Zimmer Holdings Inc

Latest Zimmer Holdings Inc News and Updates

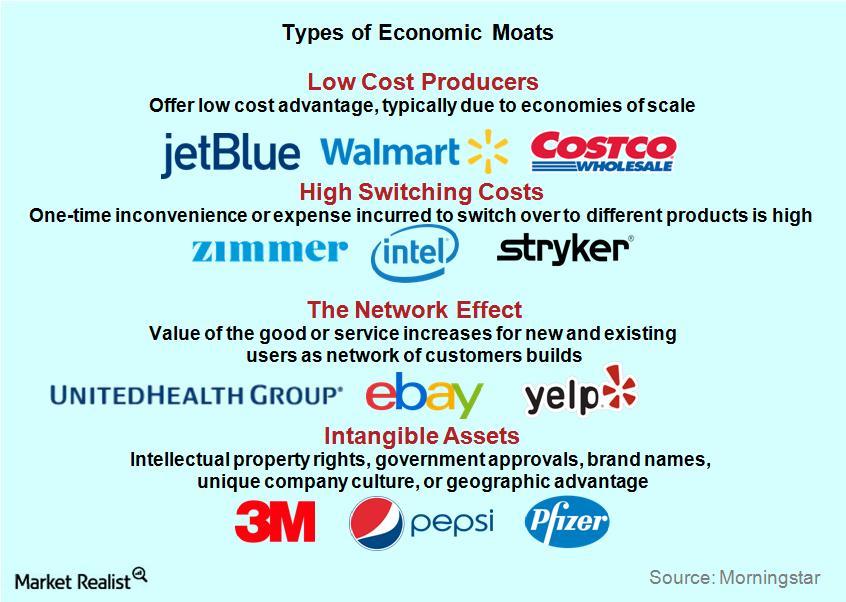

The Ins and Outs of Moat Investing

Stock selection, a cornerstone of the moat investment philosophy, has driven much of the recent success of the Morningstar® Wide Moat Focus Index.

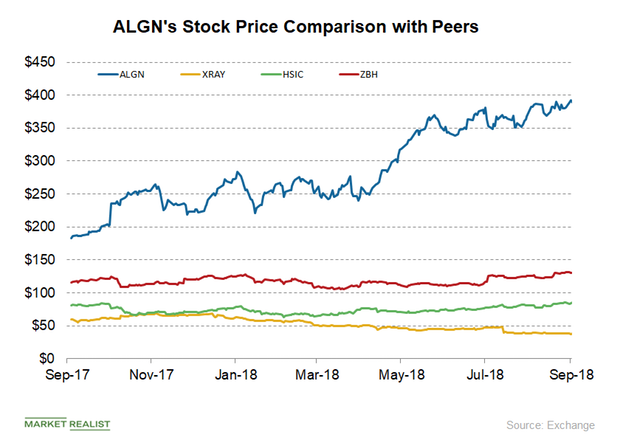

Align Technology Traded at Its 52-Week High in September

Align Technology was trading at its 52-week high of $398.88 on September 25. The stock reported its 52-week low of $180.31 on September 28, 2017.

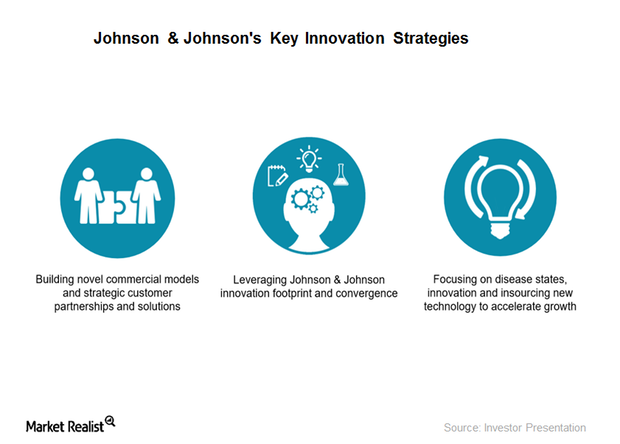

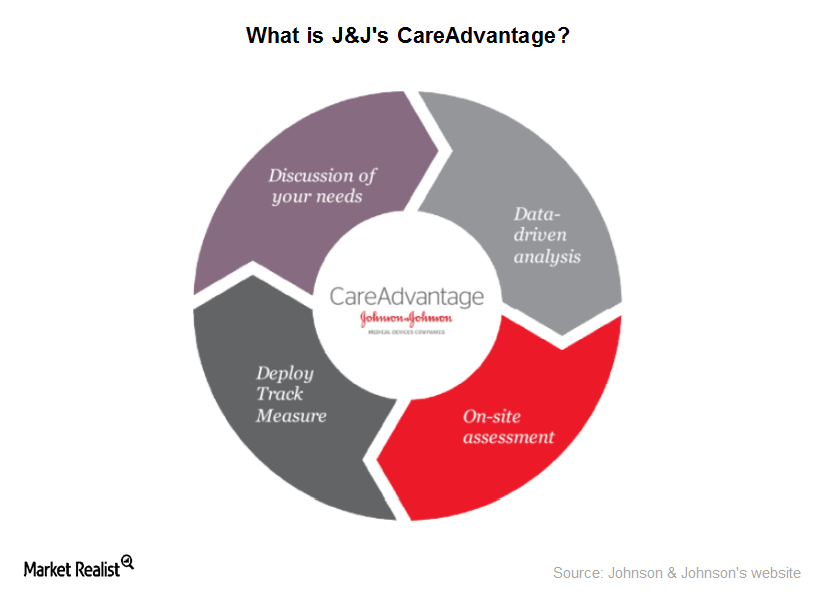

How Johnson & Johnson’s Partnerships Enhance Customer Value

Johnson & Johnson’s key innovation strategies include creating value through strategic customer partnerships and solutions.

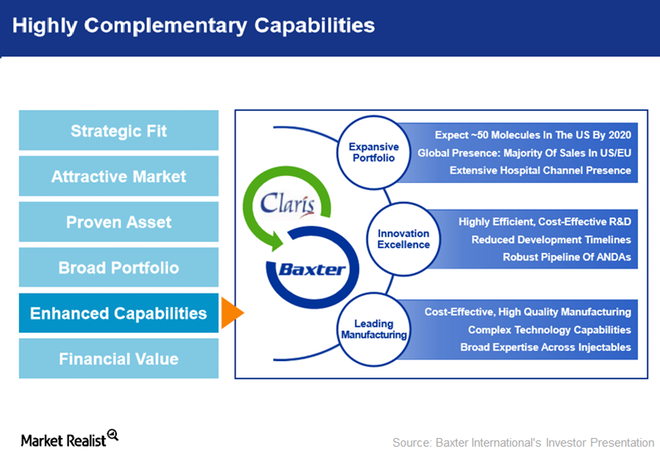

Effect of Claris Injectables Acquisition on Baxter’s 2017 Growth

On July 27, 2017, Baxter International (BAX) completed the acquisition of Claris Injectables, which is expected to help expand and strengthen Baxter’s core capabilities.

