Jack In The Box Inc

Latest Jack In The Box Inc News and Updates

Why Chipotle Has A Lot Of Room For Unit Growth

Unit growth isn’t the only factor that drives revenue. A restaurant can keep adding more restaurants. Eventually, it can capture newer markets. This is what Chipotle is doing.

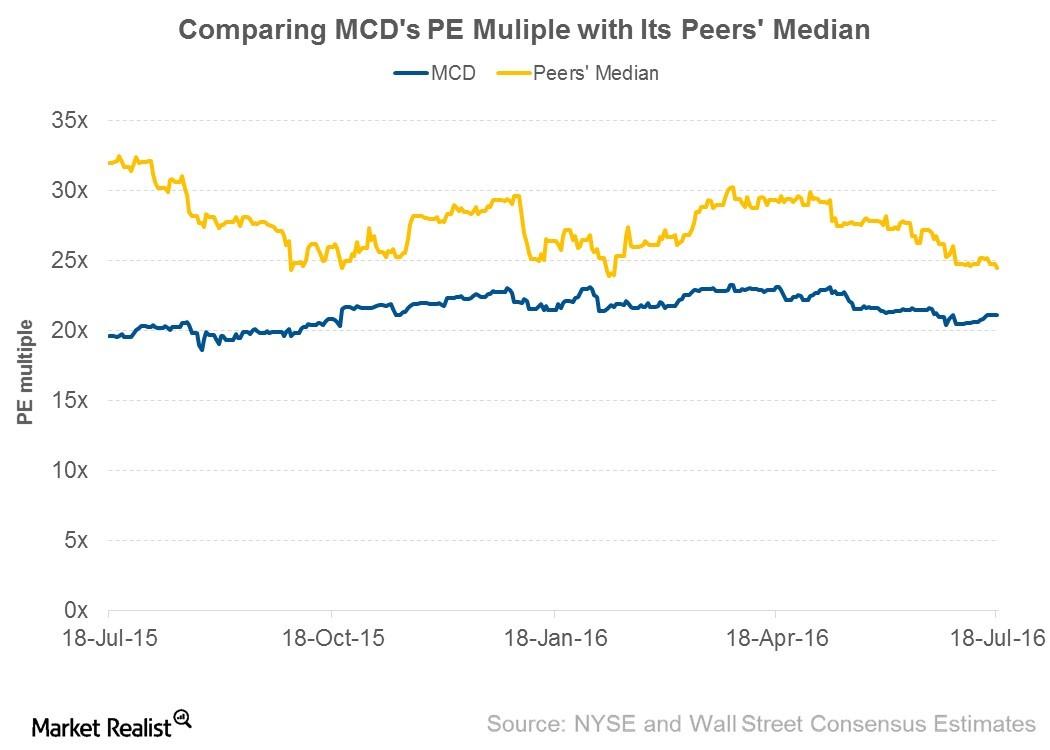

Can 2Q16 Results Drive McDonald’s Valuation Multiple Up?

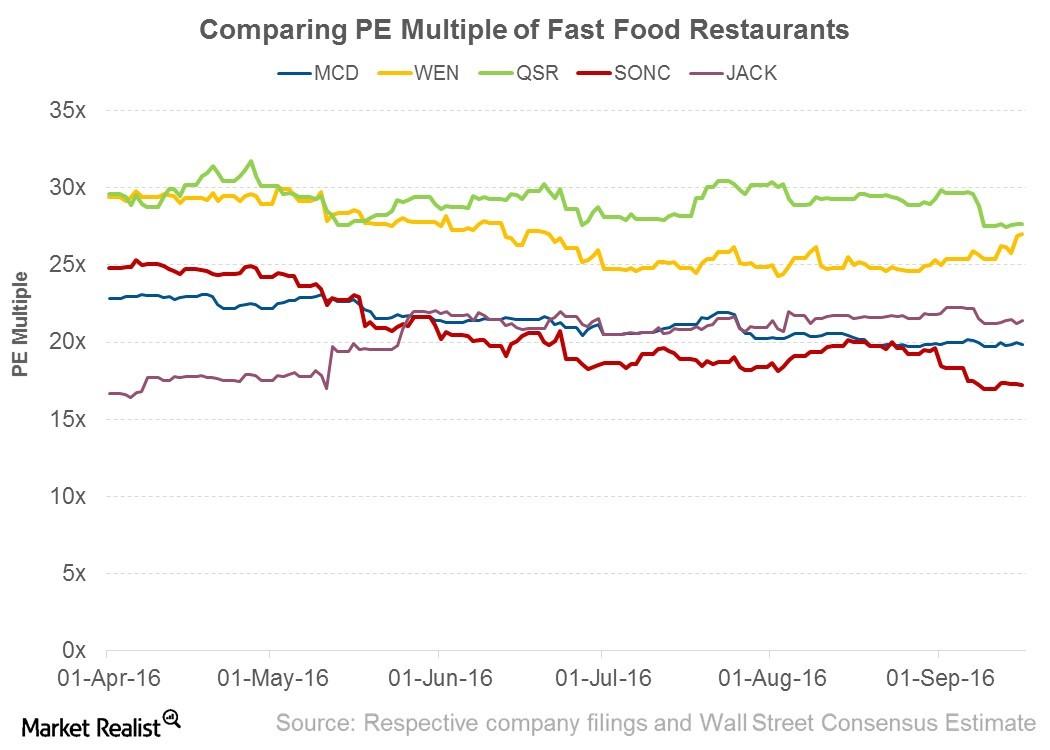

Valuation multiple Investors should look at valuation multiples when deciding whether to enter or exit a stock. Valuation multiples are driven by perceived growth, risk and uncertainties, and investors’ willingness to pay for a stock. There are various multiples to evaluate a stock. In this article, we’ll use the PE (price-to-earnings) ratio due to its […]

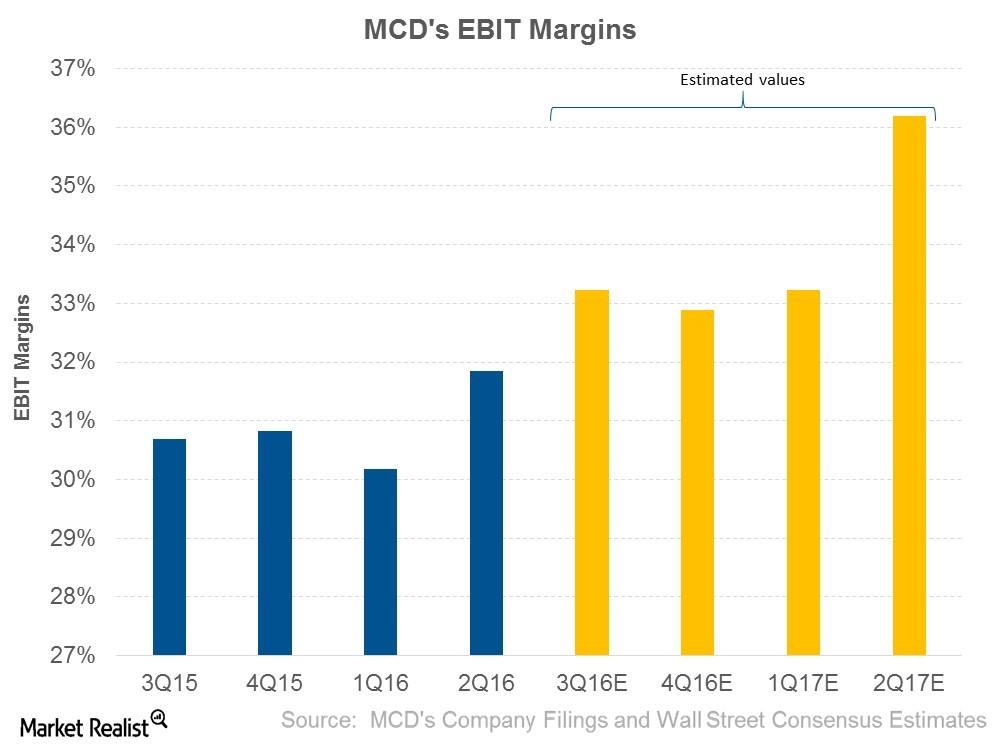

How Will McDonald’s Expand Its EBIT Margins?

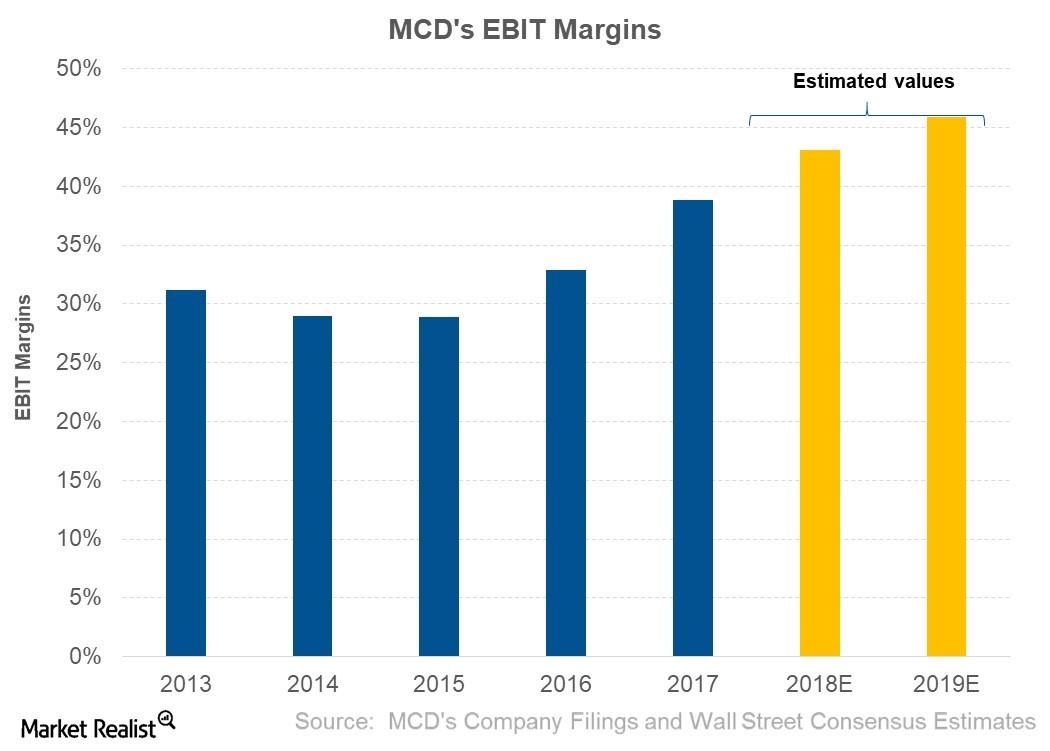

Wall Street analysts are expecting McDonald’s (MCD) to post EBIT of $2.1 billion in 3Q16. This represents an EBIT margin of 33.2% compared to 30.7% in 3Q15.

