Sprint Corp

Latest Sprint Corp News and Updates

Why AT&T Stock Hasn’t Had a Great Start This Week

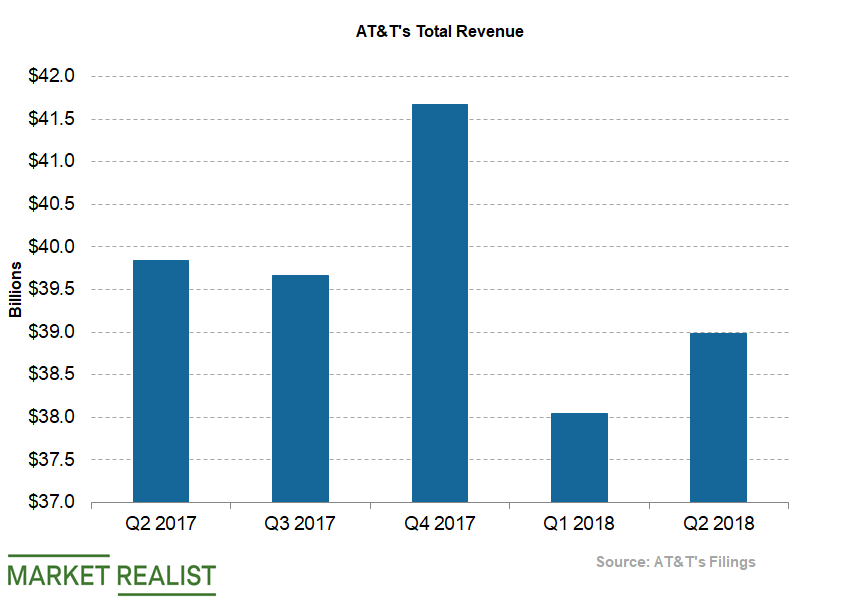

AT&T fell about 1.6% on September 16. The stock closed the trading day at $37.31, 3.72% below the 52-week high of $38.75 it saw on September 11.

AT&T Stock: Why Is It Falling Today?

AT&T (T) stock fell about 1% on Thursday. The stock closed the trading day at $38.38. The stock is trading just 0.95% below the 52-week high of $38.75.

AT&T Makes Leadership Changes, Appoints a New COO

On Tuesday, AT&T announced the appointment of John Stankey as its president and COO—a new position. AT&T stock rose 0.3% and closed at $35.38 on the day.

Dish Needs $10 Billion for Wireless, Can’t Sell Spectrum

Dish Wireless requires $10 billion for its network buildout, but it only has $1.9 billion in the bank. The FCC bars it from selling spectrum to raise cash.

What’s T-Mobile’s Updated Outlook for Fiscal 2019?

Last week, T-Mobile (TMUS) reported strong second-quarter financial results.

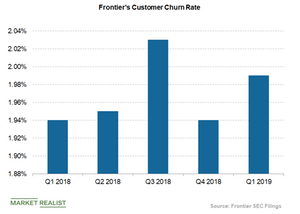

Why Did Frontier’s Customer Churn Rate Increase in Q1?

Frontier Communications (FTR) has been making efforts to retain its customers and maintain a lower churn rate in a highly competitive telecommunications sector.

What Drove T-Mobile’s Earnings in Q1?

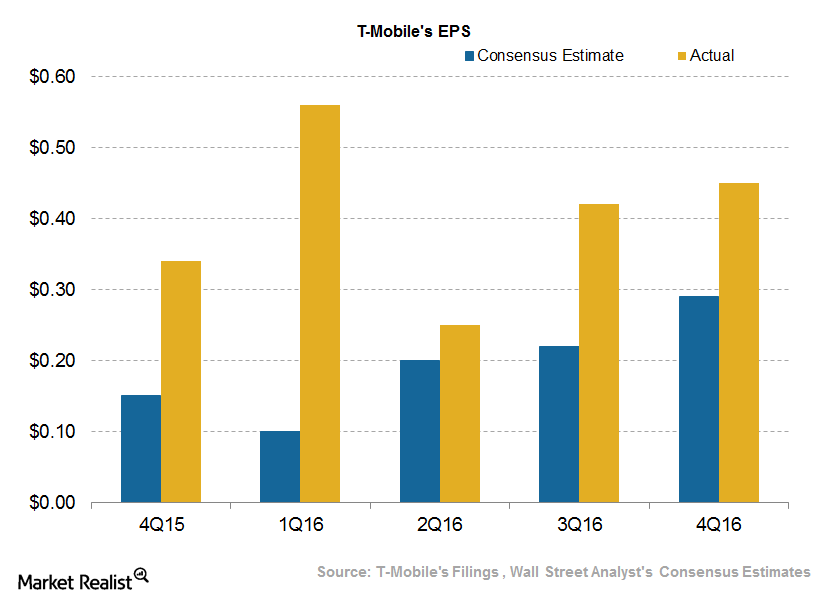

Over the past few quarters, T-Mobile beat analysts’ consensus adjusted EPS estimates. On April 25, T-Mobile delivered another solid quarterly report.

What Does 5G Have to Do with Zynga’s Business?

Zynga (ZNGA) is banking on 5G technology to enhance its growth potential.

Verizon Aims to Improve Its Leverage Target in 2019

Verizon Communications plans to have a leverage of 1.75x–2.0x in 2019. The company ended 2018 with a net debt-to-adjusted EBITDA of 2.1x.

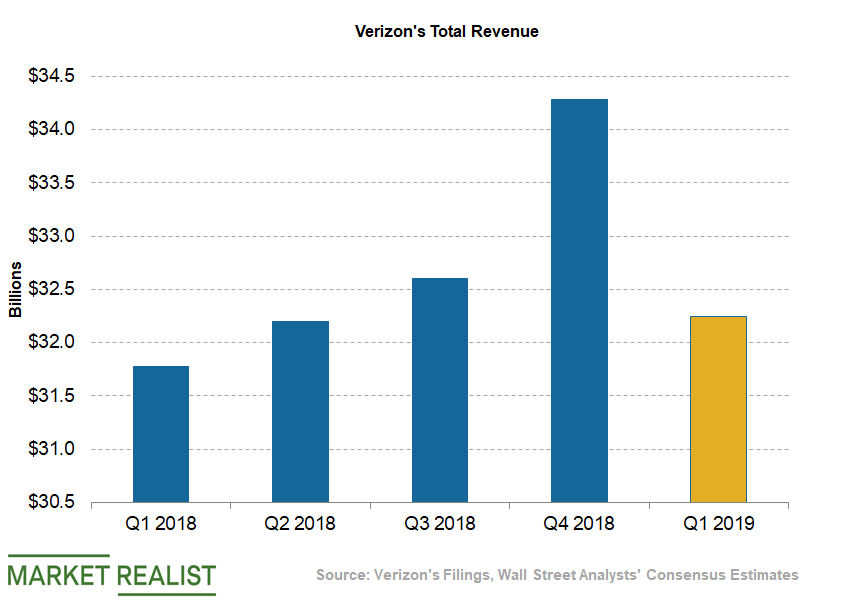

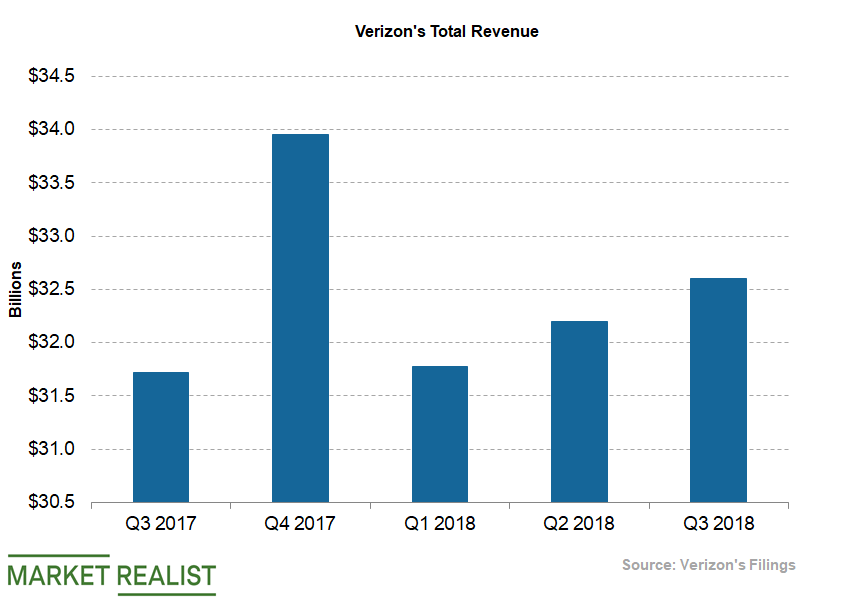

Analyzing Verizon’s Revenue Trend

In fiscal 2018, Verizon Communications’ (VZ) total operating revenues rose ~3.8% YoY to $130.9 billion from $126 billion in fiscal 2017.

