Apollo Global Management Inc

Latest Apollo Global Management Inc News and Updates

Preferred Equity: What It Is and How Companies Can Use It to Finance Buyouts

Preferred equity can represent high-priority securities. Here’s what preferred equity means and how companies can use it to finance a buyout.

Pearson Mulls Cash Offer From Asset Manager Apollo Global

Alternative asset manager Apollo Global Management offered to buy Pearson Plc. in an all-cash deal, but will the publishing company bite?

What Happens to Synnex Stock After Tech Data Merger?

Now that Synnex and Tech Data have officially merged to become TD Synnex, what will happen to Synnex stock (SNX)?

Leon Black Stepping Down as Apollo CEO Amid Scrutiny Over Jeffrey Epstein Ties

After an internal investigation into his ties to convicted sex offender Jeffrey Epstein, Leon Black is stepping down as Apollo Global Management's CEO.

Josh Harris Leads Apollo Global Management and Owns the 76ers

Josh Harris of Apollo Global Management is also an owner of the Philadelphia 76ers and the co-founder, with wife Marjorie, of Harries Philanthropies.

Apollo Merges With Athene to Build a Financial Empire

Apollo acquired its own creation, Athene, to build something beyond asset management and life insurance. Will the merger create a financial empire?

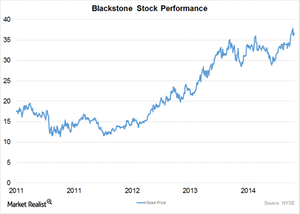

Blackstone Is Attracting New Capital

The launch of innovative ideas at the right time can help Blackstone attract a good amount of new capital through its dedicated network.Energy & Utilities Must-know: An overview of Athlon Energy

Athlon is an independent oil and gas exploration and production company. Its activities include the acquisition, exploration, and development of oil and liquids-heavy gas resources in the Permian Basin.

