Hershey Company

Latest Hershey Company News and Updates

Analyzing Hershey’s Emphasis on Product Innovation

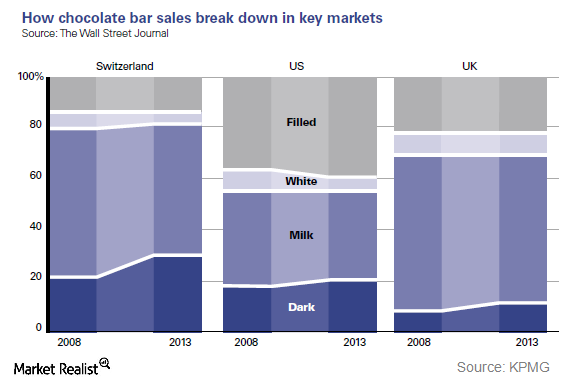

Hershey plans to position dark chocolate as a lifestyle choice in the US. It has thus begun promoting its dark chocolate brands for specific consumption.

An Overview of Hershey, America’s Largest Chocolatier

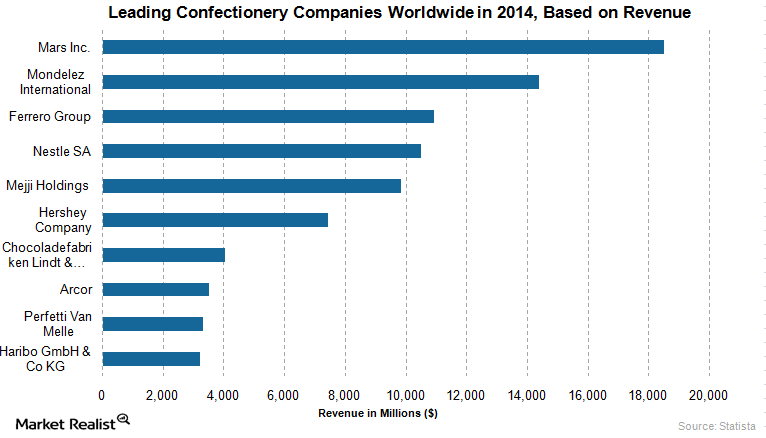

Hershey is the largest producer of chocolate in North America. It is a global leader in chocolate, sugar confectionery, and chocolate-related products.

Here’s How Wall Street Reacted to General Mills’ Q2 2019 Results

Most analysts lowered their target prices on General Mills stock following the release of its results for the second quarter of fiscal 2019.

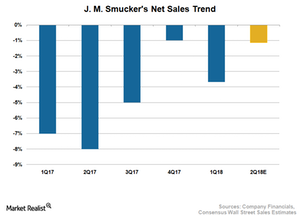

Behind J.M. Smucker’s Waning Sales

J.M. Smucker (SJM) has continued to disappoint on the sales front this year, having posted declines in sales for the past several quarters.

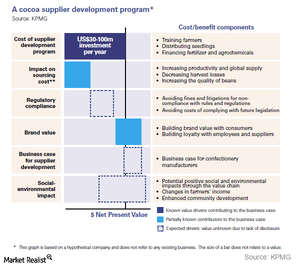

Hershey’s Steps to Improve Suppliers Productivity and Conscious Sourcing

Hershey has set a goal of sourcing 100% cocoa from certified cocoa farms. In fiscal 2014, it sourced 30% certified cocoa.

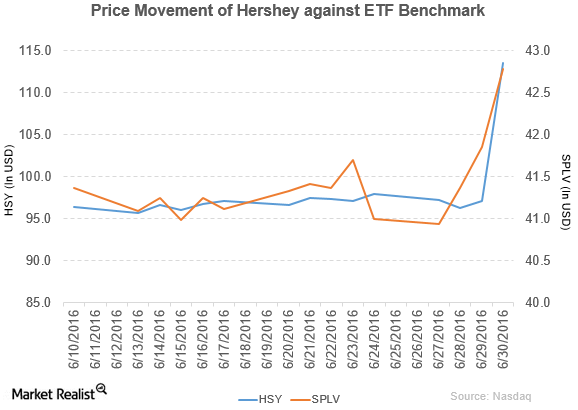

Why Did Hershey’s Stock Rise on June 30?

The Hershey Company (HSY) has a market cap of $24.2 billion. Its stock rose by 16.8% to close at $113.49 per share on June 30, 2016.

