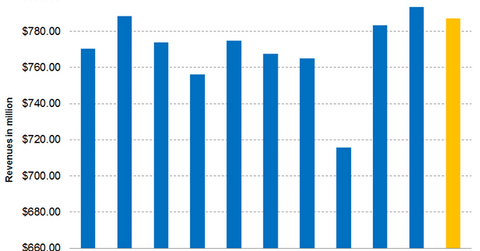

Can IFF Break the Jinx of the $700 Million Revenue Range?

Analysts are expecting International Flavors and Fragrances to post revenue of $787.20 in 3Q16, implying a 2.9% rise in its projected revenue on a year-over-year basis.

Nov. 3 2016, Updated 6:04 p.m. ET

Analysts’ revenue estimate for IFF

Analysts are expecting International Flavors and Fragrances (IFF) to post revenue of $787.20 in 3Q16, implying a 2.9% rise in its projected revenue on a year-over-year basis. In the first two quarters of 2016, IFF outperformed analysts’ revenue estimates. It remains to be seen whether IFF can keep up this trend.

It would be a pleasant surprise for investors if IFF could break the $700 million jinx and post revenue of above $800 million. Since 1Q14, IFF’s revenues have been in the range of $715 million–$793 million.

Influencing factors

IFF expects consumer fragrances to continue their strong growth, specifically in greater Asia, the EAME (Europe, Africa, the Middle-East) region, and North America. Revenues from the company’s acquisitions of Lucas Meyer Cosmetics and Ottens Flavors are expected to continue to rise in 3Q16.

International Flavors and Fragrances intends to improve its revenue in the range of $500 million–$1 billion via acquisitions by 2020. IFF continued its acquisition spree with its acquisition of David Michael & Co. IFF completed the acquisition on October 7, 2016. The combination of Ottens Flavors and David Michael is expected to strengthen IFF’s North American flavors business.

2016 outlook

International Flavors and Fragrances expects its 2016 revenue to rise in the range of 3.5%–4.5% over its 2015 total revenue on a currency neutral basis. Considering the impact of foreign exchange, which IFF estimates to be -2%, its revenue growth should be in the range of 1.5%–2.5%.

ETF investment

Investors can indirectly hold International Flavors and Fragrances by investing in the PowerShares DWA Basic Materials Momentum ETF (PYZ), which has invested 3.8% of its holdings in IFF as of November 2, 2016. The top holdings of this fund include Ashland Global Holdings (ASH), Chemours (CC), and International Paper Company (IP), which have weights of 5.5%, 5.1%, and 5.0% respectively, as of November 2, 2016.

In the next article, we’ll take a look at analysts’ expectations for IFF’s net profit margin.