ETFS Physical Swiss Gold

Latest ETFS Physical Swiss Gold News and Updates

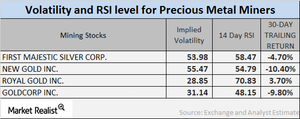

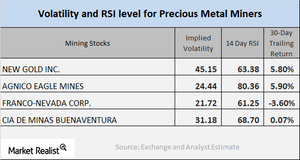

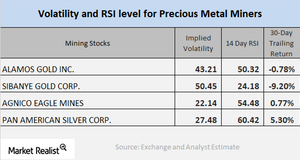

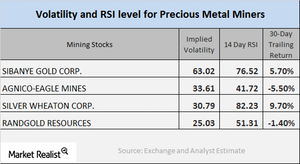

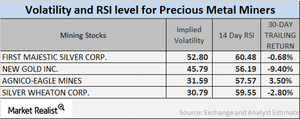

How Mining Stock Volatility Numbers Are Moving Now

First Majestic, New Gold, Agnico, and Silver Wheaton now have RSI scores of 60.5, 56.2, 57.6, 59.6, respectively.

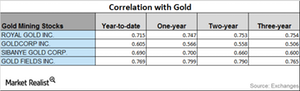

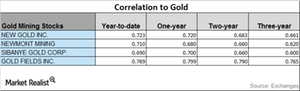

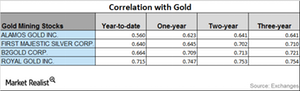

Which Stocks Are Uptrending in Their Correlations to Gold?

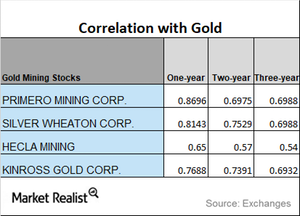

It’s expected that precious metal mining stocks will follow precious metals. So it’s crucial to know which stocks are closely associated with precious metals.

Analyzing Miners’ Correlations with Gold in January 2018

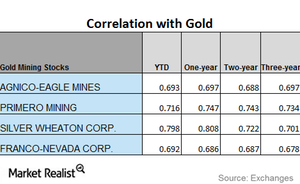

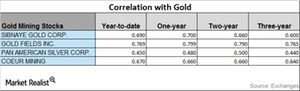

In this part of the series, we’ll analyze the correlations of the movements of a group of mining stocks with gold.

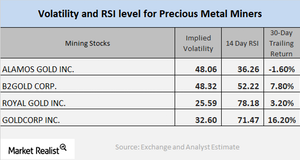

Analyzing the Technicals of Mining Stocks in January 2018

Most mining stocks have risen during the past month due to the revival in precious metals prices.

Analyzing the Correlation of Gold to Miners in January 2018

First Majestic Silver saw correlation drop during the past three years. On a three-year basis, its correlation with gold was 0.57.

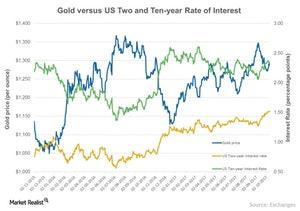

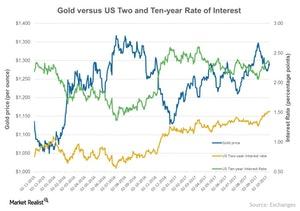

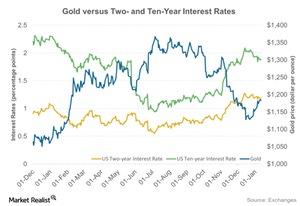

Interest Rate versus Gold: Interest Rate Wins Again

Gold is a non-yield bearing asset that reacts negatively to rises in the interest rate.

Mining Stocks Follow Precious Metals: Technical Insights

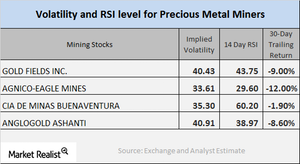

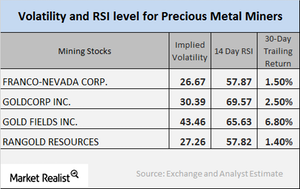

New Gold, Agnico-Eagle Mines, Franco-Nevada, and Cia de Minas Buenaventura have call-implied volatilities of 45.2%, 24.4%, 21.7%, and 31.2%, respectively.