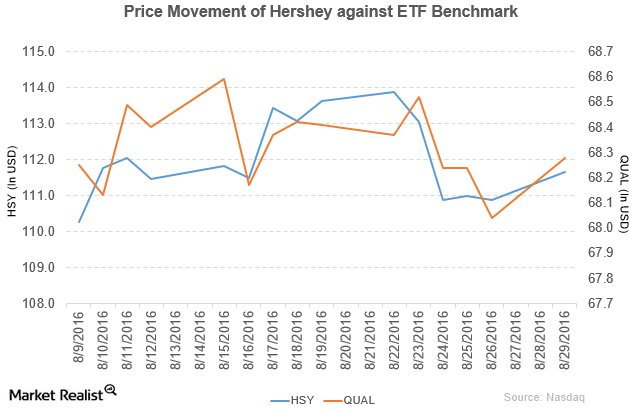

The Hershey Company Shows Mixed Price Movement on August 29

The Hershey Company (HSY) has a market cap of $23.8 billion. It rose by 0.71% to close at $111.67 per share on August 29, 2016.

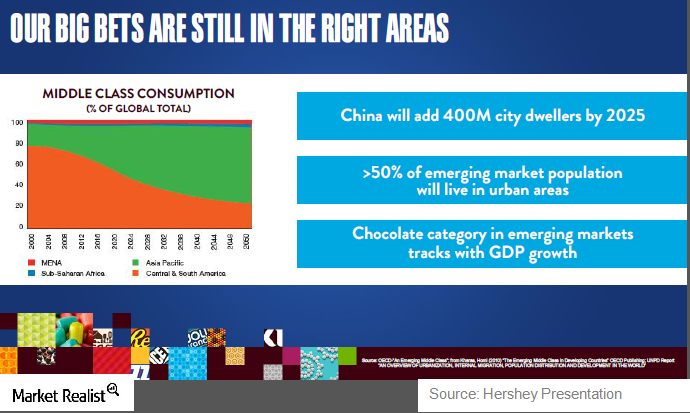

Why China Is Such an Important Market for Hershey in 2015

Hershey is the fastest-growing confectionery company in China, and Hershey expects China to become its second-largest market behind the US by 2017.

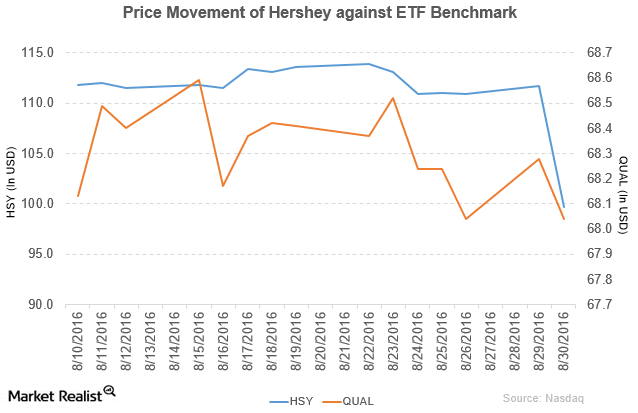

Why Did Hershey Fall by 10.8% on August 30?

The Hershey Company (HSY) has a market cap of $21.3 billion. It fell by 10.8% to close at $99.65 per share on August 30, 2016.

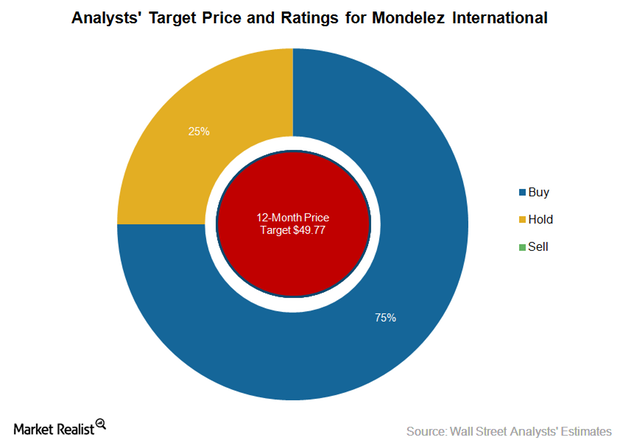

Mondelēz’s Stock: Why Do Most Analysts Rate It a ‘Buy’?

Current recommendations As of January 30, 15 of 20 analysts covering Mondelēz International’s stock had a “buy” rating. Five analysts had a “hold” recommendation, and there were no “sell” recommendations. On January 5, 2017, Berenberg Bank initiated coverage on Mondelēz International’s stock with a “buy” rating and a price target of $51. Consensus “buy” rating […]

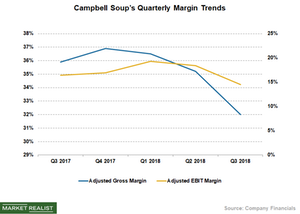

Campbell Soup’s Margins Could Continue to Contract

The Campbell Soup Company (CPB) continued to report sluggish margins as higher-than-expected inflation in commodities and transportation costs remained a drag.