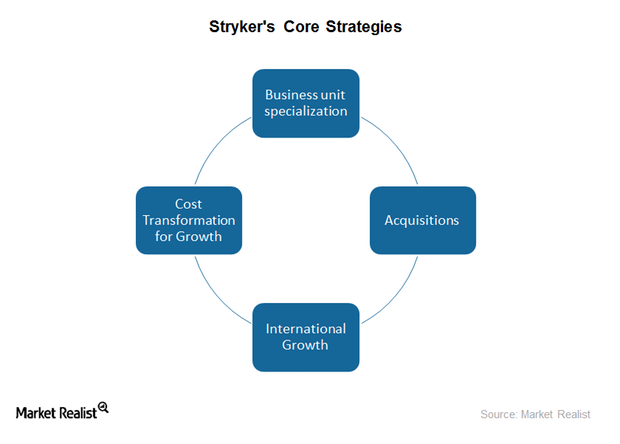

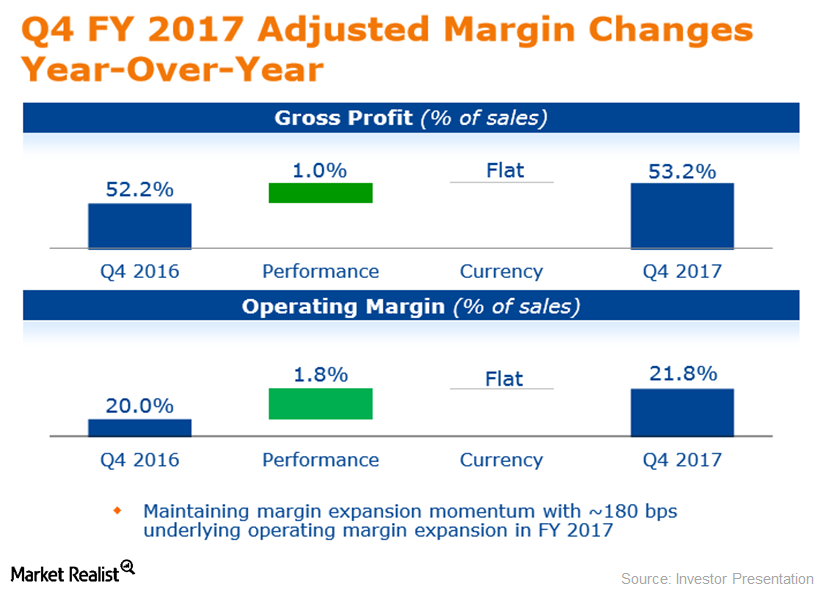

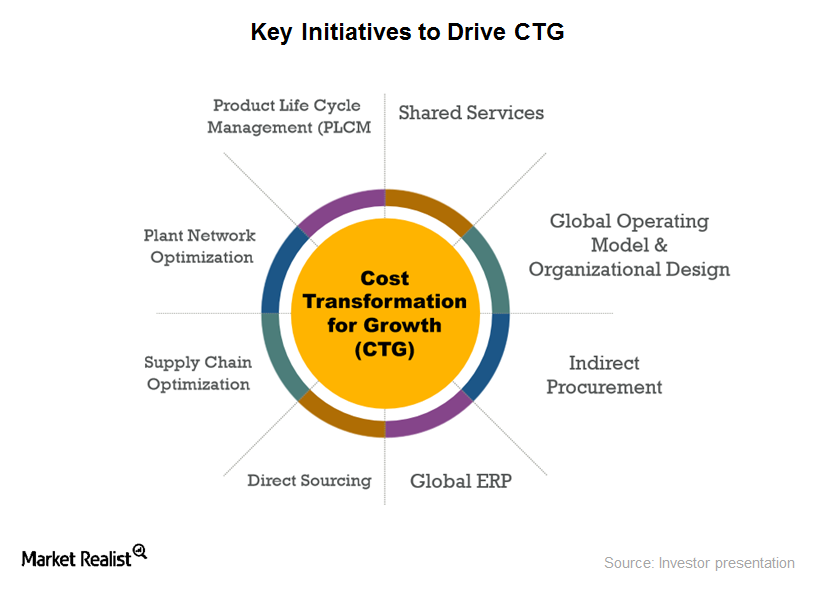

How Stryker’s Margins Are Driven by Its CTG Program

Cost transformation for growth (or CTG) is Stryker’s program that focuses on driving leveraged growth by structural cost optimization.

FDA Approves Zimmer Biomet’s ROSA, Stock Up 2.6%

Today, Zimmer Biomet Holdings’ (ZBH) ROSA Knee System received FDA 510(k) clearance for robotically assisted total knee replacement surgeries.

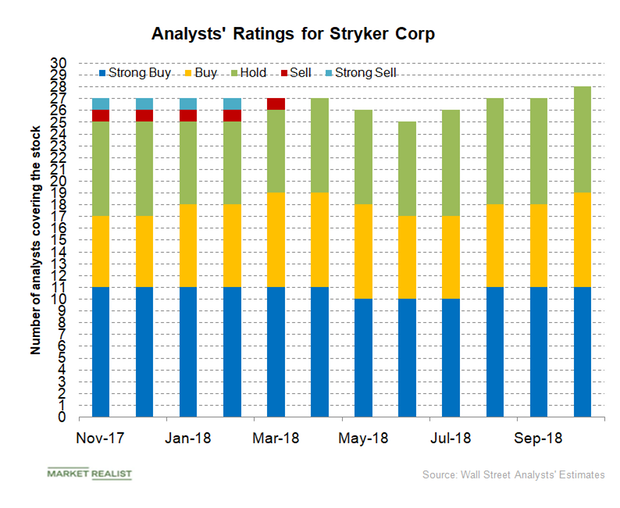

What Analysts Recommend for Stryker Stock

Of the total 28 analysts covering Stryker (SYK) in October 2018, 19 analysts have given the stock a “buy” or higher rating, and nine analysts have given Stryker a “hold” rating.

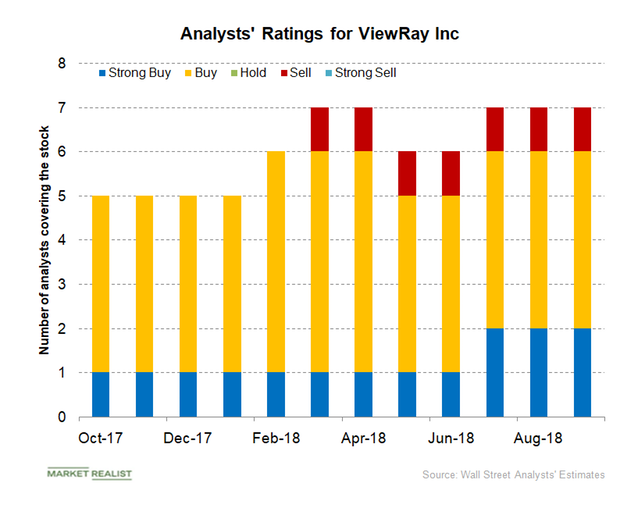

What ViewRay’s Valuation Trend Indicates

In September, of the seven analysts covering ViewRay (VRAY), six have given its stock “buy” or higher ratings, and one analyst has given it a “sell” rating.

What Analysts Expect from Haemonetics in Q1 2019

Haemonetics is expected to report 4.3% growth in revenues to $219.9 million during Q1 2019 as compared to $210.9 million during Q1 2018.

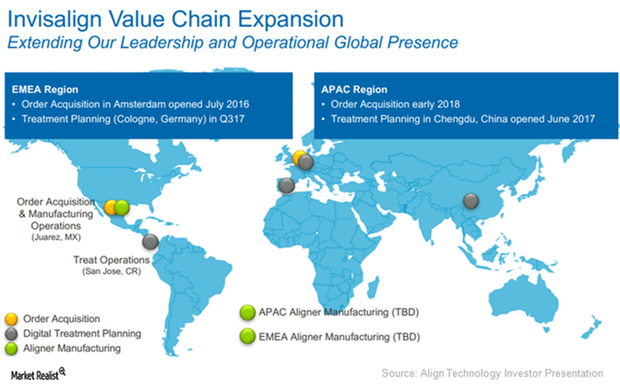

Align Technology to Execute on Key Strategic Priorities in 2018

Align Technology (ALGN) has been growing at a fast pace while it executes its strategic priorities around the world.

