United States Oil ETF

Latest United States Oil ETF News and Updates

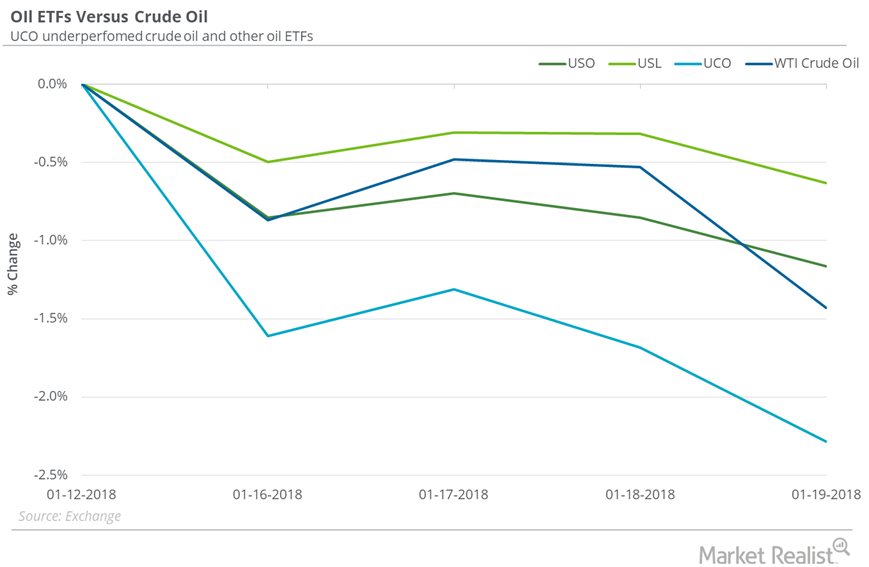

Are Oil ETFs Outperforming Oil?

Between January 12 and January 19, 2018, the United States Oil ETF (USO) fell 1.2%.

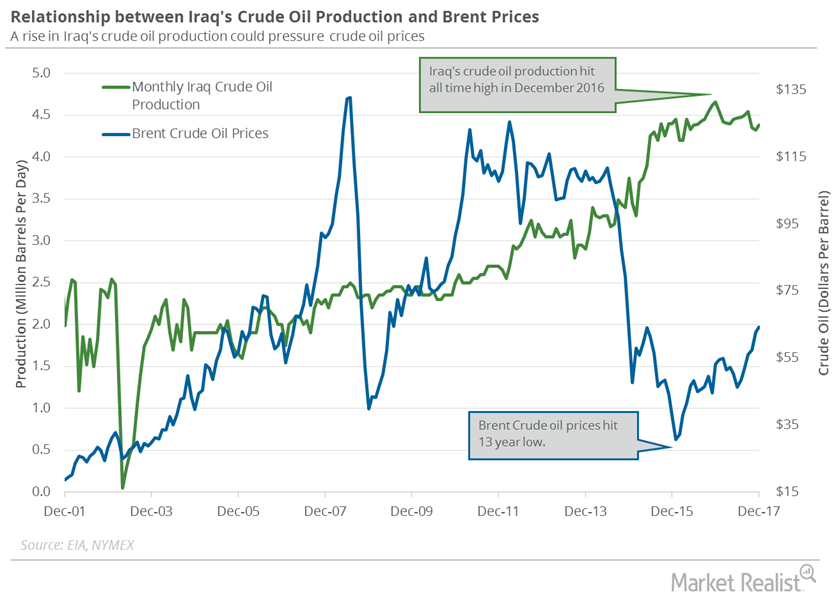

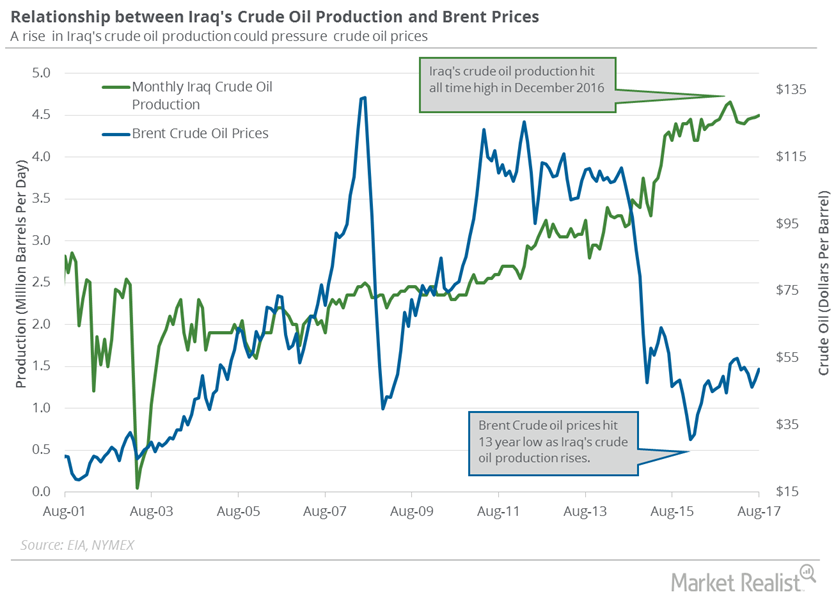

Iraq’s Crude Oil Production Capacity Could Hit 5 MMbpd

The EIA estimated that Iraq’s crude oil production increased by 60,000 bpd to 4,380,000 bpd in December 2017—compared to the previous month.

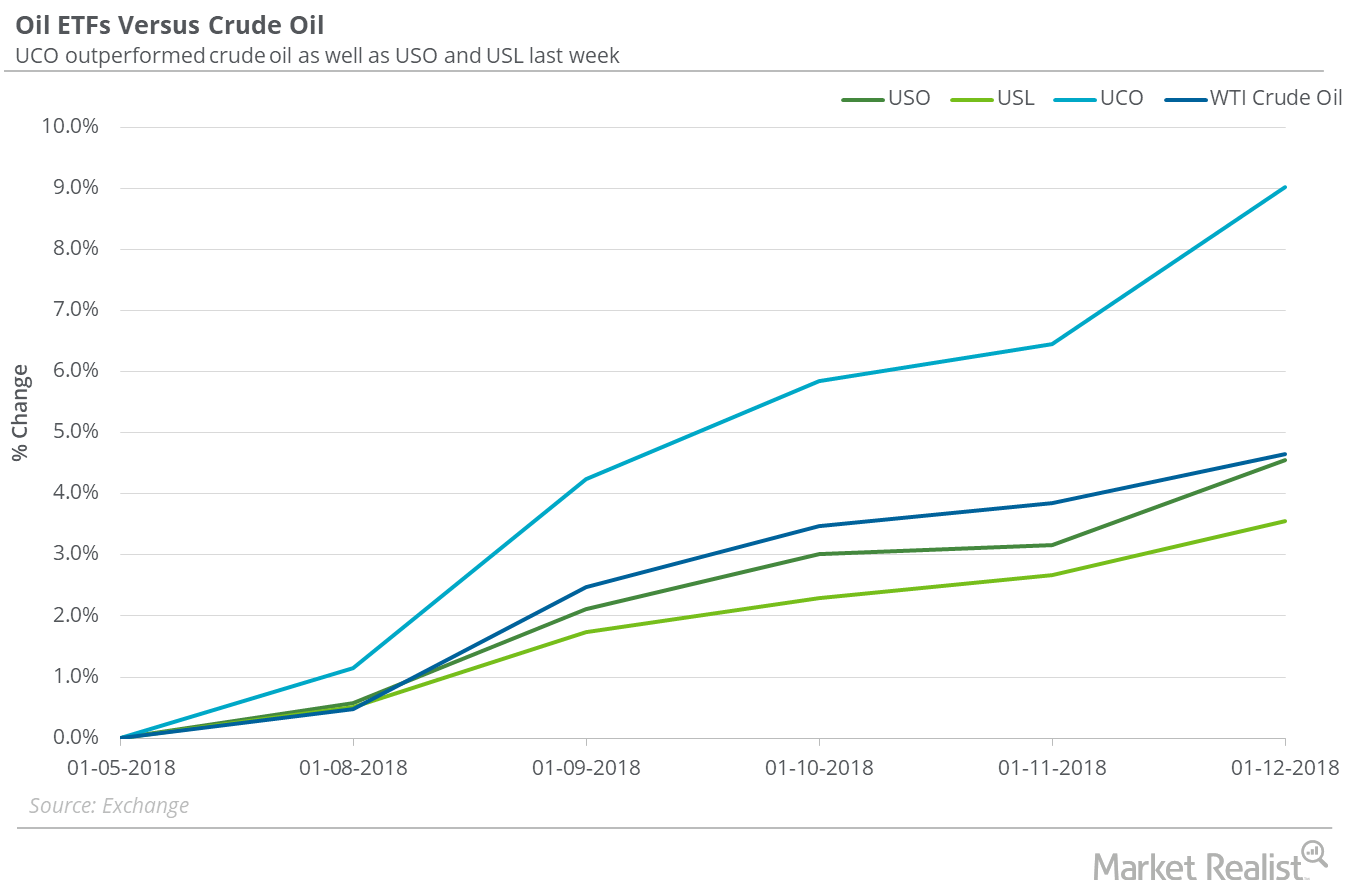

Oil ETFs: How They’re Performing at Oil’s 3-Year High

Between January 5 and January 12, 2018, the United States Oil ETF (USO), which holds positions in US crude oil active futures, gained 4.5%.

