Peabody Energy Corp

Latest Peabody Energy Corp News and Updates

Challenges before Peabody Energy’s US operations in fiscal 2015

The retirement of coal-fired power plants and the impact of new regulations proposed by the EPA present two major blows to the US thermal coal industry.Consumer Must-know: Why Peabody Energy fell 1.9% on July 22

Wall Street analysts’ consensus estimate for loss per share was $0.289.

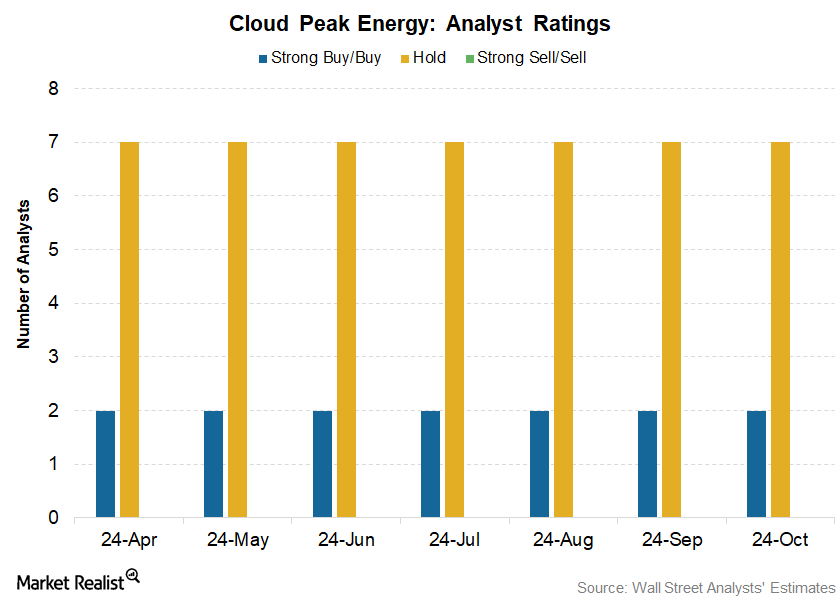

Why Most Analysts Recommend a ‘Hold’ for Cloud Peak Energy

Of the nine analysts covering Cloud Peak Energy (CLD), seven analysts rated its stock as a “hold,” and two gave CLD a “buy” or “strong buy” rating.

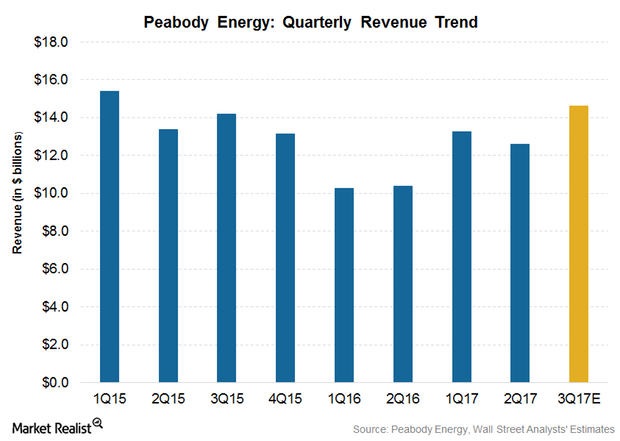

Analysts Expect Peabody Energy’s Revenues to Rise in 3Q17

In 3Q15, Peabody Energy (BTU) reported $1.42 billion in revenues. Analysts anticipate that it will post $1.46 billion in 3Q17 compared to $1.26 billion in 2Q17.