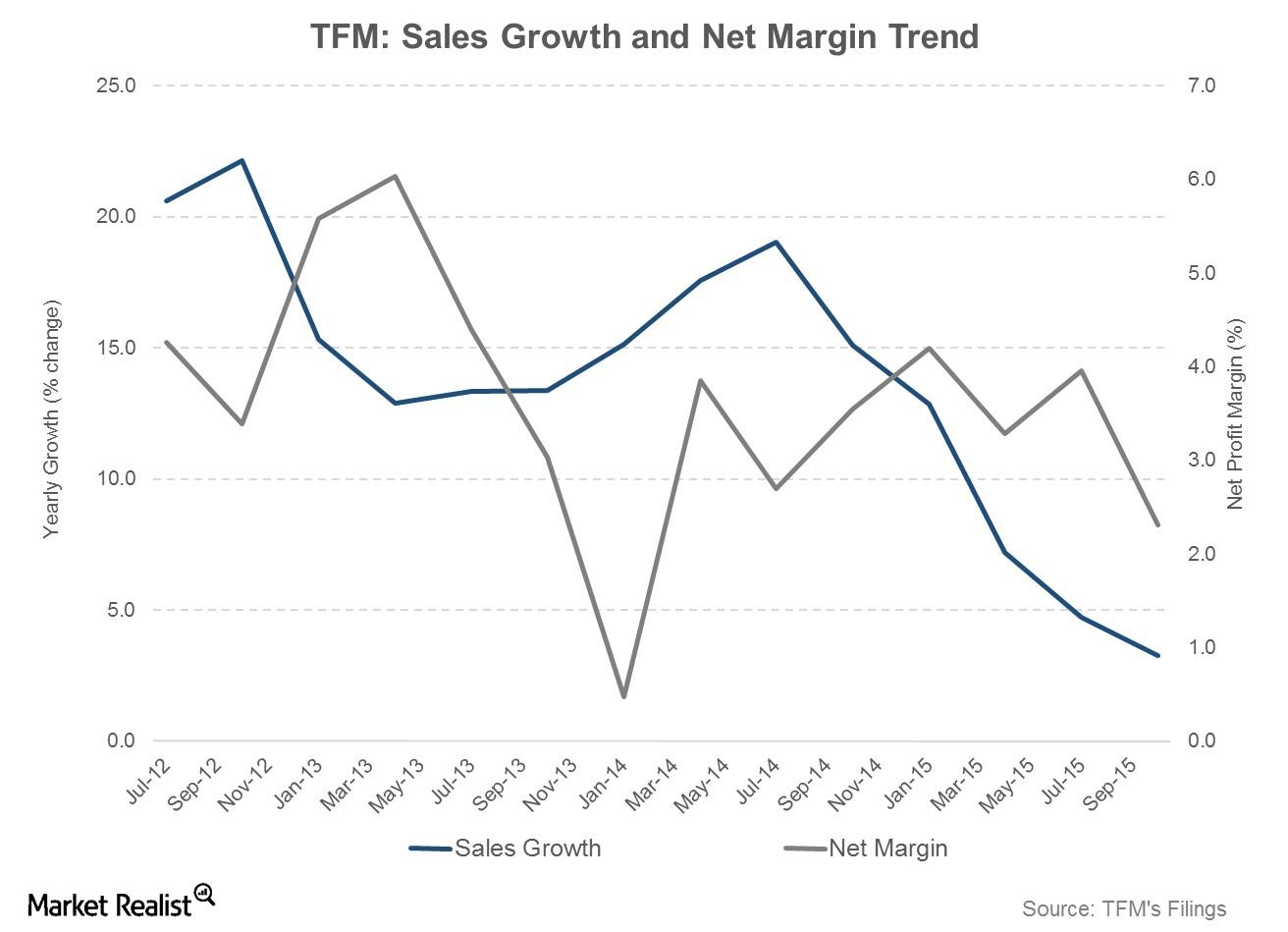

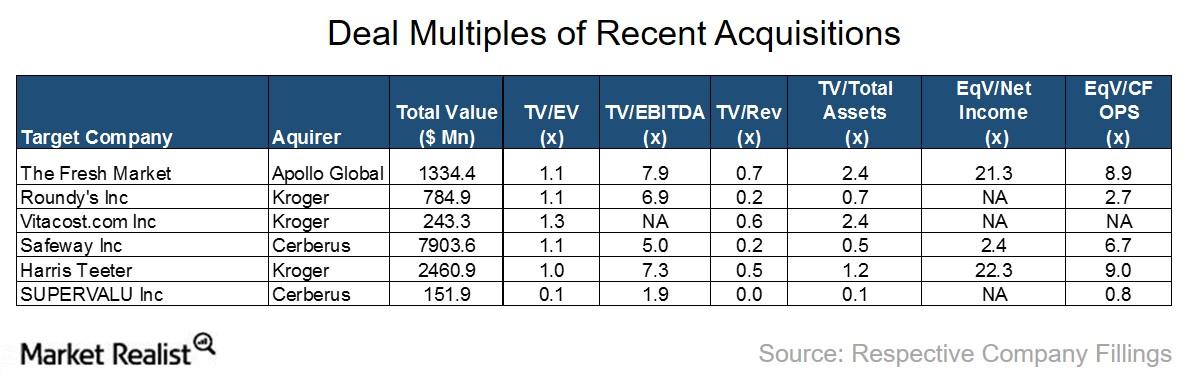

A Look at Apollo’s Definitive Deal to Acquire The Fresh Market

Apollo Global Management (APO) announced today, March 14, 2016, that it has entered into a definitive agreement to acquire The Fresh Market (TFM).

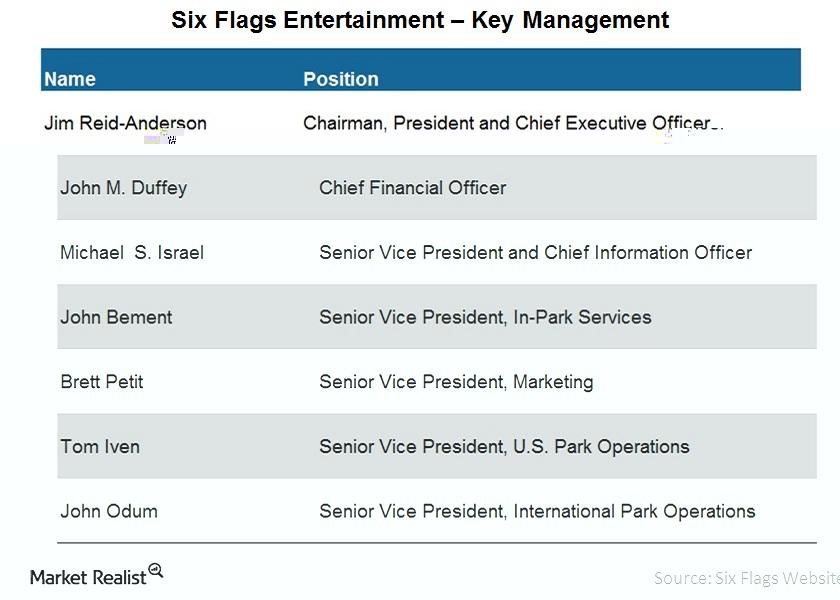

A brief overview of Six Flags’ management

Six Flags’ management plays a vital role in shaping the company and leading it in the desired direction. This article reviews three management positions.