Hershey Stock Reaches a Record High

Hershey (HSY) stock is trading at a record high thanks to the company’s price restructuring initiatives. The stock has risen 42.7% this year.

What Analysts’ Price Target Indicates for J.M. Smucker Stock

Wall Street has a price target of $114.54 per share on the J.M. Smucker Company (SJM), implying a potential downside of 5.6% based on its closing price of $121.31 on June 24.

Why Analysts Expect Hershey Stock to Fall

Wall Street maintains a consensus target price of $122.93 per share on the Hershey Company (HSY), which implies a potential downside of 10.9% based on its closing price of $137.90 on June 19.

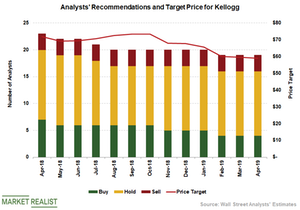

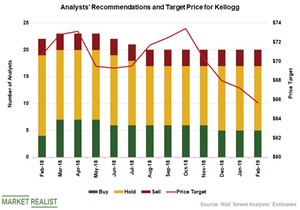

Kellogg: Analysts Recommend a ‘Hold’

Most of the analysts covering Kellogg continue to maintain a neutral outlook on the stock, which reflects near-term pressure on its earnings.

Did Kraft Heinz’s Underperformance Ring an Alarm Bell?

Shares of Kraft Heinz (KHC) crashed more than 27% on Friday, February 22, as weaker-than-expected fourth-quarter results and sluggish guidance upset investors.

Kellogg Stock: Analysts’ Recommendations

Analysts continue to suggest a “hold” rating on Kellogg (K) stock. Analysts’ target price shows a downward trend.

Could McCormick’s Improving Fundamentals Boost Its Stock?

McCormick (MKC) has seen double-digit sales and earnings growth over the past couple of quarters.

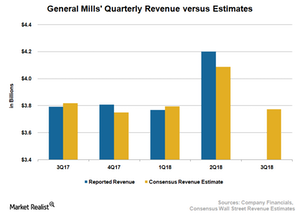

Will General Mills Sustain Its Sales Momentum in Q3?

Analysts expect General Mills (GIS) to report sales of $3.8 billion in fiscal 3Q18, reflecting a marginal decline of 0.5% on a YoY (year-over-year) basis.

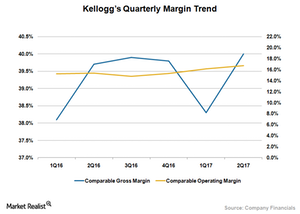

Why Kellogg’s 3Q17 Profit Margins Could Improve

Kellogg (K) posted improved profit margins despite lower sales, thanks to the company’s focus on efficiency and initiatives to reduce costs.

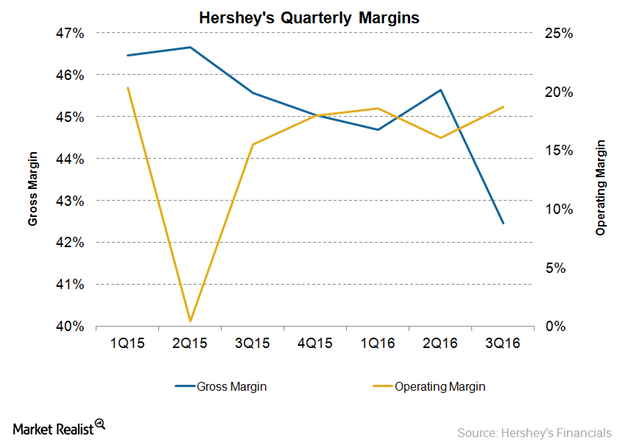

Can Hershey’s Margins Improve in 4Q16?

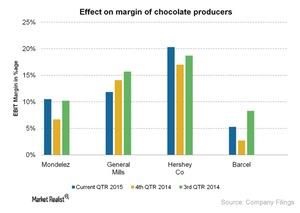

Unlike its gross margin, Hershey’s operating margin expanded to 18.7% in 3Q16 from 15.5% in 3Q15. This improvement was mainly due to a favorable comparison with 3Q15.