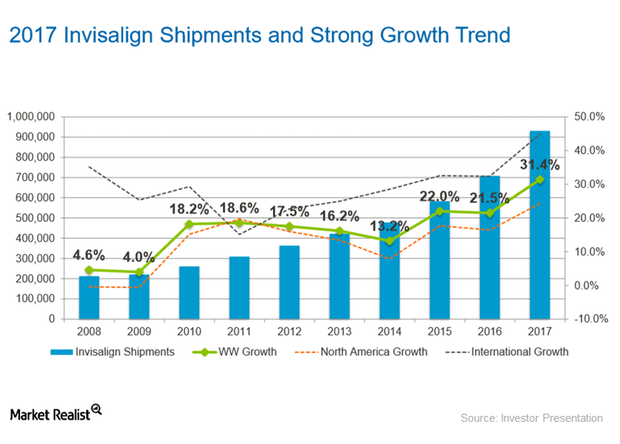

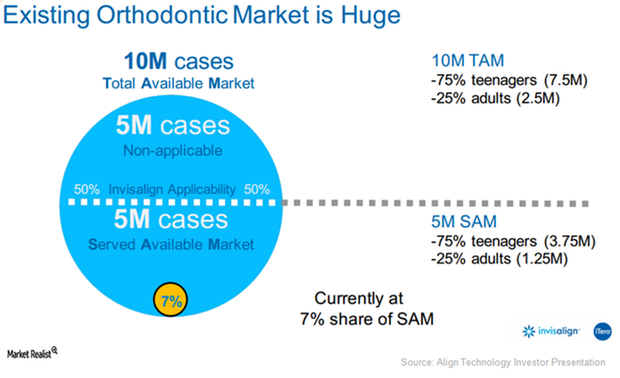

Align Technology’s Invisalign: Average Selling Price and Volumes

Increases in Align Technology’s (ALGN) Invisalign volumes and ASP were the major factors driving the company’s sales growth.

The Geographic Segments of Integer Holdings Corporation

Integer Holdings Corporation provides custom battery packs to energy, military, and environmental markets for use in extreme environments.

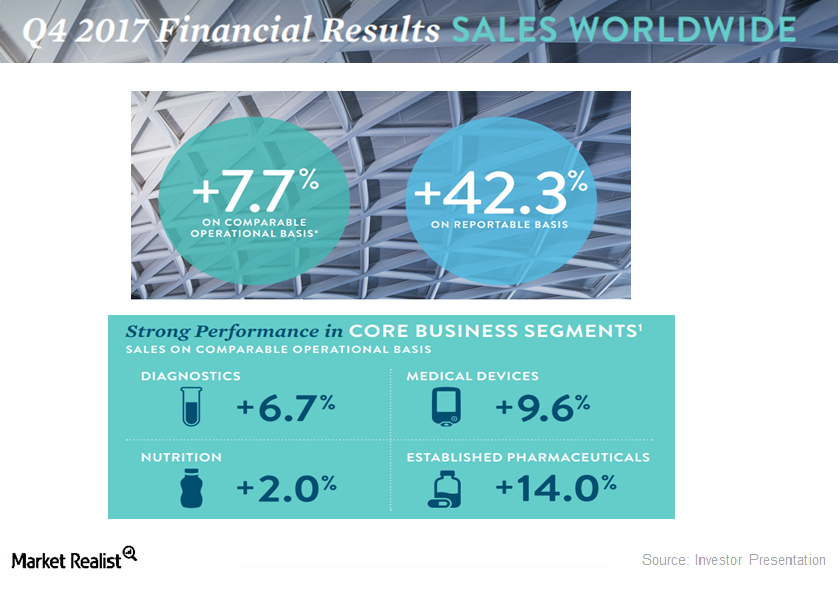

Inside Abbott Laboratories’ 4Q17 Earnings Results: Key Highlights

Abbott Laboratories (ABT) reported sales of $7.6 billion and adjusted diluted EPS (earnings per share) of $0.74 for fiscal 4Q17.

Align Technology’s Customer Acquisition Strategy Driving Market Growth

In 3Q17, Align Technology trained nearly 1,000 doctors in China.

Align Technology’s Growth Prospects amid Increasing Competition

The Chinese market is Align Technology’s major growth driver. However, the company is starting to witness strong competition from startups focused on the clear aligners market.

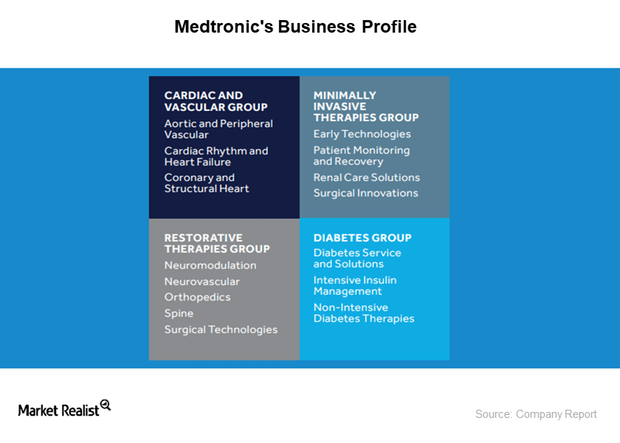

Discussing the Recent Management Changes at Medtronic

On December 20, 12 of 24 analysts surveyed by Reuters rated Medtronic (MDT) stock as a “buy,” and the remaining 12 analysts recommended a “hold.” There were no “sell” ratings given to MDT stock.

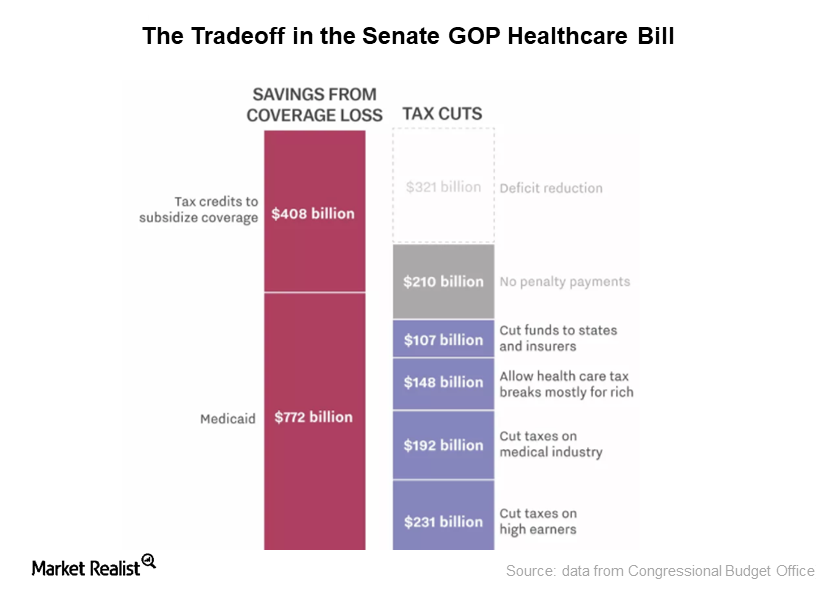

How the Corporate Tax Rate Cut Could Affect R&D in the Medtech Industry

The repeal of the tax deduction for high medical expenses may reduce the number of taxpayers opting for costly medical technologies and services.

