Goldcorp Inc

Latest Goldcorp Inc News and Updates

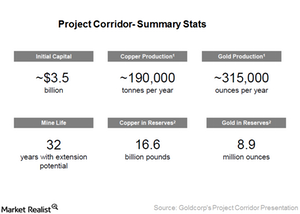

Goldcorp Acquires New Gold’s 30% Interest in the El Morro Project

On August 27, Goldcorp (GG) announced that it has entered into an agreement with New Gold (NGD) to acquire its 30% interest in the El Morro gold-copper project in Chile.

China’s Falling Stock Market Pushes Gold Upward

The turnaround from the direction that gold was headed during the last month has also supported silver prices. Silver fell marginally by 0.68% last month.

Is the Market Excited about Goldcorp’s Recent Moves?

Goldcorp (GG) announced on August 27 that it has bought the remaining 30% stake of El Morro from New Gold (NGD).

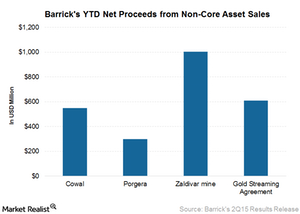

Barrick Gold in 2Q15: The Benefits of Asset Monetization

So far, Barrick has achieved 90% of its 2015 debt reduction target of $3 billion, mainly thanks to asset monetization.

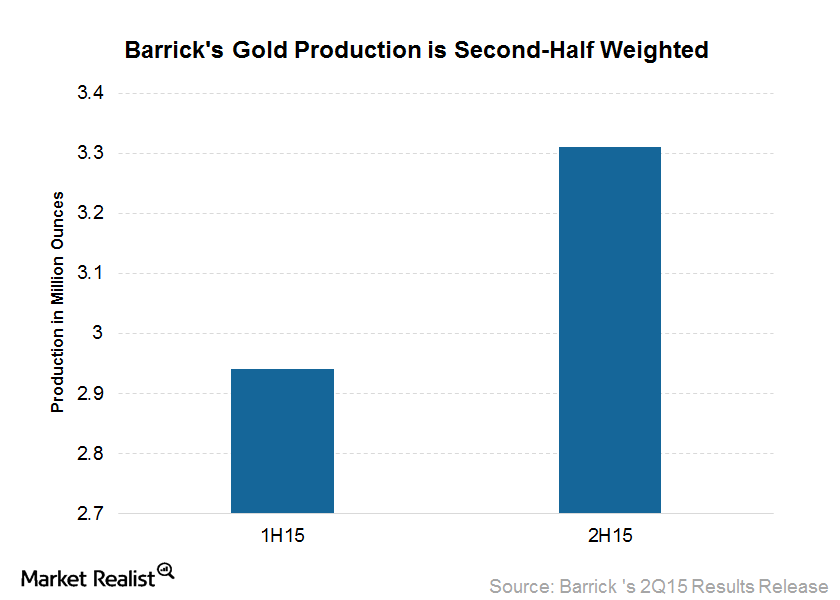

Barrick Gold Weights 2015 Production toward the 2nd Half

Barrick has reduced its 2015 gold production guidance to 6.1 million to 6.4 million ounces from 6.2 million to 6.6 million ounces.

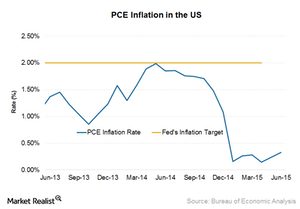

Could PCE Inflation Inspire Action at the Next Fed Meeting?

The BEA released the PCE inflation index for June on August 3, 2015. PCE inflation rose 0.30%—a pace that hasn’t been seen since December 2014.

