Consumer Discret Sel Sect SPDR® ETF

Latest Consumer Discret Sel Sect SPDR® ETF News and Updates

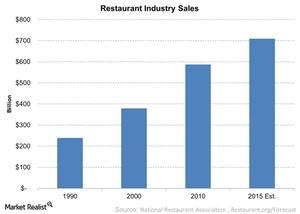

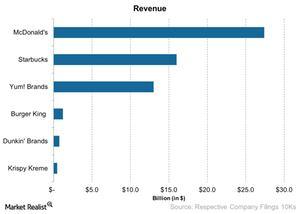

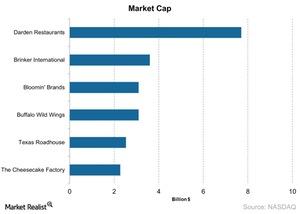

Key Indicators for Restaurant Industry Growth

Restaurant industry sales have experienced growth in the past 12 months. Sales are poised to grow to $709 billion.

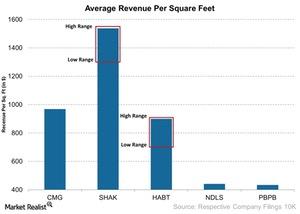

How Shake Shack’s Revenue Per Square Foot Compares with Peers

The recent rally in Shake Shack’s share prices—without any new catalyst—may indicate that investors are optimistic about the company’s prospects.

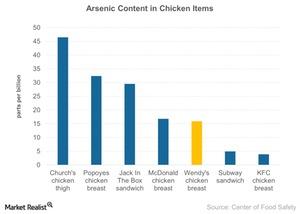

Healthy Food: Antibiotic-Free Chicken Is Gaining Importance

According to a study by researchers at John Hopkins University, the arsenic in served chicken isn’t healthy. It could increase consumers’ cancer risk.

Highlights of TPG-Axon Management’s Dropped Positions in 4Q14

In 4Q14, TPG-Axon sold its stakes in Macy’s (M), Monsanto (MON), Alibaba Group Holding (BABA), and Vantiv (VNTV).

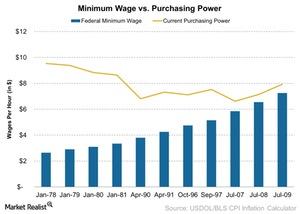

The Eroding Purchasing Power of the Minimum Wage Worker

While the absolute minimum wage has increased, when adjusted for inflation in 2015, its purchasing power has declined.

Dunkin’ Brands Diversifies Its Daypart Focus

Dunkin’ Brands is now expanding into the afternoon daypart in order to win customers in a different daypart and improve sales leverage.