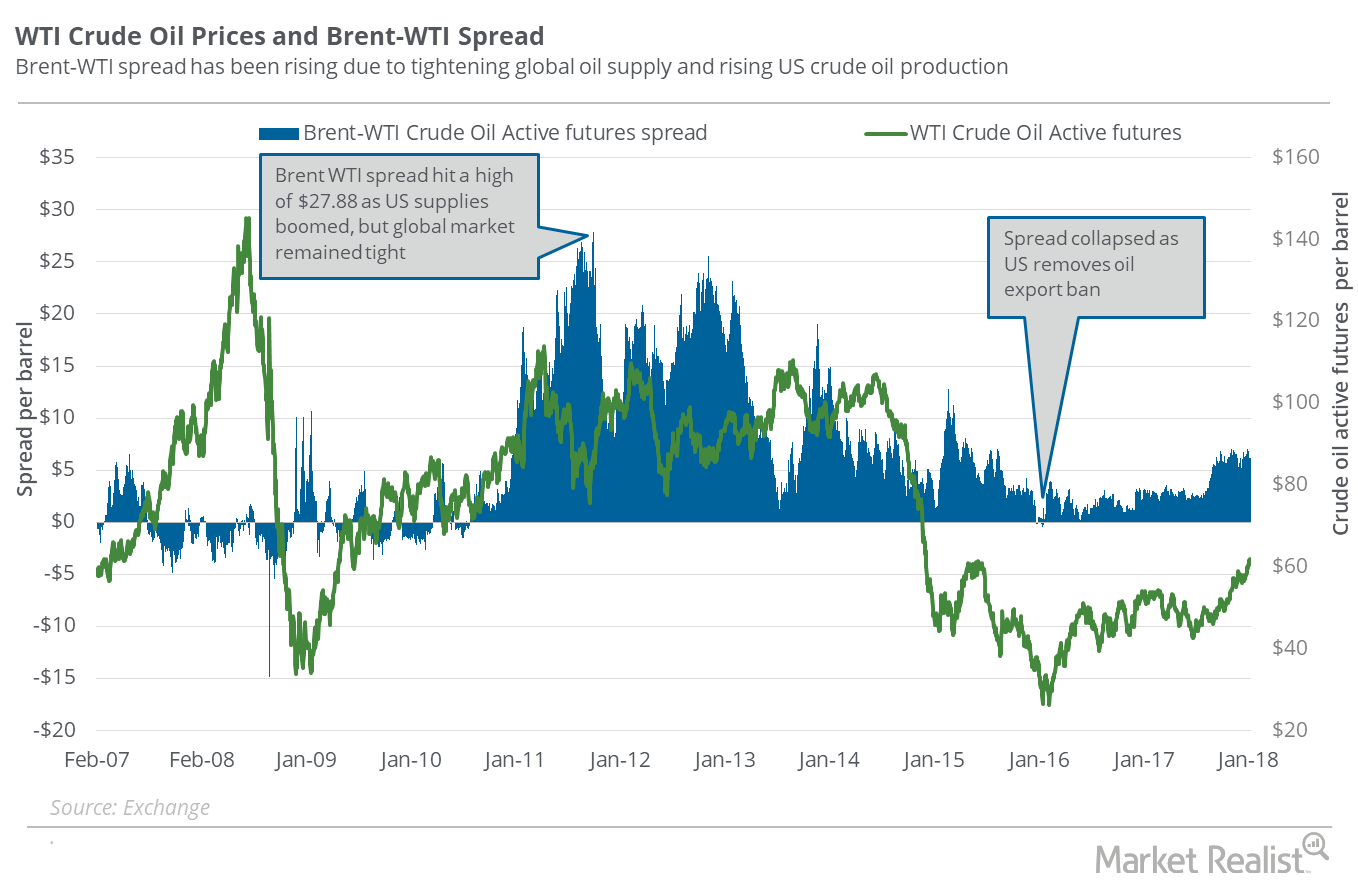

US Oil Exports Are Crucial for Oil Prices in 2018

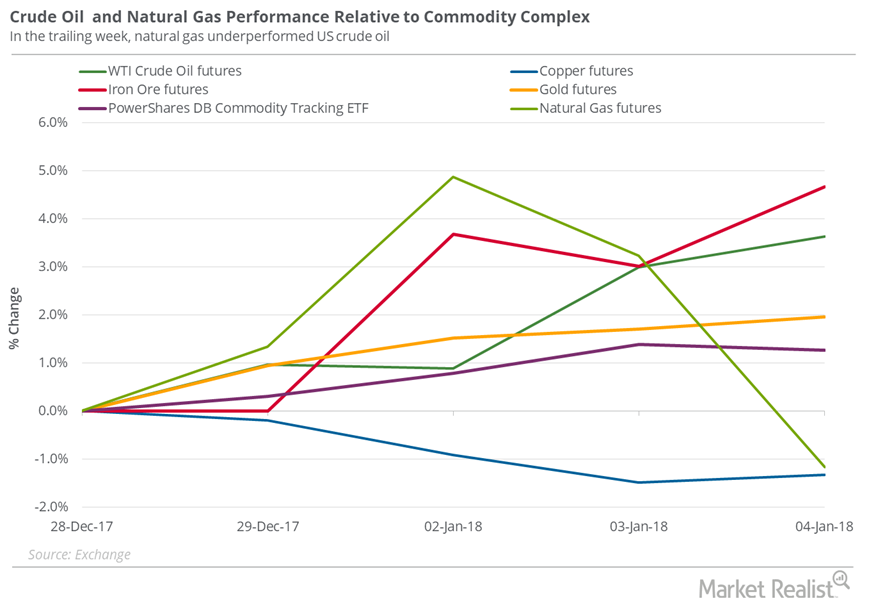

On January 8, 2018, Brent crude oil (BNO) active futures were $6.05 stronger than WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures.

Will US Crude Oil Prices Make a New 3-Year High?

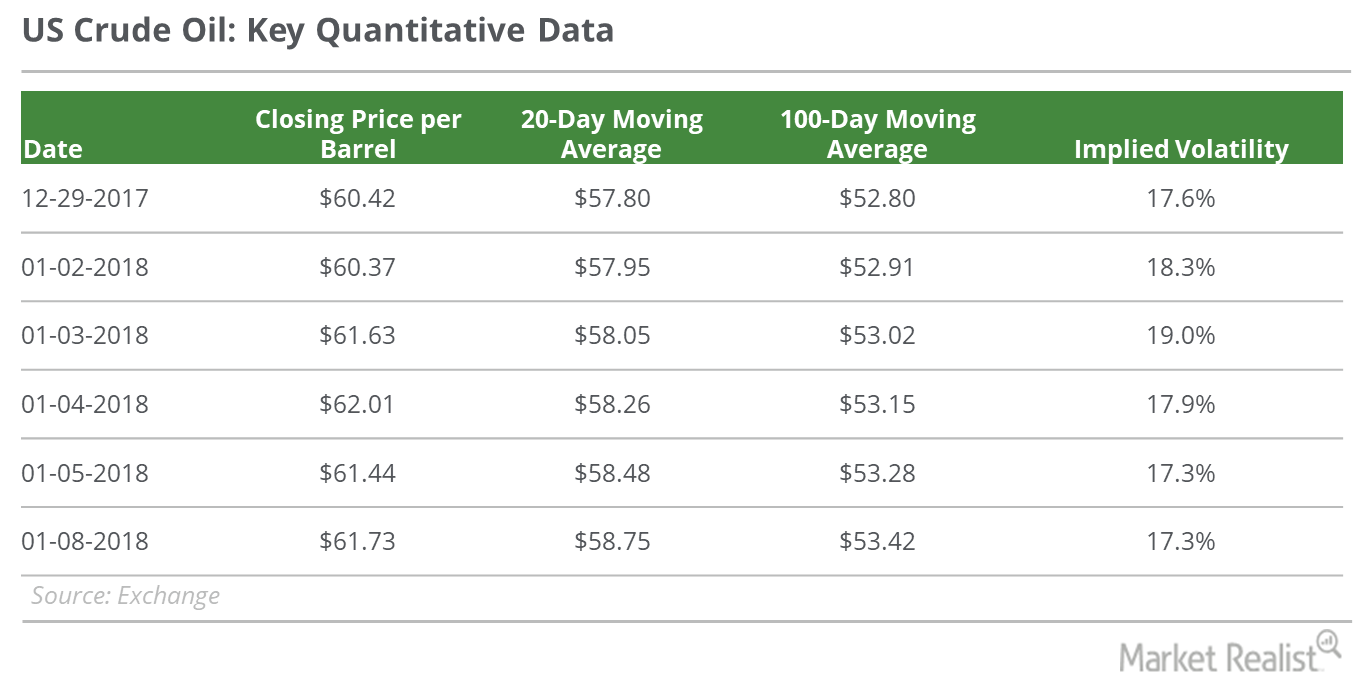

On January 8, 2018, US crude oil (USO) (USL) February 2018 futures rose 0.5% and closed at $61.73 per barrel—0.5% below the three-year high.

Crude Oil Inventories Fell, Refinery Utilization Hit 12-Year High

US crude oil futures contracts for February delivery fell 0.1% to $61.95 per barrel at 1:05 AM EST on January 5, 2018—the highest level since December 2014.

Why Oil Reached a 3-Year High

On January 4, 2018, US crude oil (USO) (USL) February 2018 futures rose 0.6% and closed at $62.01 per barrel—a three-year high.

Which Oil ETFs Might Be a Better Bet in 2018?