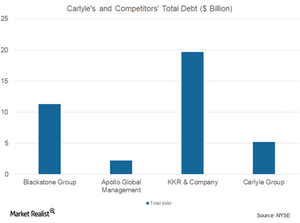

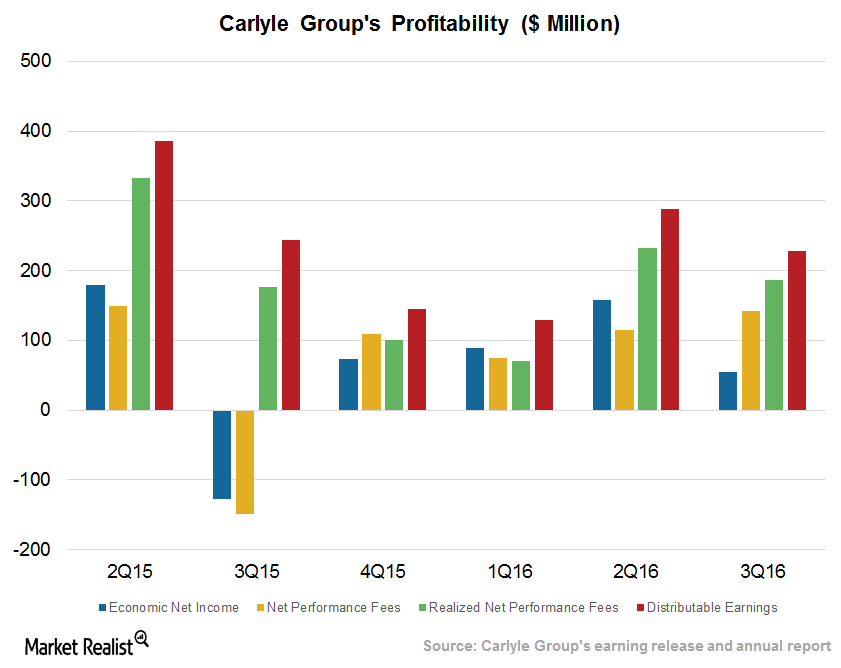

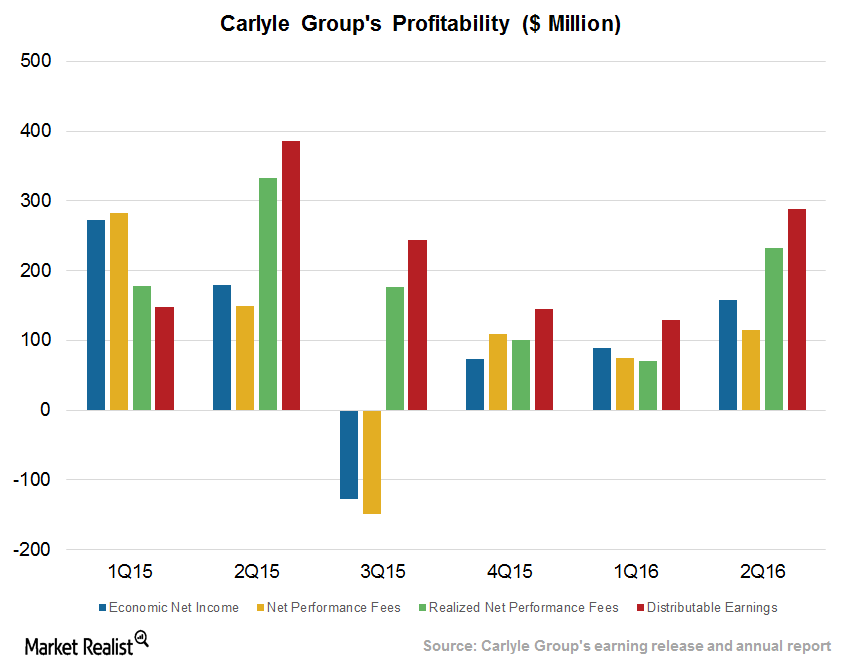

Carlyle Group’s Corporate Private Equity Division

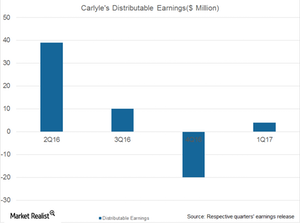

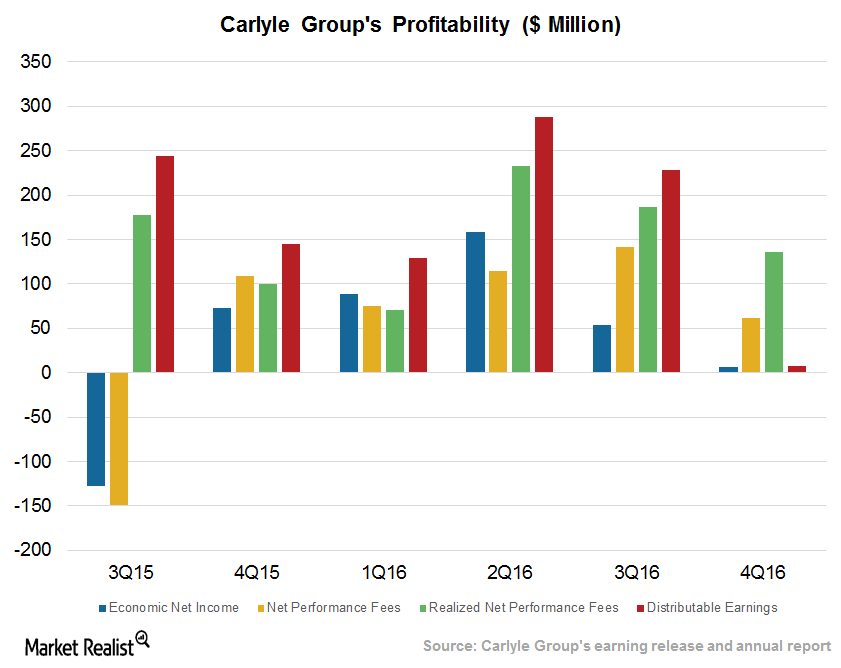

In 3Q17, the Carlyle Group’s (CG) Corporate Private Equity division saw a marginal decline in distributable earnings, from $209 million in 3Q16 to $207 million in 3Q17.