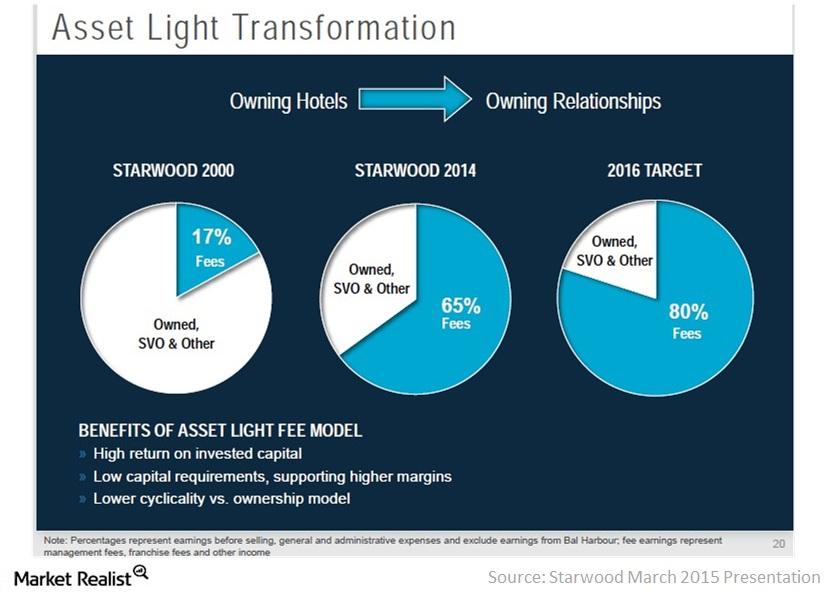

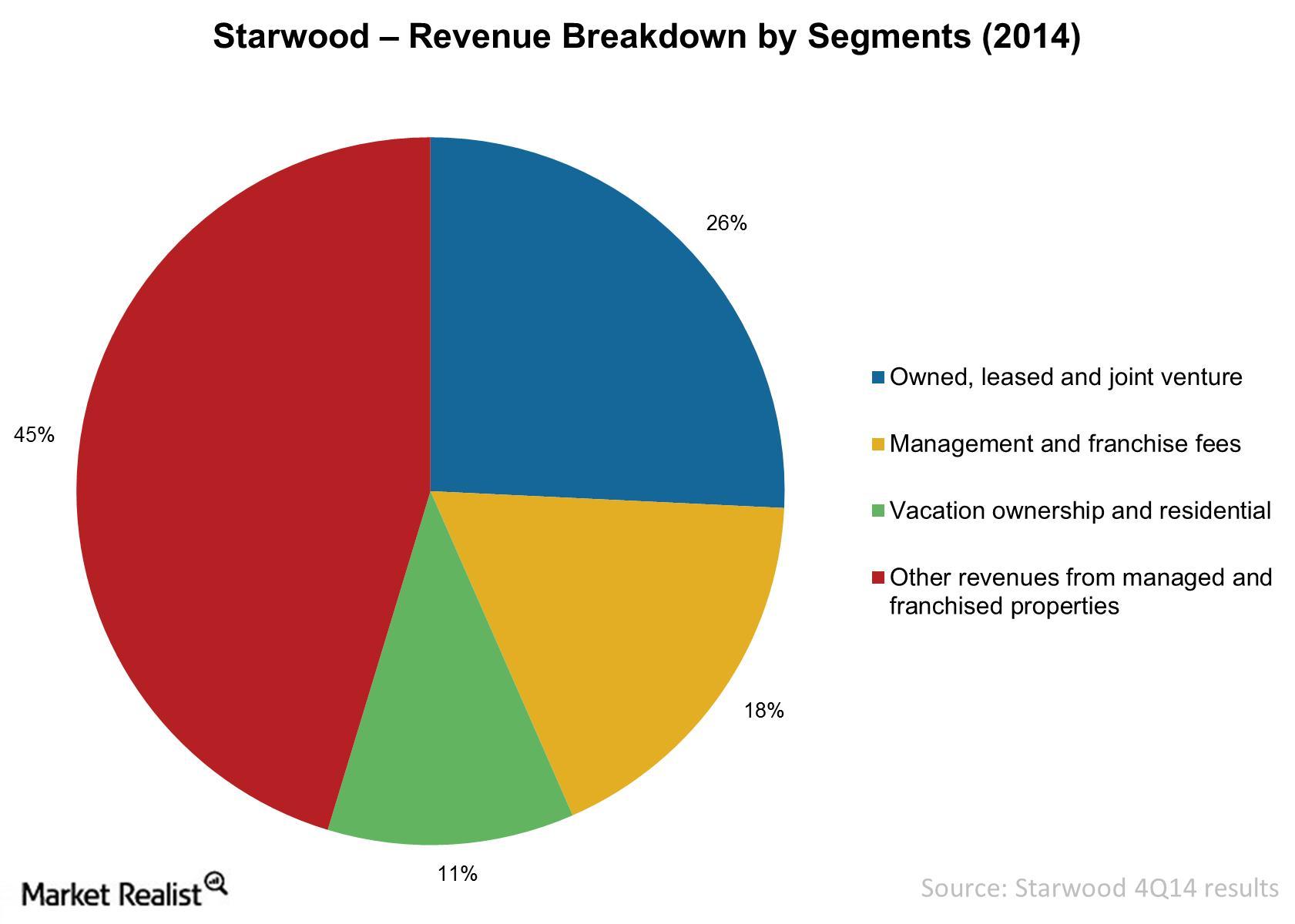

Analyzing Starwood’s Asset-Light Strategy

In 2006, Starwood’s management embarked on an asset-light strategy. It decided to sell a significant portion of Starwood’s owned hotel portfolio.

Starwood’s Vacation Ownership Business Spin-Off

On February 10, 2015, Starwood Hotels and Resorts announced plans to spin off its vacation ownership business into a separate publicly traded company.

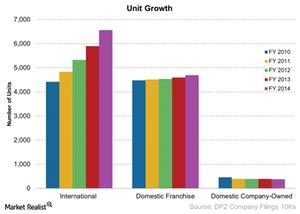

Domino’s Pizza and Its Master Franchise Model

The master franchise agreement gives the master franchisee operating rights to a supply chain in a given international region.

