A Look at T-Mobile’s 2018 Distribution Strategy

T-Mobile (TMUS) is expanding its distribution footprint as a means to drive growth in untapped US markets.

March 12 2018, Updated 10:31 a.m. ET

T-Mobile’s distribution strategy

T-Mobile (TMUS), the fastest-growing and third-largest wireless service provider in the United States, is expanding its distribution footprint as a means to drive growth in untapped US markets. The expansion of its distribution footprint means a potential customer upside.

T-Mobile planned to open 3,000 new distribution stores in 2017, including 1,500 new T-Mobile stores and 1,500 new MetroPCS stores. During the company’s recent 4Q17 earnings conference call, its management noted that it had opened nearly 1,500 new T-Mobile stores and over 1,300 new MetroPCS stores in the year. Management also highlighted that T-Mobile’s expansion of its distribution footprint would continue in 2018.

T-Mobile’s revenue trend

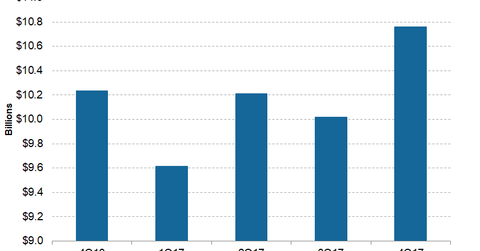

T-Mobile believes that its distribution expansion could garner new customers and subsequently boost its total revenue. In 4Q17, T-Mobile reported total revenue of $10.8 billion compared to $10.2 billion in 4Q16. T-Mobile’s top line growth will depend largely on its ability to take market share from other major US wireless service providers such as AT&T (T), Verizon (VZ), and Sprint (S).

Now let’s take a look at the wireless revenue growths of other major US wireless service providers in 4Q17. Verizon’s wireless revenue rose ~1.7% year-over-year (or YoY) to $23.8 billion in the quarter. Meanwhile, AT&T’s wireless revenue from its combined domestic operations rose ~2.5% YoY to $19.2 billion. During the same period, Sprint’s revenue from its wireless component fell ~3.0% YoY to $7.9 billion.