Peter Neil

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Peter Neil

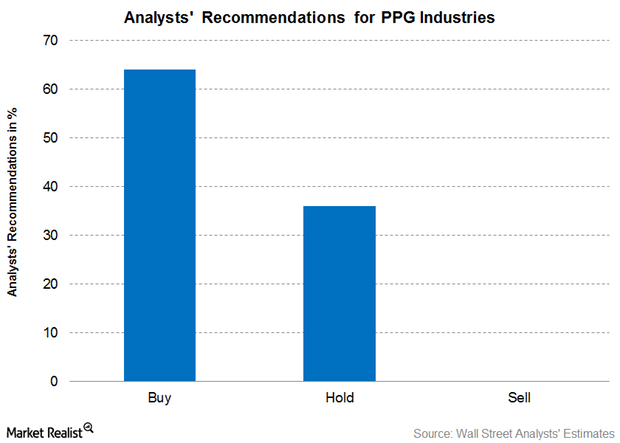

Analysts’ Recommendations and Target Price for PPG Industries

As of March 1, 2017, 22 brokerage firms were actively tracking PPG Industries (PPG) stock. About 64.0% of them have recommended a “buy” for the stock.

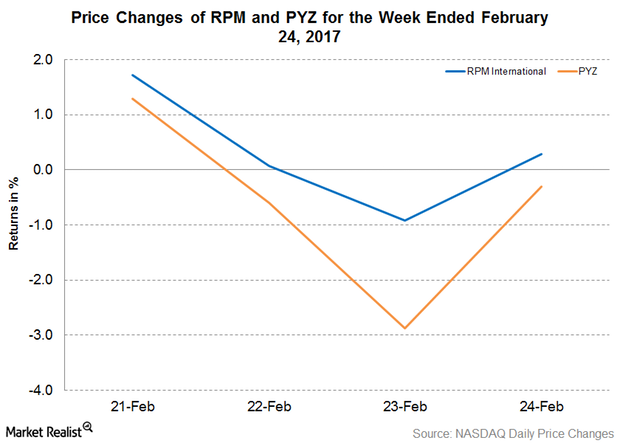

Ratner Leaves RPM International’s Board of Directors

On February 24, 2017, RPM International (RPM) announced that Charles Ratner would be retiring from RPM’s board of directors after serving the company for 12 years.

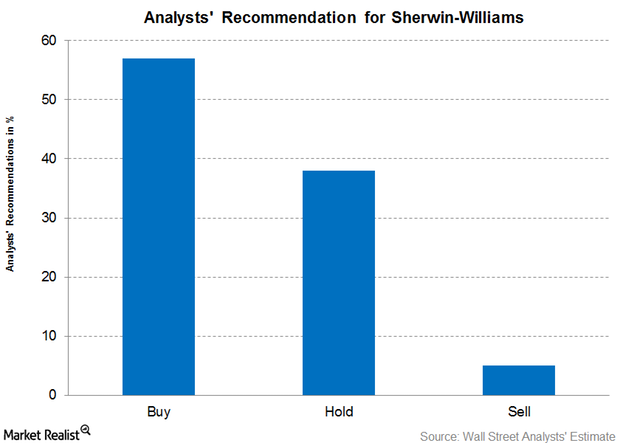

Analysts’ Latest Recommendations for Sherwin-Williams

As of February 27, 21 brokerage firms were actively tracking Sherwin-Williams stock—57% gave it a “buy,” 38% gave it a “hold,” and 5% gave it a “sell.”

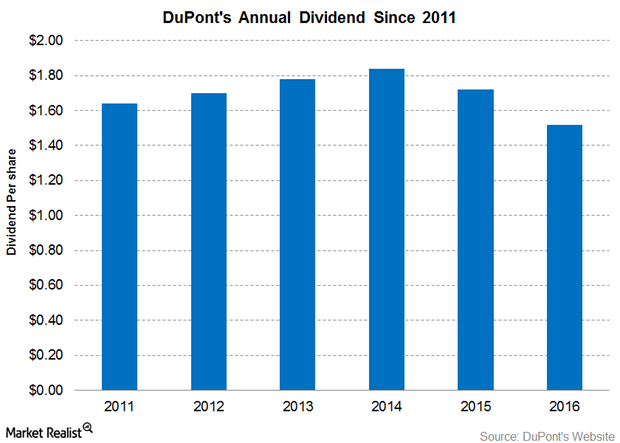

DuPont Set to Pay Its 450th Consecutive Quarterly Dividend

On January 27, 2017, DuPont (DD) declared a dividend of $0.38 per share for 1Q17 on the company’s outstanding common stock.

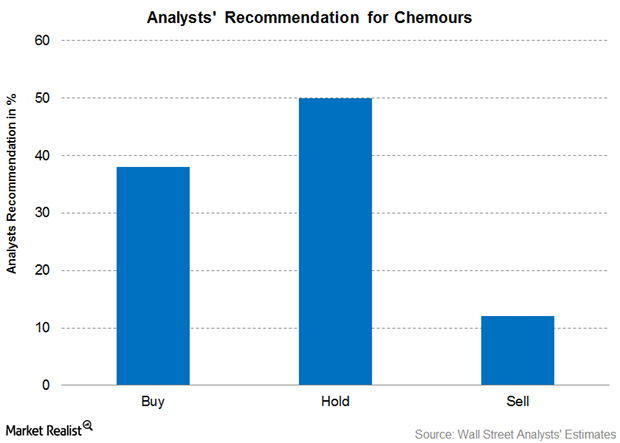

What Are Analysts’ Recommendations for Chemours?

