ETFS Physical Swiss Gold

Latest ETFS Physical Swiss Gold News and Updates

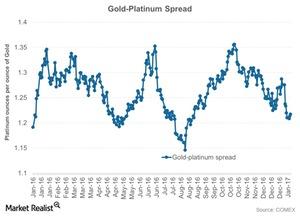

A Look at the Gold-Platinum Ratio

The demand for platinum has been very fragile over the past few years due to concerns about sales of diesel-based vehicles.

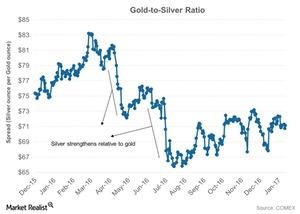

Reading the Ups and Downs of the Gold-Silver Spread

The gold-silver spread was trading at 68.5 on February 23, 2017. The spread suggests that it took 68.5 ounces of silver to buy a single ounce of gold.

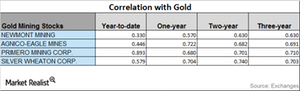

Mining Stocks and Gold Prices: Reading the Correlation

It’s important to understand which mining stocks have overperformed and underperformed precious metals.

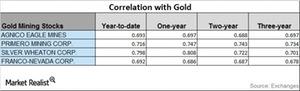

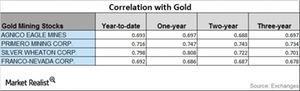

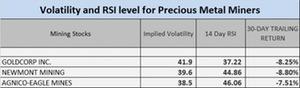

Analyzing the Correlations of Precious Metals Mining Stocks

Mining companies that have high correlations with gold include B2Gold (BTG), Royal Gold (RGLD), Agnico Eagle Mines (AEM), and Primero Mining (PPP).

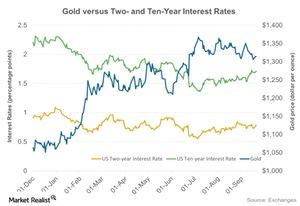

Inside Gold’s Upward and Downward Correlation Trends

Precious metal prices have risen due to uncertainty since Donald Trump won the US presidential election.

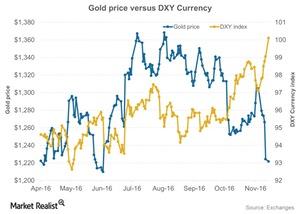

How GDP Numbers Impacted Gold and the Dollar

The reason behind the fall of the dollar on Friday, January 27, 2017, was lower-than-expected GDP numbers. The DXY ended the day 0.10% higher.

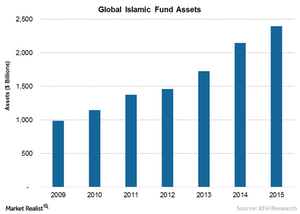

Will the Shari’ah Standard on Gold Be a Game-Changer?

In December, the AAOIFI and the WGC (World Gold Council) issued, for the first time, Shari’ah standard to deal with the use of gold (GDX) (GDXJ) as an investment in the Islamic finance industry.

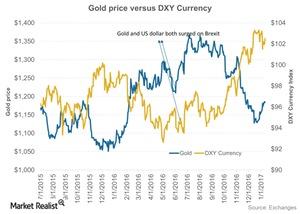

US Dollar Played on Gold in 2016

The correlation between gold and the US Dollar Index is -0.36. It means that about 36.0% of the time, gold and the dollar move in opposite directions.

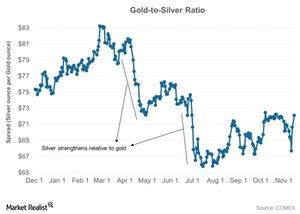

How Has the Gold-Silver Ratio Trended in 2016?

Gold and silver have been strong for the past few days. However, silver has substantially outperformed gold year-to-date.

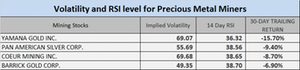

Reading the RSI Levels and Volatilities of Mining Companies

Many of the fluctuations in precious metals have been determined by the Federal Reserve’s interest rate stance. These variations play on precious metals funds.

Fed’s Hawkish Stance: Why It Impacted Precious Metals

Last week was rough for precious metals. Gold, silver, platinum, and palladium all fell. Gold had the biggest weekly fall in about three years.

Rising Volatility Continues to Affect Miners’ Stocks

The precious metals price correction that happened on September 2, 2016, extended to September 6. How did equities and funds respond?

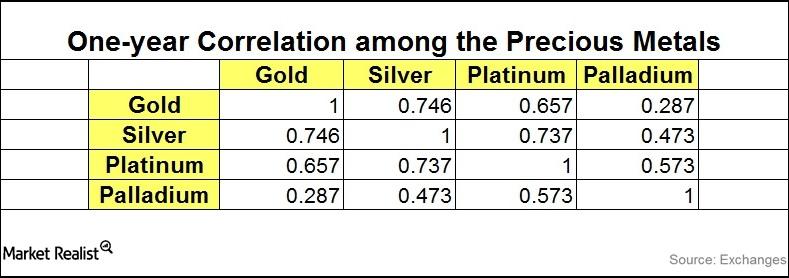

What Does the Precious Metal Correlation Suggest?

Gold and silver have a strong correlation close to 75%. This suggests that about 75% of the time, a fall in gold prices leads to a fall in silver prices.

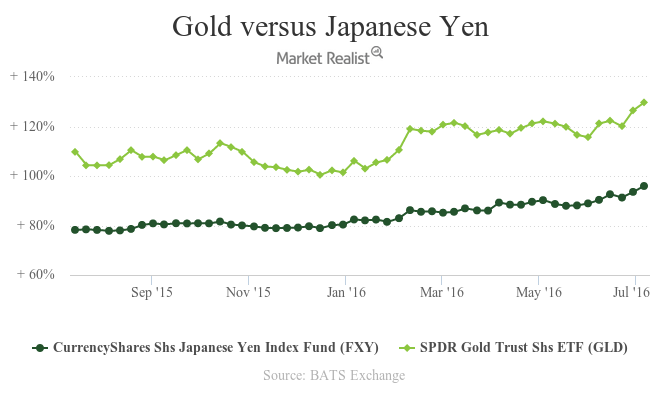

How Did the Japanese Yen Correlate with Gold?

The falling equity market took down the Japanese stock markets too.

How Much Can Brexit Affect the Precious Metals?

Brexit could send jitters around the globe, and investors may jump to safe-haven assets such as gold and silver, which have risen 21.2% and 25.6%, respectively, on a YTD (year-to-date) basis.

Why Hedge Funds Liquidated Some of Their Gold

Hedge funds increased their bets on gold as prices fell after gold’s gains in 1Q16. However, hedge funds and money managers curbed their bets on gold as it fell steadily in May.

Why Predicting Gold Returns Is a Dubious Exercise

Generally, gold is viewed as a hedge against rapid inflation and lower interest rates. That makes it hard to value gold as there are no cash flows or earnings associated with it.

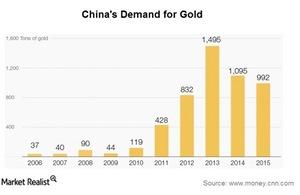

How Strong Is China’s Gold Demand?

China’s love for gold is world famous, and demand had touched its peak in 2013 when gold experienced a steep price fall.