Southwest Airlines Co

Latest Southwest Airlines Co News and Updates

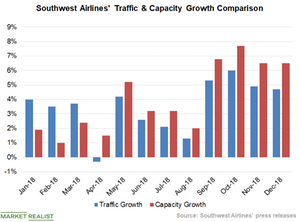

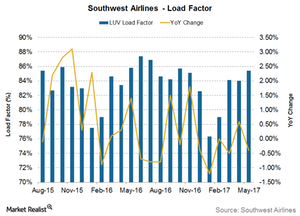

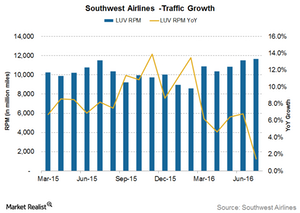

Southwest Airlines: Traffic Growth Lags the Capacity Growth Rate

Southwest Airlines’ (LUV) traffic or RPM continued to lag its capacity or ASM. The company reported its operating performance on January 8.

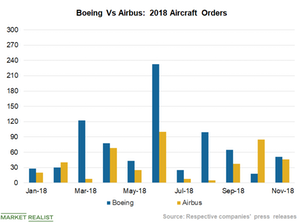

Boeing Winning the 2018 Aircraft Order Race against Rival Airbus

Boeing (BA) has been lagging behind Airbus in the order-booking race for the past few years. However, the company seems set on breaking that record this year.

How Top US Airlines Are Faring on the Valuation Front

With a return of more than 43% YTD (year-to-date), United Continental (UAL) shares have remained the biggest gainer in 2018.

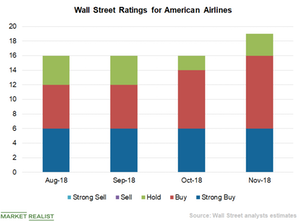

Wall Street Expects Double-Digit Price Surge in AAL Stock

American Airlines (AAL) has received a consensus “buy” rating from analysts polled by Reuters.

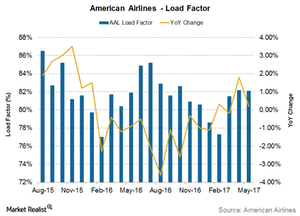

American Airlines’ Traffic Growth Outpaced Its Capacity Growth

American Airlines’ (AAL) traffic (revenue passenger miles) growth has exceeded its capacity (available seat miles) growth in the first nine months of 2018.

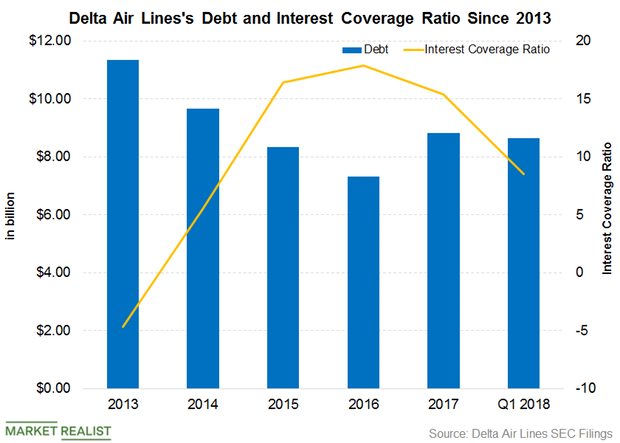

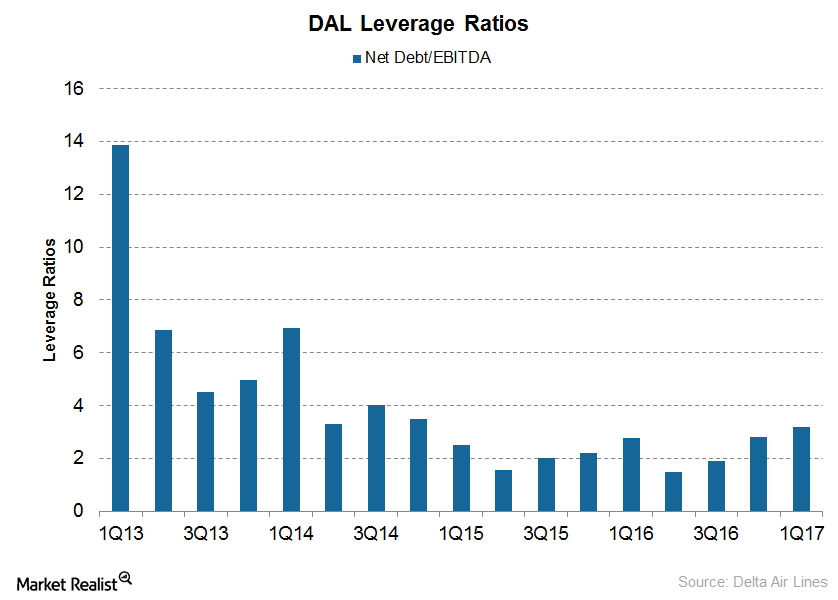

Delta Air Lines: Is Higher Debt a Concern?

Delta Air Lines’ higher debt means a higher interest expense and a higher DE (debt-to-equity) ratio. Delta Air Lines’ current DE ratio is 0.69x.

Which Stocks Have Announced $1,000 Bonuses?

In this series, we’ll be taking a look at the companies that have announced $1,000 dollar bonuses, pay raises, increased dividends, and buybacks in the last two months.

Here’s What Influenced the Outlook for Southwest Airlines

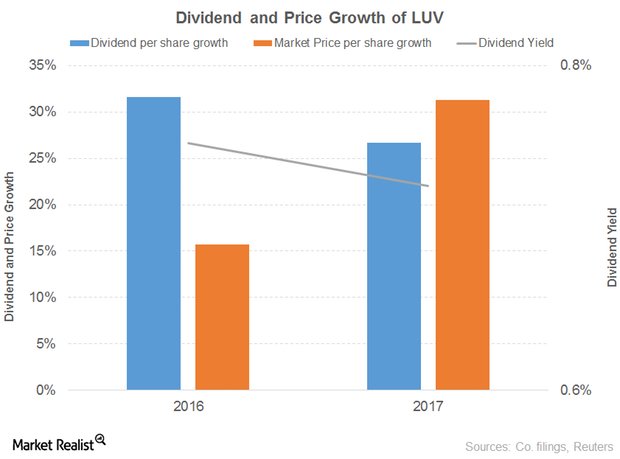

Southwest Airlines’ (LUV) operating revenue grew 3% and 4% in 2016 and 9M17, respectively.

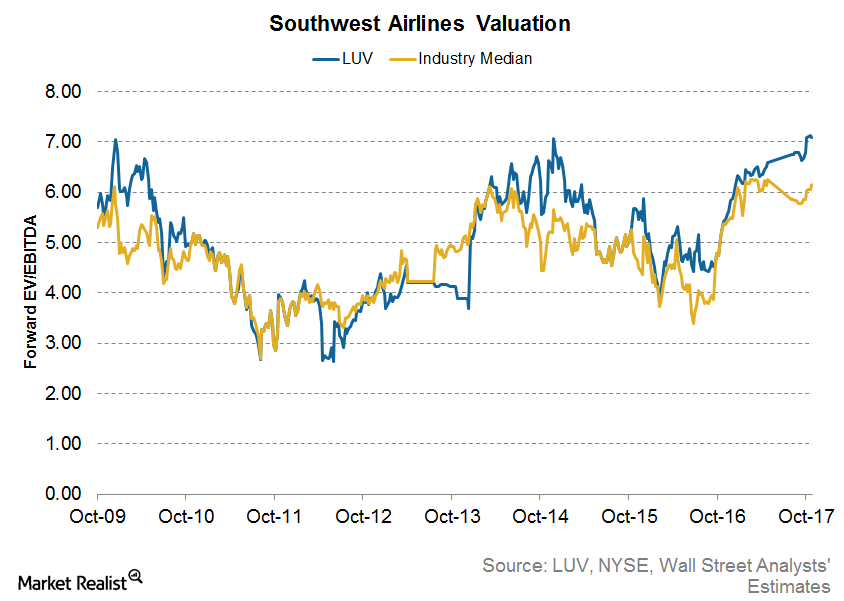

What Does Southwest Airlines’ Current Valuation Indicate?