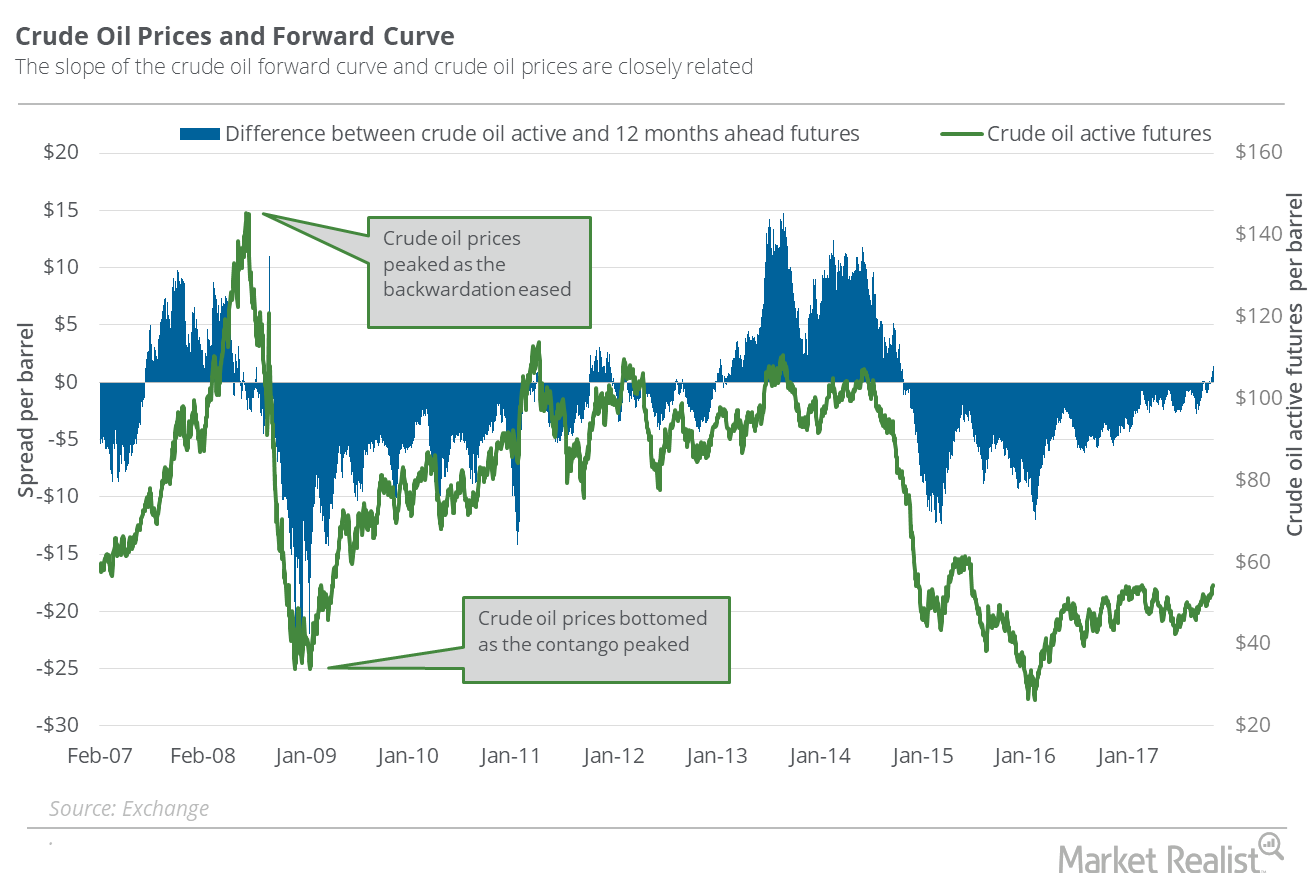

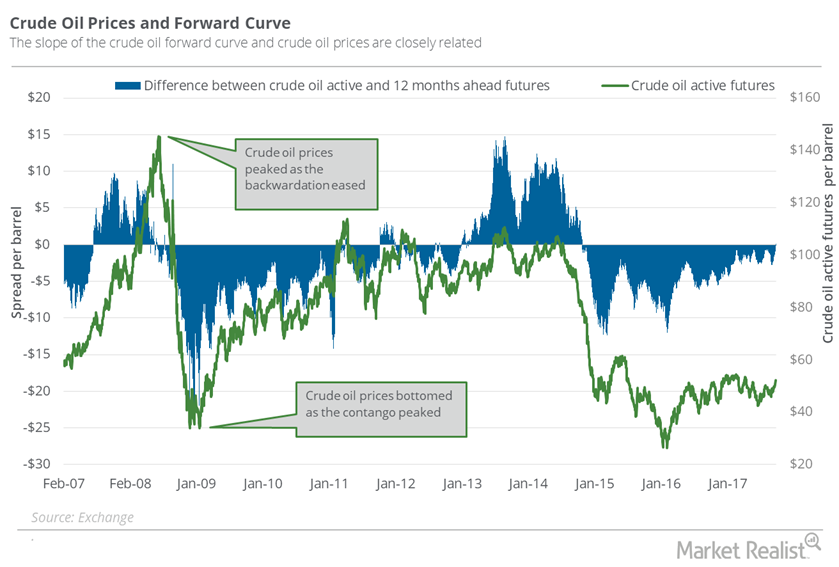

On December 29, 2017, the closing prices of US crude oil futures contracts between March 2018 and January 2019 were progressively lower.

US Crude Oil Closed at 2017 High: Will the Ride Continue?

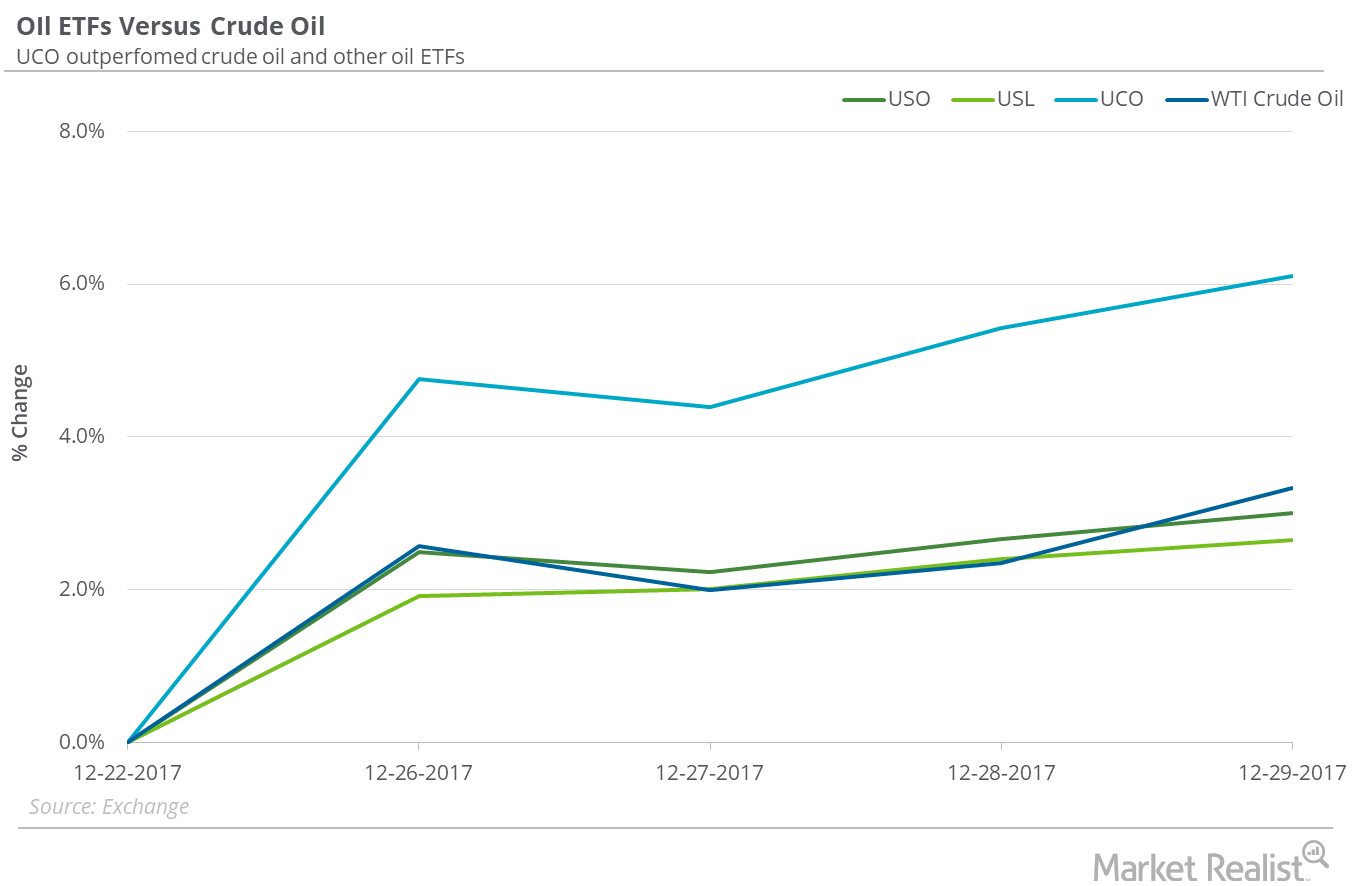

On December 22–29, US crude oil (USO) (USL) February futures rose 3.3%. On December 29, US crude oil February 2018 futures closed at $60.42 per barrel.

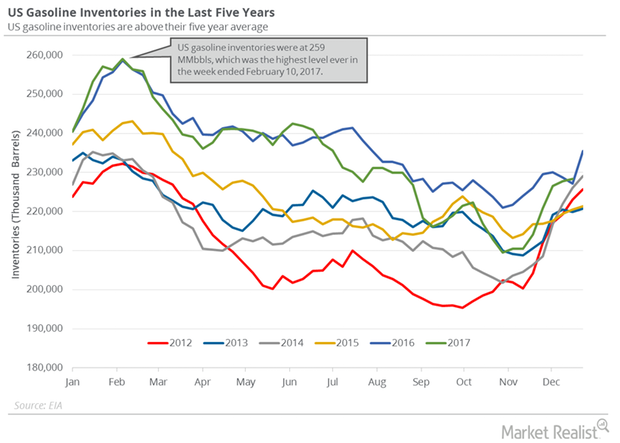

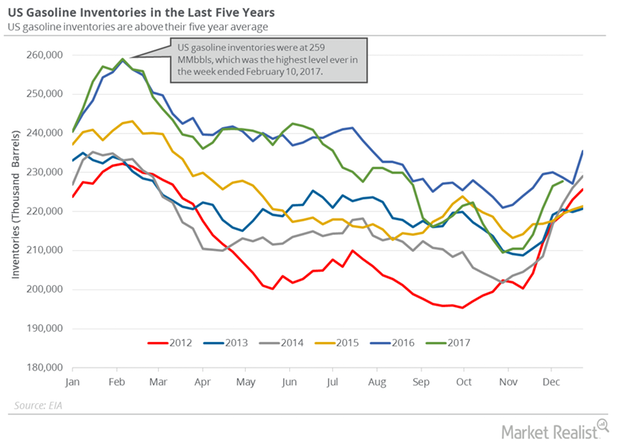

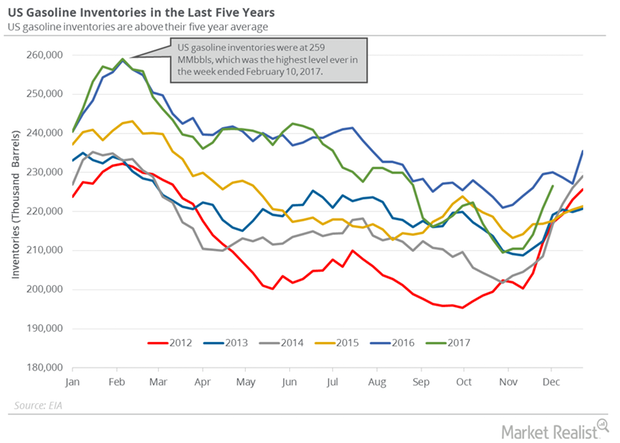

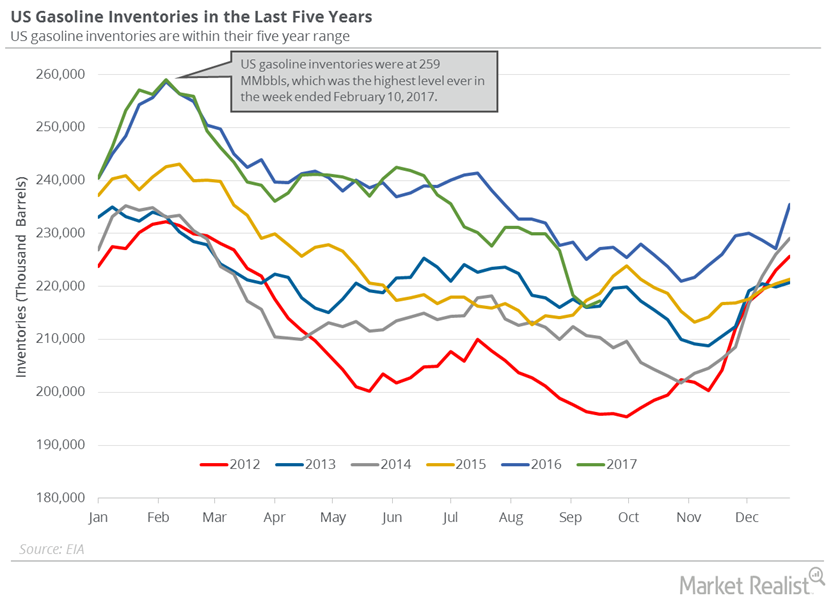

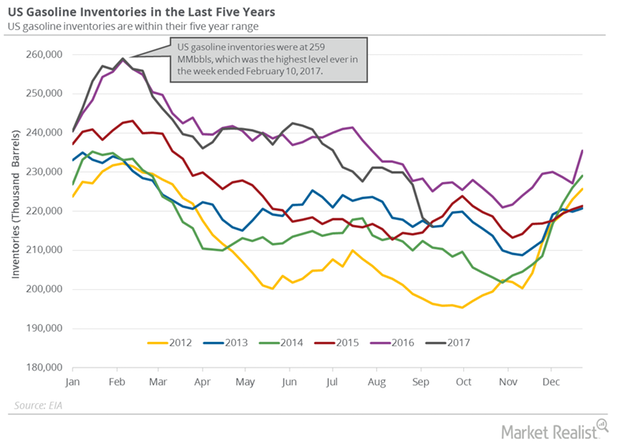

Why Oil Traders Are Tracking US Gasoline Inventories

US gasoline inventories rose by 0.5 MMbbls (million barrels) or 0.3% to 228.3 MMbbls from December 15 to 22, 2017, per the EIA.

