Goldcorp Inc

Latest Goldcorp Inc News and Updates

Directional Changes in the Correlation of Miners to Gold

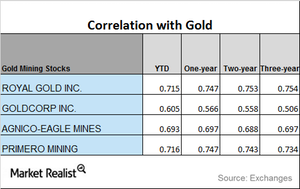

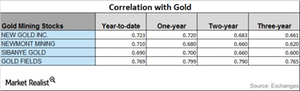

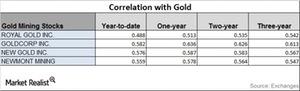

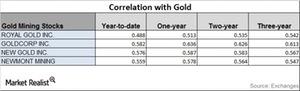

New Gold and Goldcorp have seen upward trends in their correlations with gold, while Newmont Mining has seen its correlation decline.

Your Brief Correlation Study of Major Mining Stocks Last Week

The iShares MSCI Global Gold Min (RING) and the VanEck Vectors Junior Gold Miners (GDXJ) have seen YTD (year-to-date) gains of 6.4% and 9%, respectively.

Analyzing Miners’ Trends in October

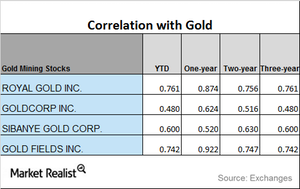

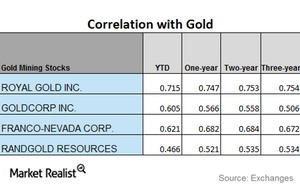

Mining stocks’ correlation with precious metals Most of the time, mining stocks’ performance follows that of precious metals. However, they can deviate. Correlational analysis can give investors some insight into how mining stocks relate to gold and silver. In this part of our series, we’ll compare Royal Gold (RGLD), Goldcorp (GG), New Gold (NGD), and Newmont Mining (NEM). Mining […]

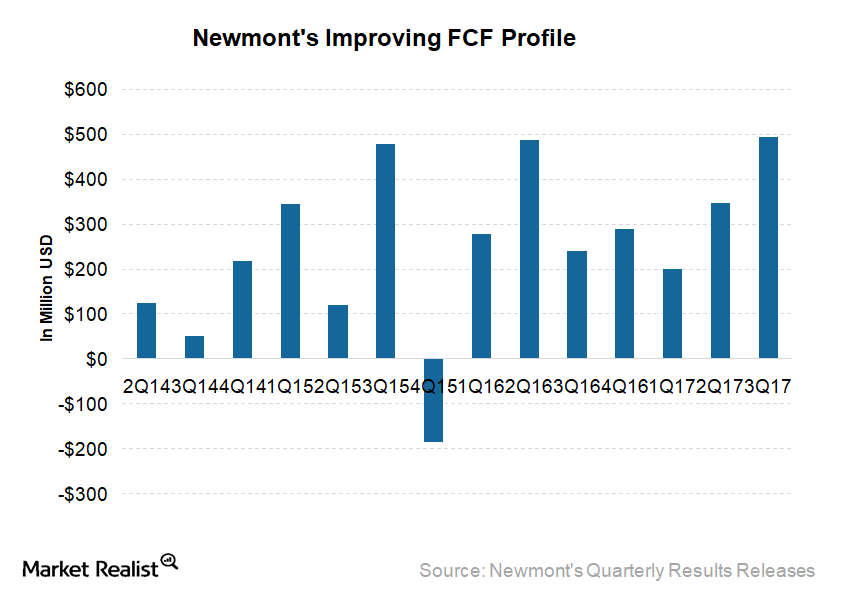

These Factors Could Drive Newmont’s Free Cash Flow

Generating FCF (free cash flow) is very important for miners (GDX)(RING) as it helps them optimize their financial leverages, invest in projects supporting long-term value, and provide shareholder returns.