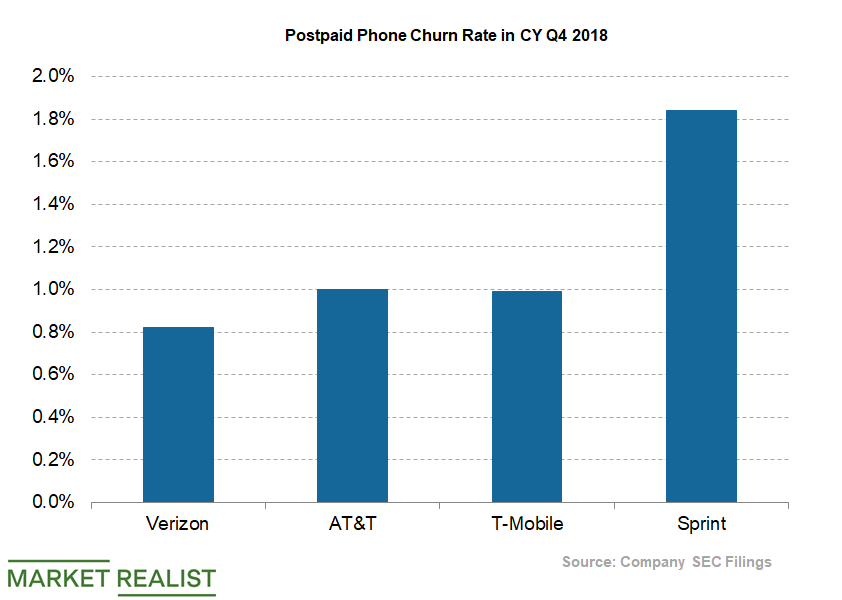

How Verizon Is Working to Keep Its Churn Rate Low

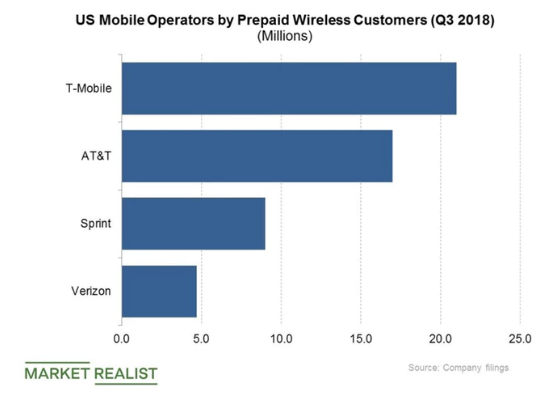

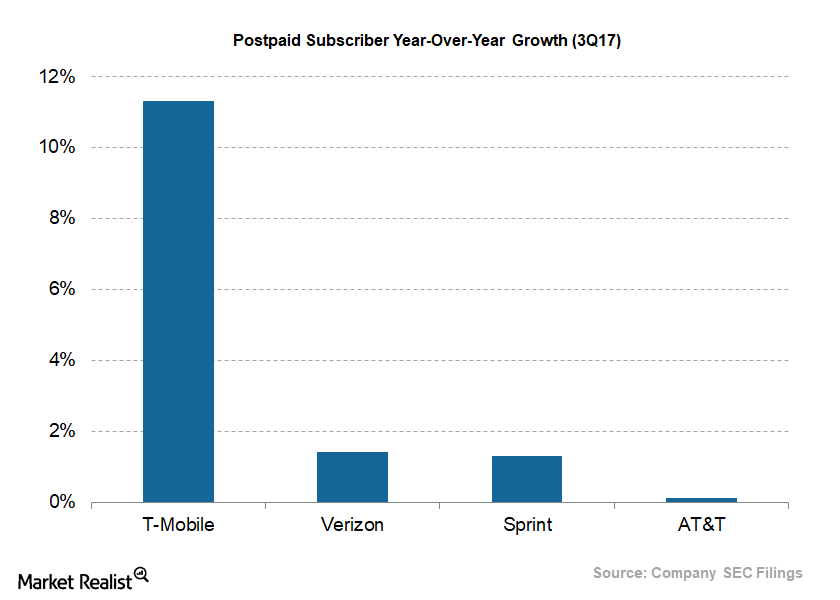

Verizon is the leading US mobile operator with the largest retail postpaid market share.

T-Mobile Sponsors Ariana Grande US Tour to Attract New Customers

Smartphone penetration hit 85% last year, a development that has forced telecommunication companies to think of creative ways to lure customers from competitors.

Why Is Verizon Losing Prepaid Customers?

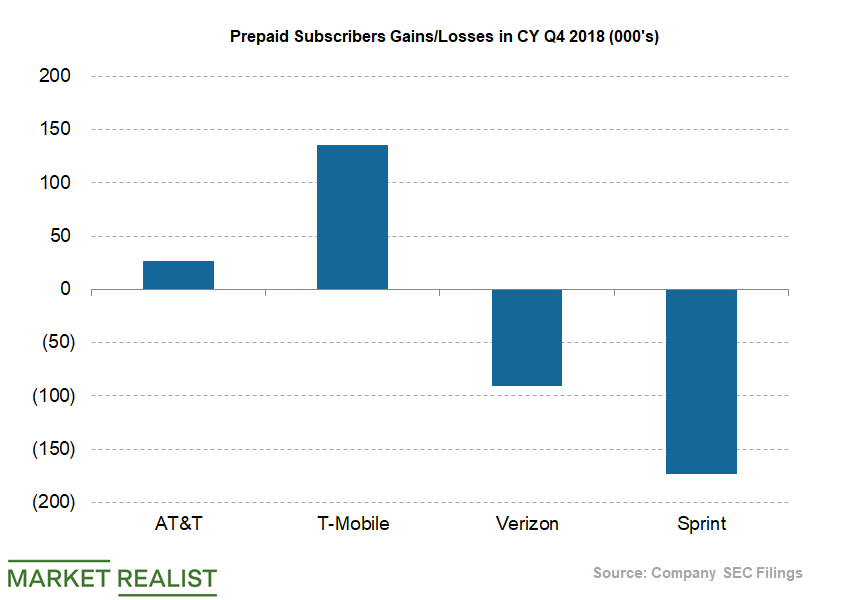

In the fourth quarter, Verizon lost 90,000 prepaid subscribers compared to 184,000 net losses in the fourth quarter of 2017.

AT&T Continues to Focus on Reducing Its Debt Levels

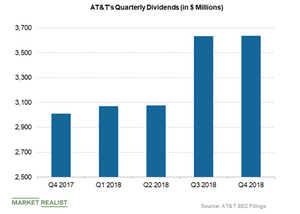

AT&T (T) ended the fourth quarter with an operating cash flow of $12.1 billion, capex of $4.2 billion, and a free cash flow balance of $7.9 billion.