Current valuation Southwest Airlines (LUV) has a forward EV-to-EBITDA[1. enterprise value to earnings before interest, tax, depreciation, and amortization] multiple of 7.1x. This is the highest multiple among the major airline carriers and is higher than its average valuation of 6.3x since September 2008. Peer comparisons American Airlines (AAL) is trading at a similar valuation […]

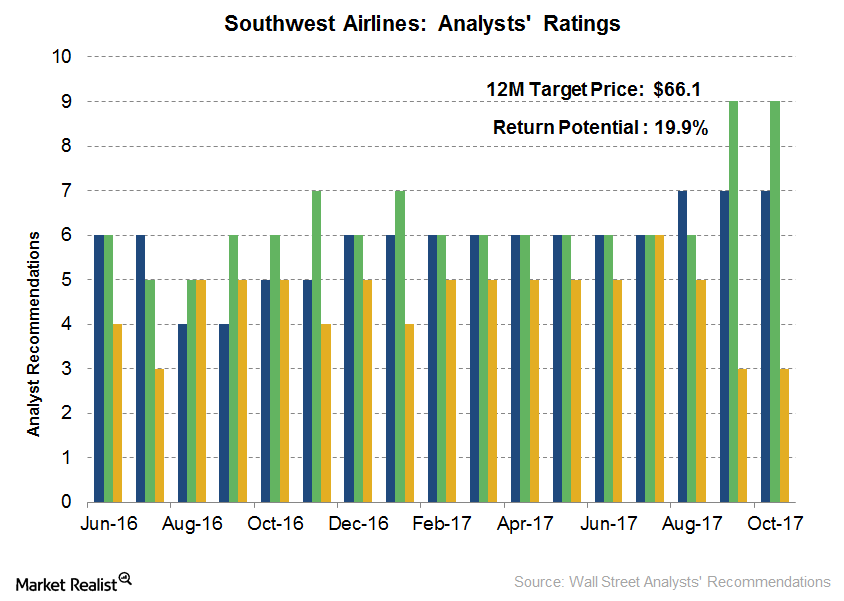

Analysts’ Recommendations for Southwest Airlines

Analysts’ recommendations Of the 17 analysts tracking Southwest Airlines (LUV), 36.8% of the analysts (seven analysts) gave a “strong buy” rating on the stock, while another 47.4% (nine analysts) gave a “buy” rating. The remaining 15.8% (three analysts) gave a “hold” rating. None of the analysts gave a “sell” or “strong sell” rating on the […]

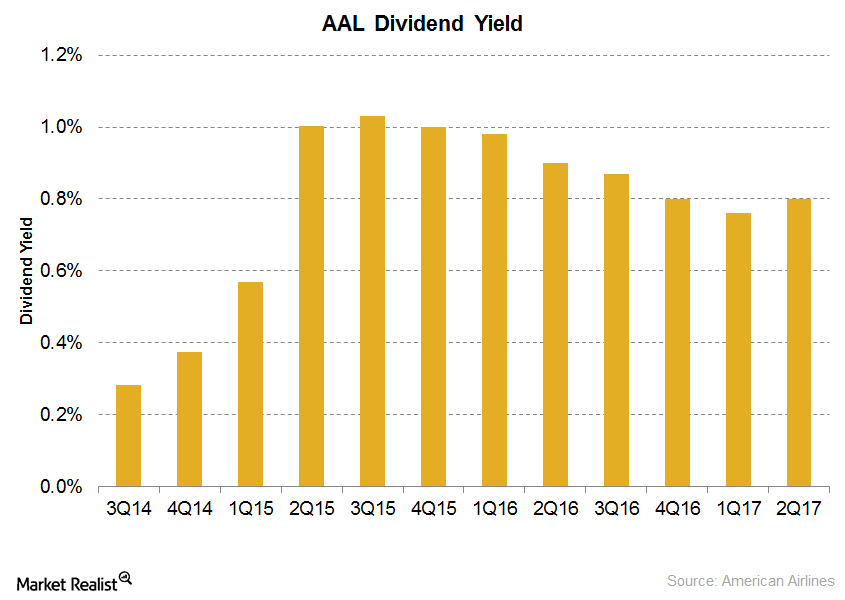

A Look at American Airlines’ Dividend Payouts

Only four airlines—Delta Air Lines (DAL), Southwest Airlines (LUV), American Airlines (AAL), and Alaska Air Group (ALK)—pay dividends to investors.