After Chemours’ 4Q16 earnings, 38.0% of the analysts recommended a “buy” for the stock, 50.0% recommended a “hold,” and 12.0% recommended a “sell.”

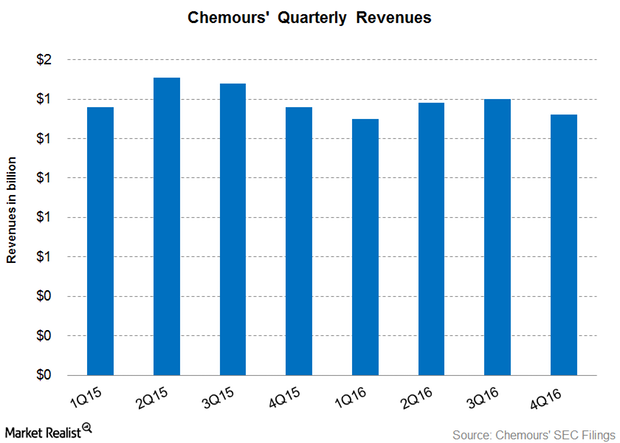

Chemours Beat Analysts’ 4Q16 Revenue Estimates

Chemours (CC) reported its 4Q16 results on February 15, 2017, after the markets closed. Chemours reported 4Q16 revenue of $1.32 billion.

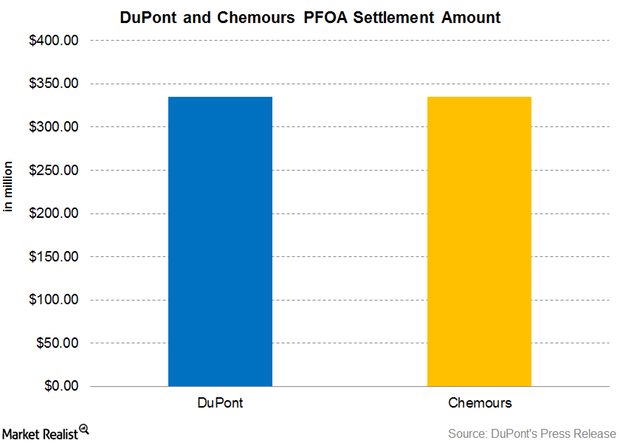

Impact of the PFOA Litigation Settlement on DuPont

On February 13, 2017, DuPont (DD) reached an agreement to a settlement involving ~3,500 lawsuits related to PFOA (perfluorooctanoic acid) and its salts.

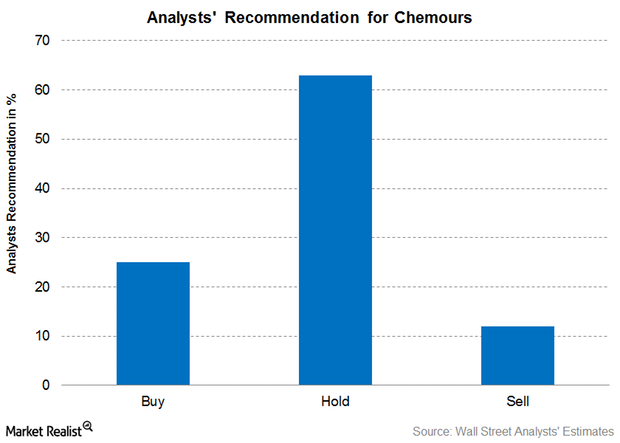

What Are Analysts Recommending for Chemours ahead of 4Q16?

As of February 9, 2017, eight brokerage firms are actively tracking Chemours (CC) stock. About 25.0% of them have recommended a “buy” for the stock.

RPM International Has Acquired Prime Resins

On January 17, 2017, RPM International (RPM) announced that it has acquired Prime Resins. The acquisition will be integrated into RPM’s USL Group.

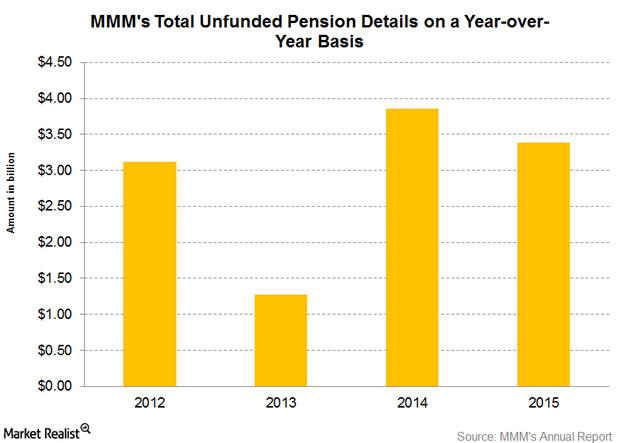

3M’s Pension Plan, Post-Retirement Benefits, and the Rate Hike

3M (MMM) offers defined benefit plans to all its US employees and those outside the United States as a well. Overall, the company has 80 defined plans across 28 countries.

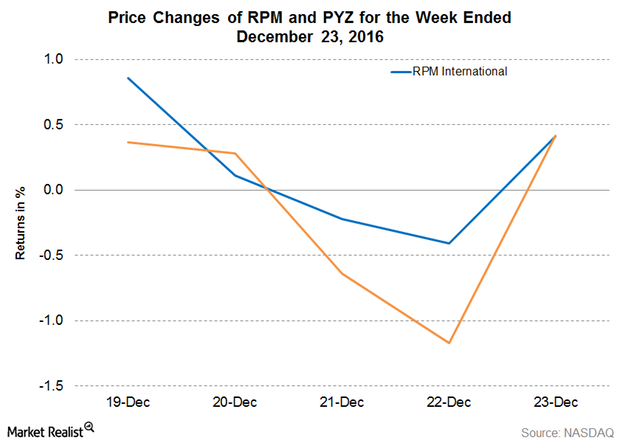

RPM International to Acquire SPS Group

On December 21, RPM announced that it has entered an agreement to acquire SPS Group.