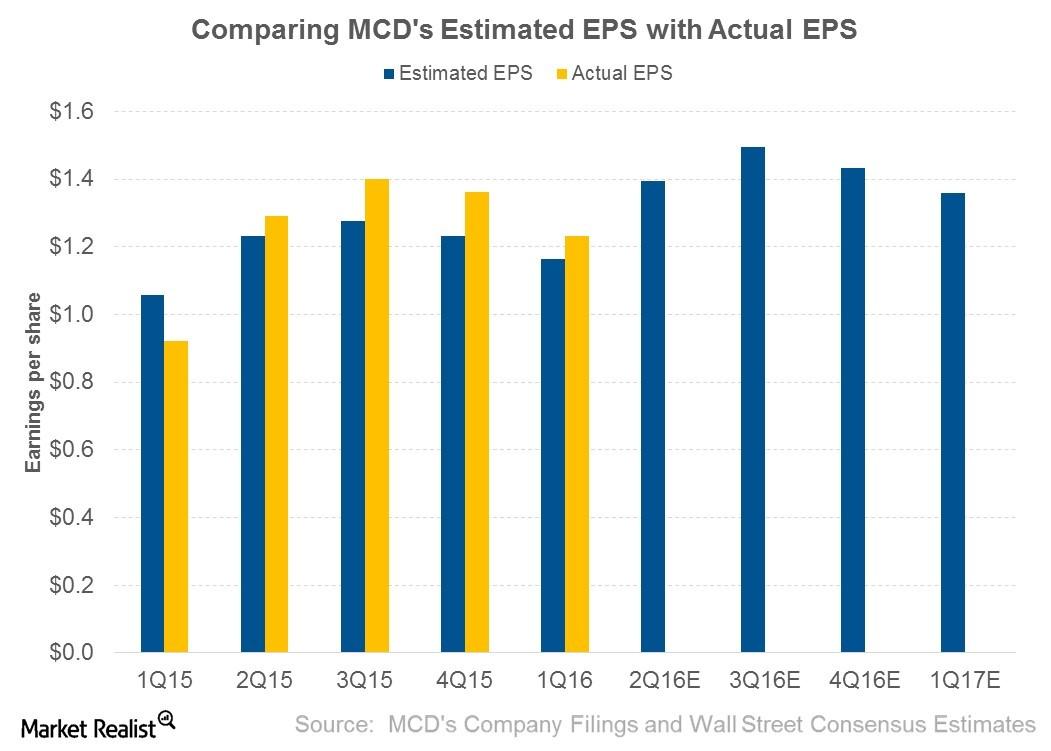

Will McDonald’s 2Q16 Earnings Beat Analysts’ Estimates?

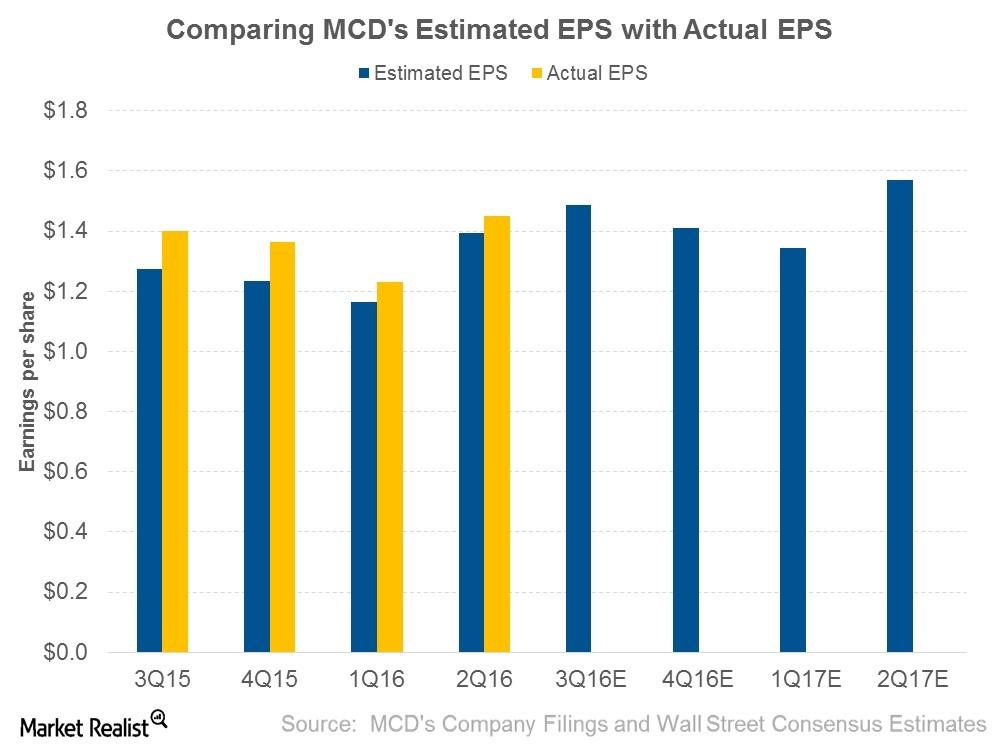

So far in this series, we’ve discussed McDonald’s (MCD) estimated revenue, sources of revenue, and estimated EBIT (earnings before interest and tax) margins.

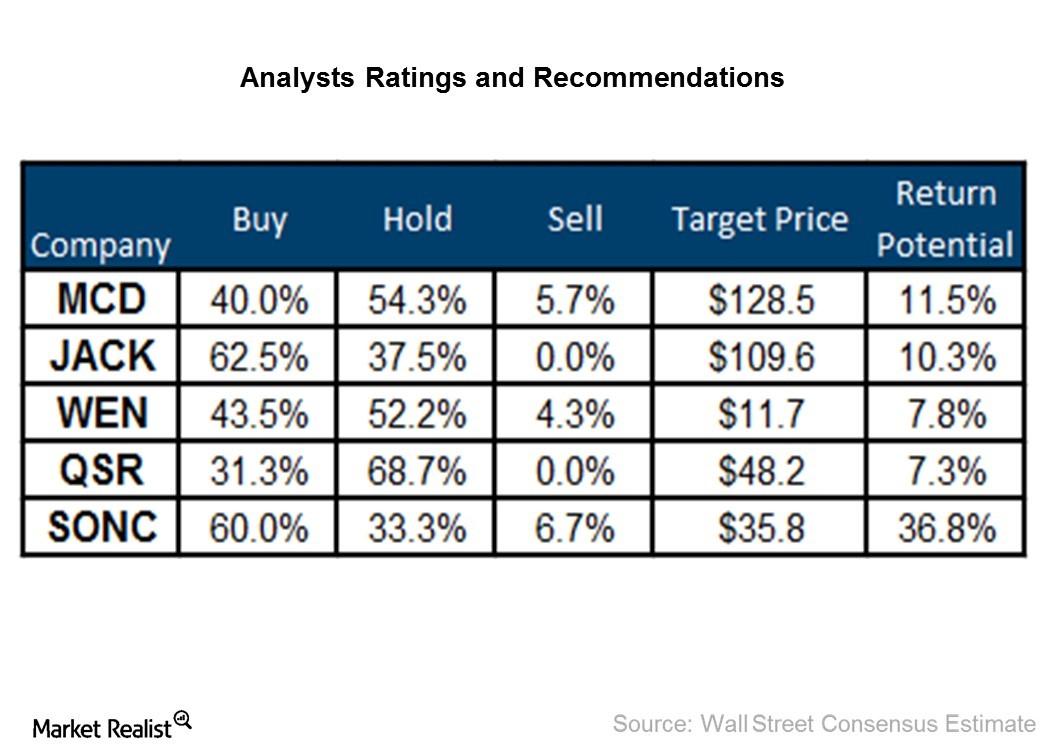

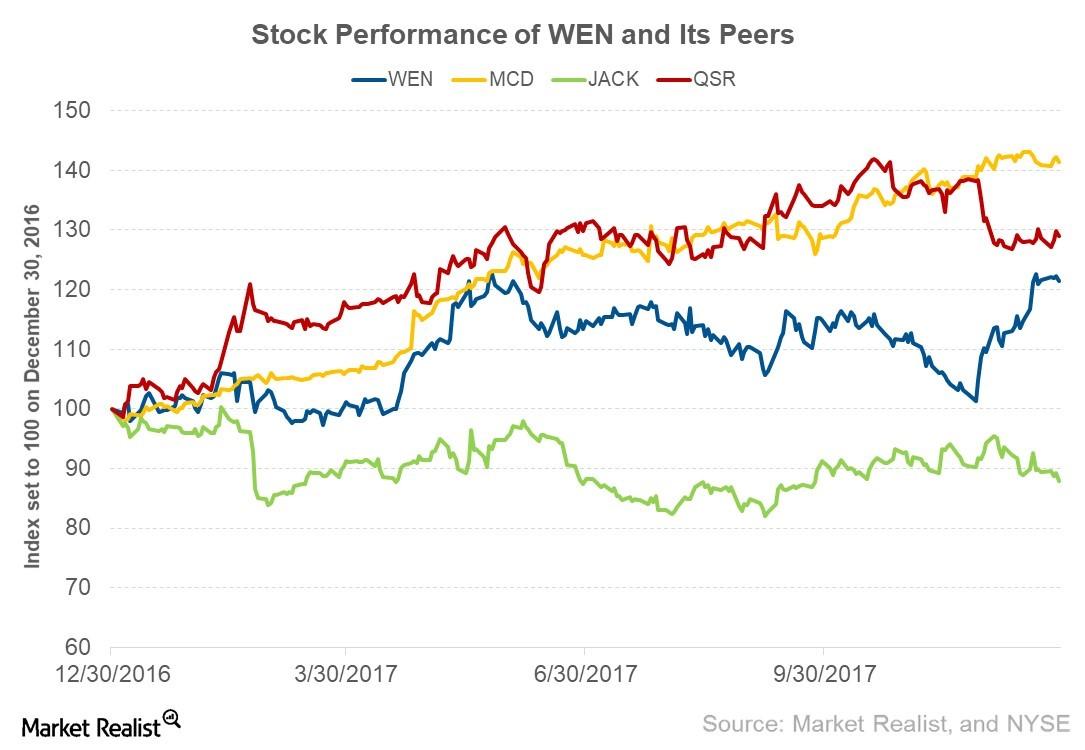

Which Fast Food Restaurants Do Analysts Favor?

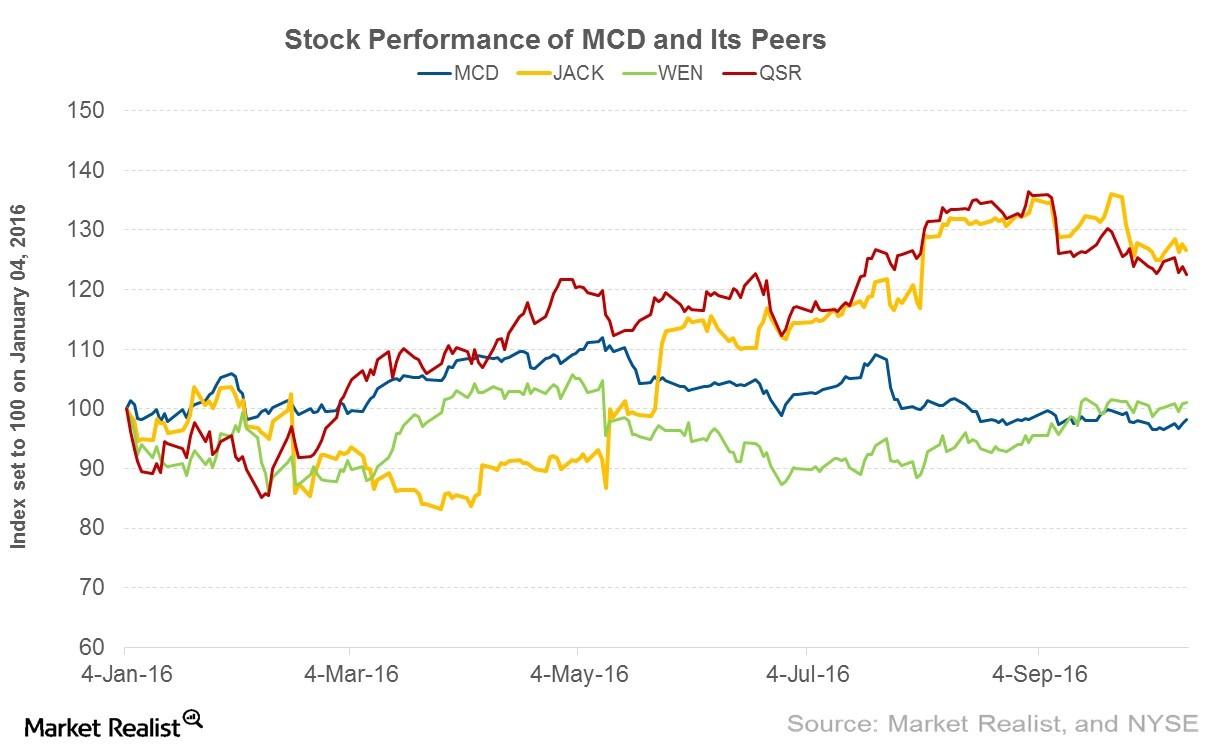

Jack in the Box (JACK) and Restaurant Brands International (QSR) are analysts’ favorites among the companies we’ve reviewed in this series.

