Dollar General Corp

Latest Dollar General Corp News and Updates

Mary Gundel’s TikTok Video Got Her Fired From Dollar General — Where Is She Now?

Mary Gundel was fired from her managerial position at Dollar General after she exposed the retailer via TikTok for unsafe working conditions.

Dollar General: Who Owns the Publicly Traded Discount Retailer?

Dollar General has been publicly traded for most of its history, with a brief period of being privately held. Who owns the discount retailer?

Mom Claims Dollar General Forced Her Son to Work for Free in Viral TikTok Video

A mom is blasting the Dollar General store her son works at, saying that they made her son clock out and still work additional hours.

Dollar General Hit With $1.2M in Fines for Workplace Hazards

Dollar General was recently fined nearly $1.3 million for “habitually disregarding workplace safety.” The discount retailer has has been hit with more than $6.5 million in penalties since 2017.

Dollar General Will Open 1,000 More Popshelf Locations in the Future

Discount retailer Dollar General plans to open 1,000 Popshelf locations in the future by 2025, with 100 new stores planned for 2022.

Farallon Capital Increases Its Position in Dollar General

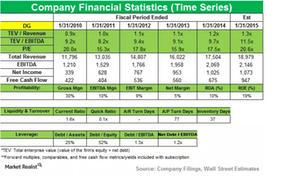

In 2014, Dollar General reported net sales of $18.9 billion, an increase of 8% compared to sales of $17.5 billion in 2013.Healthcare Farallon Capital adds a new position in Covidien

Ireland-based Covidien is a global healthcare leader that offers innovative medical technology solutions and patient care products to providers.

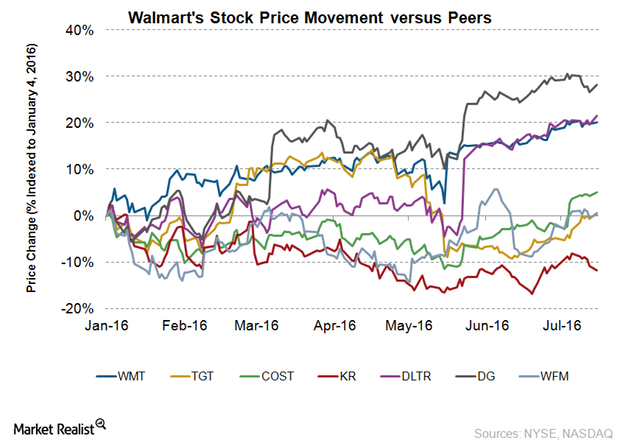

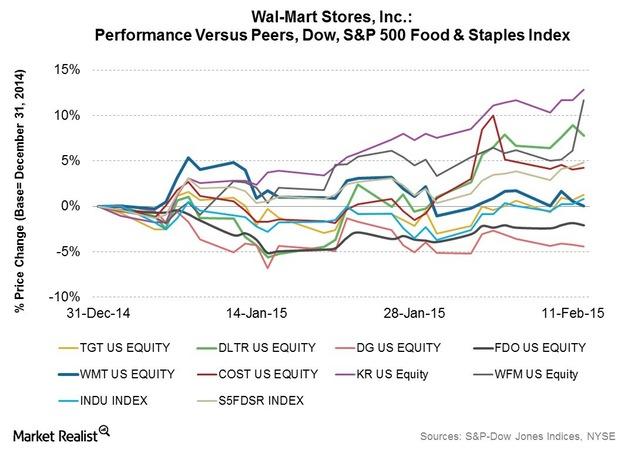

Walmart’s Stock Rises 20% Year-to-Date: Can It Rise More?

The stock price of retail giant Walmart (WMT) has risen by 20.1% on a YTD (year-to-date) basis to $73.84, as of July 18. Walmart’s stock has outperformed the S&P 500 Index, which has risen 7.7% on a YTD basis.

Costco’s Industry Positioning: A Porter’s 5 Force Analysis

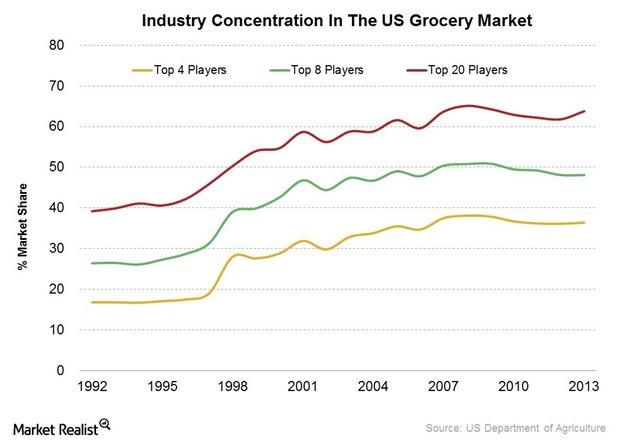

Costco’s suppliers include companies like PepsiCo (PEP), Procter & Gamble (PG), and the Kraft Heinz Company (KHC). No single supplier accounts for over 5% of revenue.