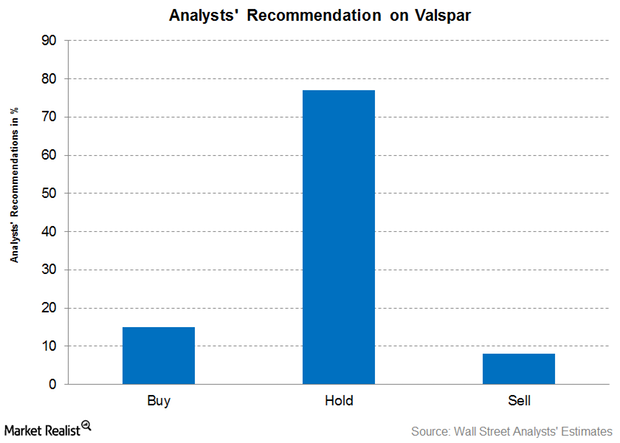

What Does Wall Street Think about Valspar?

As of December 20, 2016, 13 brokerage firms are actively tracking Valspar (VAL)) stock. About 15.0% of those analysts have recommended a “buy” for the stock.

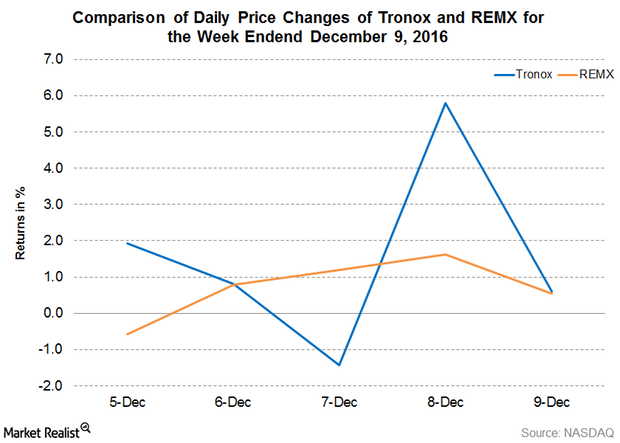

Tronox Increases Prices across All Its Titanium Dioxide Grades

On December 8, 2016, Tronox announced price rises for all of its titanium dioxide grades. The rise in titanium dioxide prices will be effective on January 1, 2017.

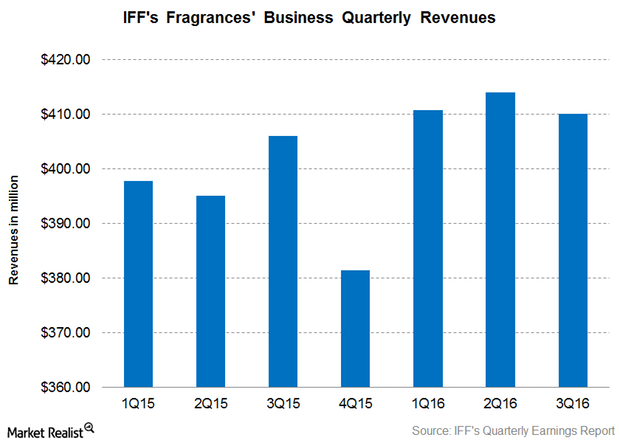

How Did IFF’s Fragrances Segment Perform in 3Q16?

IFF’s Fragrances segment reported revenues of ~$410.1 million in 3Q16, as compared to $406 million in 3Q15, implying a 1.0% YoY rise.

Analysts Are Truly Divided on Chemours after Its 3Q16 Earnings

Among the analysts covering Chemours’ stock, 33.33% analysts recommended a “buy,” while 33.33% issued a “hold,” and the remaining 33.33% issued a “sell.”

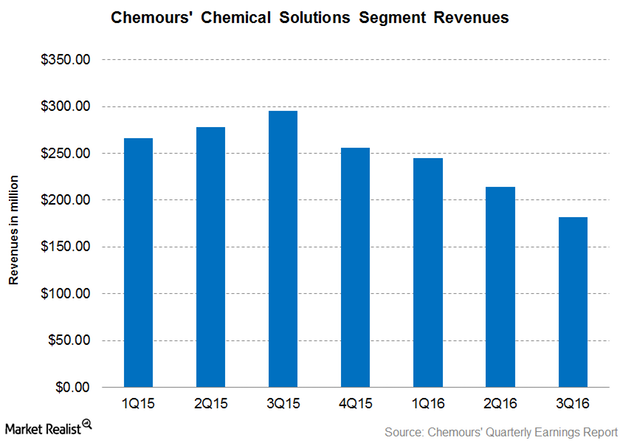

Why Did the Chemours Chemical Solutions Segment’s Revenue Dip in 3Q16?

Chemours’ Chemical Solutions segment reported revenue of $182 million in 3Q16, as compared to $295 million in 3Q15, implying a revenue fall of 38.2% YoY.

