S&P Mid Cap 400

Latest S&P Mid Cap 400 News and Updates

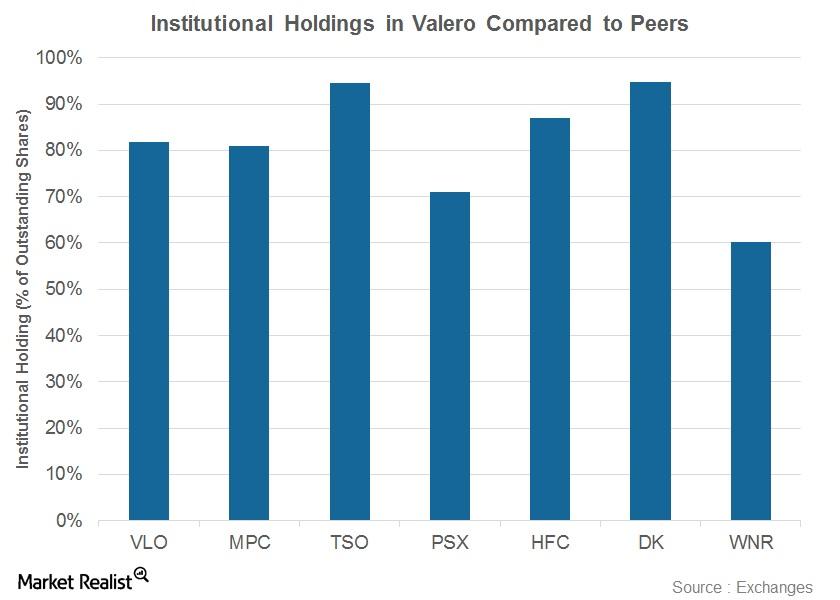

Valero’s Institutional Holdings before the 1Q17 Results

The institutional holdings in Valero Energy (VLO) are higher than the institutional holdings in Marathon Petroleum (MPC), Phillips 66 (PSX), and Western Refining (WNR).

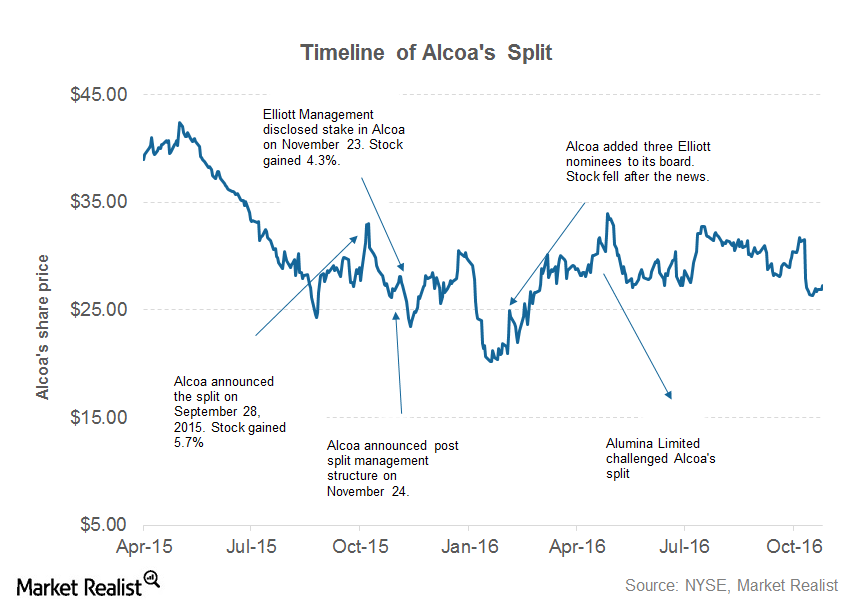

Arconic’s Tough Beginning: Controversies and Battles

Arconic is scheduled to release its 1Q17 earnings on April 25. ARNC was listed as a separate entity on November 1, 2016, when Alcoa split into two entities.