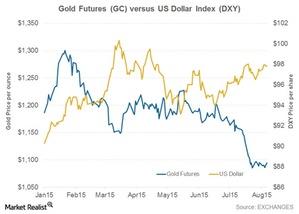

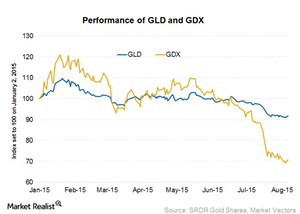

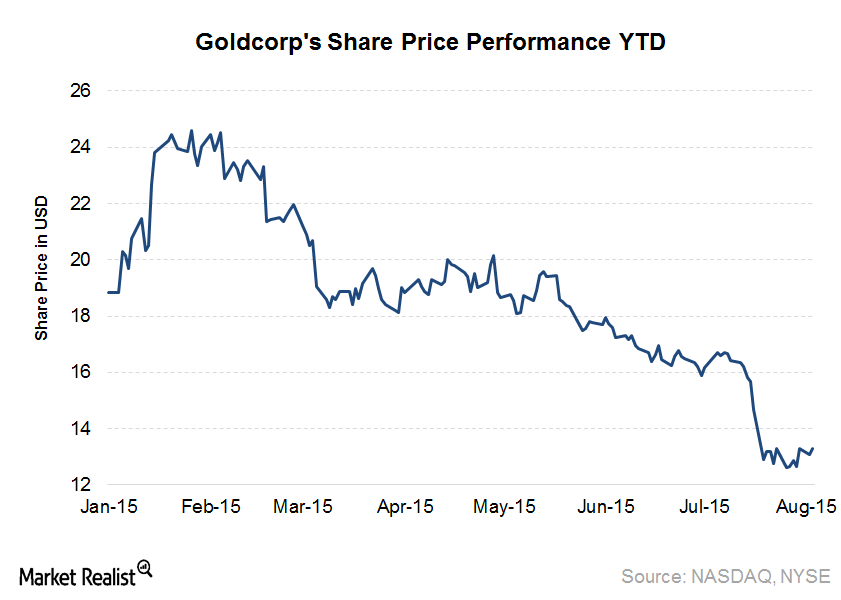

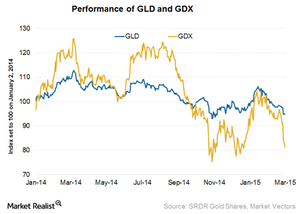

Key Indicators Are Pointing to Gold Prices

Gold prices have been steadily falling since the last week of June. As of August 11, gold prices (GLD) have fallen by 4.40% in a month.

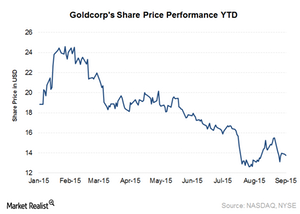

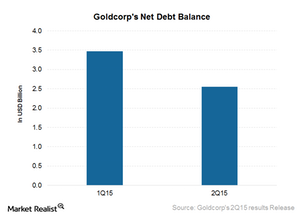

Goldcorp’s FCF Growth Could Strengthen Its Balance Sheet

Goldcorp has the strongest balance sheet in its peer group. Goldcorp’s liquidity is also comfortable at $3.2 billion, including $940 million in cash and cash equivalents.

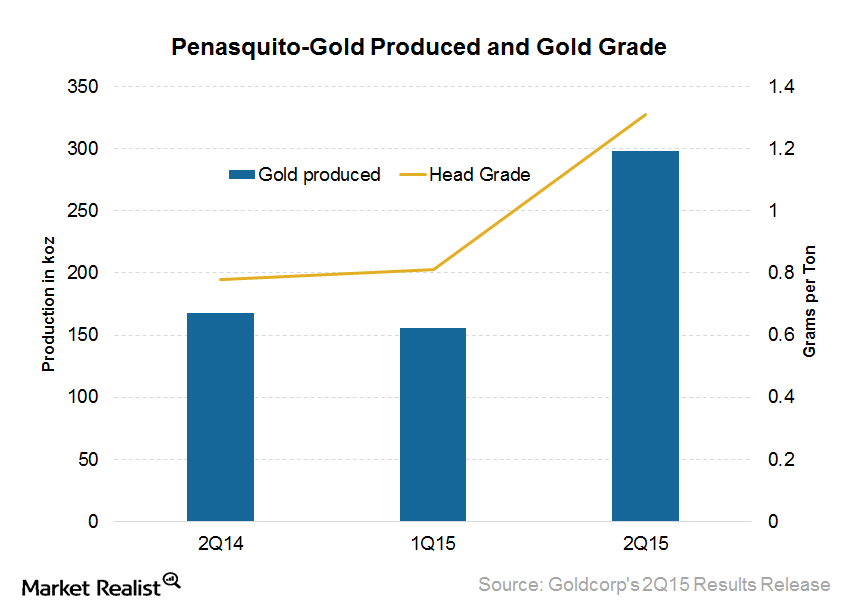

Peñasquito Helps Achieve Record Quarterly Production for Goldcorp

The Peñasquito mine contains gold, silver, lead, and zinc. It achieved its first commercial production in 2010, on schedule and on budget.