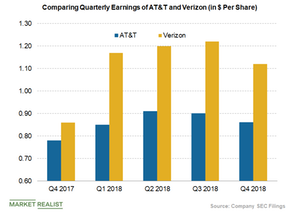

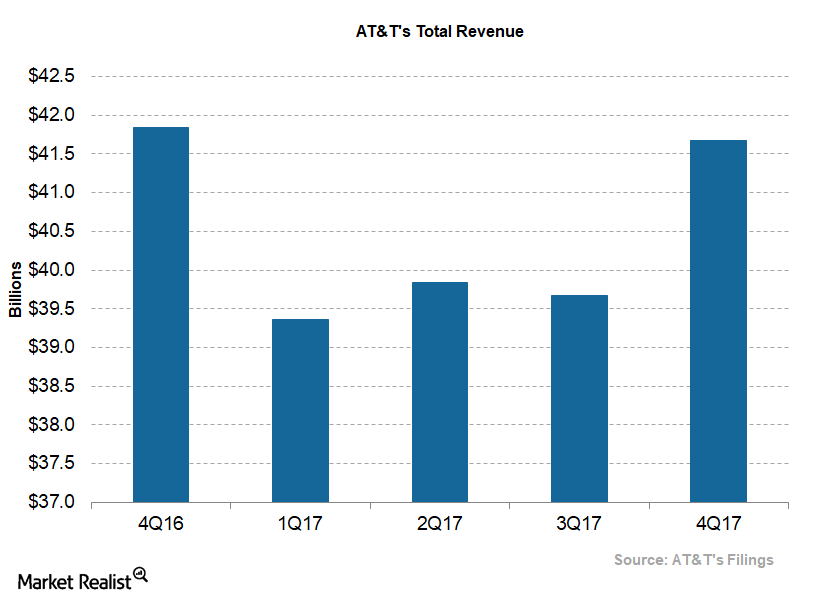

Verizon Beats, AT&T Meets Earnings Expectations in Q4

AT&T (T) posted fourth-quarter EPS of $0.86, in line with analysts’ estimates, on January 30.

Inside Verizon’s Efforts to Cut Costs and Boost Savings

Verizon (VZ), the largest US wireless service provider, has been undertaking measures to boost its savings by cutting costs.

Ericsson and Panasonic Partner on 5G

Ericsson (ERIC) and Panasonic have agreed to collaborate on exploring new 5G use cases.

How Verizon’s Revenue Compares with Peers’

In the first nine months of last year, Verizon’s (VZ) net revenue grew ~4.9% YoY (year-over-year) to $96.6 billion from $92.1 billion, and in the third quarter, its net revenue grew ~2.8% YoY to $32.6 billion from $31.7 billion.

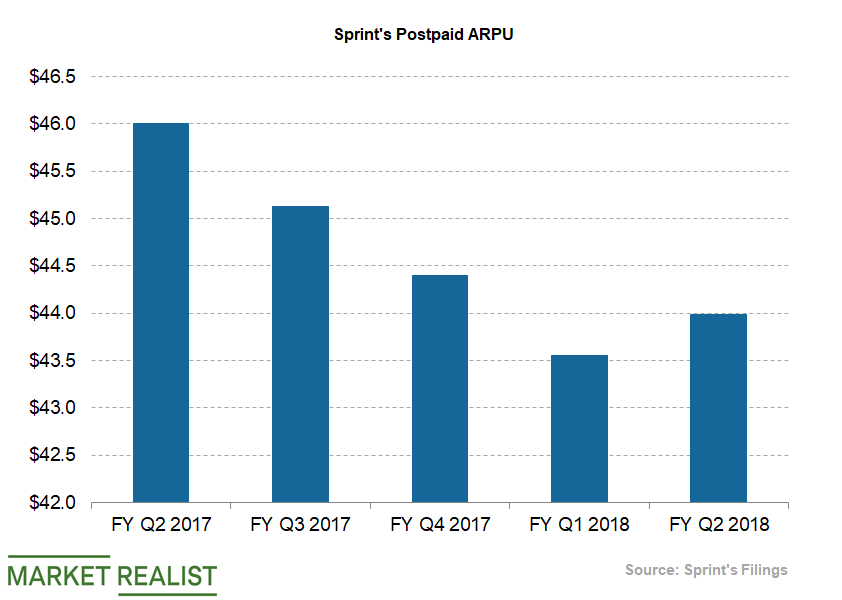

Analyzing Sprint’s Postpaid Average Revenue per User

In the second quarter of fiscal 2018 (ended in September), Sprint’s postpaid average revenue per user fell ~4.4% year-over-year to $43.99.

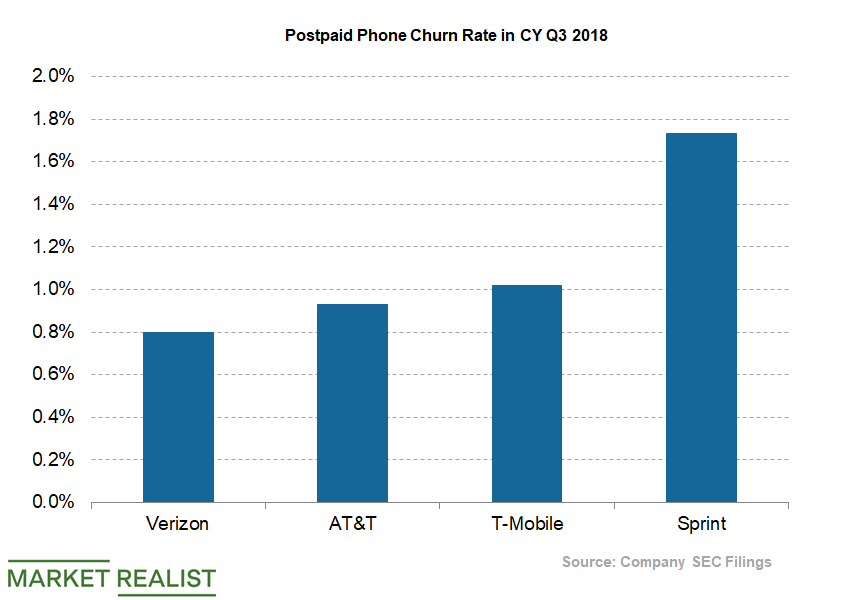

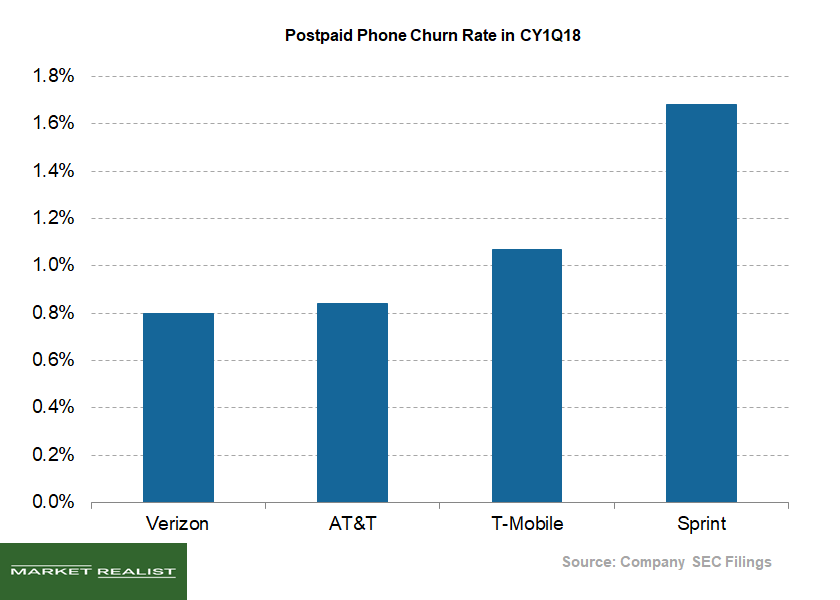

Verizon’s Postpaid Phone Churn Rate Could Rise in Fourth Quarter

Verizon is the leading US wireless service provider with the largest retail postpaid market share and the lowest postpaid phone churn rate.