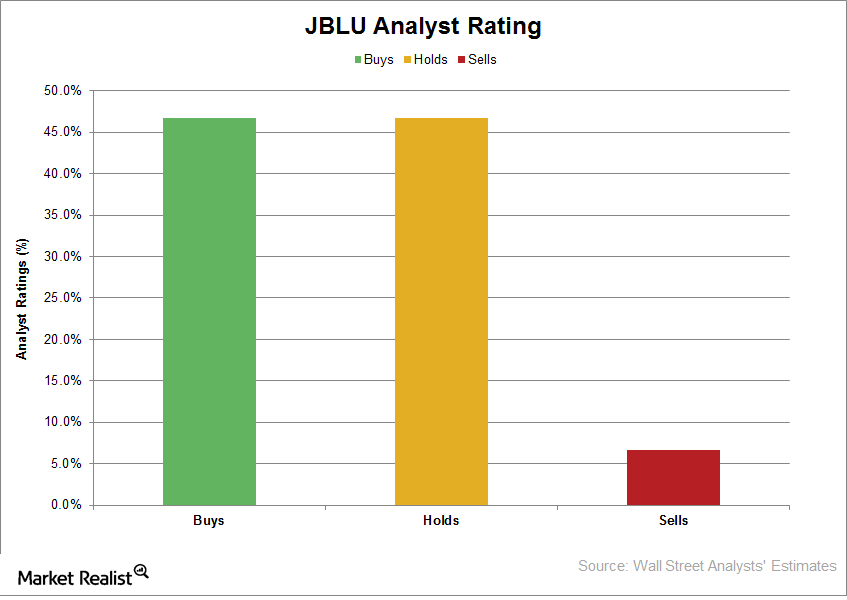

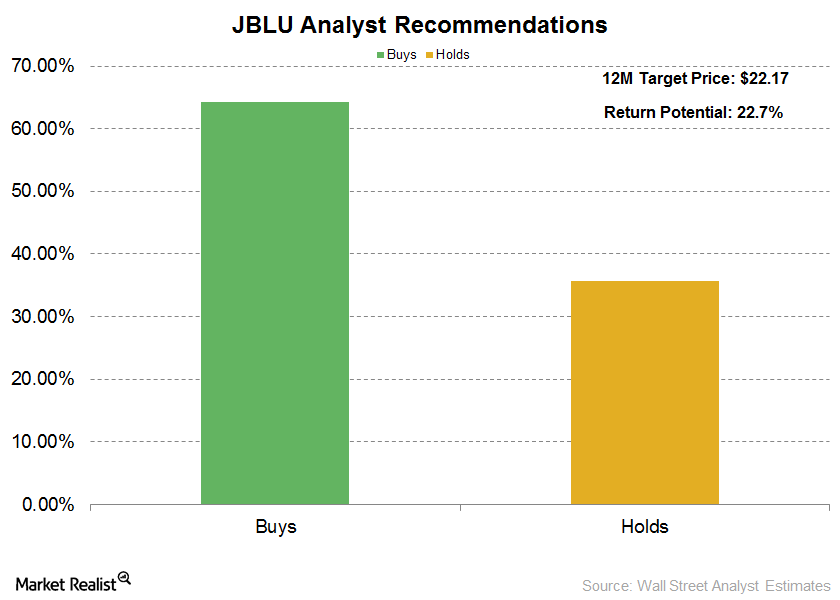

What Wall Street Analysts Recommend for JetBlue Airways

As of September 19, 2017, one analyst out of the 15 analysts tracking JetBlue Airways (JBLU) had a “strong buy” recommendation on the stock.

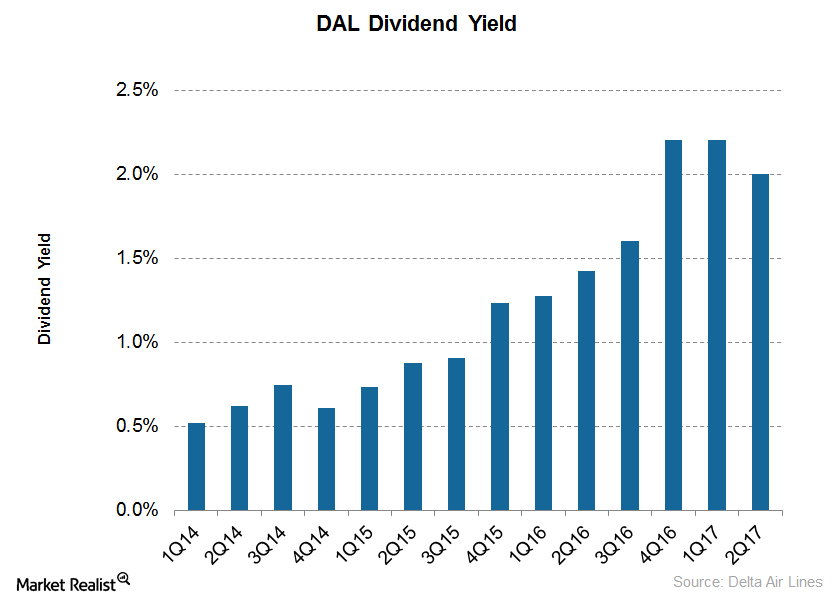

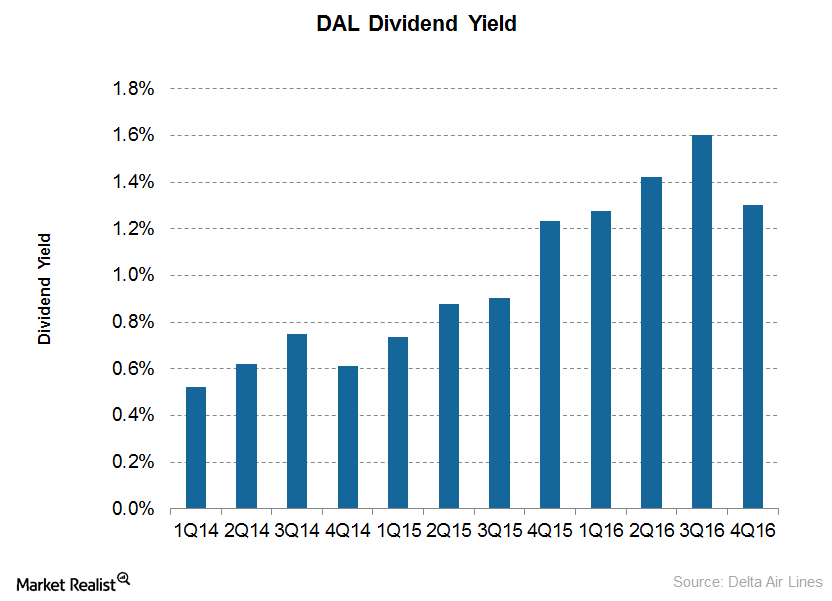

Can Delta Continue to Be the Best Airline Dividend Payer?

Delta Air Lines (DAL) has an indicated dividend yield of 2.0%, the highest among the four airlines that pay dividends.