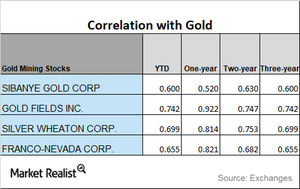

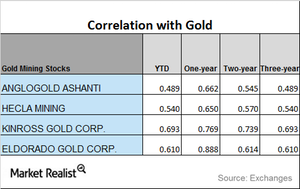

Analyzing Mining Shares’ Correlation in October

Understanding mining stocks’ correlation with gold is crucial for investors in precious metal mining stocks.

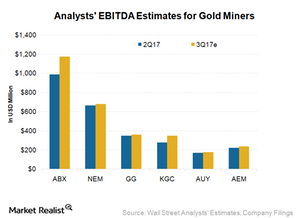

What Analysts Are Forecasting for Gold Miners’ 3Q17 Earnings

Analysts expect Barrick Gold’s (ABX) EBITDA to fall 17% YoY in 3Q17 to $988 million.

Are North Korea Tensions Continuing to Affect Precious Metals?

All the four precious metals saw an up day on Monday, October 9, 2017.

Mining Stocks so Far in 2017: A Correlation Study

Among these four mining stocks, Goldcorp has the lowest correlation with gold on a YTD basis, while Royal Gold (RGLD) has the highest correlation.

Chart in Focus: Correlation of Mining Stocks with Gold

New Gold has a three-year correlation of 0.67 and a one-year correlation of 0.88 to gold.

Understanding Mining Company Technicals amid Today’s Turbulence

Many mining stocks saw a revival in prices on Monday, September 25, 2017, since precious metals saw an upswing.

Reading the Correlation of Mining Shares

Monday, September 25, 2017, was a day of revival for mining shares as tensions in North Korea resurfaced.

Analyzing Miners’ Technicals in September 2017

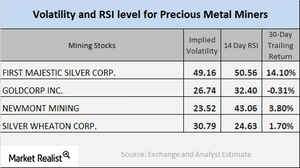

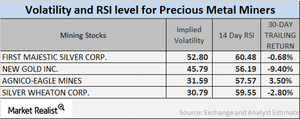

On September 22, 2017, First Majestic Silver, Goldcorp, Newmont Mining, and Silver Wheaton had volatilities of 49.1%, 26.7%, 23.5%, and 30.8%, respectively.

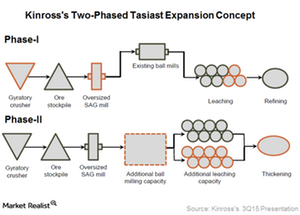

Why the Tasiast Expansion Is Key to Kinross Gold’s Potential

The Tasiast Phase One expansion is expected to increase mill throughput capacity from 8,000 tons per day to 12,000 tons per day.

Analyzing the RSI Movements of Precious Metals

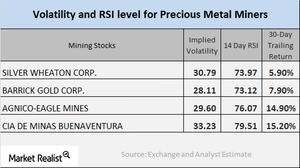

The price movement in precious metals is often closely traced by mining stocks. Before investors opt for mining stocks, they should analyze a few of the crucial technical details.

How Strongly Can North Korea Move the Precious Metals Market?

Gold futures for September expiration have risen ~3.9% over the past one-month period. Silver, platinum, and palladium have followed the same track as gold.

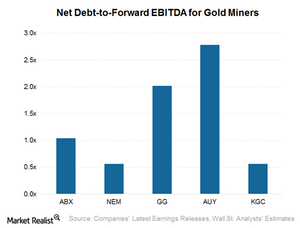

Assessing Gold Miners’ Capacity to Repay Debt through Earnings

Yamana Gold’s (AUY) net-debt-to-forward EBITDA ratio is 2.8x, which is higher than its peers’ ratios.

Analyzing Miners’ Correlation in July 2017

Royal Gold’s correlation fell from a three-year correlation of ~0.75 and a year-to-date correlation of ~0.72 with gold.

