (price-to-earnings) multiple stood at 15.80x.

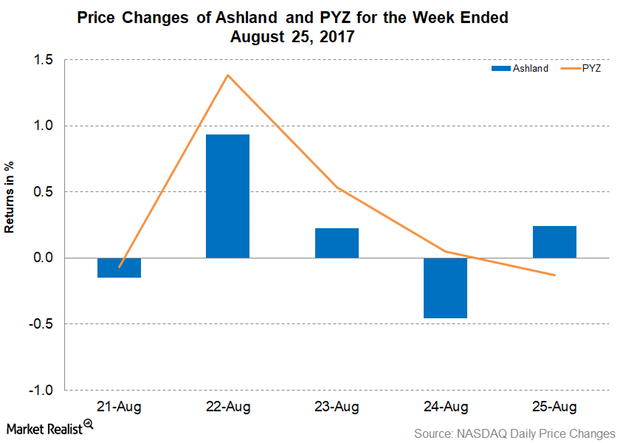

Ashland Hikes Prices of Gelcoat in EMEA

On August 25, 2017, Ashland (ASH) announced that it would hike the prices of its Gelcoat portfolio. The price hike will be 75 euros per metric ton.

Celanese Increased Vinyl Acetate Monomer Prices

Celanese stock fell 1.0% and closed at $95.77. Despite the fall in the prices, the stock was trading 4.3% above the 100-day moving average price of $91.78.

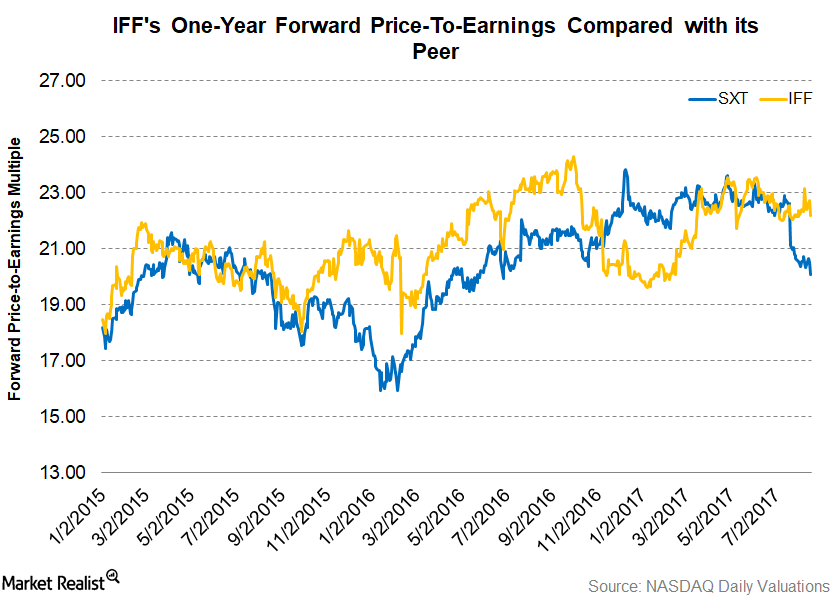

What IFF’s Valuations Suggest about the Stock

As of August 17, 2017, International Flavors and Fragrances traded at a one-year forward PE (price-to-earnings) multiple of 22.20x.

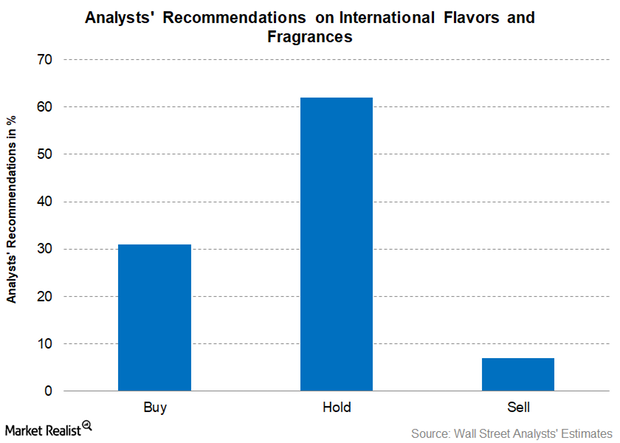

Why Most Wall Street Analysts Recommend a ‘Hold’ for IFF

International Flavors and Fragrances continues to work towards its 2020 vision of increasing its revenue by $500 million by way of acquisitions.