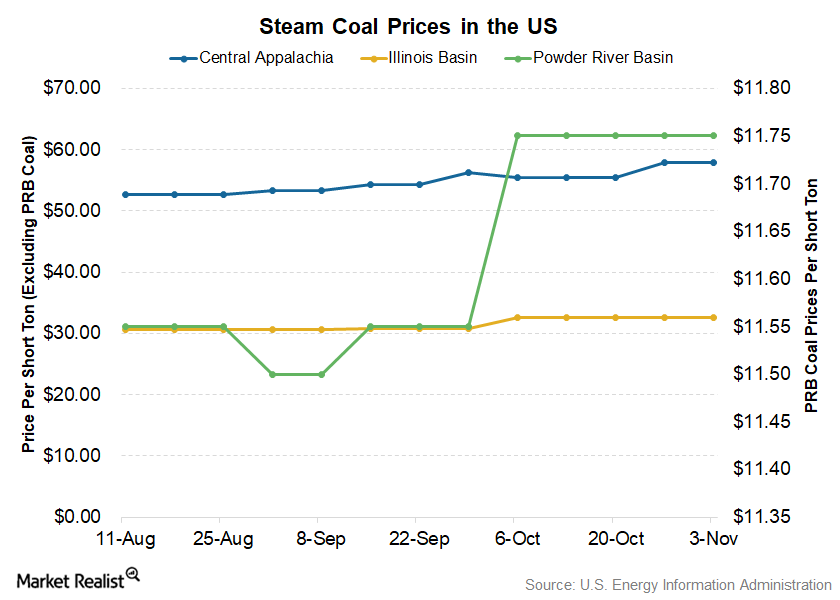

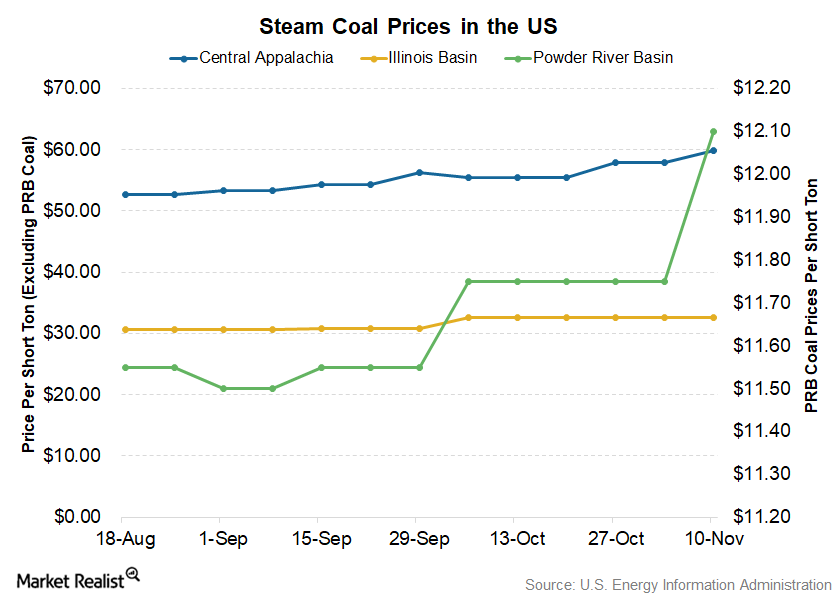

Spot Coal Prices Remained Flat in the Week Ending November 3

Powder River Basin coal settled at $11.75 per short ton, while Illinois Basin spot coal prices closed at $32.60 per short ton.

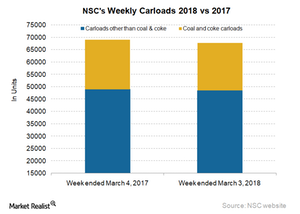

How Norfolk Southern’s Shipments Trended in Week 9

In the week ended March 3, 2018, Norfolk Southern saw a ~2% fall in carload traffic. It hauled ~67,700 carloads in the week.

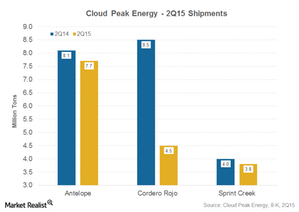

Cloud Peak Energy’s 2Q15 Shipments: Potential Risk Factors

Cloud Peak Energy (CLD) shipped 16.0 million tons of coal from its three owned and operated mines in the Powder River Basin (or PRB) in 2Q15.

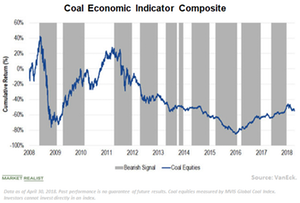

Why Coal and Power Indicators Matter for Long-Term Investing

Why are we combining thermal coal and power indicators? Thermal coal is mostly used for electricity generation.

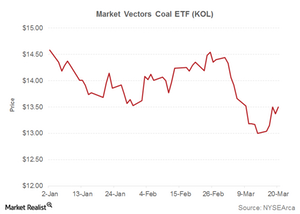

Why the RAAX ETF Has Reduced Its Exposure to Coal Equities

At launch, RAAX had a small weighting to coal, but in May, this exposure was completely eliminated based on falling coal equity prices and weakening supply and demand data.

Powder River Basin Coal Spot Prices Recovered Sharply

During the week ended November 10, 2017, PRB coal closed at $12.10 per short ton, which was ~3% higher than $11.75 per short ton that coal maintained for the past five weeks.Materials Must-know: ANR’s thermal coal business in 3Q14

ANR produces thermal coal from its mines in the Appalachian and Powder River Basin (or PRB). The company had around three billion tons of thermal coal reserves.

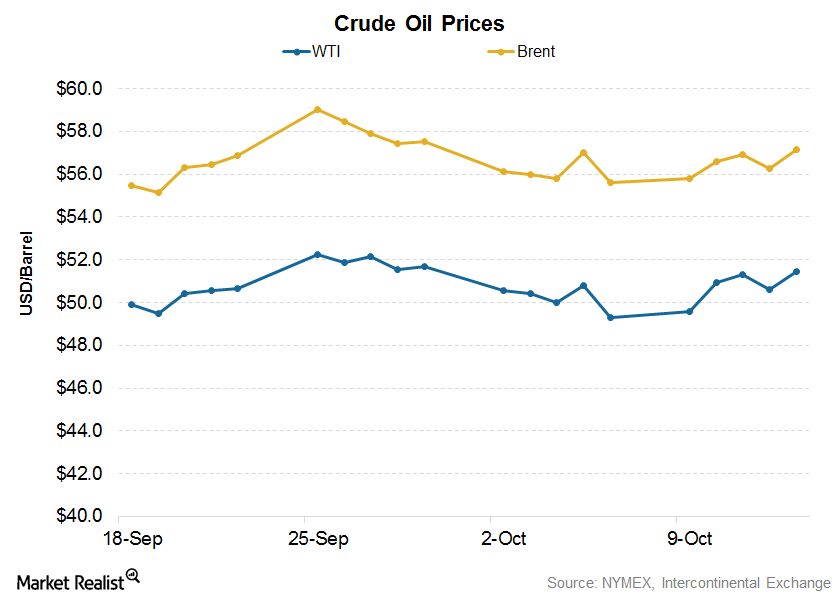

How Higher Crude Oil Prices Impact Coal Producers

On October 13, 2017, Brent crude oil prices settled at $57.17 per barrel, 3% higher than $55.60 reported during the previous week.