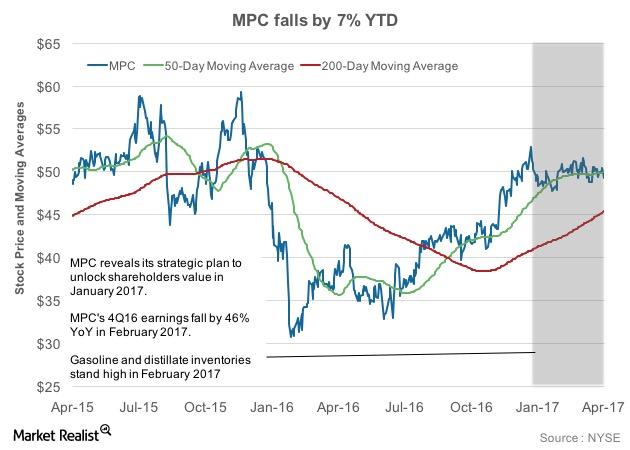

Marathon Petroleum Stock: Performance ahead of the 1Q17 Earnings

Marathon Petroleum stock has plunged 7% year-to-date. Due to its falling price in 1Q17, the stock has broken below its 50-day moving average.

Oil: Famous Recession Indicator Might Be a Concern

On January 2, US crude oil active futures settled at $46.54 per barrel—2.5% higher than the last closing level due to short covering.

Markets Will Await These Updates from Alcoa’s 1Q17 Earnings Call

In 1Q17, there were rumors that Rio Tinto (RIO) could acquire Alcoa.

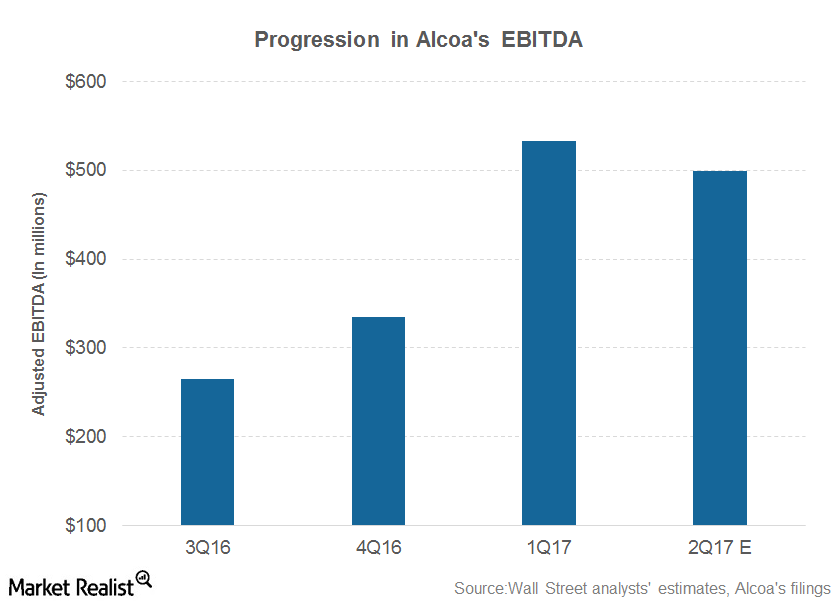

Alcoa’s 1Q17 Earnings: What Investors Need to Know

Alcoa (AA) released its 1Q17 earnings on April 24 after the markets (MDY) (MID-INDEX) closed. It held the conference call the same day.

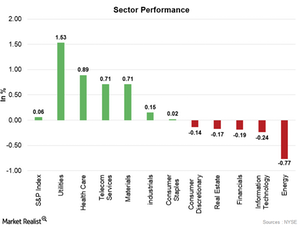

How Did the S&P 500, NASDAQ, and Dow Perform on January 25?

On January 25, six out of the S&P 500’s 11 major sectors moved higher. Strength in the utilities and health care sectors pushed the market higher.

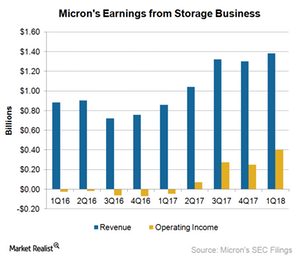

Micron Technology’s CEO Focuses on the Storage Business

Micron Technology’s (MU) fiscal 1Q18 revenues were driven by strong demand for server, mobile, and SSD (solid-state drive) memory solutions.