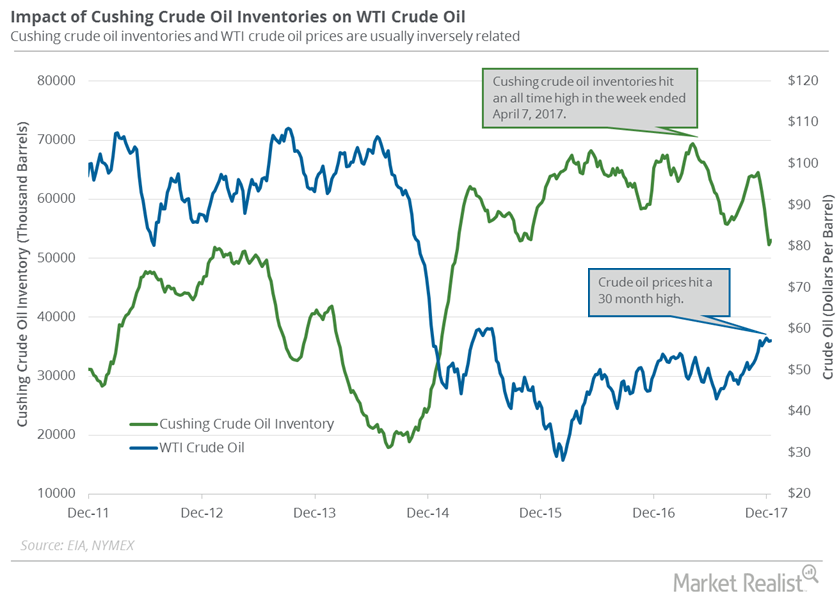

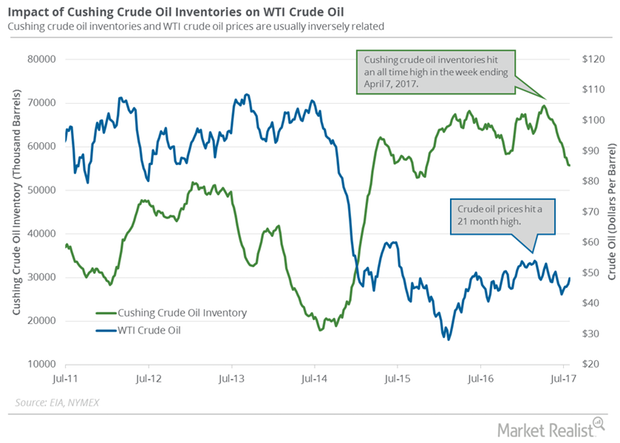

Cushing Inventories Rose for the First Time in Nearly 2 Months

Cushing inventories rose by 754,000 barrels or 1.4% to 52.9 MMbbls (million barrels) on December 8–15, 2017, according to the EIA.

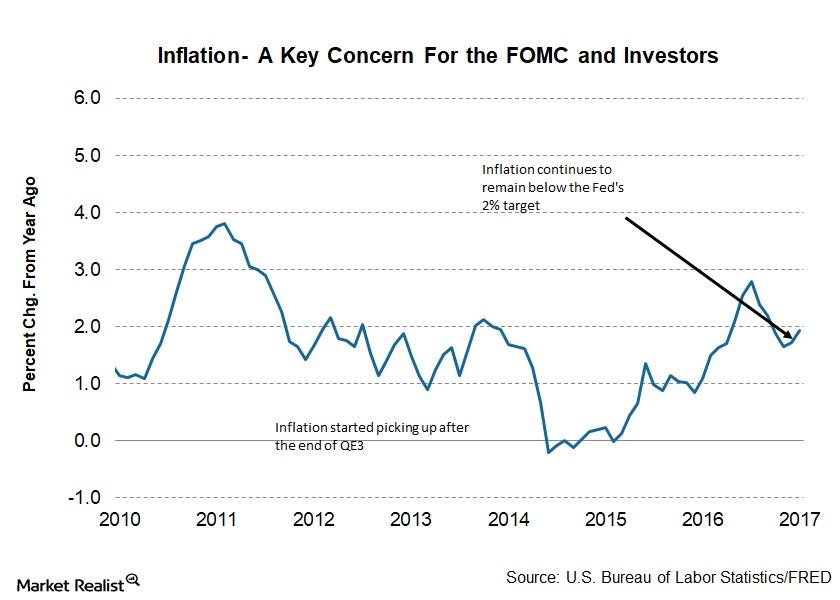

The Curious Case of Low Inflation in 2017

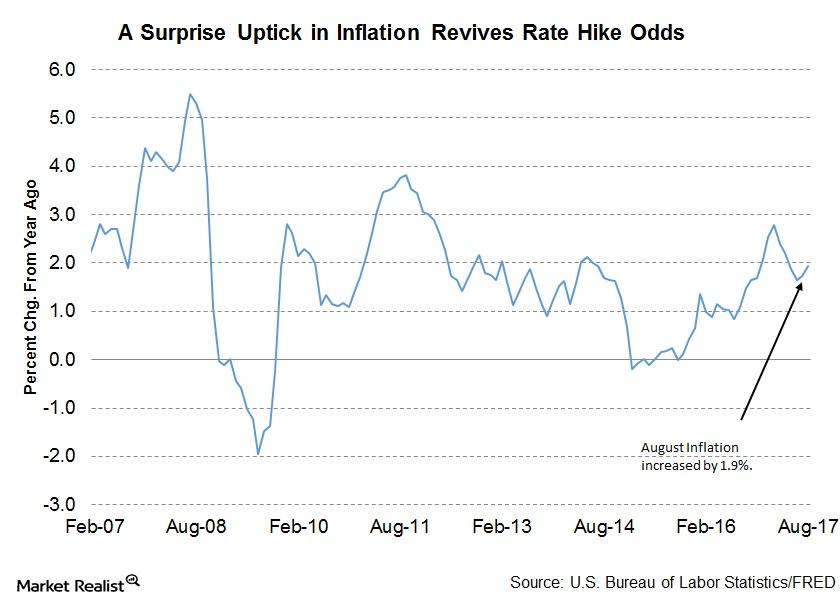

The last statement from the US Fed, which was released with its recent rate hike decision, cited lower levels of inflation but hopes that the inflation target could be achieved in 2018.

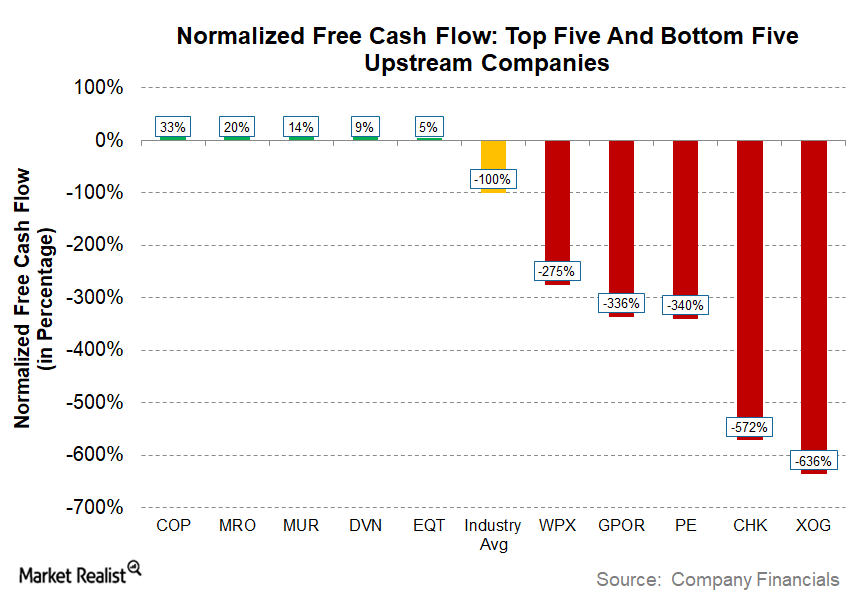

Upstream Energy’s Best and Worst Free Cash Flow Companies

Free cash flow (or FCF) is an important metric for the crude oil (USO) and natural gas (UNG) production (or upstream) sector.

US Gasoline Inventories: Bearish Driver for Crude Oil Futures

The EIA estimated that US gasoline inventories rose by 1.2 MMbbls (million barrels) to 227.7 MMbbls on December 8–15, 2017.

Analyzing the API’s Gasoline and Distillate Inventories

On December 19, 2017, the API released its crude oil inventory report. US gasoline inventories rose by 2 MMbbls (million barrels) on December 8–15, 2017.