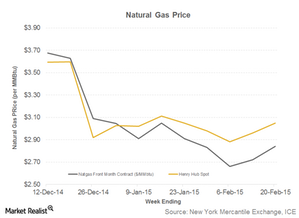

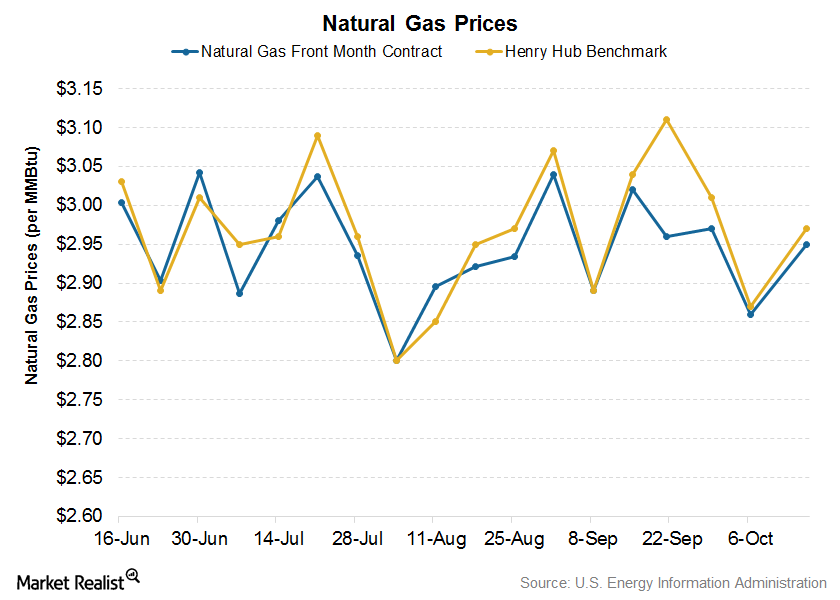

How Weather Affects Natural Gas Prices

On October 16, the November US natural gas futures contract price was reported as $2.95 per MMBtu.

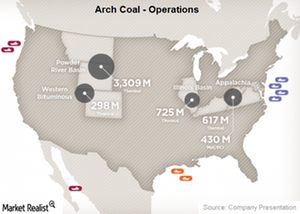

The Key Risks Involved in Arch Coal’s Business

Commodity price risk Arch Coal (ARCH) has long-term coal supply agreements for their non-trading, thermal coal sales, hence managing commodity risk for thermal coal and also to a limited extent, through the use of derivative instruments. However, sales commitments in the metallurgical coal market are typically not long-term in nature and are subject to fluctuations […]

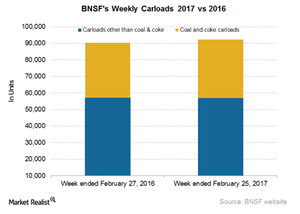

Your Guide to BNSF Railway’s Latest Carload Data

BNSF’s total railcars for the week ended February 25, 2017, rose 2.3% YoY to more than 92,000 units.

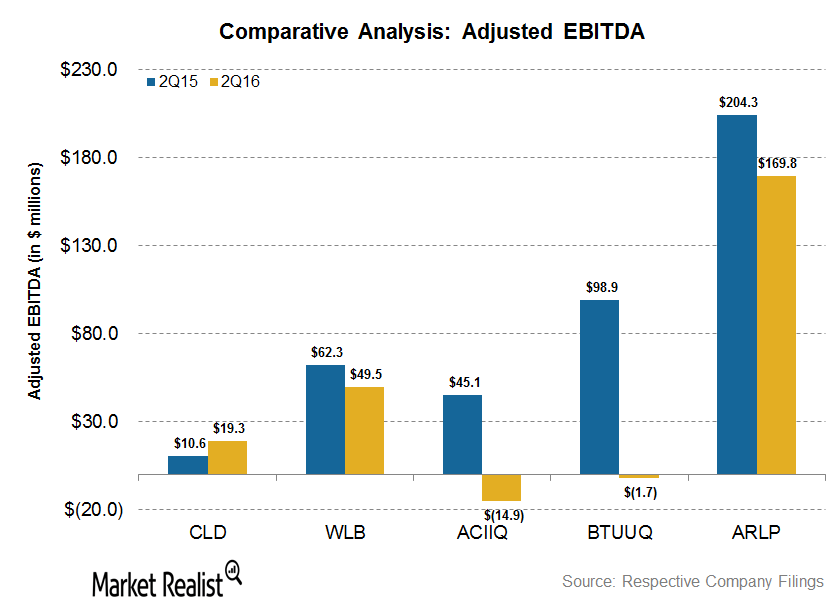

Cloud Peak Energy Topped EBITDA Margin Growth in 2Q16

Cloud Peak Energy reported positive growth in its 2Q16 EBITDA margins. Cloud Peak Energy’s EBITDA margins came in at 11.1% in 2Q16.

