Goldcorp Inc

Latest Goldcorp Inc News and Updates

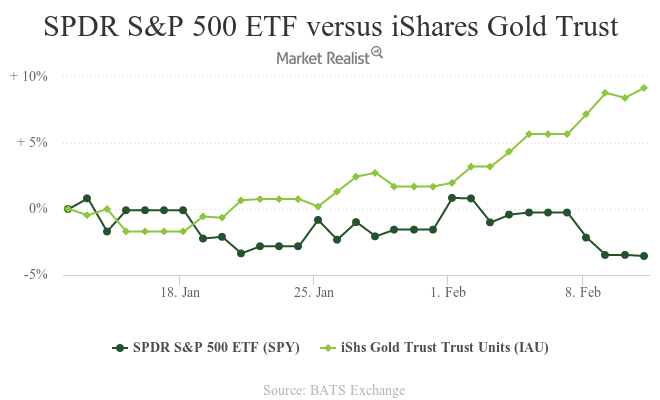

Yellen Wants to Keep Negative Rates on the Table, Helping Gold

When the Federal Reserve chair, Janet Yellen, testified to Congress on February 11, she affirmed the Fed’s consideration of negative interest rates. Under a negative interest rate scenario, investors would pay interest to the bank for holding their money.

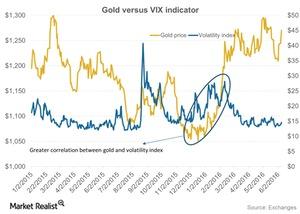

How Much Could Brexit and Volatility Control Gold?

Fears in the overall financial market about a Brexit, the possible exit of Britain from the European Union, have abated. This helped gold fall.