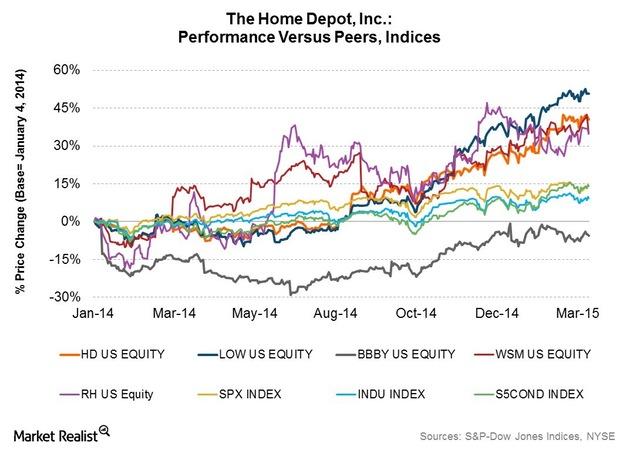

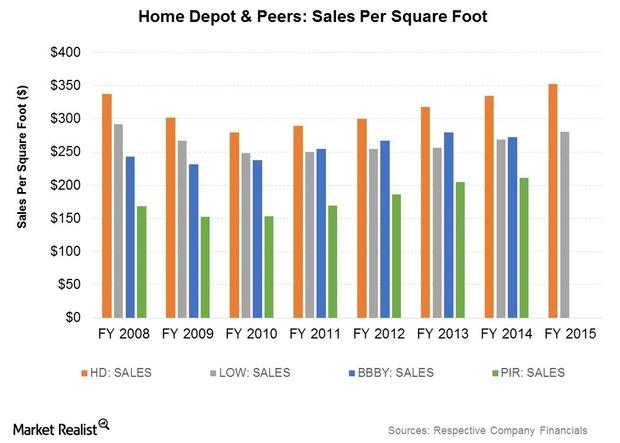

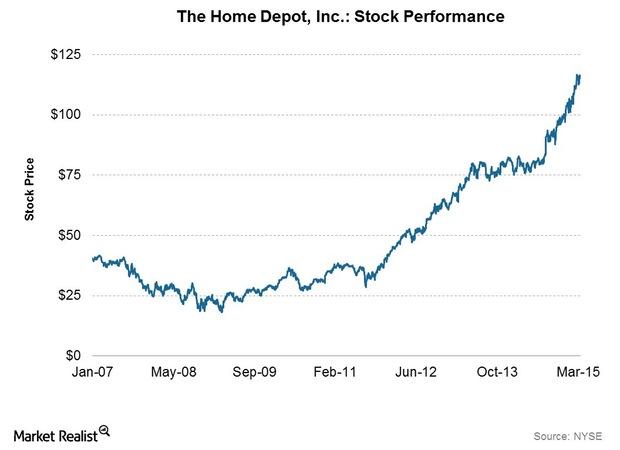

Home Depot Stock Outperforms Peer Group

Home Depot’s (HD) stock has performed well over the past five years. In fact, it’s been the best-performing stock in its peer group.

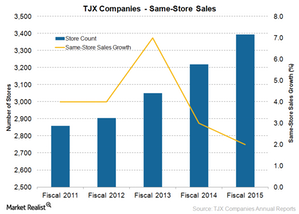

Gauging TJX Companies’ Same-Store Sales Growth

The growth in TJX Companies’ same-store sales slowed down in fiscal 2015, growing by 2.0% compared to 3.0% in fiscal 2014.

Why Domino’s Pizza Has So Much Debt

Domino’s debt is high because it was the product of a leveraged buyout. The latest recapitalization happened in 2012, leaving it with $1.57 billion in debt.

How Dunkin Donuts Is Embracing Technology

Dunikin’ is embracing technology with a phone app that allows you to search Dunkin’ Donuts locations, see nutritional information, and gift Dunkin’ treats.

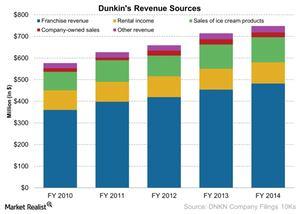

What are Dunkin’ Brands’ Five Sources of Revenue?

Dunkin’ Brands’ (DNKN) sources of revenue include franchise revenue, sale of ice cream products, company-owned sales, rental income, and other income.

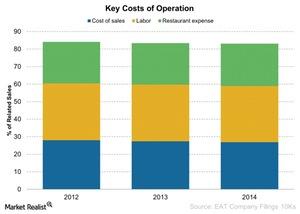

Brinker International’s Key Costs of Operations

Brinker incurs key costs of operations to run its company-owned restaurants, including cost of sales, labor and related costs, and rent and other costs.

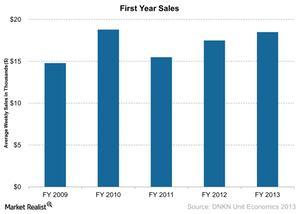

Dunkin’ Brands Has a Nearly 100% Franchise Model

Benefits to a franchise model include low need for capital, more focus on brand in marketing and menus, and a potential to penetrate faster into the market.

Dunkin’ Brands’ International Development Plan

As of December 2013, Dunkin’ Brands had 5,736 points of distribution (or POD). In its International Development Plan, it plans to expand that to 9,500.

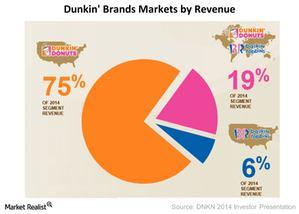

US Market Still the Biggest for Dunkin’ Brands

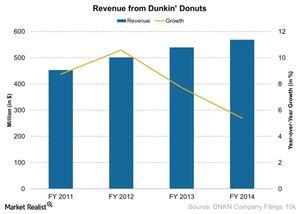

Dunkin’ Donuts is Dunkin’ Brands’ most important brand, with 77% of the revenue or $568 million in 2014. Of this, $548 million was from the US market.

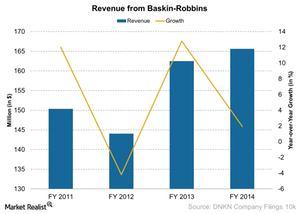

Baskin-Robbins’ Four Year Revenue Trend

As of 2014, there were about 2,500 Baskin-Robbins locations in the United States and about 5,000 locations in the international market.

Domino’s Wants to Entertain You at Its ‘Pizza Theater’

Domino’s plans to have all its stores remodelled according to the Pizza Theater design by the end of fiscal 2017.

Dunkin’ Donuts’ National and International Sales

Dunkin’ Donuts’ combined revenue from national as well as international units was $569 million in 2014. Of that, $548 million came from the US market alone.

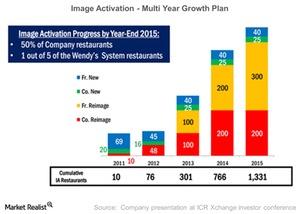

Why Did Wendy’s Start Its Image Activation Program?

From 2011 to 2012, Wendy’s (WEN) started its Image Activation program. It’s a program to remodel restaurants. It plans to remodel almost 1,331 restaurants.

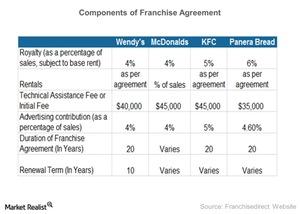

Analyzing Wendy’s Franchise Agreements

Wendy’s franchise agreements are only renewable after ten years. Wendy’s rental income from franchisees grew from $27 million in 2013 to $68 million in 2014.