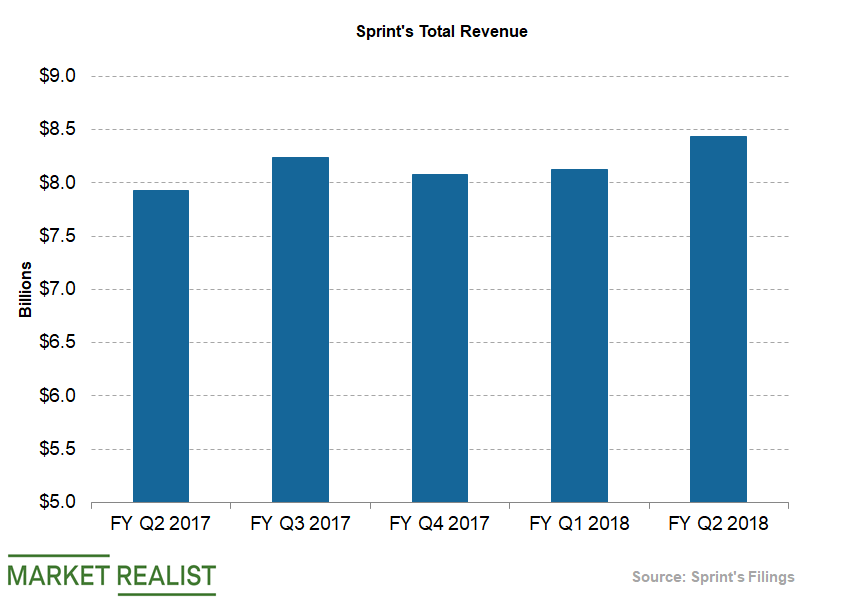

Sprint Registered Strong Revenue Growth in Q2 2018

In the second quarter of fiscal 2018, Sprint generated total net operating revenue of $8.4 billion—well above analysts’ consensus estimate.

What Strengths Differentiate AT&T from the Competition?

At the September 12 Communacopia Conference, AT&T CEO Randall Stephenson recently detailed the telecom giant’s media acquisition strategies.

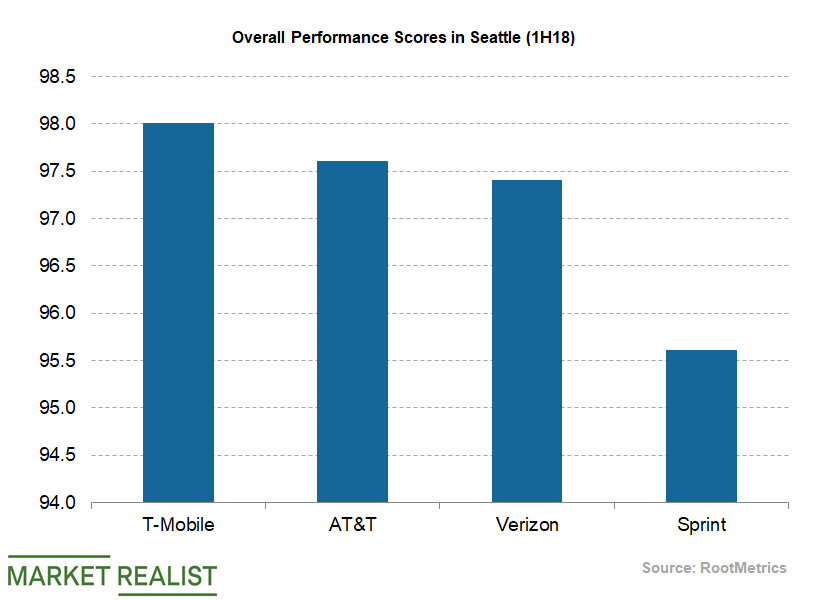

How Does T-Mobile’s Network Rank in Seattle?

According to the first half of 2018 RootScore report for Seattle, T-Mobile (TMUS) ranked first in the overall network performance category.

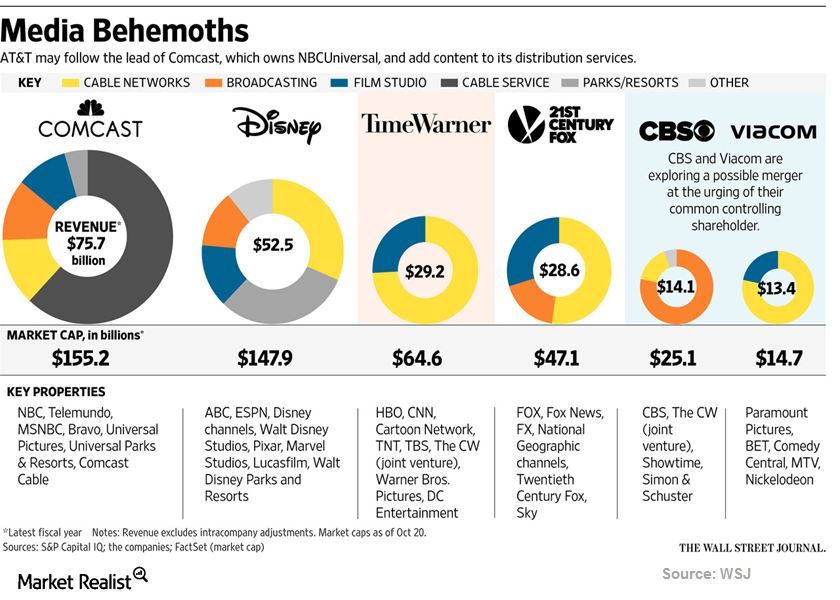

The AT&T–Time Warner Merger’s Strategic Benefits

AT&T’s (T) merger with media conglomerate Time Warner could be a win-win situation for both companies.