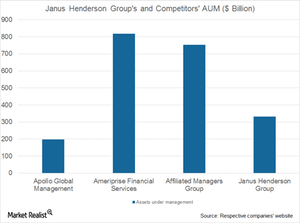

Janus-Henderson Merger: The Wait Is Over

The merger of Janus Capital Group (JNS) and Henderson Group (HGG), announced in late 2016, was finalized on May 30, 2017. It’s said to be a merger of equals.

What’s Happening Now with Carlyle’s Investment Solutions Segment?

Carlyle Group (CG) raised new capital of $3 billion in 1Q17, which included $1.4 billion from its Investment Solutions segment and $1 billion from Real Assets.

Inside Carlyle’s Expected Performance in Real Estate Assets

Real estate experts have an optimistic view of the industry, backed by a rising number of allocations in core and opportunistic funds by investors.

Understanding Carlyle’s Improved Performance despite Rate Hike Expectations

Carlyle Group has a number of credit strategies in place, and for its LPs (limited partnerships), the company is planning to invest in new credit strategies.

This Segment Is Driving Carlyle’s Numbers

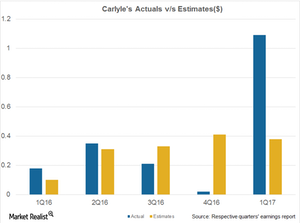

For 1Q17, Carlyle Group reported higher economic net income in its Corporate Private Equity segment, from $32 million in 1Q16 to $313 million in 1Q17.

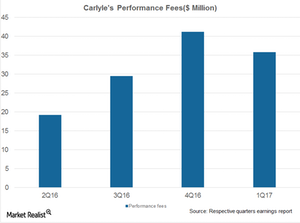

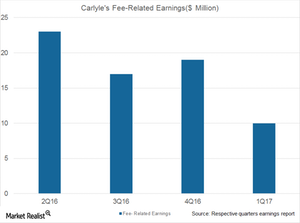

Carlyle Saw Impressive 1Q17 Results, but Can It Sustain?

After a subdued performance in 4Q16 and heavy losses in its Global Market Strategies segment, Carlyle Group (CG) reported improved numbers in 1Q17.

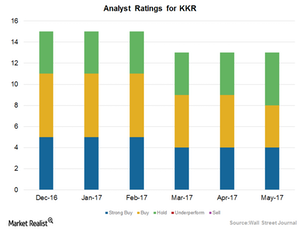

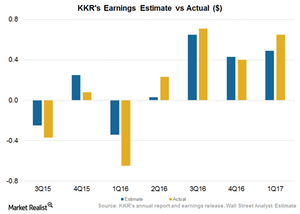

How Wall Street Analysts View KKR’s Performance in 2017

Analysts gave KKR an average target price of $21.42 from the current price, suggesting a rise of 14.3%.

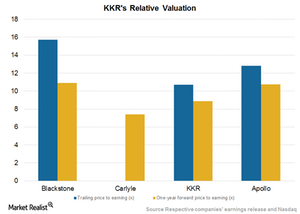

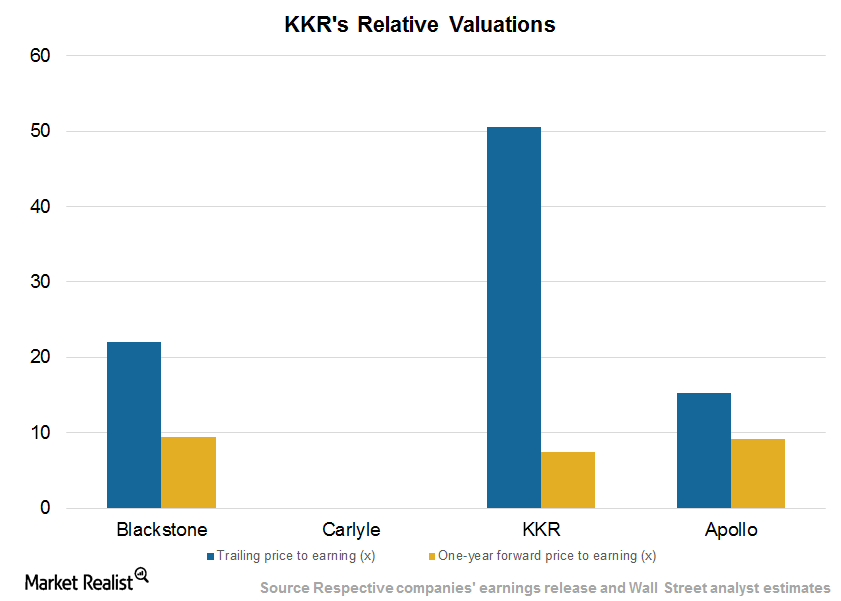

KKR’s Valuation amid Rising Equity Valuations in 2017

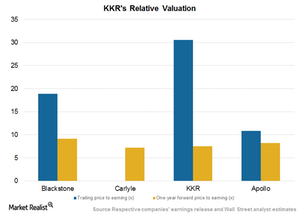

KKR & Co. (KKR) has posted earnings per share (or EPS) of $1.76 over the last four quarters.