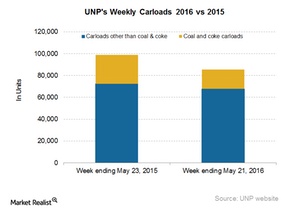

The Next Chapter in Union Pacific’s Carload Slump

In the week ending May 21, Union Pacific’s total railcars declined by 13.5% YoY to ~86,000 units, which was down from ~99,000 units one year previously.

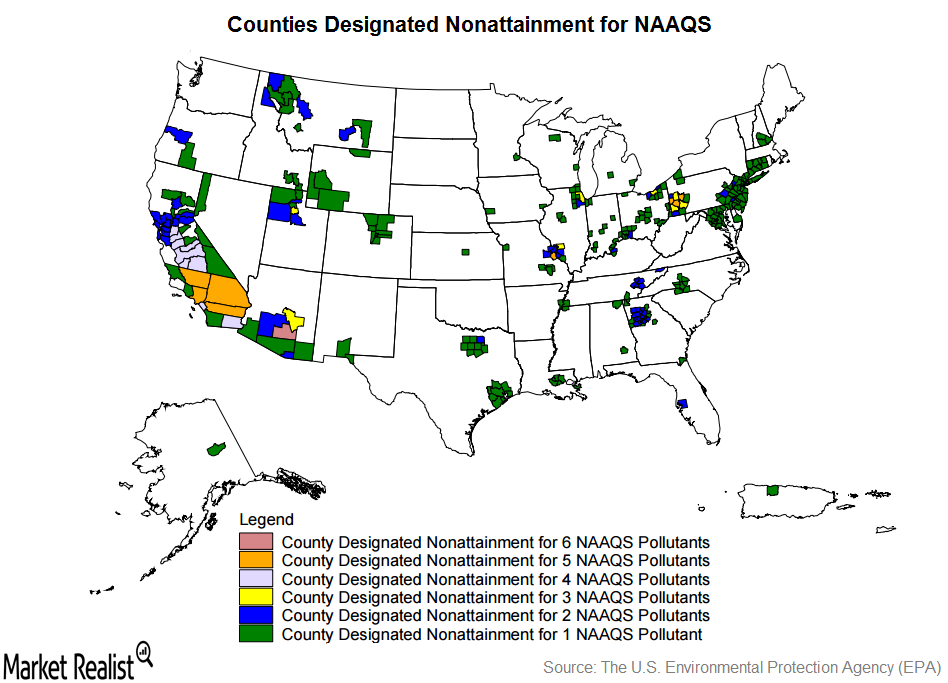

How Developments in the Clean Air Act Will Impact Coal Mining

The Clean Air Act is a national air pollution control policy that regulates the emission of hazardous pollutants from stationary and mobile sources in the United States.

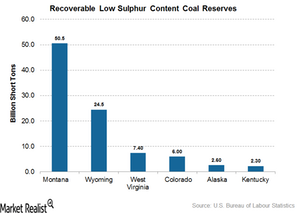

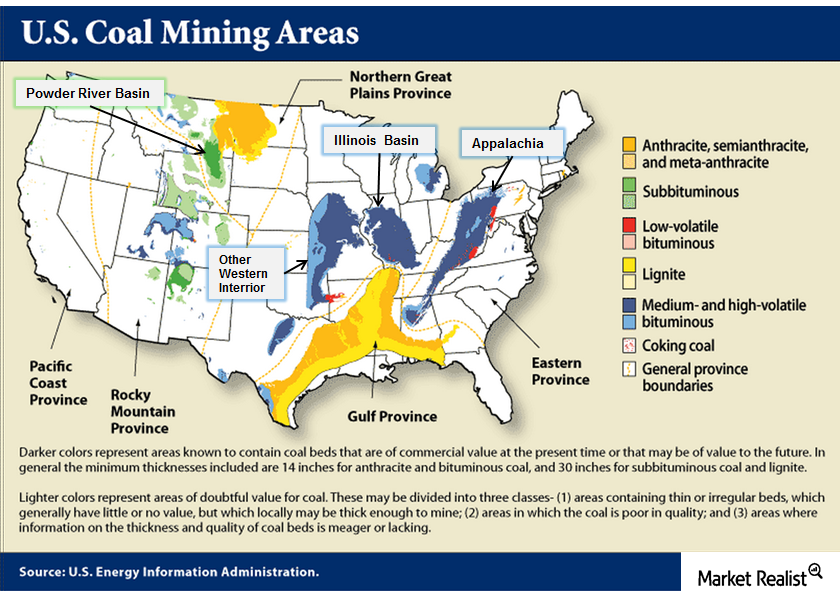

Where Are the Low Sulphur Content Coal Mines in the US?

According to the EIA, low sulphur content coal is defined as having less than 0.60 pounds of sulphur per million British thermal units.

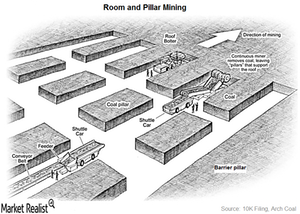

How Is Coal Mined in the US?

According to the World Coal Association, there are two main underground mining methods in the US.

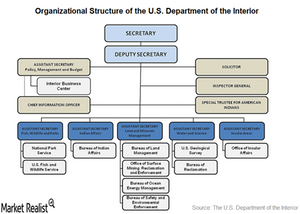

How Does the Land Ownership Pattern in the US Affect Miners?