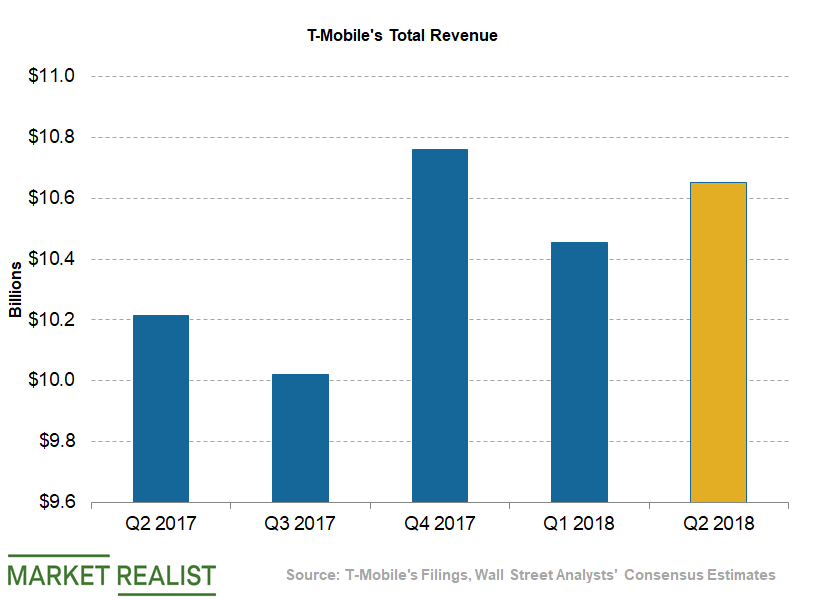

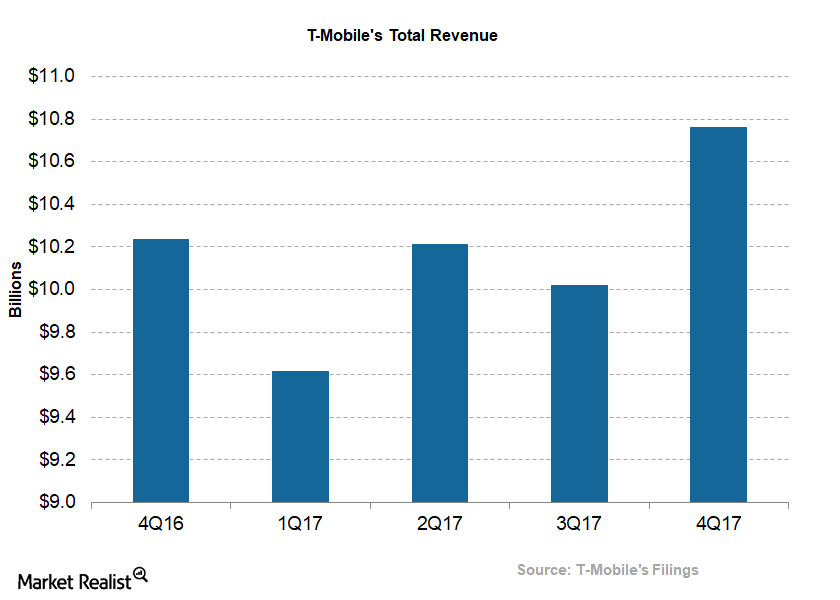

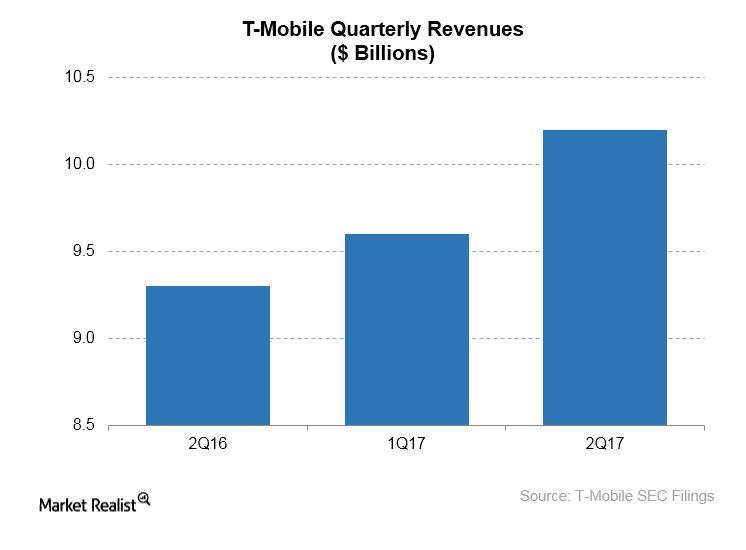

How Much Revenue Growth Will T-Mobile Record in Q2 2018?

Now let’s take a look at T-Mobile’s total expected revenue in the second quarter.

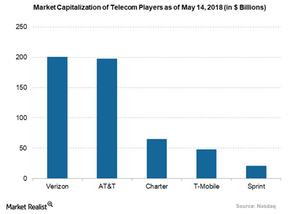

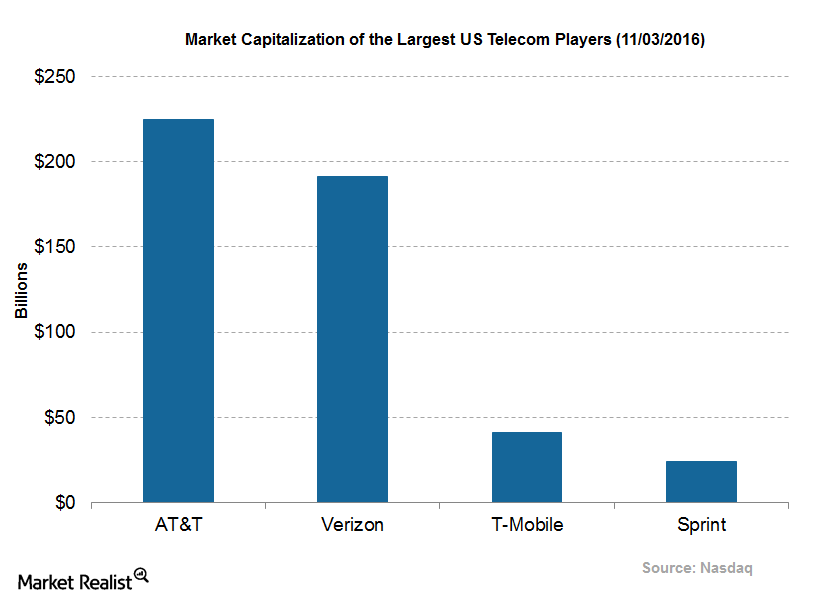

Analyzing T-Mobile’s Valuation Multiples

At the end of May 14, T-Mobile (TMUS) had a market cap of ~$47.8 billion.

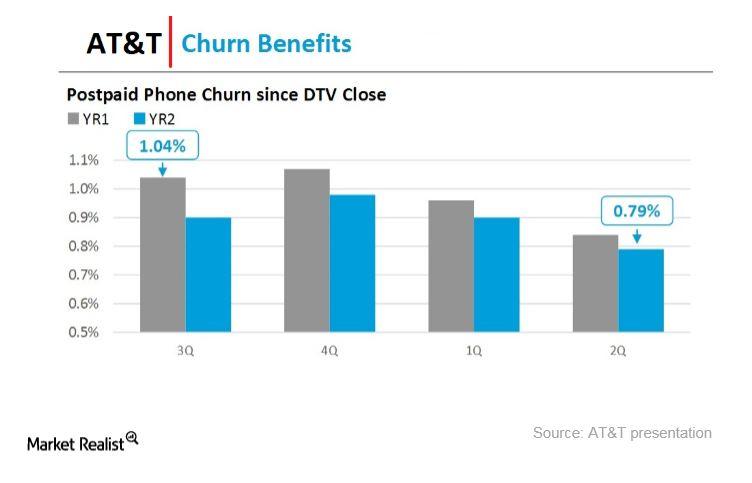

What AT&T’s Postpaid Phone Churn Rate Signals

In its recent earnings, AT&T posted its best-ever first-quarter postpaid phone churn rate of 0.84%, improving year-over-year and sequentially.

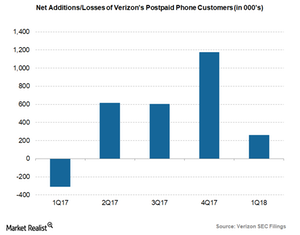

Verizon’s Customer Base in 1Q18

The performance of a mobile carrier’s network determines its customer base, and Verizon (VZ) has been making efforts to improve its network in order to keep customers.

What Are AT&T’s Top Priorities for 2018?

AT&T’s management stated that in 2018, the company’s top priority would be closing the Time Warner (TWX) deal.

A Look at T-Mobile’s 2018 Distribution Strategy

T-Mobile (TMUS) is expanding its distribution footprint as a means to drive growth in untapped US markets.

What Prompted AT&T to Merge with Time Warner?

In October 2016, AT&T (T) signed an agreement to acquire Time Warner (TWX), in which it agreed to pay $107.50 per share to Time Warner’s shareholders.

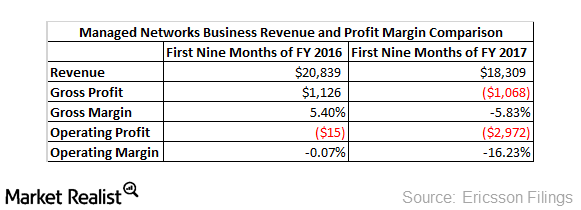

Drivers for Ericsson’s Managed Services Business Revenues

In the first nine months of fiscal 2017, Ericsson’s Managed Services business generated revenues of ~18.3 billion SEK (Swedish kronor), which is equivalent to ~$2.1 billion.

T-Mobile Is Planning New ‘Un-Carrier’ Moves in 2018

T-Mobile’s (TMUS) current “Un-Carrier” initiative is helping to strengthen and re-build customer trust.