Walmart’s Key Challenges In Its Business Environment

The NLRB filed a complaint last January. It accused Walmart of violating labor laws. The NLRB claims that the retailer acted against workers who joined unions.

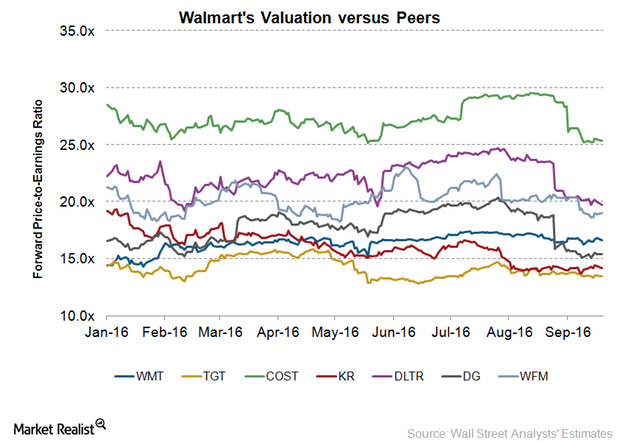

Where Does Walmart’s Valuation Stand Compared to Its Peers?

As of September 19, 2016, Walmart (WMT) was trading at a 12-month forward PE multiple of 16.6x, which is slightly above its YTD average forward PE of 16.4x.

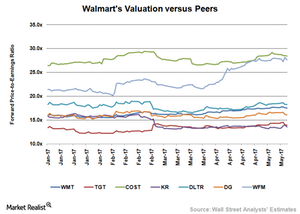

How Walmart Compares to Its Peers

On May 12, 2017, Walmart (WMT) was trading at a 12-month forward PE multiple of 17.5x.

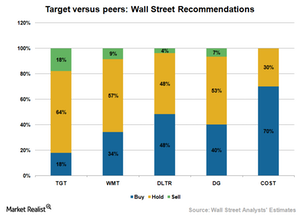

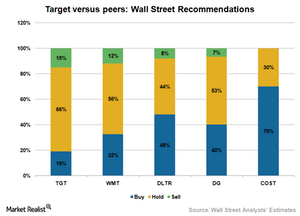

Did Analysts Change Their Views on Target after 1Q17 Results?

The majority of analysts covering Target (TGT) remain neutral on the stock.

Big Lots Stock Falls despite Telsey Advisory Group’s Upgrade

Telsey Advisory Group upgraded Big Lots from “market perform” to “outperform.” The firm also increased its 12-month target price from $20 to $31.

Analysts Upgrade Walmart amid Stock Market Turmoil

Analysts are optimistic about Walmart (NYSE:WMT) even though the US stock market crashed due to the coronavirus outbreak.

Dollar General Announces Strong Q3 Earnings

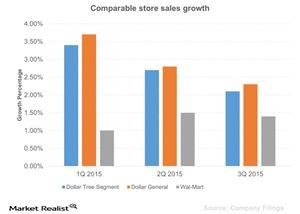

Dollar General (DG) stock was up 1.4% in the pre-market trading session today as the company declared strong third-quarter earnings.

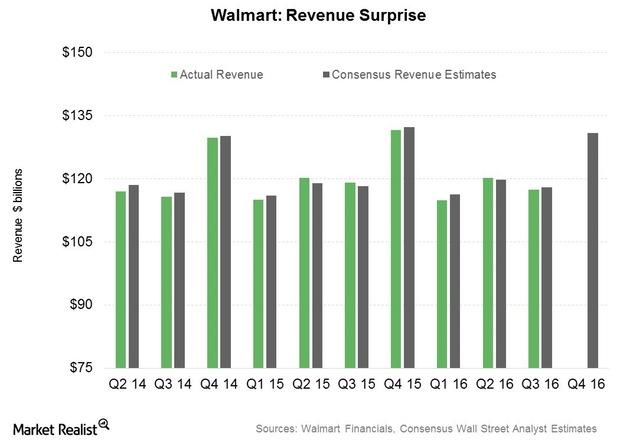

Why Foreign Currency Headwinds Have Hurt Walmart in Fiscal 2016

Adverse foreign currency movements due to an appreciating US dollar have reduced Walmart’s top line by $12.3 billion in the last three quarters.

How Has Walmart’s Profitability Dip Affected Its Outlook?

Walmart’s reported operating income margin declined from 5.6% in fiscal 2015 to 5.0% in fiscal 2016.