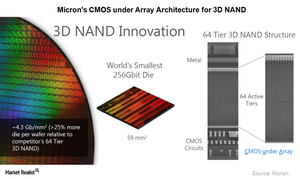

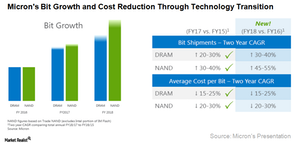

What Is Micron’s NAND Strategy for Fiscal 2018?

At the end of fiscal 1Q18, 3D NAND accounted for 80% of Micron’s total NAND output. The company expects to increase this mix to 95% by the end of fiscal 2018.

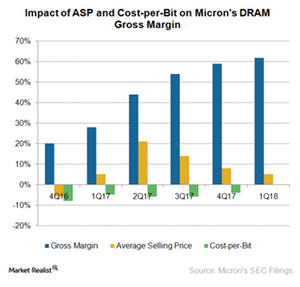

Micron’s Strategy to Improve Its DRAM Gross Margin in 2018

According to its latest earnings report, Micron’s (MU) DRAM (dynamic random-access memory) revenue rose 88% YoY (year-over-year) in fiscal 1Q18.

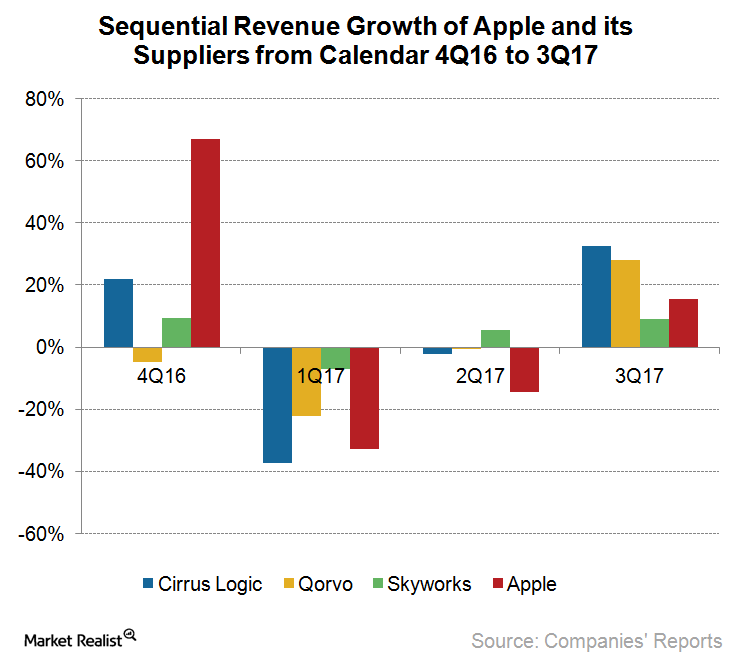

A Look at Chip Suppliers with High Exposure to Apple

KeyBanc estimates that Cirrus Logic and Skyworks Solutions could earn $0.05–$0.08 in earnings per share for every 5 million iPhone 8 and iPhone X models sold by Apple.

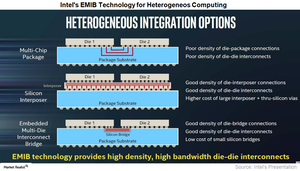

Why Is EMIB Technology so Important for Intel?

Intel (INTC) is developing an MCM (multi-chip module) by integrating AMD’s semi-custom discrete GPUs (graphics processing units) inside its processors.

Micron’s Technology Roadmap Aimed at Improving Cost Competitiveness

Micron (MU) has expanded its manufacturing capabilities by acquiring small companies like Inotera Memories and Tidal Systems.

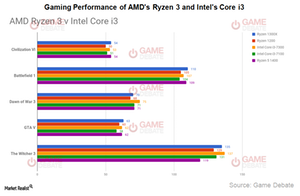

How AMD’s Ryzen 3 and Intel’s Core i3 Stack Up

Advanced Micro Devices (AMD) recently released its Ryzen 3 series for the budget PC (personal computer) segment.

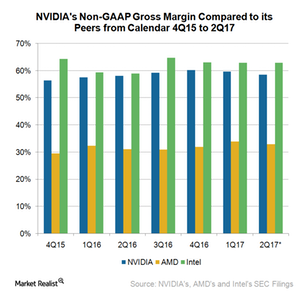

Could NVIDIA’s Revenue Growth Result in a Higher Profit Margin?