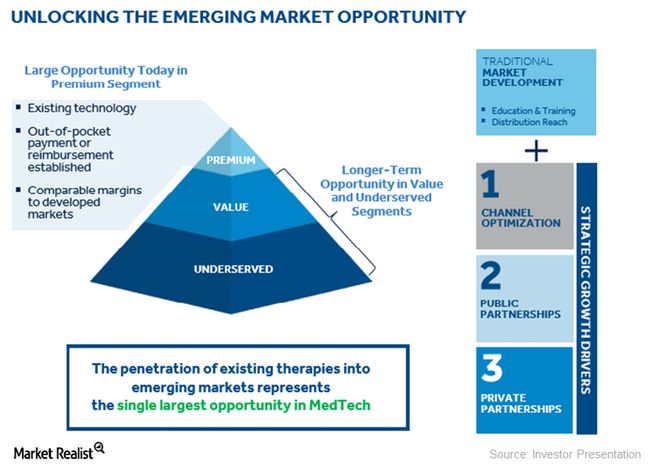

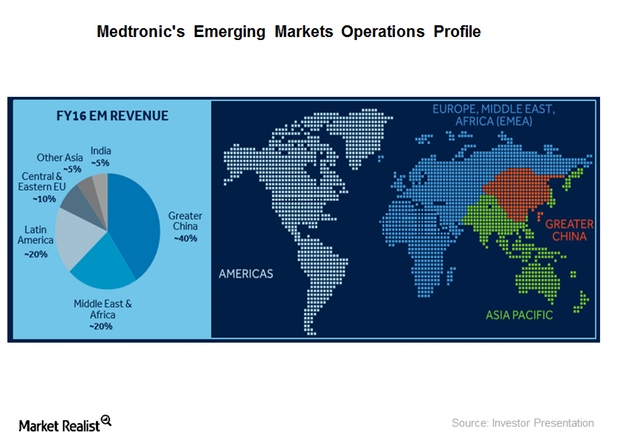

Emerging Markets Growth Is Driving Medtronic’s Geographic Strategy

In fiscal 2Q18, Medtronic registered sales of ~$1.1 billion from emerging markets.

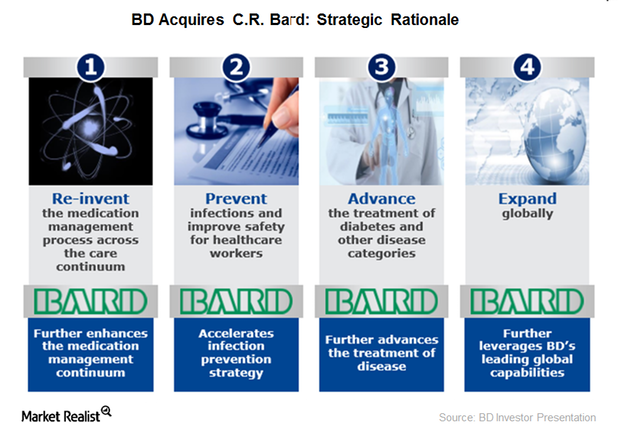

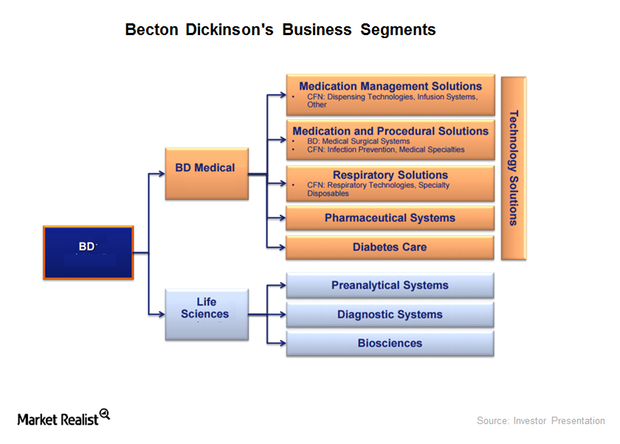

What’s Driving BD’s Operating Margin Expansion

Overview BD (BDX) has registered strong operating margin expansion in recent years. Its margin improved by 100 basis points in fiscal 2015 and 200 basis points in fiscal 2016. In fiscal 2017, BD’s margin expanded by ~180 basis points. In 4Q17, BD’s operating margin grew ~14.6% YoY (year-over-year), limited by 700 basis points due to the divestiture of BD’s […]

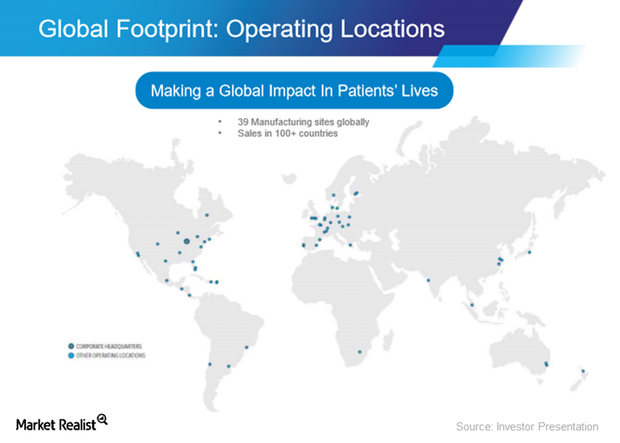

Asia-Pacific Still Zimmer Biomet’s Strongest Geography

Zimmer Biomet Holdings witnessed a strong performance in its Asia-Pacific region. It contributed 16% to the company’s total sales.

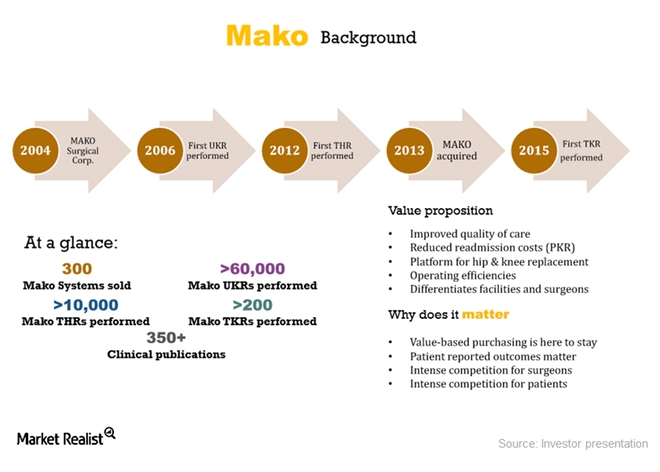

How Mako Robots Are Driving Stryker’s Sales in 2017

Mako sales in 3Q17 In 3Q17, Stryker sold 33 Mako robots, compared with 30 robots in 3Q16. In 2Q17, Stryker installed 26 Mako robots. Of these 33 robots, 23 were installed in the United States. Around 40% of US sales are expected to be in competitive accounts. Stryker is training surgeons on its total knee application […]

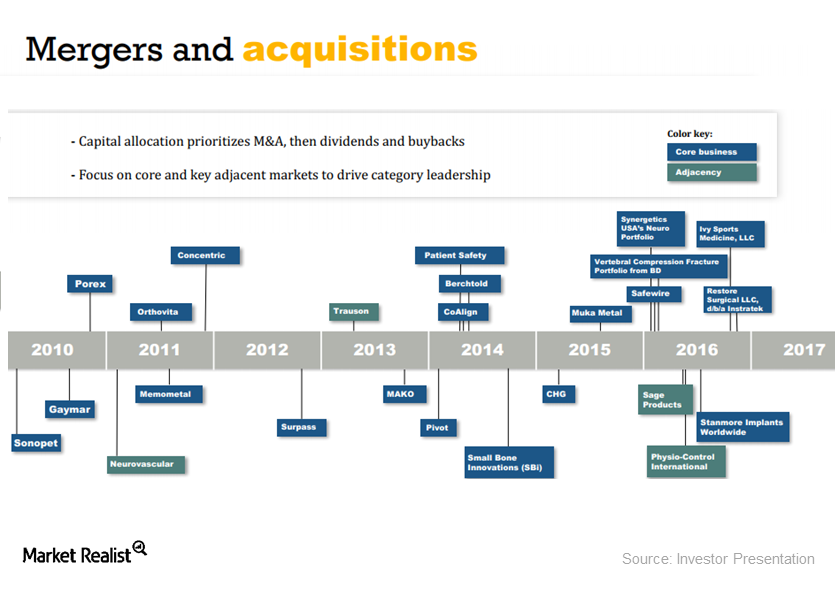

Stryker Stock Falls Due to the Impact of the Sage Products Recall

On August 23, Stryker (SYK) announced a voluntary product recall of specific lots of oral care products that form part of the company’s Sage business unit.

