First Trust Value Line Dividend Index Fund

Latest First Trust Value Line Dividend Index Fund News and Updates

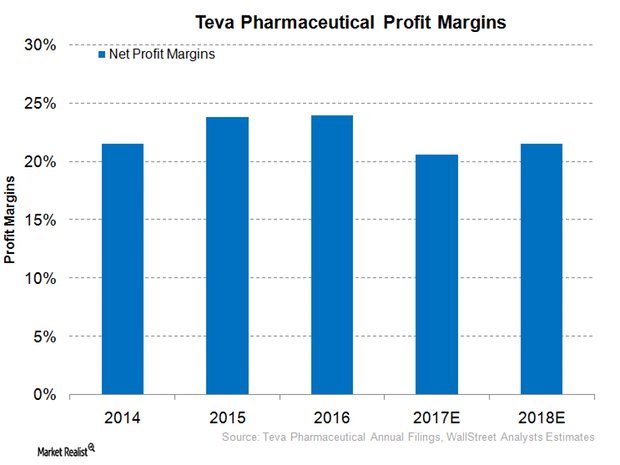

Teva Is Expected to See a Fall in Its Profit Margins in 2017

Teva Pharmaceutical (TEVA) expects its 2017 non-generally accepted accounting principles (non-GAAP) earnings per share (or EPS) to fall in the range of $4.9–$5.3.

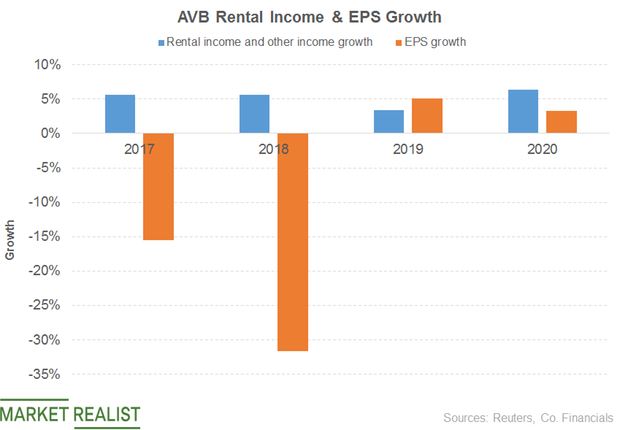

AvalonBay: What’s Driving the Dividend and Valuations?

AvalonBay’s revenue grew 7% in the first quarter, driven by rental and other income.

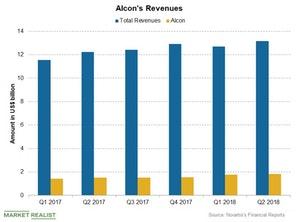

A Look at the Performance of Novartis’s Alcon

Alcon reported revenue of ~$1.82 billion in the second quarter, a 7% rise.

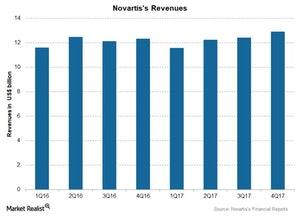

How Novartis’s Revenues Trended in 4Q17

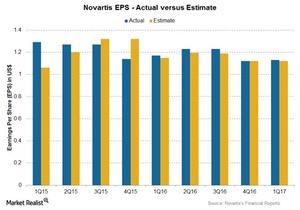

Novartis surpassed Wall Street analysts’ estimates for earnings per share (or EPS) with reported EPS of $4.86 as compared to estimates of $4.82 for 2017.

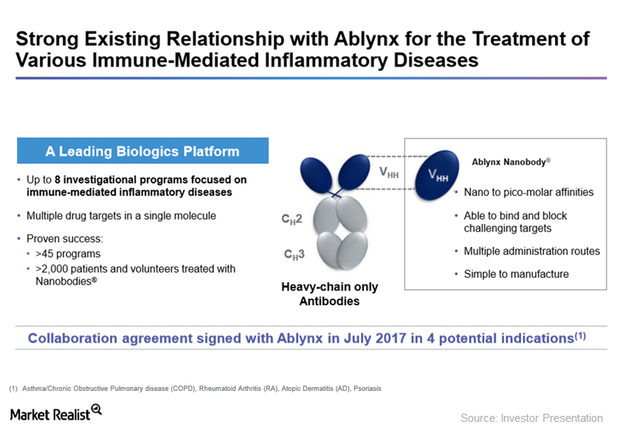

A Look at Ablynx and Sanofi’s Existing Partnership

On January 29, 2018, Sanofi (SNY) announced that it had agreed to acquire Ablynx (ABLX) for 3.9 billion euros.

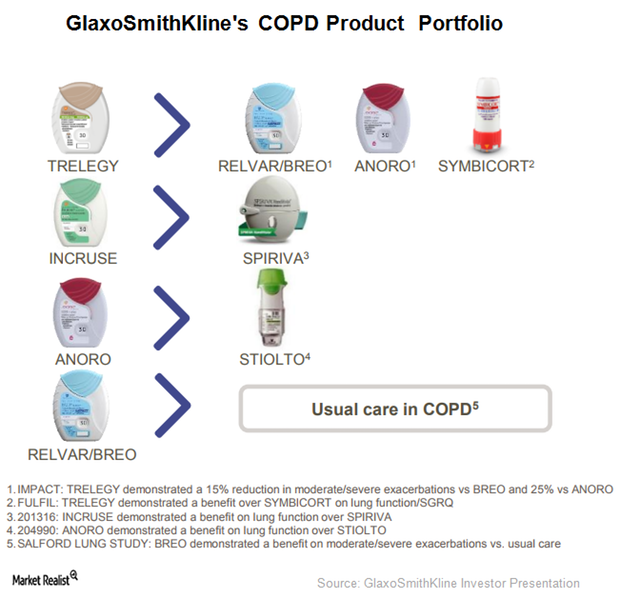

Trelegy Ellipta May Emerge as Major Growth Driver for GlaxoSmithKline

Trelegy Ellipta could enable GlaxoSmithKline to compete aggressively with other respiratory players such as Novartis (NVS).

