United States Oil ETF

Latest United States Oil ETF News and Updates

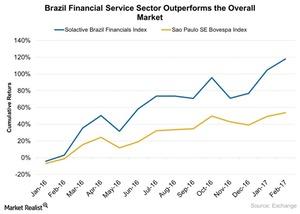

Why the Service Sector’s Contribution to Brazil Is Important

The service sector is the main contributor to Brazil’s GDP and job creation, but it’s currently suffering from structural weakness and poor international performance.

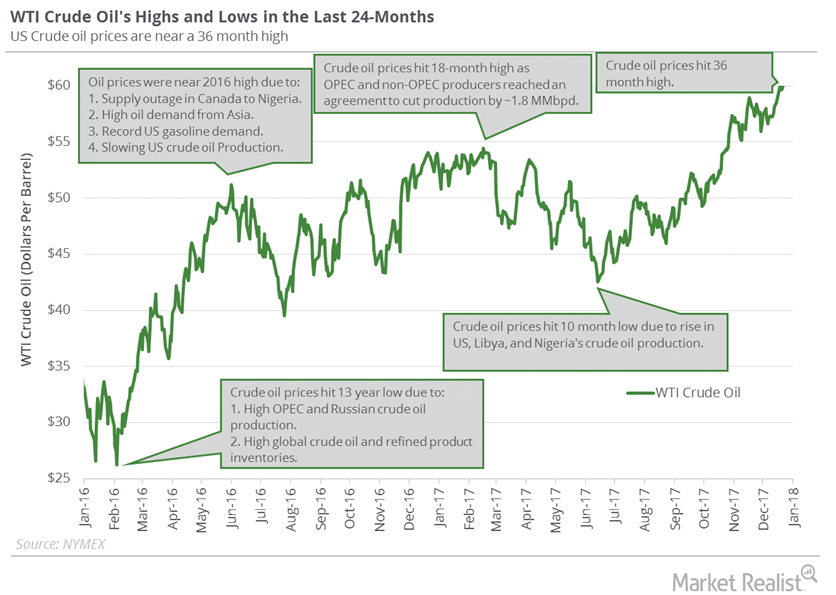

Why Oil Prices Could Move Higher

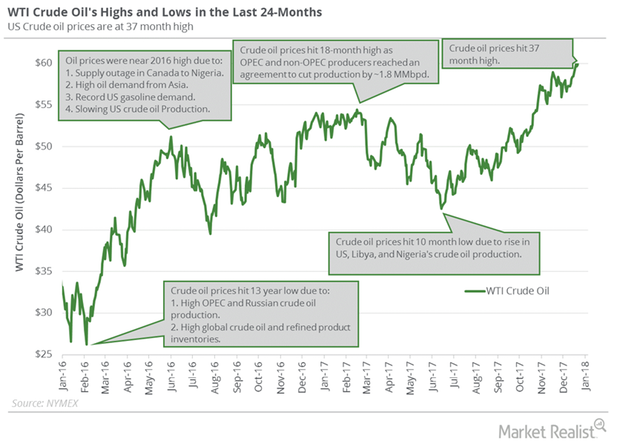

On January 12, 2018, US crude oil (USO) (USL) February 2018 futures gained 0.8% and settled at $64.3 per barrel—a three-year high.

FOMC Meeting Could Surprise Crude Oil Traders

US crude oil (UCO) (USL) futures contracts for January delivery rose 0.7% and were trading at $58.4 per barrel at 1:02 AM EST on December 12, 2017.

Energy Sector and Crude Oil Prices Helped the S&P 500

The S&P 500 rose ~0.7% to 2,733.01 on May 21 due to the rise in industrial stocks and crude oil prices—the highest level in more than two months.

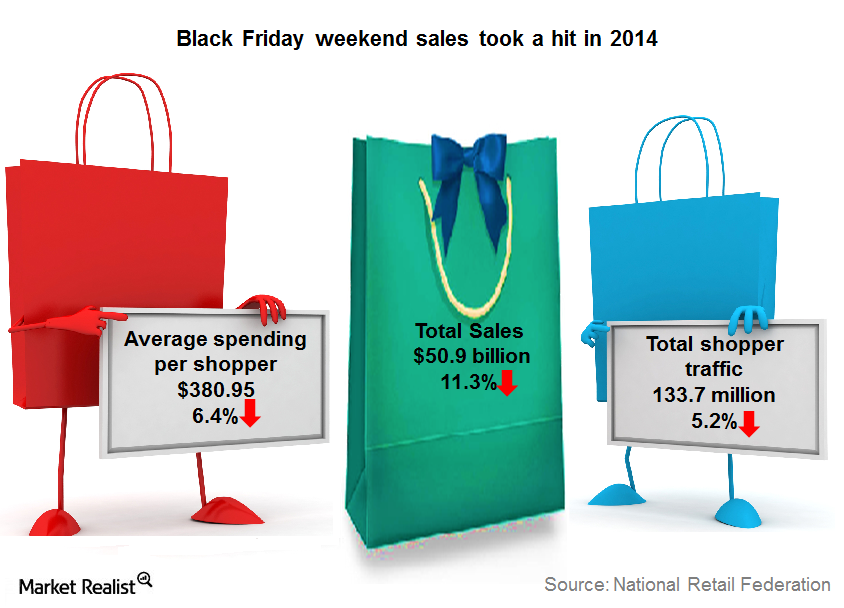

Santa Could Yet Bring Cheer To Holiday Retail Sales

We think the final tally for holiday retail sales could differ from the gloomy picture some of the initial estimates had painted.

Futures Spread: Does It Signal End of Oil’s Oversupply Concern?

On October 17, 2017, US crude oil (USO) (OIIL) December 2018 futures traded $0.46 below the December 2017 futures.

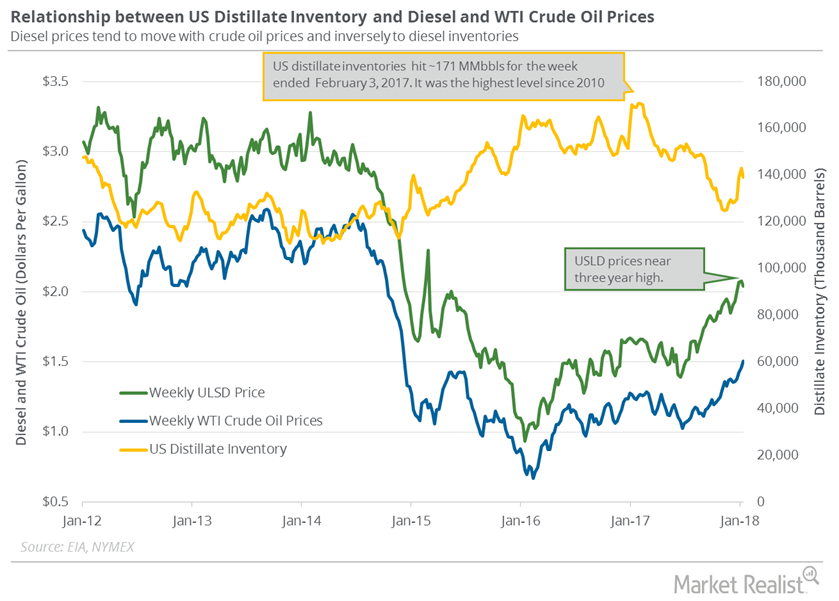

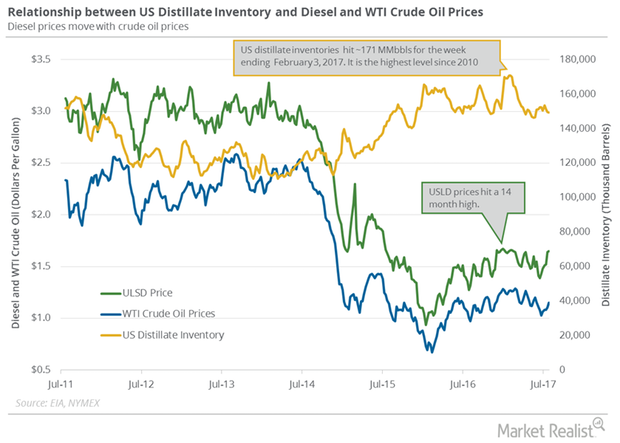

US Distillate Inventories Fell for the Tenth Straight Week

The EIA (U.S. Energy Information Administration) reported that US distillate inventories fell by 2 MMbbls to 148.3 MMbbls on April 7–14, 2017.