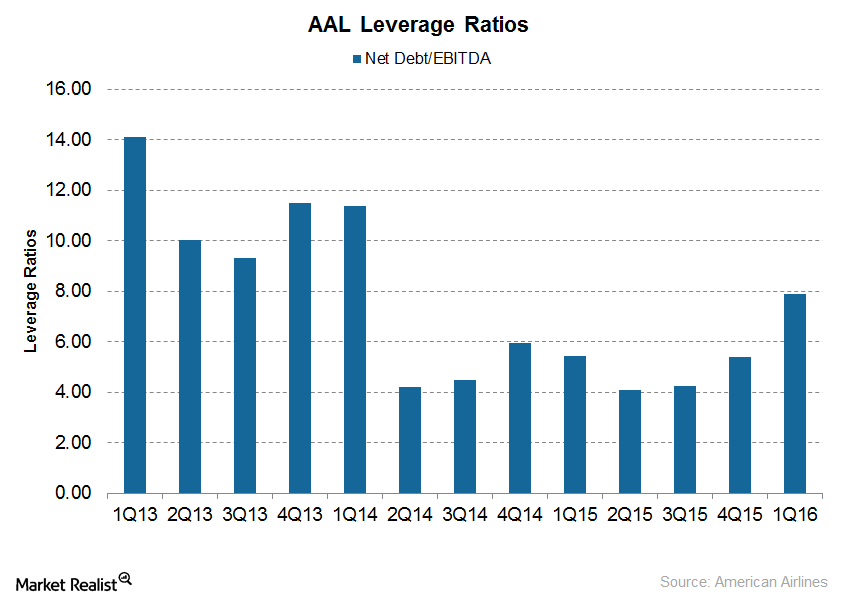

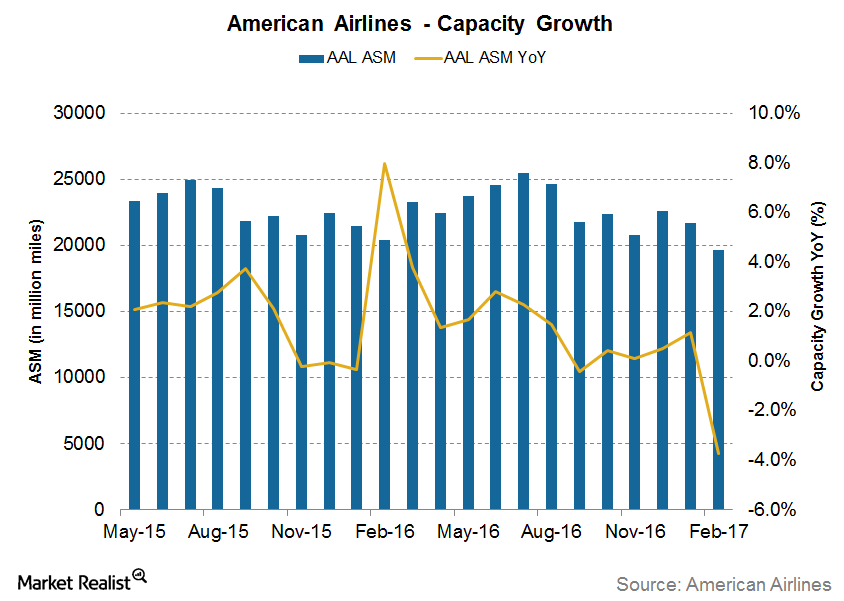

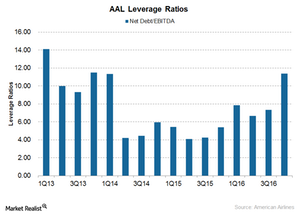

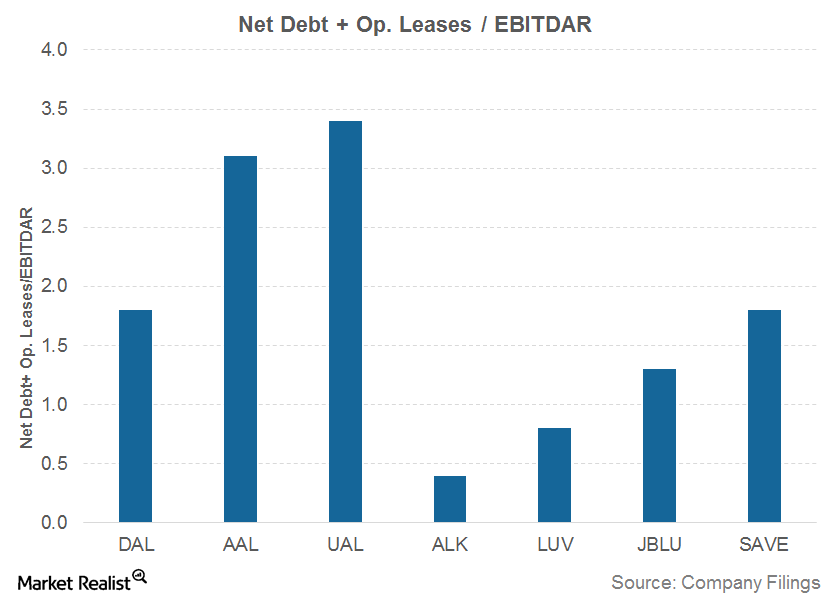

Why Investors Should Be Concerned about American Airlines’ Debt

AAL has paid little attention to its total debt, which rose from $20.8 billion at the end of 2015 to $24.3 billion at the end of 2016 and $24.5 billion at the end of 1Q17.

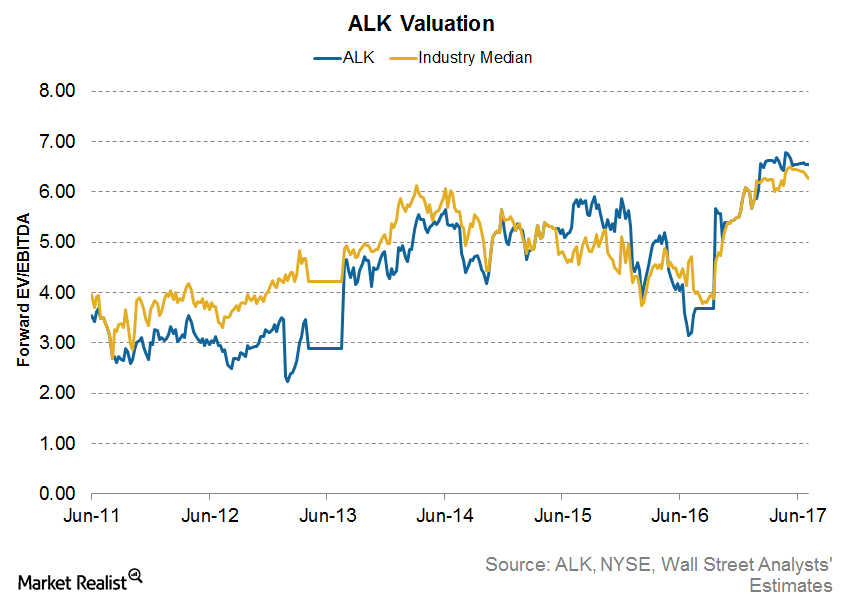

Inside Alaska Air’s Valuation: Cheap Enough?

Alaska Air Group (ALK) is now trading at 6.6x its forward EV-to-EBITDA ratio—one of the highest valuations in the industry.

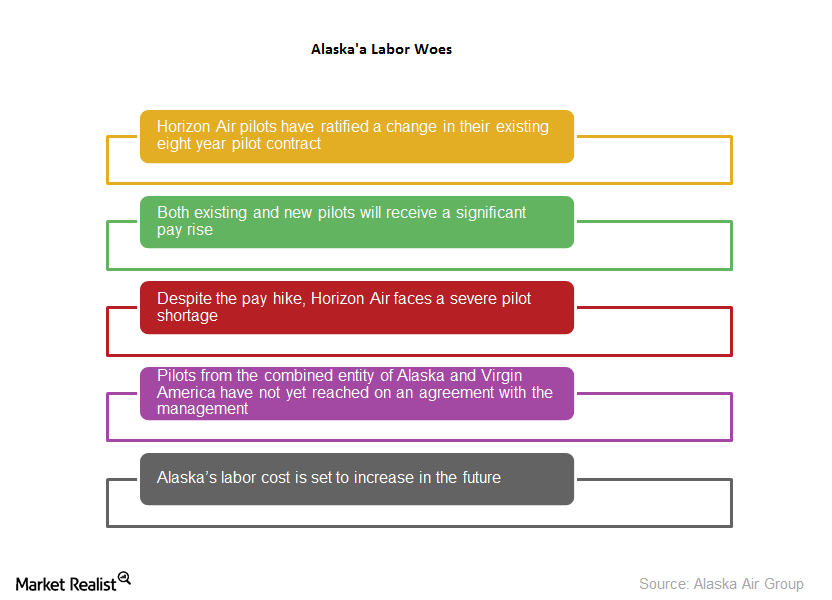

Horizon Air’s Pilots Ratify Change in Agreement

Horizon Air pilots have ratified a change in their existing eight-year pilot contract that entitles both existing and new pilots to receive significant pay raises.