For fiscal 2Q18, analysts expect NVIDIA to report earnings per share of $0.78, which marks a sequential decline of 8.2%.

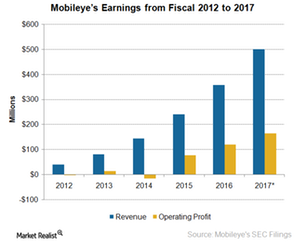

How the Acquisition of Mobileye Could Affect Intel’s Earnings

Intel (INTC) is acquiring Mobileye (MBLY) for $15.3 billion in order to grow in the autonomous vehicle market.

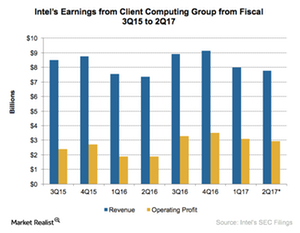

What’s Going on with Intel’s Client Computing Group?

Intel (INTC) is currently going through a phase of slow growth, which is threatening its top position in the semiconductor industry.

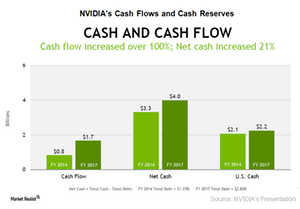

What NVIDIA’s Cash Position Says about Its Financial Health

NVIDIA’s operating cash flow fell 8.7% year-over-year to $282 million in fiscal 1Q18 as its revenues were hit by seasonal weakness. Its accounts receivables increased 87% YoY.

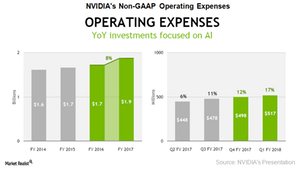

Why NVIDIA Is Increasing Its Operating Expenses in Fiscal 2018

NVIDIA’s non-GAAP operating expenses rose 17% year-over-year to $517 million in fiscal 1Q18. NVDA expects to increase its operating expenses to $530 million in fiscal 2Q18.

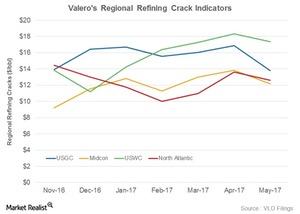

What Valero Needs to Soar in 2Q17

Valero’s crack indicators have fallen in all of these areas in May 2017 (as of May 23) as compared to April 2017.

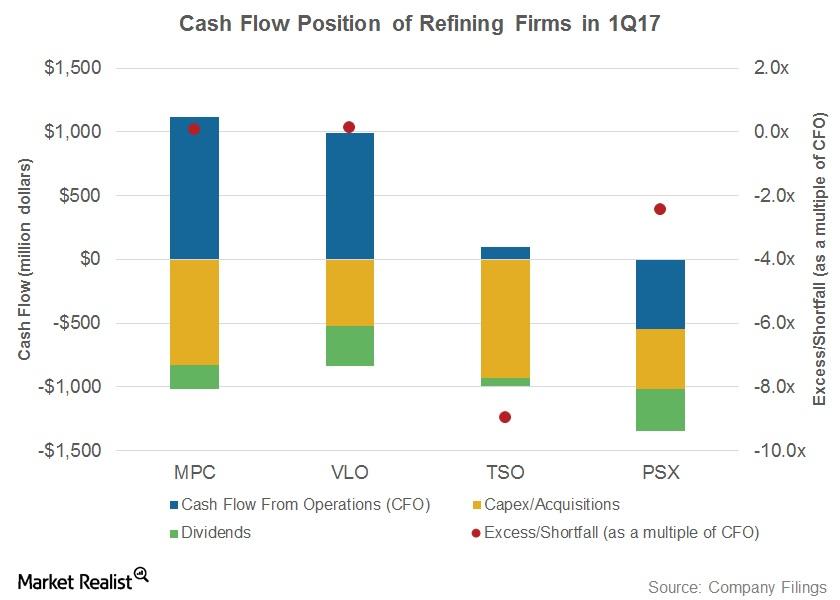

How Major Refiners’ Cash Flows Fared in 1Q17

Refiners’ cash flows have turned volatile over the past few quarters due to volatile refining earnings.