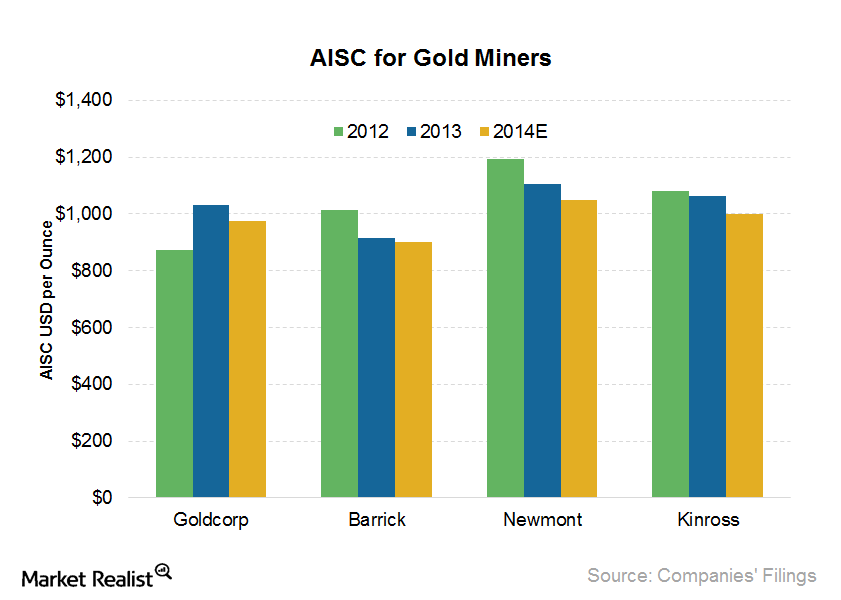

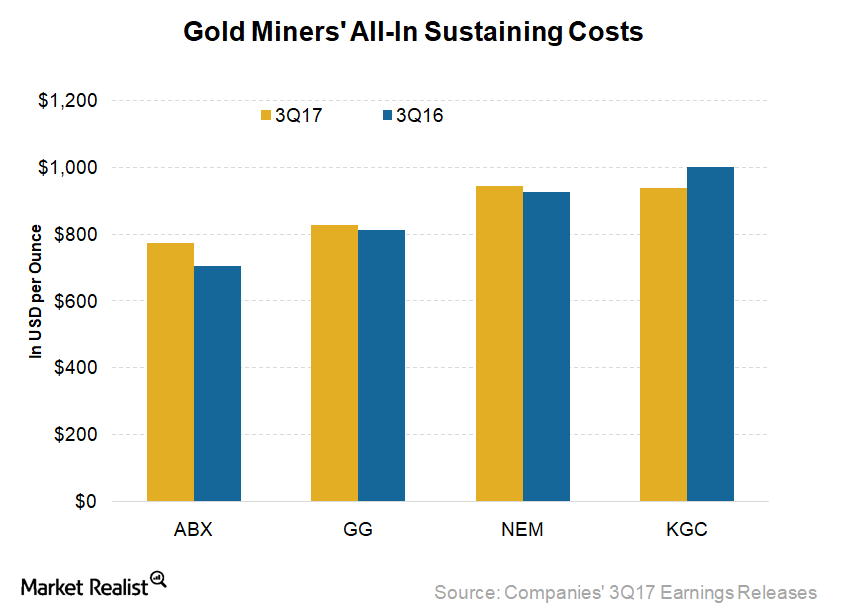

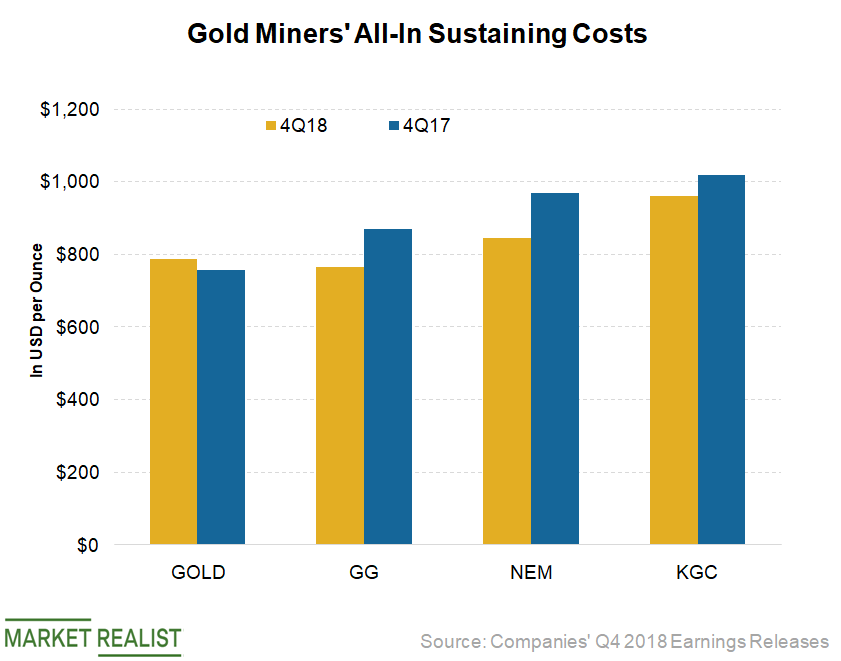

Goldcorp’s cost reduction compared to its peers

Goldcorp’s (GG) all-in sustaining costs (or AISC) are falling. In 2013, its AISC was $1,031 per ounce. It expects the AISC to be in the range of $950–$1,000 for 2014.

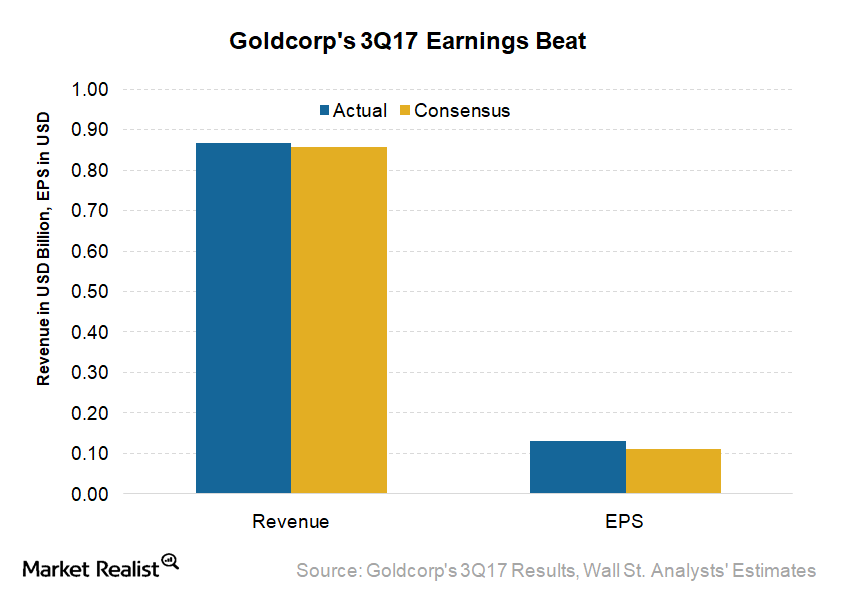

Key Insights from Goldcorp’s 3Q17 Earnings

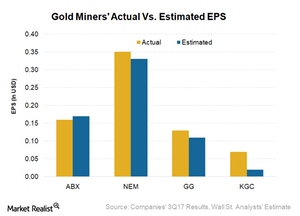

Goldcorp (GG) reported its 3Q17 results after the market closed on October 25, 2017. It reported EPS (earnings per share) of $0.13, which beat analysts’ expectations by $0.02.