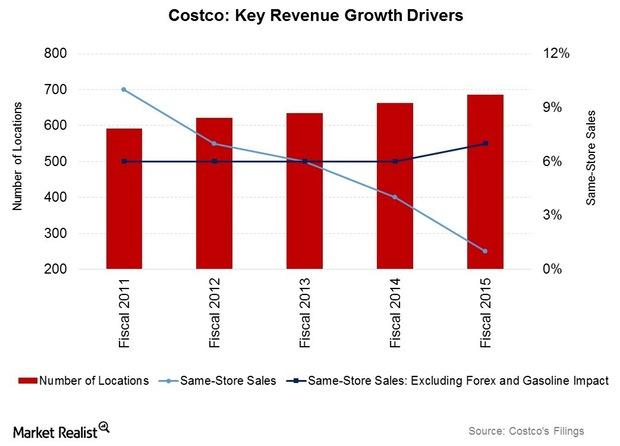

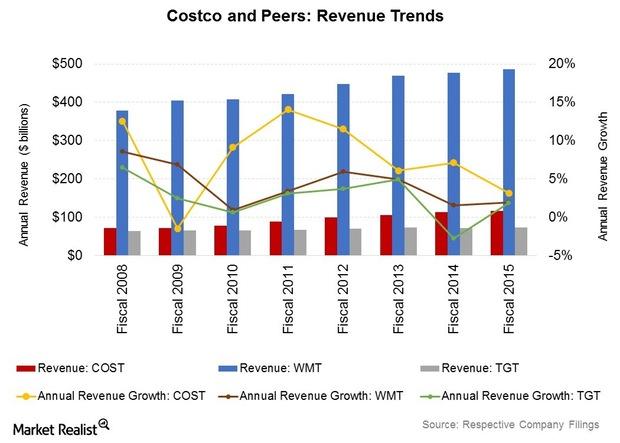

Costco’s Revenue Growth Likely to Moderate in Fiscal 2Q16

Costco posted record results for fiscal 2015. Revenue grew by 3.2% to $116.2 billion, and net income rose by 15.5% to $2.4 billion.

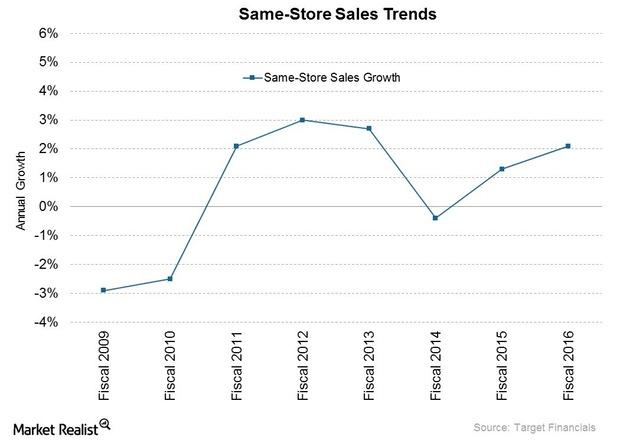

Analyzing Target’s Same-Store Sales Growth in Fiscal 2016

Target had upbeat revenue performance in fiscal 4Q16 and 2016. Store traffic was up by 1.3% YoY in fiscal 2016, trending in positive territory in all four quarters of the year.

Why Dollar General Stock Surged after Its Q2 Results

Dollar General (DG) surged about 8% in premarket trading today after crushing expectations in its second-quarter results. It also raised its guidance for fiscal 2019.

Why Wells Fargo Downgraded Dollar General Stock

Wells Fargo downgraded Dollar General (DG) stock to “market perform” from “outperform” on July 25. It remains positive about the company’s prospects.

Dollar General versus Dollar Tree: A Quick Look

The US dollar industry is highly concentrated and dominated by two major players, Dollar General (DG) and Dollar Tree (DLTR).