Can Investors Expect Momentum from McDonald’s 3Q16 Earnings?

McDonald’s (MCD) is scheduled to announce its 3Q16 results on October 21, 2016. As of October 13, 2016, it was trading at $115.40, a fall of 9.4% from July 25.

Can McDonald’s Beat Analysts’ Earnings Estimates Again in 3Q16?

In the last four quarters, McDonald’s has beaten analysts’ estimates. In 3Q16, analysts are expecting the company to post EPS of $1.48, a year-over-year rise of 6.1%.

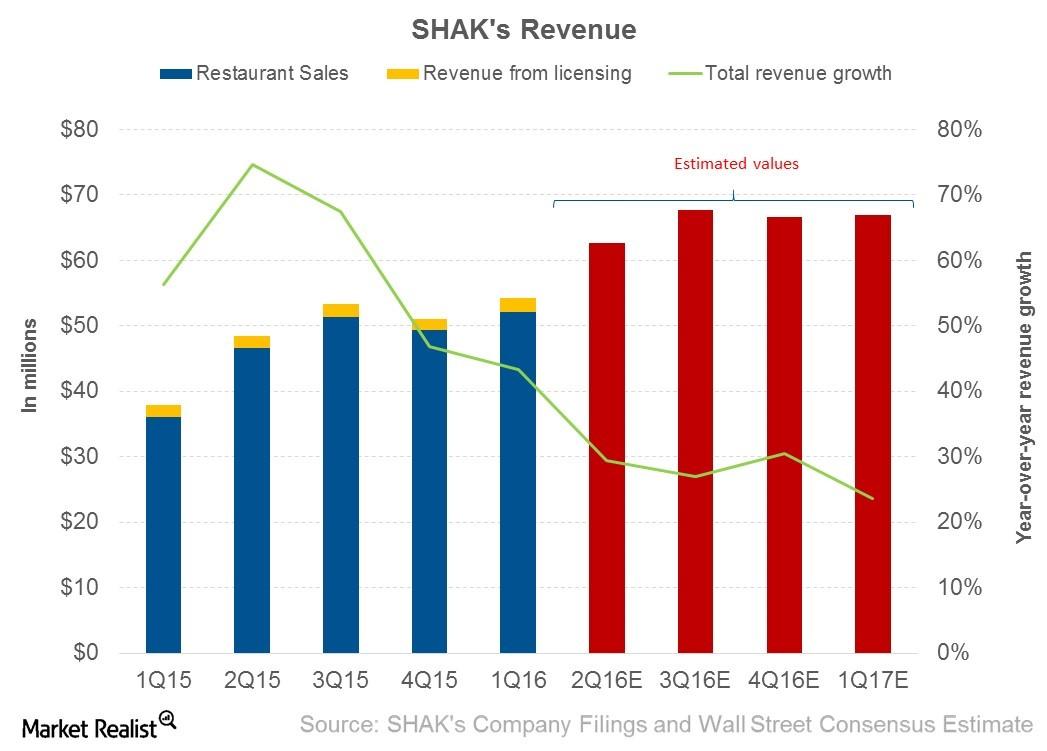

What Is the Outlook for Shake Shack in 2016?

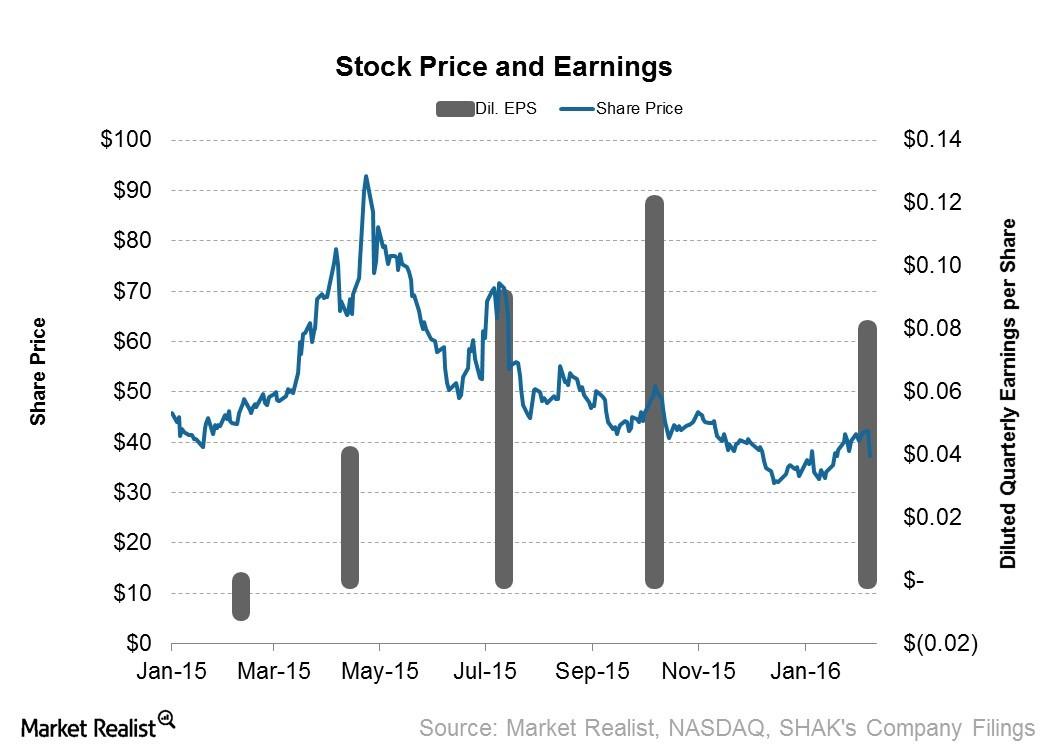

A New York–based fine casual restaurant chain, Shake Shack (SHAK) announced its 4Q15 results on March 7, 2016. SHAK reported an overall revenue of $51.1 million and earnings per share of $0.08.

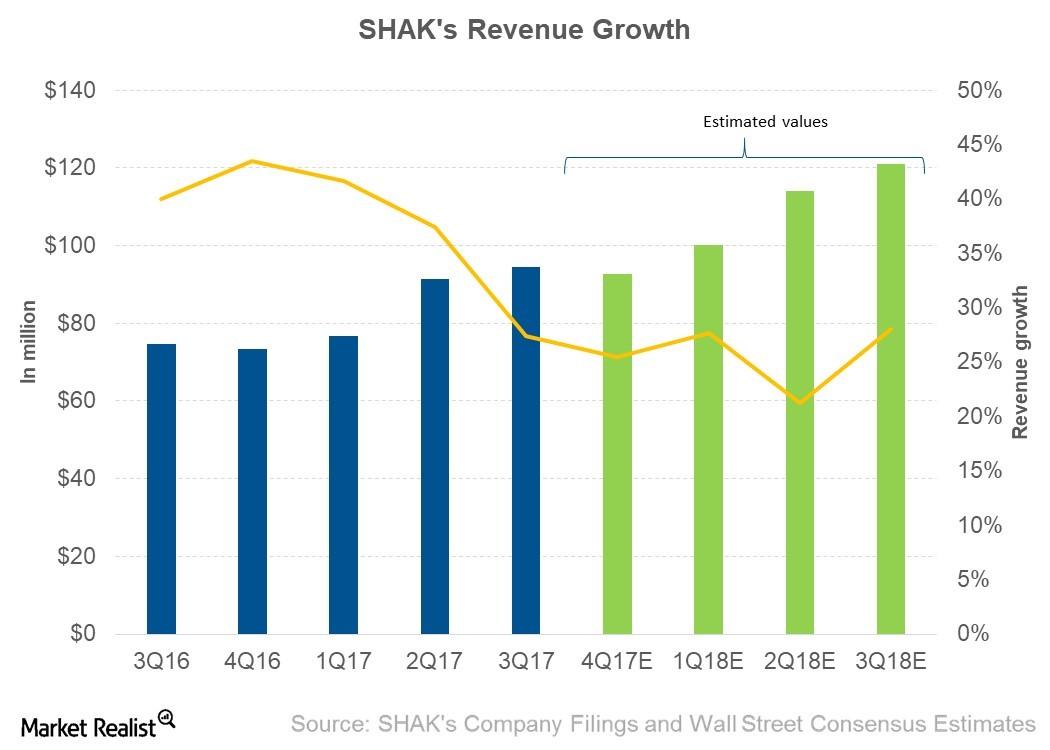

Why Analysts Are Expecting Shake Shack to Rise over the Next 4 Quarters

For the next four quarters, analysts are expecting Shake Shack (SHAK) to post revenues of $427.9 million, which would be a 27.4% YoY (year-over-year) rise.

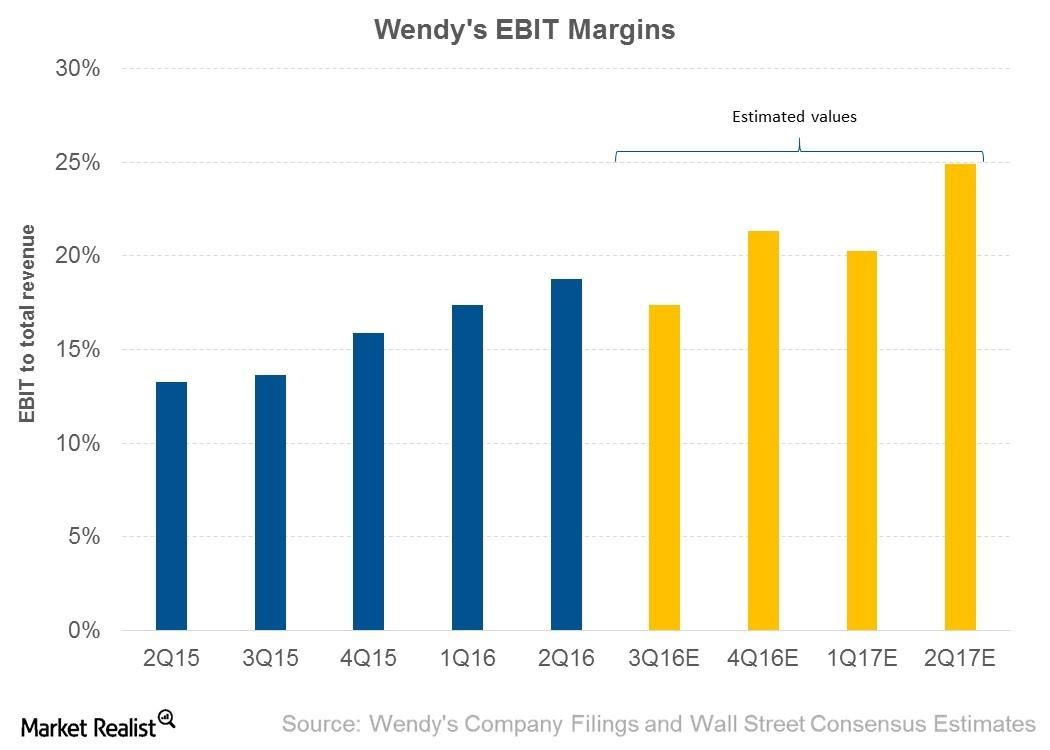

Why Did Wendy’s EBIT Margins Expand in 2Q16?