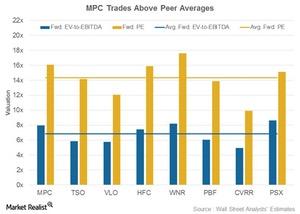

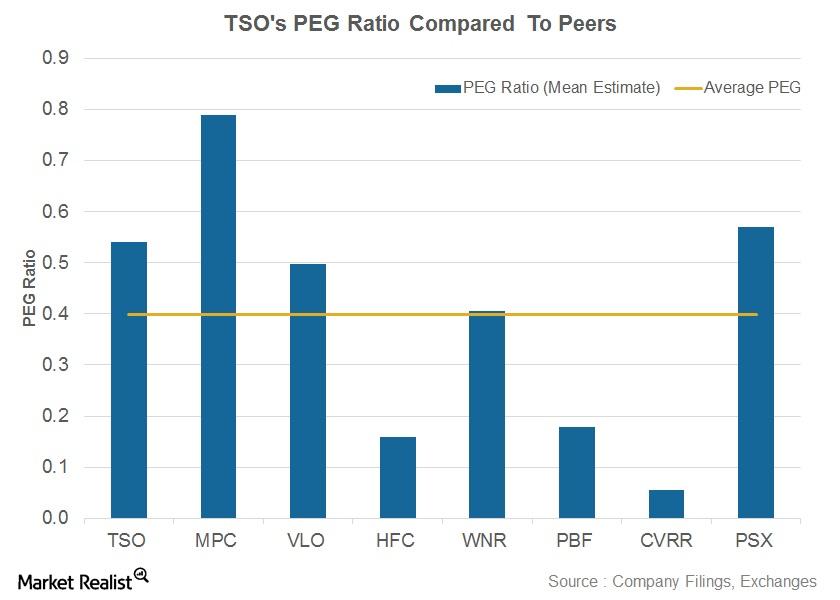

Why MPC’s Valuation Commands a Premium over the Peer Average

MPC’s valuations are above the peer averages likely because it’s now in the process of restructuring its organization to unlock value.

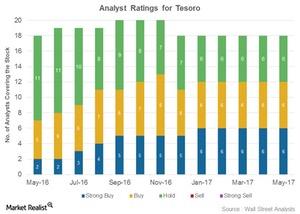

How Analysts Rated Tesoro on Its 1Q17 Earnings Day

Tesoro (TSO) has been rated by 18 analysts. Of those, 12 have assigned the stock a “buy” or “strong buy” rating.

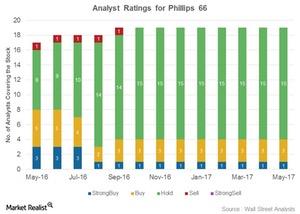

Analysts’ Ratings for Phillips 66 after Its 1Q17 Earnings

After its earnings, Phillips 66 was rated by 19 analysts. Four analysts gave it a “buy,” 15 gave it a “hold,” and no analysts gave it a “sell.”

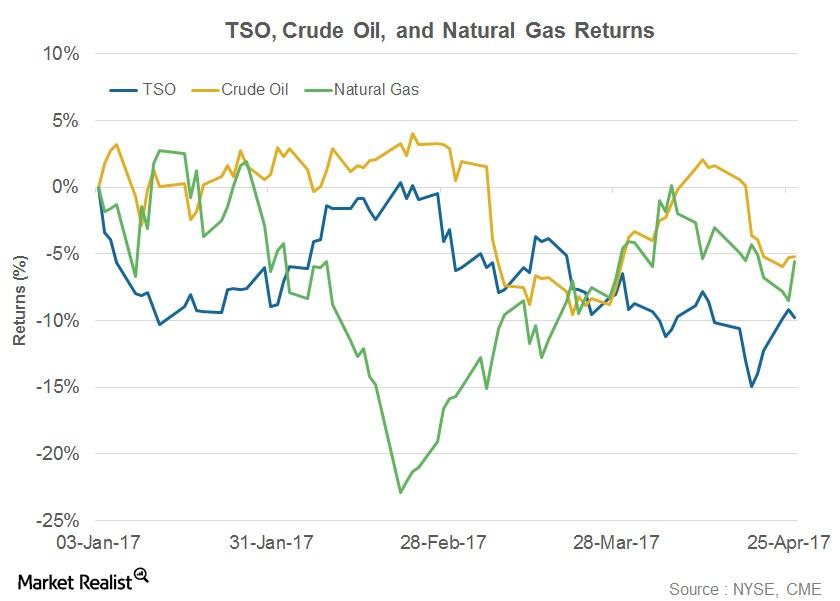

How Did Tesoro’s Stock Perform Pre-1Q17 Earnings?