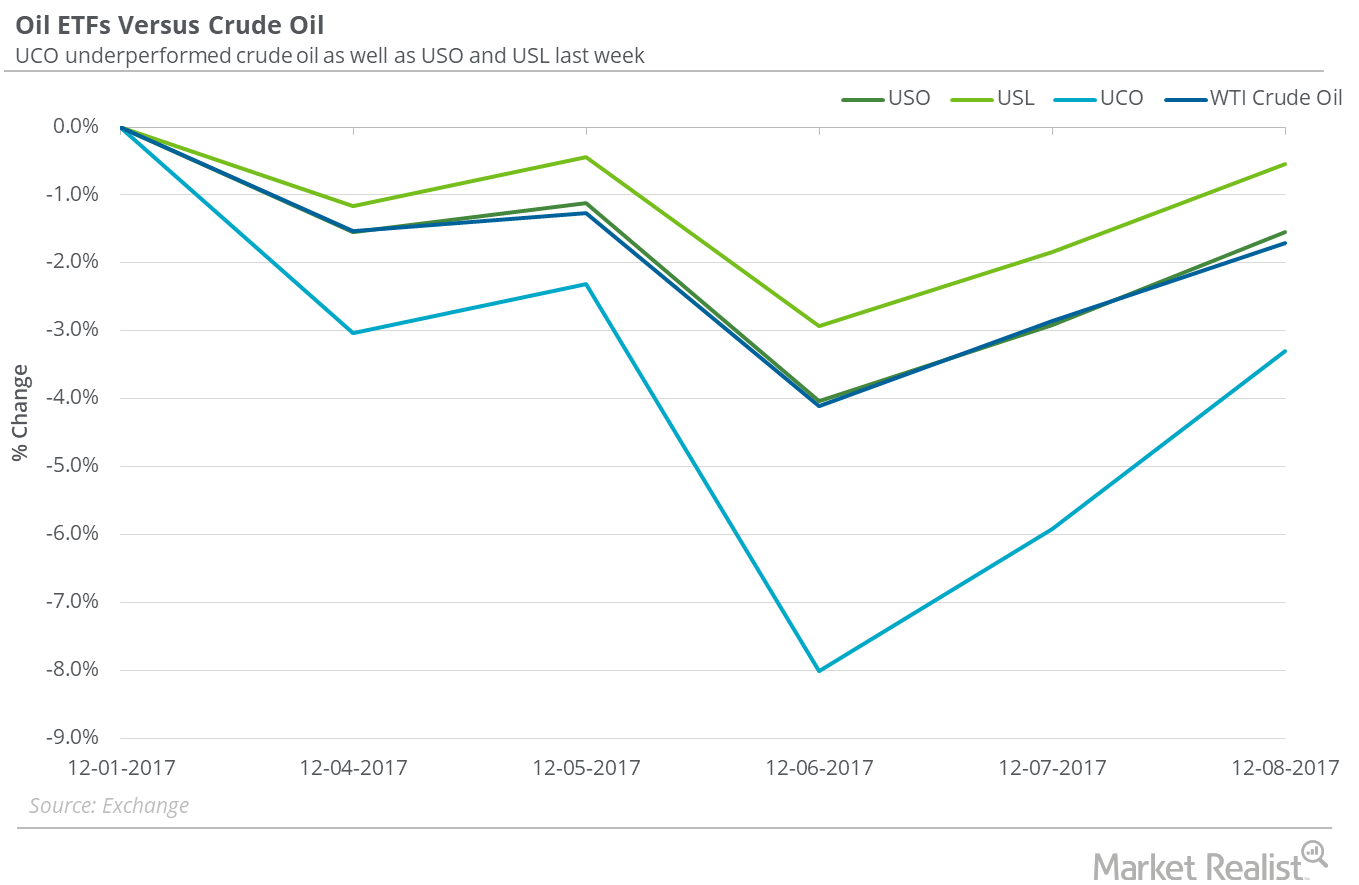

Oil ETFs That Outperformed US Crude Oil Last Week

On December 1–8, 2017, the United States Oil Fund (USO), which holds crude US oil futures contracts, fell 1.5%. US crude oil January 2018 futures fell 1.7%.

The Primary Cause of Yield Curve Flattening

Interest rates and inflation The pace of interest rate hikes and inflation rate growth have a profound influence on the US yield curve. The US Fed has been communicating its intent to increase interest rates from the current ultra-low level to a target rate of 2.5% over the next few years. The conditions required for […]

Is Oil’s Rise Coming to a Halt?

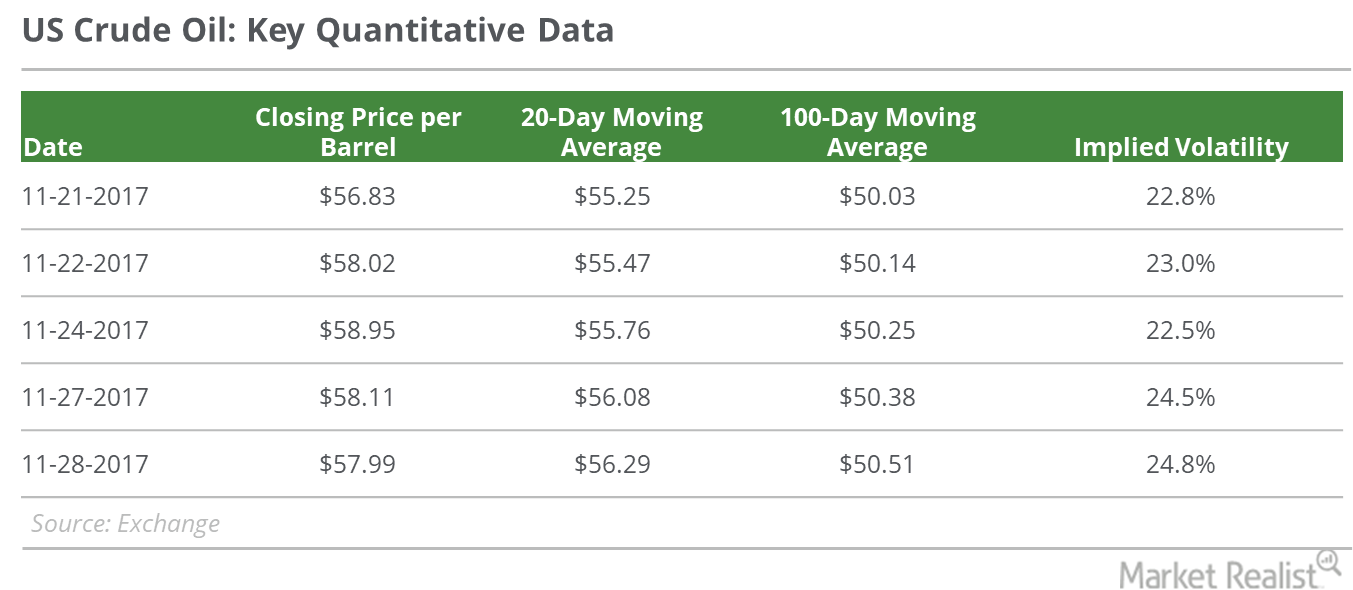

On November 28, 2017, US crude oil (USO) (USL) active futures fell 0.2% and closed at $57.99 per barrel. All eyes are on the outcome of OPEC’s meeting.

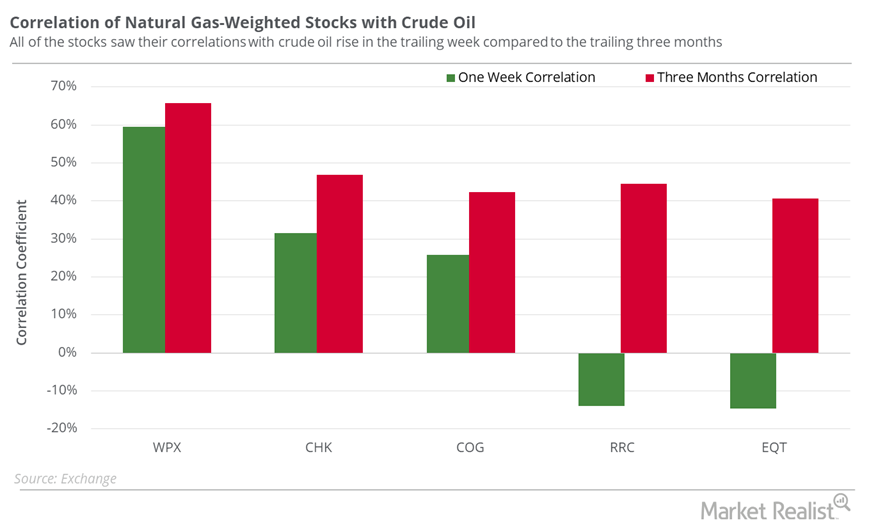

Which Natural Gas–Weighted Stocks Could Take Cues from Oil?

Antero Resources (AR) and Gulfport Energy (GPOR) are among the natural gas–weighted stocks that had the highest correlations with natural gas prices in the trailing week.

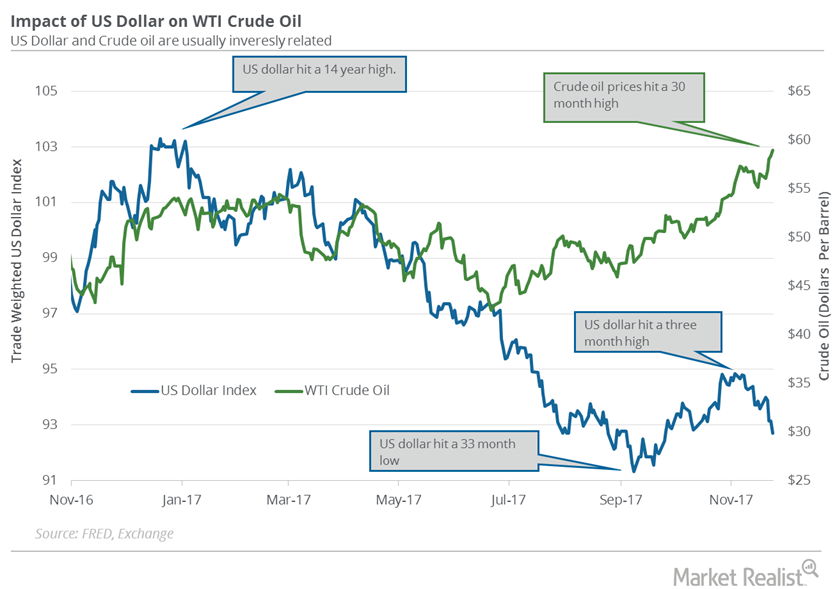

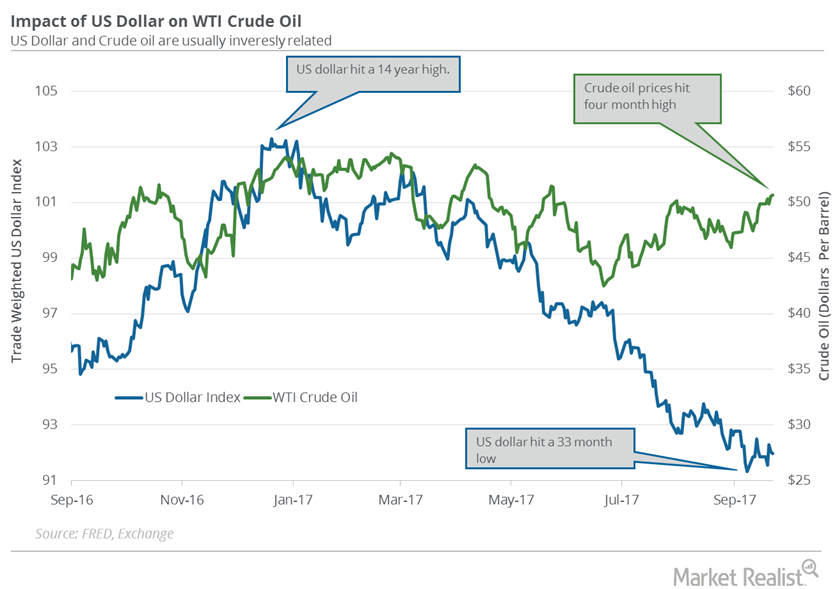

US Dollar Is near a 2-Month Low

The US Dollar Index fell 0.5% to 92.7 on November 24, 2017—the lowest level in almost two months. The US dollar (UUP) fell 1.27% last week.