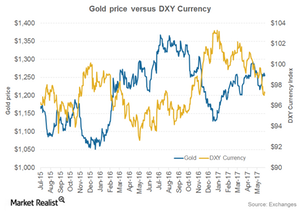

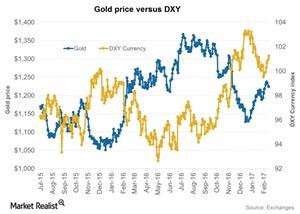

How the Euro Pushed the Dollar Lower and What It Meant for Gold

July 20, 2017, was an up day for the euro, which put downward pressure on the US dollar as represented by the U.S. Dollar Index (or DXY).

What’s the Correlation between the Dollar and Gold?

The rise in gold on June 6 also boosted the other three precious metals. Silver futures for August delivery were 1.4% higher for the day and closed at $17.6 per ounce.

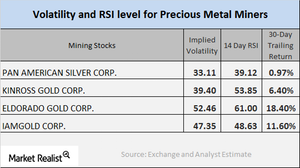

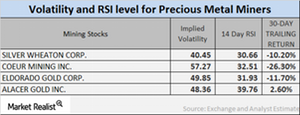

Are RSI Numbers Moving Away from or Close to Critical Levels?

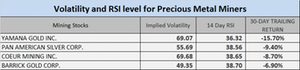

Investors are constantly speculating about the impact on precious metals of a possible Fed rate hike in June. Let’s look at some 14-day RSI scores and implied volatility.

How Are the Correlations of Mining Stocks Moving?

Fears surrounding a potential upcoming interest rate hike took over precious metals recently, and they fell at the beginning of May 2017.

Will the Dollar Get Burned by Another Rate Hike?

While the US dollar has seen a decline in 2017, the increased possibility of a Fed rate hike in June could give the currency some breathing room.

Upcoming French Elections Could Impact Gold

Since the French elections are right around the corner, investors might start parking their money in safe-haven assets like gold.

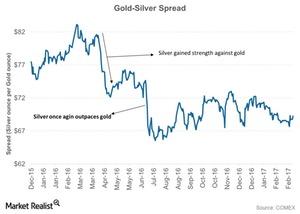

Analyzing the Gold-Silver Spread as Investors Await Further Cues

When analyzing the precious metals market, it’s important to take a look at the relationship between gold (SGOL) and silver (SIVR).

What Scenarios Decide How Precious Metals Move?

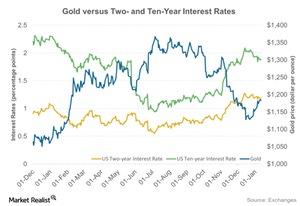

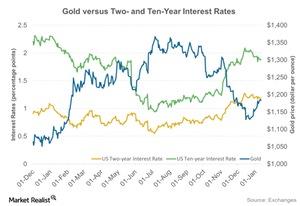

The directional move of the interest rate is a crucial determinant of the direction precious metals will take.

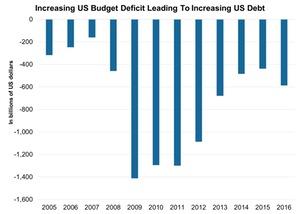

How Big Is the US Debt Compared to Other Nations?

Japan leads the nations with its rising debt-to-GDP ratio. The United States is in seventh place.

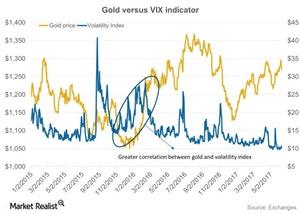

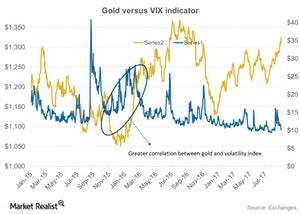

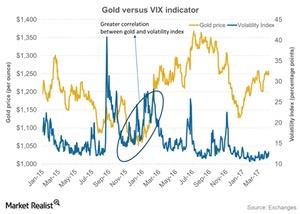

How Precious Metals Have Performed amid Volatility

Precious metal mining stocks are known to closely track the performances of precious metals.