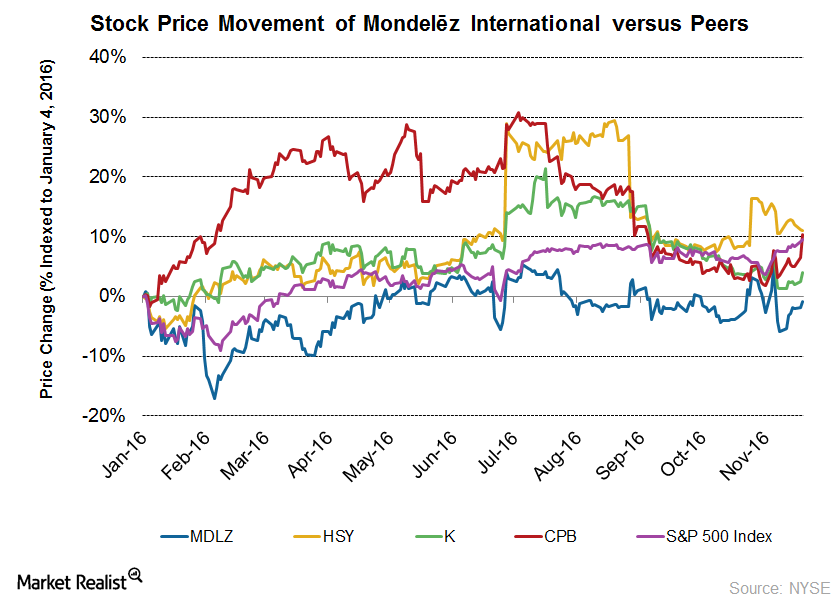

Why Has Mondelēz International Been Rising for Two Months?

Mondelēz International’s (MDLZ) stock rose 3.6% to $44.32 per share on October 26, 2016, after the announcement of the company’s 3Q16 results.

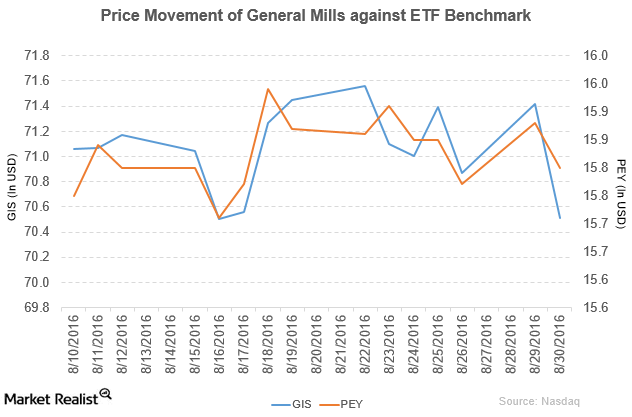

General Mills Made Key Changes in Its Management

General Mills (GIS) has a market cap of $42.6 billion. It fell by 1.3% to close at $70.51 per share on August 30, 2016.

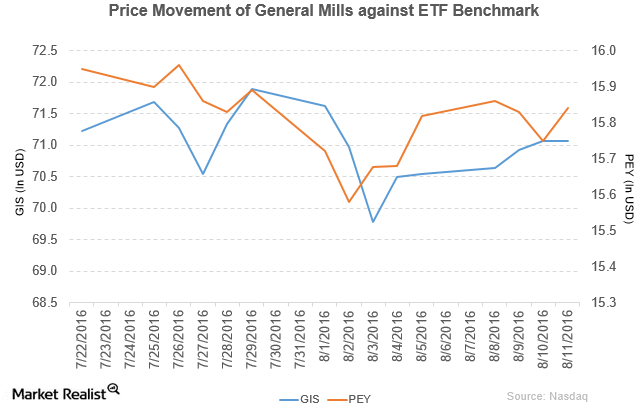

General Mills Rose by Just 0.01% on August 11: Why?

General Mills (GIS) has a market cap of $42.7 billion. It rose by 0.01% to close at $71.07 per share on August 11, 2016.

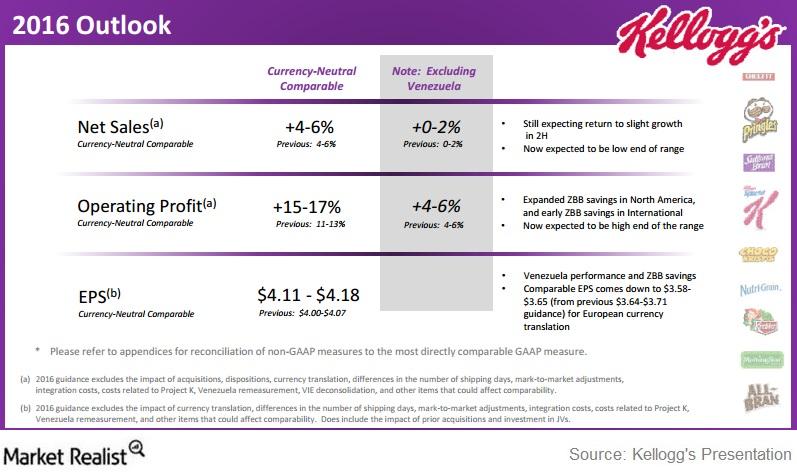

What Made Kellogg Update Its Fiscal 2016 Guidance?