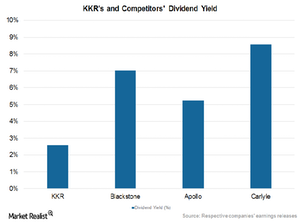

KKR’s Distribution Policy: A Reward for Unit Holders

KKR & Co. (KKR) paid a fixed dividend of $0.17 in May 2017 according to its policy announced in 2016.

How KKR Is Performing in Relation to Alternative Managers

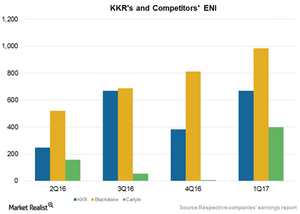

KKR & Co. (KKR) has reported an increase in its economic net income (or ENI) to $668.5 million in 1Q17 compared to $383.2 million in 4Q16.

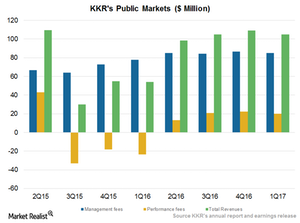

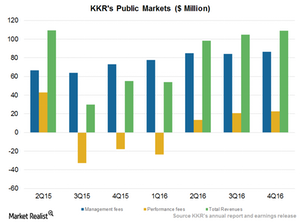

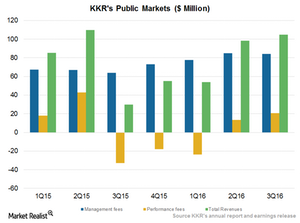

What Could Lead KKR’s Public Market Segment to Rise or Fall?

KKR has seen a decline in its base fees to $85.5 million in 1Q17 compared to $86.7 million in 4Q16.

KKR’s 2Q17 Performance on Deployments, Rise in Holdings

In 1Q17, KKR & Co. (KKR) deployed ~$5.4 billion in its Public Markets and Private Markets segments. KKR is expected to post EPS of $0.49 in 2Q17 and $2.15 in fiscal 2017, representing year-over-year growth of 113% and 216%, respectively.

Alternatives’ Deployments May Remain Stable on Fundamentals

In 2016, alternatives saw higher investments as well as exits on the back of improved liquidity, rising markets, higher valuations, and distressed pricing in corporate credit.

KKR Private Markets Segment Projects Deployment and Growth in 2017

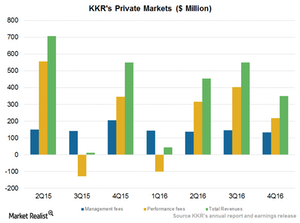

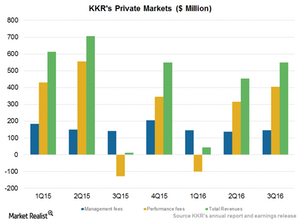

KKR & Company’s (KKR) Private Markets segment contributed almost 71% of the company’s total revenues in 4Q16.

Why KKR’s Valuations Could Rise in 2017

First Data (FDC) is one of KKR’s major holdings. The stock has risen 7.8% in 4Q16 as compared to a substantial decline in 1H16.

KKR Enhances Dividends and Repurchase Program on Growth

KKR & Company (KKR) is creating value for shareholders through share dividends and repurchases.

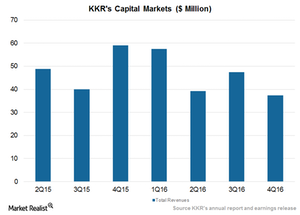

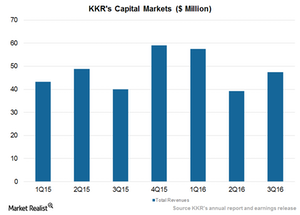

KKR’s Capital Markets Segment Was Subdued amid Lower Activity

KKR’s (KKR) Capital Markets and Principal Activities segment complements its activities in both private and public markets.

KKR Public Markets Could See Slower Growth in 2017 on Rate Hikes

Public markets have performed well over the past couple of quarters mainly due to a rebound in energy prices (USO), which has led to rising prices of distressed credit.