What Zimmer Biomet’s Leadership Transition Could Mean for Its Core Growth Strategy

In July 2017, David Dvorak stepped down as chief executive officer and president of Zimmer Biomet (ZBH) and resigned from its board of directors.

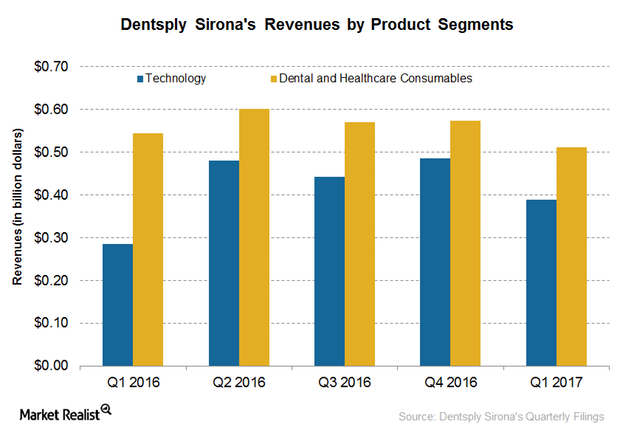

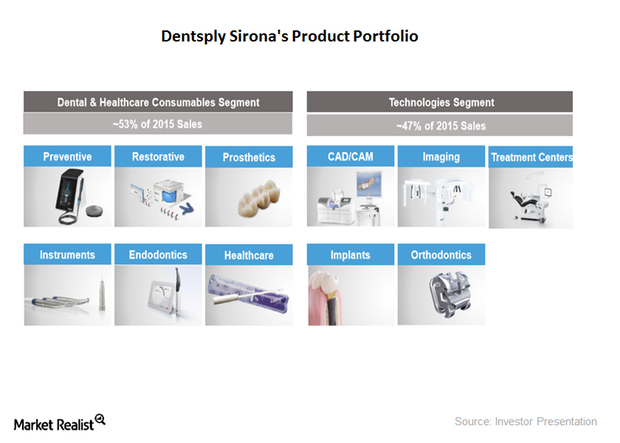

Dental and Healthcare Consumables Grew but Missed Expectations in 2Q17

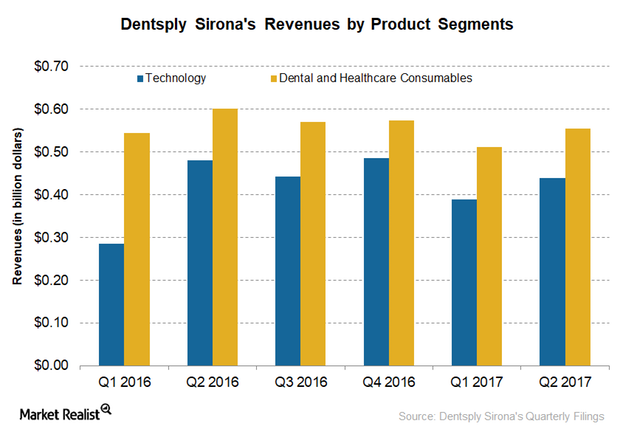

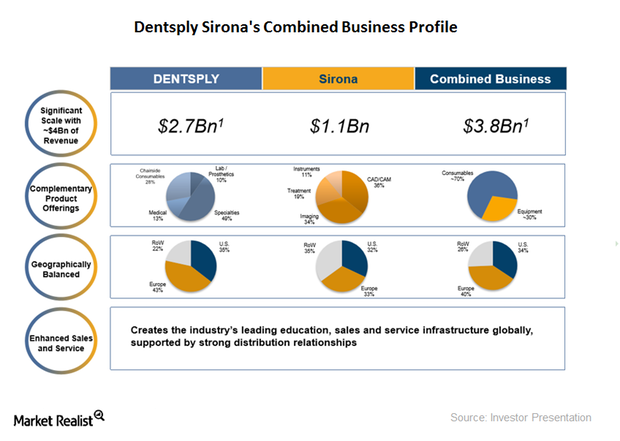

In 2Q17, Dentsply Sirona’s (XRAY) Dental and Healthcare Consumables business contributed ~56% to the company’s total revenues and registered sales of ~$554 million.

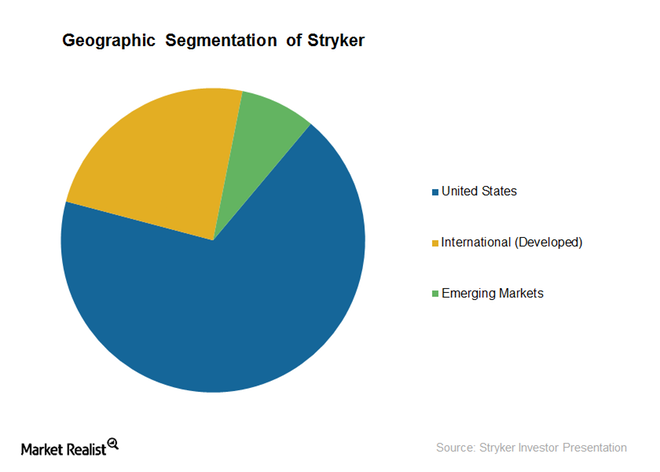

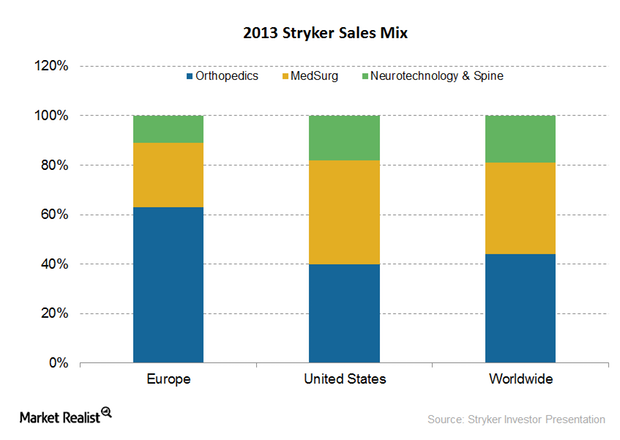

How Stryker Plans to Capture the International Markets

Most of Stryker’s emerging market sales are from China. However, Europe and emerging markets sales have witnessed high growth in recent quarters.

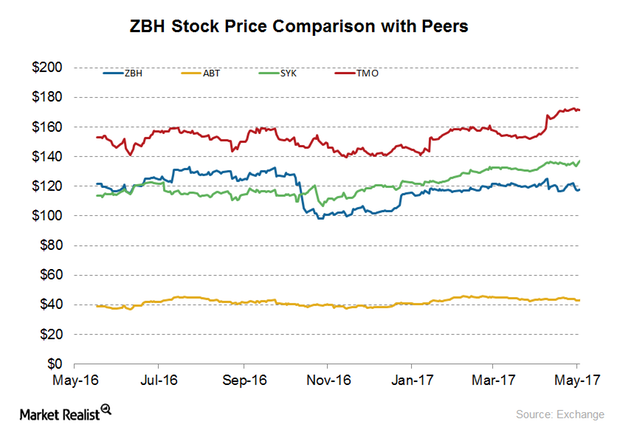

How Zimmer Biomet Stock Has Performed Recently

Zimmer Biomet Holdings (ZBH) was trading at $118.40 on May 30, 2017. It has a 50-day moving average of $119.70 and a 200-day moving average of $114.20.