Will Crude Oil Futures Rise or Fall This Week?

WTI crude oil (SCO) futures settled at $64.30 per barrel on January 12, 2018—the highest level since December 2014.

Could La Niña Save Natural Gas Bulls?

On October 4, 2017, natural gas (UNG) November futures closed at $2.94 per MMBtu (million British thermal units), a rise of 1.6% from the last trading session.

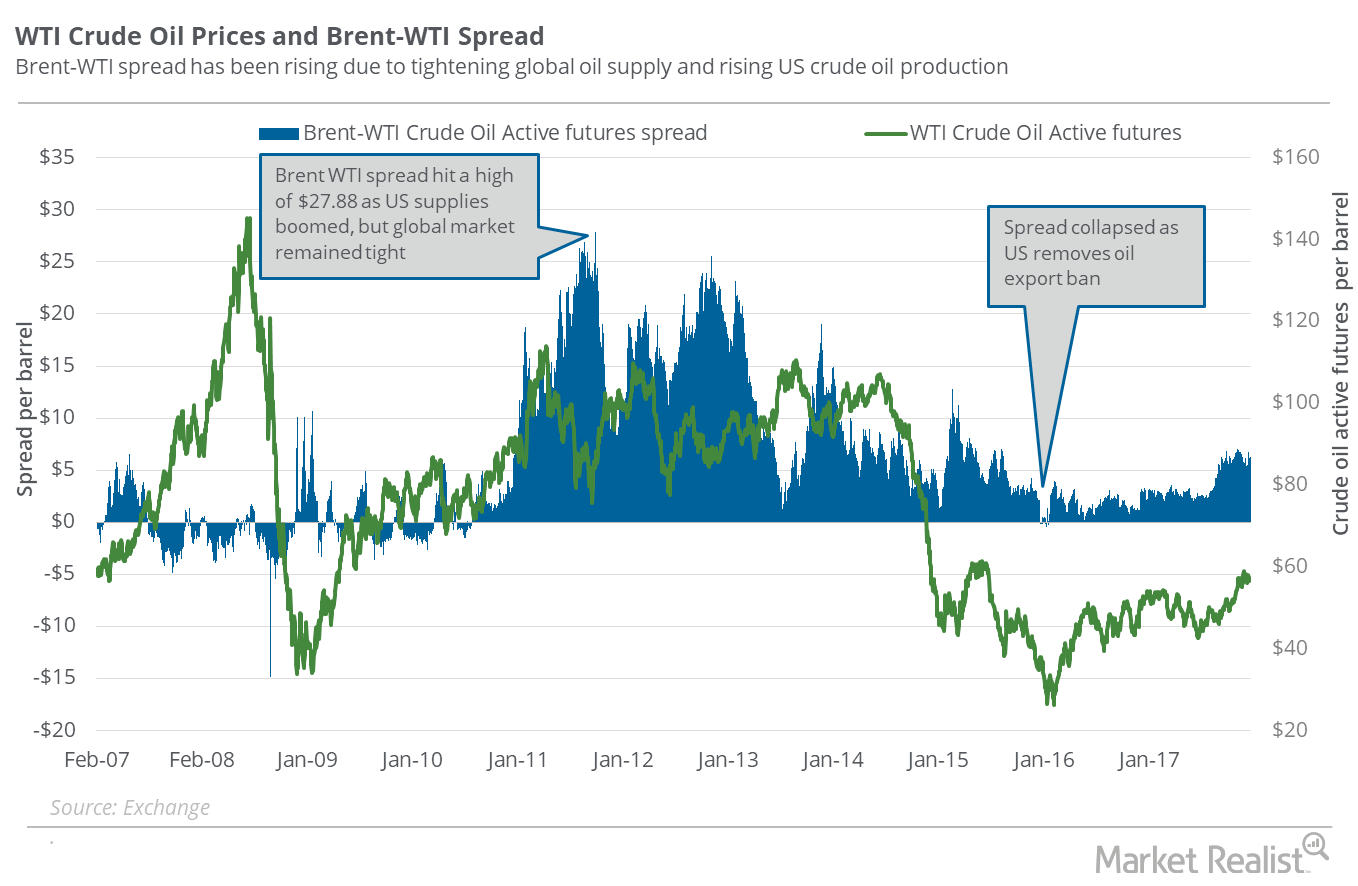

Comparing WTI’s and Brent’s Performance

The Brent-WTI spread On December 18, 2017, Brent crude oil (BNO) active futures’ premium to WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures was $6.30. On December 11, 2017, the Brent-WTI spread was $6.70. On December 11, 2017, the shutdown of the Forties Pipeline System boosted Brent oil prices. That day, the spread expanded […]

US Distillate Inventories Fell for the Third Time in 10 Weeks

US distillate inventories fell by 3.8 MMbbls or 2.7% to 139.2 MMbbls on January 5–12, 2018. The inventories fell by 29.9 MMbbls or 18% from a year ago.

Are Supply Concerns Pushing Oil Higher?

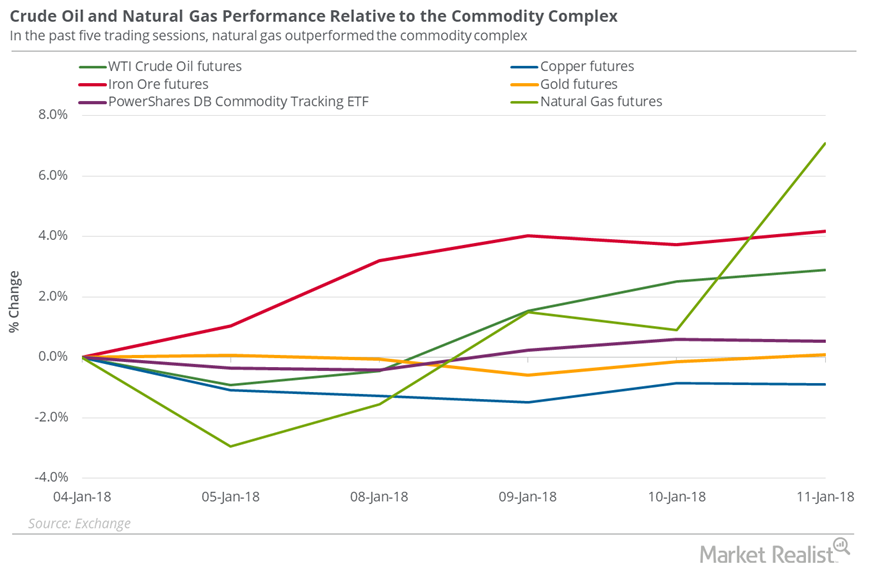

On January 11, 2018, US crude oil’s (USO) (USL) February 2018 futures gained 0.4% and settled at $63.80 per barrel, a new three-year high.

