What Analysts Expect from McDonald’s Revenue in 2019

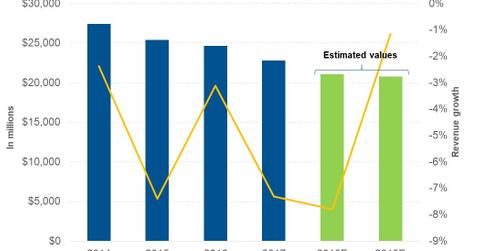

In the first three quarters of 2018, McDonald’s (MCD) revenue fell 9.3% to $15.86 billion.

Jan. 8 2019, Updated 3:25 p.m. ET

Revenue expectations for 2018

In the first three quarters of 2018, McDonald’s (MCD) revenue fell 9.3% to $15.86 billion compared to $17.48 billion in the corresponding three quarters of the previous year. The fall in McDonald’s revenue was the result of its strategic refranchising initiative.

To generate stable and predictable revenue, McDonald’s adopted a refranchising strategy at the beginning of 2015. The company is focusing on increasing the ownership of its franchised restaurants to ~95% in the long term. By the end of the third quarter, the company operated 92.5% of its restaurants as franchised. However, some of the fall in its revenue was offset by positive SSSG (same-store sales growth) and the net addition of new franchised restaurants. In the first nine months of 2018, McDonald’s same-store sales grew 4.5%.

In the fourth quarter, analysts expect McDonald’s to post revenue of $5.17 billion to take its total for 2018 to $21.04 billion, which represents a fall of 7.8% from $22.82 billion in 2017.

During the same period, McDonald’s peers Starbucks (SBUX) and Wendy’s (WEN) are expected to post revenue growth of 10.6% and 30.2%, respectively. However, Jack in the Box’s (JACK) revenue is likely to fall 38.1%.

Analysts’ 2019 revenue expectations

For 2019, analysts expect McDonald’s to post revenue of $20.8 billion, a fall of 1.2% from $21.04 billion in 2018. The company’s refranchising of its company-owned restaurants will likely lower its revenue in 2019.

To drive its SSSG, McDonald’s is focusing on the deployment of its EOTF (Experience of the Future) initiative, improved convenience via delivery and digital initiatives, and menu innovations. By the end of the third quarter, the company had implemented EOTF in 6,000 restaurants. Its management plans to complete the implementation of EOTF in 12,000 restaurants by the end of 2019. McDonald’s also continues to expand its delivery service across the world through its partnership with Uber Eats.

During the same period, McDonald’s peers Starbucks, Wendy’s, and Jack in the Box are expected to post revenue rises of 5.8%, 3.7%, and 6.1%, respectively.

Next, we’ll look at analysts’ EPS expectations.