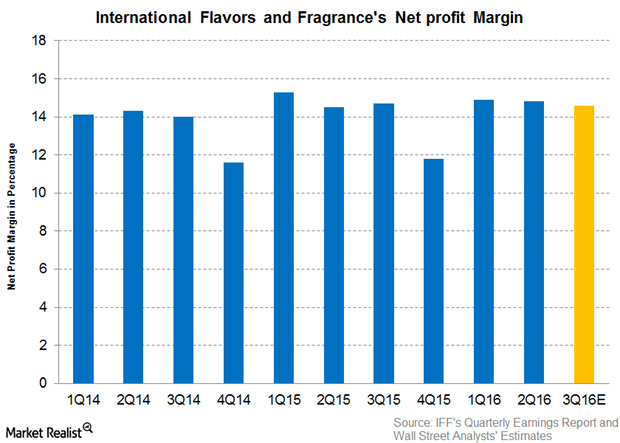

Can IFF Surprise Analysts with a Higher Net Profit Margin?

Wall Street analysts are expecting International Flavors and Fragrances (IFF) to post a net profit margin of 14.6% in 3Q16, compared to 14.7% in 2Q16.

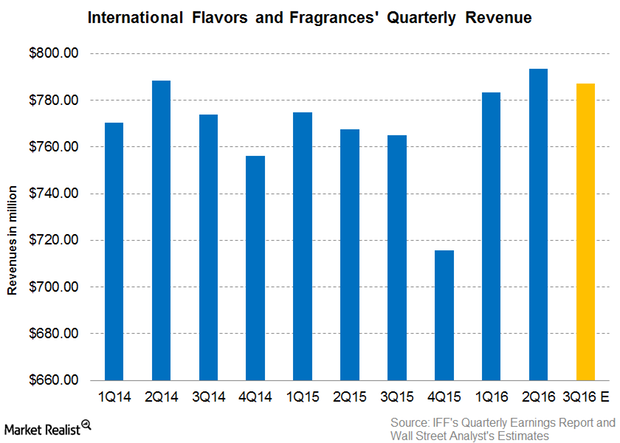

Can IFF Break the Jinx of the $700 Million Revenue Range?

Analysts are expecting International Flavors and Fragrances to post revenue of $787.20 in 3Q16, implying a 2.9% rise in its projected revenue on a year-over-year basis.

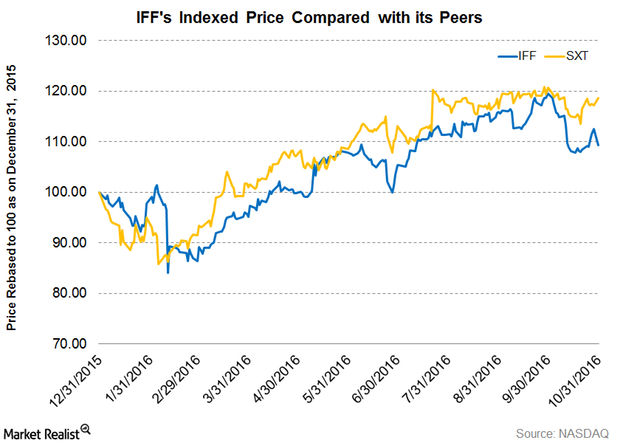

IFF Is Trading High: Can This Continue ahead of Its 3Q16 Results?

International Flavors and Fragrances (IFF) is set to report its 3Q16 earnings after the market closes on November 7, 2016.

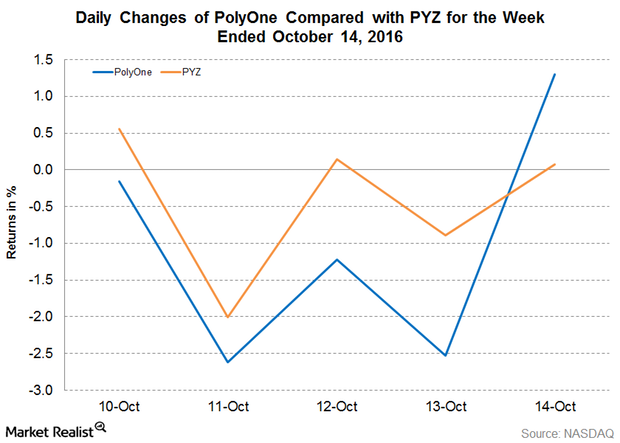

PolyOne Will Manufacture Specialty Materials in India

On October 12, 2016, PolyOne (POL) announced that it would produce specialty engineered materials at its existing facility in Pune, India.

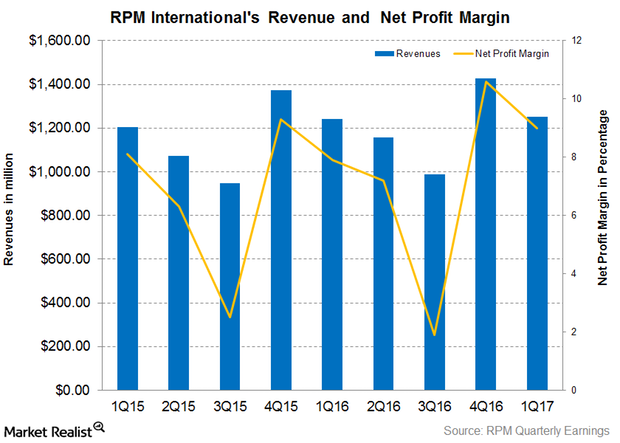

Why Did RPM’s Fiscal 1Q17 Revenues Miss Analyst Estimates?

RPM International (RPM) reported fiscal 1Q17 revenues of $1.25 billion, which missed analysts’ expectation of $1.30 billion.