Land ownership in the US can be broadly divided into the following categories: federally owned land, state-owned land, privately owned land, and Native American land.

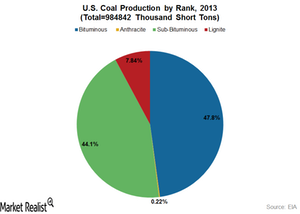

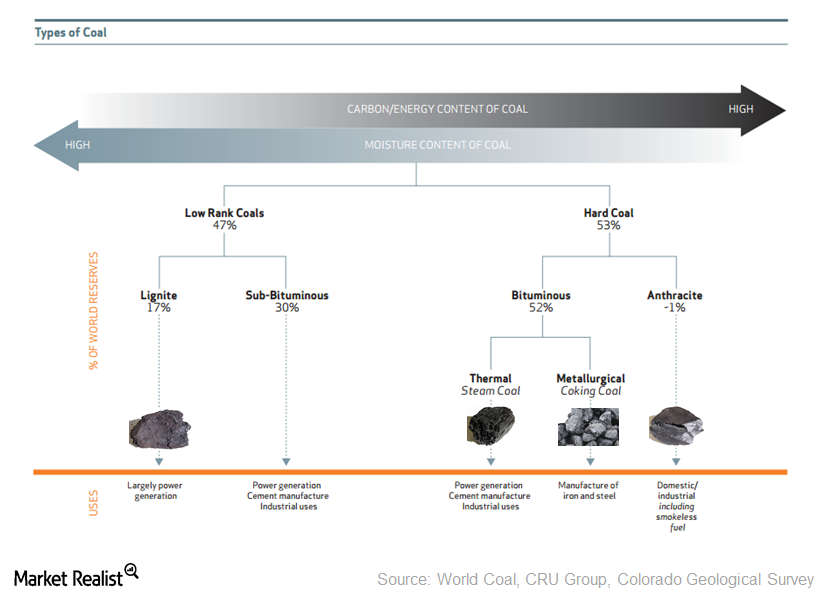

What Are the Different Types of Coal?

Coal types differ from each other as a result of the difference in their organic matter content and maturity.

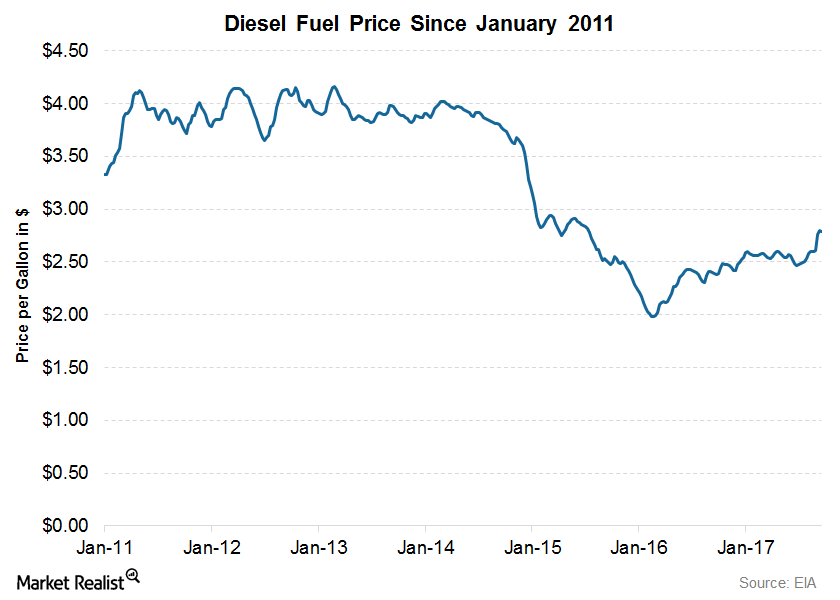

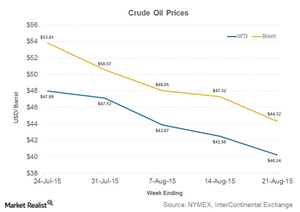

Crude Oil Fell below $30: Positive or Negative for Coal?

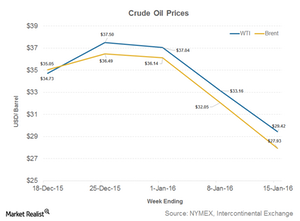

Crude oil prices dropped significantly during the week ended January 15, 2016. WTI (West Texas Intermediate) crude oil prices closed at $29.42 per MMBtu on January 15, 2016.