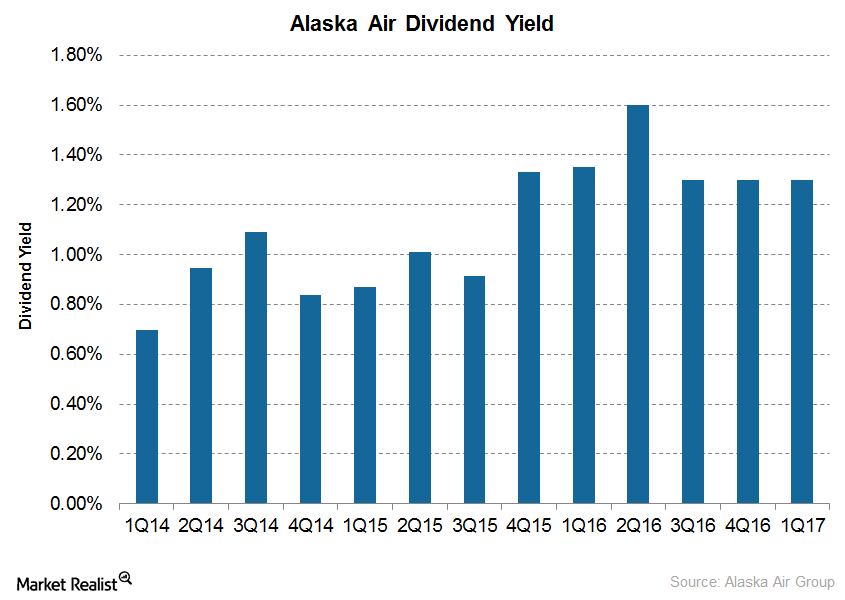

Inside Alaska Air’s Dividend Payout Prospects in 2017

There are only four airlines that currently pay dividends. This is due to the fact that airlines have struggled to stay profitable for a long time now.

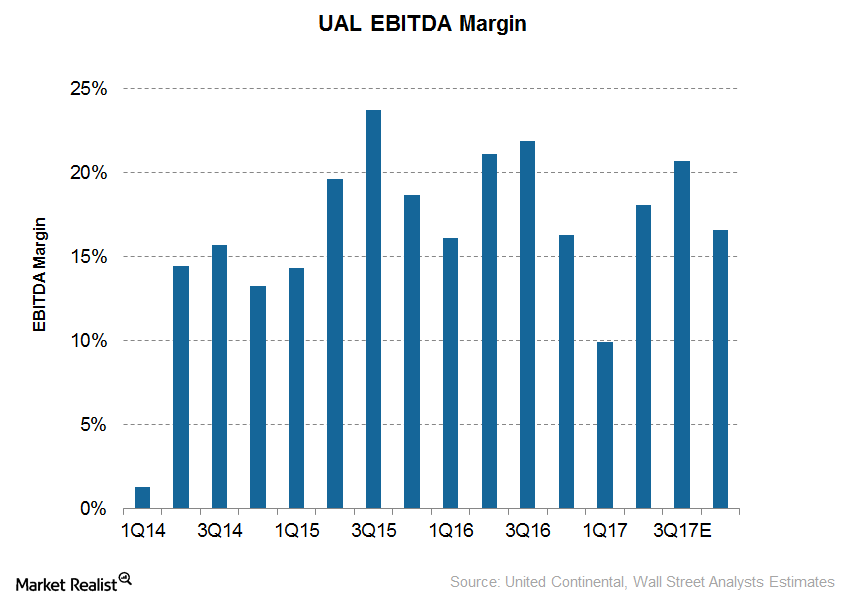

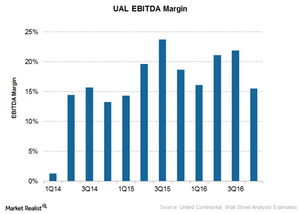

Can United Continental Improve Its Margins in 2017?

United Continental’s (UAL) EBITDA is expected to fall 10% to $1.8 billion.

What Delta Air Lines’ Debt Position Means for Investors

During 1Q17, Delta Air Lines’ (DAL) debt rose by ~$2 billion at a blended interest rate of just 3.3%.

Is LUV on Track to Achieve Its Unit Revenue Guidance?

Because Southwest Airlines’ (LUV) traffic growth lagged its capacity growth in three of the first five months of 2017, its utilization also fell in three of the five months.

Why American Airlines Improved Its Unit Revenue Guidance for 2Q17

AAL’s utilization rose 0.3% YoY (year-over-year) in February, then by 1.8% YoY in April and 0.2% YoY in May.

Will American Follow United Continental in High Capacity Growth?

For May 2017, American Airlines (AAL) reported a 2.3% YoY (year-over-year) growth in capacity—its highest growth so far in 2017.

Why American Airlines Has Higher Debt Compared to Its Peers

As opposed to most other airlines that have been reducing their debts, American Airlines’ (AAL) debt has risen, partly due to its focus on completing its integration with US Airways.

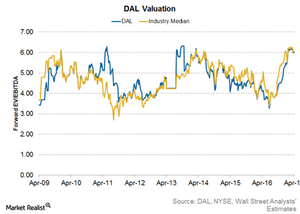

What’s Priced into Delta’s Valuation?

Delta Air Lines (DAL) is currently valued at 5.3x its forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple.

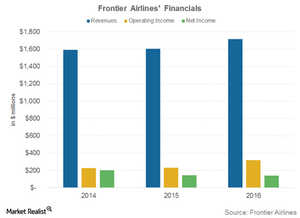

Frontier Airlines Cut Costs and Became Profitable

Frontier Airlines earned 42% of its revenue from ancillary fees or non-ticket revenue in 2016—a significant rise compared to 25% in 2015.

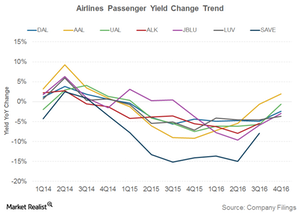

Airlines’ Passenger Yields Fall—What Does It Mean for Investors?

In 4Q16, Southwest Airlines’s (LUV) yields fell 4% year-over-year to 14.7 cents, followed by Alaska Air’s (ALK) 3.3% decline in yield to 13.4 cents.