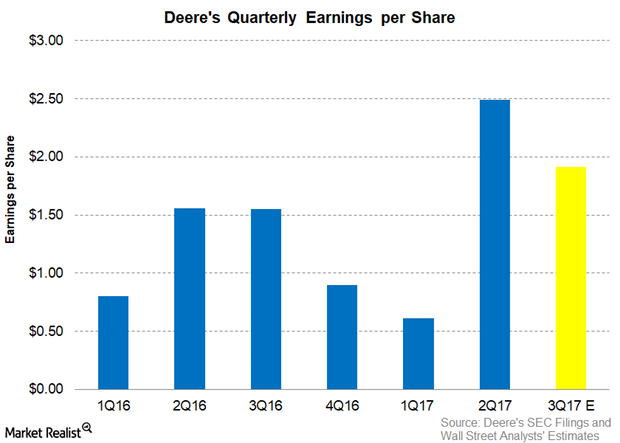

Can Deere Beat the Analysts’ Earnings Estimate Again in Fiscal 3Q17?

Analysts are expecting Deere (DE) to post EPS earnings per share of $1.91 for fiscal 3Q17, which would be an increase of 23.2% on a YoY basis.

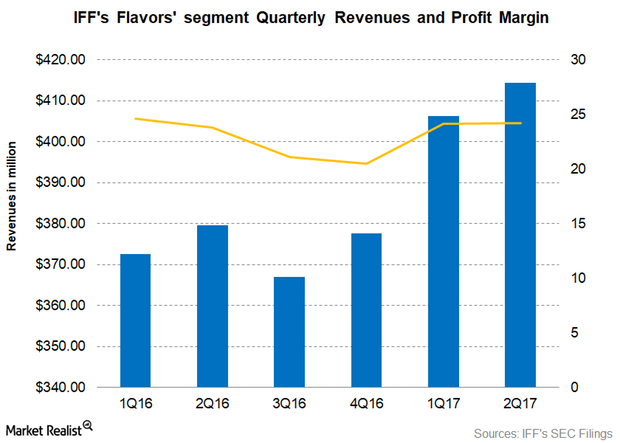

How IFF’s Flavors Segment Performed in 2Q17

The Flavors segment of International Flavors and Fragrances (IFF) has increased its revenue contribution to IFF’s overall revenue.

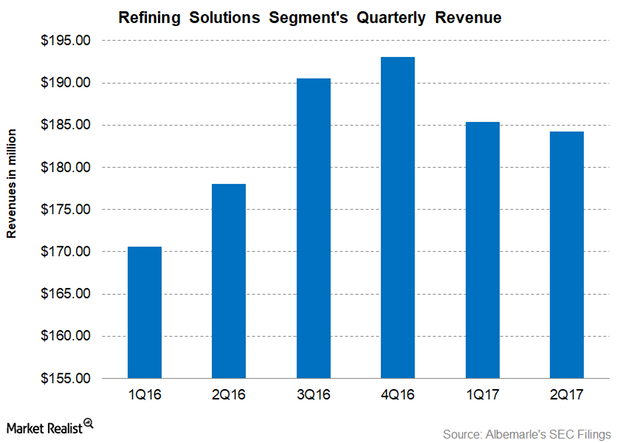

How Albemarle’s Refining Solutions Segment Performed in 2Q17

Albemarle’s (ALB) Refining Solutions is the company’s lowest revenue generator, accounting for 25.0% of its total revenues in 2Q17 compared to 26.6% in 2Q16.