In 2Q16, Wendy’s posted EBIT of $71.7 million—an EBIT margin of 18.7% compared to 13.3% in 2Q15. Analysts expected the EBIT margin to be 16.7%.

Must-Know: McDonald’s Has Got Tough Competition

McDonald’s (MCD) competition includes large international and national food chains as well as regional and local retailers of food products.

What to Expect from Jack in the Box’s Q2 Earnings

For the second quarter, analysts expect Jack in the Box to report revenue of $211.1 million—a fall of 2.1% from the second quarter of 2019.

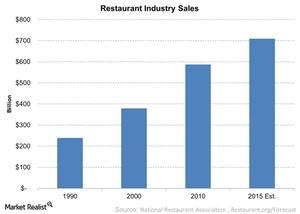

The Restaurant Industry: An Overview

More Americans are eating out, and they’re eating out more often. The restaurant industry’s share of the food dollar is 51%, up from 25% in 1955.

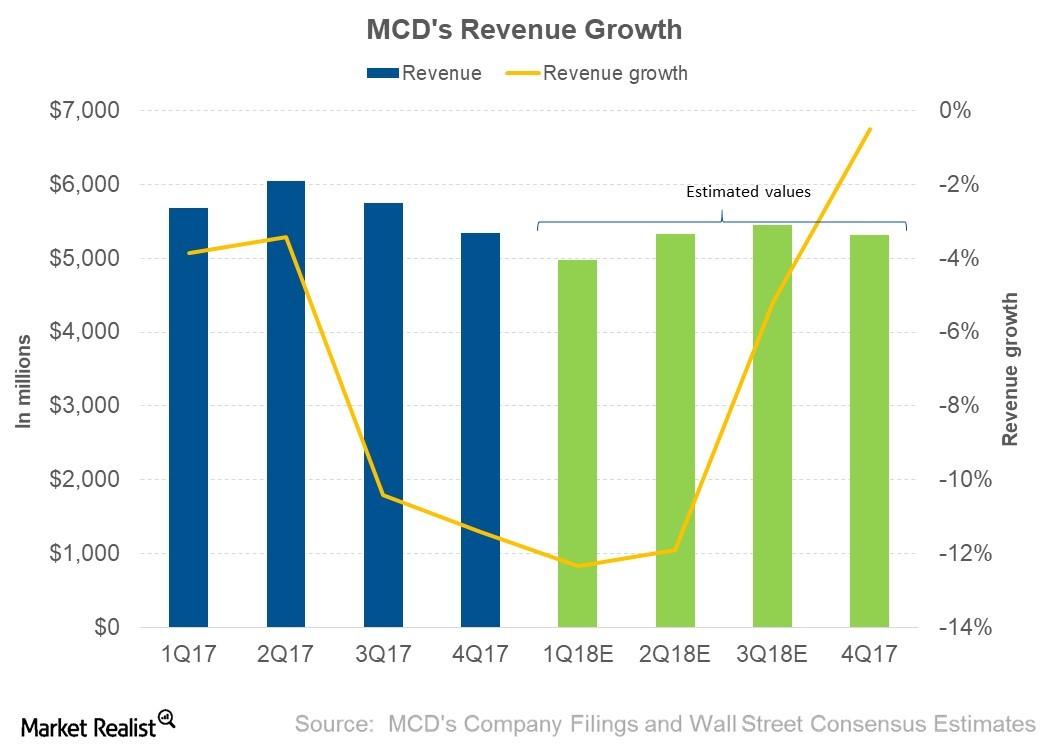

Analysts Expect McDonald’s Revenue to Fall in Q1 2019

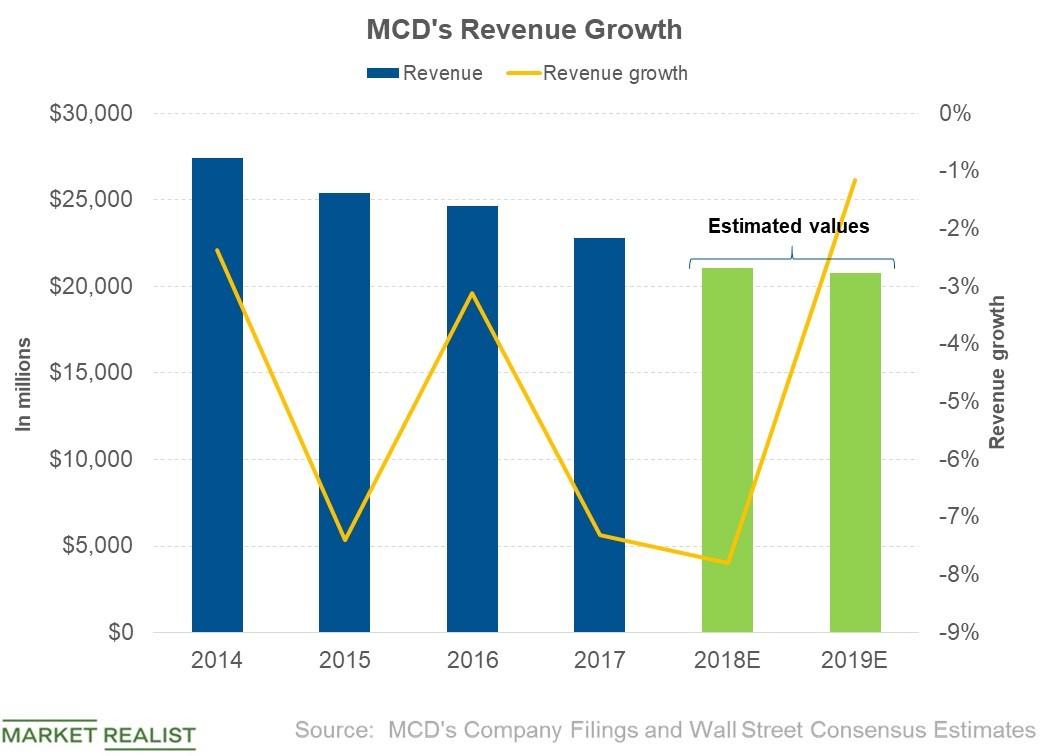

In the first quarter of 2019, analysts expect McDonald’s (MCD) revenue to fall 4.1% YoY (year-over-year) to $4.93 billion from $5.14 billion, likely due to its company-owned restaurant count falling.

What Analysts Expect from McDonald’s Revenue in 2019

In the first three quarters of 2018, McDonald’s (MCD) revenue fell 9.3% to $15.86 billion.

Why McDonald’s EBIT Margin Expanded in 2018

McDonald’s (MCD) has posted EBIT (earnings before interest and tax) of ~$8.9 billion, which represents an EBIT margin of 38.8%.

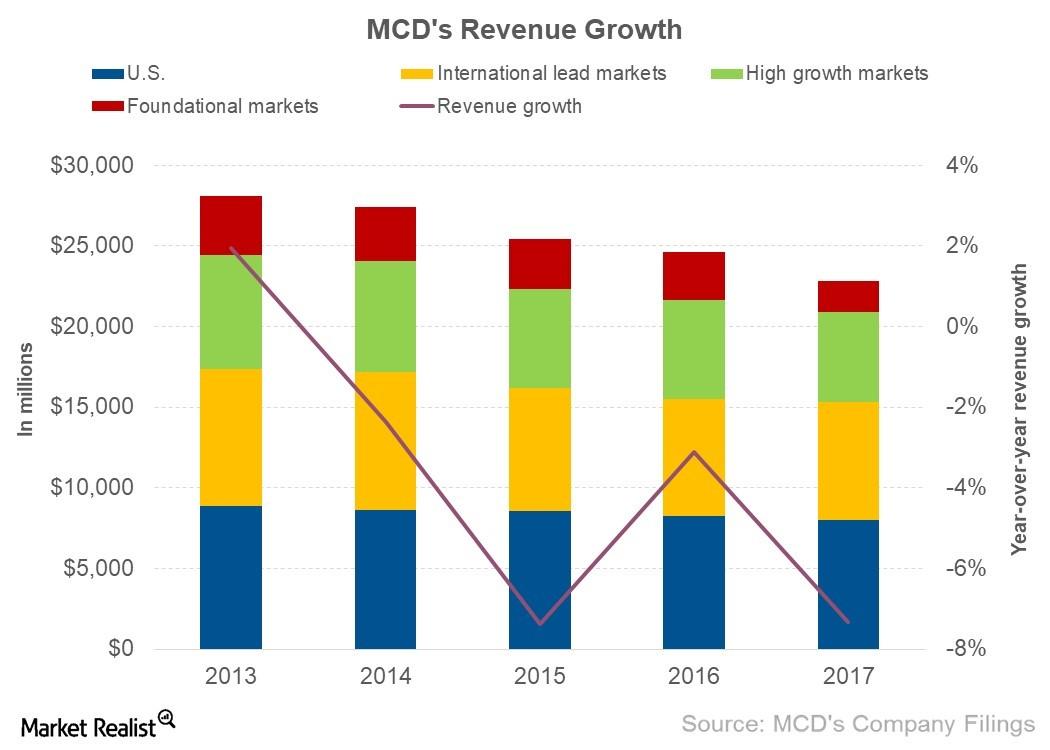

Why McDonald’s Revenues Declined in 2017

In 2017, McDonald’s (MCD) posted revenues of ~$22.8 billion, which represents a fall of 7.3% from ~$24.6 billion in 2016.