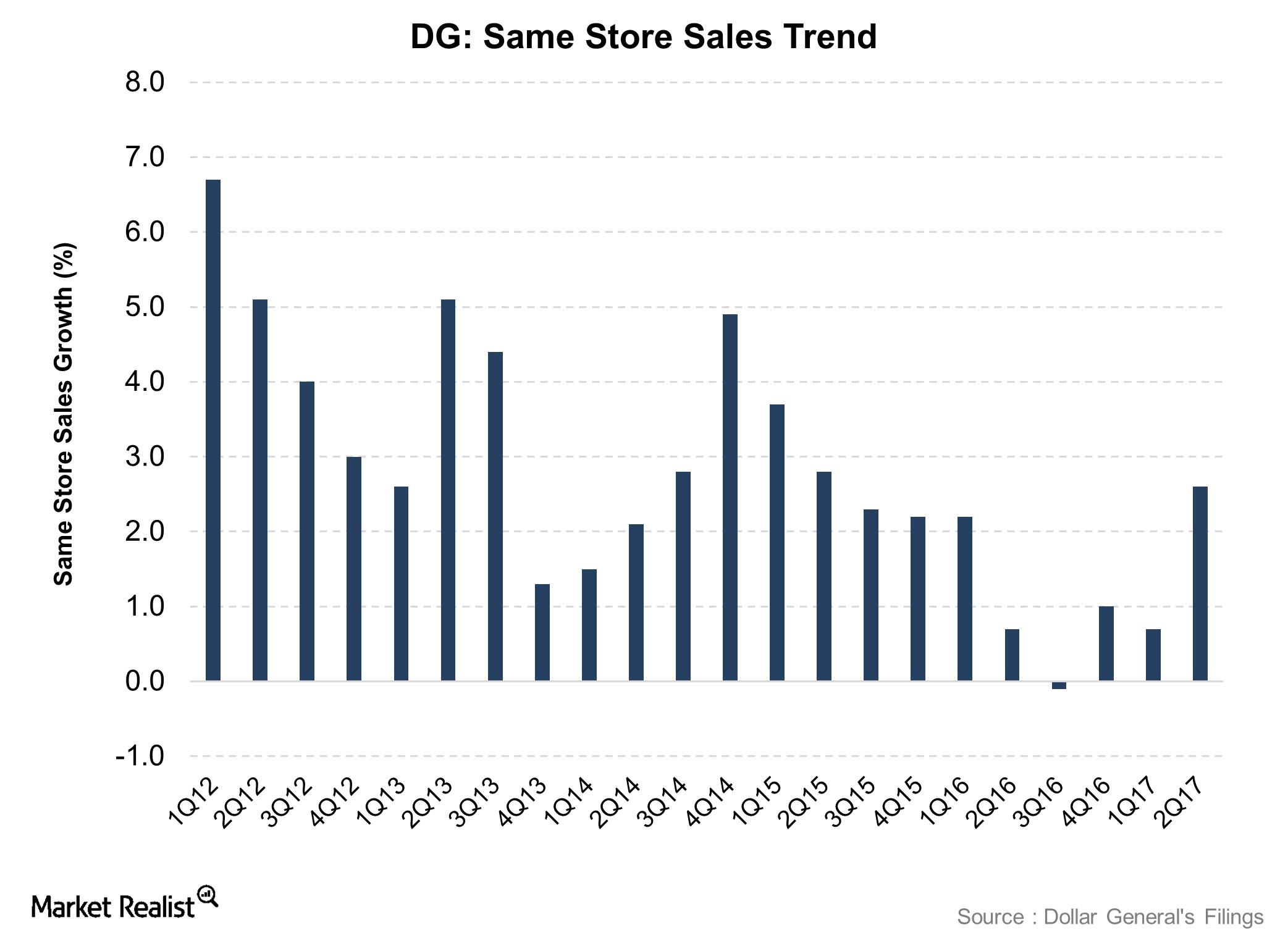

Behind Dollar General’s Fiscal 2Q17 Top Line

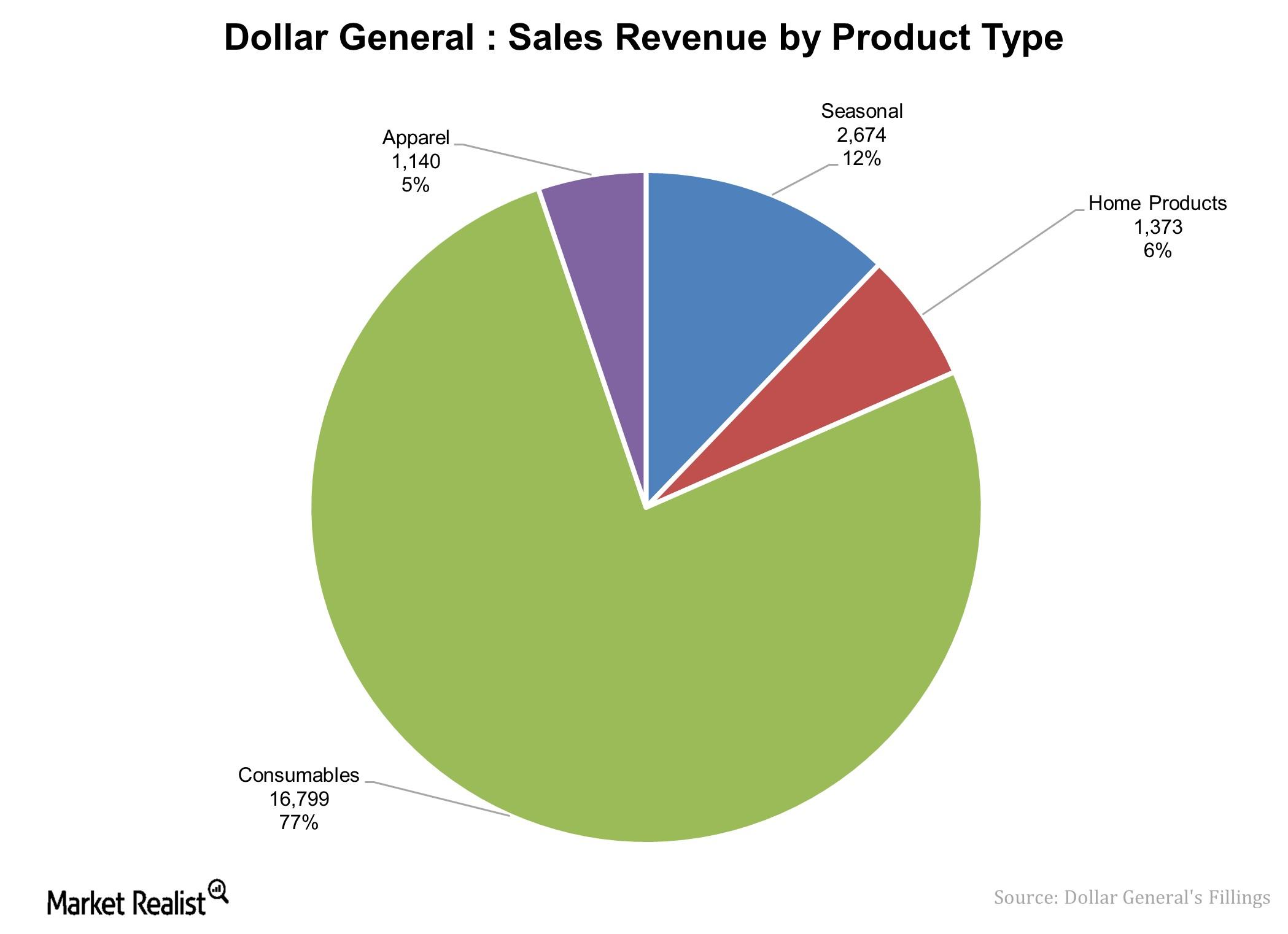

Dollar General (DG) saw its top line rise 8.1% YoY (year-over-year) to $5.6 billion, driven by an 8.9% rise in demand for consumables.

What Analysts Think of Target Stock

The majority of analysts covering Target (TGT) are neutral on the stock. Analysts’ consensus rating on TGT was 2.9 on a scale of 1.0 (strong buy) to 5.0 (strong sell).

Understanding Dollar General’s Business Strategies

Dollar General’s (DG) business strategy revolves around driving profitable topline growth while enhancing its low-cost operator position and capturing new growth opportunities.