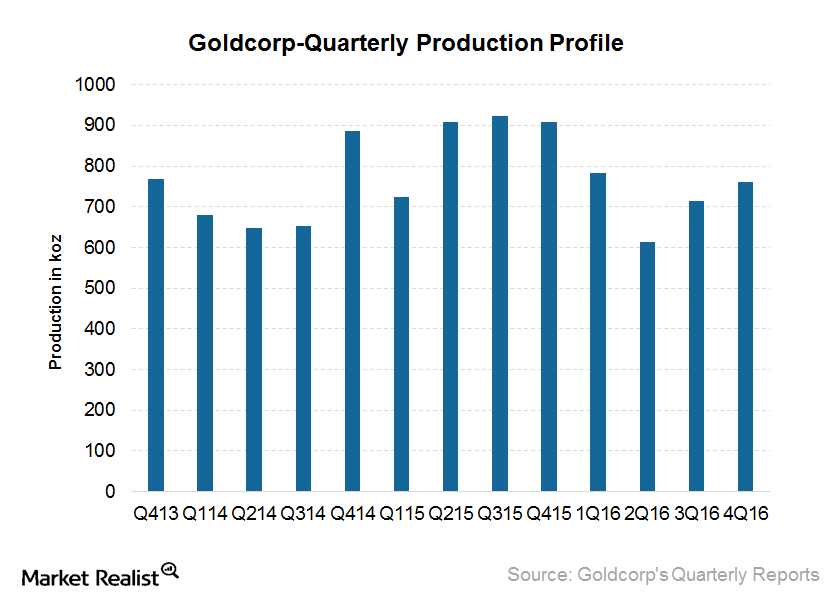

What Are the Drivers of Goldcorp’s Production Growth?

Goldcorp’s gold production fell 16% year-over-year in 4Q16 to 761,000 ounces. The company’s management had guided for 2.8 million–3.1 million ounces of gold production in 2016.

How Interest Rates Are Impacting Precious Metals

Many of the recent changes in precious metals have been determined by changes in the interest rates offered on US Treasuries.

How Mining Stocks Reacted to Plummeting Metals

Mining companies that have high correlations to gold include Royal Gold (RGLD), Goldcorp (GG), New Gold (NGD), and Newmont Mining (NEM).

How Are Miners and Gold Correlated?

The substantial returns of most mining companies have been due to safe-haven bids that boosted gold and other precious metals.

Reading the RSI Levels and Volatilities of Mining Companies

Many of the fluctuations in precious metals have been determined by the Federal Reserve’s interest rate stance. These variations play on precious metals funds.

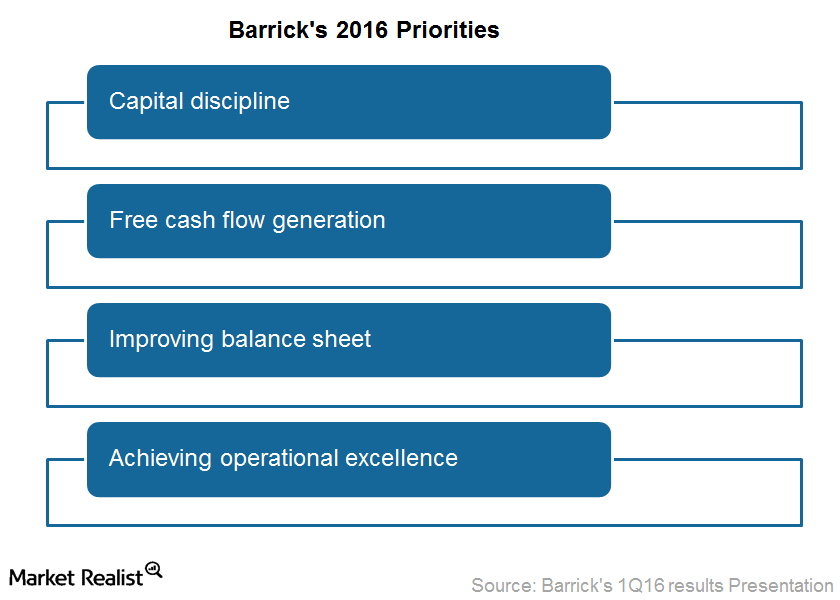

What Will Barrick Gold’s Focus on Its 4 Priorities Achieve?