Emerging Markets: Wendy’s International Expansion Plans

Wendy’s performance has been based on the economy, consumers’ preferences, and spending patterns in the US. International expansion will have its own complexities.

QSCC: Wendy’s Supply Chain Management

QSCC (Quality Supply Chain Co-op, Inc.) is an independent non-profit organization that’s responsible for the Wendy’s (WEN) supply chain management.

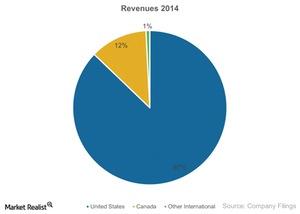

What Are Starwood’s Revenue Sources?

The revenue from owned, leased, and consolidated joint ventures is primarily derived from hotel operations. This includes room rentals and food and beverage sales.

Domino’s Pizza Enjoys the Dual Benefits of Vertical Integration

Because Domino’s Pizza sells dough and ingredients to its own franchises, the company derives dual benefits from the supply chain segment.

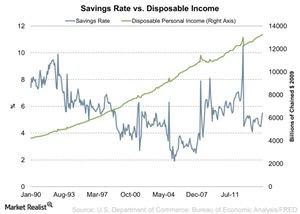

Higher Disposable Income: A Reason for Restaurants to Cheer

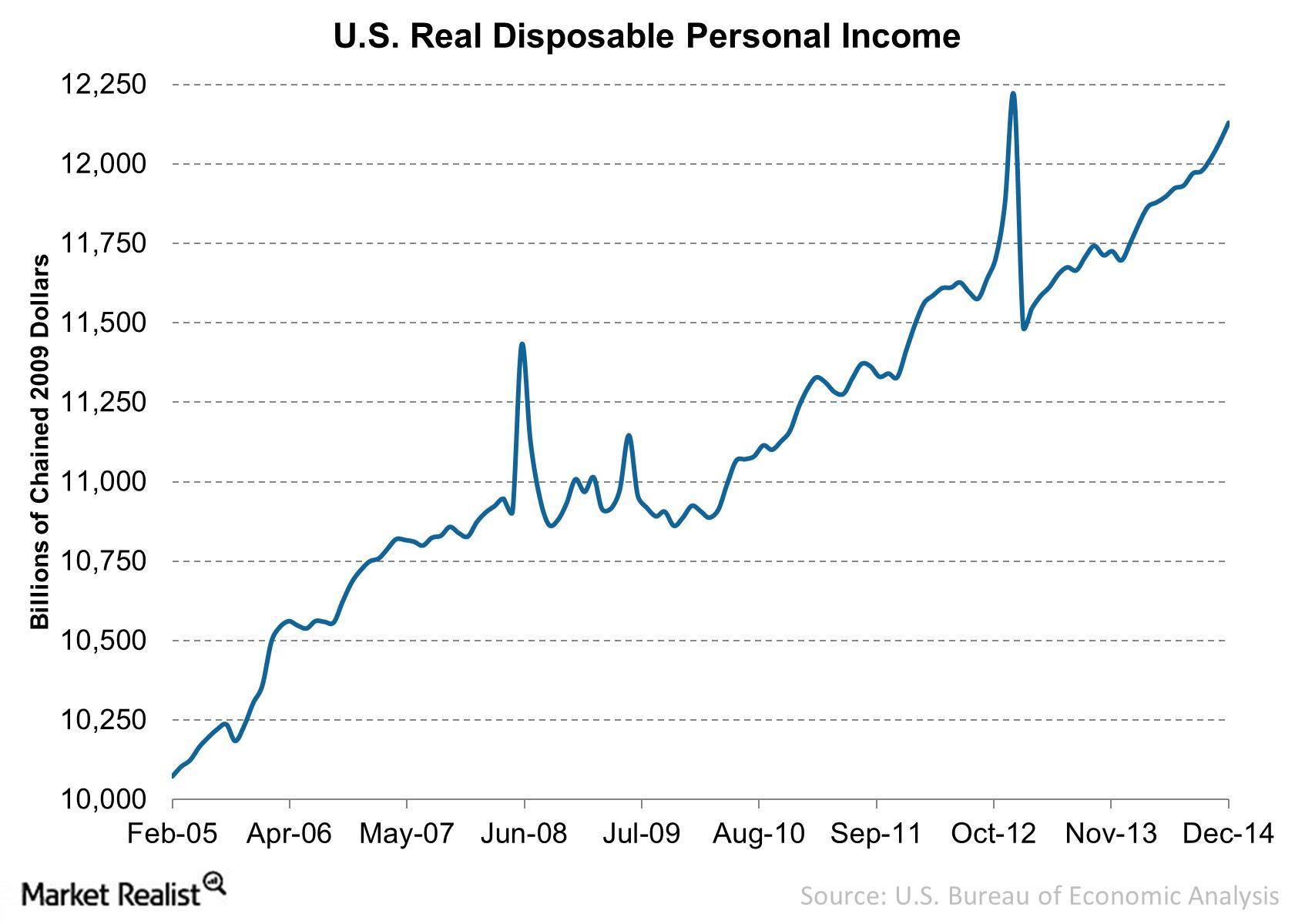

Disposable income increased by 40 basis points month-over-month in January. On a YoY (year-over-year) basis, disposable income increased 9.5%.

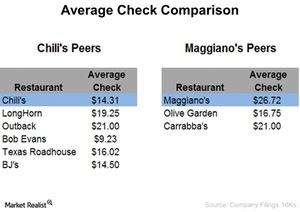

Average Checks at Chili’s and Maggiano’s – Why Do They Matter?