What Analysts Expect for McDonald’s Revenue in 2018

Revenue expectations In 2018, analysts expect McDonald’s (MCD) to post revenue of $21.1 billion, which represents a fall of 7.7% from its revenue of $22.8 billion in 2017. As part of its optimizing strategy, McDonald’s has been refranchising its company-owned restaurants. The refranchising is expected to lower the company’s revenue in 2018. However, some of […]

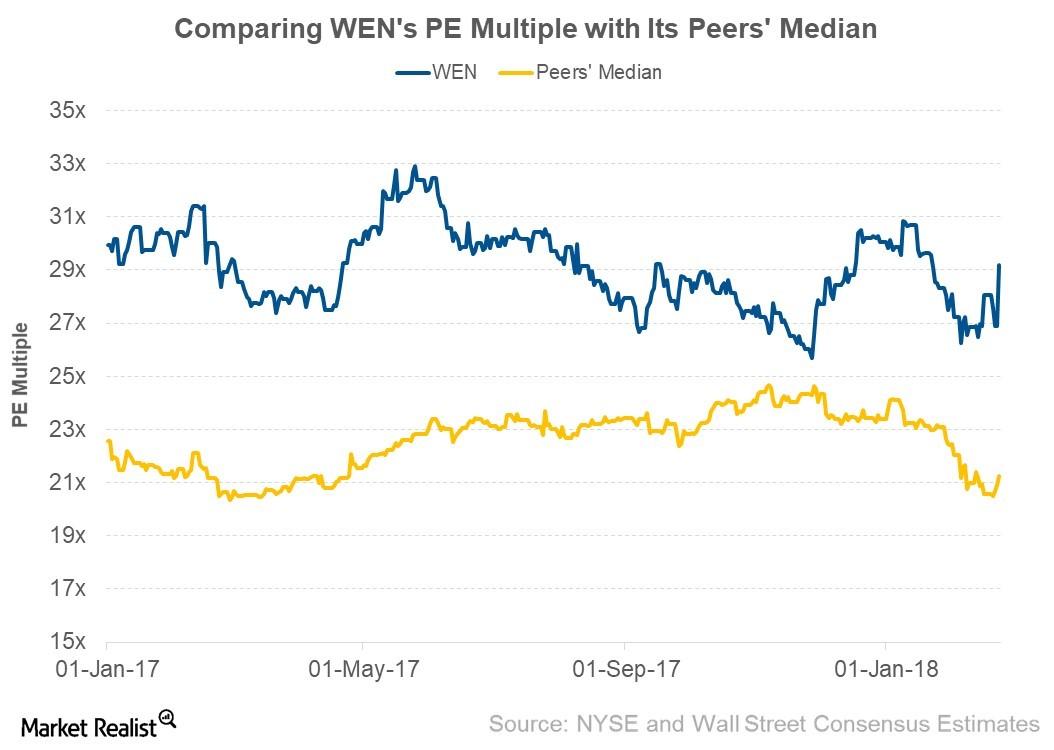

How Wendy’s Valuation Multiple Compares to Its Peers

The initiatives taken by Wendy’s management to drive SSSG appear to have led to a rise in WEN stock and a higher valuation multiple.

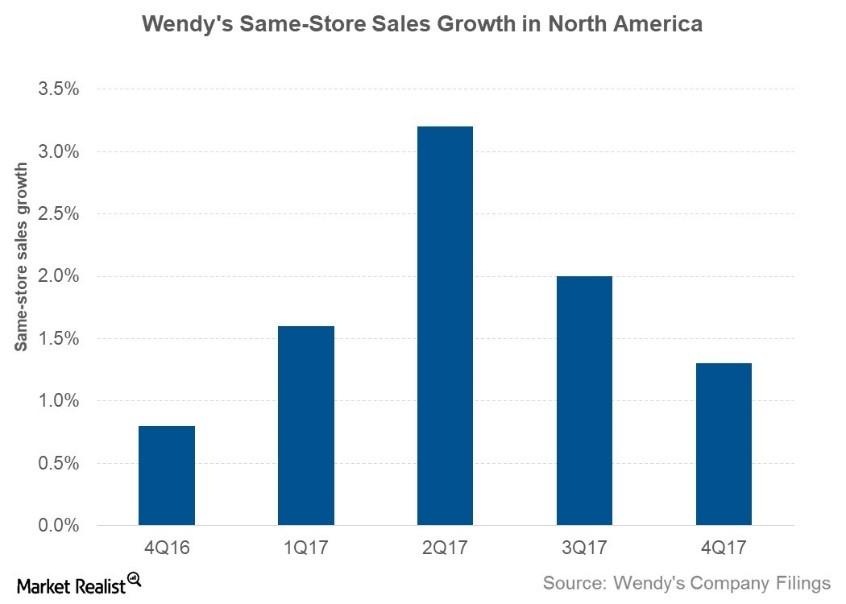

What Drove Wendy’s Same-Store Sales Growth in 4Q17?

Wendy’s (WEN) posted SSSG (same-store sales growth) of 1.3% in the North American region compared to 0.8% in 4Q16.

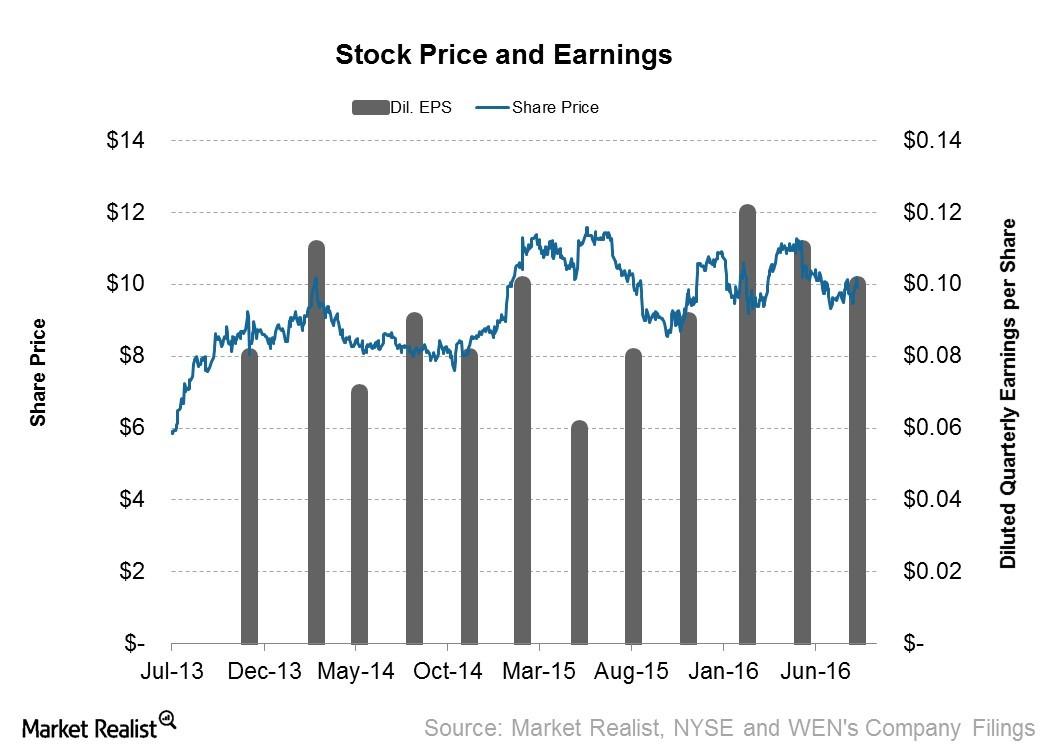

What’s Driving Wendy’s Stock Price

In this series, we’ll look at analysts’ earnings and revenue estimates for the next four quarters. We’ll also review Wendy’s valuation and analysts’ recommendations.

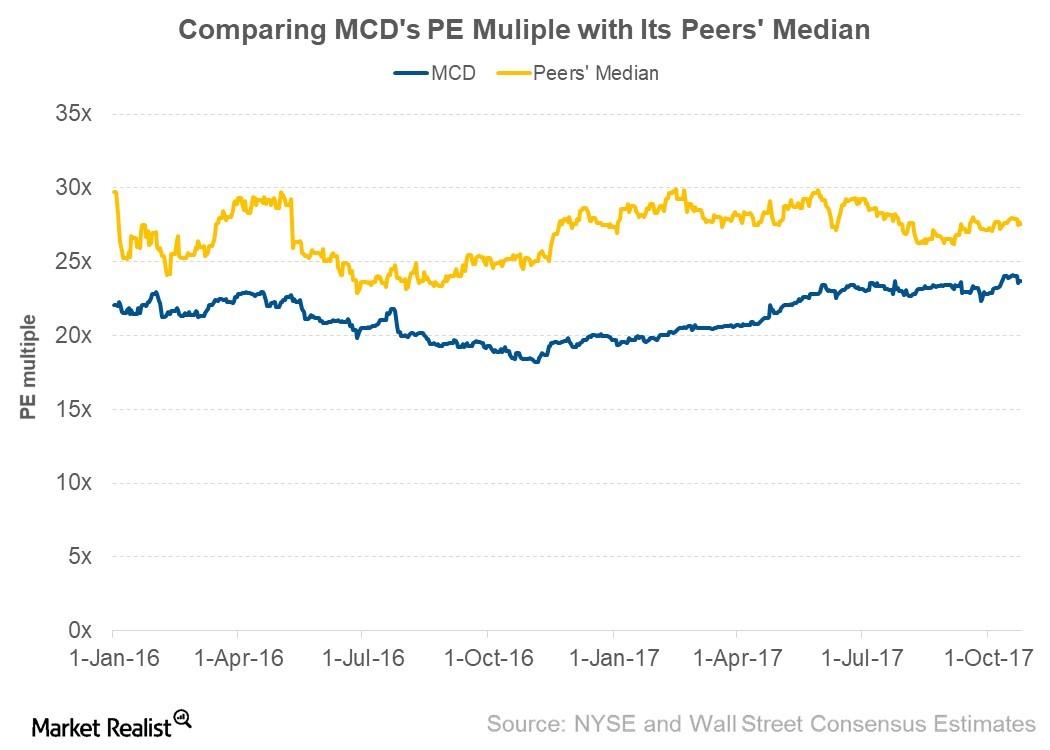

McDonald’s Valuation Multiple Compared to Its Peers

As of October 25, 2017, McDonald’s was trading at a forward PE multiple of 23.66x compared to 23.57x before the announcement of 3Q17 earnings.

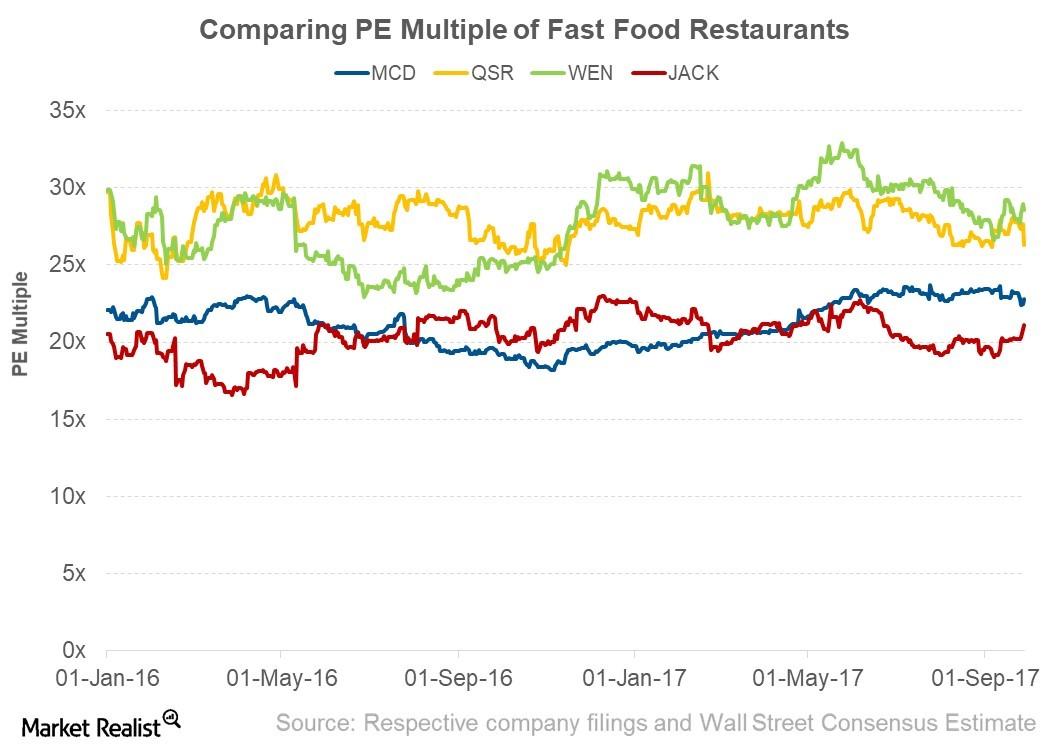

How Fast Food Restaurants’ Valuation Multiples Stack Up

Wendy’s (WEN) has been trading above its peers’ valuation multiple.