Since January 3, 2017, TSO stock has fallen 9.8%. Comparatively, crude oil prices have fallen 5.2%, and natural gas prices have fallen 5.6% year-to-date.

Key Updates Markets Are Waiting for in U.S. Steel’s 1Q17 Call

In this article, we’ll analyze the key updates the markets are waiting for in U.S. Steel’s 1Q17 earnings call.

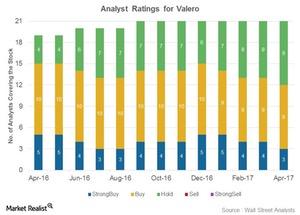

Are Valero’s Analyst Ratings Weaker or Stronger before the 1Q Results?

Of the 21 analysts covering Valero Energy (VLO), 12 (57%) analysts have assigned “buy” or “strong buy” ratings, while nine (43%) have assigned “hold” ratings.

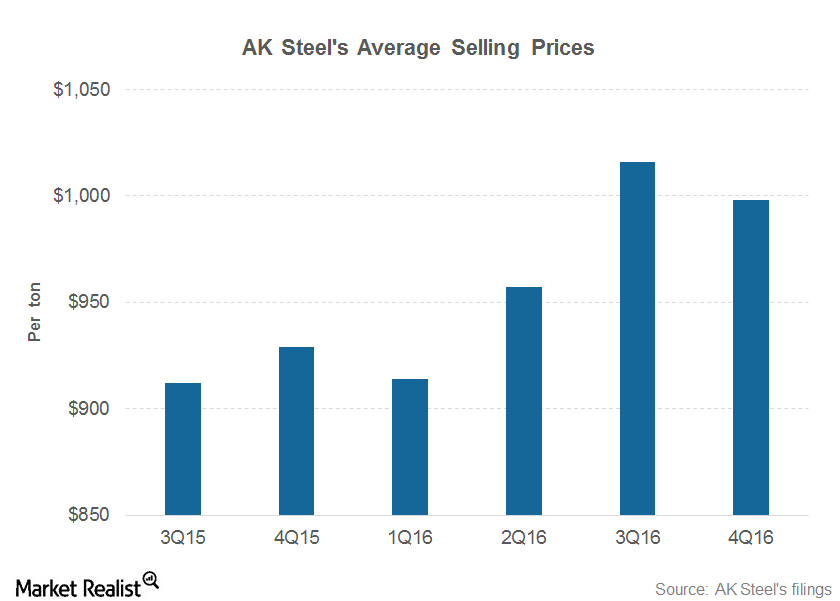

Can AK Steel Regain Its Lost Mojo in 1Q17?

Previously, we looked at AK Steel’s (AKS) 1Q17 earnings estimates. In this article, we’ll look at some key updates the markets could be anticipating in the company’s 1Q17 earnings call.

Why Short Interest in Valero Soared in 2017

Valero Energy (VLO) has witnessed a rise in its short interest since mid-February 2017.