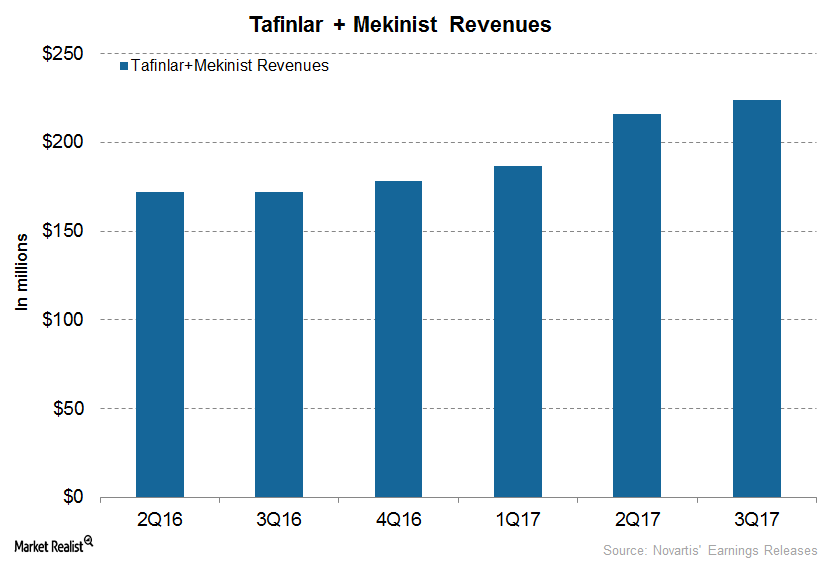

How Is Novartis’s Tafinlar+Mekinist Positioned for 2018?

In 1Q17, 2Q17, and 3Q17, Tafinlar+Mekinist reported revenues of $187 million, $216 million, and $224 million, respectively.

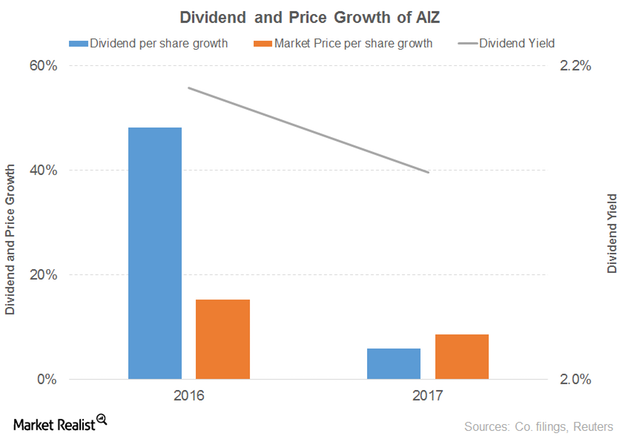

Why Assurant Has a Positive Outlook despite a Weak 2017

Assurant’s (AIZ) revenue fell 27% and 18% in 2016 and 9M17, respectively.

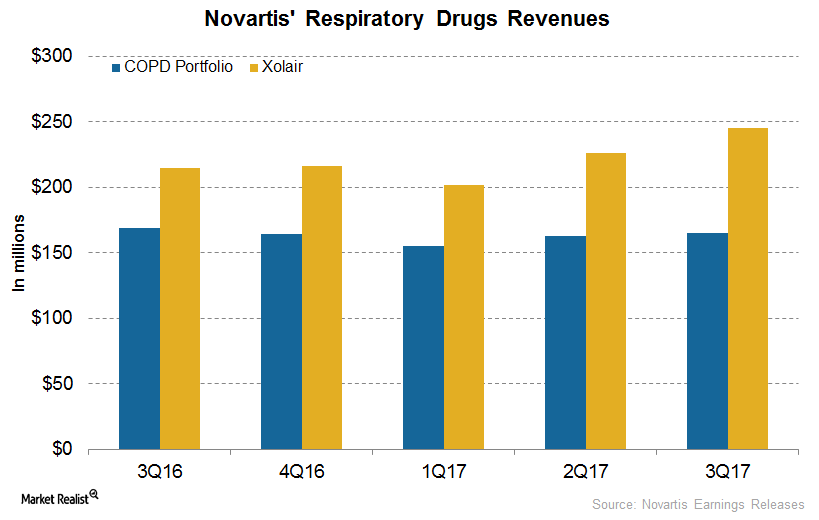

Behind Novartis’s Respiratory Drug Performance in 3Q17

In 3Q17, Novartis’s COPD (Chronic Obstructive Pulmonary Disorder) portfolio reported revenues of $165 million, which with ~2% higher YoY and 1% higher QoQ.

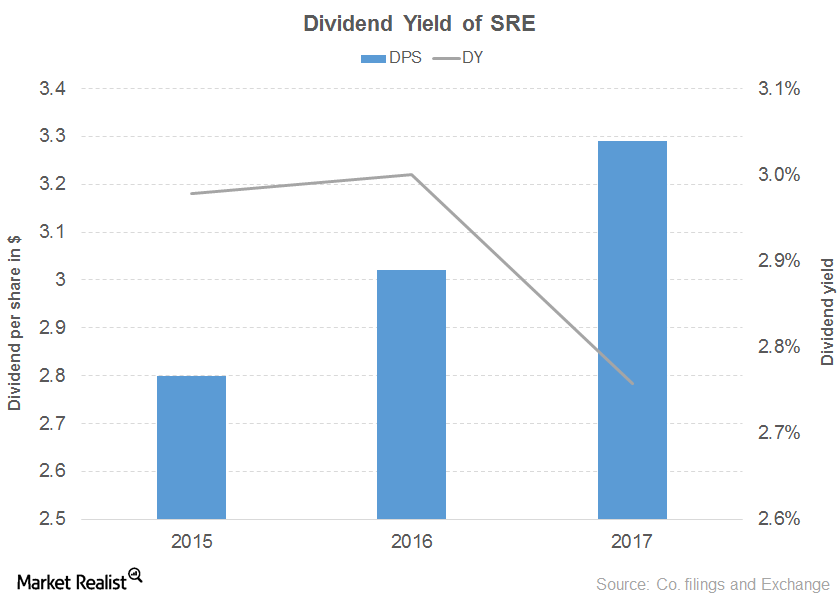

What Led to Sempra Energy’s Sharp Fall in Dividend Yield?