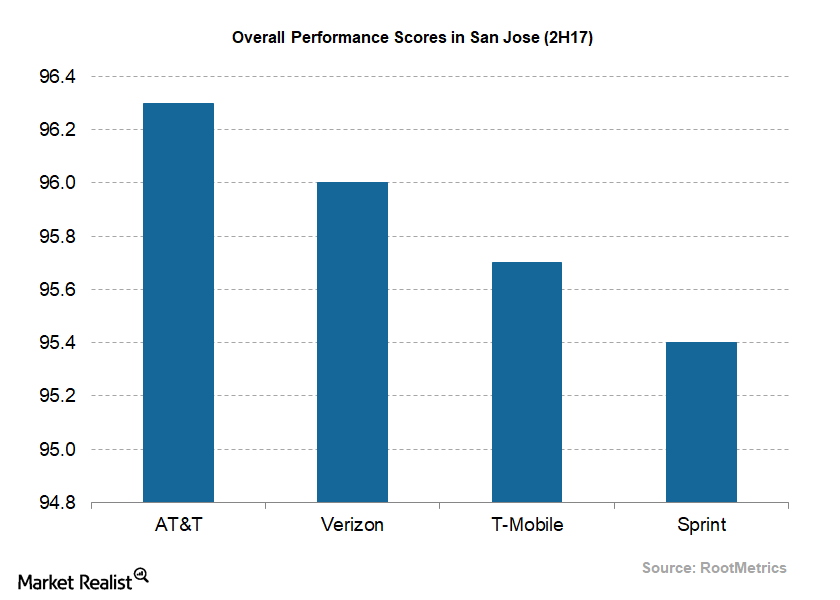

How Sprint’s Network Is Performing in San Jose

Sprint’s median download speed declined from 20.6 Mbps in the first half of 2017 to 15.5 Mbps in the second half of 2017.

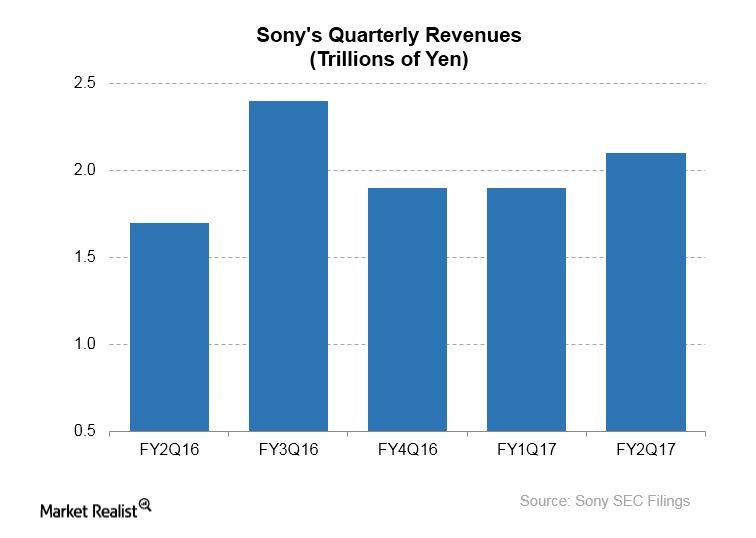

Tracing Sony’s Return to Its Aibo Robot Dog Business

Sony’s original Aibo sold for between $600 and over $2,000. The new Aibo starts at $1,700, a price that puts the product in the range of competitors.

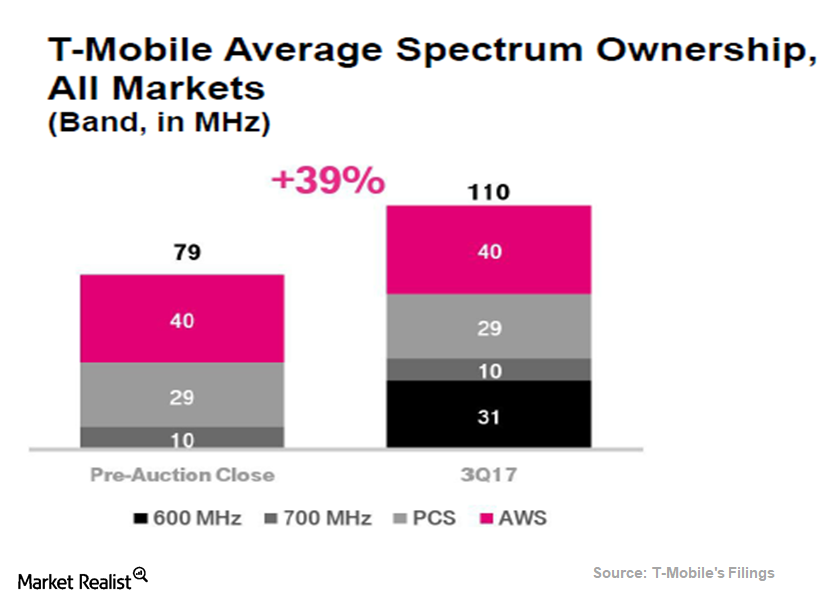

Understanding the Trends in T-Mobile’s Low-Band Spectrum Rollout

T-Mobile has a solid spectrum position and owned an average of ~110 MHz spectrum nationwide at the end of 3Q17—an increase of ~39% in spectrum holdings.

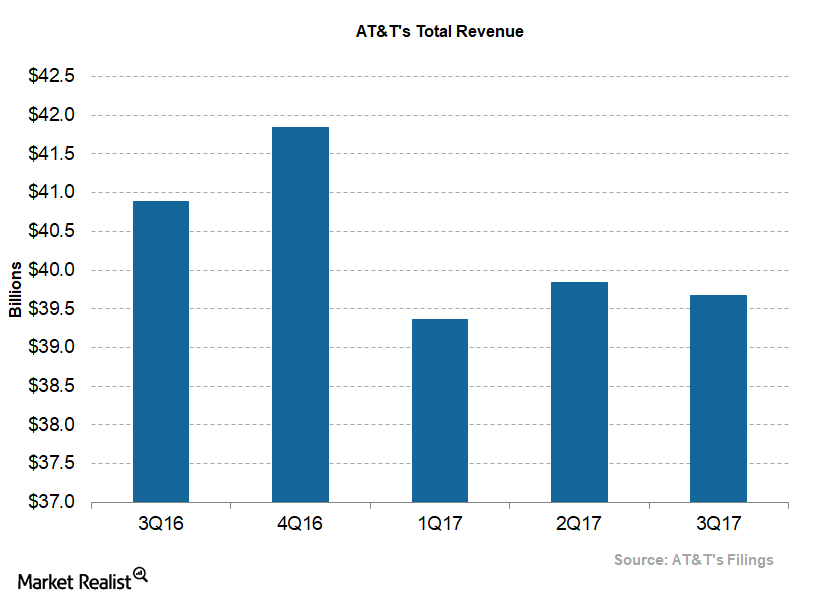

What Impacted AT&T Stock in October 2017?

AT&T’s operating margin rose to 16.1% in 3Q17 from 15.7% in 3Q16.

T-Mobile Disrupts an Already Chaotic Scene

T-Mobile puts a twist to unlimited data T-Mobile (TMUS) won’t allow rival wireless network operators any peace. T-Mobile, and to some extent Sprint (S), prompted market leaders AT&T (T) and Verizon (VZ) to bring back unlimited data plans after years of outage. Unlimited data plans hadn’t made much economic sense to them. On September 19, T-Mobile struck again, […]

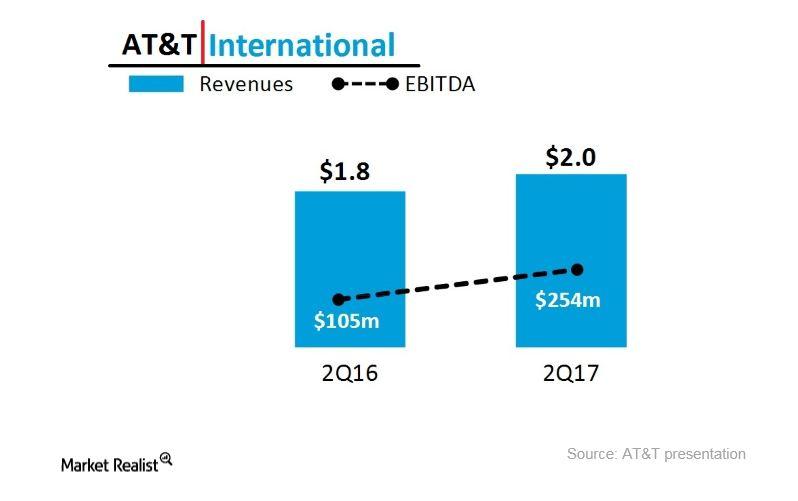

Analysis of AT&T’s International Business

Regulators are reviewing AT&T’s proposal to merge with Time Warner in a transaction valued at $85.4 billion.

