Celanese: Another Round of Price Hikes on Some Products

Celanese’s stock price fell 1.3% and closed at $96.78 for the week ending September 8, 2017. It traded 4.40% above the 100-day moving average price.

Sept. 12 2017, Published 7:44 a.m. ET

Celanese hikes a few product prices

On September 6, 2017, Celanese announced price hikes on several products of its acetyl intermediates. It also hiked the prices of Vinyl Acetate Monomer. It hiked prices across different regions. The price hikes will be effective immediately or as the contract allows. Below are the price changes:

- Acetic Acid prices rose by $0.04 per pound in the US and Canada, by $90 per metric ton in Mexico and South America, and by 80 euros per metric ton in EMEA (Europe, Middle East and Africa).

- Acetic Anhydride prices will rise by $0.04 per pound in the US and Canada, by $90 per metric ton in Mexico and South America, and by 100 euros per metric ton in EMEA.

- Acetic Acid/Acetic Anhydride blend prices will rise by $0.04 per pound in the US and Canada, by $90 per metric ton in Mexico and South America, and by 100 euros per metric ton in EMEA.

- Ethyl Acetate prices will rise by $0.06 per pound in the US and Canada, by $130 per metric ton in Mexico and South America, and by 125 euros per metric ton in EMEA.

- Vinyl Acetate Monomer prices will rise by 500 renminbi per metric ton in China. In Asia, excluding China, the price increase will be $100 per metric ton.

The price increase could be positive for Celanese if the volumes don’t fall. The effect could be seen in 3Q17. The Acetyl Intermediates segment reported revenue of $649 million in 2Q17—an increase of 9.60% compared to 2Q16.

Celanese’s stock price

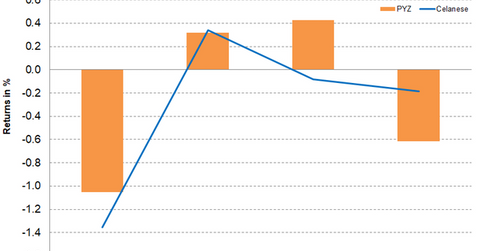

Celanese’s stock price fell 1.3% and closed at $96.78 for the week ending September 8, 2017. Despite a decline in the stock price, Celanese traded 4.40% above the 100-day moving average price of $92.70, which indicates a prevailing upward trend in the stock. Analysts expect more upside in the stock. Analysts expect a 12-month target price of $104.41, which implies a return potential of 7.90% over the closing price on September 8, 2017.

Investors looking to invest indirectly in Celanese can invest in the PowerShares DWA Basic Materials Momentum Portfolio ETF (PYZ). PYZ has invested 3.10% of its portfolio in Celanese. The fund also invests in Chemours (CC), FMC (FMC), and Albemarle (ALB) with weights of 4.90%, 4.70%, and 3.70%, respectively, as of September 8, 2017.