Sempra Energy’s revenue for the first half of 2017 rose 7.0%, driven by every segment.

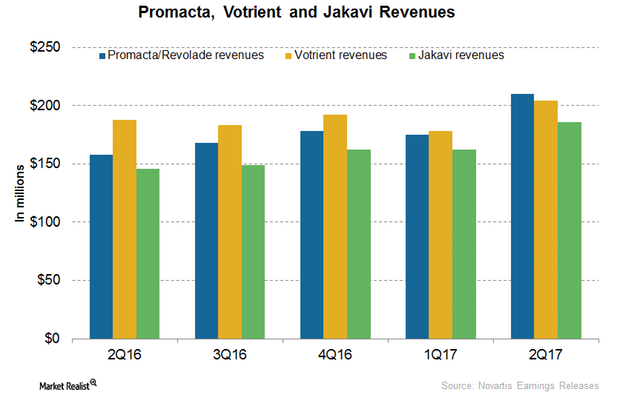

How Novartis’s Promacta, Votrient, and Jakavi Performed in 1H17

In 1H17, Novartis’s (NVS) Promacta/Revolade reported revenues of around $385 million, which reflected ~33% growth on a year-over-year (or YoY) basis.

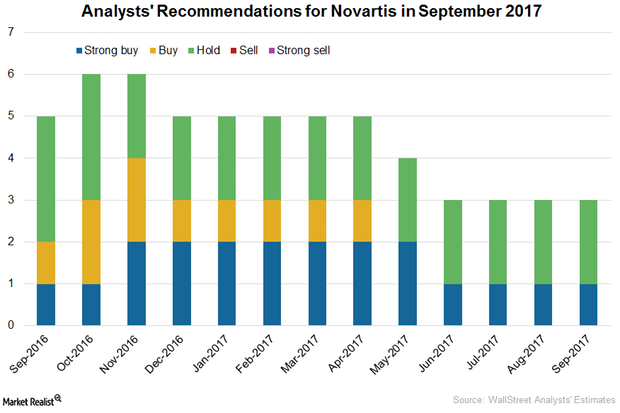

What Analysts Recommend for Novartis in September 2017

Three analysts were analyzing Novartis in September 2017. One analyst recommended a “strong buy,” while the other two recommended a “hold.”

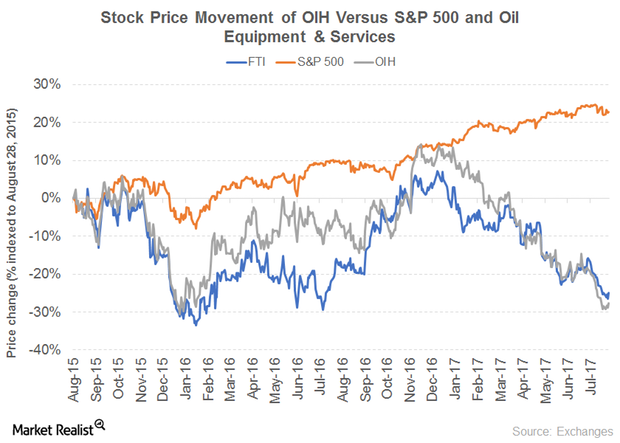

What Could Drive TechnipFMC’s Dividend Yield

How TechnipFMC intends to maintain its yield FMC Technologies and Technip merged to become TechnipFMC (FTI) in 2017, an international provider of subsea, onshore, offshore, and surface projects. The synergy aims to combat the challenges of low oil prices and a challenging outlook through cost cutting and the enhancement of efficiency. The company recorded 51% revenue […]

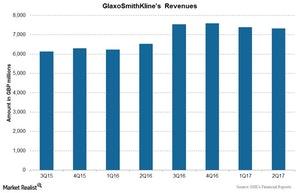

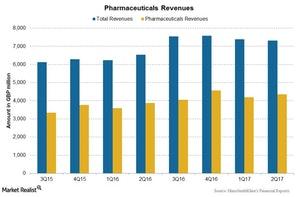

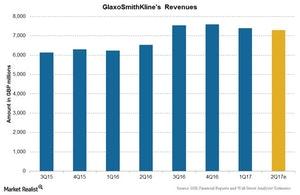

GlaxoSmithKline Reported Revenue Growth in 2Q17

GlaxoSmithKline (GSK) reported revenues of 7.32 billion pounds in 2Q17—12% growth compared to revenues of 6.53 billion pounds in 2Q16.

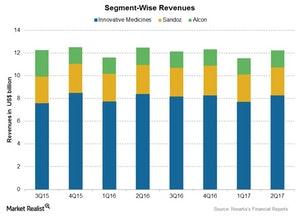

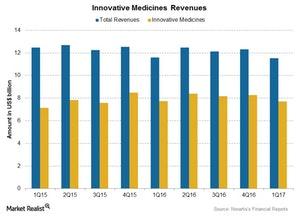

Inside Novartis’s 2Q17 Revenues

Novartis (NVS) reported flat revenues of $12.24 billion on a constant-currency basis for 2Q17. This included a 2% decline due to foreign exchange.