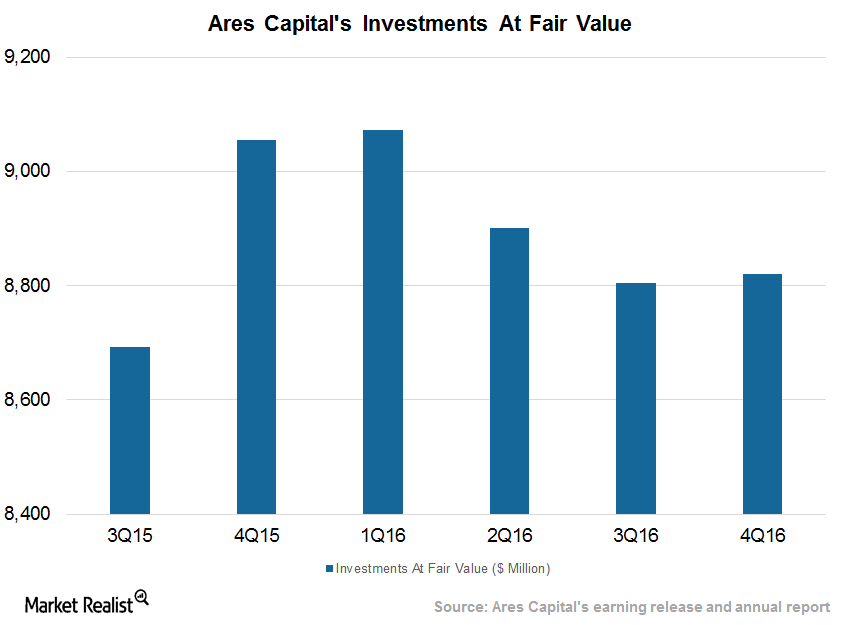

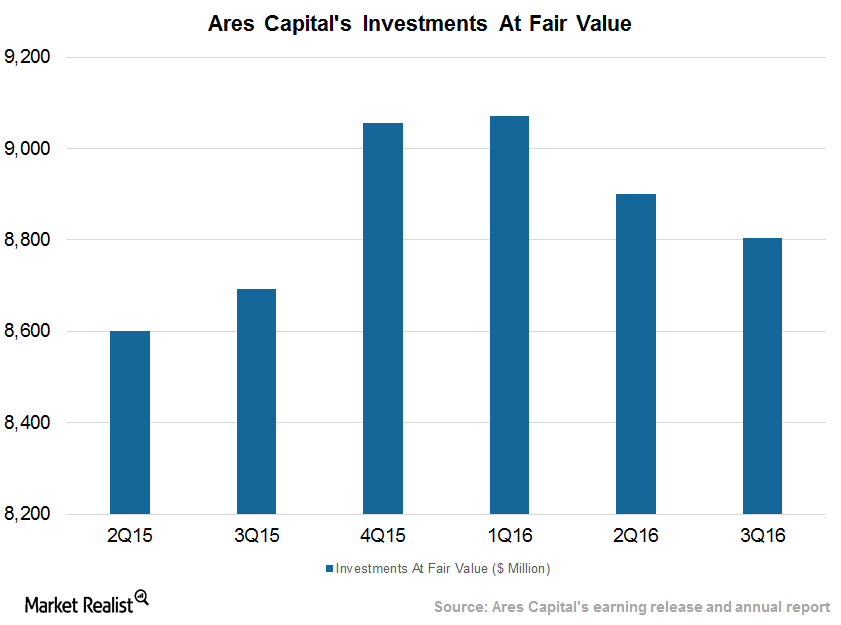

ARCC’s Net Investments Rose on Senior Secured Loans in 4Q16

By the end of December 2016, Ares Capital (ARCC) had a diversified portfolio of 218 companies totaling $8.8 billion at fair value.

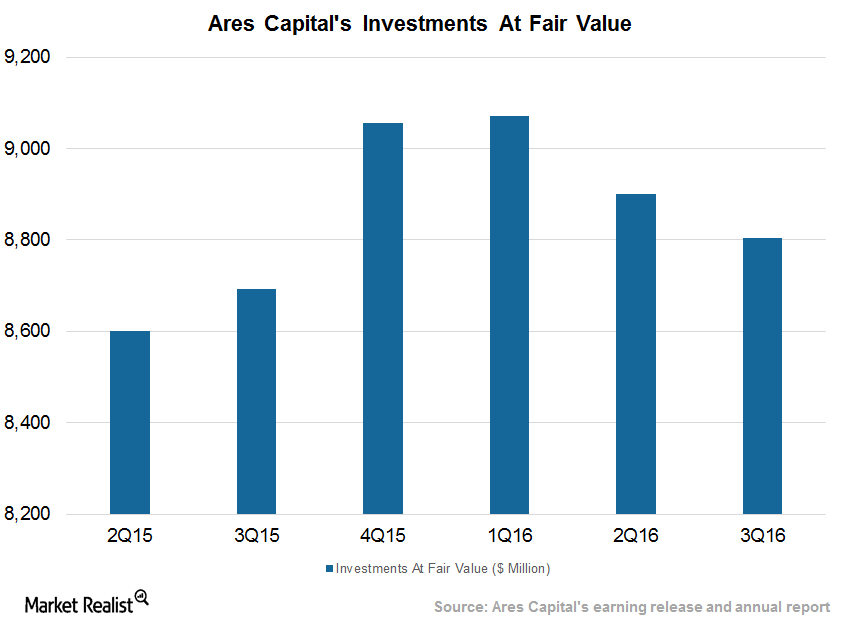

How Ares Capital’s Net Investments Could Rise in 4Q16

Net investments to rise Ares Capital (ARCC) has seen subdued deployment over the past few quarters. The company’s investments have fallen since 1Q16, mainly due to higher exits. In 4Q16, Ares might see marginally higher net investments due to new programs and first- and second-lien lending. As of September 30, 2016, Ares Capital had a diversified […]