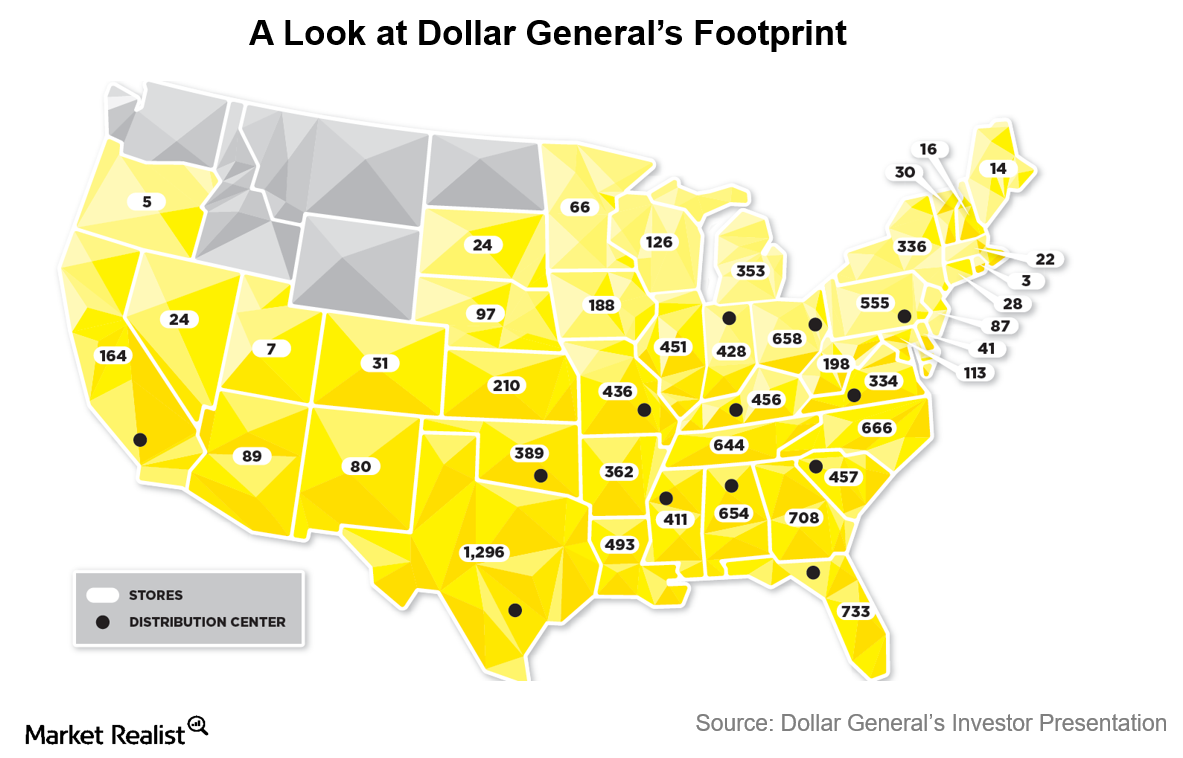

Dollar General’s Supply Chain and Distribution Model

Dollar General (DG) must maintain an efficient supply chain in order to juggle hundreds of products in over 13,000 stores in 44 states across the United States.

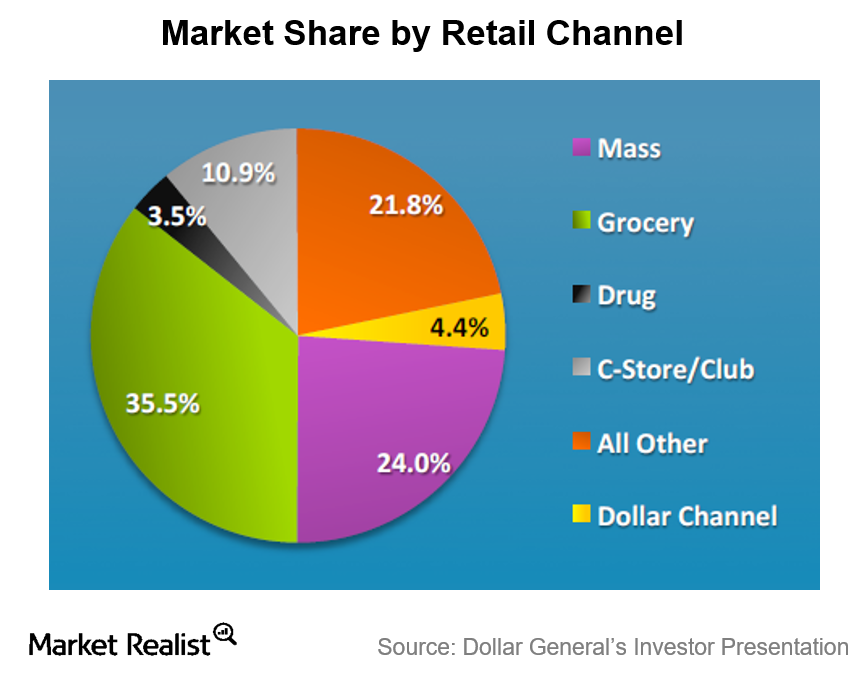

Understanding the US Dollar Store Industry

Dollar stores follow a small-box format to maintain low costs. Target customers are typically lower- and middle-income families.