Is Oil Set to Make Record Highs in 2018?

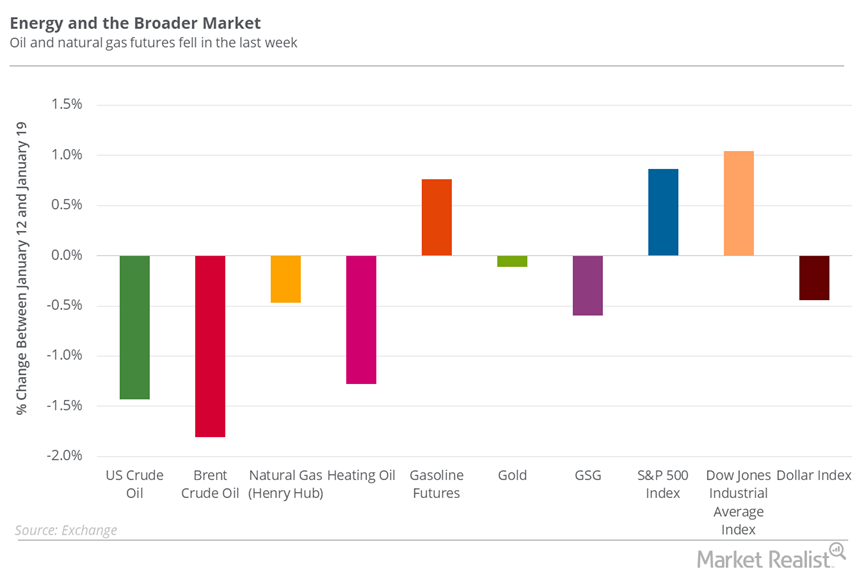

Between January 12 and January 19, 2018, US crude oil (USO) (USL) March futures fell 1.4%.

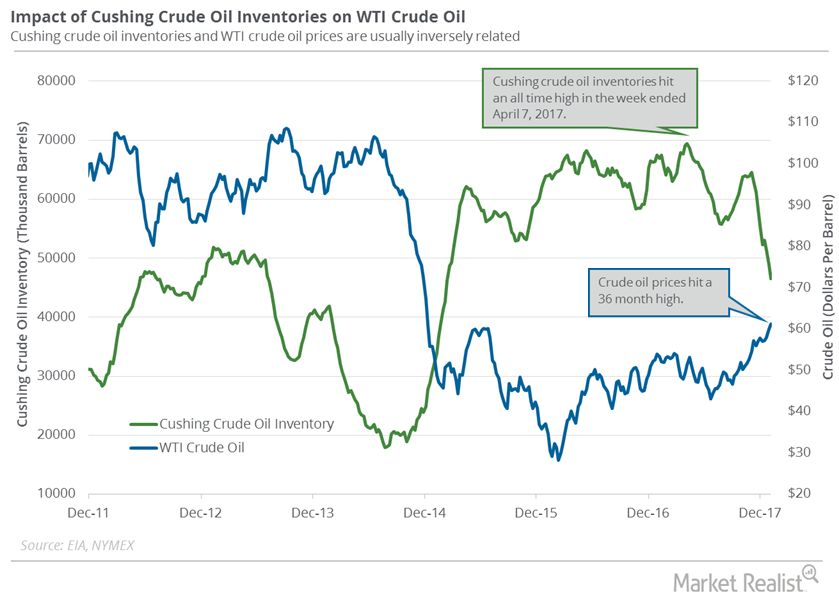

Cushing Inventories Hit February 2015 Low

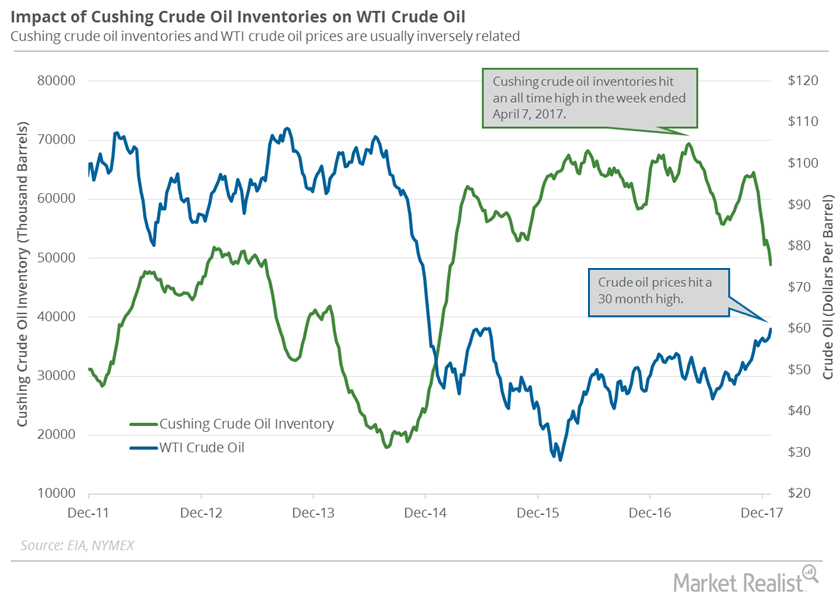

A Bloomberg survey estimated that the crude oil inventories at Cushing could have fallen by 1.5 MMbbls between December 29, 2017, and January 5, 2018.

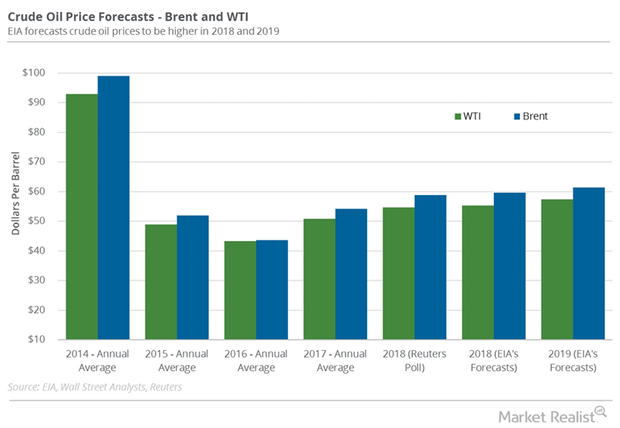

What Could Impact Oil Prices in 2018?