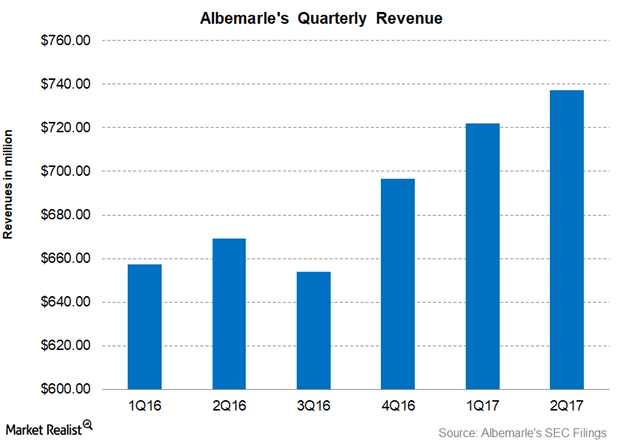

Albemarle’s 2Q17 Revenues Rose on Higher Volumes

ALB has guided its fiscal 2017 revenues to be in the range of ~$2.9 billion–$3.1 billion.

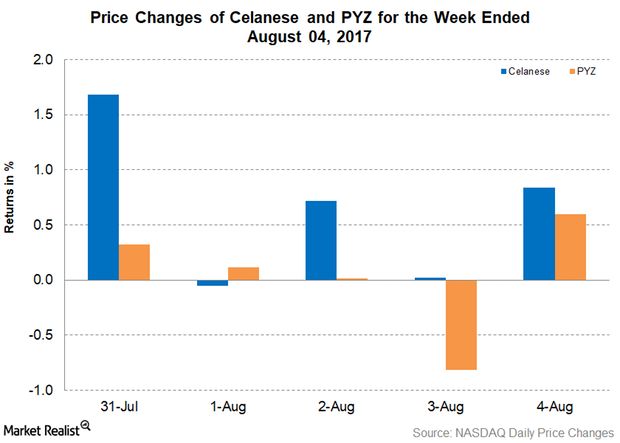

Celanese Impacts Price Hikes on Acetyl Intermediates

On August 2, 2017, Celanese (CE) announced that it’s increasing the prices of a few acetyl intermediates. The price increase will be effective immediately.

Tronox Will Sell Its Alkali Chemicals Business

On August 2, 2017, Tronox (TROX) announced that it entered into a definitive agreement with Genesis Energy LP (GEL) to sell its alkali chemicals business.

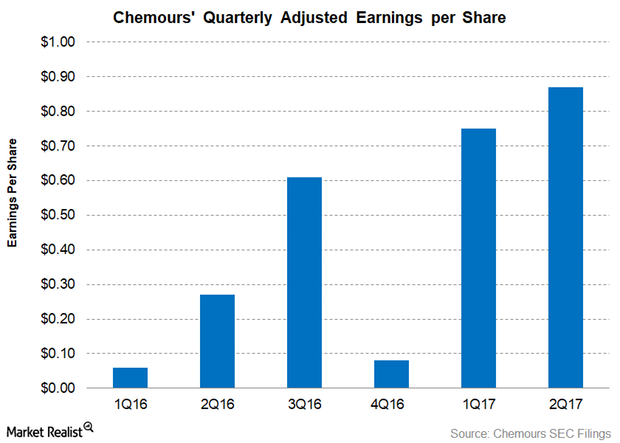

Chemours Stock Fell despite Strong Earnings in 2Q17

Chemours (CC) reported its 2Q17 earnings on August 2, 2017, after the markets closed. The company’s management held a conference call on August 3, 2017.

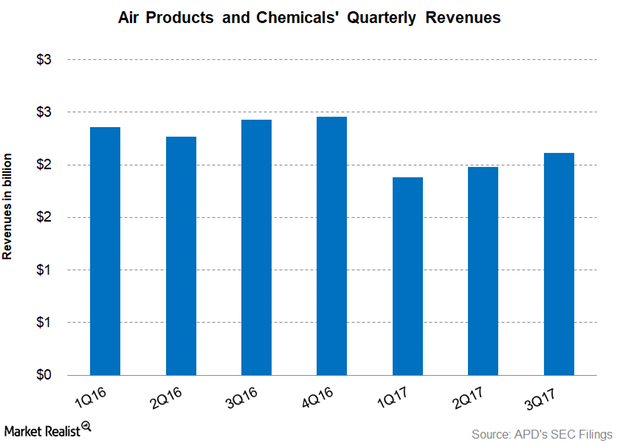

Why Air Products & Chemicals’ Revenue Rose in 3Q17

Air Products & Chemicals (APD) follows October 1–September 30 as its fiscal year. The company reported revenue of $2.11 billion.