The average check at Chili’s in 2014 was $14.31, lower than its main peers. Maggiano’s average check was $26.72, the highest among its peers.

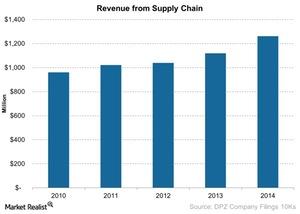

Domino’s Pizza Relies on its Supply Chain to Get It Right

Supply chain segment In terms of revenue, the supply chain is Domino’s Pizza’s (DPZ) most important segment. In fiscal 2014, it contributed 63%, or $1.26 billion, toward the company’s total revenue. Domino’s international master franchises have the right to operate a supply chain in their respective regions. The facilities The supply chain segment consists of the […]

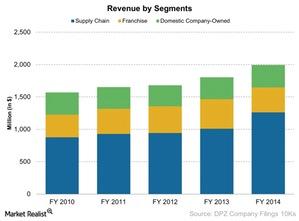

Which of Domino’s Pizza’s Three Business Segments Performs Best?

Of its three main business segments, Domino’s Pizza earns least revenue from its company-owned stores.

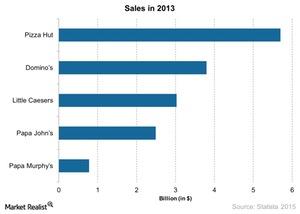

Domino’s: The Second-Largest Pizza Chain in the World

Domino’s (DPZ) is the second-largest pizza chain in the world, with a total of 11,629 restaurant units. Its total system sales in 2013 were $3.8 billion.

Domino’s Pizza: Serving 1.5 million Pies a Day

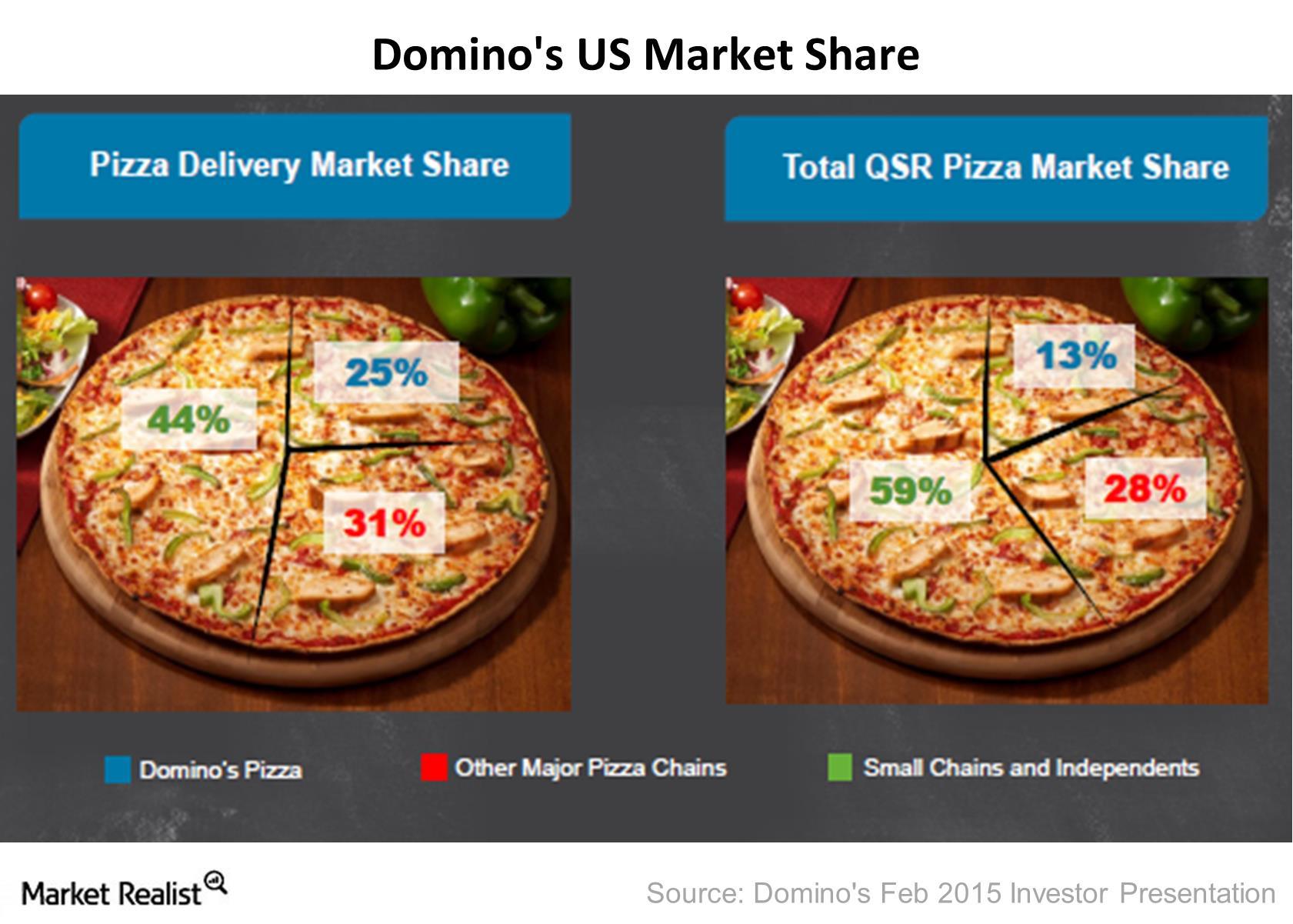

Domino’s Pizza had a 13% market share of the quick service restaurant industry in the US as of December 2014.