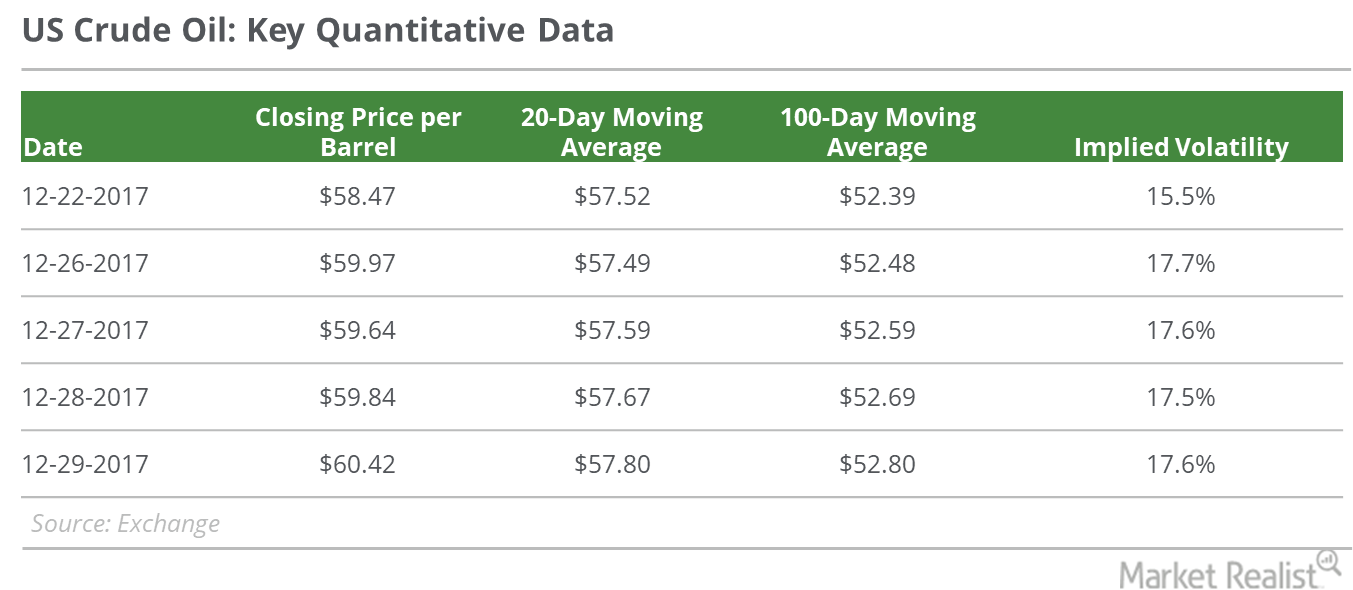

On December 29, 2017, US crude oil’s (USO) (USL) February 2018 futures rose 1% and closed at the 2017 highest closing price of $60.42 per barrel.

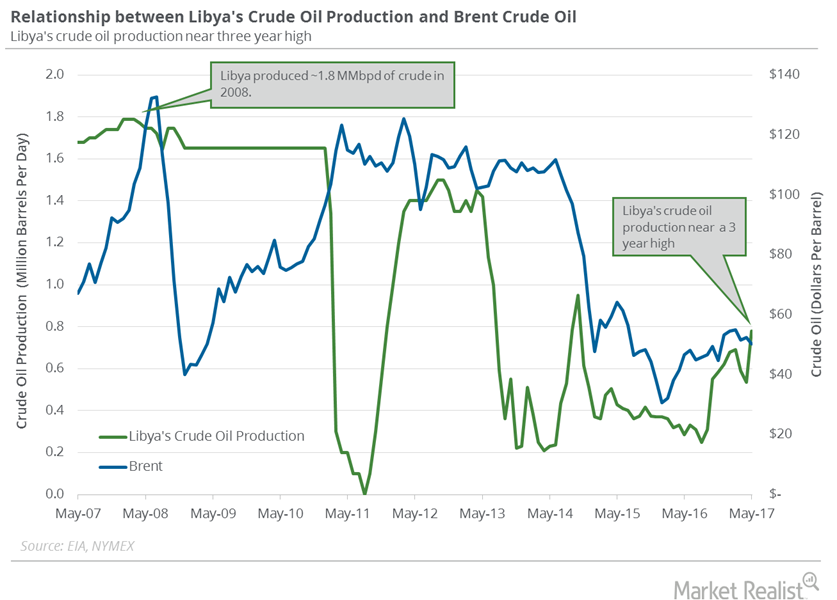

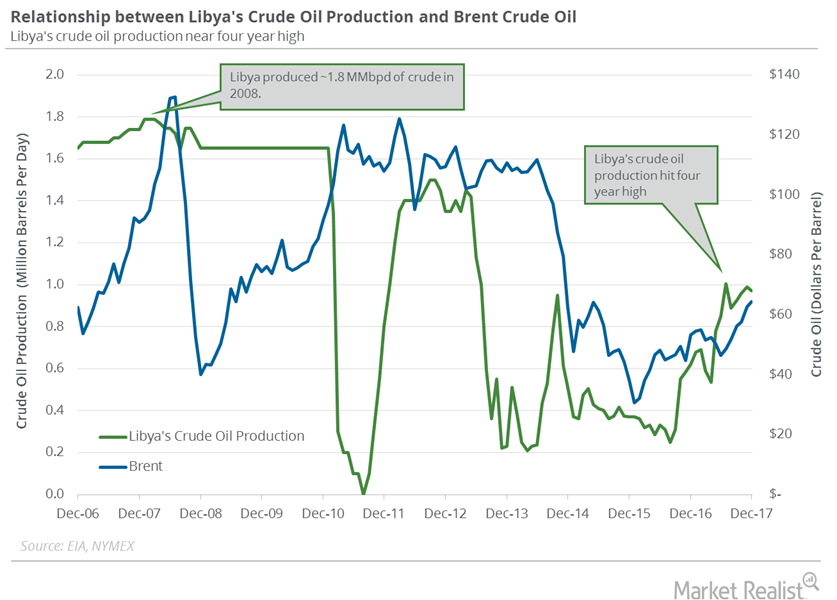

Libya’s Crude Oil Production Is at a 4-Year High

August West Texas Intermediate (or WTI) crude oil futures contracts rose $1.03 per barrel, or 2.2%, and settled at $47.07 per barrel on July 3, 2017.

US Distillate Inventories Fell for the Fourth Straight Week

The EIA (U.S. Energy Information Administration) reported that US distillate inventories fell by 1.72 MMbbls to 147.7 MMbbls on July 28–August 4, 2017.

Crude Oil Futures: Next Important Resistance Level

WTI crude oil (UCO) futures closed at $62.01 per barrel on January 4, 2018—the highest level since December 2014. WTI prices rose ~12.4% in 2017.

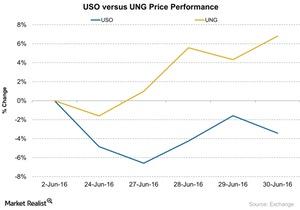

Why Did UNG Outperform USO?

From June 23—30, the United States Natural Gas ETF (UNG) outperformed the United States Oil ETF (USO). UNG rose ~6.8%, while USO fell ~3.4%.

Will Fox’s ‘Biggest Story of 2016’ Be Important Driver for 2017?

On Friday, December 30, 2016, Fox Business Network’s David Asman, Dagen McDowell, and Lauren Simonetti talked about the “biggest business story of 2016.”

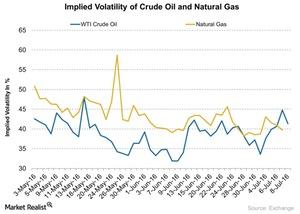

What Are the Implied Volatilities of Crude Oil and Natural Gas?

Crude oil’s (USO) (OIIL) implied volatility was 41.3% on July 8, 2016.

The World’s Top Oil-Producing Countries

These are the countries who produce the most oil in the world as well how much they produce

Key Oil Price Indicators at the End of 2019

Last week, WTI crude oil prices gained 0.6%—the third consecutive weekly gain. The rally in oil prices started towards the end of 2019.