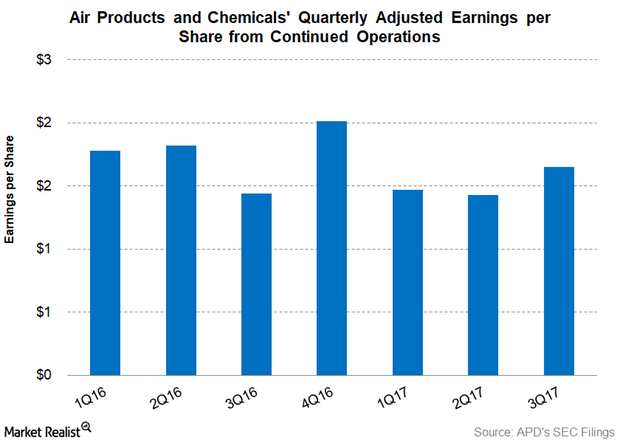

Air Products & Chemicals’ Stock Price Rose

Air Products & Chemicals (APD) announced its fiscal 3Q17 earnings on August 1, 2017. Its adjusted EPS from continuing operations was $1.65.

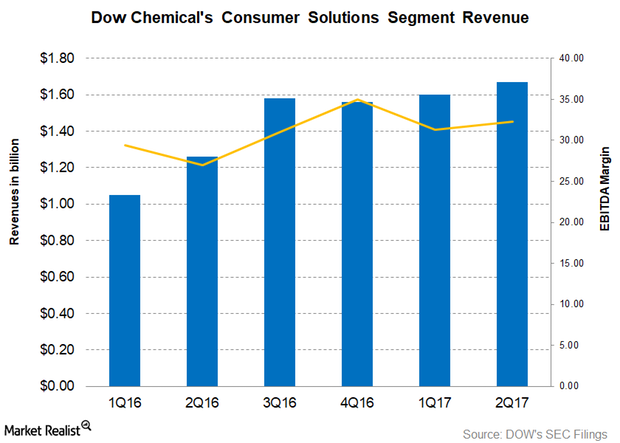

How Dow Chemical’s Consumer Solutions Segment Performed in 2Q17

Dow Chemical’s (DOW) Consumer Solutions segment is the fourth largest segment in terms of revenue.

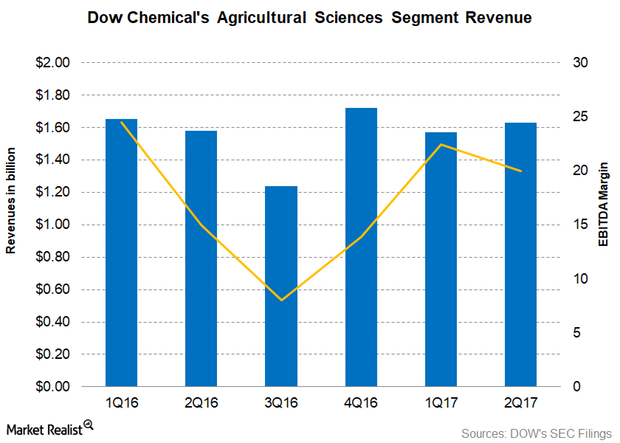

What Boosted DOW’s Agricultural Sciences Segment’s 2Q17 Revenues?

Dow Chemical’s (DOW) Agricultural Sciences segment accounted for 11.8% of DOW’s total revenue as compared to 13.2% in 2Q16.

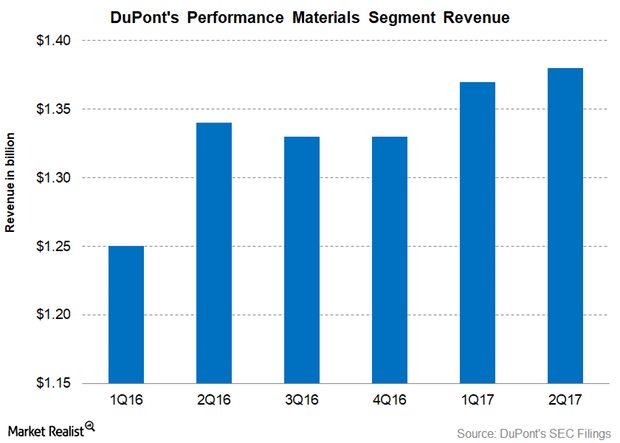

DuPont’s Performance Materials Segment’s Revenue Rose in 2Q17

In 2Q17, DuPont’s Performance Materials segment reported revenue of $1.38 billion—a increase of 3.40% on a YoY (year-over-year) basis.