Home Depot’s Target Market and Customer Base

Home Depot invests considerable sums in providing a superior customer experience. Its co-founders say “the customer has a bill of rights at The Home Depot.”

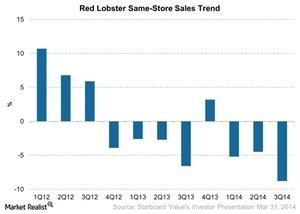

Why Darden Restaurants Sold Red Lobster

Activist investor Starboard Value opposed Red Lobster’s sale, stating that Darden management could do more to turn the undervalued brand around.

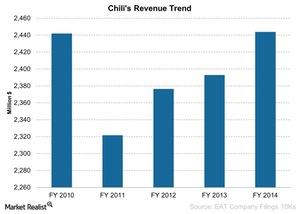

Why Chili’s Matters the Most to Brinker International

Chili’s is the most important restaurant under the Brinker (EAT) umbrella. Chili’s contributed 86%, or $2,443 million, to the company’s sales in 2014.

Home Depot (HD): Built of Strong Stuff

Fiscal 2015 was a record year for Home Depot. The stock has returned over 47% over the past year and over 10% year-to-date.

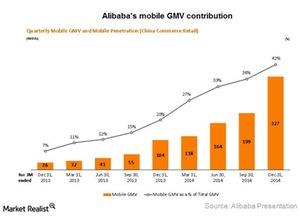

Mobile Commerce: One of Alibaba’s Key Growth Drivers

For the quarter ending in December 2014, Alibaba achieved 265 million monthly active users on its mobile commerce apps. This is a sequential growth of 22%.

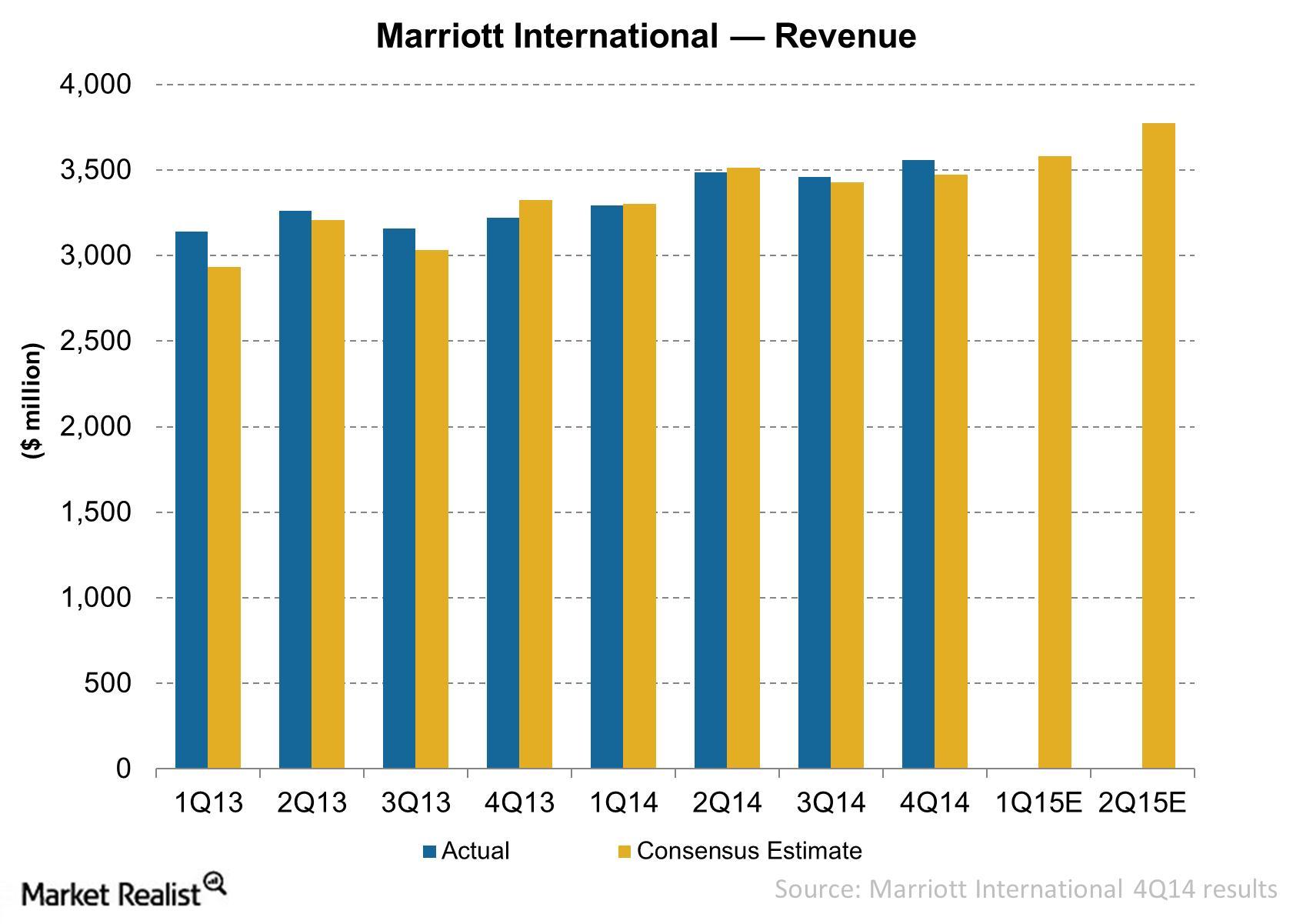

Why Marriott’s Revenue Increased in 2014

Marriott’s revenues totaled nearly $3.6 billion in the fourth quarter of 2014, compared to $3.2 billion in the fourth quarter of 2013.