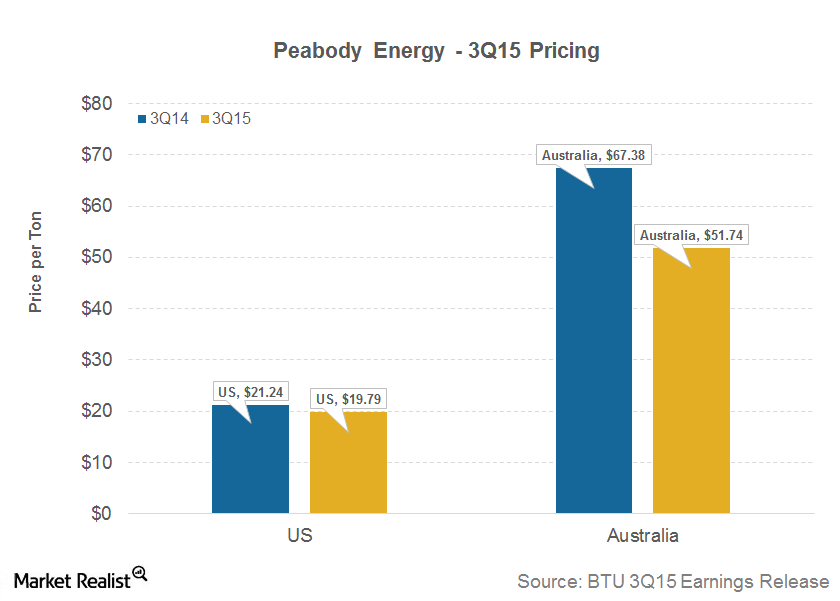

Lower Shipments and Pricing Hampered Peabody’s 3Q15 Revenues

Peabody Energy’s (BTU) US operations posted revenue per ton of $19.79 in 3Q15, down from $21.24 in 3Q14.

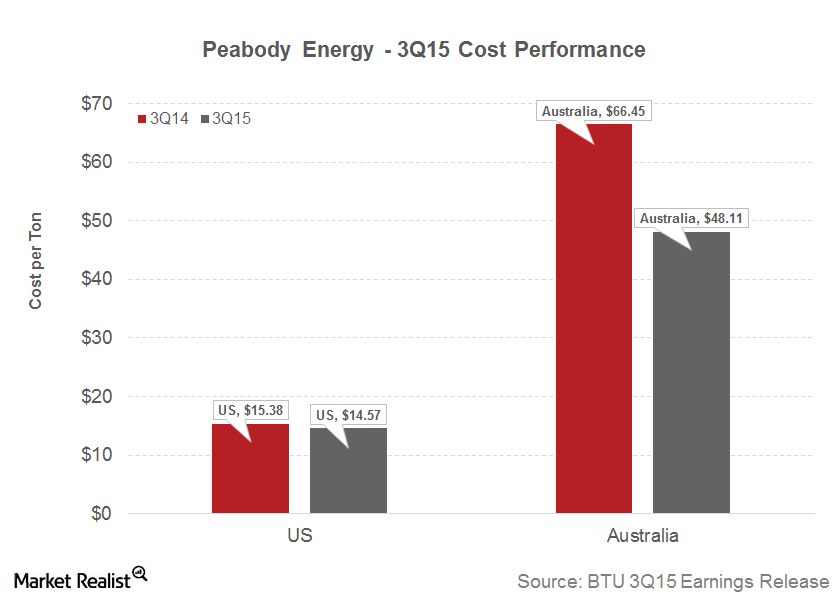

Will Peabody Energy’s Impressive 3Q15 Cost Performance Help?

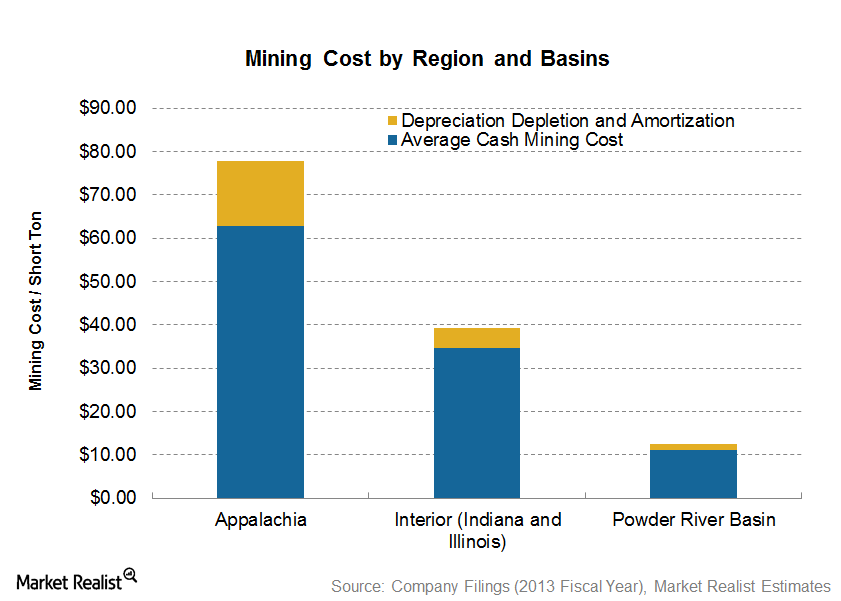

Peabody Energy (BTU) reported Midwest production costs of $32.51 a ton in 3Q15, compared to $34.56 a ton in 3Q14.