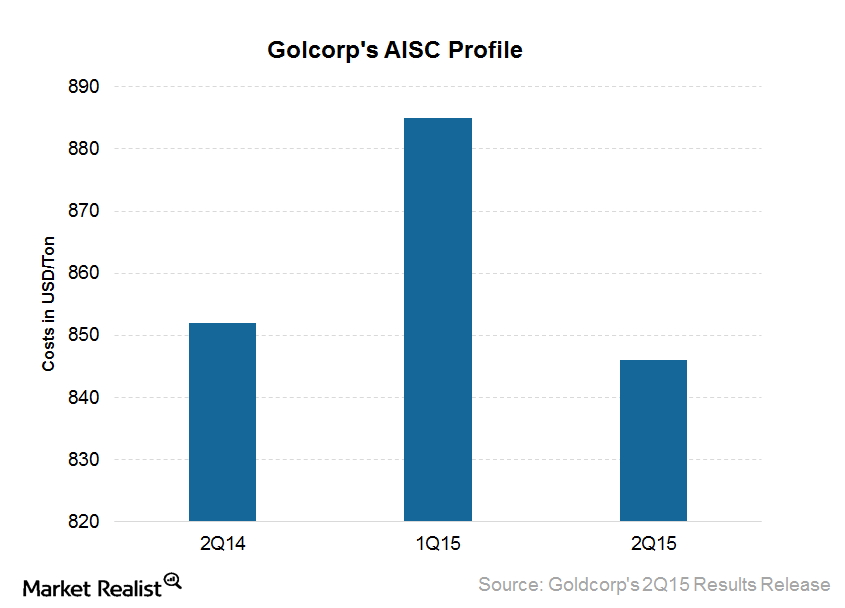

Improved Cost Outlook Bodes Well for Goldcorp’s Future

Goldcorp reported a strong reduction in all-in sustaining costs (or AISC) for 2Q15. AISC came in at $846 per ounce, compared with $885 per ounce in 1Q15 and $852 in 2Q14.

Do Falling Gold Prices Mean More Mergers Are in the Cards?

Gold touched its lowest level on July 24. Its price fell to $1,073.70. Miner ETFs have suffered more than gold prices themselves.

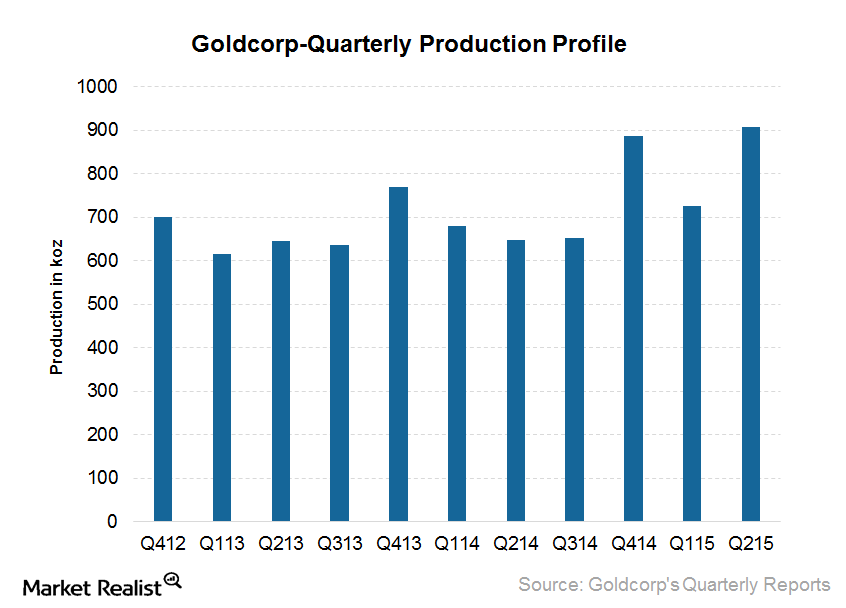

Goldcorp’s Production Growth Starts to Deliver in 2Q15

In 2Q15, Goldcorp achieved record gold production of 908,000 ounces. The Peñasquito mine in Mexico posted a record 298,000 ounces—33% of total gold production.

How Goldcorp Beat Estimates in Its 2Q15 Earnings

Goldcorp announced its 2Q15 results on July 30. The company’s gold production showed very strong growth at 25.3% quarter-over-quarter.