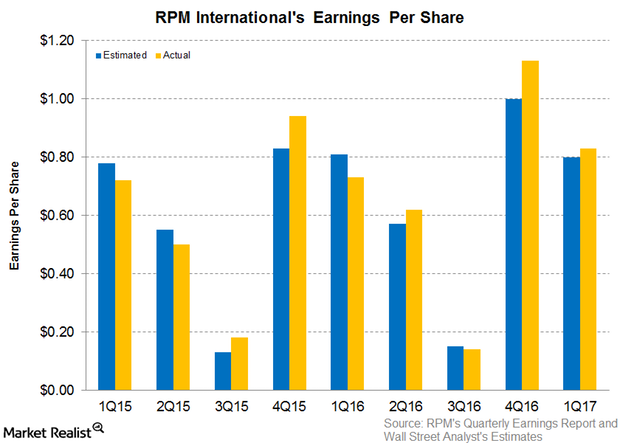

RPM International’s Fiscal 1Q17 Earnings Beat Analysts’ Estimates

RPM International reported adjusted EPS (or earnings per share) of $0.83, which beat analysts’ estimate of $0.80.

What Are Analysts’ Recommendations for H.B. Fuller?

About 66% of the brokerage firms covering FUL stock have recommended a “buy,” 34% have recommended a “hold,” and none have recommended a “sell.”

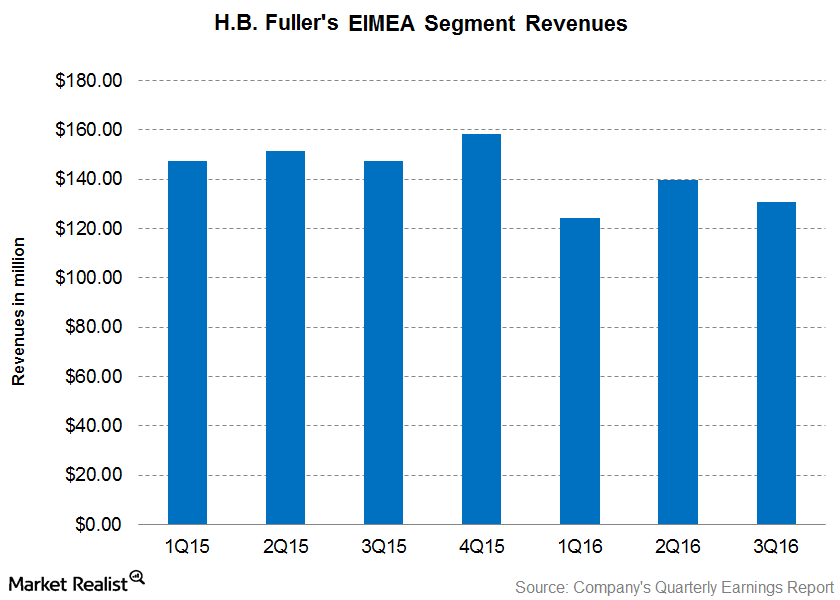

H.B. Fuller’s EIMEA Segment Saw Volume and Margin Growth in 3Q16

In 3Q16, H.B. Fuller’s EIMEA segment reported revenue of $130.6 million, or 25.5% of the company’s total revenue.

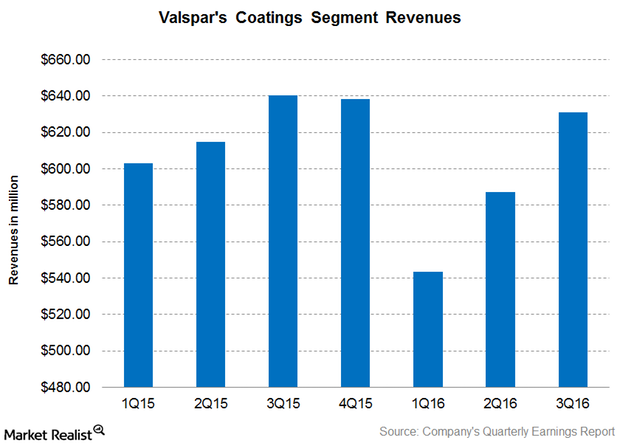

Why Did Valspar’s Coatings Segment Revenue Fall in 3Q16?

Valspar (VAL) reports its revenue under two segments, namely: the coatings segment and paints segment.

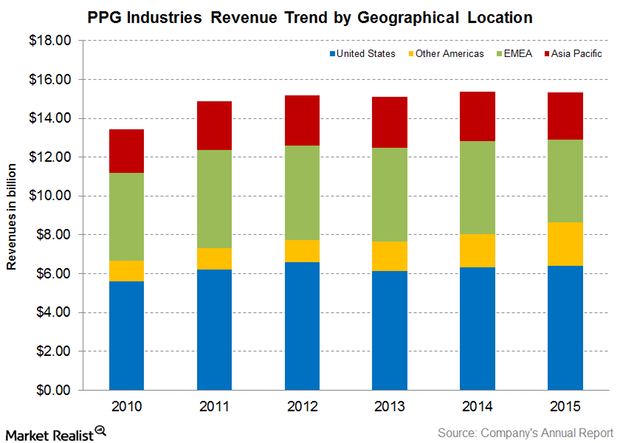

PPG Industries’ Geographical Revenue Mix

PPG Industries (PPG) is a leading global player in the paint and coatings segment, operating in 70 global locations. Let’s look at their revenue contributions to PPG.

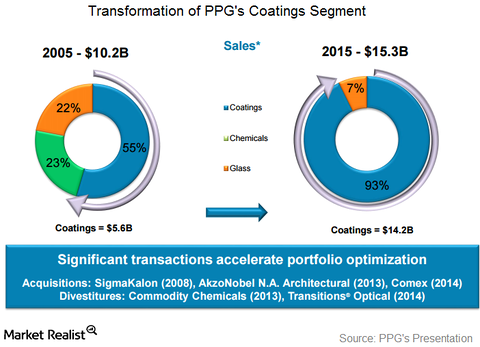

PPG Industries’ Business Model Aids Its Coatings Segment

PPG Industries’ (PPG) coatings segment has been growing at a CAGR of 7.1% since 2010. PPG has been able to increase its revenues basically through acquisitions.