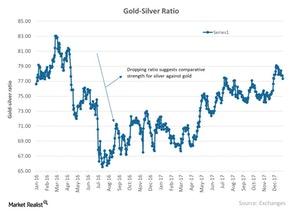

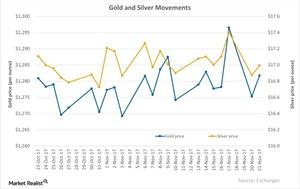

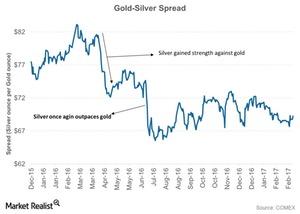

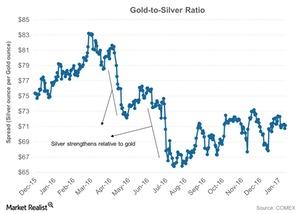

Reading the Recent Gold-Silver Spread

Among these spreads, the gold-silver spread is the most talked about because it measures the number of silver ounces it takes to buy a single ounce of gold.

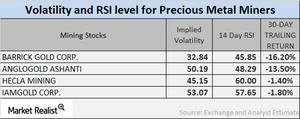

What Mining Stocks’ Indicators at the End of December Tell Us

Agnico, Randgold, Yamana, and Barrick have call implied volatilities of 24.3%, 21.1%, 38.8%, and 22.8%, respectively.

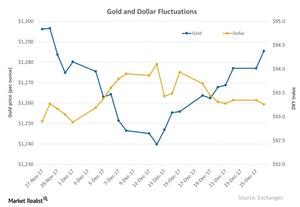

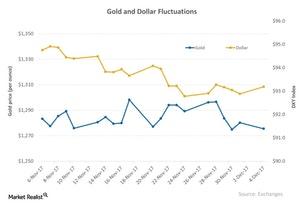

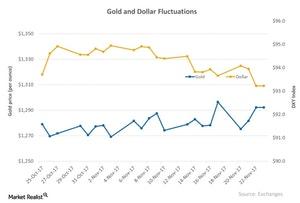

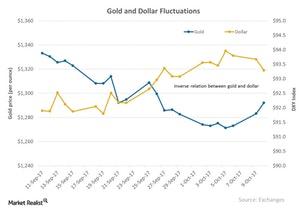

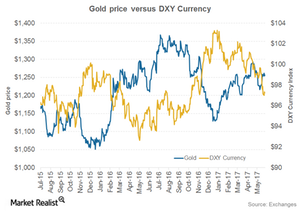

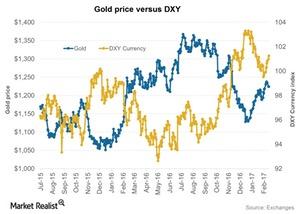

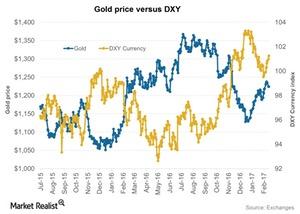

How the Dollar and Gold Moved in December

Gold and the US dollar are mostly inversely related to each other.

What Direction Is the Correlation of Miners Headed?

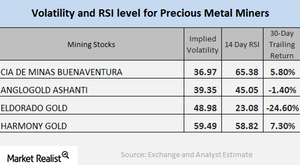

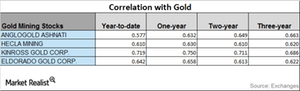

On a year-to-date basis, AngloGold has seen the highest correlation to gold, while Cia De Minas has the lowest year-to-date correlation.

Rate Hike Could Move Precious Metals and Miners

Investors have their eyes set on the interest rates. A rise in the interest rates causes the demand for precious metals to fall.

The Tax Reform Bill’s Impact on Precious Metals

All four precious metals saw a down day on Monday, December 4, 2017, after the US dollar, in which the four metals are priced, rose $0.39%, propelled by the Senate passing its tax reform bill.