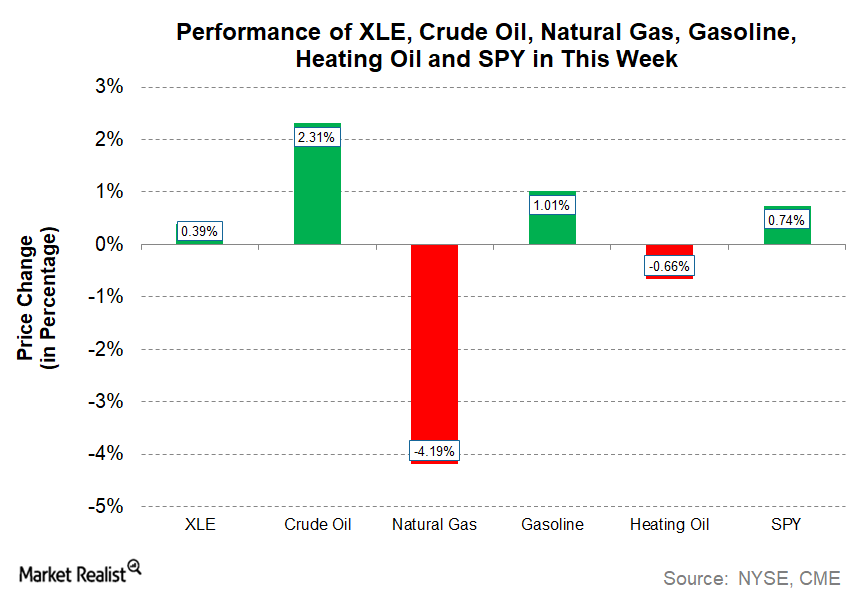

Energy Sector Saw a Mixed Performance This Week

With the mixed performance from natural gas and crude oil, the energy sector is showing a modest increase this week.

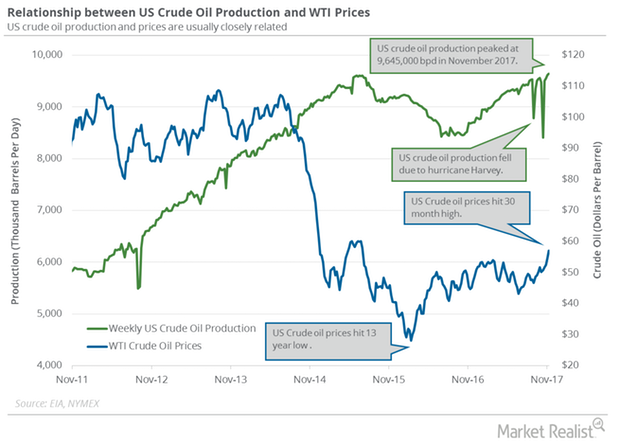

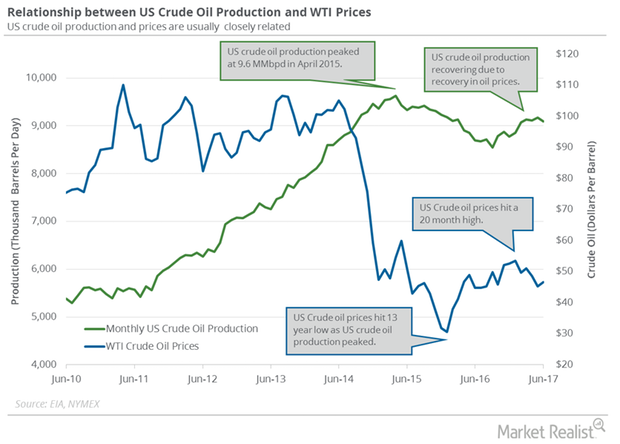

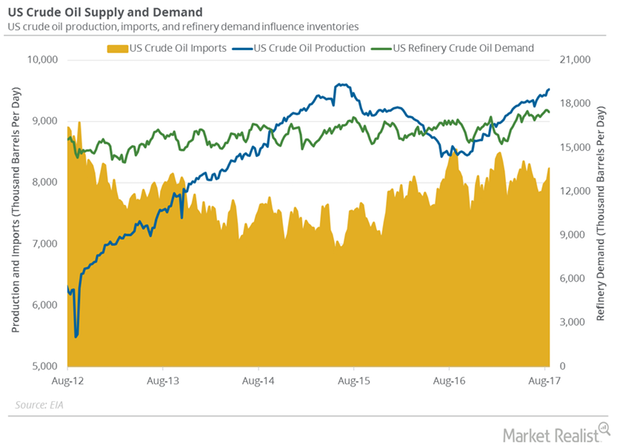

US Crude Oil Production: Bearish Driver for Oil Prices

The EIA estimates that US crude oil production rose by 25,000 bpd (barrels per day) or 0.3% to 9,645,000 bpd on November 3–10, 2017.

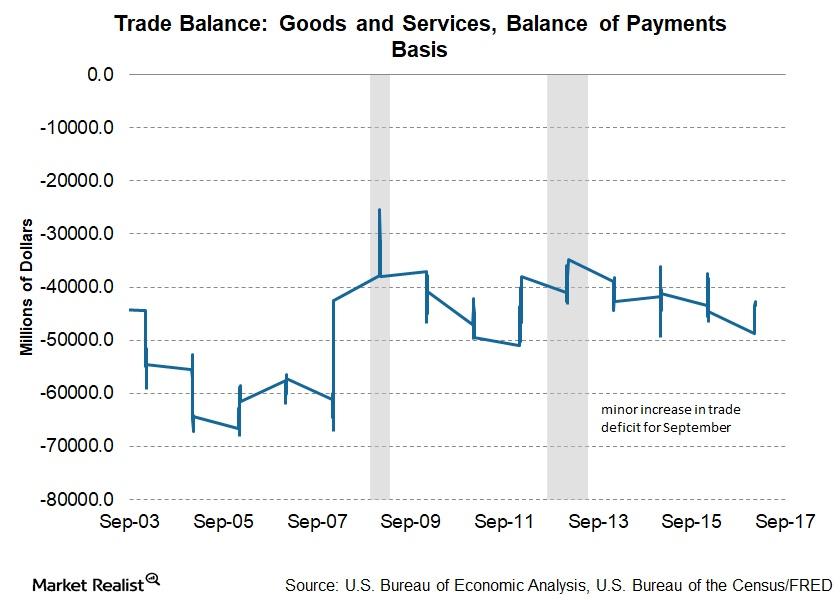

What Led to the Rise in the US Trade Deficit in September?

The latest report was released on November 3 and indicated that the goods and services deficit was $43.5 billion in September, or $0.7 billion higher than in August.

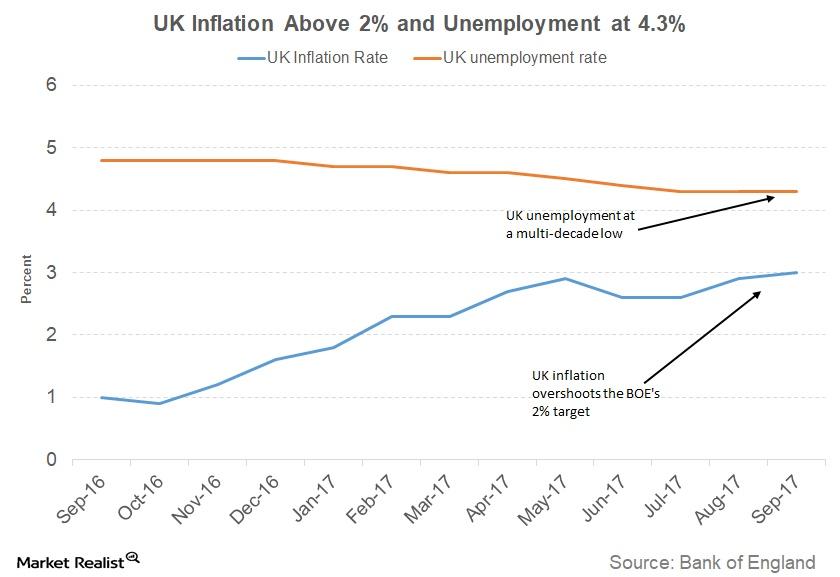

Why the Bank of England Wants Inflation to Fall

The central bank said that the key reason for such sharp increase in prices was due to the depreciation of the British pound after the Brexit referendum.

Is the Oil Market Balancing?

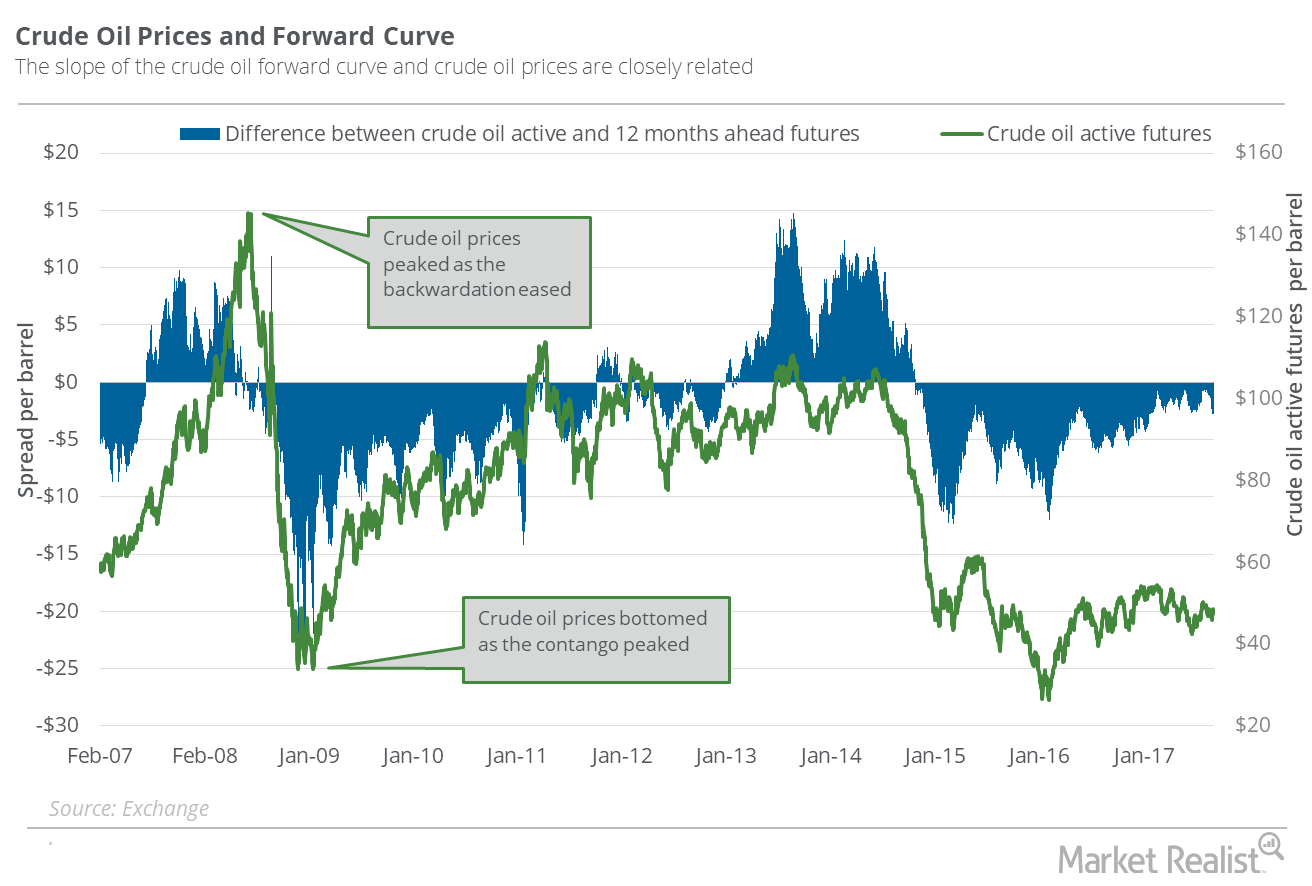

On October 31, 2017, US crude oil (USO) December 2018 futures settled $1.4 below December 2017 futures.