Newmont Reports Strong Gold Production in 2Q15

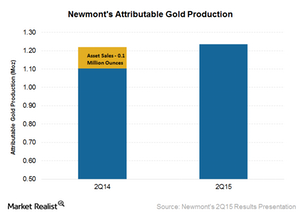

Newmont Mining’s (NEM) attributable gold production for 2Q15 was 1.24 million ounces. This is higher by 0.2 million ounces compared to the same quarter last year.

Newmont Mining Reports Solid 2Q15 Results

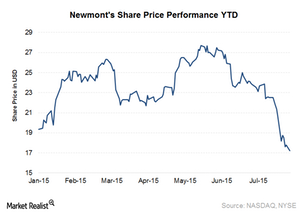

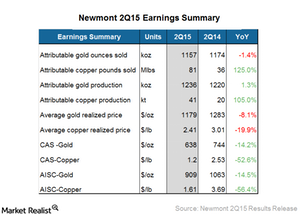

Newmont Mining (NEM) announced its 2Q15 results on July 22. It reported adjusted EPS of $0.26 and adjusted EBITDA of $692 million.

Key Highlights of Newmont’s 2Q15 Earnings

In its 2Q15 earnings release, Newmont Mining (NEM) reported net income attributable to shareholders of $131 million, or $0.26 per share. This compares to $101 million, or $0.20 per share, in 2Q14.

Newmont Mining’s Acquisition Makes Strategic Sense

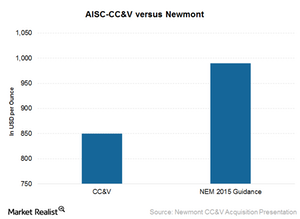

The CC&V mine acquisition will help Newmont achieve a lower-cost profile. The mine’s cost attributable to sales and all-in sustaining costs are lower than Newmont’s current averages.

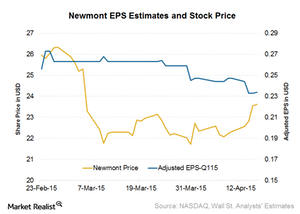

What Are Market Expectations for Newmont in 1Q15?

Analysts’ sales estimate for Newmont is $1.93 billion for 1Q15 compared to $1.80 billion in 4Q14.

Newmont Will Release 1Q15 Results on April 24

Newmont Mining is the world’s second largest gold producer. It’s the only gold company included in the S&P 500 Index and Fortune 500.

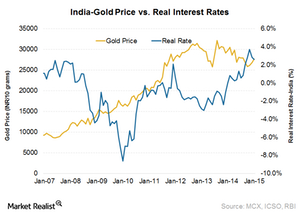

India’s rising real interest rate is negative for gold

India’s real interest rate has moved up rapidly in the last few months due to declining inflation.

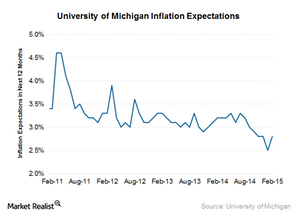

What do US inflation expectations mean?

In 2014, inflation expectations were 2.8% to 3.3%. In January 2015, expectations dropped to 2.5%, the lowest since September 2010.

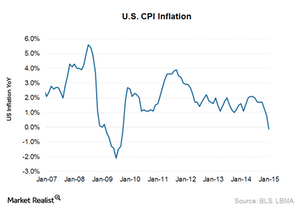

US inflation rate hits negative for the first time since 2009

The US Consumer Price Index reading for the month of January was -0.1%. This is the first negative US inflation reading since October 2009.

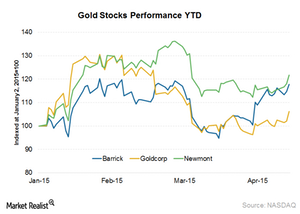

Why tracking gold indicators is important for investors

In this series, we’ll look at some gold indicators investors can track to get a sense of what direction the price of gold will take.

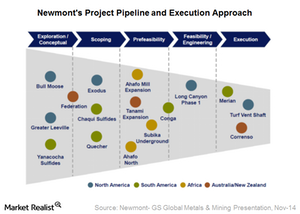

How is Newmont’s project pipeline looking?

Newmont Mining has a strong project pipeline of 16 projects across different stages of development throughout the world.