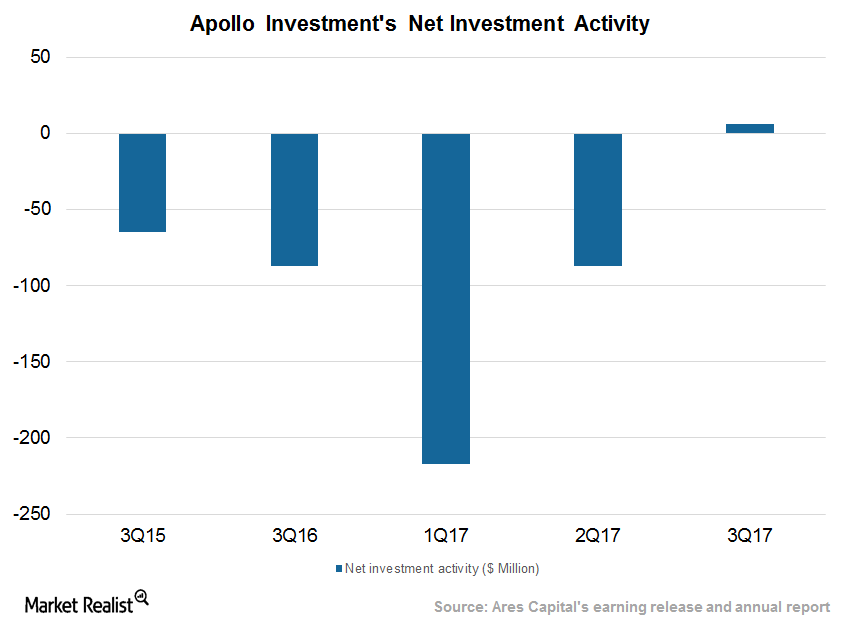

Apollo Investment Sees Net Investments Turn Positive in Fiscal 3Q17

In fiscal 3Q17, Apollo Investments (AINV) sold $17.1 million in investments and repaid $178.2 million.

Alternatives to See Improved Realizations and Deployments in 2017

In 2016, alternative asset managers saw higher exits and investments on the back of improved liquidity. The trend is expected to continue in 2017.

Apollo Investment’s Net Exits Trend Expected to Reverse in 2017

Apollo Investment’s (AINV) total portfolio stood at ~$2.6 billion in fiscal 2Q17 compared to ~$3.2 billion in fiscal 2Q16.

Blackstone and KKR Deployments Rise in 2016 on Valuations

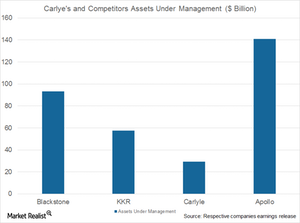

Blackstone Group (BX), the world’s largest alternative manager, invested $2.9 billion during the September 2016 quarter.

KKR Valuations Fair amid Volatile Performance and Capital Raises

KKR & Company (KKR) expects to post EPS (earnings per share) of $0.41 in 3Q16, reflecting a subdued performance compared to its 3Q15 numbers.

KKR Maintains Dividends, Continues with Repurchases in 3Q

As of October 2016, KKR has bought back 31.5 million common units for $457 million of its announced $500 million share repurchase program in December 2015.

KKR Capital Markets Manages Higher Revenues on Deal Making

KKR’s Capital Markets and Principal Activities segment saw revenues of $47 million in 3Q16, as compared to $40 million in 3Q15 and $39 million in 2Q16.

KKR Public Markets’ Performance Rises on Improved Credit Pricing

In 3Q16, KKR’s Public Markets segment reported total revenues of $84 million in 3Q16, as compared to $64 million in 3Q15.

KKR Private Markets Segment Rises on Performance Fees in 3Q

In 3Q16, KKR’s Private Markets segment reported revenues of $549 million in 3Q16, as compared to $12 million in 3Q15 and $453 million in 2Q16.

Ares Capital Enhances Originations in 3Q16

By the end of September 2016, Ares Capital (ARCC) had a diversified portfolio of 215 companies totaling $8.8 billion at fair value.