Barrick Gold (ABX) wants to achieve positive free cash flow even at a gold price of $1,000 per ounce.

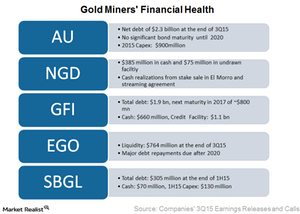

Which Intermediate Gold Miners Could Run into Financial Concerns?

Eldorado Gold is well placed financially. It had a liquidity of $763.8 million, including $388.8 million in cash, cash equivalents, and term deposits.

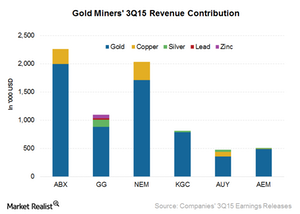

Why You Should Look Out for Gold Miners’ Commodity Exposure

It’s important to understand not only miners’ geography but also their revenue composition in terms of commodity exposure.

Why Have Newmont and Agnico Outperformed?

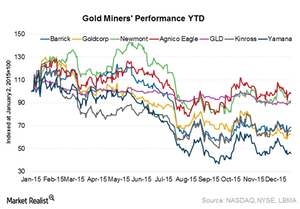

In this series, we’ll look at various factors that are affecting gold miners like Barrick Gold, Newmont Mining, Goldcorp, Yamana Gold, Agnico Eagle Mines, and Kinross Gold.

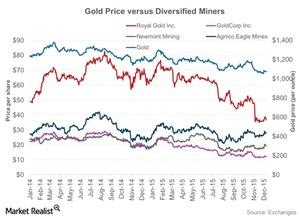

How Gold Prices Impact Diversified Miners

The term “diversified miners” refers to mining companies that are not into streamlined gold or silver mining, but also mine base metals.

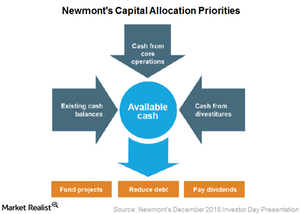

How Will Newmont’s Capital Allocation Priorities Look Like?

Newmont Mining outlined its capital allocation priorities. Management mentioned that they aim to fund their projects through cash generated from core operations.

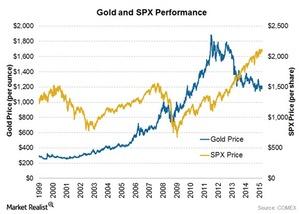

Gold’s Correlation to the Equity Markets

A look at gold and equity market performance demonstrates that a falling stock market isn’t necessarily a catalyst for a major rally in gold.

What Can You Learn from the Recent Gold Price Swings?

After getting a good start to the year—driven by strong demand from Asia, the Greek crisis, and the Swiss currency cap removal—gold prices started pulling back in April.

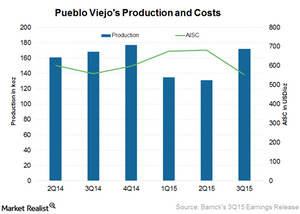

Barrick: What Will Drive Increased Recoveries for Pueblo Viejo?

The Pueblo Viejo mine is a joint venture between Barrick Gold Corporation (ABX) at 60% and Goldcorp (GG) at 40%.