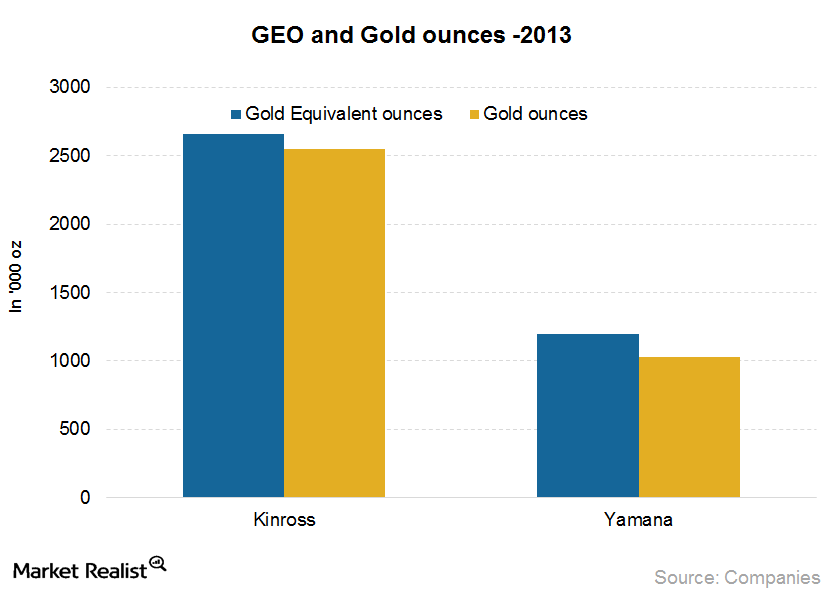

Must-read: Understanding gold companies’ gold equivalent ounces

It’s important to understand GEO or gold equivalent ounces because gold companies like Goldcorp (GG), Barrick Gold (ABX), Newmont Mining (NEM), and Kinross (KGC), measure their production and reserves in different ways. You need to make sure you’re comparing apples to apples.

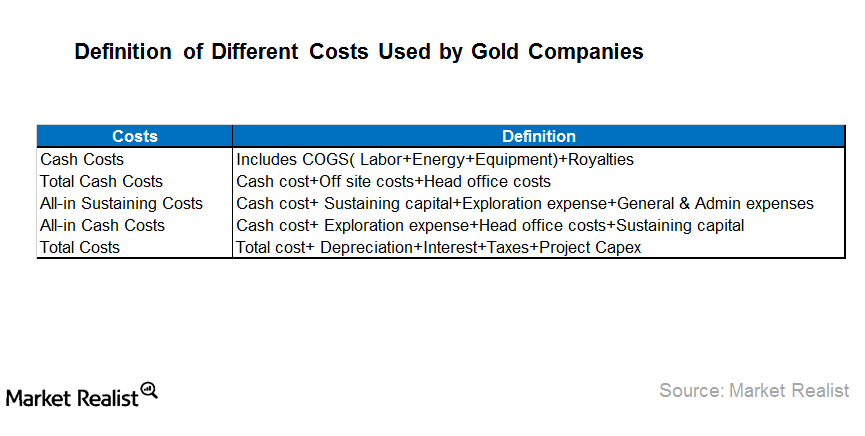

Must-know: Deciphering gold companies’ cost reporting

Gold mining companies like Goldcorp Inc. (GG), Barrick Gold Corp. (ABX), and Newmont Mining Inc. (NEM) report cash costs, total cash costs, total costs, and all-in cash costs. It can be very confusing for investors to understand exactly what’s what here.Materials Gold companies’ cash costs and all-in sustaining cash costs

In the gold industry, substantial discrepancies exist between the actual costs incurred and the costs reported by the companies. In this part, we’ll discuss different methodologies and how effective they are at representing a company’s true costs.Materials Must-know: Is gold an effective hedge against inflation?

An inflation hedge is basically an investment that’s expected to increase its value over a specific period of time. Gold might not have a linear relationship with inflation. However, it’s probably better than most of the investment alternatives available. It protects the portfolio against inflation.

Why is gold considered so special as an investment?

Gold is an unusual metal. It exists in the Earth’s crust as an element. It’s not chemically combined with other metals. Silver and copper are the only other metals naturally found in their elemental form.Materials Must-know: A guide to investing in gold

Investing in gold is complex. It’s challenging because it’s hard to predict gold prices in the future. However, there are many indicators that investors can track. The indicators help to determine the direction that gold prices will take.