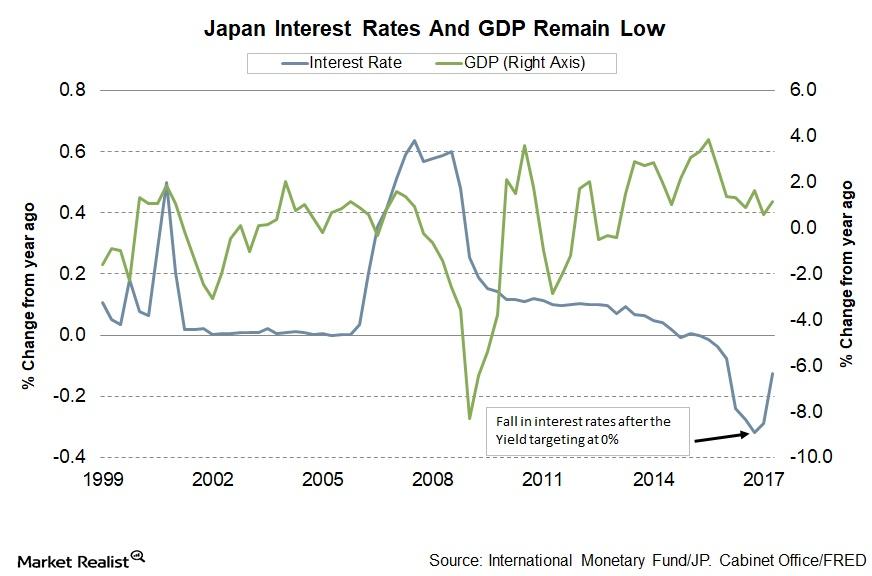

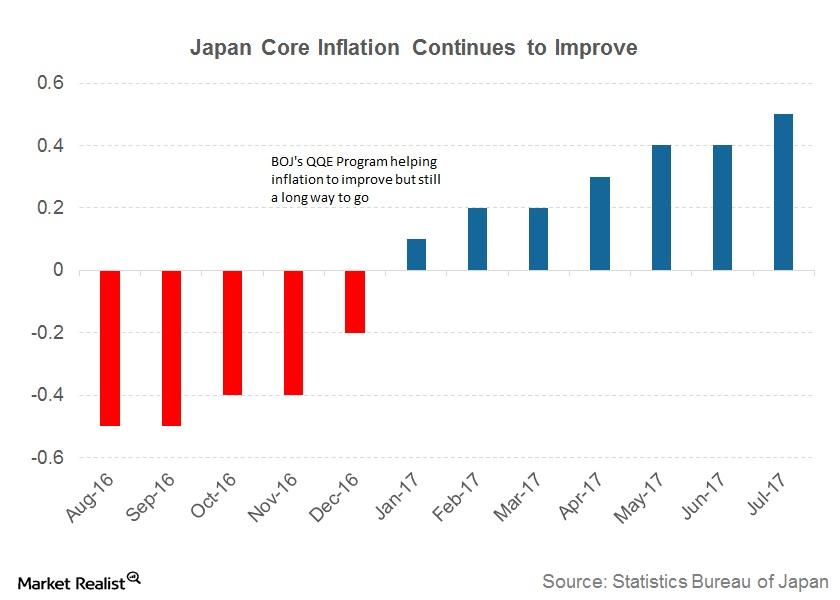

Bank of Japan Thinks the Inflation Target Can Be Achieved by 2019

For Japan’s economy, the main struggle has been the low level of inflation. Japan’s inflation has been low for the past three decades.

The Smell of Natural Gas: Ripe for a Pullback?

On October 18, natural gas November futures closed at $2.85 per MMBtu (million British thermal units)—3.6% below the last trading session’s closing price.

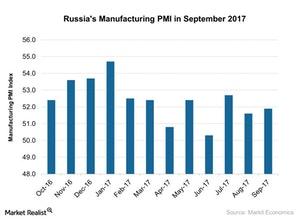

Russia’s Manufacturing PMI Improved Marginally in September

The final Russia Manufacturing PMI (Purchasing Managers’ Index) rose marginally in September 2017. It was 51.9 in September compared to 51.6 in August.

Gasoline Inventories Could Pressure Crude Oil Prices

The API estimates that US gasoline inventories rose by 4.19 MMbbls on September 22–29, 2017. The market expected a build by 1.08 MMbbls.

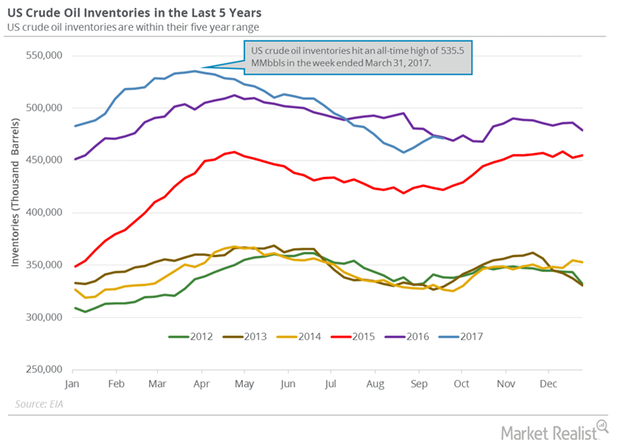

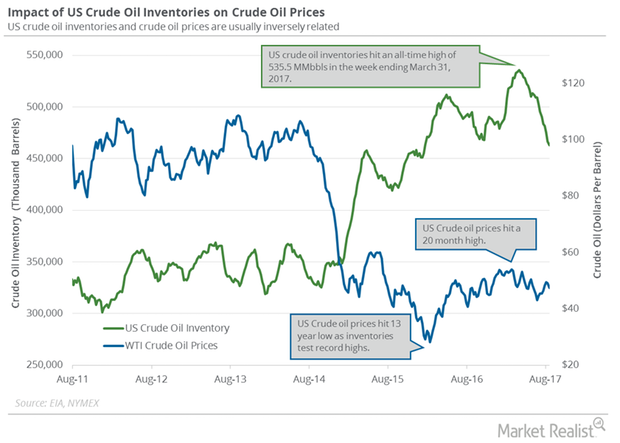

How Record US Crude Oil Exports Are Impacting Crude Oil Inventories and Prices

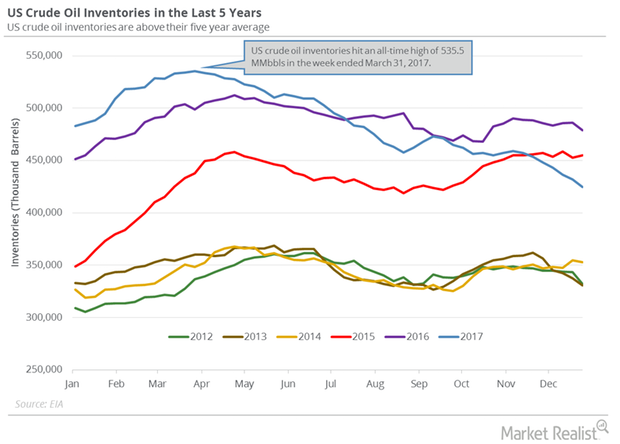

On September 27, the EIA released its weekly report, estimating that US crude oil inventories fell to 470.9 MMbbls from September 15–22, 2017.

Understanding the Oil Futures’ Forward Curve

On September 26, 2017, US crude oil November 2017 futures traded just $0.14 below the November 2018 futures.

Why Kurdish Regions Are Crucial for Iraq’s Crude Oil Exports

Iraq is the second-largest OPEC producer. The EIA (U.S. Energy Information Administration) estimates that Iraq’s crude oil production rose by 25,000 bpd (barrels per day) to 4,500,000 bpd in August 2017.

US Dollar Could Help Crude Oil Futures

The US Dollar Index fell 0.1% to 91.97 on September 22, 2017. However, the US dollar rose 0.7% on September 20, 2017, after the FOMC’s meeting.

Why Rising Japanese Inflation Isn’t Good Enough for Bank of Japan

The BOJ’s (Bank of Japan’s) qualitative and quantitative easing (or QQE) programs and a negative interest rate are helping to slowly revive Japanese inflation.

US Gasoline Inventories Fell for 4th Time in 5 Weeks

The EIA (U.S. Energy Information Administration) estimates that US gasoline inventories fell 2.1 MMbbls (million barrels), or 1%, to 216.1 MMbbls between September 8, 2017, and September 15, 2017.

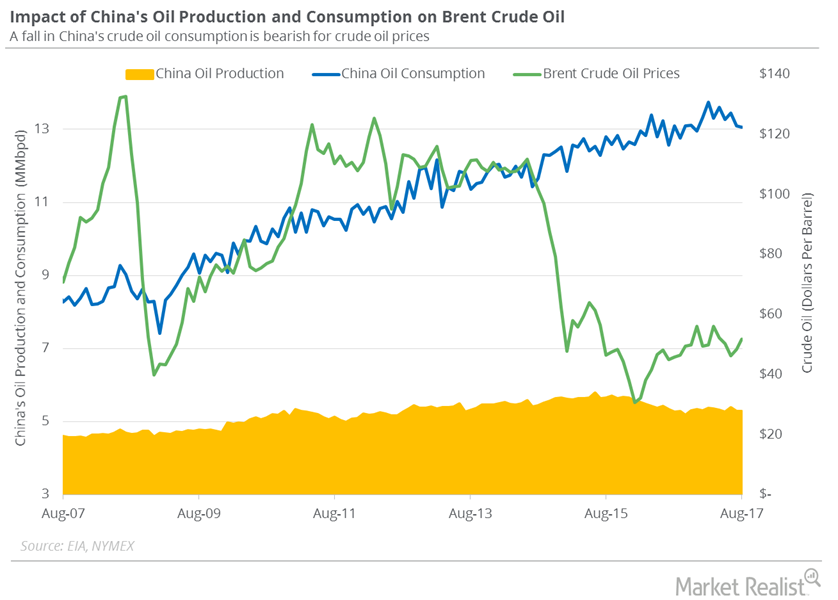

China’s Crude Oil Imports Hit a 2017 Low

China’s General Administration of Customs estimates that China’s crude oil imports fell by 180,000 bpd to 8 MMbpd in August 2017—compared to July 2017.