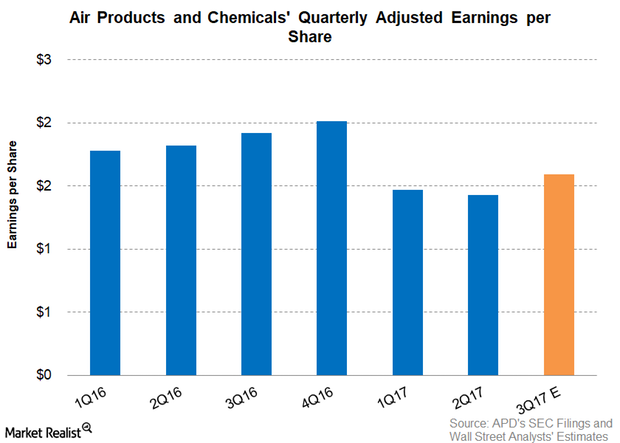

How Analysts View APD’s Fiscal 3Q17 Adjusted Earnings

On March 31, 2017, APD was left with $485.3 million from its share repurchase program.

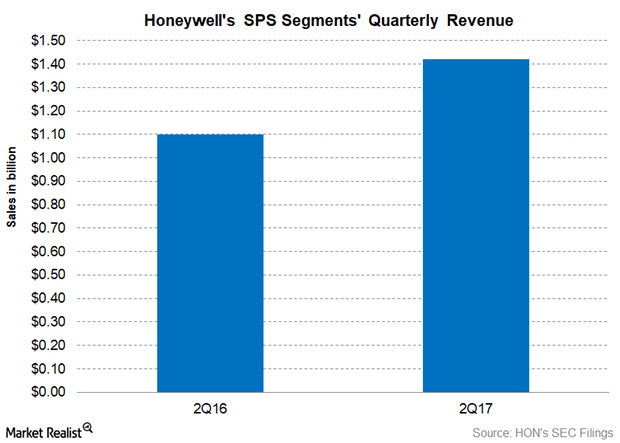

Honeywell’s Safety and Productivity Solutions: Why Revenue Rose

Honeywell’s (HON) Safety and Productivity Solutions segment is the smallest revenue contributor, accounting for 14.2% of HON’s total revenue.

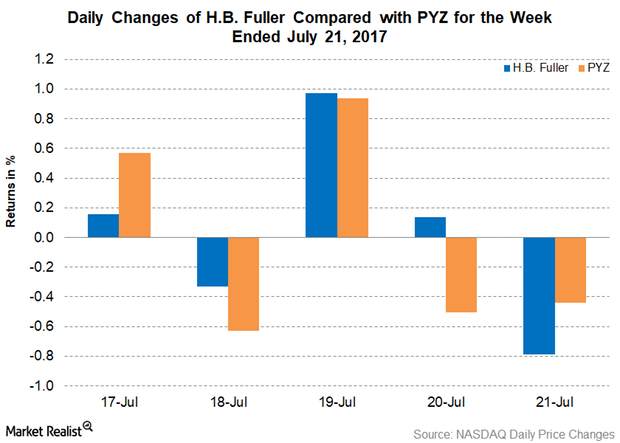

H.B. Fuller Will Acquire Adecol

H.B. Fuller had a quiet week with a meager gain of 0.1% for the week ending July 21, 2017. The stock closed at $51.50.