Crude Oil Basics: Types of Crude Oil

Many think of crude oil as one single commodity that’s the same everywhere. But that isn’t the case. It actually has many different varieties.

Oil Prices This Week: Key Fundamentals and Outlook

Last week, WTI crude oil prices rose just 0.1%, while the United States Oil Fund LP (USO) rose 0.2%. Crude oil rose for the third consecutive week.

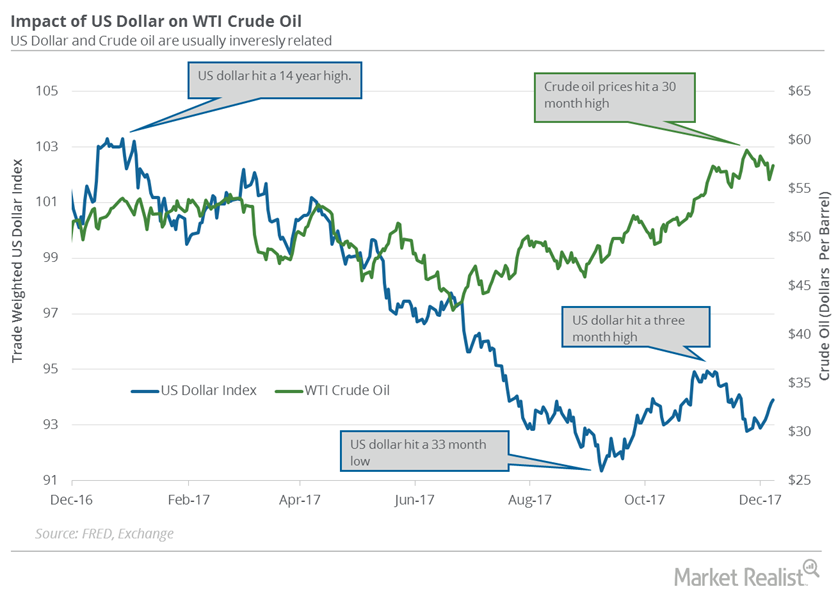

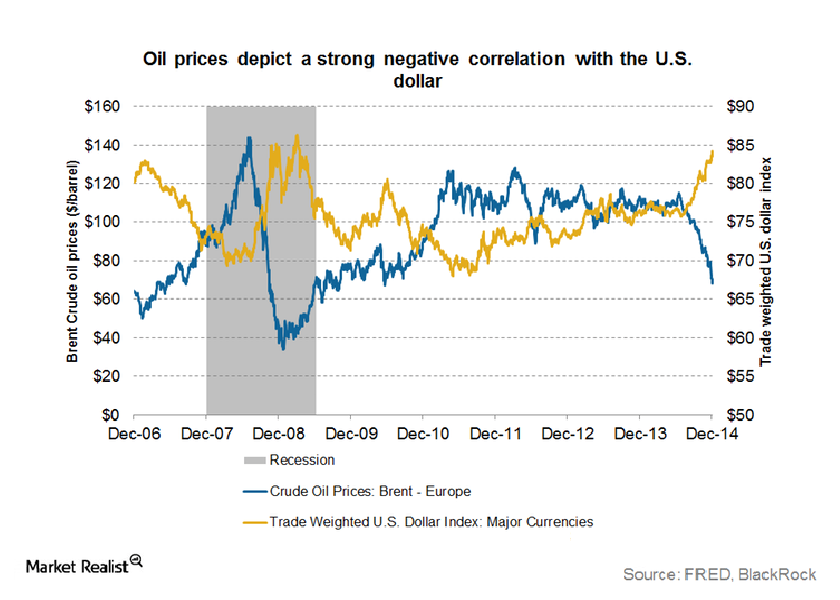

How the strengthening US dollar is impacting crude oil prices

The US dollar plays a major role in the price movements of commodities such as gold and crude oil. A strengthening US dollar is often seen as negative.

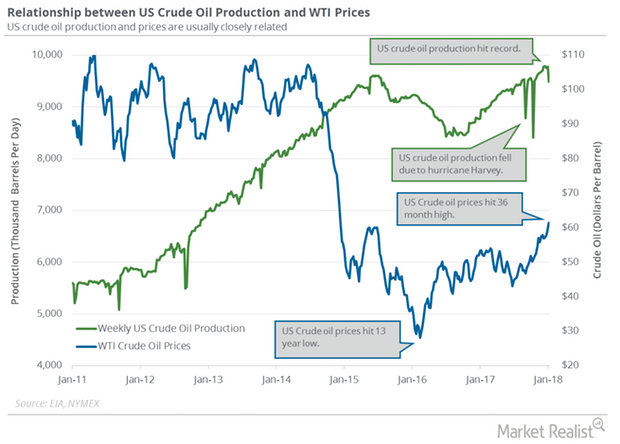

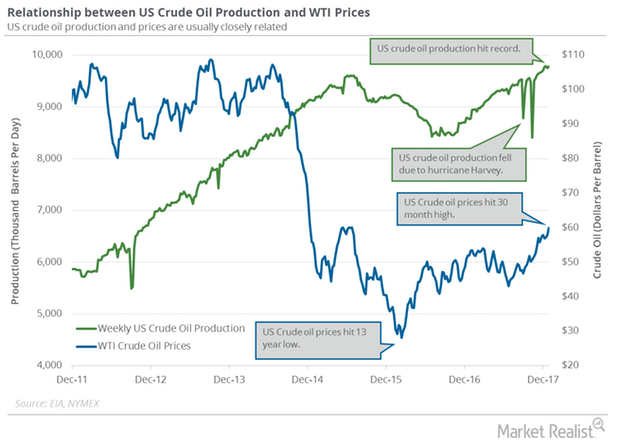

Will US Oil Production Pressure Crude Oil Futures?

February WTI crude oil futures contracts fell 0.9% to $63.73 per barrel on January 16. Brent oil futures fell 1.6% to $69.15 per barrel on the same day.

Will US Crude Oil Production Undermine Crude Oil Futures?

According to the EIA, US crude oil production increased by 28,000 bpd (barrels per day) to 9,782,000 bpd on December 22–29, 2017.

Cushing Inventories Fell 33% from the Peak

Analysts expect that Cushing crude oil inventories could have declined on January 5–12, 2018. A fall in Cushing inventories is bullish for oil prices.

Traders Could Start Booking a Profit in Crude Oil Futures

On January 16, 2018, Goldman Sachs said that crude oil prices could exceed its forecast in the coming months.

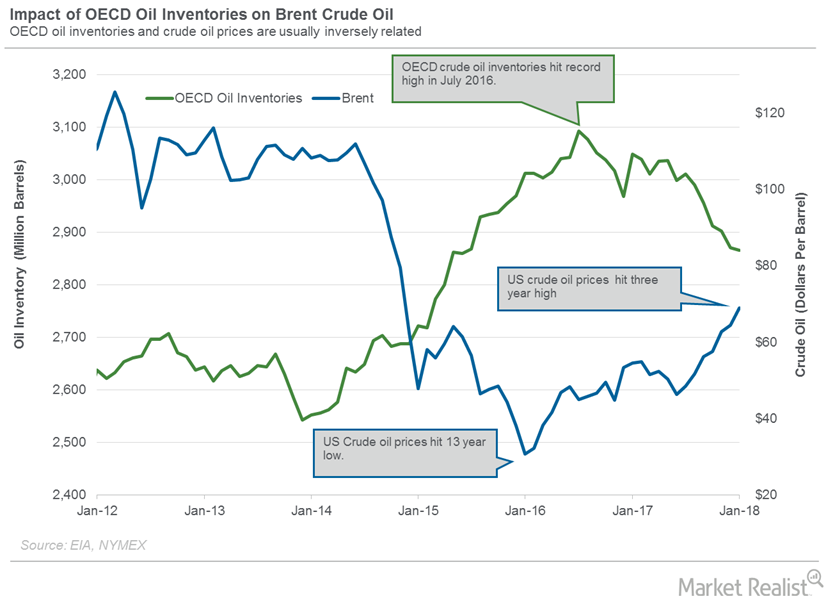

OECD’s Crude Oil Inventories Are near June 2015 Low

According to the EIA, OECD’s crude oil inventories declined 0.2% to 2,865 MMbbls in January 2018—compared to the previous month.