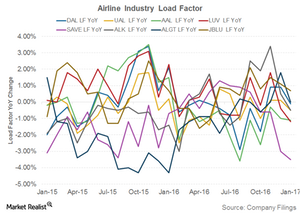

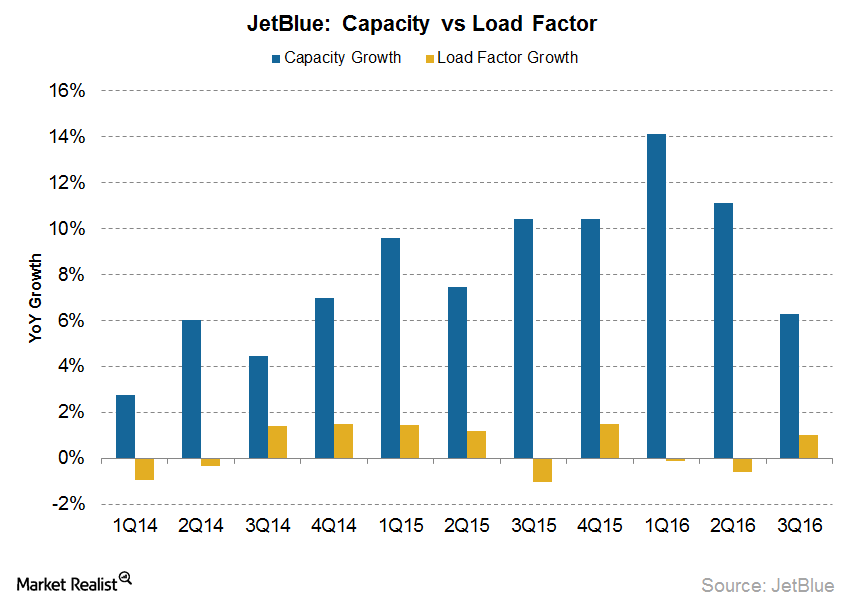

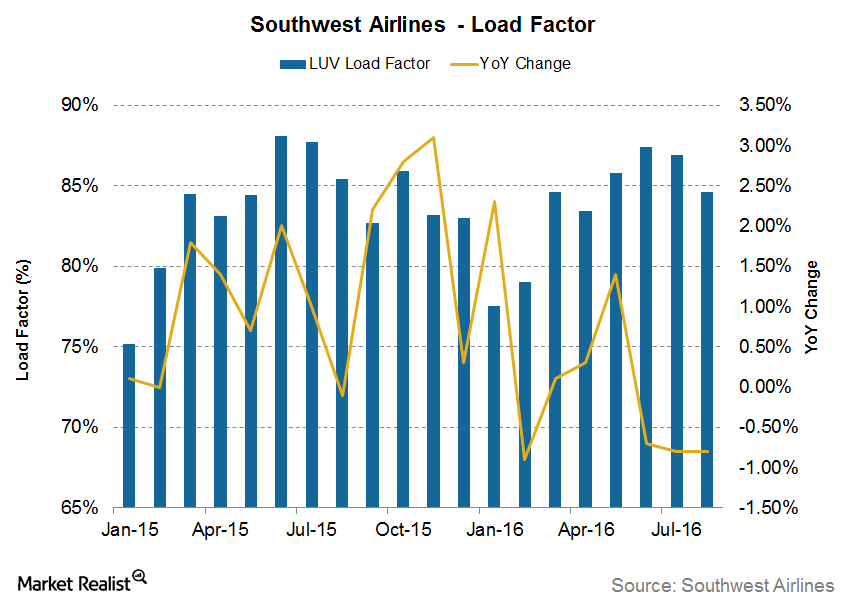

What Higher Capacity Means for Airlines’ Utilization

The load factor Airlines’ capacity utilization is measured using the passenger load factor, which is calculated by dividing traffic by capacity. Analyzing airlines’ load factors As discussed in the previous article, most airlines saw high capacity growth in January 2017. As a result, all airlines except JetBlue Airways witnessed a decline in their load factors. […]

Can Delta Air Lines Increase Its Dividend Payouts in 2017?

Delta Air Lines started paying dividends only in 2013, and it’s one of the few airlines that pay dividends.

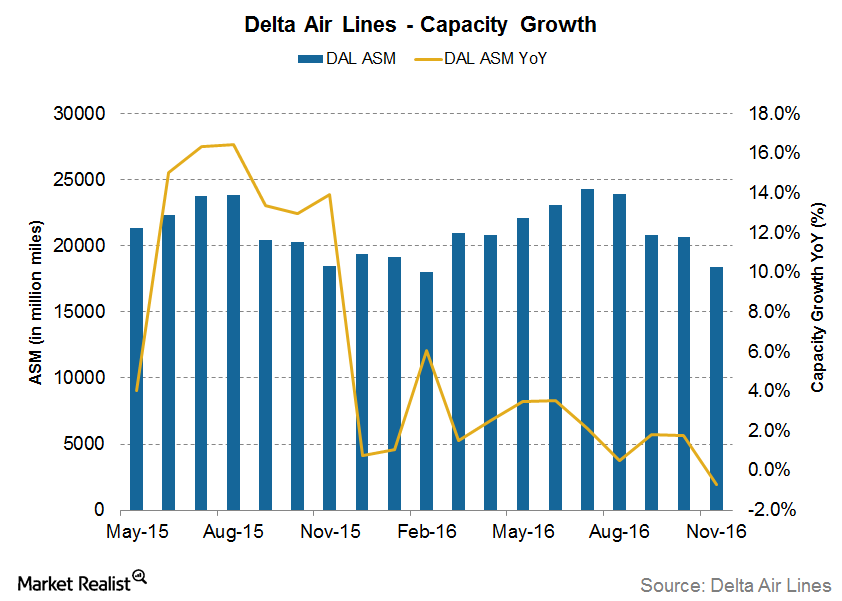

Will Delta Air Lines’ Strong Operational Performance Last?

Delta Air Lines (DAL) saw average traffic of about 50 million passenger miles for the quarter, a 0.8% year-over-year improvement

Will United Continental’s Margins Improve in 2017?

For 4Q16, analysts are expecting United Continental’s (UAL) EBITDA to fall 26% to $1.4 billion.

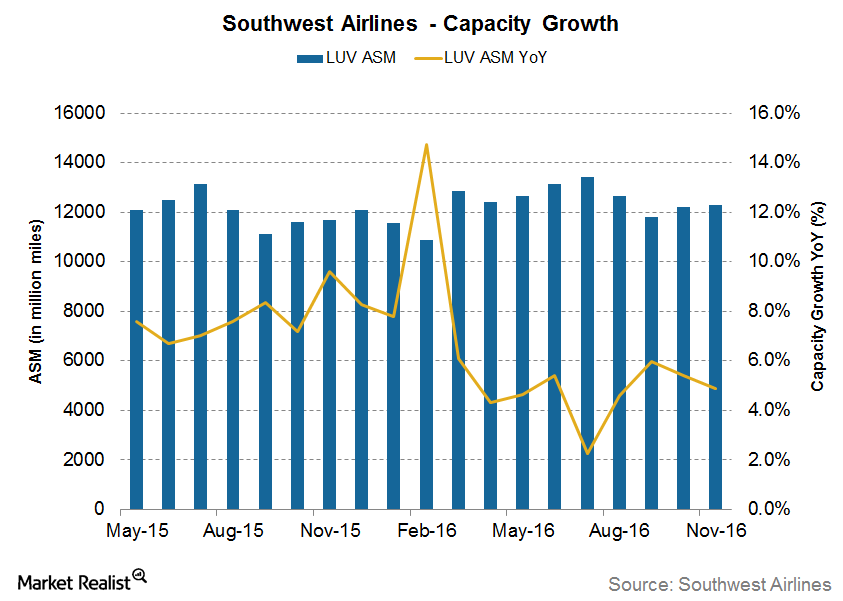

Southwest Airlines: Slowing Capacity Growth in November

For November 2016, Southwest Airlines’ (LUV) capacity grew 4.9% YoY (year-over-year). It’s slower than 5.4% YoY growth the previous month.

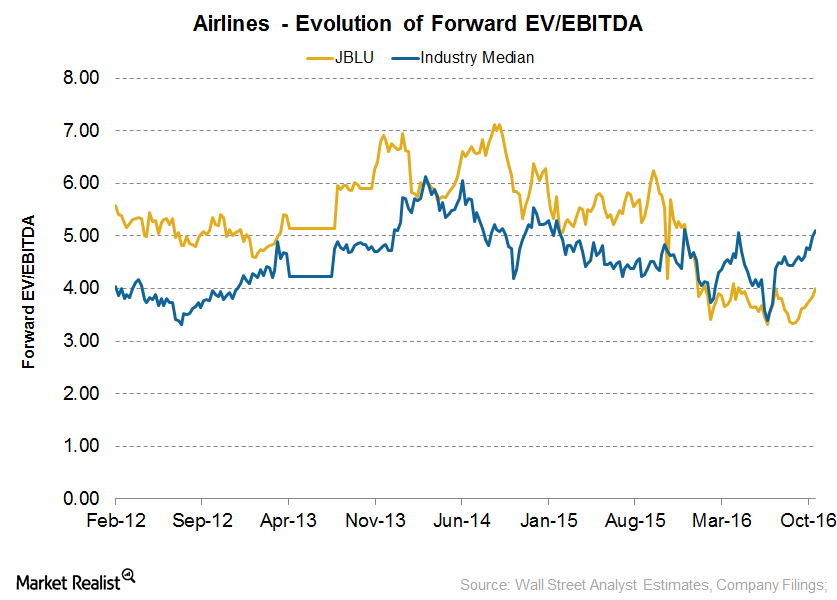

Could JetBlue’s Valuation Change after 3Q16?