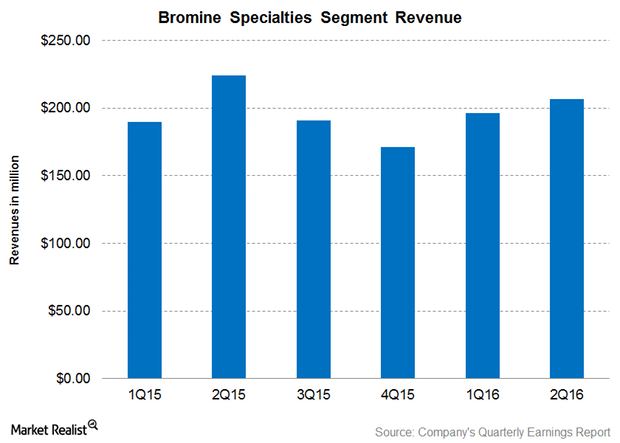

Albemarle’s Bromine Specialties Segment: Why Revenue Fell in 2Q16

In 2Q16, Albemarle’s (ALB) Bromine Specialties segment reported revenue of $206.9 million, representing 30.9% of Albemarle’s total revenue.

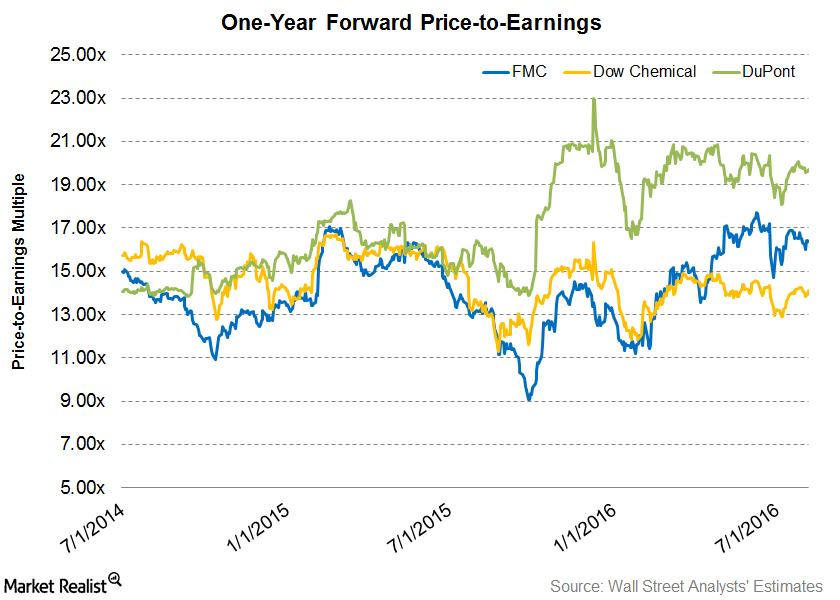

Where Do FMC’s Valuations Stand after Its 2Q16 Earnings?

Forward price-to-earnings (or PE) is a relative valuation method that considers a company’s future earnings for calculation.

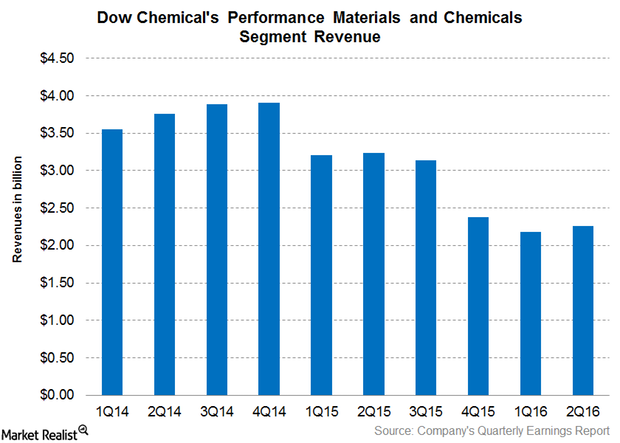

Why Dow’s Performance Materials and Chemicals’ Revenue Fell

Dow Chemical’s Performance Materials and Chemicals segment is the second largest revenue contributor to its total revenue.

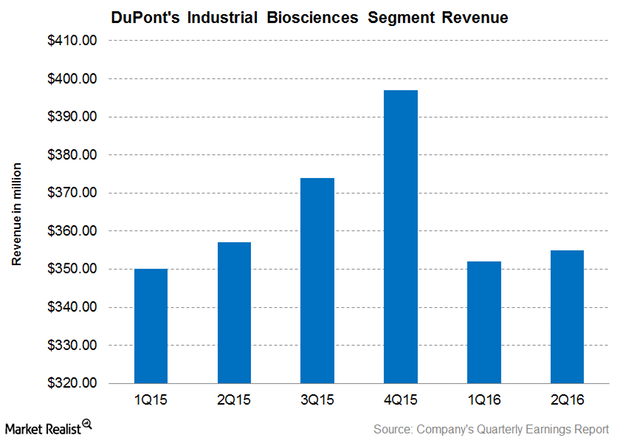

Why Did DuPont’s Industrial Biosciences Segment Revenue Fall in 2Q16?

For 2Q16, DuPont’s Industrial Biosciences segment reported revenues of $355 million, representing 5% of the company’s total revenue.