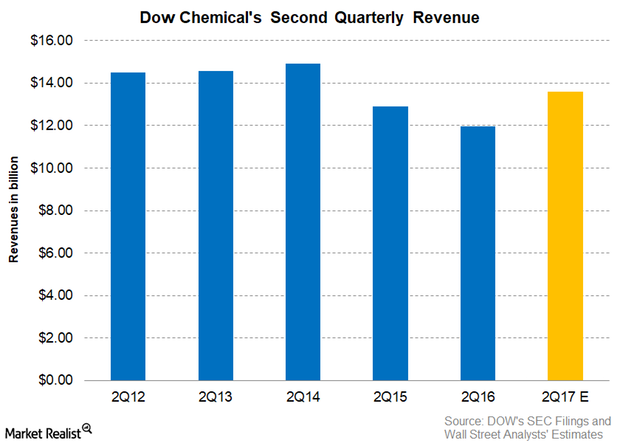

Understanding DOW’s High 2Q17 Revenue Hopes

As of July 21, 2017, analysts are expecting Dow Chemical (DOW) to post revenues of ~$13.6 billion for 2Q17, which would represent a 14.0% rise on a YoY basis.

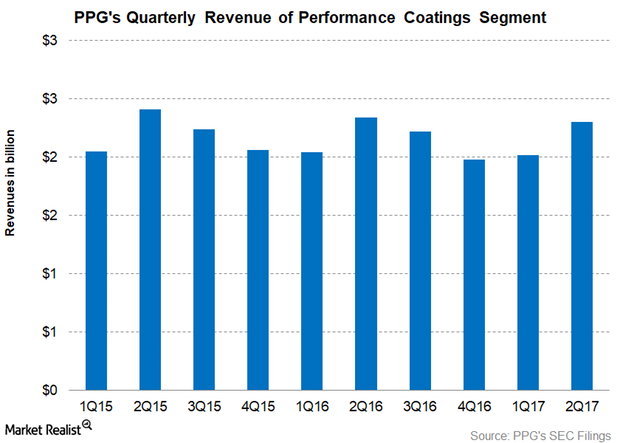

What Led to PPG’s Performance Coatings Segment’s Revenue Fall?

PPG Industries’ Performance Coatings segment is its largest revenue contributor. The segment’s contribution to PPG’s overall revenue fell from 61.8% in 2Q16 to 60.5% in 2Q17.

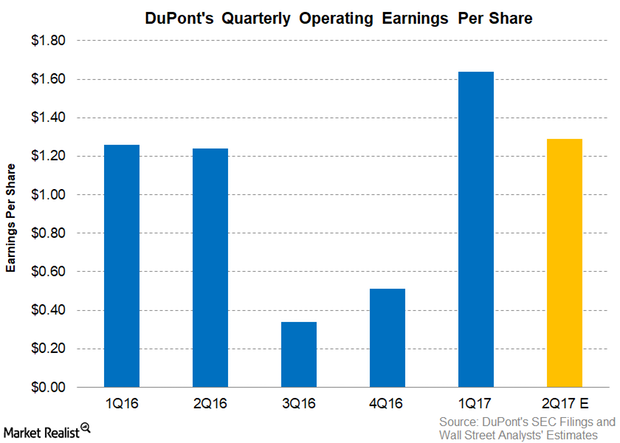

What Can We Expect for DuPont’s Earnings per Share in 2Q17?

DuPont’s earnings per share estimates for 2Q17 As of July 19, 2017, analysts expected DuPont (DDD) to post operating EPS (earnings per share) of $1.29, an increase of 4.0% YoY (year-over-year). In 2Q16, DuPont reported operating EPS of $1.24. The forecast increase in DuPont’s operating EPS is expected to be driven by improved SG&A (selling, general, […]

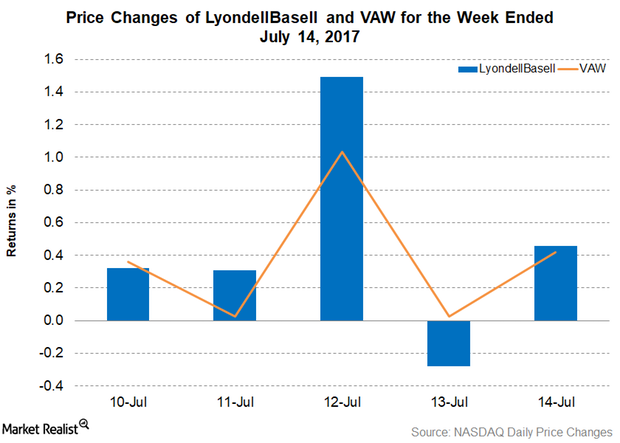

Who’s LyondellBasell Cooking up a License Deal with Now?