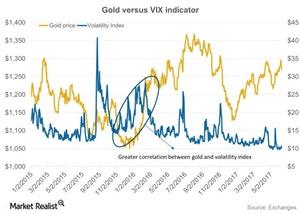

Is the Dollar-Gold Relationship Getting Stronger?

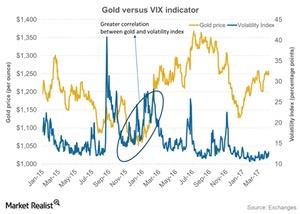

Precious metals have been closely associated with the movement of the US dollar over the last few months.

What Led to the Recent Rebound in Precious Metals?

After a substantial slump on Monday, gold futures for December delivery rose 0.5% on Tuesday and closed at $1,281.7 per ounce.

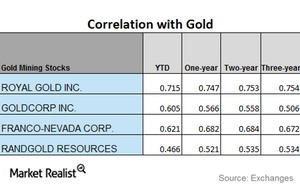

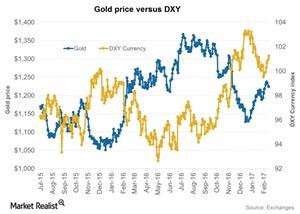

Comparing Miners’ Correlation with Gold

Correlation analysis Mining stocks’ performance usually depends on precious metal prices. Correlation analysis can give investors some perspective on how mining stocks relate to precious metals, especially gold. In this part of our series, we’ll look at four miners—Royal Gold (RGLD), Goldcorp (GG), Franco-Nevada (FNV), and Randgold Resources (GOLD)—and their correlation with gold. On Monday, the ETFS Physical […]

India’s Gold Imports Have Fallen: What’s Going On?

For India, gold imports have fallen 16% in value to ~$2.9 billion in October 2017 compared to $3.5 billion in the corresponding month last year.

Mining Stocks: Understanding Correlation

When you look at mining stocks’ performance, it’s important to analyze their correlation with gold. These stocks typically take their directional cues from gold, which is the most dominant among precious metals.

Who’s Pro Gold and Who’s Not?

Geopolitical events like the tensions with North Korea helped drive the price of gold higher in September 2017.

What Mining Stocks’ Implied Volatility Tells Us

As of October 24, 2017, Silver Wheaton (SLW), Yamana Gold (AUY), Barrick Gold (ABX), and AngloGold Ashanti (AU) had implied volatility readings of 30.8%, 48.4%, 29.1%, and 40.9%, respectively.

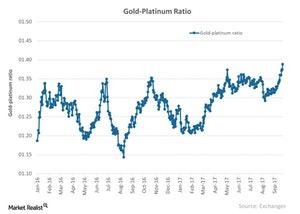

Platinum Ratio Analysis: Which Way Is Platinum Moving?

The gold-platinum spread was ~1.38 on October 23. The RSI (relative strength index) level for the gold-platinum spread is now at 93.9.

Which Elements Impact Precious Metals?

Gold fell for the third consecutive day on October 18, 2017, as the US dollar regained strength. However, October 19 was an up day for gold and silver.

A Brief New Look at the Technical Indicators of Mining Stocks

The Physical Silver Shares (SIVR) and Physical Swiss Gold Shares (SGOL) witnessed rises on Friday, October 16, climbing 0.98% and 0.81%, respectively.

Are North Korea Tensions Continuing to Affect Precious Metals?

All the four precious metals saw an up day on Monday, October 9, 2017.

Could North Korea Be Affecting Precious Metal Prices?

North Korean tensions Like the US dollar, global tensions can be responsible for precious metal price fluctuations. North Korea has interpreted US president Donald Trump’s comments as a declaration of war, stating that Pyongyang has the right to take countermeasures, including shooting down US bombers outside of its airspace. The ongoing unrest in the Korean peninsula has led to a global […]

How North Korea Has Affected the Precious Metal Market

Precious metals have been buoyed by tension in North Korea. If North Korea does another missile test, it could prompt investors to move to haven assets such as gold, silver, Treasuries, and major currencies.