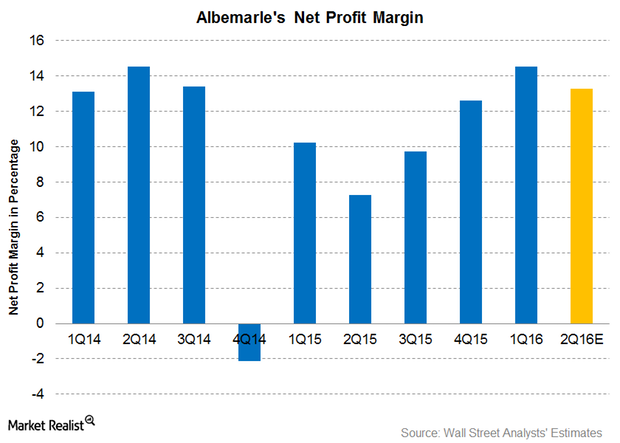

Albemarle: How Much Net Profit Margin Are Analysts Predicting?

As of July 26, 2016, analysts are expecting Albemarle’s (ALB) net profit margin to be about 13.3% in 2Q16. That compares to 7.3% in 2Q15 and 14.5% in 1Q16.

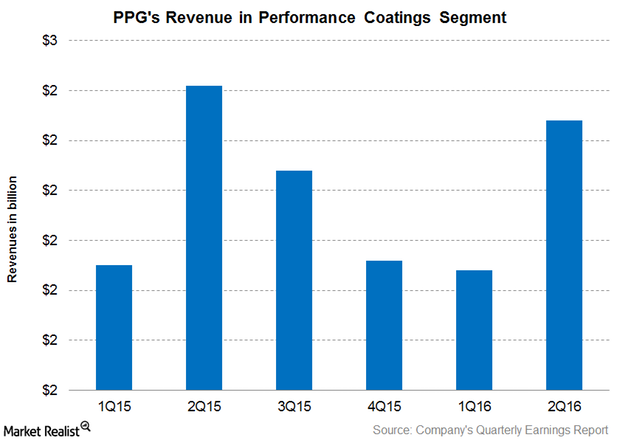

Why PPG Industries’ 2Q16 Revenue from Performance Coatings Fell

In 2Q16, PPG Industries’ Performance Coatings segment, the largest revenue contributor, accounted for approximately 57.5% of PPG’s total revenues.

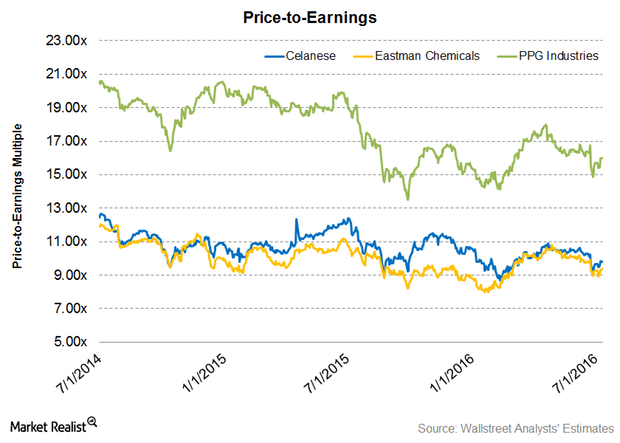

Where Do Celanese Valuations Stand before Its 2Q16 Earnings Report?

On July 11, Celanese’s forward EV-to-EBITDA ratio stood at 7.5x.

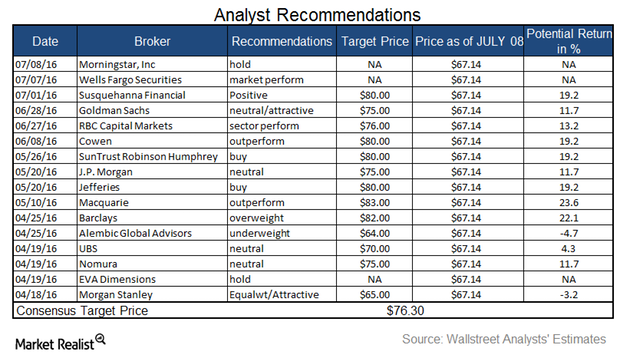

Analysts’ Ratings for Celanese before Its 2Q16 Earnings Release

On July 12, 2016, Celanese’s (CE) consensus 12-month target price was $76.30, indicating a return potential of 11.3% from that day’s closing price of $68.57.

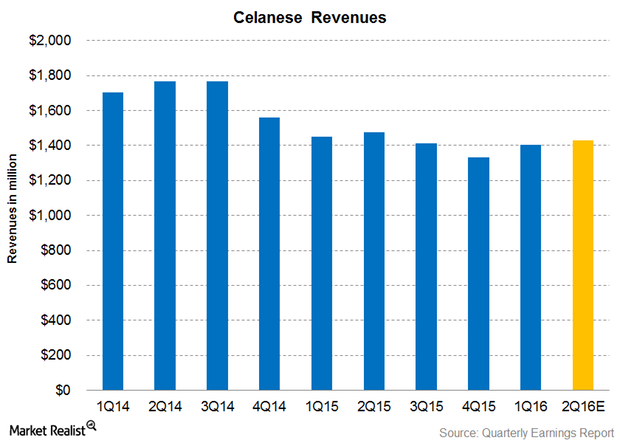

Can Celanese Outperform Analysts’ Revenue Estimates in 2Q16?

Celanese (CE) will announce its 2Q16 earnings report on July 26, 2016. In this series, we’ll look at the company’s 2016 guidance and valuations, analysts’ expectations, and other factors that could help investors make informed decisions.