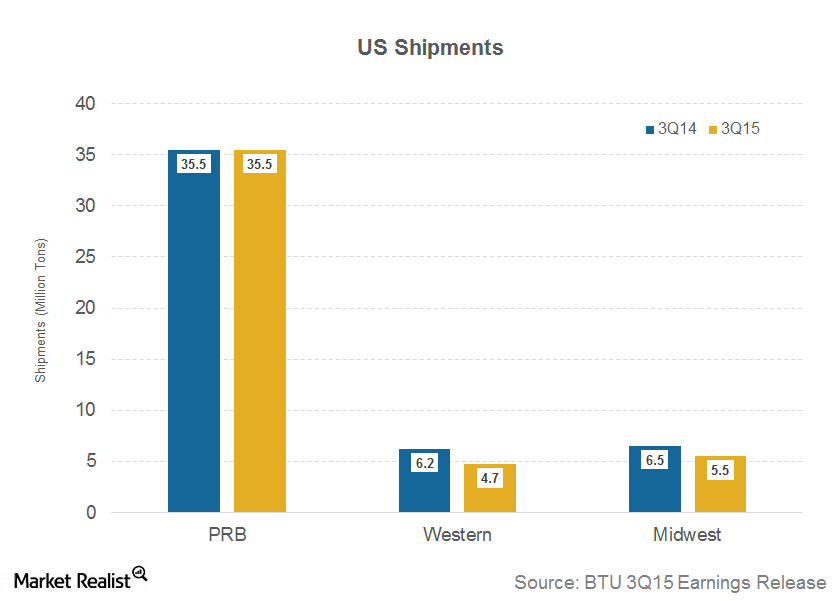

Natural Gas Weighed Heavily on Peabody Energy’s US Shipments

Peabody Energy’s (BTU) US operations sold 45.7 million tons of thermal coal (KOL) in 3Q15, 5.2% lower than 3Q14’s 48.2 million tons.

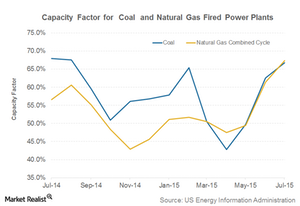

Capacity Factors Still Indicate Shift from Coal to Natural Gas

Capacity factors for coal-fired plants fell YoY and rose substantially for natural gas-fired power plants. This shows a shift from coal to natural gas as a fuel for electricity generation.

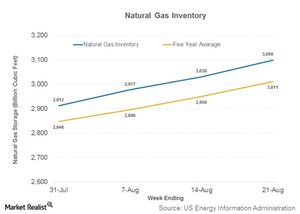

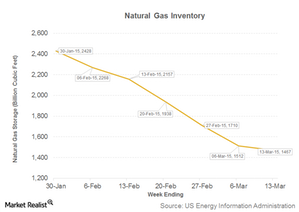

Natural Gas Inventory Figure Puts Pressure on Coal

The EIA’s natural gas inventory report for the week ended August 21 came in at 3,099 billion cubic feet, compared to 3,030 Bcf a week earlier. Natural gas is stored underground to save the fuel for peak demand during the winter.

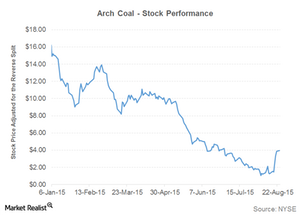

Why Arch Coal Rallied During a Bad Week for the S&P 500

Arch Coal’s (ACI) shares posted an astounding 205% rise during the week ending August 21. The stock closed at $3.85 on August 21.

Why Arch Coal Is in the News for Debt Exchange

On August 4, 2015, Arch Coal completed a reverse stock split to boost its stock price above the dollar mark and stay listed on the NYSE.

Continued Slump in Crude Oil Prices May Benefit Coal

Crude oil prices are a mixed driver for the coal industry (KOL) in the United States. On the one hand, a fall in crude oil prices results in a fall in fuel costs.

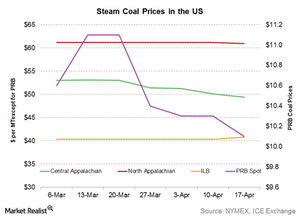

Coal Prices Dropped as Natural Gas Prices Rose

Central Appalachian thermal coal prices came in at $49.40 per ton for the week ending April 17—down from $50.10 per ton the previous week.

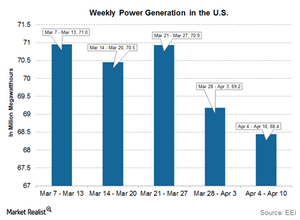

US Electricity Production Falls for the Second Straight Week

Electricity storage is expensive. Most of the produced electricity is consumed instantaneously. As a result, electricity generation mirrors consumption.

The Latest Natural Gas Inventory Report Proves Neutral for Coal

The EIA (US Energy Information Administration) publishes a weekly natural gas inventory and withdrawal report every Thursday.

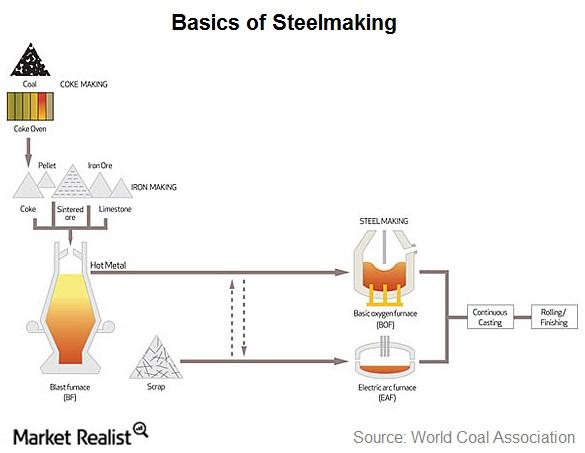

SunCoke Energy’s presence in the steelmaking process

Coke is used in the iron making process, which in turn is used in the steelmaking process. SunCoke Energy produced 4.2 million tons of coke in 2013.