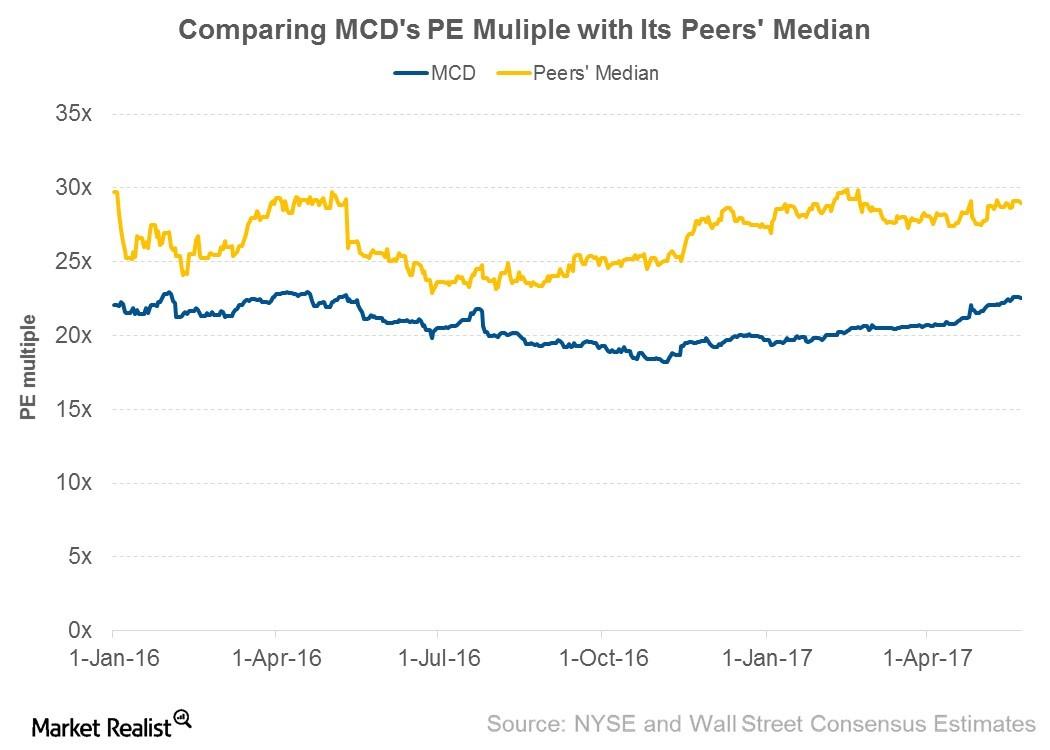

Analyzing McDonald’s Valuation Multiple

As of May 24, 2017, McDonald’s was trading at a PE multiple of 22.6x—compared to 21.3x before the announcement of its 1Q17 earnings.

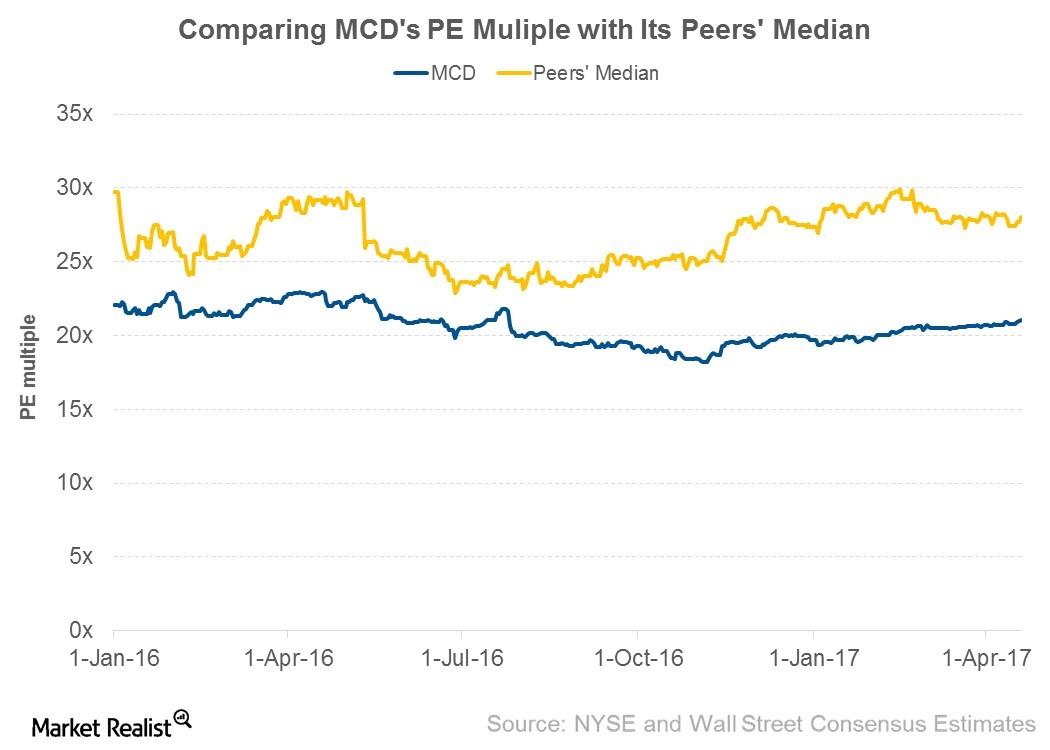

Where McDonald’s Valuation Multiple Stands Next to Peers

As of April 19, 2017, McDonald’s was trading at a PE multiple of 21.1x, as compared to 19.9x before the announcement of its 4Q16 earnings.

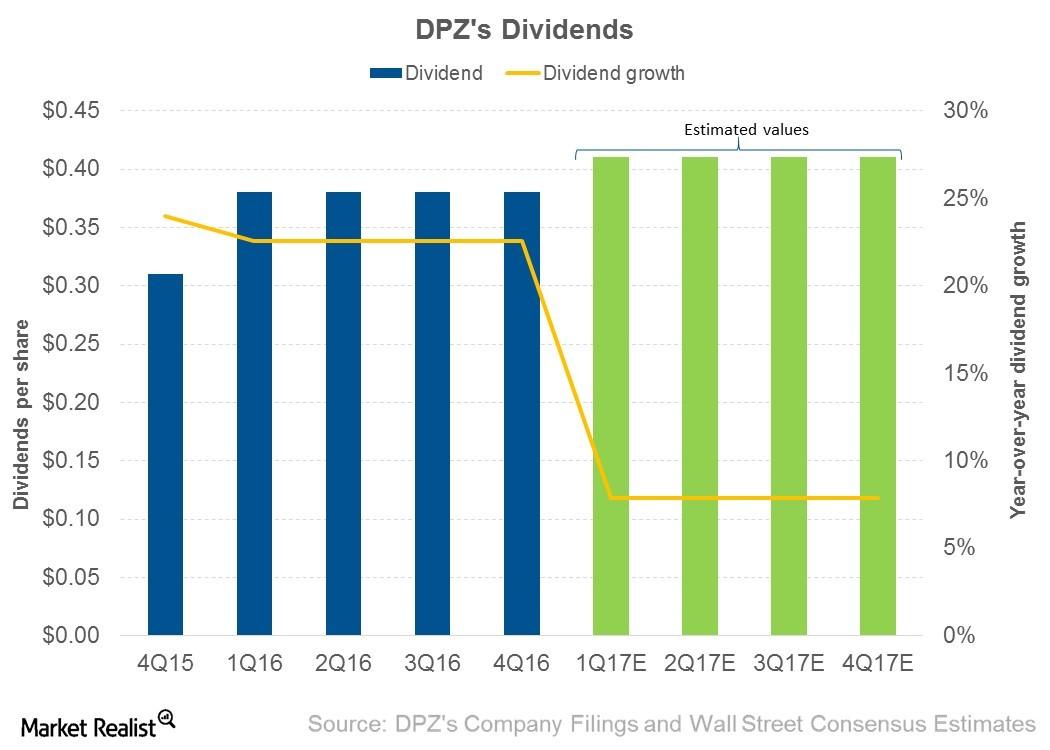

Why Domino’s Dividend Policy Is Important

In 2016, Domino’s Pizza (DPZ) paid dividends of $1.52—growth of 22.5% from $1.24 in 2015. In 2017, analysts expect its dividends to rise 7.9% to $1.64.

Behind the Valuation Multiples of Fast Food Restaurants

As of September 16, 2016, these five fast food restaurants were trading at a median PE multiple of 21.4x.

Wendy’s Stock Fell Due to Declining Sales

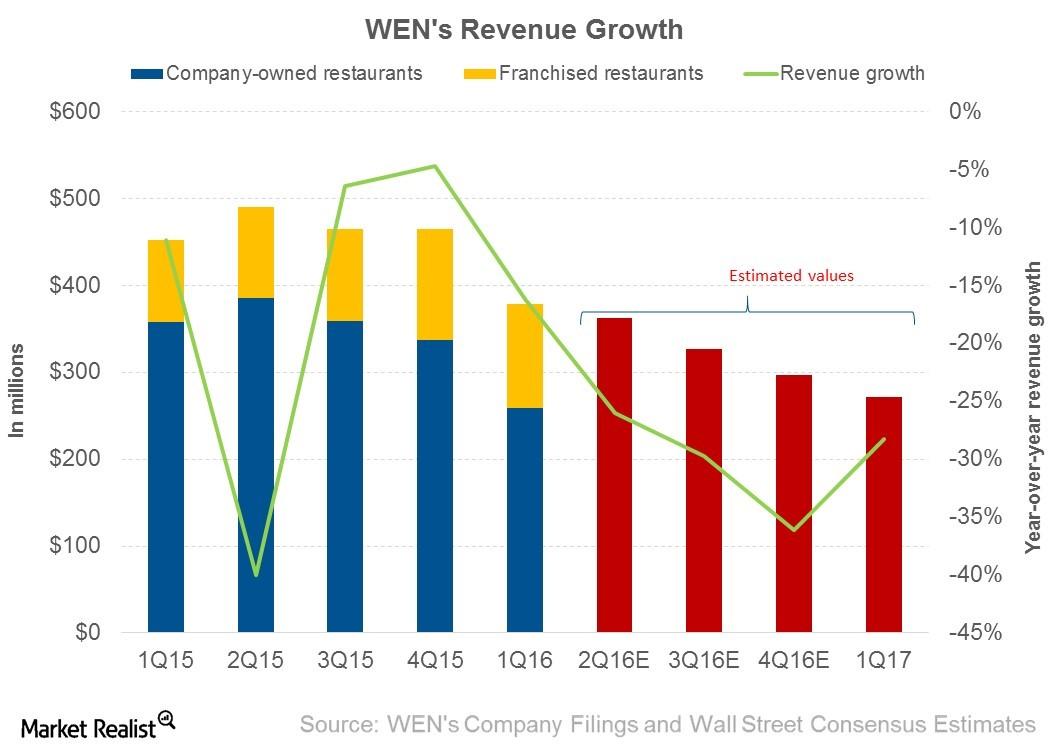

Wendy’s (WEN) posted its 2Q16 results on August 10, 2016. The company posted adjusted EPS (earnings per share) of $0.11 on revenue of $382.7 million.