Must-Read Notes on Barrick Gold’s 3Q15 Earnings and Conference

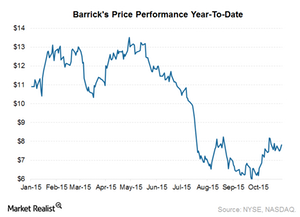

Barrick Gold (ABX) reported its 3Q15 results on October 28 after market hours and held its conference call the next day. Its results beat market expectations.

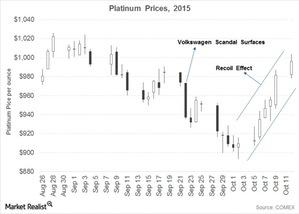

Analyzing the Coiled Spring Effect in Platinum Prices

After the VW scandal, platinum prices jumped to an almost two-week high, again entering the $1,000 territory after hitting a low of $893.4 on October 2.

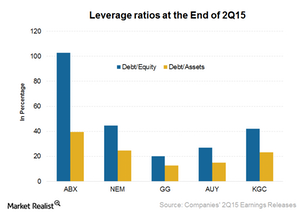

Comp: Analyzing the Financial Leverage for Gold Miners

Barrick Gold’s (ABX) financial leverage is among the highest in the industry. Barrick has a high debt-to-assets ratio of 40%.

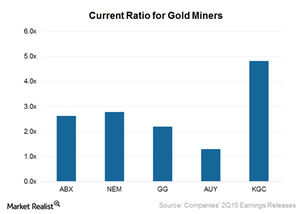

Comp: Importance of Looking at Gold Miners’ Liquidity Profile

In a weaker commodity price environment, a company’s short-term liquidity might come under more pressure. It could be forced to take drastic measures.

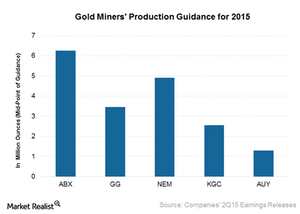

Comp: Which Gold Miners Expect Production Growth Going Forward?

Yamana Gold (AUY) expects higher gold production in the second half of the year compared to the first half of the year. It’s expected to be more than 15% higher.

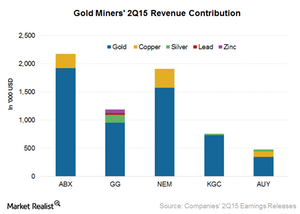

Comp: Do Gold Miners with an Exposure to Copper Face Downside?

Newmont Mining (NEM) has exposure to gold and copper. In 2Q15, it generated 18% of its revenue from copper. The rest of its revenue was from gold sales.

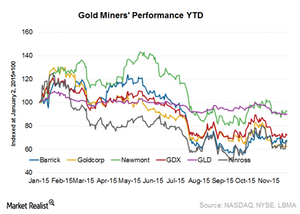

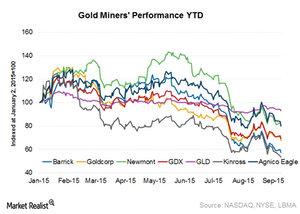

Comparative Analysis: How Have Gold Miners Performed This Year?

Gold prices, as tracked by the SPDR Gold Trust (GLD), have significantly outperformed the VanEck Vectors Gold Miners Index (GDX) since 2008.

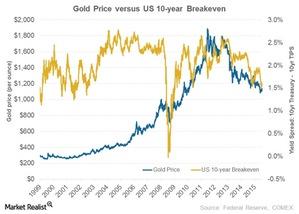

Inflation and Its Relationship to Gold Prices

Gold is a traditional hedge against inflation. Conditions that represent inflation include rising property prices, a rising stock market, and increasing asset values.

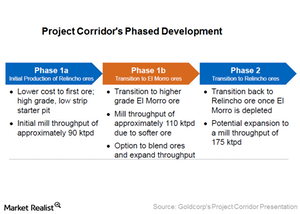

Goldcorp Forms Project Corridor Joint Venture with Teck Resources

The combined project will be a 50:50 joint venture between Goldcorp and Teck with the interim name of Project Corridor.