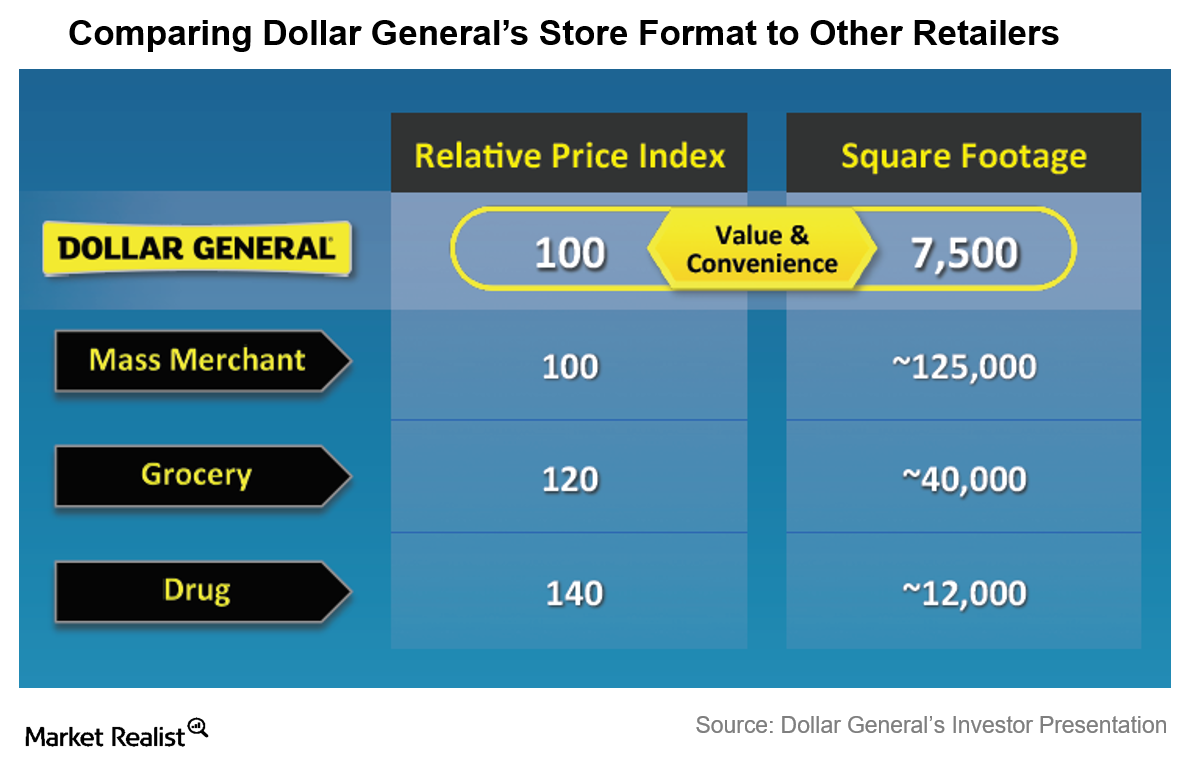

Dollar General: Why Small-Format Stores Are Key

Dollar General (DG) operates dollar stores that offer a variety of inexpensive merchandise, including home products, seasonal products, consumables, and apparel.

A Snapshot of Dollar General, America’s Largest Dollar Store Chain

Headquartered in Tennessee, Dollar General (DG) is the largest discount store retailer in the United States in terms of total sales.

Understanding Dollar General’s Key Product Offerings

Dollar General (DG) is the largest discount store retailers in the United States in terms of total revenue generated.