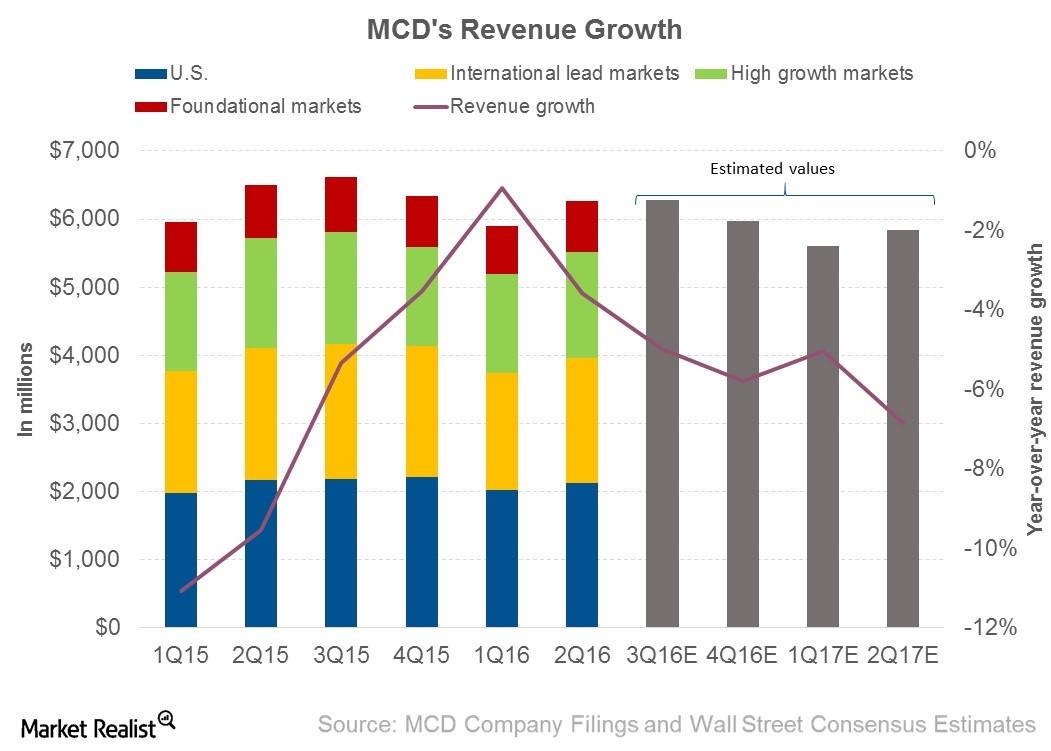

Why Did McDonald’s Revenue Decline in 2Q16?

In 2Q16, McDonald’s revenue declined by 3.6% from $6.5 billion to $6.3 billion.

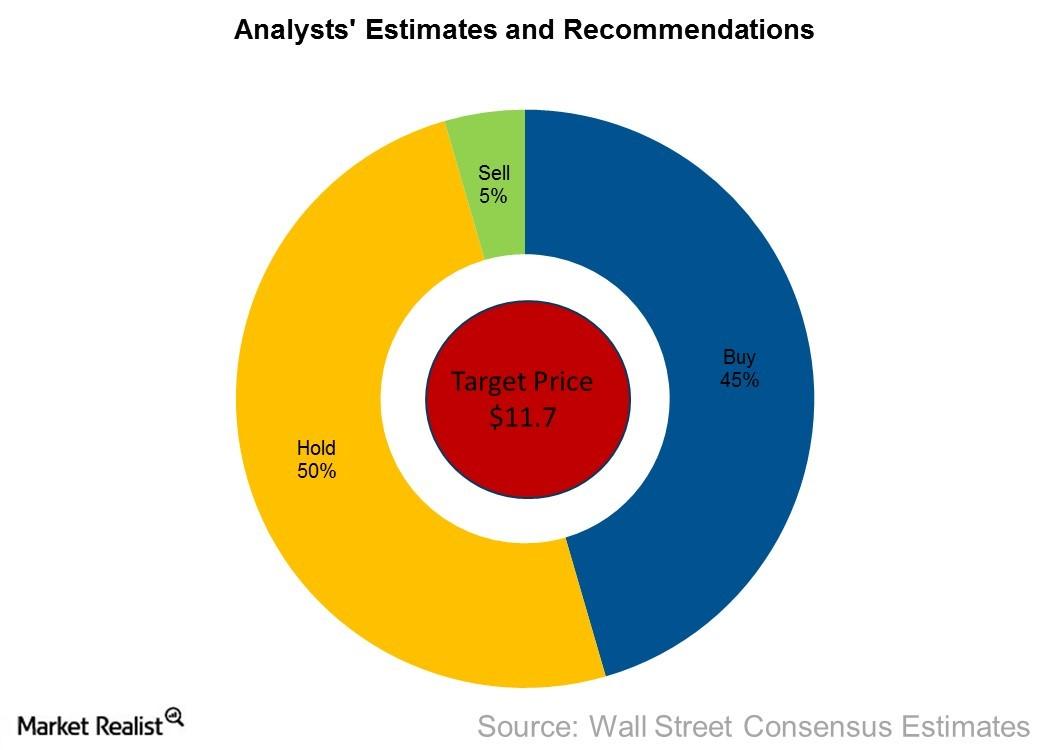

The Word on the Street: What Analysts Are Saying about Wendy’s

According to Bloomberg, of the ten analysts surveyed, 45.5% have issued “buy” recommendations for Wendy’s, while 50% have issued “hold” recommendations.

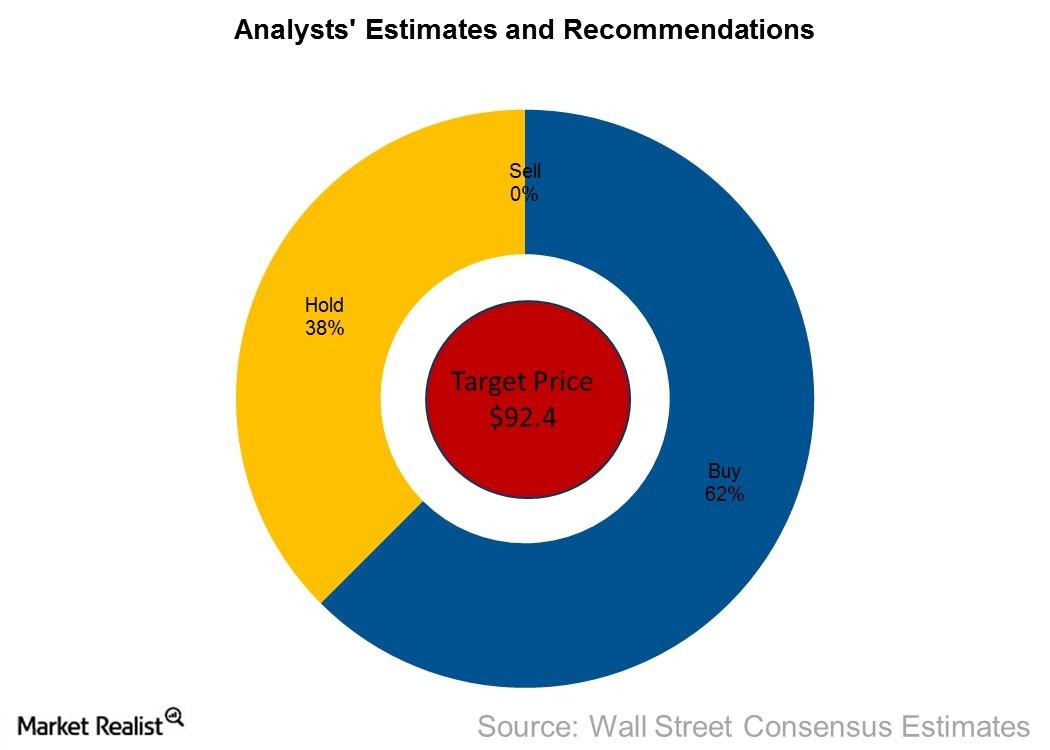

The Word on the Street: How Analysts See JACK

According to a Bloomberg survey of 16 analysts, 62.5% have given “buy” recommendations for JACK, and 37.5% have given “hold” recommendations.

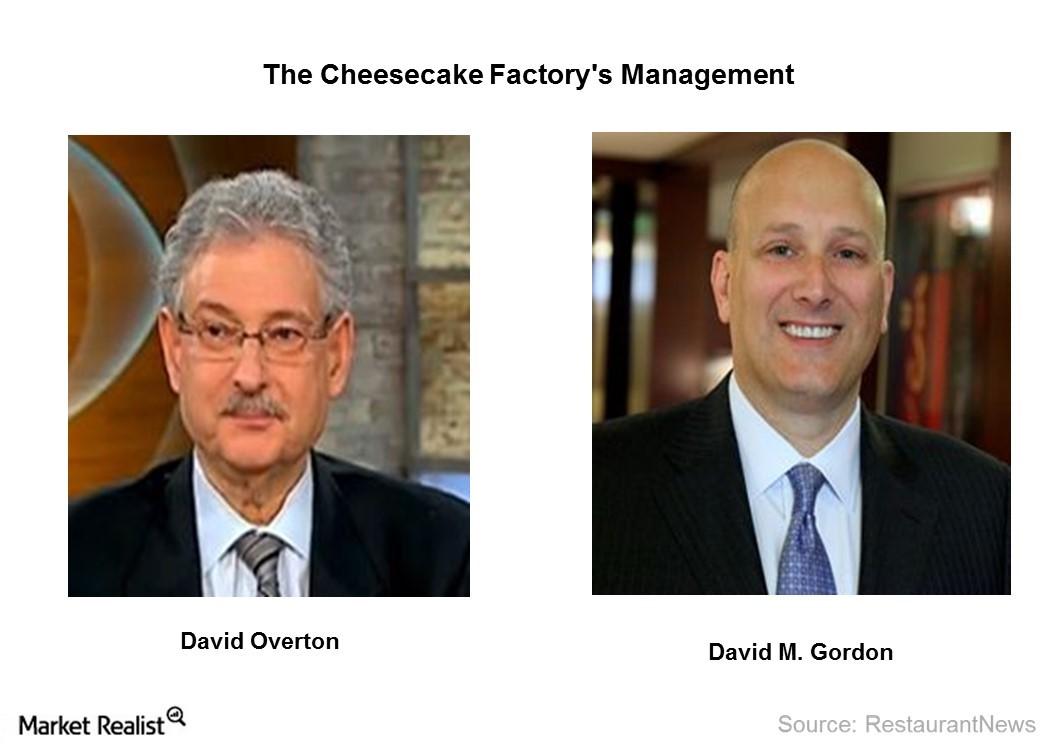

Getting to Know The Cheesecake Factory’s Management

A company is greatly impacted by its management’s decisions. In this article, we’ll discuss The Cheesecake Factory’s (CAKE) management and its achievements.

What Really Drove Shake Shack’s Revenue in 1Q16?

In 1Q16, Shake Shack saw a 43.3% rise in revenue over $37.8 million in 1Q15, driven by unit growth and same-store sales growth.

Why Did Wendy’s Revenue Fall in 1Q16?

Wendy’s Company (WEN) generates its revenue through company-owned restaurant sales, franchisee fees, rental income, and royalty collected from franchisees.