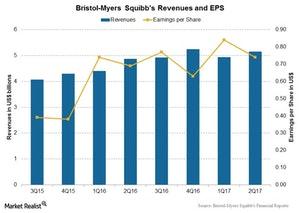

Bristol-Myers Squibb’s Valuation after 2Q17 Earnings

Bristol-Myers Squibb (BMY) met Wall Street analysts’ estimate for EPS at $0.74. It also surpassed the estimates for revenues.

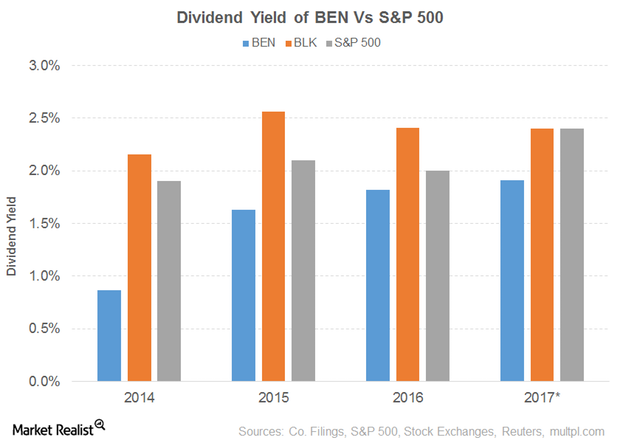

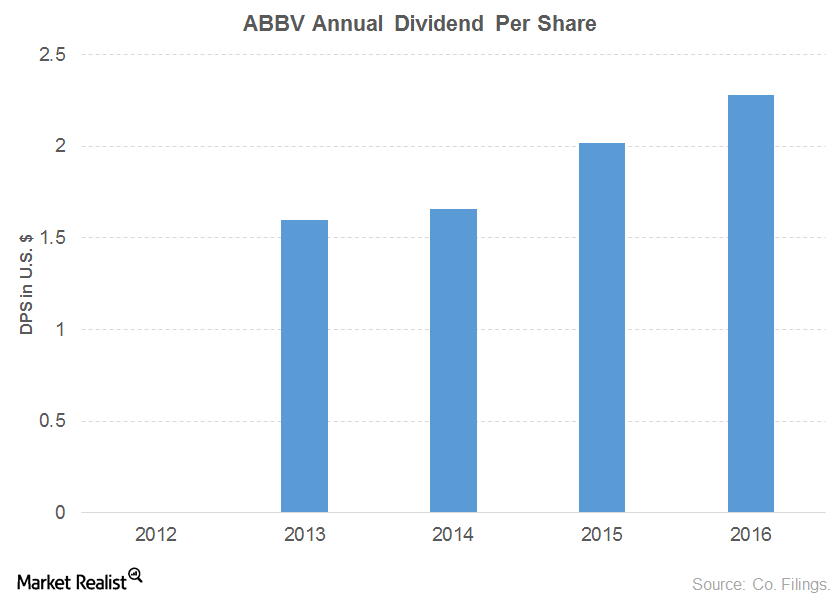

Dividend Yield of Franklin Resources

Franklin Resources (BEN) has recorded consistent growth in dividends since at least March 1982.

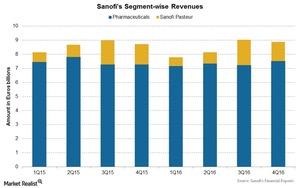

Sanofi’s General Medicines and Consumer Healthcare in 2Q17

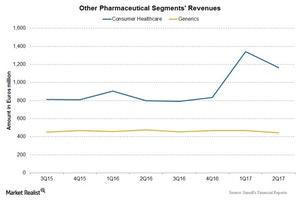

General Medicines Sanofi’s (SNY) generic business contributed ~5.1% of its total revenue in 2Q17. The business reported revenue of 442 million euros in 2Q17, an 8% decrease from 2Q16. Revenue fell due to lower sales in US markets, European markets, and emerging markets. This fall was partially offset by the growth in the rest of […]

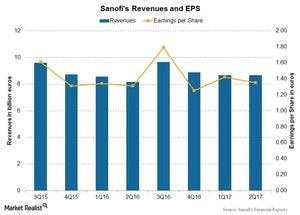

A Look at Sanofi’s Post-2Q17 Valuation

Sanofi (SNY), one of the world’s largest pharmaceutical companies, reported operational growth of 5.5% to reach revenue of 8.7 billion euros in 2Q17.

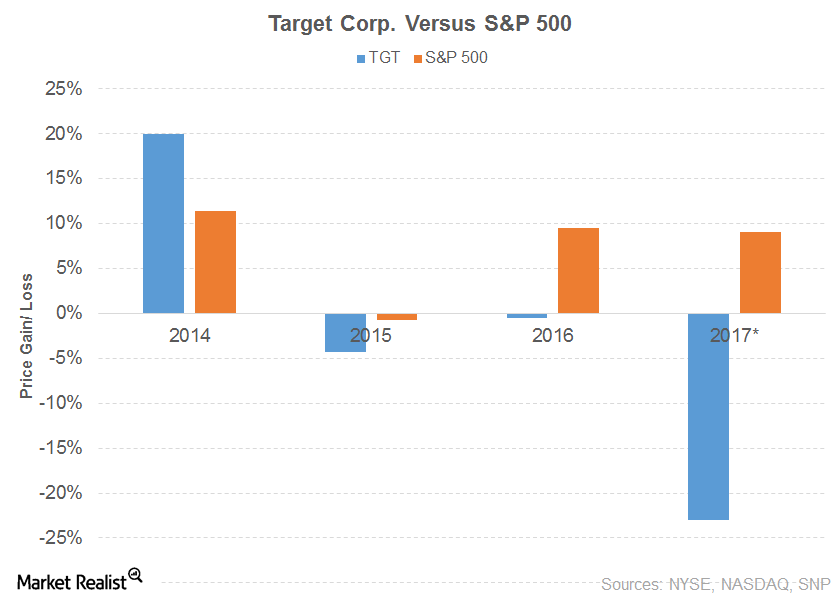

Target’ s Performance as a Dividend Aristocrat

Target’s (TGT) sales for 2016 fell 6.0% due to lower comparable store sales and weak store traffic.