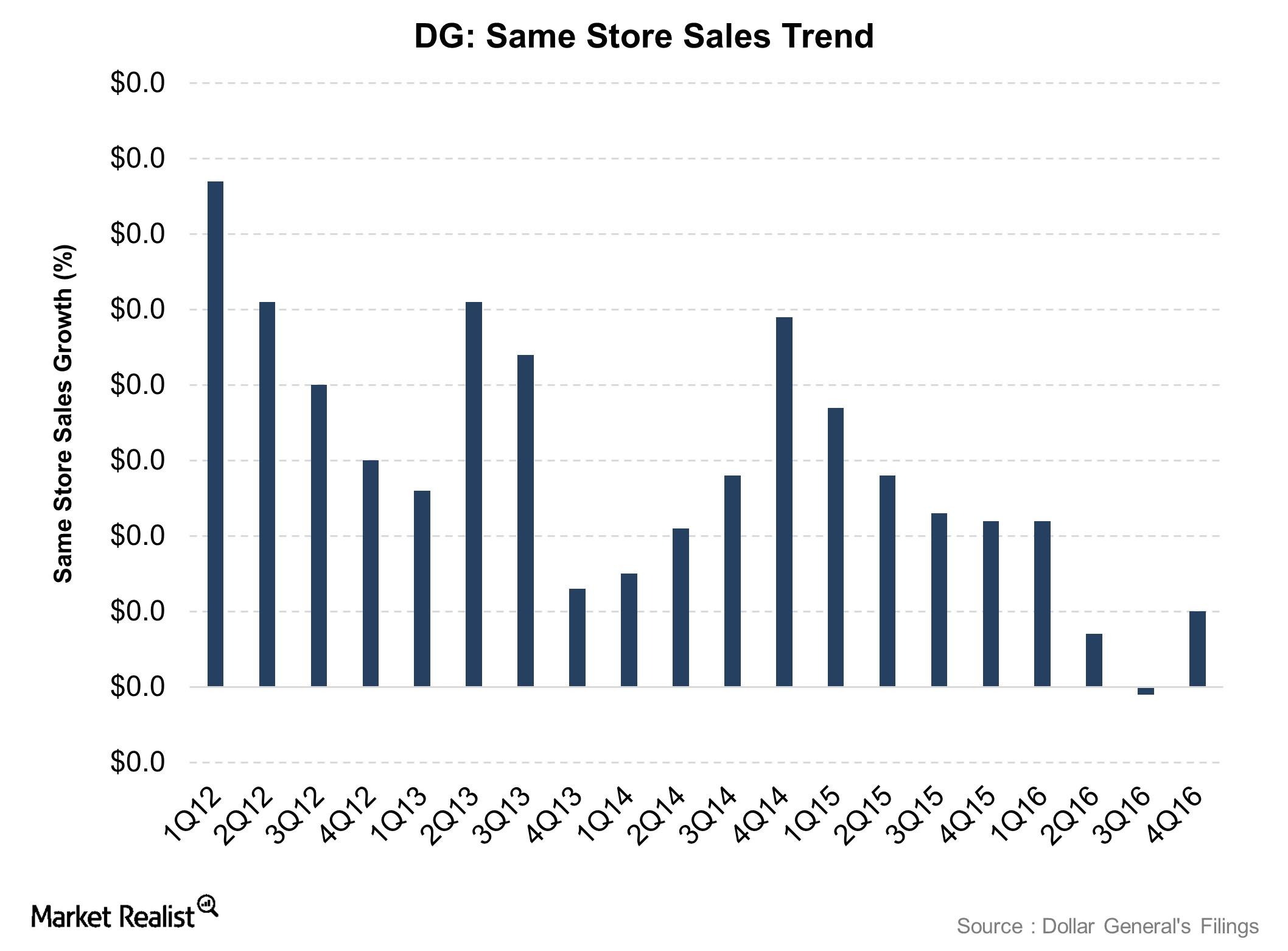

Dollar General’s Sales Comps Turn to Growth in Fiscal 4Q16

In fiscal 4Q16, Dollar General’s (DG) top line increased 13.7% year-over-year to $6 billion.

Target’s Signature Categories Beat Overall Business in Fiscal 2Q

Target’s (TGT) Signature Categories include Style, Baby, Kids, and Wellness. Target’s Signature Categories outpaced the total business by 3 percentage points in fiscal 2Q16.

Dollar Tree: A Positive Mix of Organic and Inorganic Growth

Dollar Tree (DLTR) (XRT) (XLY) is pretty consistent for extracting organic growth from its business, seeing growth in the mid-single digits over the years.

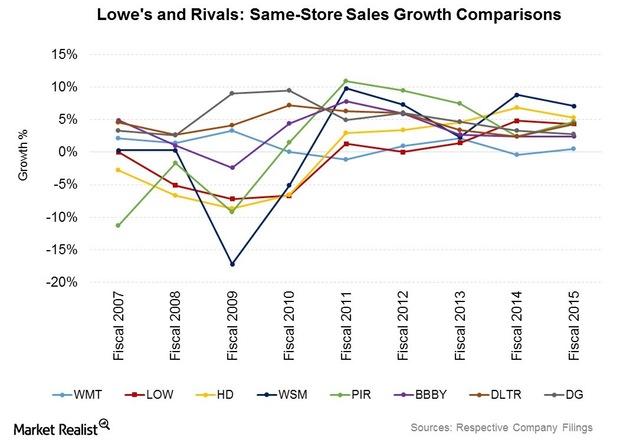

What Are Lowe’s Strengths and Weaknesses?

Lowe’s (LOW) is one of the largest and oldest big box retailers around. It’s been publicly listed since 1961.

The Wal-Mart Impact on Food Price Deflation

What starts as a competitive strategy for Wal-Mart may also affect the general level of grocery price inflation in the United States.

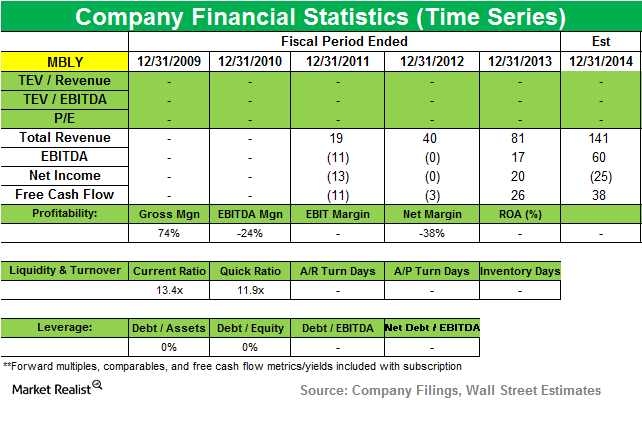

Tiger Global starts new position in Mobileye

Mobileye, the Israel-based vehicle safety technology company, earned gross proceeds from its initial public offering of $1.023 billion.

Must-know: Tiger Global Management’s holdings in 3Q14

Tiger Global Management’s holdings included 48 stocks during the third quarter. The size of the fund’s US long portfolio fell slightly from $7.8 billion to $7.5 billion.