In its fiscal 2Q16 earnings release, Kellogg stated that it expects its fiscal 2016 cash flow from operating activities to be ~$1.7 billion.

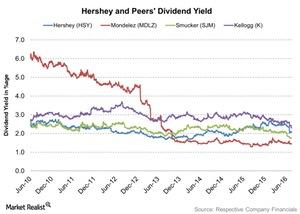

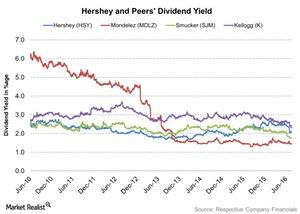

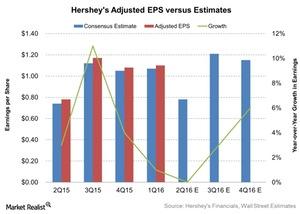

Hershey’s Returns, Including a 6% Dividend Hike, Hit a Sweet Spot

On July 28, 2016, Hershey (HSY) declared its 347th consecutive regular dividend on its common stock and 128th consecutive regular dividend on its Class B common stock.

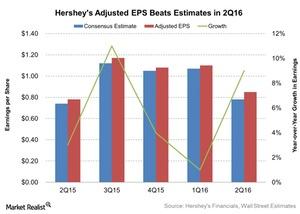

Hershey’s Earnings Surpassed Estimates in Fiscal 2Q16

Hershey (HSY) reported its fiscal 2Q16 earnings on July 28, 2016. Adjusted EPS came in around $0.85 for 2Q16, a growth of 9% compared to $0.78 in 2Q15.

Why Did General Mills Expand the Recall of Its Products?

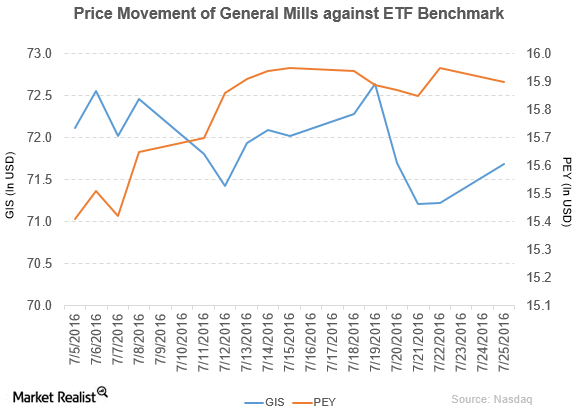

General Mills rose by 0.66% to close at $71.69 per share on July 25. The stock’s weekly, monthly, and YTD price movements were -0.82%, 8.1%, and 27.1%.

Hershey Shareholders Thrive on 346 Straight Dividend Payouts

On May 4, Hershey (HSY) announced that its board of directors approved quarterly dividends of $0.58 on the common stock and $0.53 on the Class B common stock.

General Mills Announces Restructuring Plans

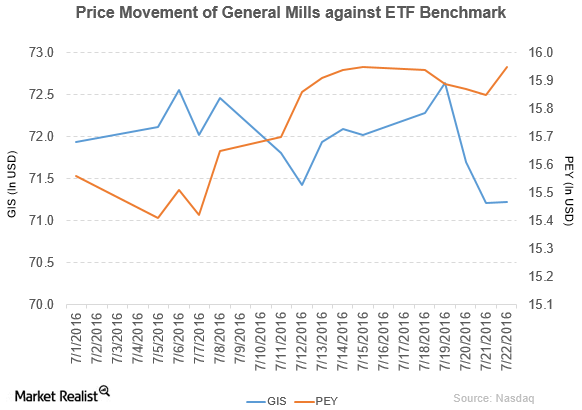

General Mills fell by 1.1% to close at $71.22 per share in the third week of July. Its weekly, monthly, and YTD price movements were -1.1%, 8.0%, and 26.2%.

Why Hershey’s Earnings Could Have Been Pressured in 2Q16

Analysts expect Hershey’s adjusted EPS to be $0.78, which is in line with 2Q15 EPS.

