How Ares Capital’s Net Investments Could Rise in 4Q16

Net investments to rise Ares Capital (ARCC) has seen subdued deployment over the past few quarters. The company’s investments have fallen since 1Q16, mainly due to higher exits. In 4Q16, Ares might see marginally higher net investments due to new programs and first- and second-lien lending. As of September 30, 2016, Ares Capital had a diversified […]

Feb. 15 2017, Updated 7:38 a.m. ET

Net investments to rise

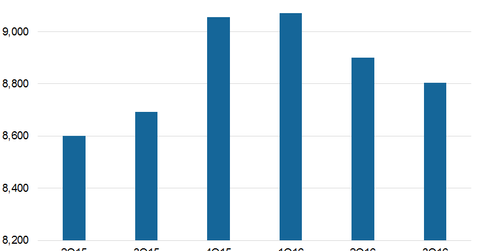

Ares Capital (ARCC) has seen subdued deployment over the past few quarters. The company’s investments have fallen since 1Q16, mainly due to higher exits. In 4Q16, Ares might see marginally higher net investments due to new programs and first- and second-lien lending. As of September 30, 2016, Ares Capital had a diversified portfolio of 215 companies totaling $8.8 billion at fair value. The company deployed a total of $1.53 billion in new investments and total exits of $1.5 billion in 3Q16, resulting in net investments of $30 million.

Ares Capital’s yields have fallen marginally over the past few quarters due to lower yields on subordinated SSLP (senior secured loan program) certificates and lower transaction flow in high-yield markets. The company’s weighted average yield was 8.7% on September 30, 2016, compared with 9.1% on December 31, 2015, and 9.4% on September 30, 2015. Its yield on debt and other income-producing securities stood at 9.8%. Investment management peers’ assets under management were as follows:

- Carlyle Group (CG): $158 billion

- KKR & Co. (KKR): $99 billion

- Apollo Global Management (APO): $187 billion

Together, these companies form 5.0% of the PowerShares Global Listed Private Equity ETF (PSP).

Preference for first- and second-lien loans

Ares Capital saw exits of $1.5 billion during 3Q16. Of these sales or exits, 77% were first-lien senior secured loans and 18% were second-lien senior secured loans, and the remaining 5% were SSLP loans. Of the investments made during the quarter, 52% were in first-lien senior secured loans and 23% were in second-lien senior secured loans. The company’s investment trends clearly reflect a preference for first- and second-lien loans rather than structured investments. In 4Q16, its expected to achieve higher net investments with major deployments towards second-lien loans and the SSLP. In the next part of this series, we’ll take a look at Ares Capital’s credit statistics in 4Q16.