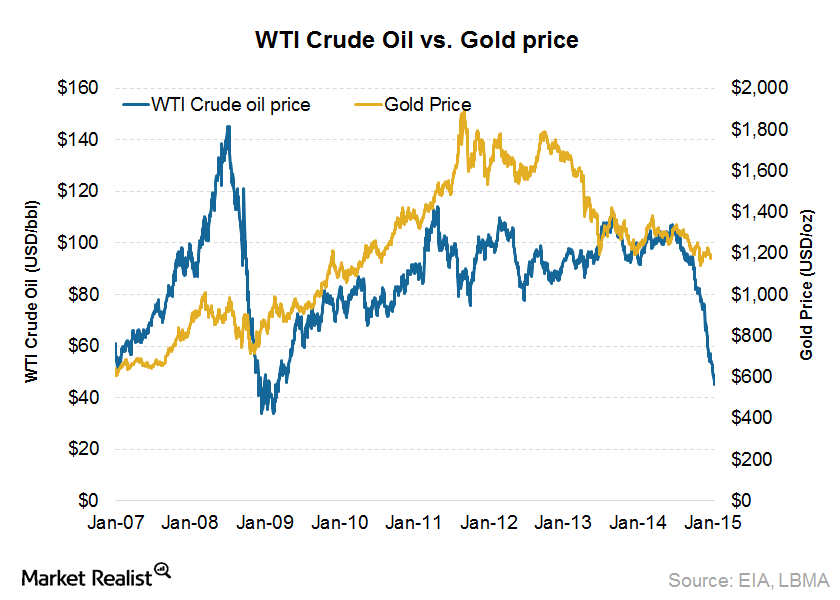

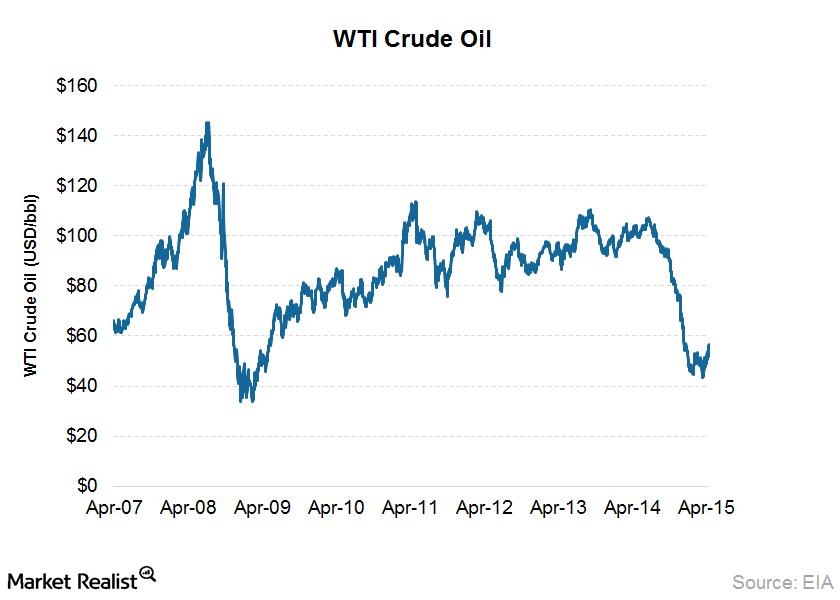

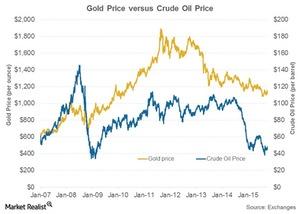

Low crude oil prices impact gold

Cheaper oil means lower inflation. This means gold should be affected negatively since it’s usually considered a hedge against inflation.

Assessing variables that drive the outlook for gold prices

Physical buying from China and India should support the demand for gold. But a rate hike by the Fed could be the catalyst that could take gold down.

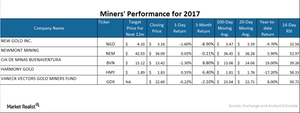

These Gold Miners Surprised Us with Unit Costs in 3Q17

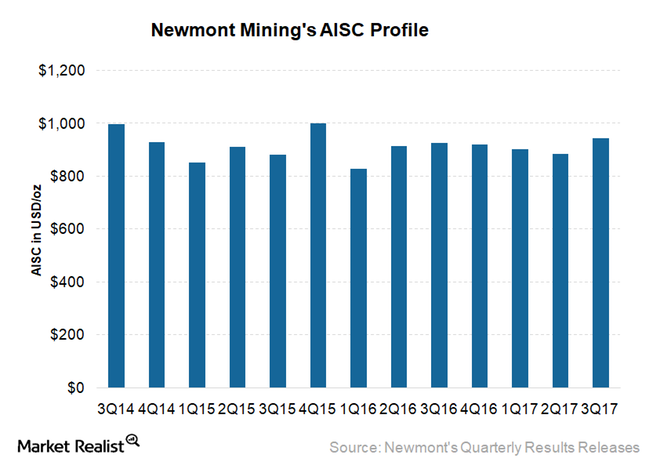

AISC (all-in sustaining costs) are an encompassing measure that helps compare miners’ performance—a vital metric for investors. They show the company’s margin cushion at prevailing gold prices (GLD)(IAU).