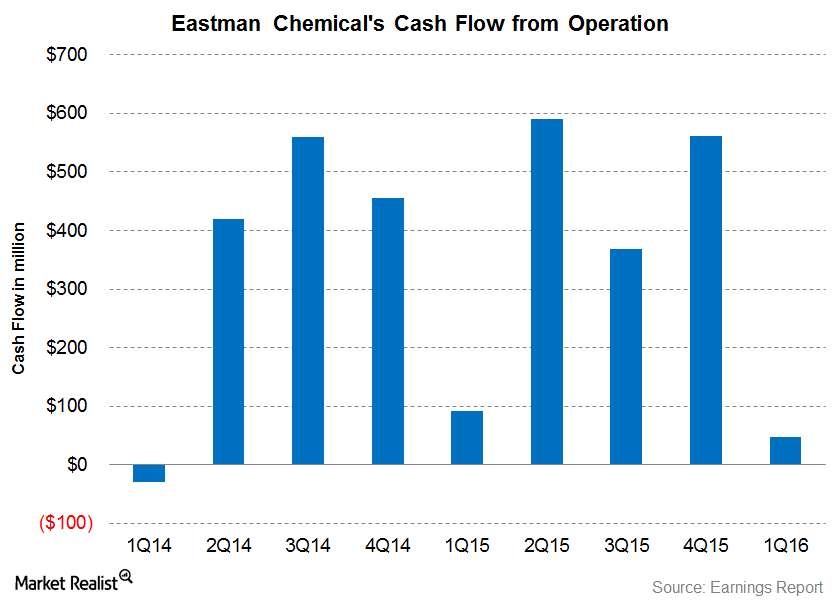

Can Eastman Chemical Generate Higher Operating Cash Flows?

In 1Q16, Eastman Chemical (EMN) reported operating cash flow of $47 million compared to $91 million in 1Q15. The decline was primarily due to the seasonal increase in working capital.

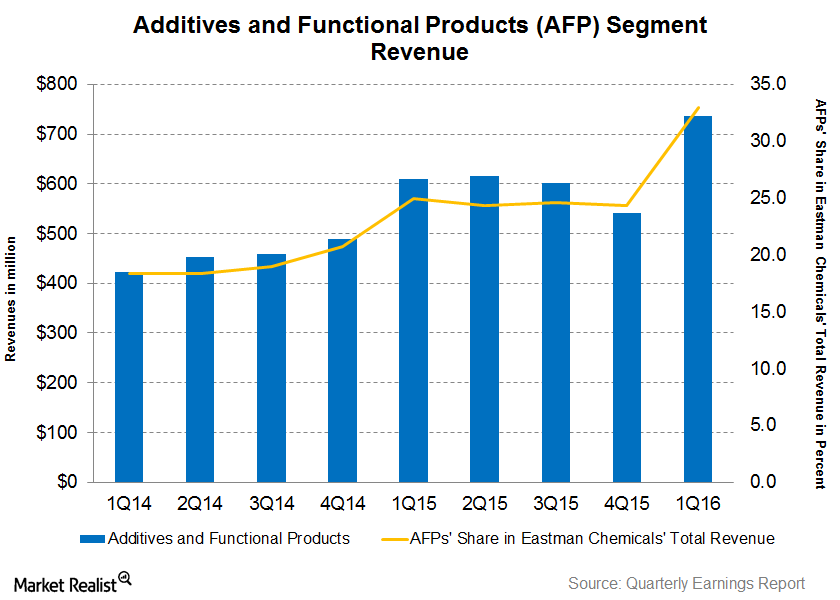

Can Eastman’s Additives & Functional Products Segment Deliver?

Eastman Chemical’s (EMN) Additives & Functional Products segment is the company’s strongest segment. It has grown significantly since 1Q14.

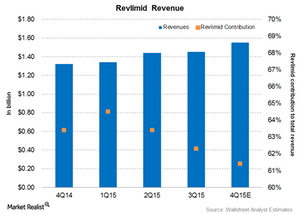

Revlimid Continues to Drive Celgene’s Revenue

Revlimid (lenalidomide) is one of Celgene’s (CELG) main revenue drivers. It had revenues of $1.4 billion in 3Q15, excluding the adverse impact of foreign exchange fluctuations.

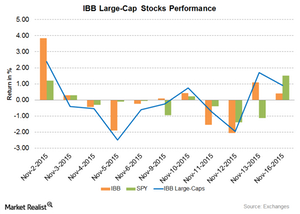

Illumina Continued to Rise, Led the Large-Cap Stocks

Illumina (ILMN) rose by 2.7% on November 16, 2015. It rose for the fourth consecutive trading session. Illumina rose 10% in the trailing five-day period.

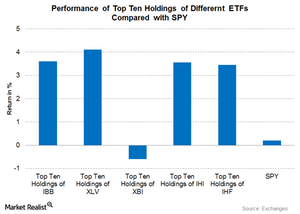

Allergan Drives the Performance of XLV’s Top Ten Holdings

Allergan gained 14.9% for the week ended October 30, 2015. The company’s stocks gained on the news of a possible merger with Pfizer.

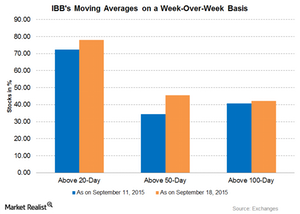

Dyax Traded above Its 100-Day Moving Average

Dyax (DYAX) gained 9.41% last week. The stock went up after Dyax presented at the Morgan Stanley global healthcare conference, which took place September 16-18 in New York.