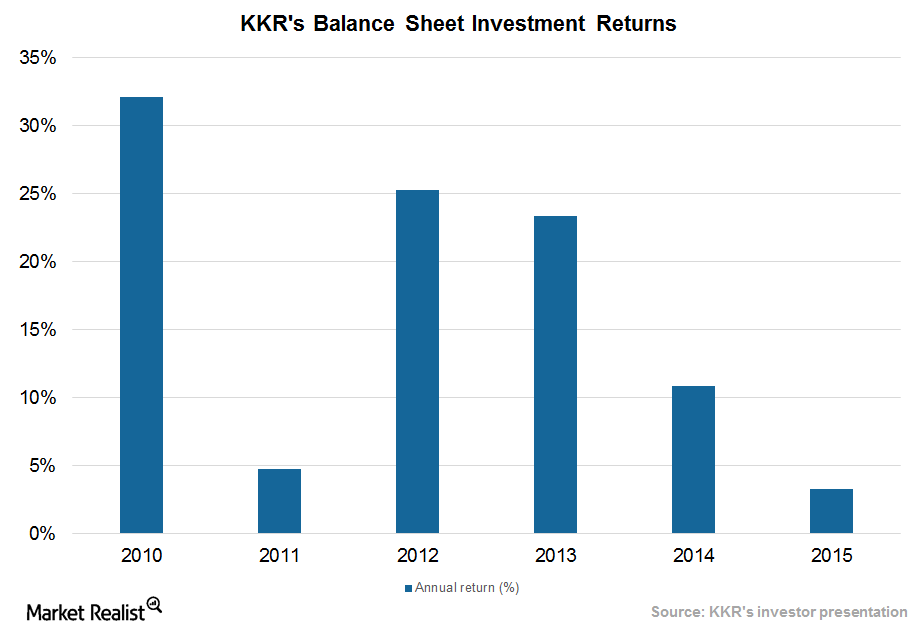

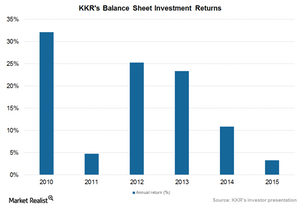

Alternatives Are Sitting on Record Capital, Making Investments

In 2015, fund managers took advantage of lower valuations and the availability of a record dry powder in order to make fresh investments at lower valuations.

What’s the Valuation of The Fresh Market Deal?

The transaction value of the deal between Apollo and The Fresh Market stands at $1,334 million. Apollo is paying 7.9x the EBITDA.

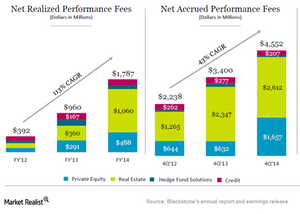

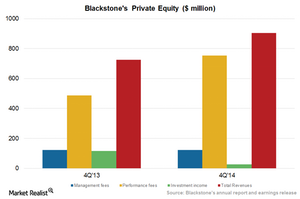

Blackstone’s Dominant Performance in Private Equity Space

Blackstone (BX) generated revenues of $2.7 billion and economic income of $1.8 billion for the year, backed by strong performance of BCP V and BCP VI.

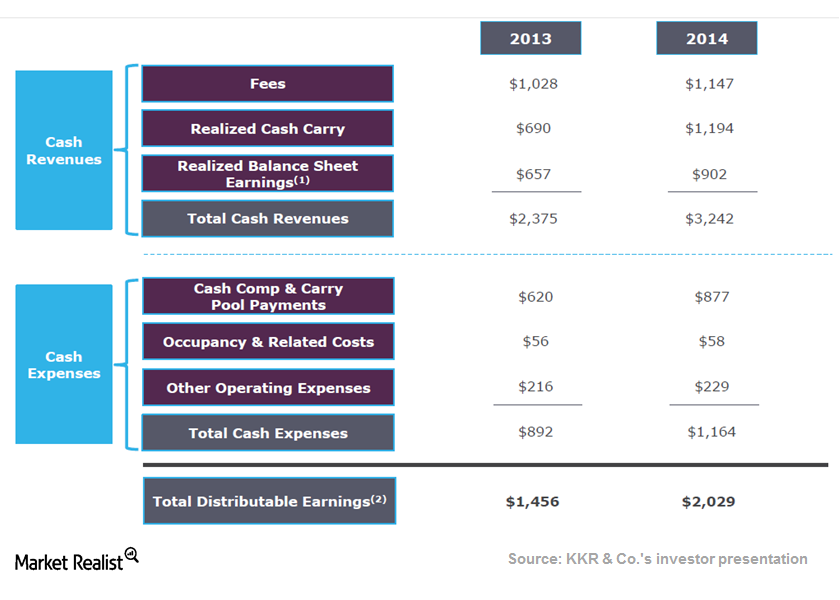

What does KKR’s revenue model look like?

KKR has a diverse revenue model, making fees for providing investment management to its funds, investment vehicles, managed accounts, and finance companies.

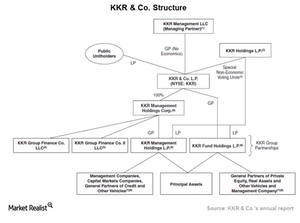

How KKR structures its investment vehicles

KKR structures its investment vehicles as a partnership or combination of domestic and overseas partnerships that contribute capital toward the fund.

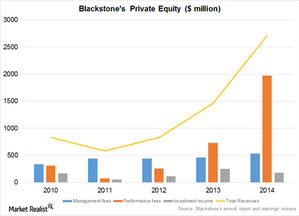

Blackstone relies on private equity division to drive growth

Blackstone (BX) manages a total of $73 billion assets in the private equity segment and has generated an annual return of 16% since its inception.

Blackstone Group: The $290 billion alternative investment manager

Alternative investment management attempts to outperform the major indices, instead of replicating returns as is the case in passive fund management.