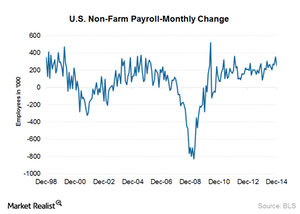

How US labor conditions impact gold investors

It’s important to keep an eye on labor conditions since they offer a look at the future direction of gold prices and ultimately gold-backed ETFs.

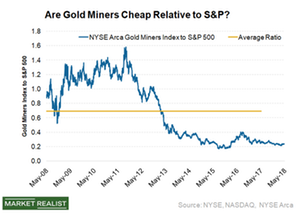

Which Gold Miners Could Offer Valuation Upsides after Q2 2018?

The average ratio of the NYSE Arca Gold Miners Index and the S&P 500 Index (SPY) is 0.18 compared to the ten-year average of 0.68.

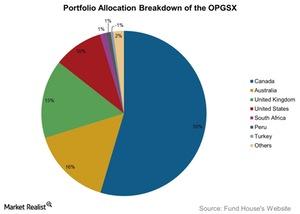

An Overview of OPGSX’s Precious Metal Holdings

OPGSX may also invest up to one-fifth of its portfolio directly into gold or silver bullion and other precious metals.

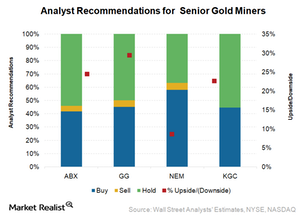

Which Senior Gold Miners Are Analysts Betting On?

As a group, the average gains of North American senior gold miners (GDX) (RING) have been muted.Materials Why an increase in real interest rates makes gold lose its sheen

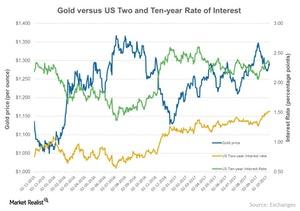

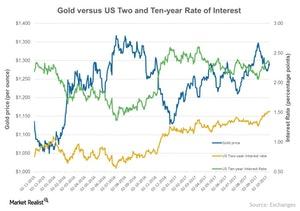

Gold doesn’t give any returns besides appreciation. Appreciation doesn’t always happen. As a result, gold has to compete against assets that yield something. When the return on the alternate assets begins to rise, the demand for gold falls. In a scenario where the real interest rates are rising continuously, the demand for gold—as an investment—will start falling.

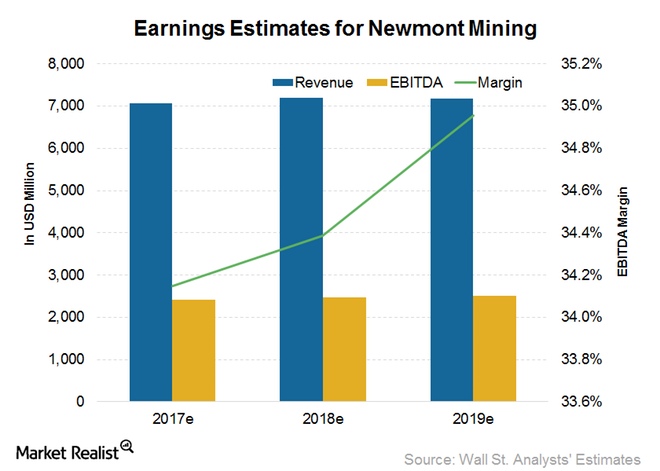

Analysts’ Estimates: Could NEM’s Near-Term Profitability Decline?

Although 2017 has not been very good for Newmont Mining stock due to short-term issues, its outlook remains strong.Materials Must-know: Why US debt to GDP and gold price move together

Debt to gross domestic product (or GDP) is the ratio that shows how much a country owes versus how much it earns. Investors use this ratio to measure a country’s ability to make future payments on its debt. This impacts the country’s borrowing costs and government bond yields.

Which Stocks Are Uptrending in Their Correlations to Gold?

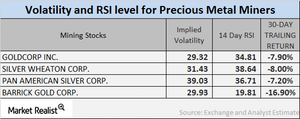

It’s expected that precious metal mining stocks will follow precious metals. So it’s crucial to know which stocks are closely associated with precious metals.