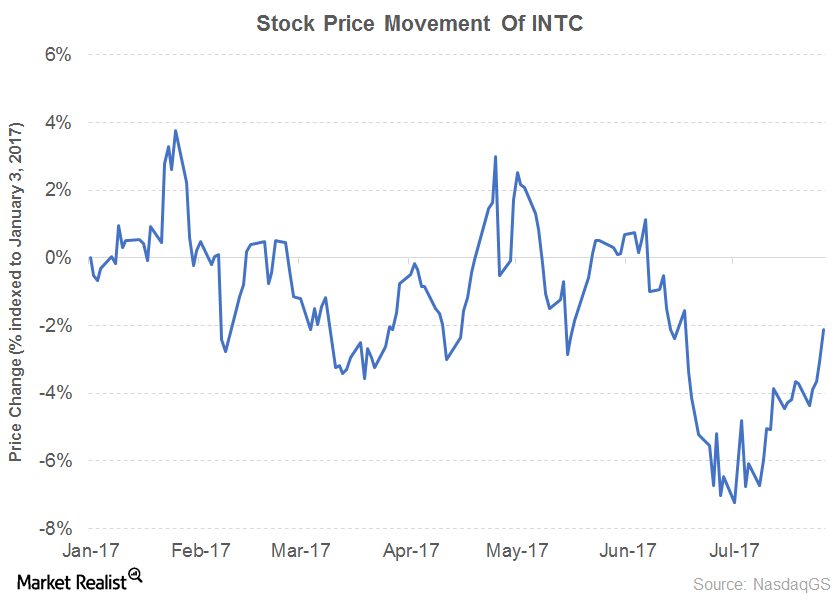

Have Intel and Procter & Gamble Been Able to Increase Dividends?

Intel (INTC) released its 2Q17 results on July 27, 2017. The company’s revenue and EPS for the first half of 2017 rose 8.5% and 72.0%, respectively.

GSK’s 2Q17 Earnings: Pharmaceuticals Segment

GSK’s Pharmaceuticals segment’s contribution to the company’s total revenues was 59.5% in 2Q17.

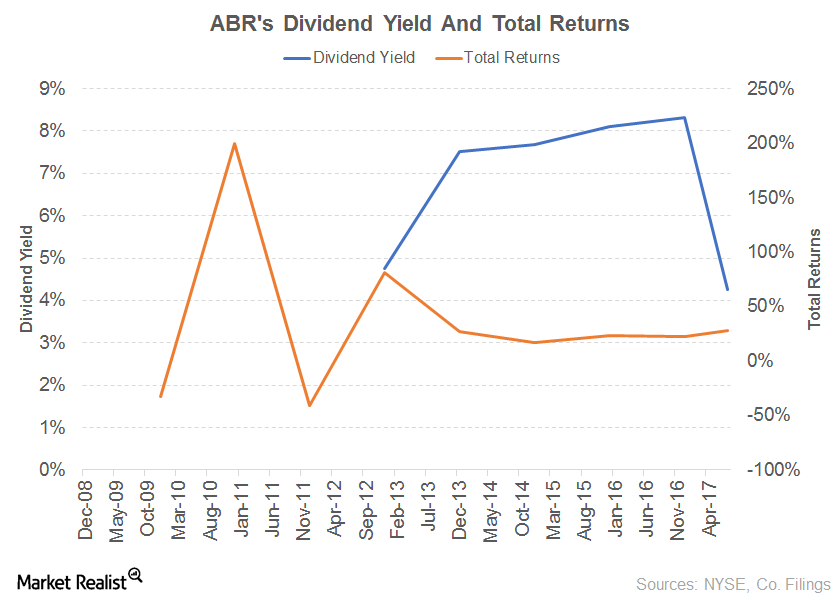

Arbor Realty Trust’s Dividend Growth Prospects

Arbor Realty Trust (ABR) paid 74.1% of its earnings as dividends in 2016 compared to 56.7% in 1Q17.

Unpacking GlaxoSmithKline’s 2Q17 Revenue Expectations

Analysts expect to see a growth of ~11.4% in GlaxoSmithKline’s (GSK) 2Q17 revenues, which are expected to total nearly 7.3 billion British pounds.

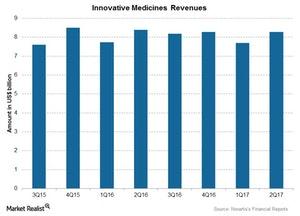

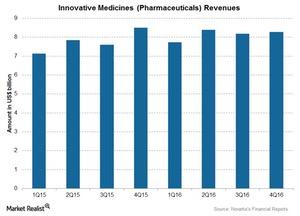

Novartis in 2Q17: Performance of Innovative Medicines

The overall contribution of the Innovative Medicines segment was ~67.6% at $8.28 billion for 2Q17.

Novartis’s 2Q17 Estimates: Innovative Medicines Segment

The overall contribution of Novartis’s (NVS) Innovative Medicines segment is ~67.0% of its total revenues.

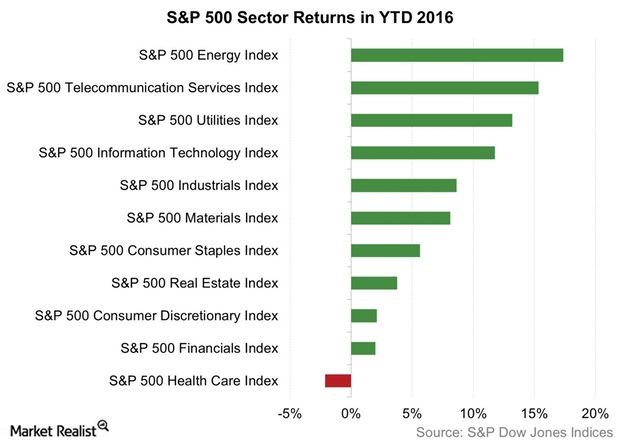

The Top Dividend-Growing Healthcare and Industrials Stocks

The sector has seen the weakest growth in its top and bottom lines due to uncertainty in terms of sector reforms.