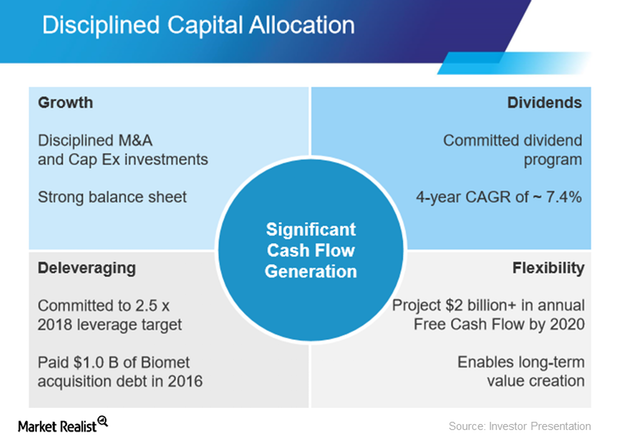

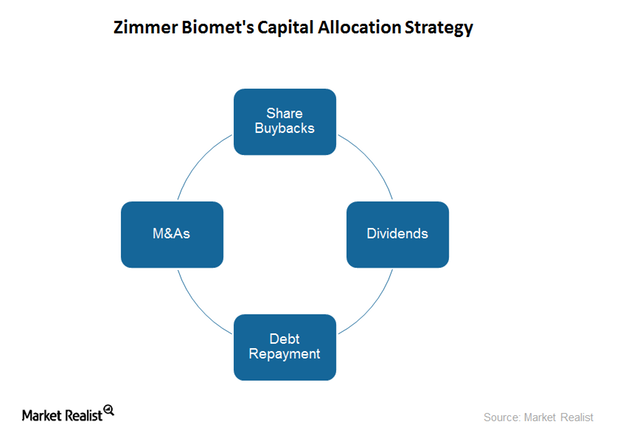

Zimmer Biomet’s Capital Allocation Strategy to Create Value

In February 2016, Zimmer Biomet authorized up to $1.0 billion of the company’s common stock for share repurchases, all of which remains authorized to date.

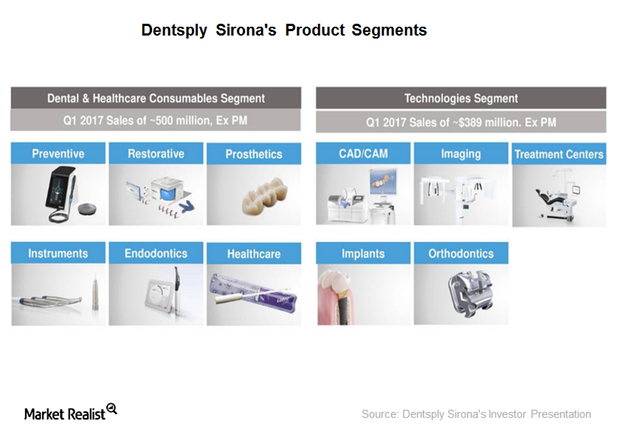

Dentsply Sirona’s New Growth Strategy to Accelerate Digital Dentistry Penetration

Dentsply Sirona is the largest dental equipment and solutions manufacturer in the United States. Digital dentistry is a megatrend in the market.

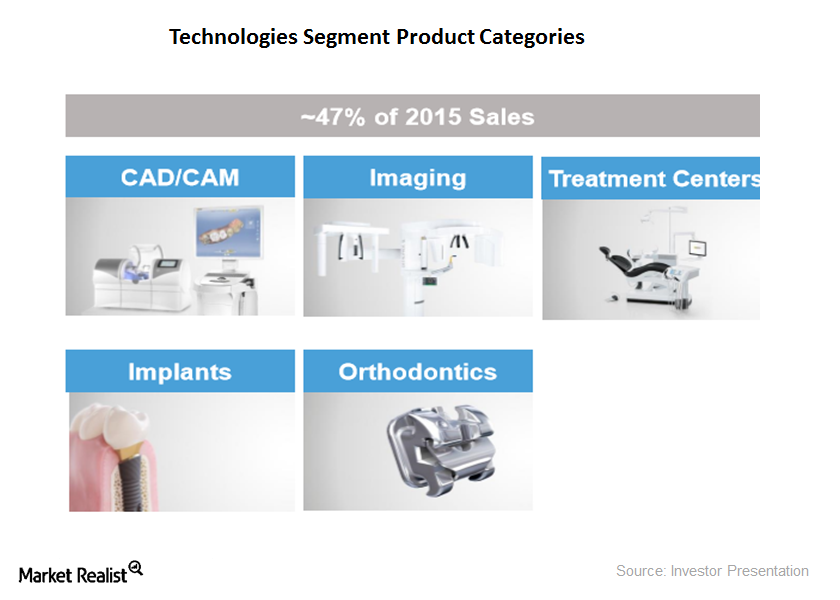

What Dragged Down Technology Business Sales in 1Q17?

Dentsply Sirona’s Technology segment sales Dentsply Sirona (XRAY) reported ~$900 million of revenues worldwide in 1Q17. Of that, ~$389 million was generated through Dentsply Sirona’s Technology segment, which contributed ~43.2% to Dentsply Sirona’s total revenues. On a constant currency basis, the Technology segment’s sales declined by approximately 8.1%. The segment’s sales were flat in Europe. The […]

A Look at BD’s Deal Rationale in Its C.R. Bard Acquisition

BD’s acquisition of C.R. Bard is aimed at providing a comprehensive product portfolio to customers at more reasonable costs and enhanced efficiency.

Johnson & Johnson’s Expandable Cage Acquisition to Accelerate the Spine Division

On January 3, DePuy Synthes, a subsidiary of Johnson & Johnson (JNJ), entered into an asset purchase and development agreement with Interventional Spine.

Inside the Latest Capability Advancement in Johnson & Johnson’s Orthopedics

On January 9, JNJ’s Medical Device division announced its Orthopedic Episode of Care Approach, a data-driven program that will accelerate value-based care.

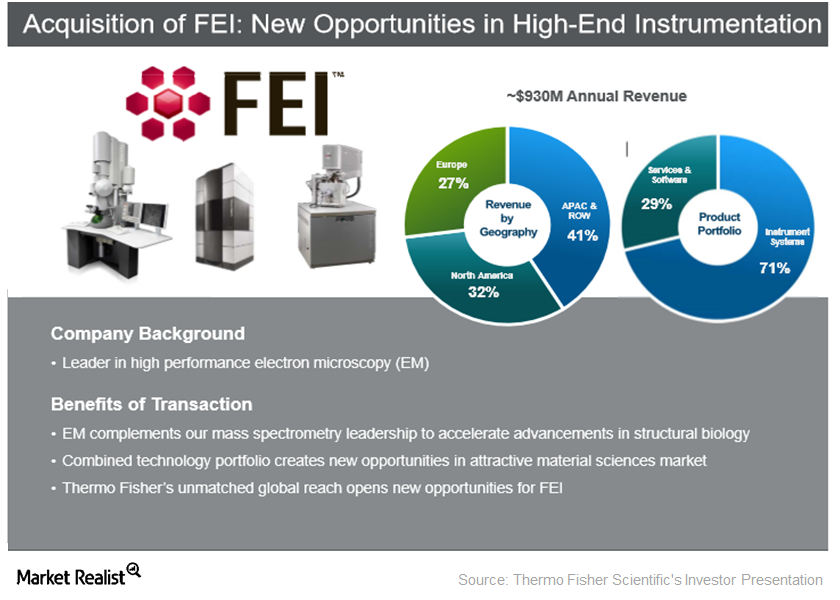

How Is Thermo Fisher Scientific’s FEI Integration Process Going?