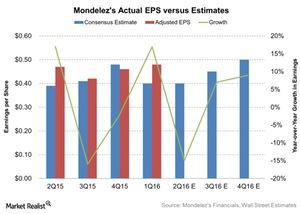

How Hershey Benefits from the barkTHINS Acquisition

The company expects that the barkTHINS acquisition will be dilutive in 2016 and 2017, before turning accretive in 2018.

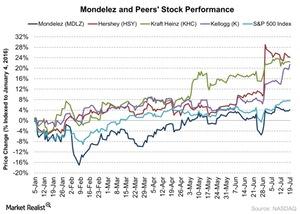

What’s Expected of Mondelez’s Earnings for 2Q16?

Analysts expect Mondelez’s adjusted EPS to be $0.40 compared to $0.47 in 2Q15.

Did Oreo Cookies, Trident Gum Sales Boost Mondelez’s 2Q Earnings?

Mondelez International (MDLZ), maker of Cadbury chocolates and Oreo cookies, is all set to report its fiscal 2Q16 earnings results on July 27 before the market opens.

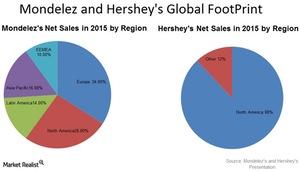

Why Was Mondelez Interested in Hershey?

Mondelez wanted a greater share in the North American market to recover from its declining revenue growth. Hershey would have benefited Mondelez’s revenue.

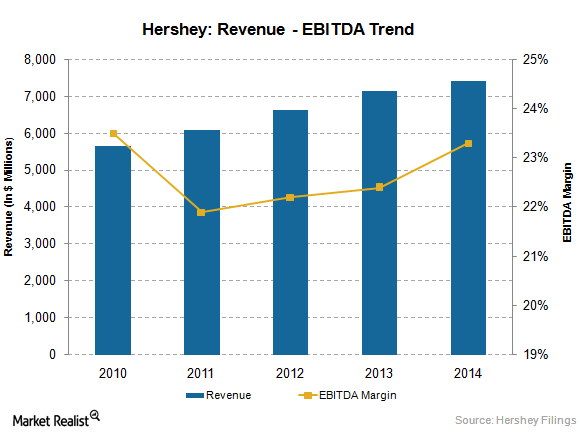

Evaluating Hershey’s Financials Against Its Competitors

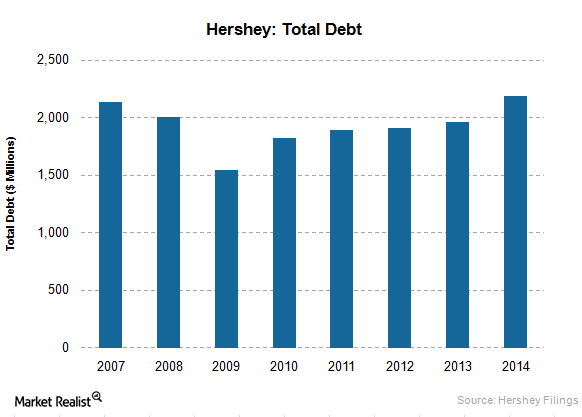

Hershey had a total debt of $2.4 billion on its balance sheet in 2014. It had a total debt-to-equity ratio of 195% during the same period.

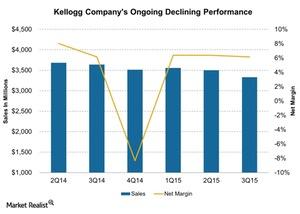

Kellogg Company’s Disappointing Performance in 3Q15

The Kellogg Company’s (K) net sales in 3Q15 fell 8.5% quarter-over-quarter to $3.3 billion due to the effect of currency translation. The company also missed analyst estimates of $3.4 billion in revenue.