Dividend Growth for Qualcomm and Crown Castle International

Qualcomm (QCOM) recorded a year-over-year decline in revenues for 2Q17 after growth in the preceding quarter.

What Happened to Novartis’s Valuation after 1Q17?

Novartis reported EPS of $1.13 on revenues of $11.54 billion for 1Q17, which represents 2% YoY operational growth in revenues.

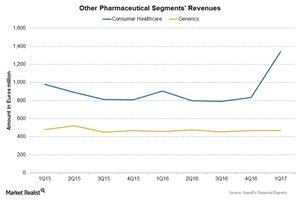

Sanofi’s Generics and Consumer Healthcare Business in 1Q17

Sanofi’s (SNY) Generics business contributes ~5% to the group’s total revenues.

Novartis’s 1Q17 Estimates: Innovative Medicines Segment

Novartis’s (NVS) Innovative Medicines segment includes products for therapeutic areas such as oncology, cardiometabolic, immunology, and dermatology.

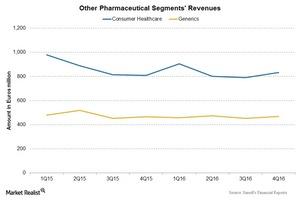

Why Sanofi’s Consumer Healthcare and Generics Segment Still Matters

Sanofi’s (SNY) Consumer Healthcare segment reported a 1.6% YoY (year-over-year) fall in revenues at 3.33 billion euros (about $3.56 billion) in 2016.

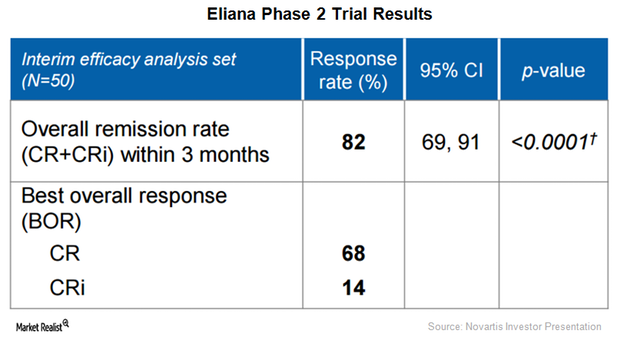

Could Novartis’s CTL019 Capture Significant Market Share?

Currently, an estimated 7,000 patients suffer from pediatric ALL in the US, Europe, Japan, Canada, and Israel.

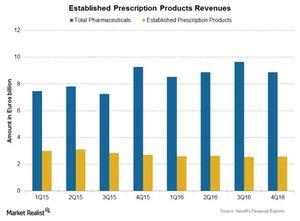

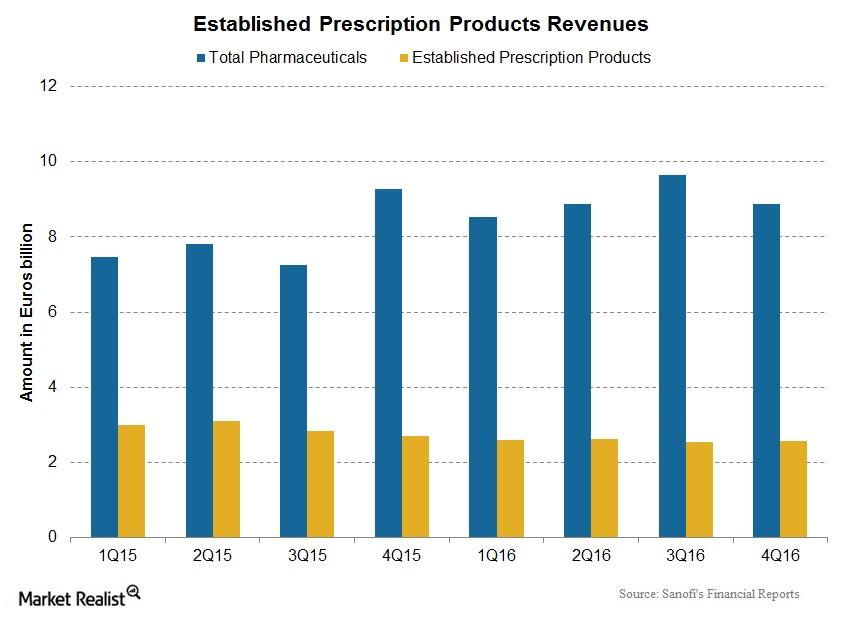

Are Sanofi’s Established Prescription Products Adding Up?

Sanofi’s (SNY) Established Prescription Products segment contributed nearly 30.5% of the company’s total revenues in 2016.

Inside Sanofi’s Overall Revenue Performance in 2016

Sanofi (SNY) reported a YoY (year-over-year) revenue growth of ~1.2% at constant exchange rates for 2016.

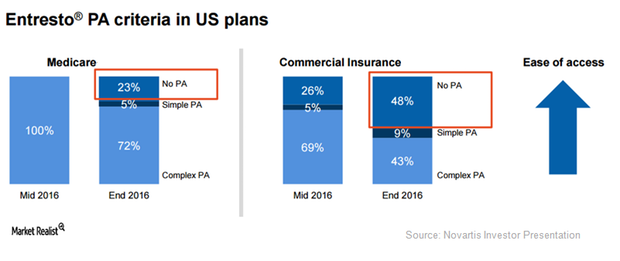

Why Entresto Could Become Key Growth Driver for Novartis in 2017

Novartis (NVS) expects modest prescription growth for its heart failure drug, Entresto, in 1Q17.