On July 12, 2017, LyondellBasell (LYB) granted its Spherizone and Lupotech T Licenses to Shaanxi Coal Yulin Energy and Chemical.

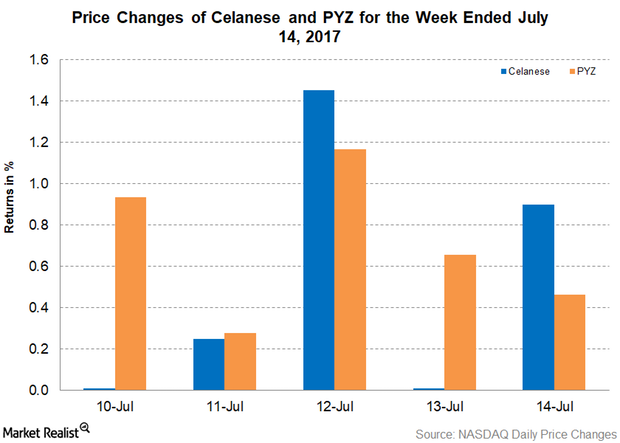

Inside Celanese’s Price Hikes Products

On July 12, 2017, Celanese (CE) announced that it will be increasing the prices of a few of its acetyl intermediate products.

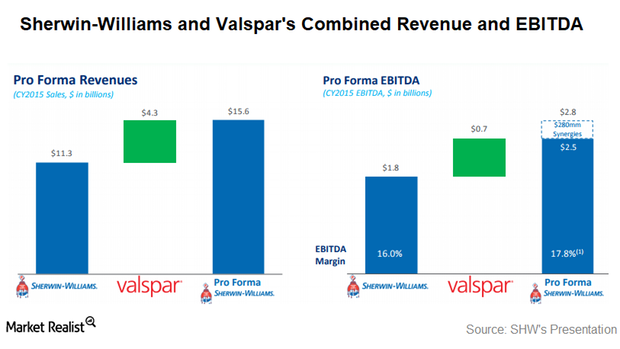

Analyzing Sherwin-Williams and Valspar’s Acquisition Deal

On March 20, 2016, Sherwin-Williams (SHW) announced that it entered into a definitive agreement to acquire Valspar in an all-cash transaction.

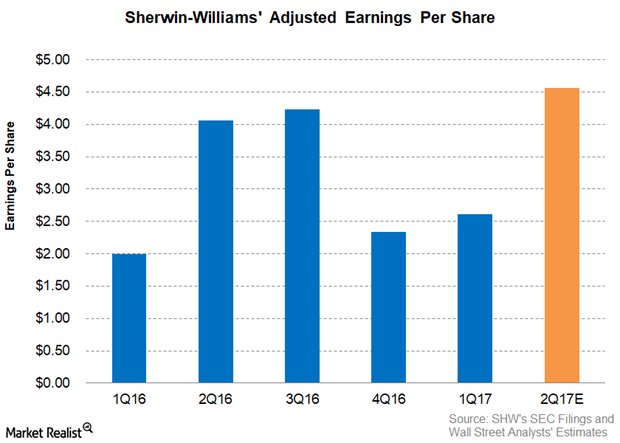

Analysts Expect Sherwin-Williams’ 2Q17 Adjusted EPS to Rise

Analysts expect Sherwin-Williams (SHW) to post adjusted EPS (earnings per share) of $4.56 in 2Q17—an increase of 12.2% on a year-over-year basis.

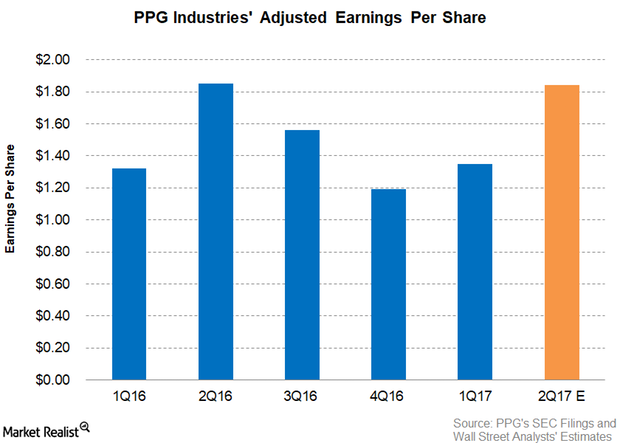

Can PPG Industries’ 2Q17 Adjusted EPS Beat Estimates?

