RPM International to Acquire SPS Group

On December 21, RPM announced that it has entered an agreement to acquire SPS Group.

Dec. 27 2016, Updated 1:05 p.m. ET

RPM International continues its growth strategy

On December 21, RPM announced that it has entered an agreement to acquire SPS Group. This is RPM’s second acquisition in its fiscal 2017. RPM’s financial year is from June 1 to May 31. Earlier in September, RPM acquired Specialty Polymer Coatings, a Canadian manufacturer dealing with the global oil and gas pipeline market with annual sales of ~$26 million. SPS Group is a leading Dutch coating company with annual net sales of approximately $60 million. However, RPM didn’t disclose the terms of the agreement.

Impact on RPM

The revenues from this acquisition will be reflected in RPM’s books by approximately fiscal 2Q18. SPS will operate under RPM’s Rust-Oleum European business. Frank Sullivan, chair and CEO, said, “By leveraging the manufacturing and distribution strengths of SPS, we expect this acquisition to accelerate Rust-Oleum’s growth in the Netherlands and other nearby European countries.”

RPM’s borrowing went up by ~$20 million in fiscal 1Q17 due to acquisitions made during that period. RPM might fund the SPS acquisition through debt. As a result, the interest expense might go up in the subsequent quarters. However, RPM with an interest coverage ratio of ~5.0x, RPM is well positioned to service its debts.

RPM stock price

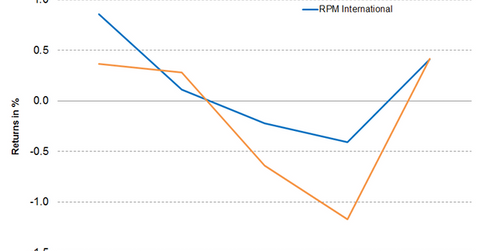

On December 23, 2016, RPM closed at $54.01 and gained 0.7% for the week. The PowerShares DWA Basic Materials Momentum Portfolio (PYZ), which holds 2.6% in RPM as of December 23, dropped 0.8% for the week and closed at $60.18. RPM’s stock price closed 3.6% higher than the 100-day moving average price of $52.14, indicating an upward trend in the stock. Analysts expect RPM’s 12-month target price to be at $55.50, implying a potential return of 2.8% from the closing price as of December 23, 2016. On a year-to-date basis, RPM has gained 22.6%.

Notably, investors can hold RPM indirectly by investing in the PowerShares DWA Basic Materials Momentum Portfolio. The top holdings of this fund include Chemours (CC), International Paper (IP), and Ashland Global Holdings (ASH), which have weights of 6.2%, 5.5%, and 5.5%, respectively, as of December 23, 2016.