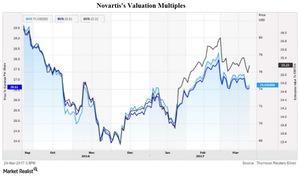

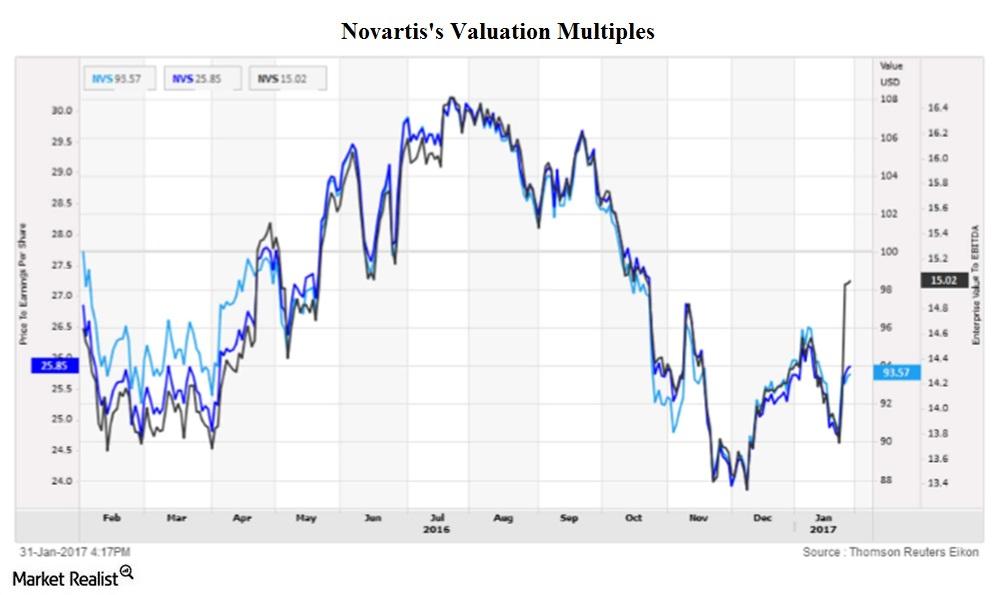

Novartis’s Valuation Compared to Its Peers’

Novartis’s valuation has followed the industry’s overall trend over the last five years. Whether the healthcare sector’s valuation rises or falls, Novartis will definitely be affected.

What Will Drive AstraZeneca’s Oncology Revenues in 2017?

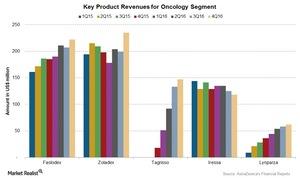

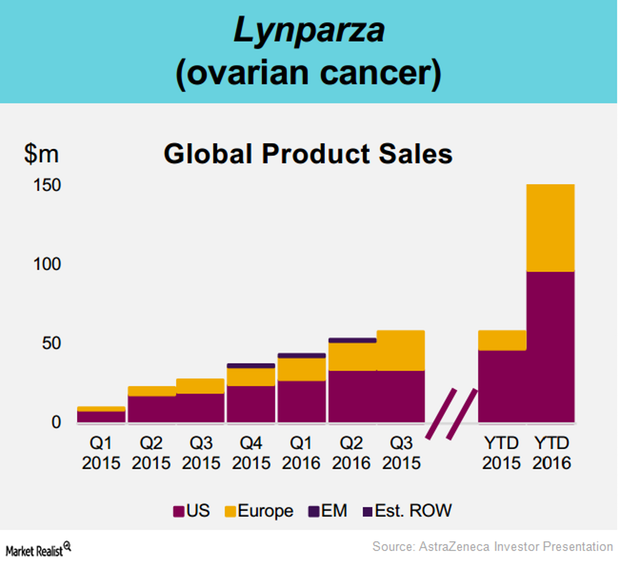

In 2016, AstraZeneca’s (AZN) poly ADP-ribose polymerase (or PARP) inhibitor, Lynparza, managed to report revenues close to $218 million.

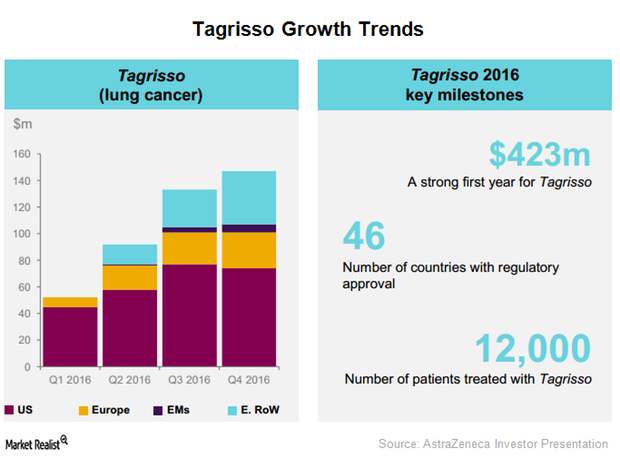

Growth of AstraZeneca’s Oncology Segment in 2016

The revenues for AstraZeneca’s (AZN) Oncology segment rose ~20% at constant exchange rates in 2016.

These Prescription Products Matter to Sanofi’s Growth

Sanofi’s (SNY) established prescription products contributed nearly 28.9% of the company’s total 4Q16 revenues.

Novartis’s Valuation after the 4Q16 Results

On January 31, 2017, Novartis was trading at a forward PE multiple of ~15.2x. Based on its last-five-year multiple range, this is neither high nor low.