Will API Inventory Data Impact Energy Stocks?

Today, the API plans to release its oil inventory data for the week ended August 30. Gasoline inventories are expected to fall by 1.8 MMbbls.

The US Energy Sector: An Overview

To understand the US energy sector, it’s essential first to understand the country’s energy needs. The US uses various energy sources to meet its energy needs.

Where Is US Crude Oil Headed? An Energy Update

On August 30, US crude oil October futures settled at $55.1 per barrel. On a week-over-week basis, US crude oil prices rose 1.7%.

Can the US-China Trade War Spiral into a Crude Oil War?

Although the US doesn’t export much crude oil to China, the additional supply of cheap Iranian oil could pressure both Brent and WTI crude prices.

How US Production Is Affecting WTI Crude Oil Prices

Between February 11, 2016, and July 15, 2019, WTI crude oil prices rose 127.3%. The United States Oil Fund LP (USO) gained 53.9% in the period.

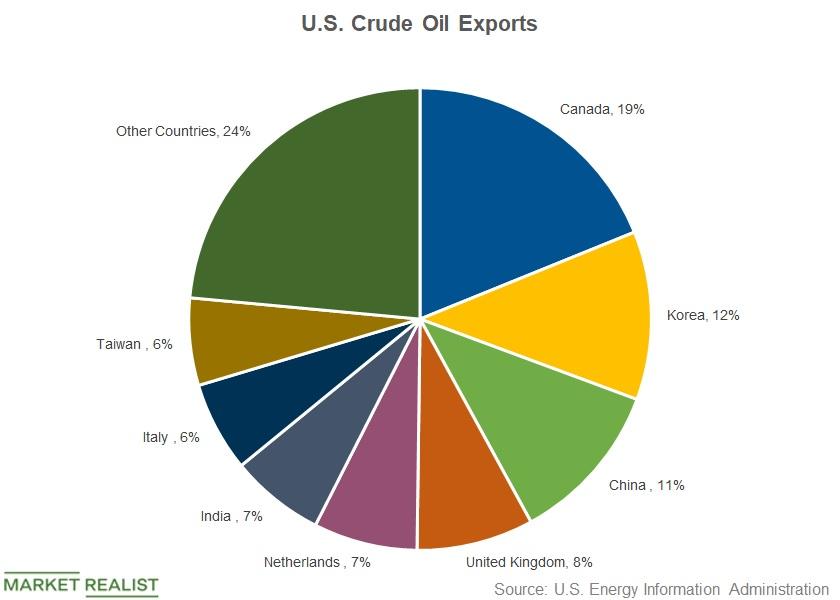

Where Does the United States Export Oil?

In this part, we’ll take a look at the top countries where the US exports its crude oil.

Why the US Imposed Sanctions on Iran and Why They Matter

The United States first imposed restrictions on its activities with Iran in 1979, after the seizure of the US embassy in Tehran.

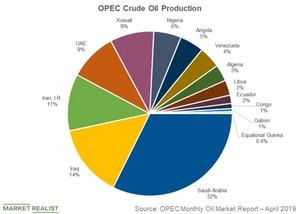

OPEC’s Role in World Oil Production

OPEC (the Organisation of the Petroleum Exporting Countries) aims to “coordinate and unify the petroleum policies of its Member Countries.”

Investing Defensively Can Lose You a Fortune

I bet you may have heard a lot about investing defensively while the market faded.

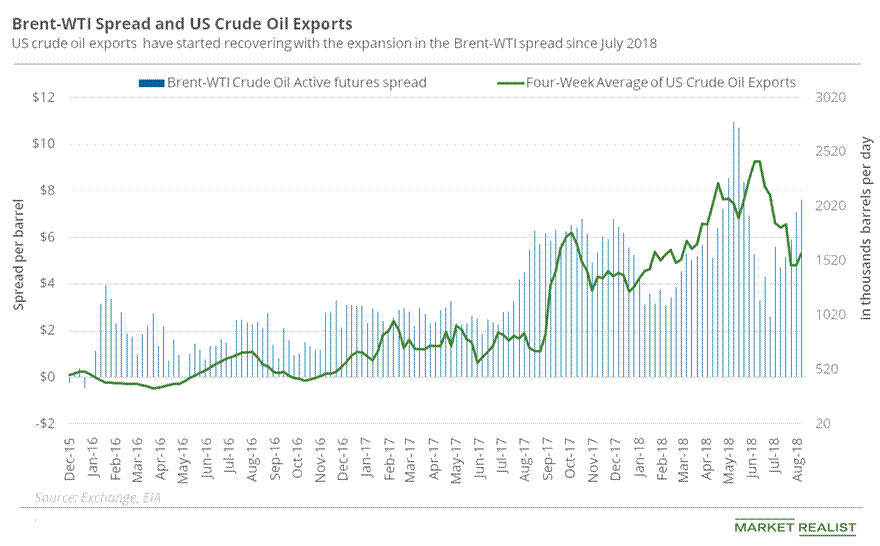

Brent-WTI Spread Might Push Oil Exports and Downstream Stocks Up

On September 10, 2018, Brent crude oil November futures settled ~$9.83 higher than WTI crude oil October futures, the highest level for the Brent-WTI spread since June 19, 2018.

What Are the Implications of Iran Nuclear Deal Exit?

In this series, we’ll analyze how the US exit from the Iran deal has affected markets and how recent developments could affect oil prices and volatility.

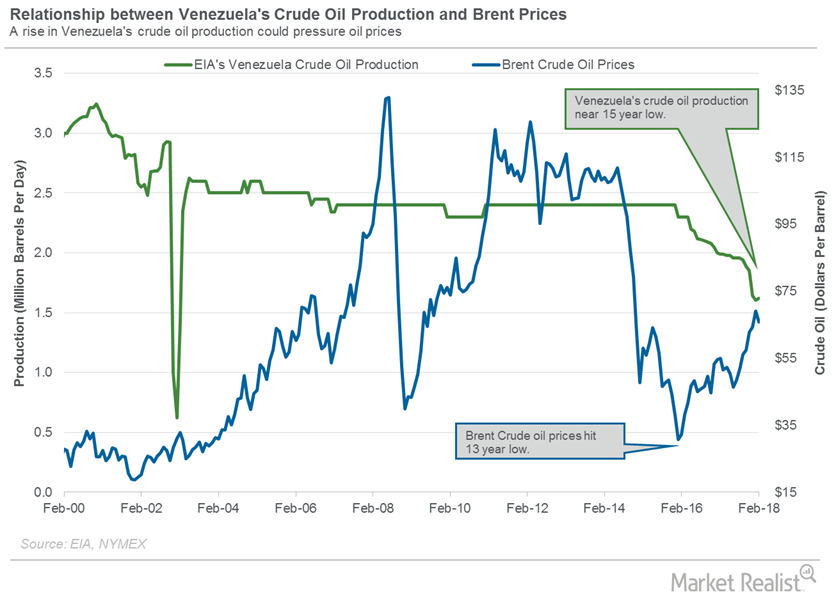

Crude Oil Traders Track Venezuela’s Oil Production

The EIA estimates that Venezuela’s crude oil production increased by 15,000 bpd to 1,620,000 bpd in February 2018—compared to January 2018.