Analysts are expecting PPG Industries (PPG) to post adjusted EPS of $1.84 in 2Q17, which implies a fall of 0.50% YoY.Company & Industry Overviews Tronox Hikes Soda Ash Price with Immediate Effect

On July 5, 2017, Tronox (TROX) announced that it’s increasing the price of soda ash by $6 per short ton, applicable to bulk and packaged products.

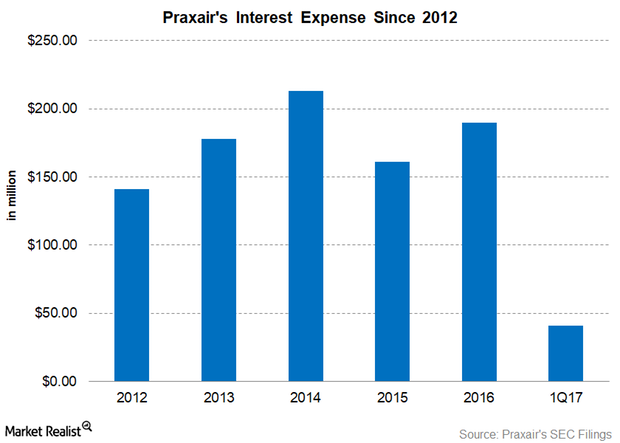

Can Praxair Manage Its Interest Expense?

Praxair’s (PX) interest expense has been on an upward trend since 2012 when its debt grew.

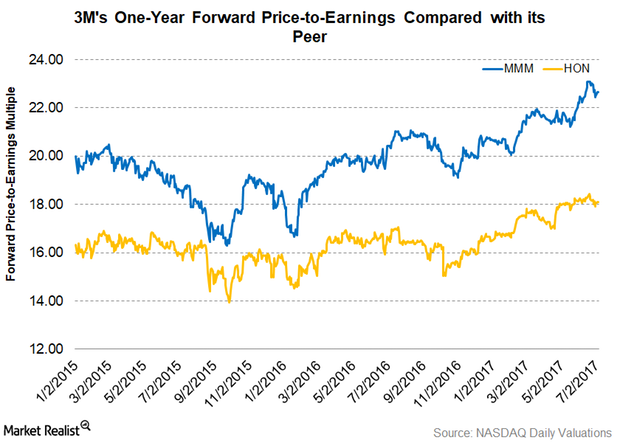

Why 3M Is Trading at a Premium Compared to Its Peers

In this article, we’ll look at MMM’s latest valuations and compare them to its peers’. On July 3, 2017, MMM was trading at a one-year forward PE of 22.70x.

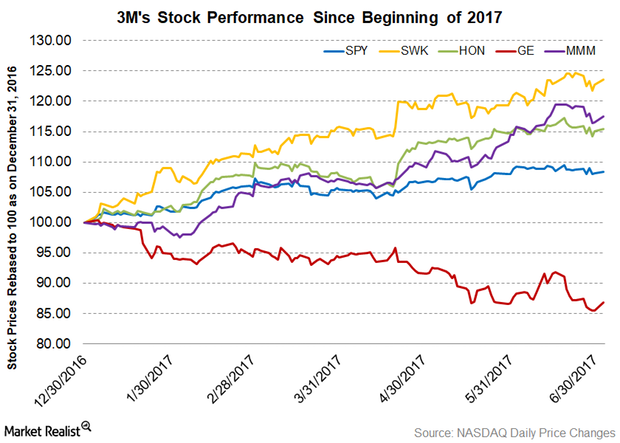

How Does 3M Company Compare to Its Industrial Peers?

Among 3M Company’s (MMM) industrial peers, MMM stock has been the second-best performer since the beginning of 2017.