How Gold Miners Could Benefit from Deregulation

A record number of junior companies attended the Precious Metals Summit. We are finding companies with attractive development projects in North America and West Africa as well as some exciting discoveries that merit watching.

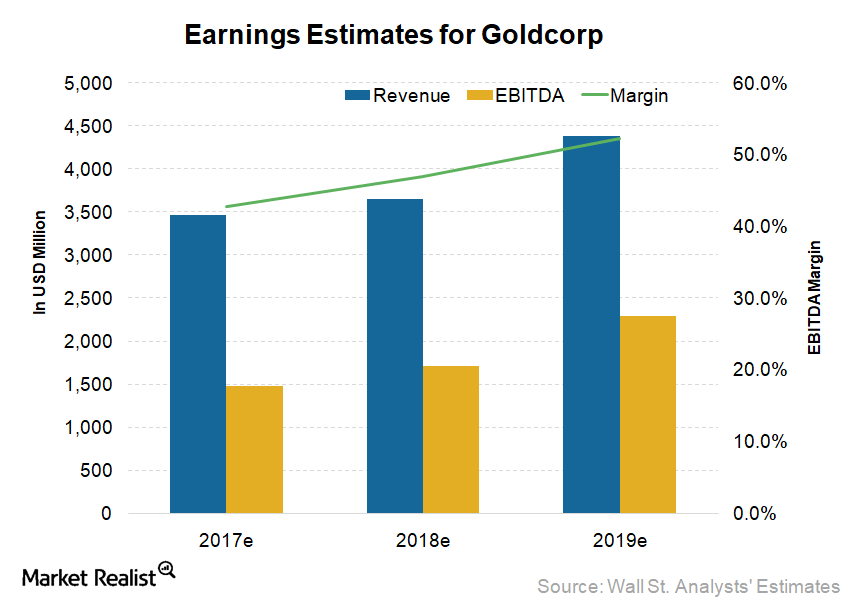

Do Goldcorp’s Earnings Estimates Reflect Analysts’ Increasing Optimism?

Goldcorp (GG) has given negative returns in 2017. Its stock has lost 6.1% of its value as compared to a gain of 12.8% in the iShares Gold Trust (GLD) and 11.1% in the VanEck Vectors Gold Miners ETF (GDX).

Senior Gold Miners’ Earnings Beats and Misses in 3Q17

All the gold miners (RING)(GDX) we’re covering in this series except for Barrick Gold (ABX) reported earnings beats in 3Q17.

Foreign Exchange and Fuel Tailwinds Could Help Newmont in 1Q15

Investors should watch out for any tailwinds or headwinds that could impact Newmont’s costs in 1Q15.