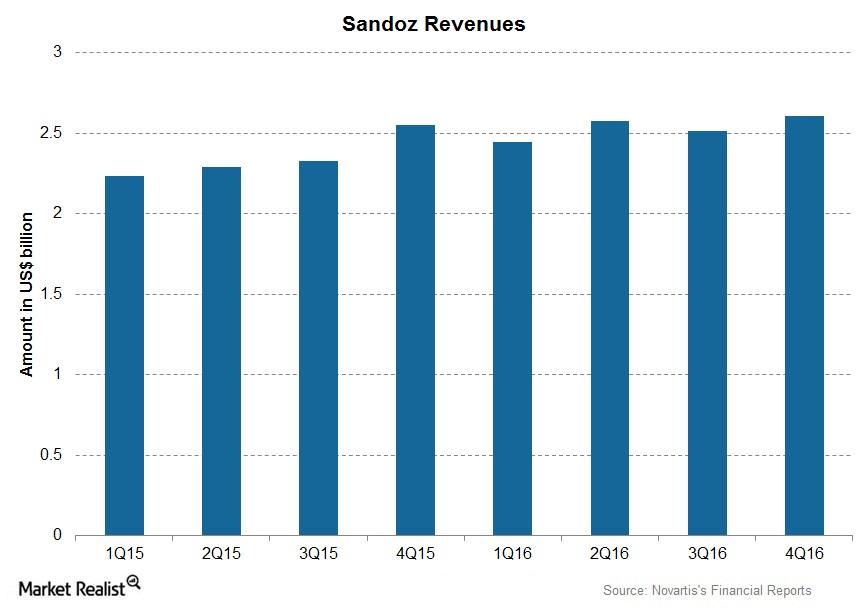

Inside Novartis’s Generics Performance in 4Q16

Sandoz, the Generics segment of Novartis (NVS), is second-largest generic medicines provider worldwide and number one in differentiated generics.

Analysts Expect Negative Growth for Novartis in 4Q16

Analysts expect an ~1.1% decline in Novartis’s (NVS) 4Q16 revenues to ~$12.4 billion following the effects of the acquisition and divestiture of several products.

How Did Novartis’s Innovative Medicines Segment Perform?

The overall contribution of the innovative medicines segment was ~67% at $8,173 million for 3Q16.

AstraZeneca’s Lynparza Is Still a Leading PARP Inhibitor in 2016

On October 26, 2016, AstraZeneca (AZN) announced that Lynparza managed to demonstrate a superior clinical profile in the Phase 3 SOLO-2 trial.

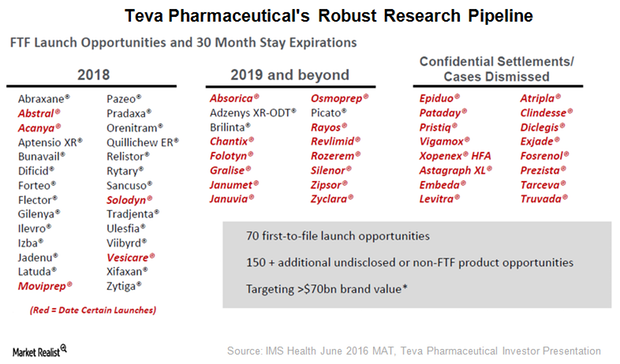

Teva’s Research Pipeline to Culminate in Many New Drug Launches?

Teva Pharmaceutical’s (TEVA) generic research pipeline is expected to result in more than 30 first-to-file (or FTF) launches in 2016 and 2017.

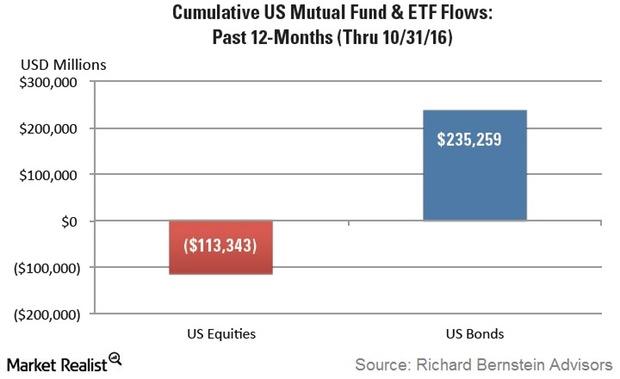

Bernstein: Excess Risk Aversion Has Made Investors ‘Wallflowers’

In his November Insights newsletter, Richard Bernstein stated, “It is incredible that investors have basically been wallflowers during the second longest bull market of the post-war period.”

Richard Bernstein: Don’t Fear the Bear Market

A legitimate bull market In this series, we’ve taken a look at Richard Bernstein’s views on investors’ fear of an impending bear market. In Richard Bernstein Advisors’ October Insights newsletter, he rejects the notion that the current rise in US stocks (SPLV) (OEF) has been brought about only by the Fed’s easy monetary policy. In the […]

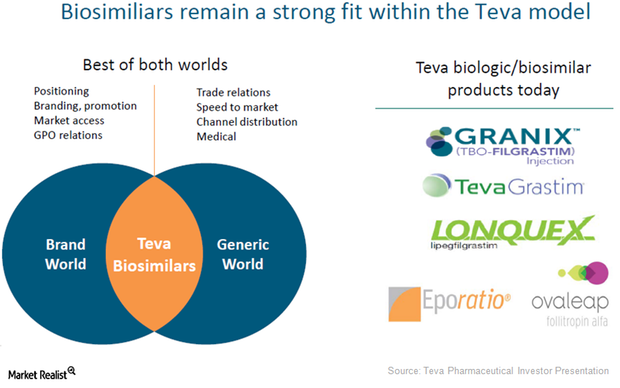

A Look at Teva’s Dominance in the Biosimilar Space

As one of the early entrants in biosimilars, Teva Pharmaceutical Industries (TEVA) has managed to become one of the biggest players in the biosimilar space.

Why Is Sanofi Expanding in the CHC Space?

Sanofi (SNY) plans to become a leading company in the CHC business. The asset swap will exclude Boehringer Ingelheim’s CHC business in China.