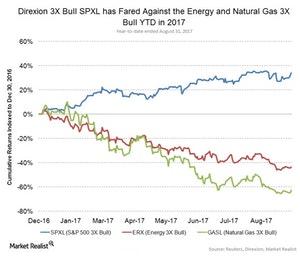

Should Energy Stocks Go in Your Back-to-School Shopping Basket?

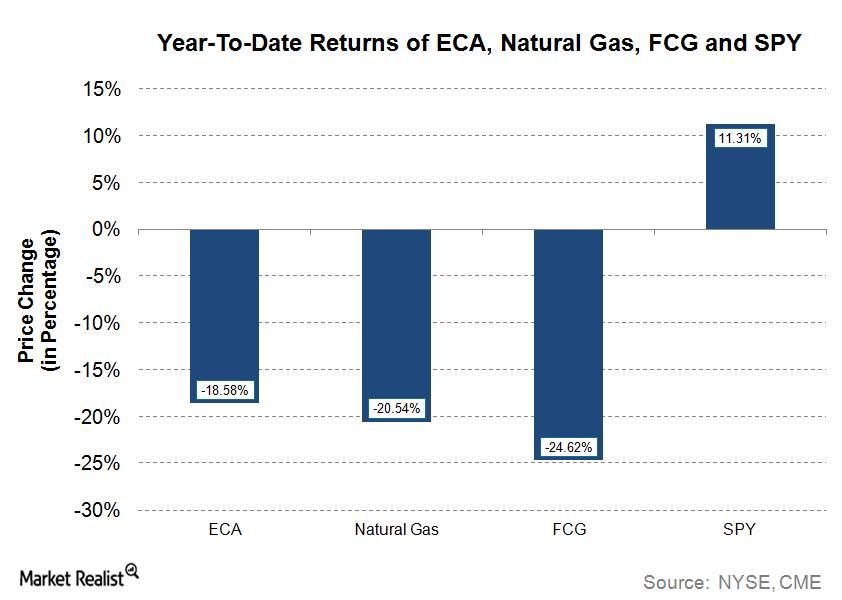

The energy sector, as tracked by the Energy Select Sector SPDR Fund (XLE), has lost ~17.0% year-to-date as of August 31.

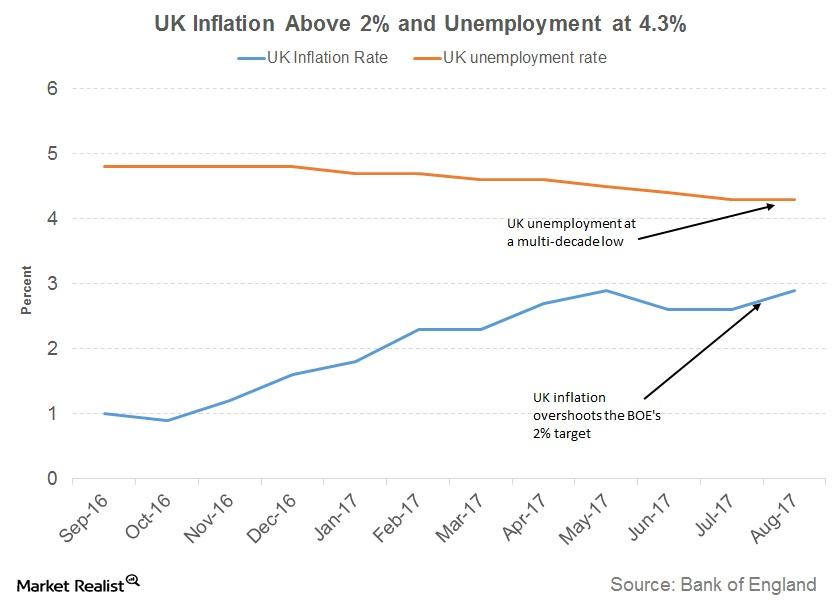

Will Inflation and Unemployment Push the BOE to Raise Rates?

Inflation in the United Kingdom has been on a higher trajectory with consumer prices in the United Kingdom rising 2.9% in August year-over-year.

Will the Sudden Rise in Inflation Change the US Fed’s Outlook?

The consumer price inflation (CPI) data reported on Thursday indicated an increase of 0.4% in August. The year-over-year rate improved from 1.7% to 1.9% for August.

Is Natural Gas a Good Short for Bears at $3?

On September 13, natural gas October futures closed at $3.058 per MMBtu (million British thermal units). The same day, natural gas prices rose 1.9%.

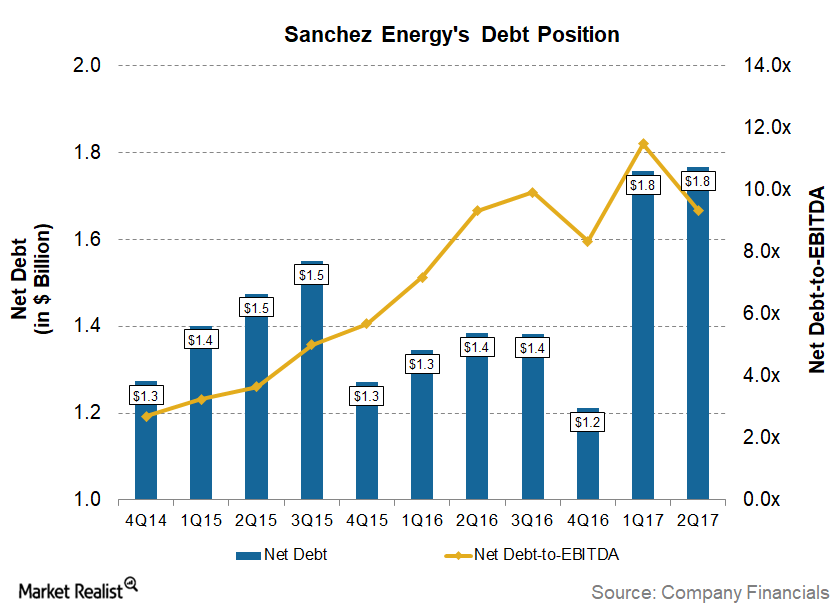

Is Sanchez Energy Repeating an Old Debt Mistake?

Since 1Q16, crude oil (USO)(SCO) prices have risen from lows of $26.05 per barrel to $49.30 per barrel as of September 13.

US Crude Oil Production Hit a 5-Month Low

US crude oil production hit a five-month low due to slowing crude oil rigs and lower crude oil (XLE) (USO) (UCO) prices in the past few months.

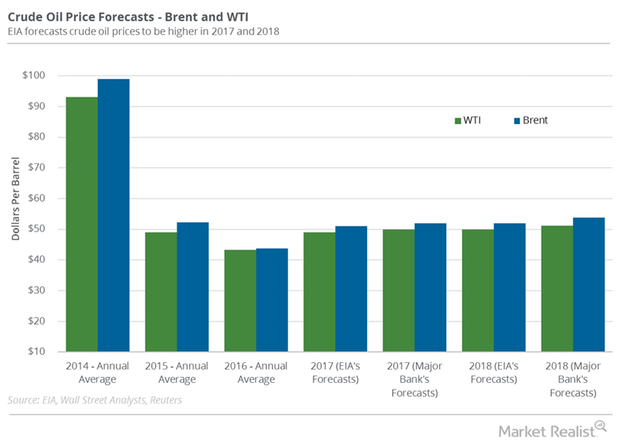

Why Were Crude Oil Price Forecasts Downgraded Again?

A Wall Street Journal survey estimates that US crude oil prices could average $51 per barrel in 2018—$2 per barrel lower than previous estimates.

Have Oil Supply Glut Concerns Relaxed since Harvey?

On September 5, US crude oil October 2018 futures traded at a premium of $1.94 to October 2017 futures. On August 29, the premium was at $2.37.

Harvey and API Crude Oil Inventories: The Impact on Crude Futures

US crude oil futures contracts for October delivery fell 0.3% to $46.44 per barrel on August 29, 2017.

Will US Crude Oil Futures Rise above Key Moving Averages?

Let’s track some important events for oil and gas traders between August 28 and September 1, 2017.

How Encana Stock Has Performed This Year

Year-to-date, Encana’s (ECA) stock has fallen ~19% to $9.53. The stock is trading below its 50-week and 200-week moving averages.

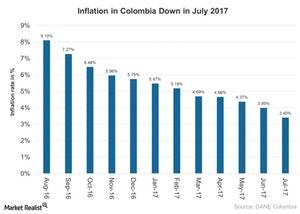

Inflation in Colombia Continues to Fall in July 2017

Consumer prices in Colombia (GXG) rose 3.4% on a year-over-year basis in July 2017, lower than the 4.0% rise in June 2017.

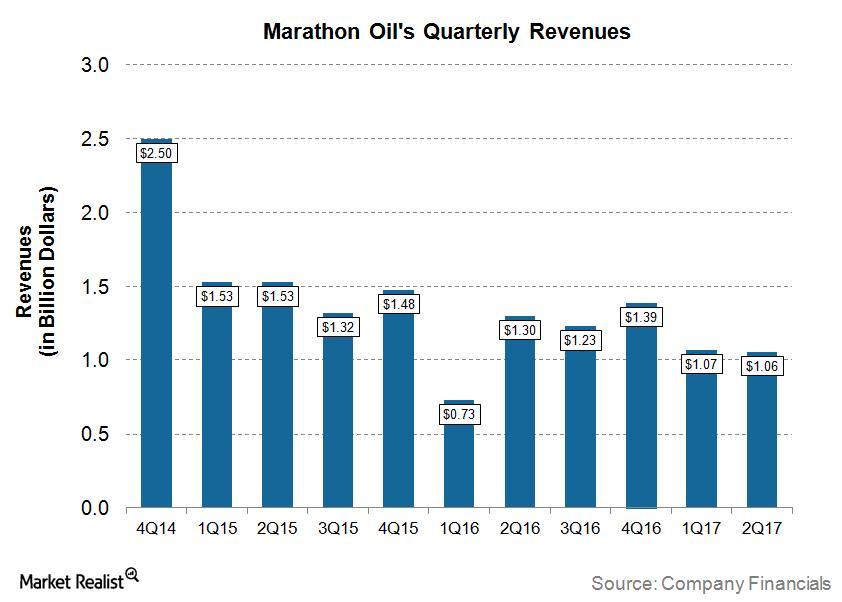

Analyzing Marathon Oil’s 2Q17 Revenues

For 2Q17, Marathon Oil (MRO) reported revenues of ~$1.06 billion, which was higher than Wall Street analysts’ consensus for revenues of ~$1.02 billion.

Cushing Inventories Fell 20% from the Peak

A preliminary market survey estimates that Cushing inventories fell on July 28–August 4, 2017. Inventories fell for the 11th consecutive week.