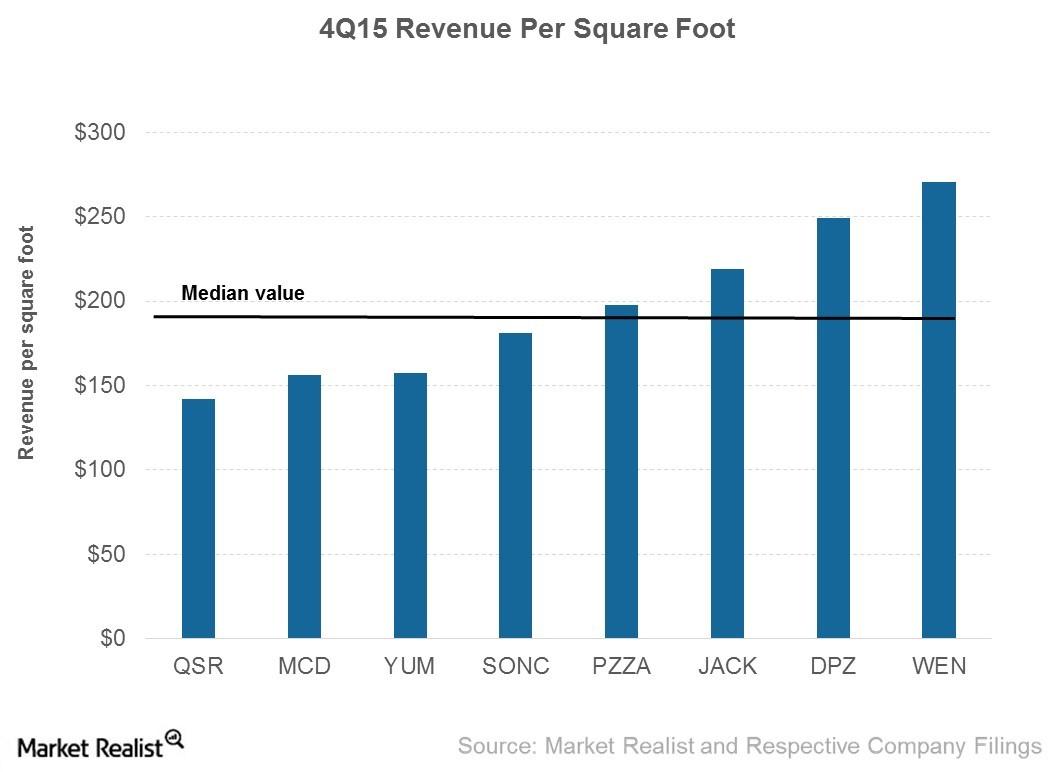

Which Fast Food Restaurant Led in 4Q15 Revenue Per Square Foot?

In 4Q15, MCD, YUM, WEN, QSR, JACK, SONC, PZZA, and DPZ generated an average revenue of $189 per square foot.

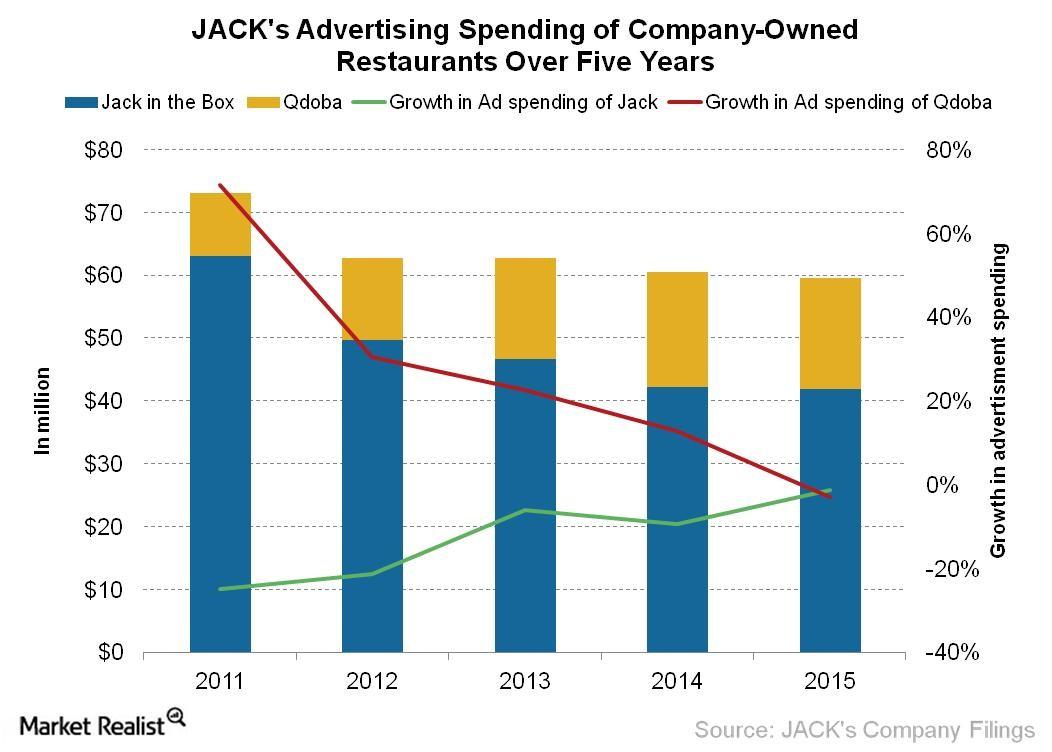

Analyzing Jack in the Box’s Marketing Strategies

Jack in the Box (JACK) manages marketing funds that include contributions from both its franchise and company-owned restaurants.

Jack in the Box: Improving Efficiency through Technology

To speed up service, Jack in the Box (JACK) used a two-way intercom when it opened its first restaurant in 1951.

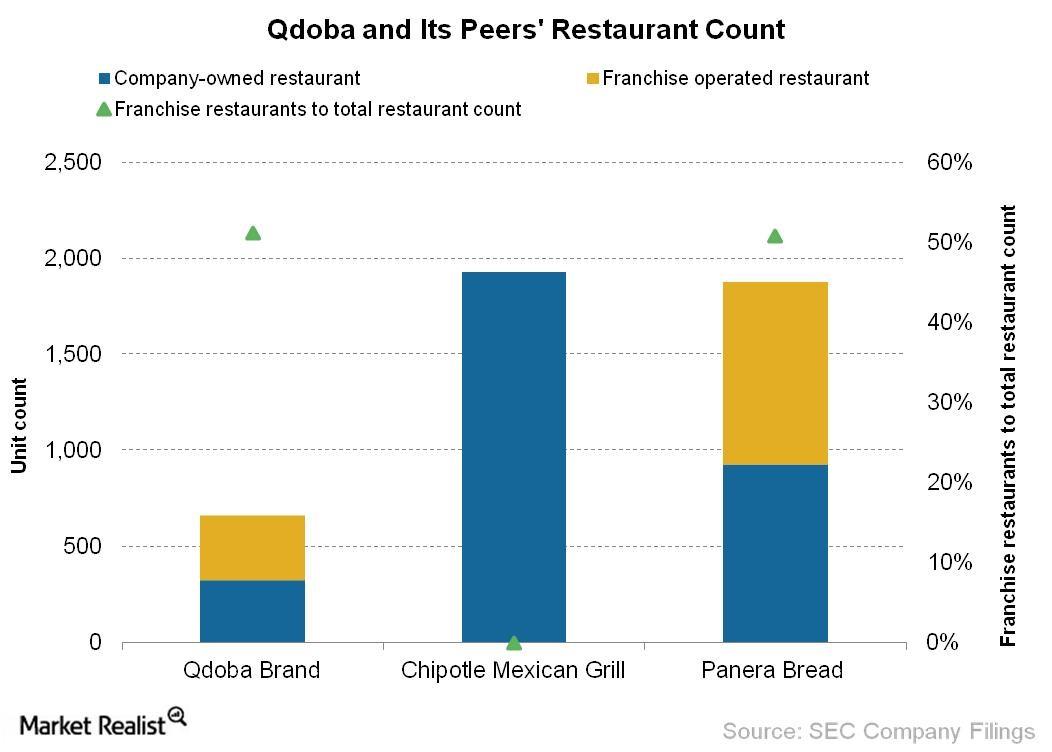

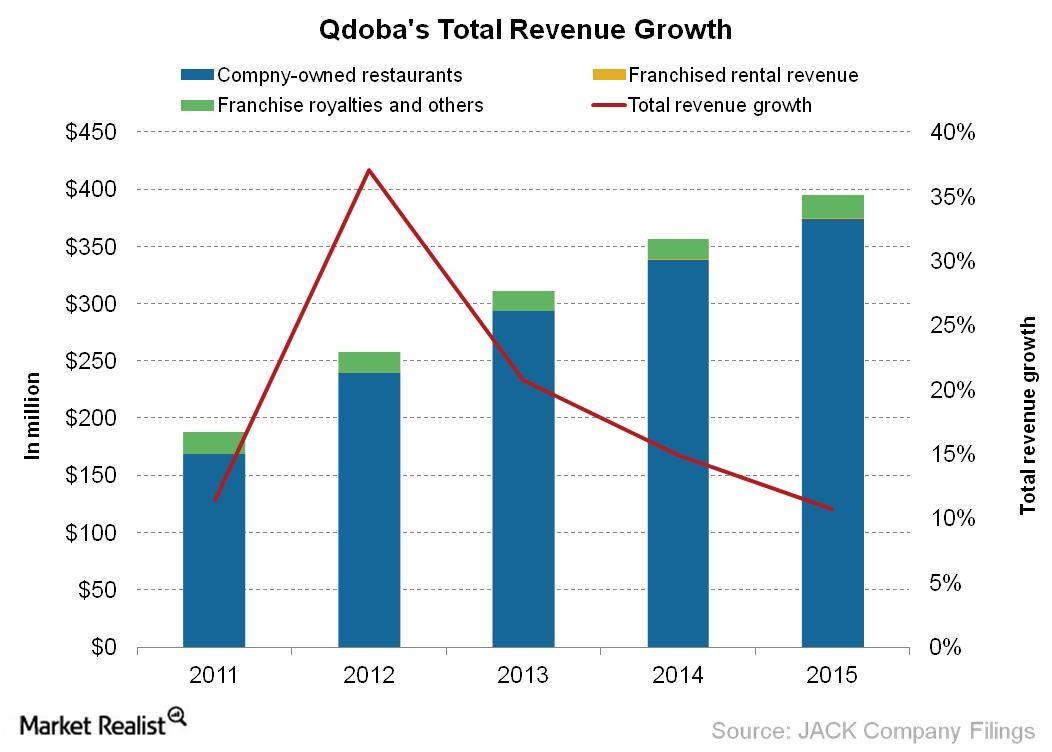

Understanding Qdoba Mexican Eats’ Franchisee Model

Since Jack in the Box’s acquisition of brand Qdoba Mexican Grill, now named Qdoba Mexican Eats, the brand has grown from a mere 85 restaurants to 661.

A Look at Qdoba Mexican Eats’ Business Model

In 2003, when Jack in the Box (JACK) acquired Qdoba Mexican Grill for $45 million, Qdoba was operating 85 outlets with a total revenue of $65 million.

Jack in the Box: The Food Is Better at the Box

Headquartered in San Diego, California, Jack in the Box (JACK), was founded by Robert O. Peterson in 1951.

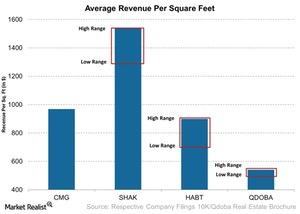

Chipotle’s Revenue Per Square Foot: Two Times More than Qdoba’s

Chipotle’s average restaurant size is about 2,550 square feet. With an average restaurant volume of $2.4 million, the revenue per square foot comes to $969.

Key Indicators for Restaurant Industry Growth

Restaurant industry sales have experienced growth in the past 12 months. Sales are poised to grow to $709 billion.

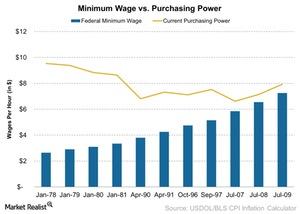

The Eroding Purchasing Power of the Minimum Wage Worker

While the absolute minimum wage has increased, when adjusted for inflation in 2015, its purchasing power has declined.