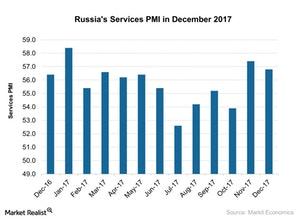

How Russia’s Service Activity Looked in December 2017

According to a report by Markit Economics, Russia’s service PMI (purchasing managers’ index) showed a weaker improvement in December as compared to November 2017.

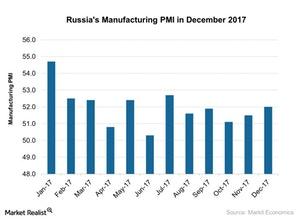

Russia’s Manufacturing PMI Improved in December 2017

According to a report by Markit Economics, the final Russia manufacturing PMI (purchasing managers’ index) improved in December as compared to November 2017.

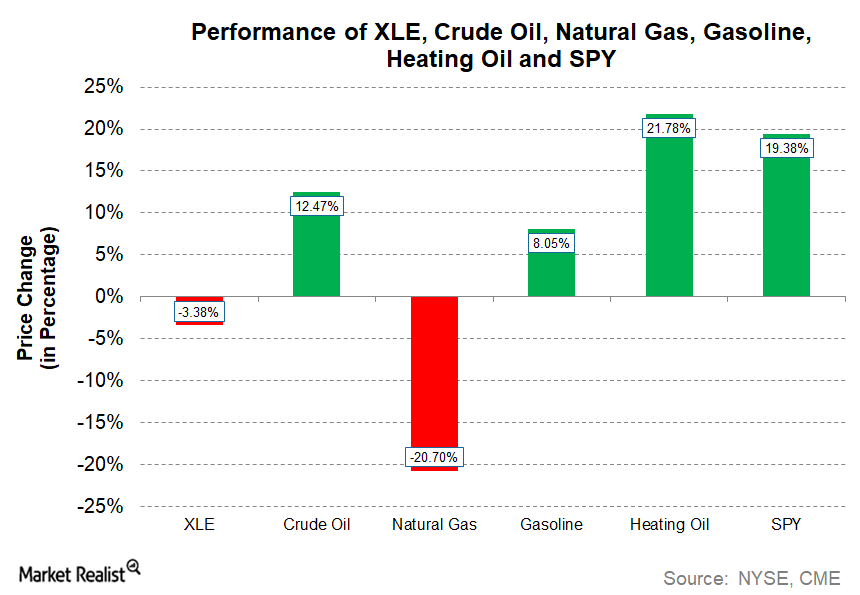

How the Energy Sector Performed in 2017

In this series, we’ll look at the best-performing and worst-performing stocks of the Energy Select Sector SPDR ETF (XLE) and analyze the earnings and developments behind the movements.

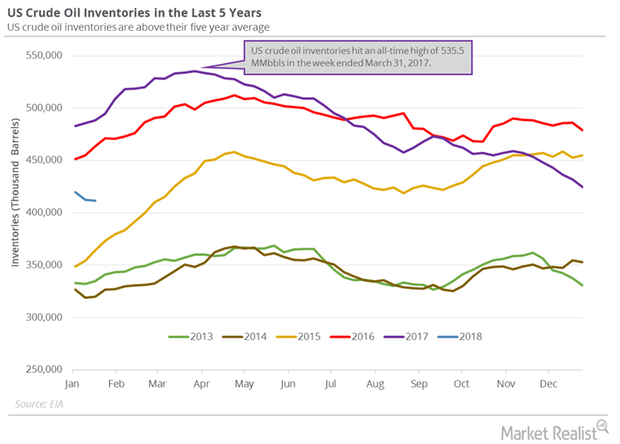

US Crude Oil Inventories Hit February 2015 Low

US crude oil inventories fell by 1.1 MMbbls (million barrels) to 411.6 MMbbls on January 12–19, 2018. Inventories decreased 0.3% week-over-week.

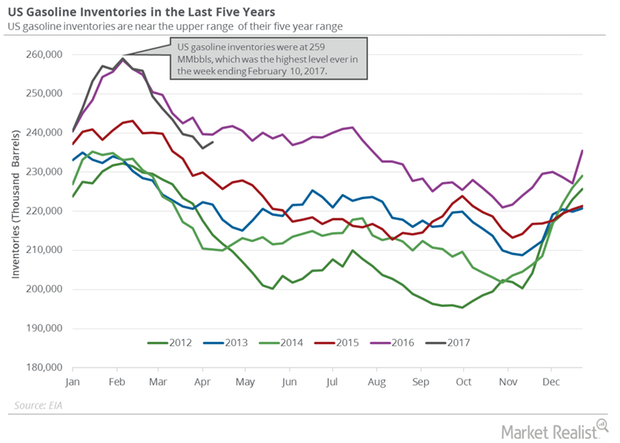

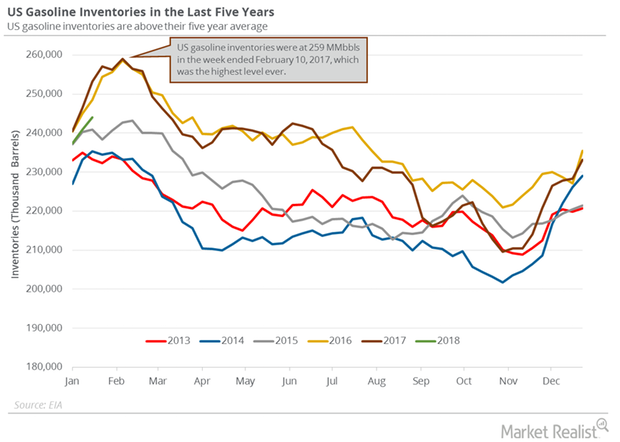

US Gasoline Inventories Could Threaten Crude Oil Prices

According to the EIA, US gasoline inventories increased by 3.1 MMbbls (million barrels) to 244 MMbbls on January 12–19, 2018.

Restarting the Wintershall Oilfields in Libya Could Impact Oil Prices

On January 21, the NOC (National Oil Corporation) of Libya said that it would restart the Wintershall AG’s Sara oilfield. NOC is a state-owned oil company.