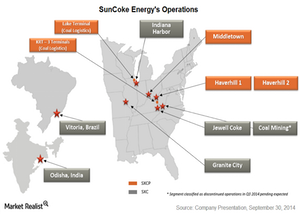

A quick look at SunCoke Energy’s US operations

SunCoke Energy (SXC) is the largest independent manufacturer of coke, which is used in steelmaking. It runs five coke making plants in the United States.

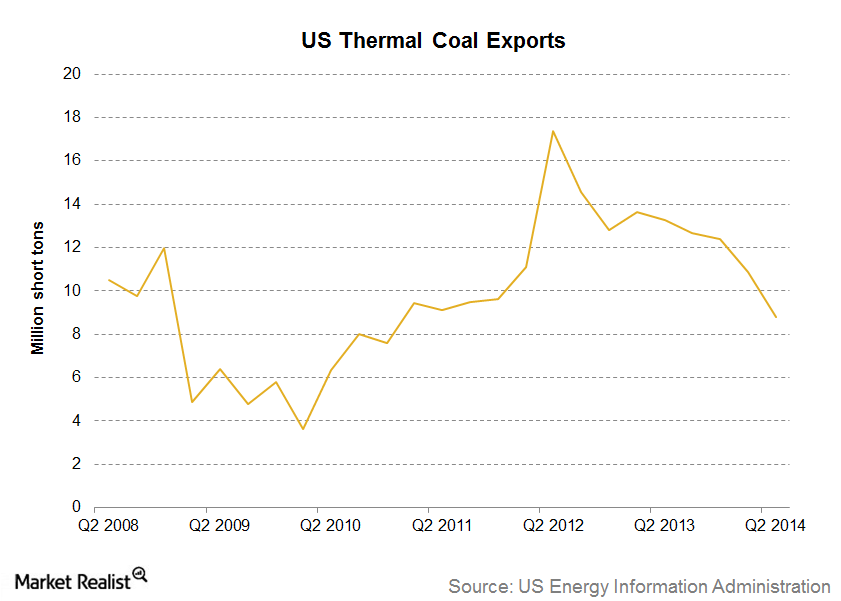

Must-know: US thermal coal exports are falling

US thermal coal exports were 19.6 million tons in the first half of 2014—down from 26.9 million tons during same period in 2013. The drop was mainly driven by falling demand from Europe.

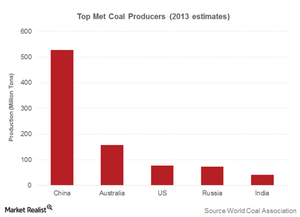

Who are the swing met coal producers in the global market?

In the seaborne met coal market, the swing producers are clearly the Australian producers. Australia is the second largest of the met coal producers. It’s the largest met coal exporter.

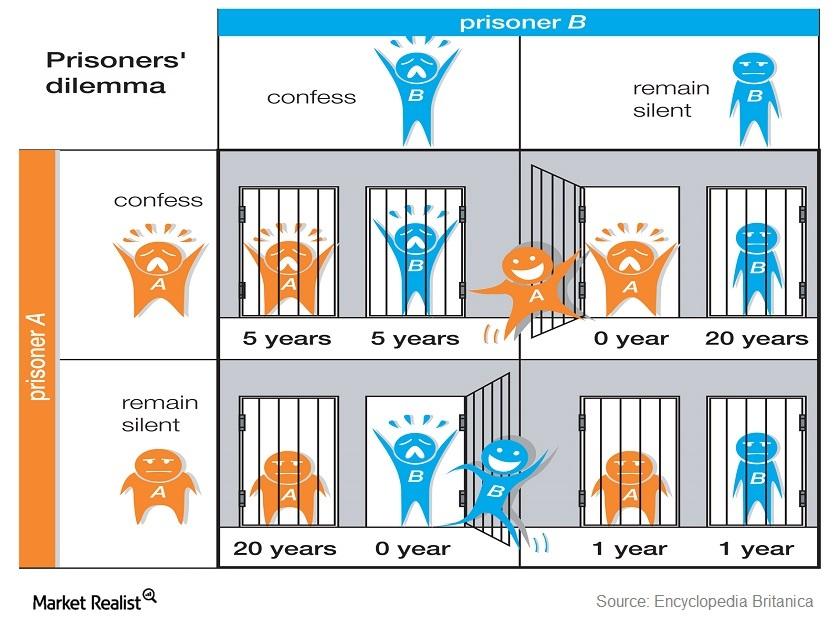

Falling commodity prices and the prisoner’s dilemma

There’s mistrust in the global commodity markets. From crude oil to met coal and iron ore, producers haven’t cut production. They’re waiting for others to do it first.Consumer Must-know: An overview of Appalachian coal

The Appalachian coal region is the oldest coal producing region in the U.S.—geologically and commercially. The Appalachian’s coal seams are ~300 million years old. They’re the oldest coal seams in the U.S. Appalachian coal fueled most of the Industrial Revolution after the Civil War in the 19th Century.

Must-know: The US coal mining areas and coal specifications

Coal mining in the U.S. can be segregated into three main areas: Appalachia, Interior, and West.

Why underground mines cost higher compared to surface coal mines

Underground mining is more expensive because it’s more capital intensive. Coal companies have to drill more, and use more expensive and complicated machines.

The “buried sunshine”—the coalification process and coal types

Coal is often called the “buried sunshine” because it developed from the remains of plants and greens that existed as long as 400 million years ago.