A Look at AT&T’s Customer Retention

AT&T (T) noted that it added 2.8 million net wireless subscribers in 2Q17, up from 2.7 million in 1Q17.

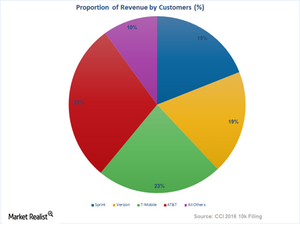

Is Telecom Consolidation Threatening Crown Castle?

The changing political scenario under the Trump administration has led to the anticipation of widespread M&A activity in the telecom industry.

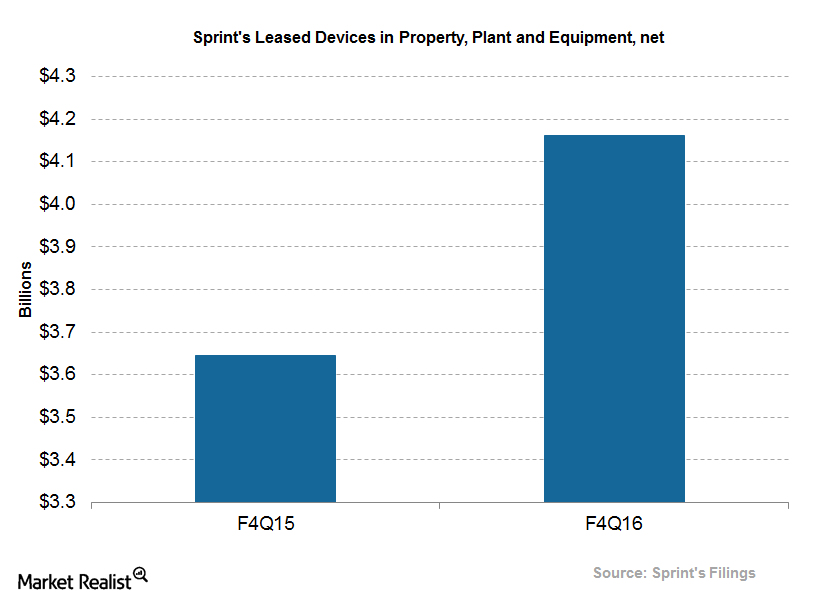

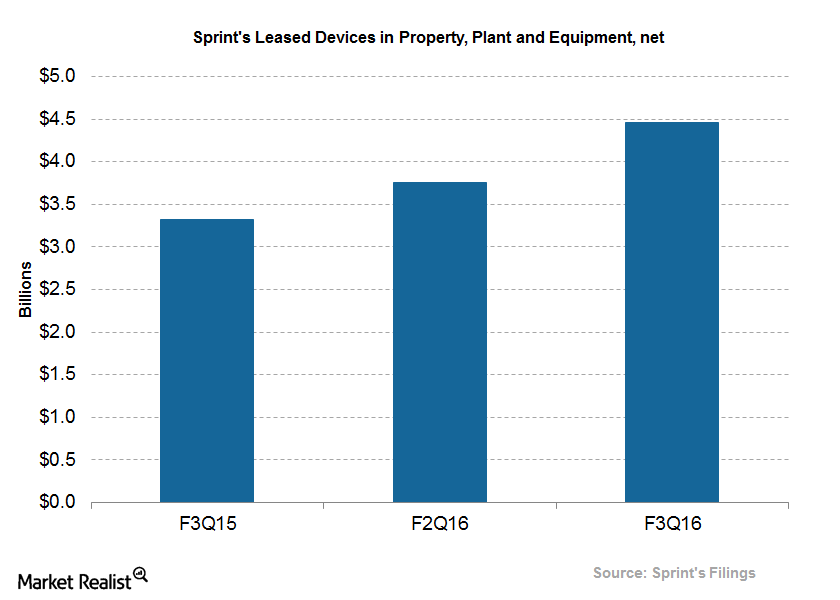

Sprint Remains Focused on Handset Leasing to Accelerate Growth

Sprint’s device leasing has helped it to regain its financial position. The take rates of Sprint’s leasing plans have continued to surpass its installment plans in the last few quarters.

Why Sprint Is Focusing on Handset Leasing

The take rate of Sprint’s (S) leasing plans continued to surpass its installment plans in fiscal 3Q16. Its take rate of leasing plans reached ~43.0% that quarter.

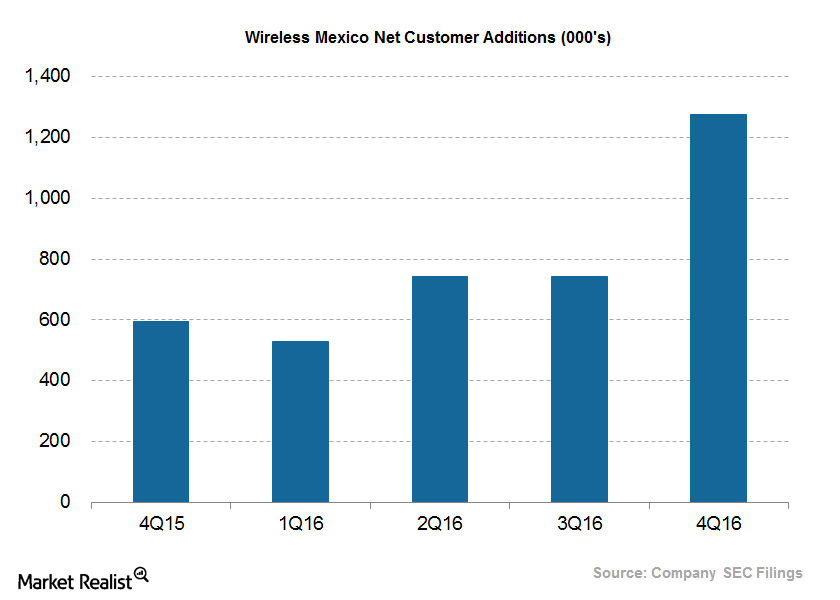

Why Is AT&T Continuing to Gain Market Share in Mexico?

AT&T (T) is continuing to invest significantly in Mexico. The company expects this investment to start paying off in 2017, which should help its profitability going forward.