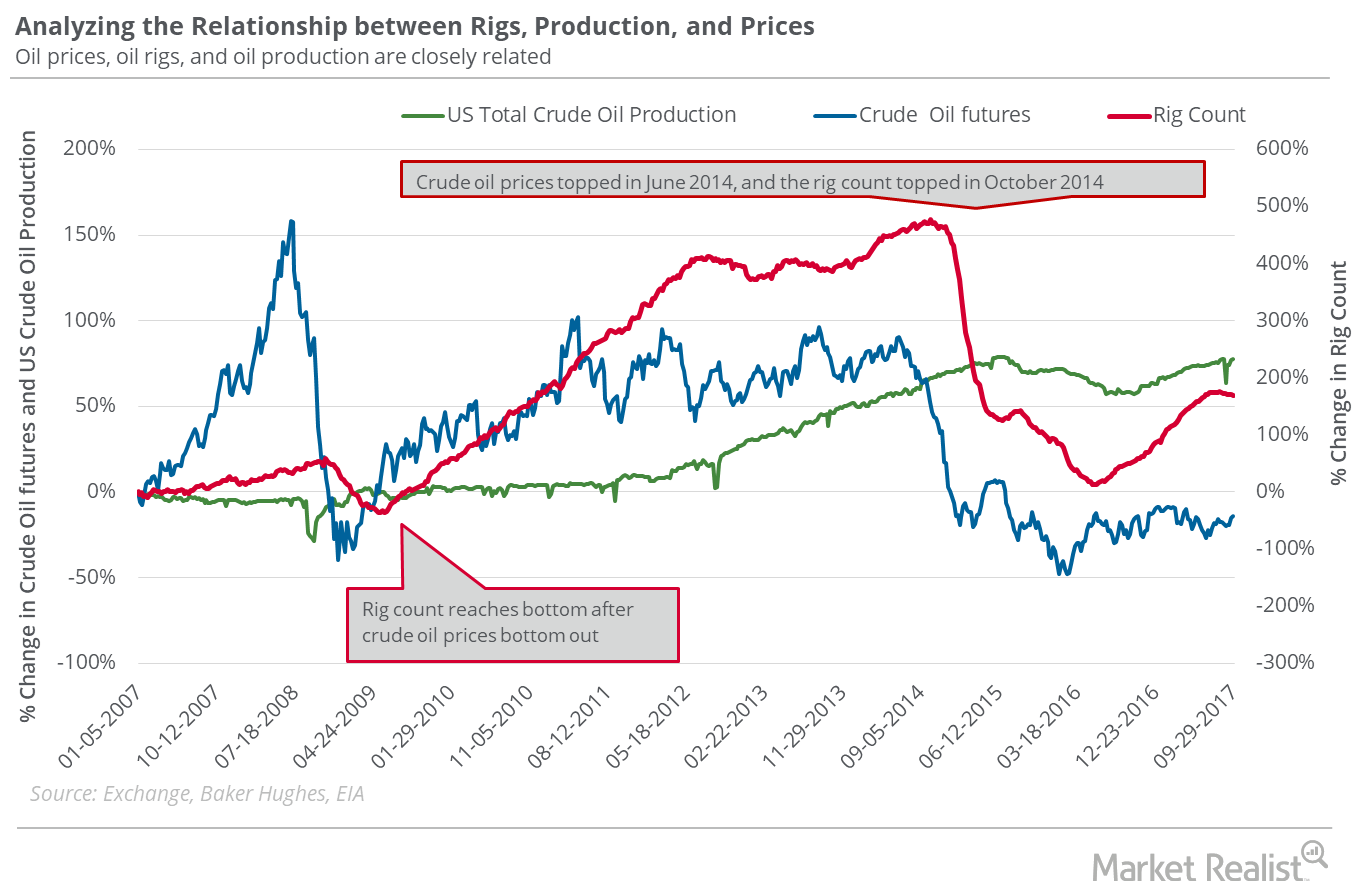

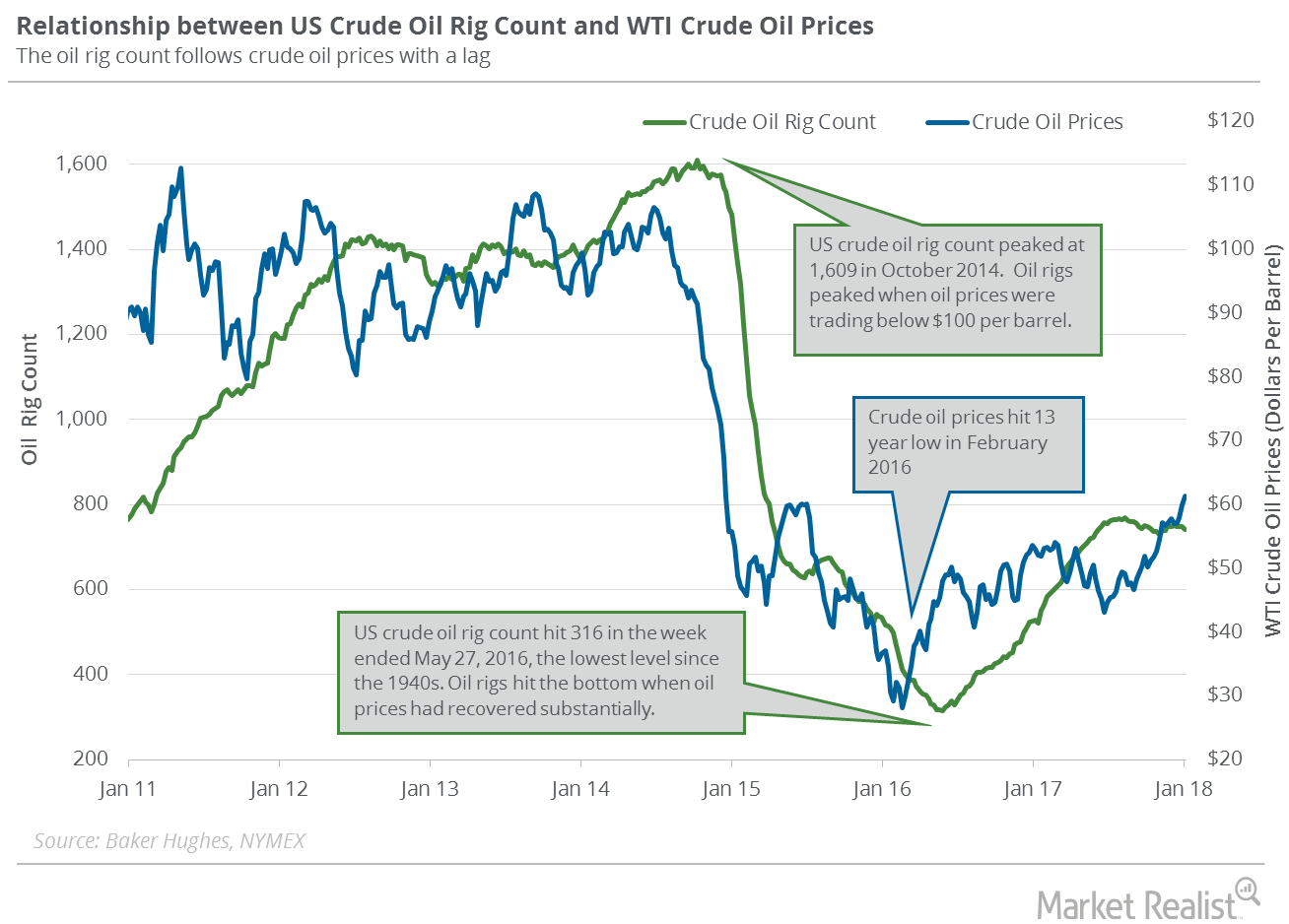

Are US Crude Oil Rigs Indicating a Slowdown in Oil Production?

On January 19, 2018, Baker Hughes released its weekly US crude oil rigs report. US crude oil rigs decreased by five to 747 on January 12–19, 2018.