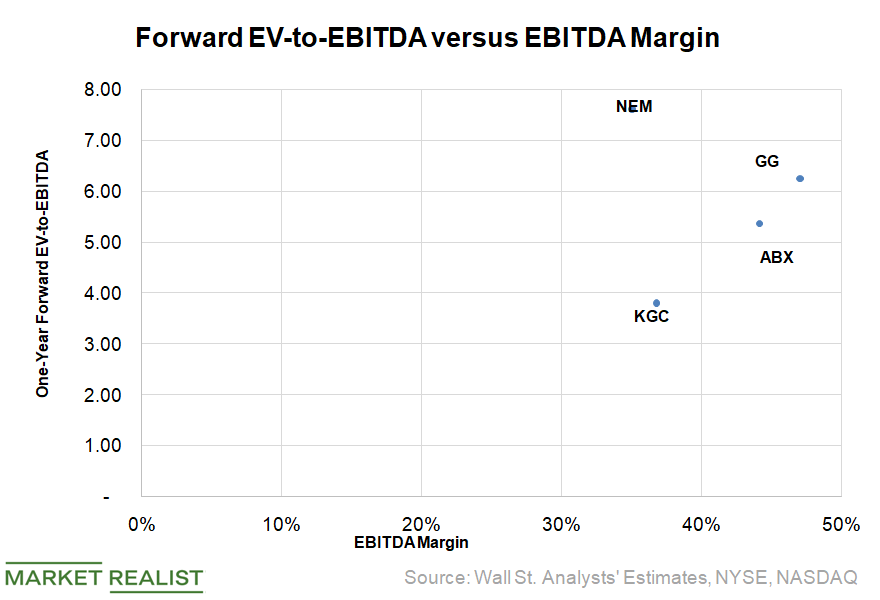

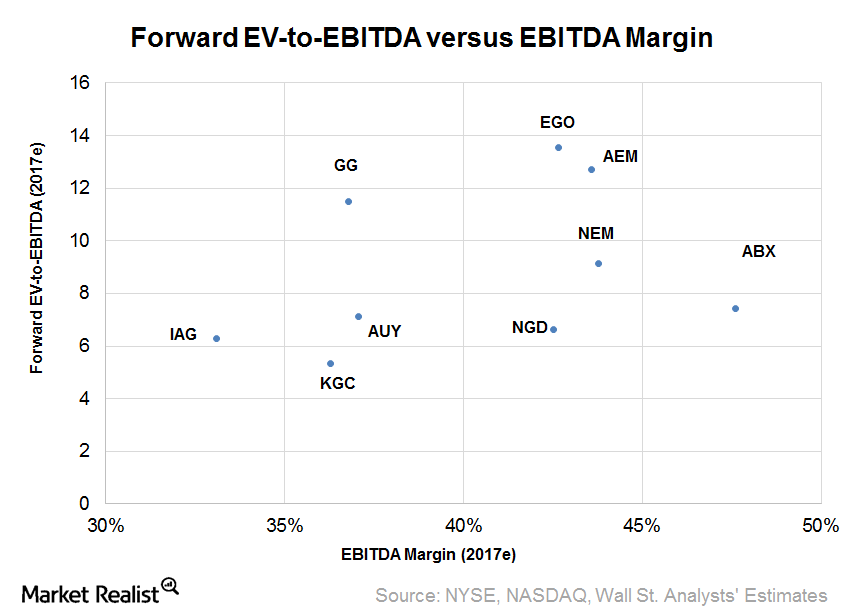

Valuations in Gold: Where’s the Upside among Miners Today?

Among senior gold miners, Goldcorp is trading at the highest multiple of 10.3x—a premium of 31% compared to the peer average.

Which Gold Miners Are Ray Dalio and John Paulson Betting On?

Hedge funds increased their net positions in the SPDR Gold Shares ETF during the first quarter.

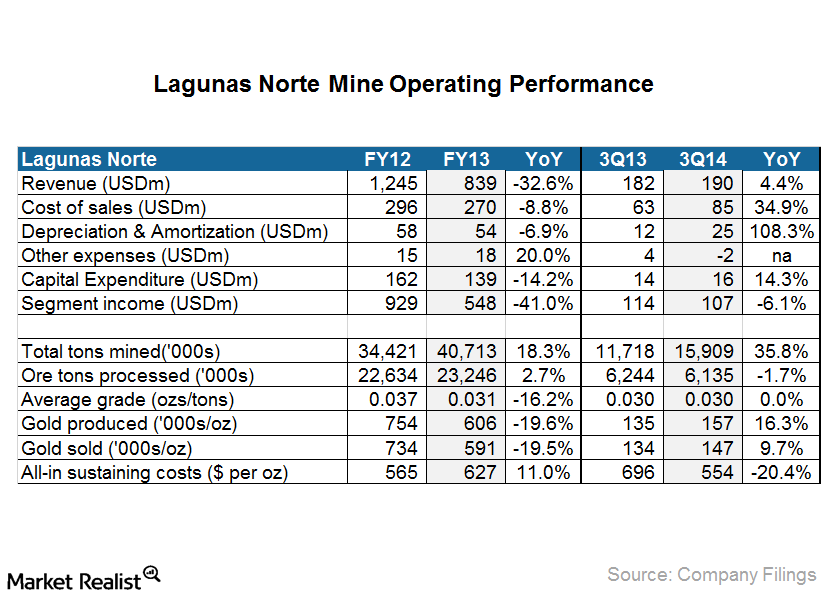

Lagunas Norte: AISC down due to lower sustaining capex

All-in sustaining costs (or AISC) came in at $554 per ounce, a reduction of $142 per ounce from the same period last year. The reduction was mainly due to lower sustaining capital expenditure (or capex).Materials Why gold and the US dollar have an inverse relationship

Gold and the U.S. dollar were associated when the gold standard was being used. During this time, the value of a unit of currency was tied to the specific amount of gold. The gold standard was used from 1900 to 1971. The separation was made in 1971. The U.S. dollar and gold were freed. They could be valued based on supply and demand.

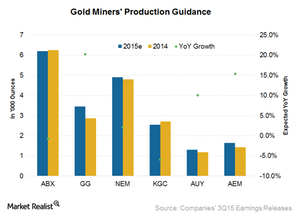

As Good as Gold: Analyzing Gold Miners’ Production Growth

In 3Q15, Goldcorp (GG) posted record gold production of 922,200 ounces—2% growth quarter-over-quarter and 42% growth year-over-year.

Mining Stocks Are Recovering from Their Slump

The Direxion Daily Gold Miners (NUGT) and the ProShares Ultra Silver (AGQ), both leveraged mining funds, both have recovered and jumped 19.4% and 24.9%, respectively, on a five-day trailing basis.