Miners: Correlation Trends in August 2017

Silver Wheaton has the highest correlation with gold, while Franco-Nevada has the lowest correlation.

What Miners’ Technical Indicators Suggest

Most of the miners have seen an upswing in their prices over the past week.

A Look at Volatilities for Precious Metal Miners

In this part of the series, we’ll look at some important technical indicators, including volatility figures and RSI levels for major miners.

Analyzing Miners’ Correlation in July 2017

Royal Gold’s correlation fell from a three-year correlation of ~0.75 and a year-to-date correlation of ~0.72 with gold.

How the Euro Pushed the Dollar Lower and What It Meant for Gold

July 20, 2017, was an up day for the euro, which put downward pressure on the US dollar as represented by the U.S. Dollar Index (or DXY).

RSI Levels Have Fallen: Will Miners Rebound Soon?

Gold and silver-based funds such as SGOL and SIVR are impacted by changes in precious metal prices. They fell due to the fall in precious metals on Friday.

Why Mining Stocks’ Relative Strength Levels Keep Falling

In this article, we’ll take a look at the variables that determine how attractive particular mining stocks or shares are or could become.

What’s the Volatility of Mining Stocks?

Though the precious metals survived the Fed’s interest rate hike, the miners took a hit. Most mining stocks saw a considerable down day on Wednesday.

The Ups and Downs of the Dollar and Gold

On June 6, 2017, the US Dollar Index plunged to its lowest level in seven months, which helped dollar-denominated precious metals regain value.

Are RSI Numbers Moving Away from or Close to Critical Levels?

Investors are constantly speculating about the impact on precious metals of a possible Fed rate hike in June. Let’s look at some 14-day RSI scores and implied volatility.

Volatility for Precious Metal Miners: Movement Going Forward

The ETFS Physical Swiss Gold (SGOL) and the ETFS Physical Silver (SIVR) have risen 8.5% and 4.1%, respectively, on a year-to-date basis as of May 18, 2017.

What’s the Correlation between the Dollar and Gold in Last 5 Days?

One of the critical elements that plays on precious metals besides the overall market sentiment is the US dollar.

How the Dollar’s Revival Is Impacting Precious Metals in May

The US Dollar Index, which prices the dollar against a basket of six major world currencies, has risen ~0.46% on a trailing-five-day basis.

Will the Dollar Get Burned by Another Rate Hike?

While the US dollar has seen a decline in 2017, the increased possibility of a Fed rate hike in June could give the currency some breathing room.

Inside the Monthly Mining Correlations as of May 3

Metal investors have to study upward and downward trends as price change predictability can be affected by rises and falls in precious metal prices.

Gauging the Role of the US Dollar in the April 19 Fall of Precious Metals

Another important phenomenon that played on the fall of precious metals on Wednesday, April 19, was the upswing of the US dollar.

How Miners’ Correlations to Gold Are Trending

As global tumult grips markets and investors turn to mining stocks as safe havens, it’s crucial to understand which stocks are closely tied to precious metals.

Upcoming French Elections Could Impact Gold

Since the French elections are right around the corner, investors might start parking their money in safe-haven assets like gold.

How Is Gold Fields’ Correlation with Gold Trending?

Turbulence in markets due to the viability of the Trump Administration, the upcoming French elections, and the Brexit vote caused precious metals to rise.

Analyzing the Gold-Silver Spread as Investors Await Further Cues

When analyzing the precious metals market, it’s important to take a look at the relationship between gold (SGOL) and silver (SIVR).

How Did Mining Stocks Correlate with Gold in March 2017?

Yamana’s correlation with gold has increased from a three-year correlation of ~0.74 to a one-year correlation of ~0.80.

Where Is the Gold-Silver Ratio Headed?

When analyzing the precious metals market, it’s important to take a look at the relationship between gold and silver.

These Mining Stocks Have Downward Trending Correlations with Gold

Uncertainty in the market significantly affects the performances of precious metals. It also affects precious metals mining stocks, which are known to closely track precious metals.

What Scenarios Decide How Precious Metals Move?

The directional move of the interest rate is a crucial determinant of the direction precious metals will take.