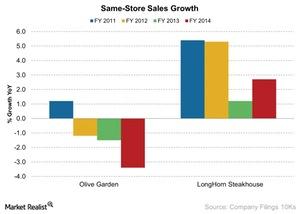

Olive Garden and LongHorn Steakhouse’s Same-Store Sales Growth

LongHorn Steakhouse’s same-store sales increased to 2.7% in 2014 year-over-year from 1.2% in 2013. This is lower compared to fiscal 2012 and fiscal 2011.

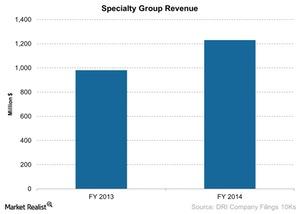

Darden’s Specialty Restaurant Group: The Capital Grille

As of fiscal 2014, revenue from Specialty Restaurant Group was $1,230 million, or 19.5% of the total revenue for Darden Restaurants.

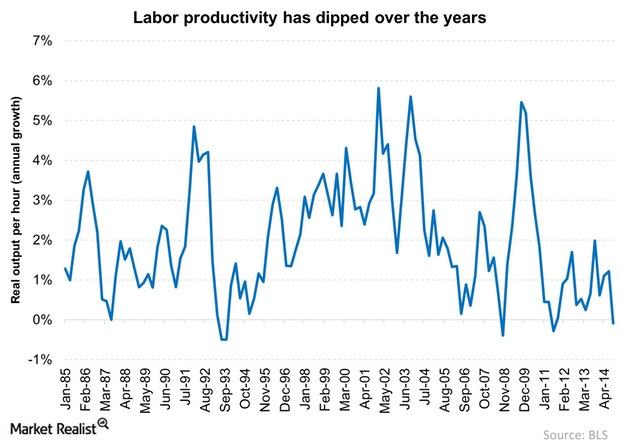

Why Low Labor Productivity Could Affect GDP Growth

Labor productivity growth has slumped to a negative. The 30-year average is 2%. However, this average has been quite volatile.

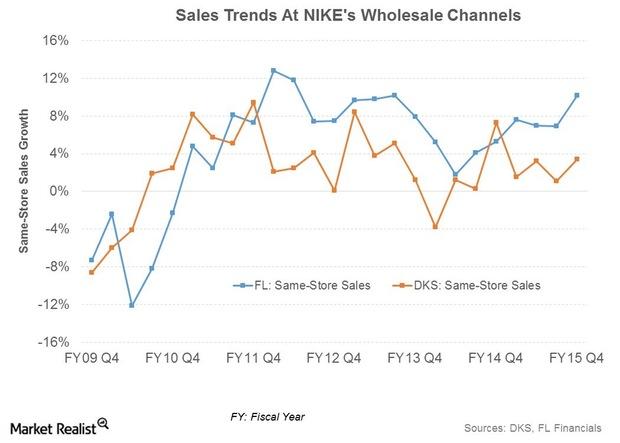

How Nike Benefits from Its Wholesale Partnerships

Nike (NKE) has a number of stores-within-stores, or exclusive standalone stores, partnering with retailers.

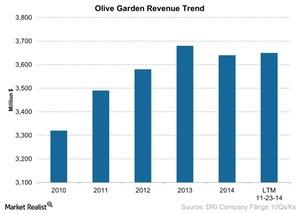

Olive Garden: Darden’s Most Important Brand

In 2014, Olive Garden contributed about 58% to Darden’s revenues as of fiscal 2014. Olive Garden gained importance after Darden sold Red Lobster in 2014.

Business Overview of Darden Restaurants

As of 2014, Darden Restaurants owned 1,520 restaurants, excluding more than 700 Red Lobster locations.

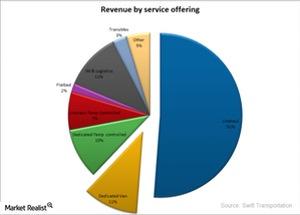

Swift Transportation: A Company Overview

Swift operates a diverse fleet of 18,000 tractors, 60,000 trailers, and 8,700 intermodal containers from more than 40 terminals in the US and Mexico.

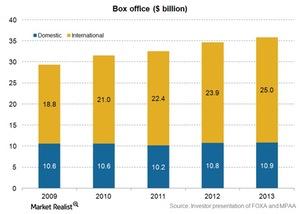

How do the largest studios make money in motion pictures?

The largest studios are owned by conglomerates like 21st Century Fox (FOXA) whose studio had the largest 2014 domestic box office market share.