A Look at T-Mobile’s Earnings Trends

T-Mobile’s earnings in the last few quarters In the last few quarters, T-Mobile (TMUS) has managed to beat analysts’ EPS (earnings per share) estimates. T-Mobile delivered another solid quarter in 4Q16, with strong subscriber metrics and adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) growth. T-Mobile added 1.2 million net postpaid customers, with 933,000 […]

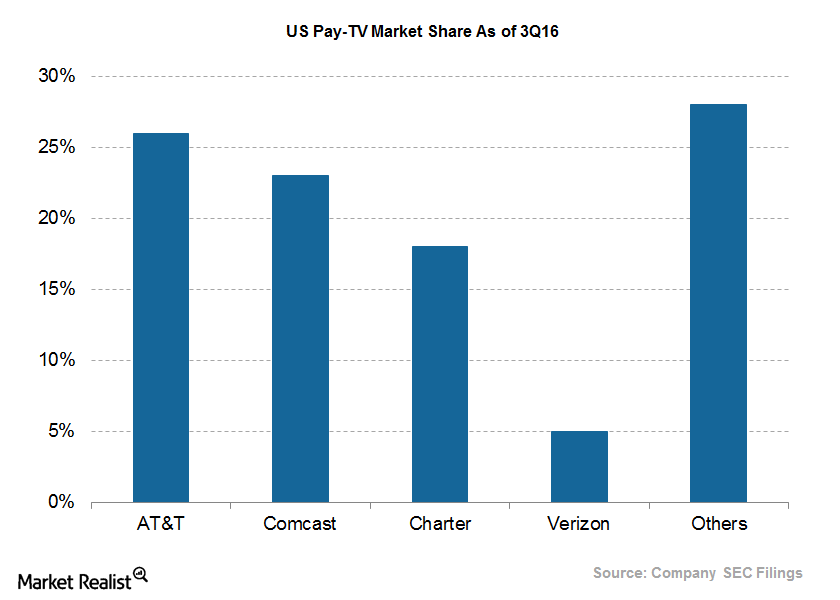

How a Verizon-Charter Deal Could Impact the US Pay-TV Space

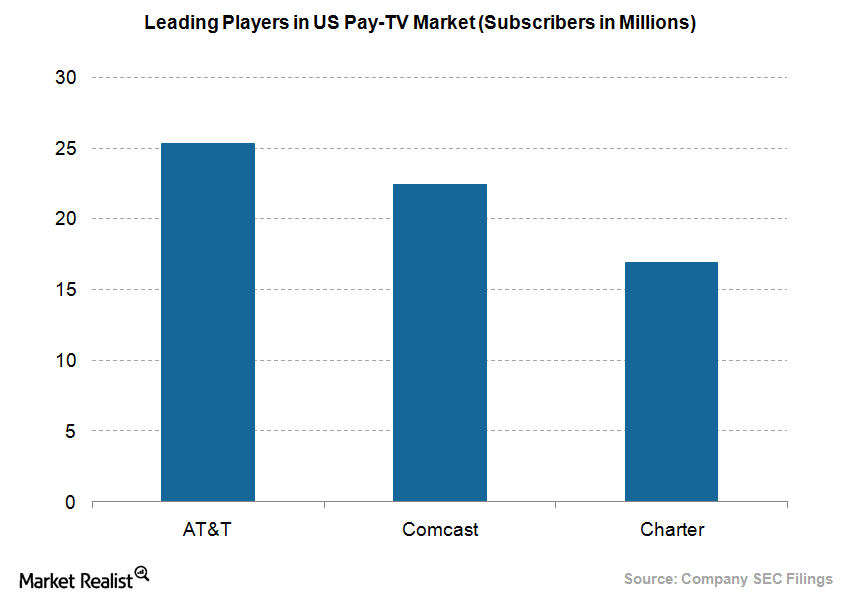

The potential acquisition of Charter Communications (CHTR) could be seen as another attempt by Verizon (VZ) to pursue revenue growth outside its traditional carrier business.

Analyzing the Concentration of US Media Ownership

Time Warner (TWX) has high-quality content assets, and AT&T (T) has extensive customer relationships across the wireless, video, and fixed broadband platforms.

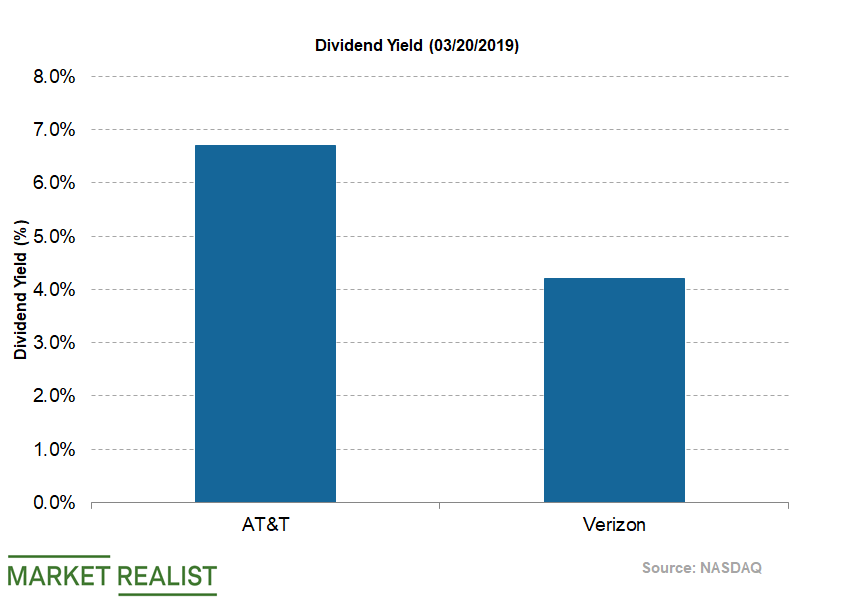

A Look at AT&T’s Value Proposition in the US Telecom Market

In this part of the series, we’ll look at some value-centric measures for AT&T (T) compared to the other major companies in the US wireless space.

AT&T Has Taken a Different Approach to Diversify Wireless Business

Like Verizon, AT&T (T) also saw a revenue decline in its US wireless business in the last quarter on a year-over-year basis.

AT&T Is Investing Heavily in This to Grow Its 4G LTE Footprint

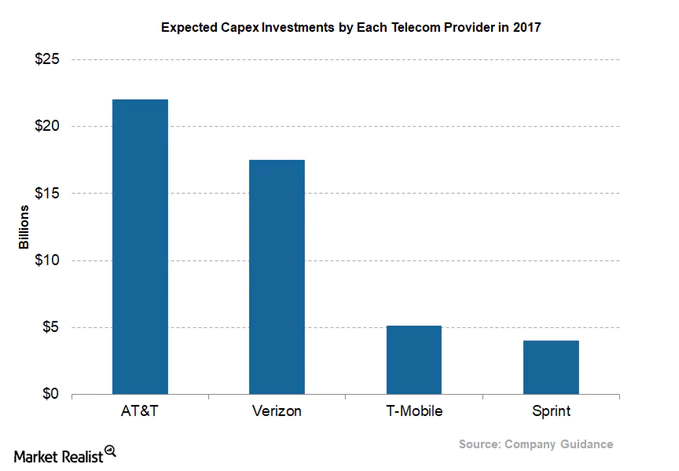

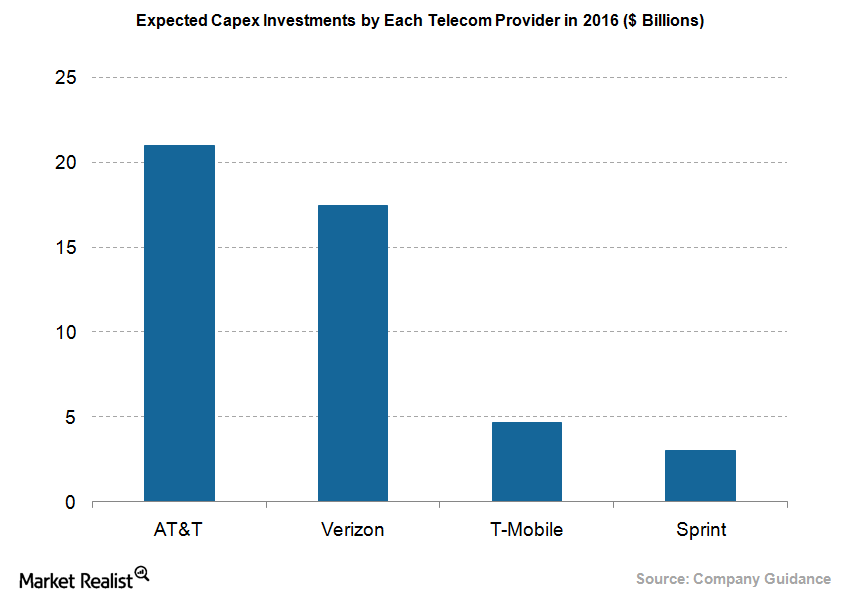

AT&T already spent $10.3 billion in capex in the first half of 2016 and expects to spend a total of $21 billion in 2016.