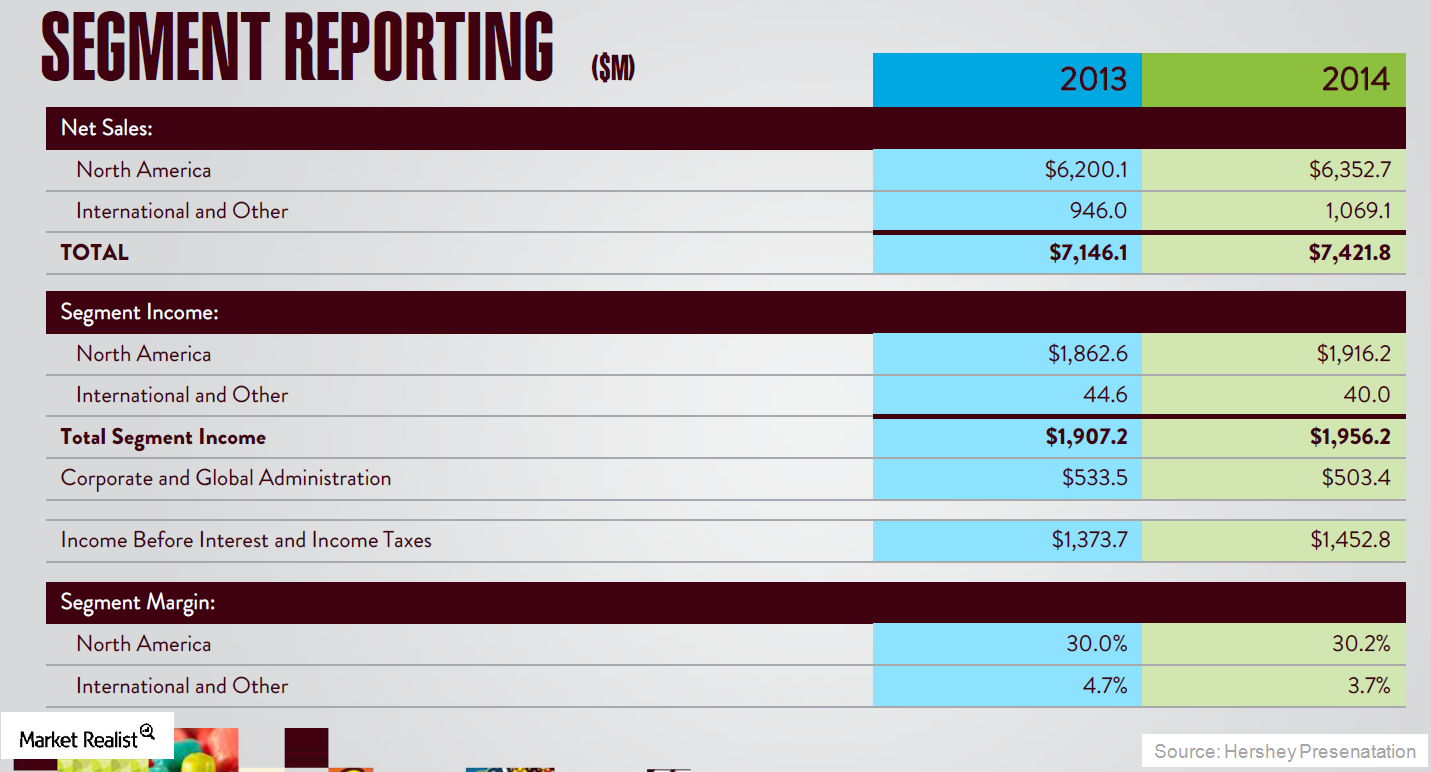

Hershey’s New Focus on International Growth Opportunities in 2015

Hershey’s international segment contributes only ~30% of total revenues. Its goal is to increase international revenues to ~50% of total revenues by 2018.

Hershey’s Competitive Strategies for North America in 2015

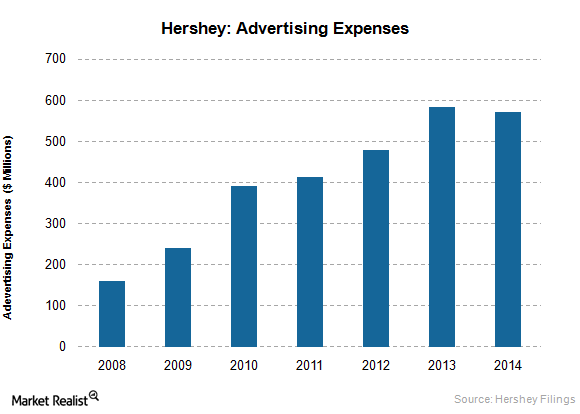

Along with advertising, Hershey is focusing on cross-merchandising complimentary products like beverages and snacks, which should help expand consumption.

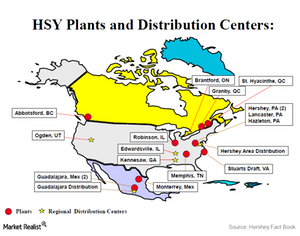

How Hershey Gained from Improving Its Supply Chain

In 2010, Hershey announced Project Next Century, which aims to streamline its global supply chain operations and create a more competitive cost structure.

Evaluating Hershey’s Marketing Strategies and Initiatives

Hershey applies a micro-marketing concept to its businesses, which means that it markets certain products to small target audiences.