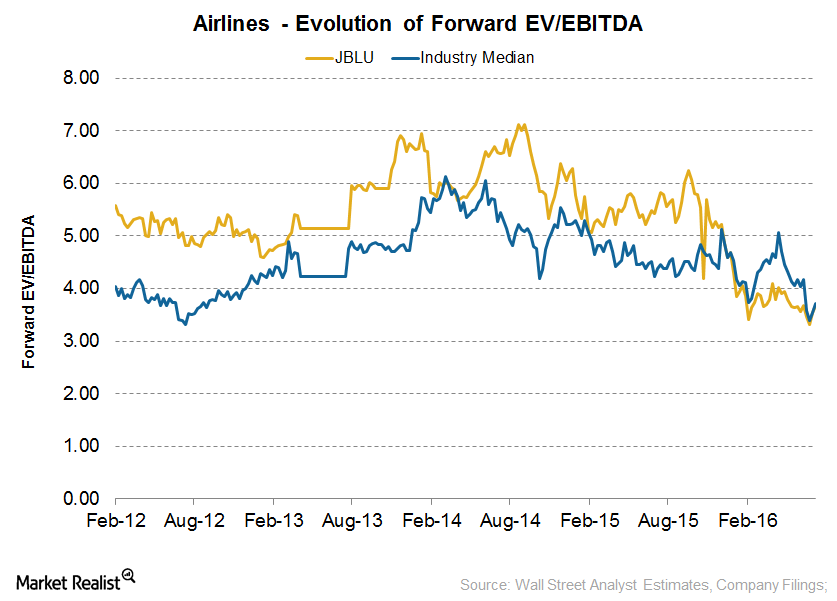

Currently, JetBlue Airways (JBLU) is valued at 4x its forward EV/EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple.

JetBlue: The Latest Analyst Estimates and Recommendations

Following JetBlue’s 2Q16 earnings release, analysts’ consensus estimate for revenues remains unchanged.

JetBlue Airways: Checking Up on Operational Performance in 3Q16

JetBlue Airways (JBLU) saw average traffic of about 11.9 billion passenger miles for the quarter, a 7.6% year-over-year increase

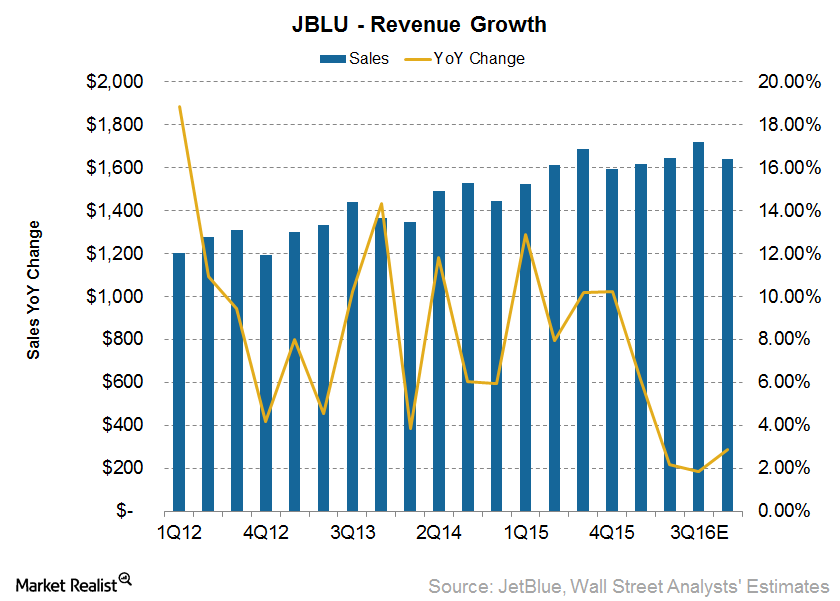

Do Analysts Expect JetBlue’s Revenue to Rise in 3Q16?

Analysts expect JetBlue Airways’ (JBLU) 3Q16 revenue to come in at $1.7 billion, a year-over-year rise of 2.2%.

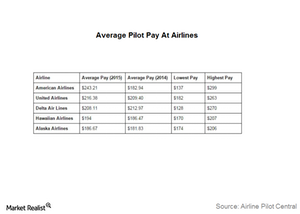

Why Is Delta’s Pilot Deal Important for the Airline Industry?

All airline pilots have their eyes on Delta Air Lines’ (DAL) final agreement with its pilots. This is because Delta’s deal will set a precedent in the industry.

Is Southwest Airlines On Track to Achieve Its Utilization Goals?

In 2015, Southwest Airlines’ prudent approach to capacity growth resulted in the better utilization of its capacity.

How Traffic Growth Lags behind Capacity at Southwest Airlines

In July 2016, Southwest Airlines’ (LUV) traffic grew by 1.4% YoY, which was slightly lower than its capacity growth of 2.3% YoY.

Could JetBlue Airways’ Valuation Change after 2Q16?

As of July 22, 2016, JetBlue was valued at 3.8x its forward EV-to-EBITDA multiple, which is lower than its average valuation of 4.8x since September 2009.

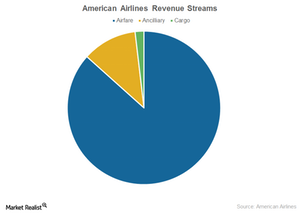

What Are American Airlines’ Key Revenue Streams?

In this part of the series, we’ll look at the main services and categories that add to American Airlines’ (AAL) revenues. The major component of revenues still comes from airfares.

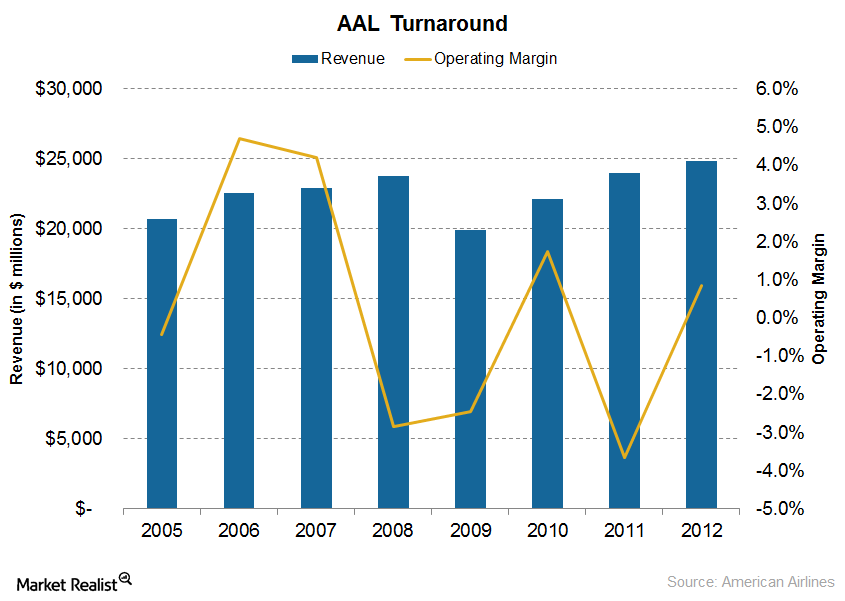

How Did American Airlines Recover from Bankruptcy?