How Gold Stocks Have Performed This Year

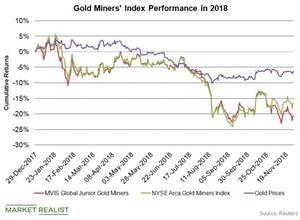

Gold and gold miners didn’t start off the year on a good note.

Will a Rate Hike Pull the Lid off Gold?

Though an increase in rates may initially dim the luster of the metal, after the hike, gold may soar, uninterrupted by looming fears.

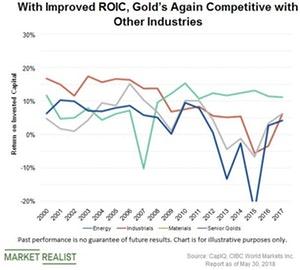

How Gold Mining Industry Has Revived Itself

The last ten years have been a roller coaster ride for the gold (GLD) (GDXJ) (GDX) mining industry.Financials GG’s merger and acquisition strategy is different than its peers

Although every gold miner talks about only doing merger and acquisition (or M&A) strategies that are in shareholders’ best interests, GG sticks to its strategy—unlike most of its peers.

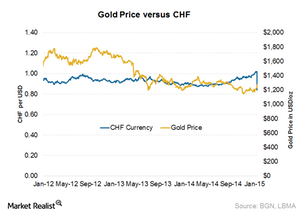

Why the Swiss National Bank removed the cap against the euro

A cap was put in place to stop the currency’s appreciation. An appreciating local currency is detrimental to exporters.

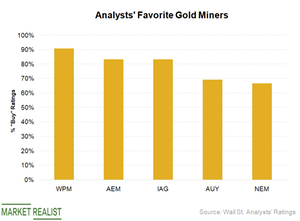

The Five Gold Stocks Wall Street Is Loving Lately

Gold miners usually act as a leveraged play on gold prices. In 2018, the VanEck Vectors Gold Miners ETF (GDX) fell 9.3%, amplifying the 1.9% fall in gold prices (GLD).

Which Senior Gold Miners Are Analysts Loving Lately and Why?

In this series, we’ll consider recommendations, target prices, estimates, and potential upsides and downsides for senior gold miners.

How Do Gold Miners’ Leverage Ratios Look?

Barrick has reduced its debt more than 57% in the last four years from $13.4 billion at the end of 2014 to $5.7 billion at the end of 2018.

How Gold Miners’ Costs Stack Up

Barrick Gold (GOLD) reported AISC of $788 per ounce and a cost of sales of $980 per ounce in the fourth quarter.

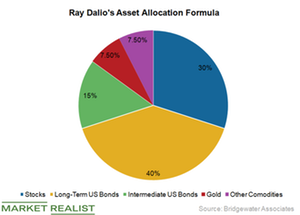

Buffett versus Dalio on Gold: Whose Advice Should You Take?

When it comes to investing in stocks, Berkshire Hathway’s (BRK.A) chair, Warren Buffett, and Bridgewater’s founder, Ray Dalio, have similar advice.

Can Newmont Mining Outperform Its Peers in 2019?

Newmont Mining (NEM) reported its fourth-quarter earnings results before the market opened on February 21.

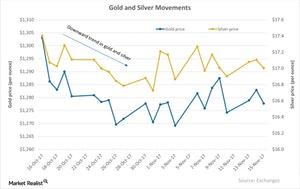

The Most Crucial Element in the Precious Metals Downtrend

Gold ended the day almost flat on Wednesday, May 2, and closed at $1,304.90 per ounce.

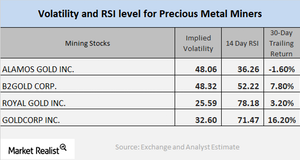

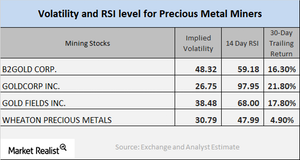

Analyzing the Technicals of Mining Stocks in January 2018

Most mining stocks have risen during the past month due to the revival in precious metals prices.

Reading the Performance of Mining Shares amid Surging Metals

On January 12, 2018, precious metals were once again on a rising streak, which also led to increasing prices for mining shares.