Analyzing Hershey’s Segments and Product Offerings

In its international business, Hershey is mainly focusing in emerging markets of Mexico, Brazil, India, and China.

A Glance at Hershey’s Leadership in the US Confectionery Industry

Hershey is a leading player in the confectionery industry, which grew globally at a CAGR of 4.9% from 2009–2014, reaching $198.4 billion in 2014.

A Global Shortage of Cocoa Beans Forces Prices Higher

Cocoa bean production is being pushed to fulfill the current demand. A major reason for the decline in cocoa supply is the unproductive mature cocoa trees in West Africa.

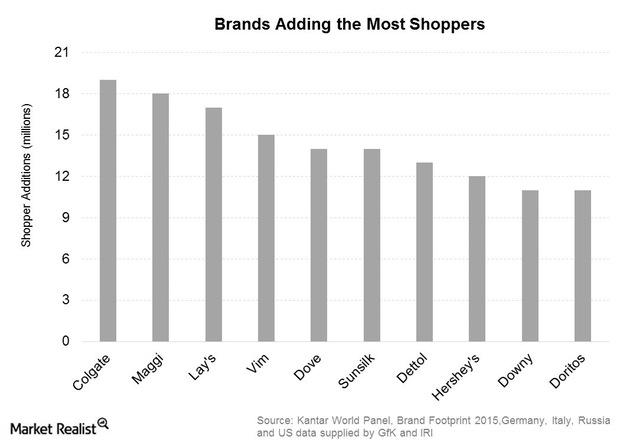

Procter & Gamble’s Downy: World’s Fastest-Growing Brand

According to Kantar World Panel’s Brand Footprint 2015 report, Procter & Gamble’s (PG) fabric softener Downy was the fastest-growing brand in 2014.

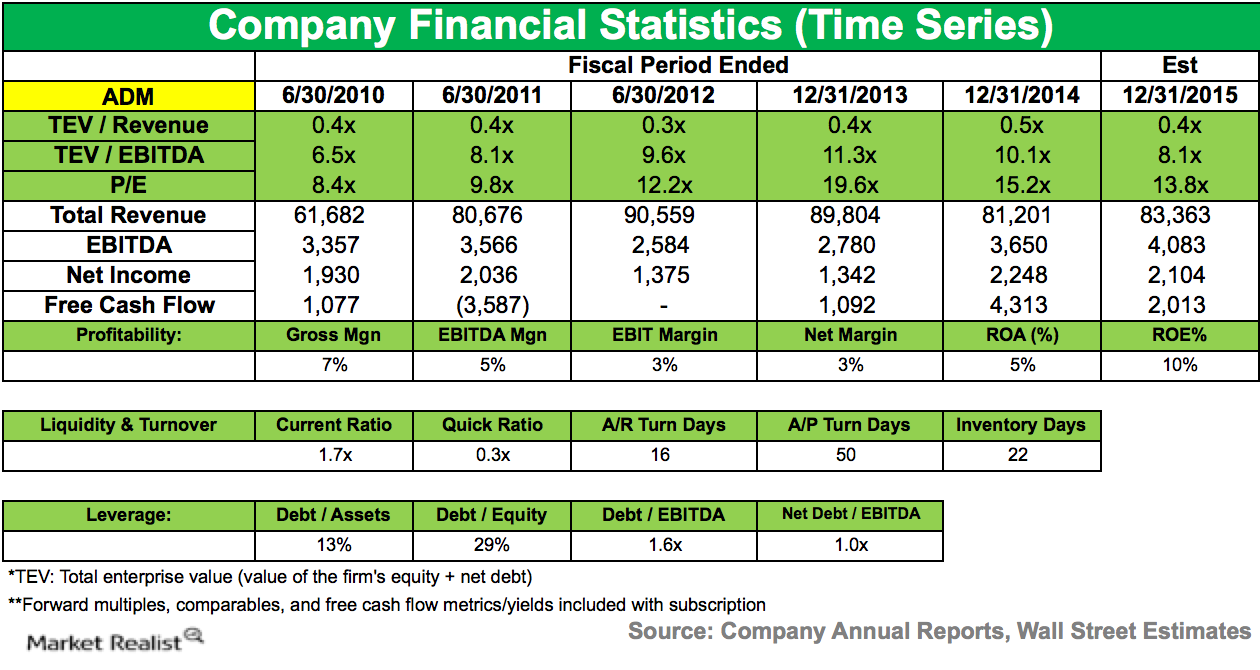

Citadel Advisors Reduces Position in Archer Daniels Midland

The Archer Daniels Midland Company is a processor of oilseeds, corn, wheat, cocoa, and other agricultural commodities.