Soon after US Airways declared its intention to merge with American Airlines, AAL started working on its weak points and restructuring costs.

Which Airline Has the Highest Leverage?

The airline industry is a capital-intensive industry with heavy investments required in building infrastructure, fleets, and their maintenance. As a result, airline stocks generally have high levels of debt on their balance sheets.Industrials Must-know: External factors that influence the airline industry

The airline industry has contributed to the globalization of the world economy. It connects buyers and sellers. It also transports goods across nations. It breaks the barrier of distance and time. The industry’s future looks bright. Travel expenditure in the U.S. is expected to grow by 4.3% in 2014 and 5.1% in 2015.

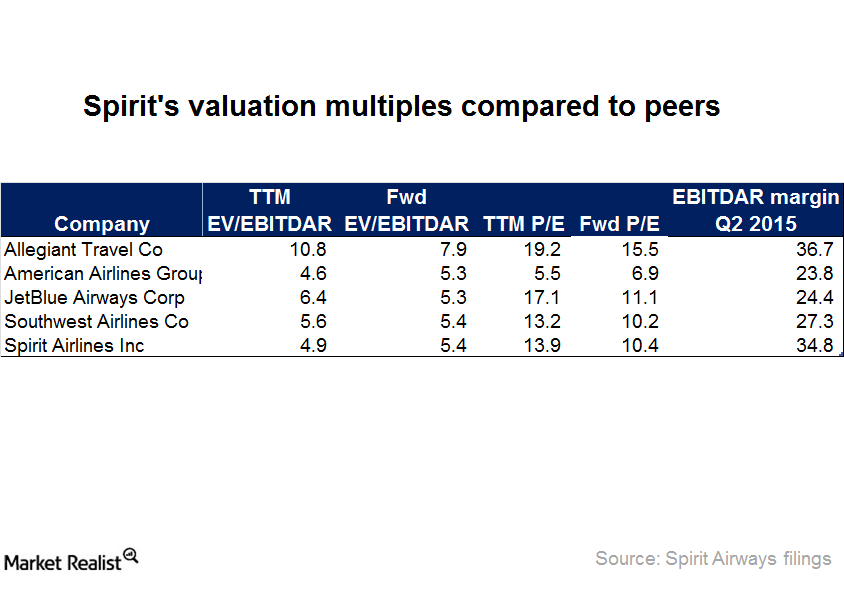

Spirit Airlines’ Valuation Ratio: How Does It Stack Up?

Spirit and its competitors have seen their EV/EBITDA decrease in the last six months due to the fear of a large increase in available seat miles.

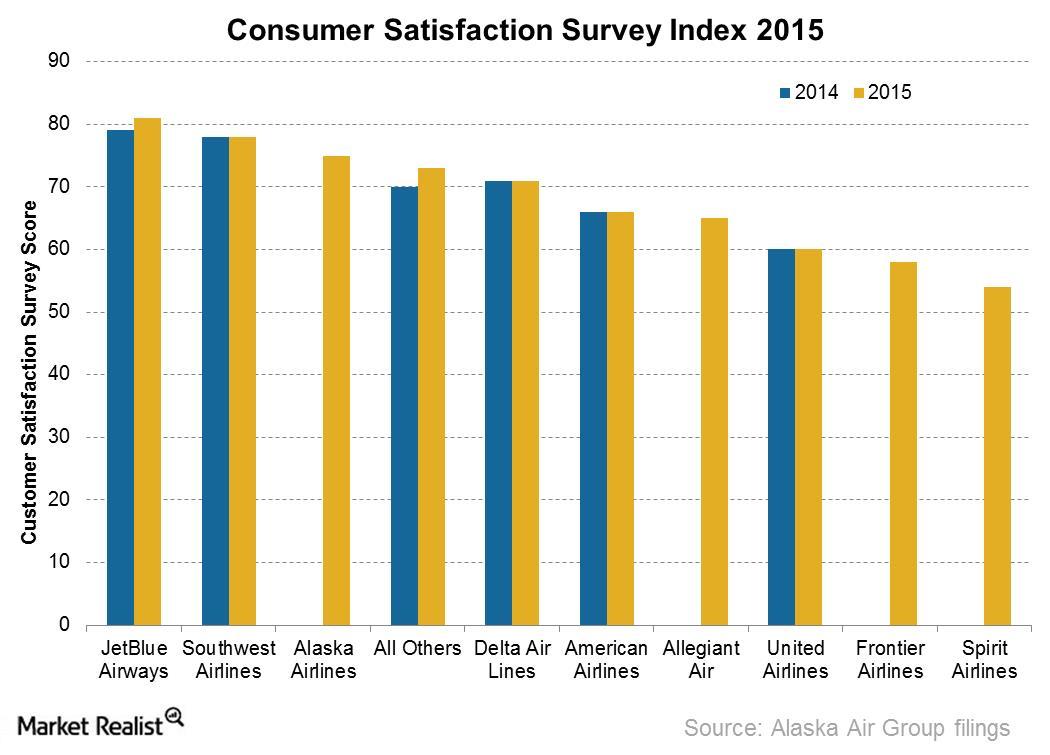

Alaska Airlines’ Keys to High Customer Satisfaction

For the seventh consecutive year, Alaska Airlines held the top spot in Customer Satisfaction among the Traditional Network Carriers survey conducted by J.D. Power.

Southwest’s Low Cost Strategy Helps Maintain a Competitive Edge

Southwest is known to be the pioneer of low cost travel in the industry. Its 42-year record of profitable operations is enough to prove the success of the company’s business model.

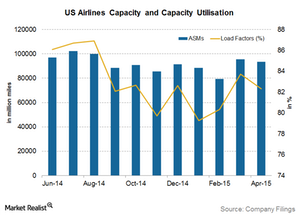

Improving Capacity Utilization Adds to Airline Profitability

Capacity utilization has improved from the lows of ~57% in the 1970s to ~76% in 2014 and 81.88% in year-to-date 2015.

The Key Variables Impacting Airline Stocks

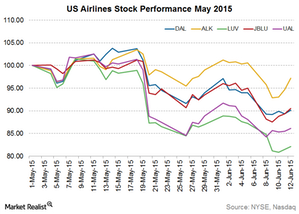

A strengthening dollar led to improved profitability for US airlines in 1Q15 while subduing profitability for non-US airlines. This further increased the industry’s performance gap across the globe.

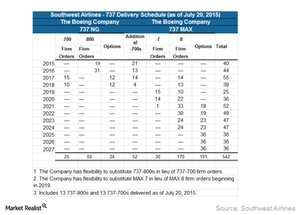

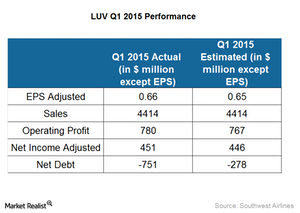

What Were Southwest’s Key Performance Drivers for 1Q15?

Southwest Airlines posted excellent financial performance metrics in 1Q15, including ~6% growth in available seat miles.Industrials Why political and legal factors impact the airline industry

The airline industry is widely impacted by regulations and restrictions related to international trade, tax policy, and competition. It’s also impacted by issues like war, terrorism, and the outbreak of diseases—such as Ebola. These issues are political. As a result, they require government intervention.