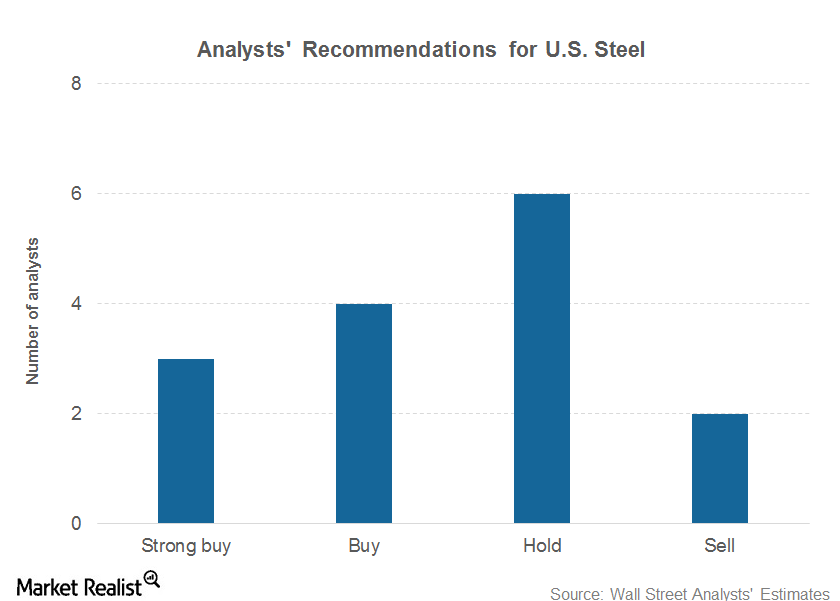

Analysts Might Take a Fresh Look at U.S. Steel Corporation

U.S. Steel Corporation will release its 1Q17 earnings on April 24 after the market closes. The company’s earnings conference call will be on April 25.

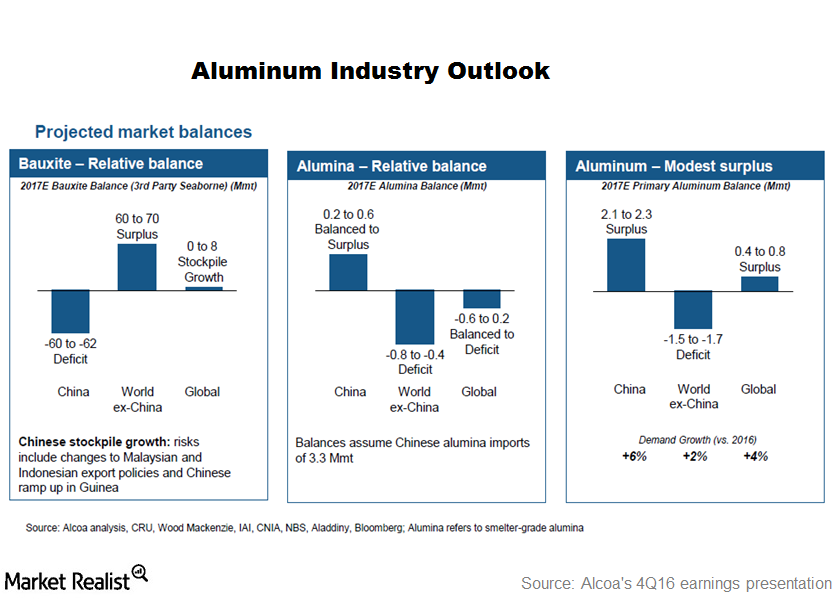

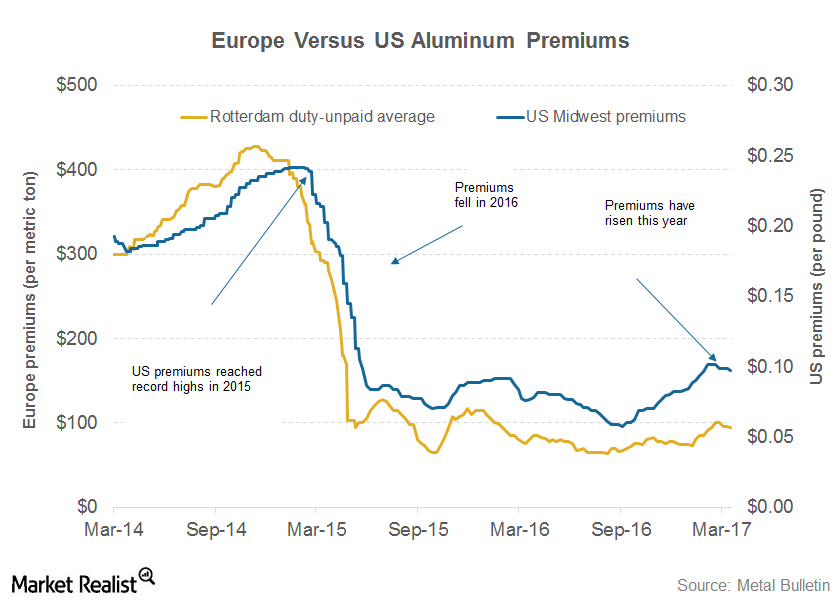

What Should Alcoa Investors Make of Aluminum Premiums?