Thermo Fisher Scientific (TMO) completed the acquisition of FEI Company on September 19, 2016.

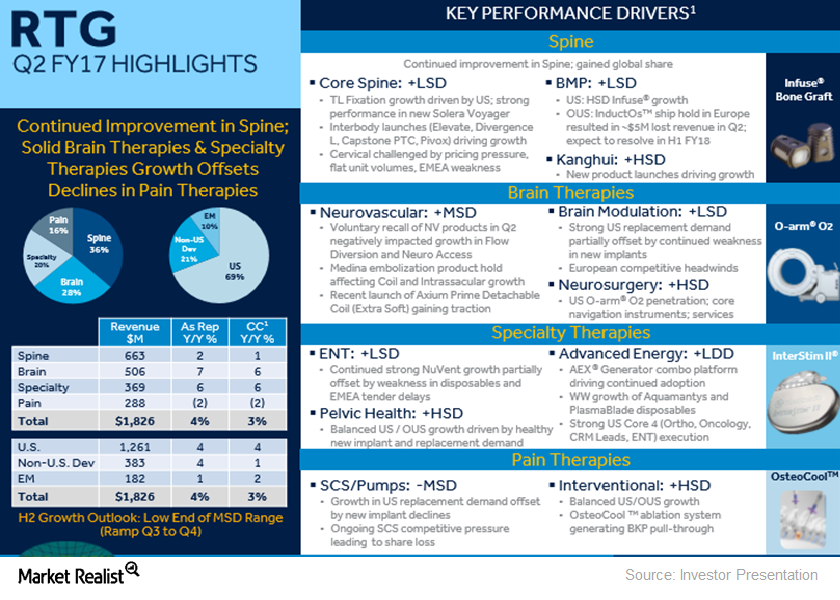

Medtronic’s RTG Sales in Fiscal 2Q17: The Brain and Restorative Therapies Story

Of Medtronic’s ~$7.3 billion in worldwide revenue in fiscal 2Q17, ~$1.8 billion came from its RTG segment, representing ~25% of the company total.

Exploring the Nuances of Stryker’s Cost Transformation for Growth

Cost transformation growth is one of Stryker’s key strategies for driving growth. The company has come a long way from its decentralized structure prior to 2010.

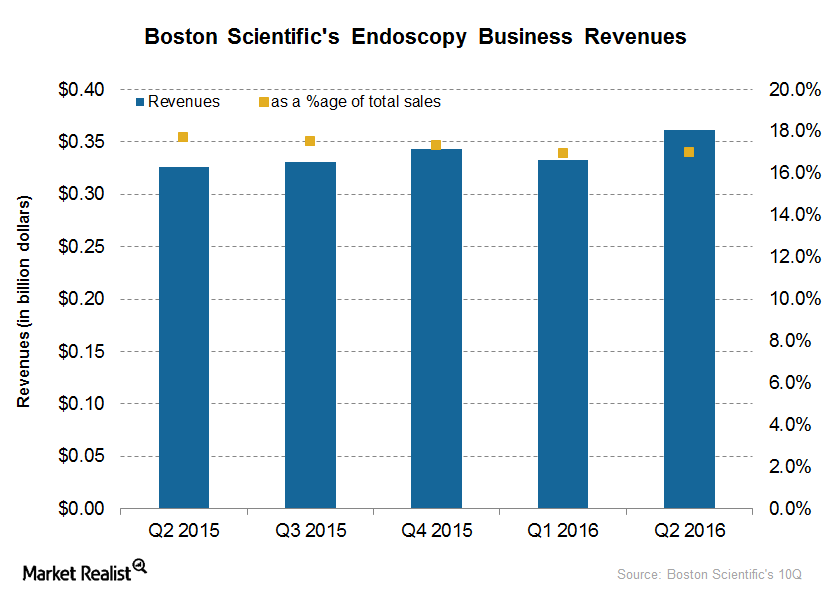

Boston Scientific’s Acquisition of EndoChoice: Must-Know Details

On September 27, 2016, Boston Scientific (BSX) announced the acquisition of EndoChoice Holdings for $210 million.

How Stryker Plans to Leverage the Under-Tapped Europe Opportunity

Europe represents a potential growth opportunity for Stryker, as the company currently has a low market share in Europe compared to other developed markets.

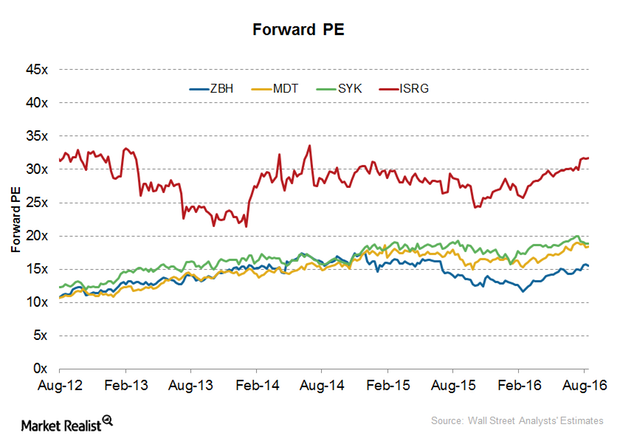

A Look at Zimmer Biomet’s Latest Valuation

After the release of its 2Q16 earnings results on July 28, 2016, Zimmer Biomet Holdings (ZBH) was trading at a forward price-to-earnings multiple in the range of 15.5x–16.2x.

A Brief Look at the Technologies Segment Sales in 2Q16

In 2Q16, Dentsply Sirona’s leading position in the Digital Sensor category and rebound in the Lab business drove its Technologies segment sales.

A Look at Medtronic’s Geographic Strategy in 2016

Globalization is one of Medtronic’s (MDT) key growth strategies.

What’s the Verdict on Becton Dickinson’s Strategic Portfolio Review?

Becton Dickinson (BDX) completed its annual strategic review of its portfolio, which was initiated after the acquisition of CareFusion.

A Brief Look at Dentsply Sirona’s Business Model

Dentsply Sirona (XRAY) offers a broad portfolio of dental equipment and consumables that have urological and surgical applications.

Introducing Dentsply Sirona, a Leading Dental Products Manufacturer

Dentsply Sirona (XRAY) is the largest manufacturer of dental equipment and technologies in the world. The company was formed in February 2016.

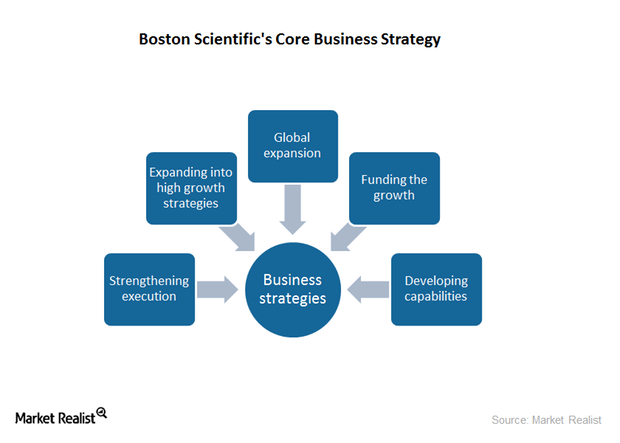

The Business Strategies Driving Boston Scientific’s Growth

Boston Scientific registered emerging market sales growth of approximately 13% in 2015, representing a steady growth in international markets.