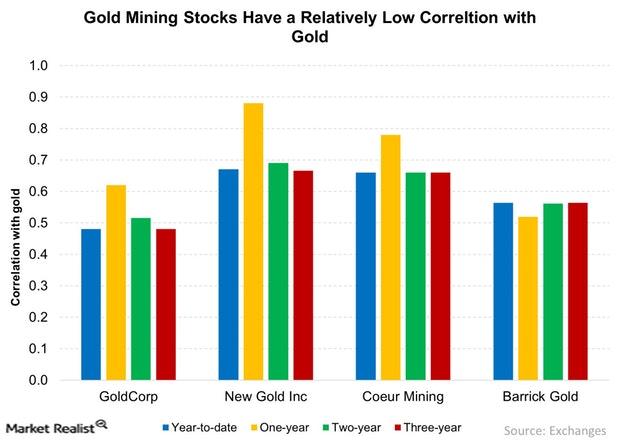

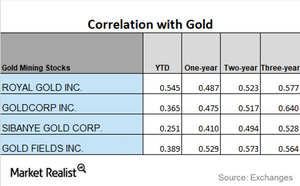

What’s the 3-Year Correlation between Miners and Gold?

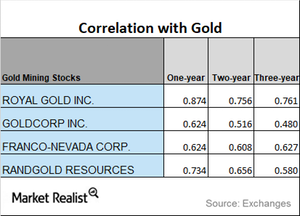

Gold is the most influential precious metal, and most miners follow its price trends.

Your End-of-2017 Correlation Study of the Major Miners

The PowerShares DB Gold Fund (DGL) and the VanEck Merk Gold Trust (OUNZ) rose 2.2% over the five trading days leading up to December 27, 2017.

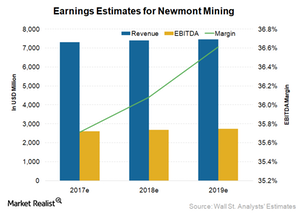

These Factors Are Driving Analysts’ Estimates for Newmont Mining

Newmont Mining’s mean consensus revenue for 2017 is $7.3 billion. This implies year-over-year (or YoY) growth of 8.1%.

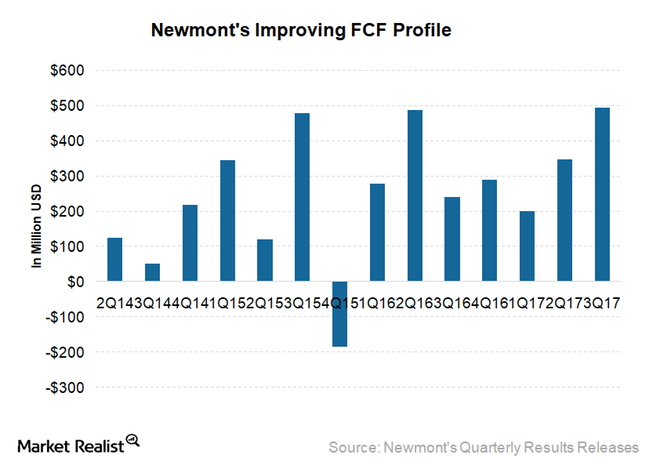

How Newmont Mining Plans to Generate Free Cash Flow in 2018

As NEM’s all-in sustaining costs (or AISC) have fallen 22.0% since 2012, its FCF has improved by $3.60 per share.

Investors Might See a Bump in Newmont’s Costs in 2018 before Improving

Newmont Mining (NEM) is expecting its newest mines to add production at just $750 per ounce.

How the Federal Reserve’s Rate Hike Affected Precious Metals

Precious metals and miners saw some relief on December 13 after the Fed raised rates as expected. Sibanye Gold (SBGL), Aurico Gold (AUQ), and Goldcorp (GG) rose 3.5%, 3.6%, and 5.8%, respectively.

Rate Hike Could Move Precious Metals and Miners

Investors have their eyes set on the interest rates. A rise in the interest rates causes the demand for precious metals to fall.

A Brief Analysis of the Miners in November 2017

RGLD, GG, SBGL, and GOLD reported RSI levels of 52.5, 62.7, 49.2, and 81.4, respectively.

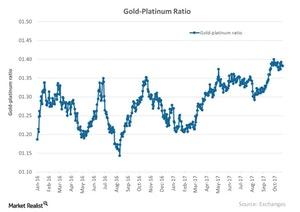

Insight into the Platinum Markets in November 2017

The gold-platinum ratio was ~1.4 on November 22, 2017.

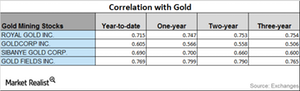

Comparing Miners’ Correlation with Gold

Correlation analysis Mining stocks’ performance usually depends on precious metal prices. Correlation analysis can give investors some perspective on how mining stocks relate to precious metals, especially gold. In this part of our series, we’ll look at four miners—Royal Gold (RGLD), Goldcorp (GG), Franco-Nevada (FNV), and Randgold Resources (GOLD)—and their correlation with gold. On Monday, the ETFS Physical […]

India’s Gold Imports Have Fallen: What’s Going On?

For India, gold imports have fallen 16% in value to ~$2.9 billion in October 2017 compared to $3.5 billion in the corresponding month last year.