Aluminum premiums are key indicators that investors in primary producers such as Century Aluminum (CENX), Norsk Hydro (NHYDY), and Rio Tinto (RIO) should track.

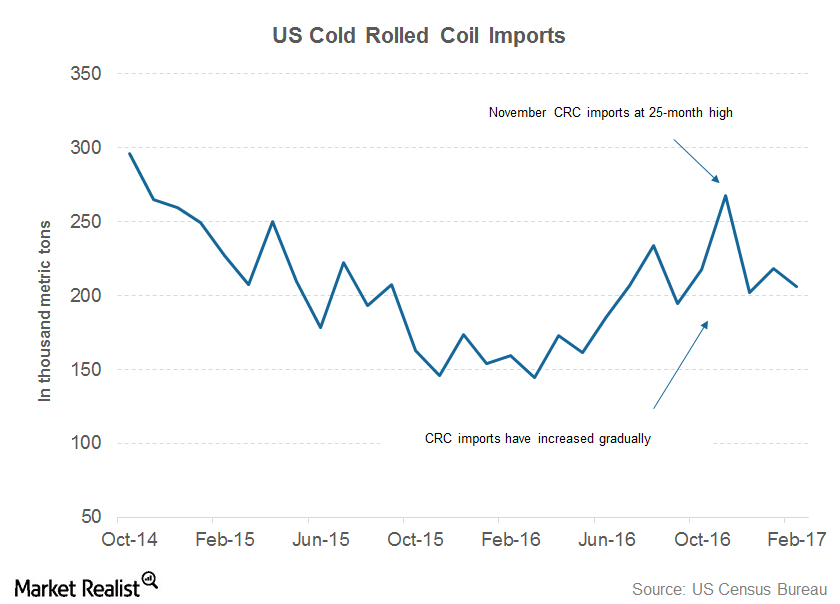

What the Divergence in Flat Rolled Steel Imports Tells Us

In this article, we’ll look at February 2017’s flat rolled steel imports and study whether there’s a divergence in the imports of these products.

How Does Tesoro’s PEG Compare to Its Peers’?

In this article, we’ll compare Tesoro’s (TSO) PEG ratio (price-to-earnings to blended growth rate) to those of its peers. We’ve considered the mean estimate of PEG.

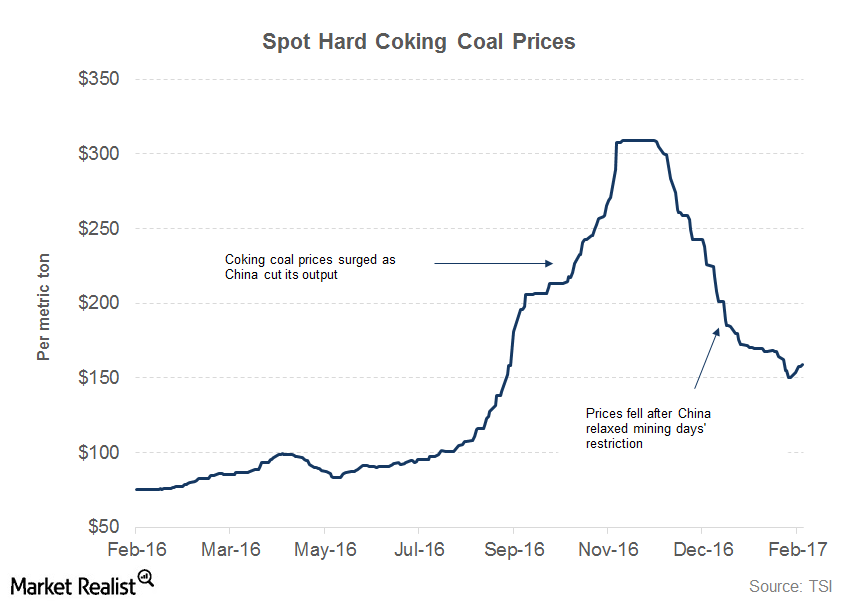

How Raw Material Prices Could Impact U.S. Steel’s Performance

ArcelorMittal’s mining operations generated an operating income of $203 million in 4Q16, almost double what they generated in 3Q16.