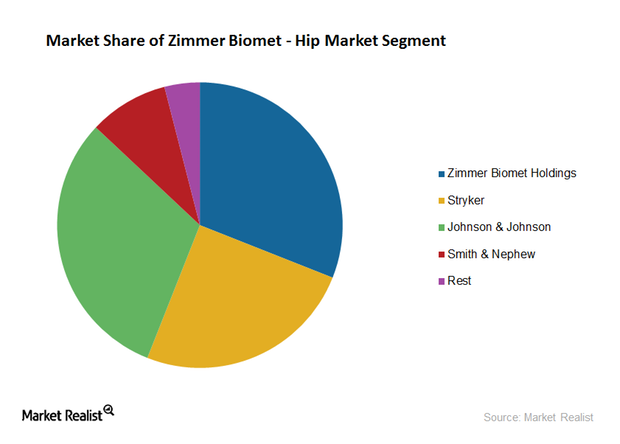

Zimmer Biomet’s Competition in the Hip Implant Market

Zimmer Biomet (ZBH) is one of the leading hip implant providers in the United States, with approximately 31% market share.

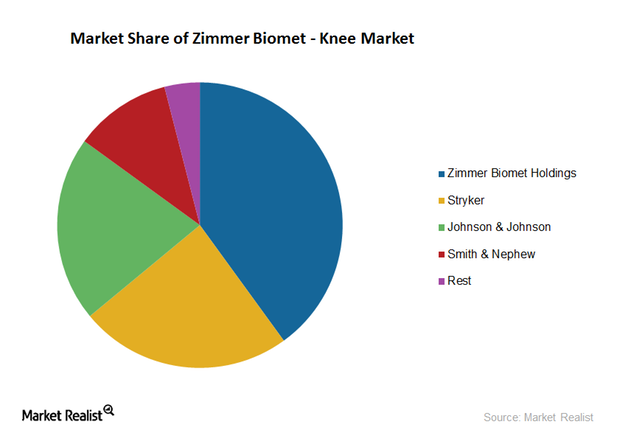

Zimmer Biomet Faces Market Share Erosion in the Knee Implant Market

Zimmer Biomet (ZBH) is the leading provider of knee implants in the United States. It has approximately 40% market share, followed by Stryker, Johnson & Johnson, and Smith & Nephew.

Zimmer Biomet’s Capital Allocation Strategy and Shareholder Value

Zimmer Biomet has spent $125 million in share repurchases so far in 2016. In February, it authorized up to $1 billion of the company’s common stock for share repurchases.

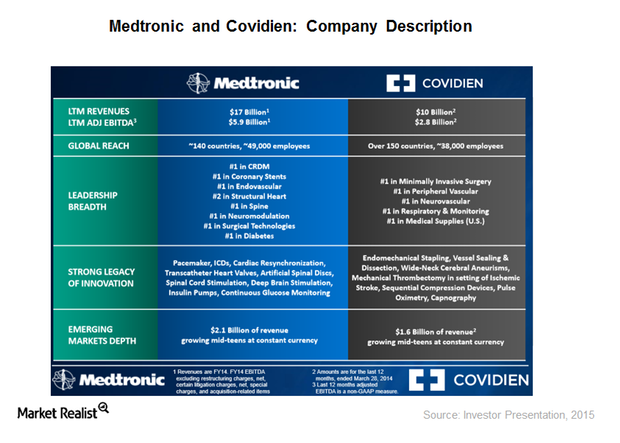

Sizing up Medtronic-Covidien, the Biggest Deal in the Medical Device Industry

On January 26, Medtronic completed the acquisition of Covidien for $42.9 billion in cash and Medtronic stocks and assumed Covidien’s debt of ~$5 billion.

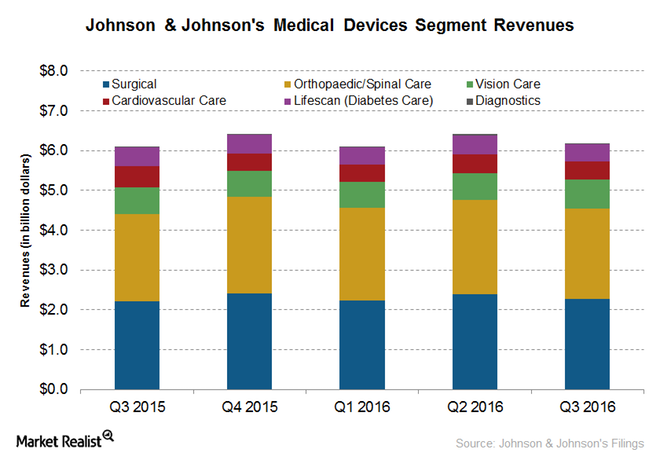

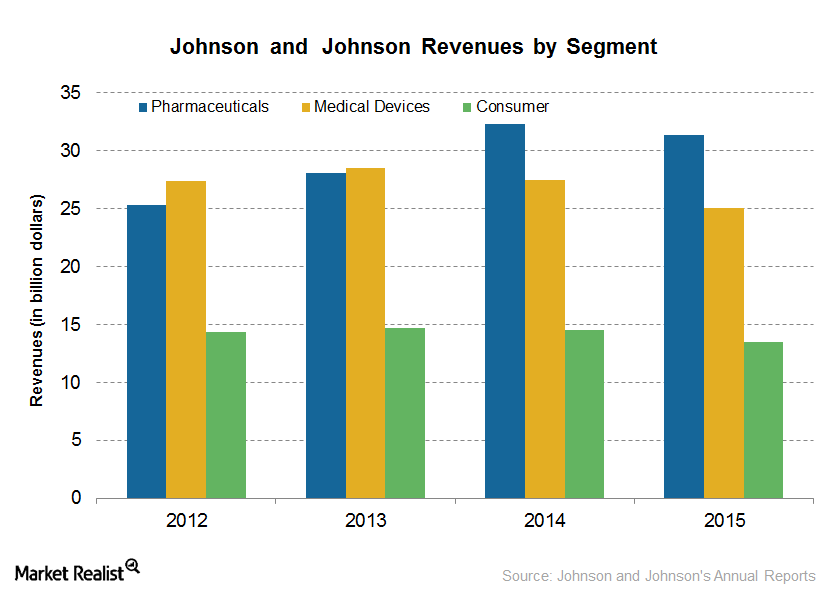

How Johnson & Johnson Hopes to Boost Its Medical Device Segment

Johnson and Johnson’s (JNJ) medical device business segment comprises of cardiovascular, diabetes care, orthopedics, surgery, and vision care divisions.

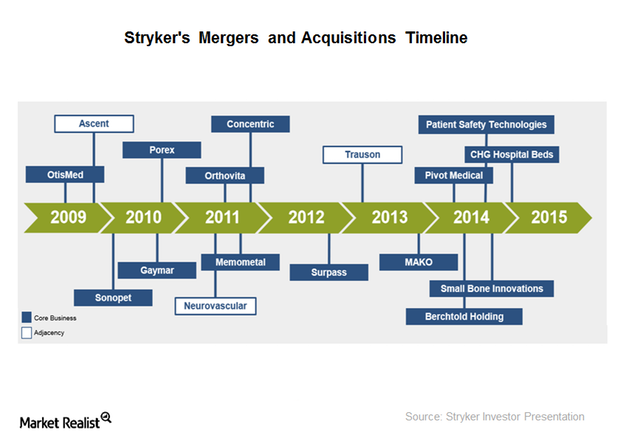

How Inorganic Growth Strategy of Stryker Is Driving Growth

Stryker has expanded its portfolio and geographic reach through mergers and acquisitions and product development. It saw a 7.3% sales growth in 2014.