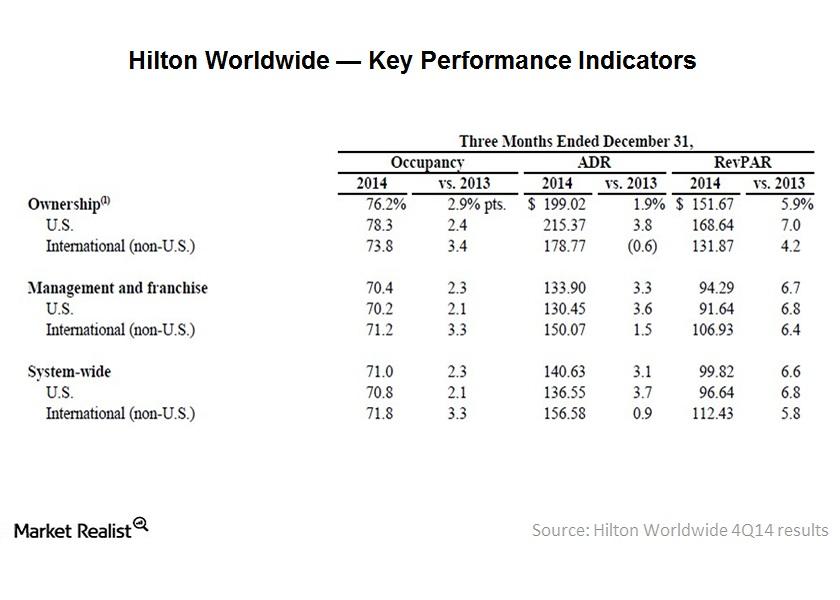

Hilton’s revenue was driven by occupancy and room pricing

Hilton Worldwide (HLT) generates revenue from its hotel operations. Hilton’s system-wide occupancy increased 2.3% YoY to 71% in 4Q14.

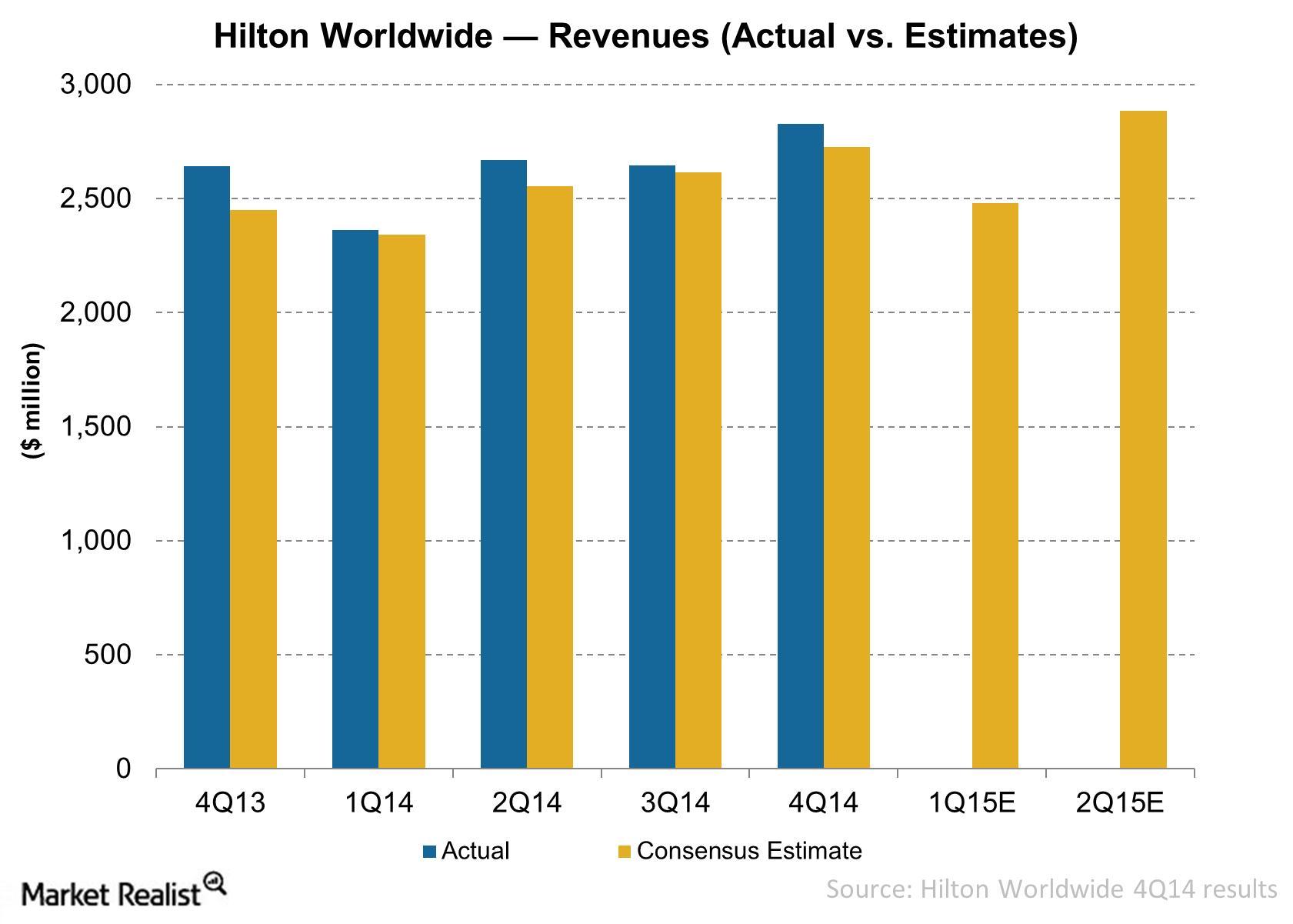

Why did Hilton’s revenue increase in 2014?

Hilton’s 4Q14 revenue increased 7% YoY to $2,828 million. For 2014, its revenue increased by 10.5 billion, or 7.9%—compared to 2013.

Disposable income increases, drives demand for leisure

Real disposable income increased 3.7% year-over-year. This boosts consumer buying power and means consumer spending in leisure activities may increase.