KKR’s Valuation amid Rising Equity Valuations in 2017

KKR & Co. (KKR) has posted earnings per share (or EPS) of $1.76 over the last four quarters.

May 22 2017, Updated 9:07 a.m. ET

Earnings estimate for KKR

KKR & Co. (KKR) has posted earnings per share (or EPS) of $1.76 over the last four quarters. However, the company’s EPS should fall in the current quarter to $0.49, mostly due to decreasing growth rates. The falling earnings growth rates have been mostly due to subdued performance in broad equity markets.

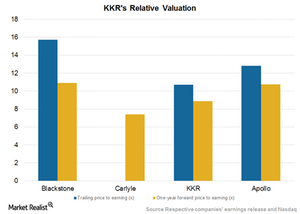

The decline in earnings has been also due to shifting of investments from equity to debt asset classes triggered from the recent interest rate hikes. KKR’s forward price-to-earnings (or PE) ratio stands at ~8.9x compared to the industry average of ~9.5x.

KKR is trading at a discount compared to the industry, mainly due to lower dividend yields and an increase in its EPS to $0.65 in 1Q17 from $0.40 in the previous quarter. Blackstone Group’s (BX) forward price-to-earnings ratio stood at ~10.9x, Apollo Global Management’s forward PE ratio was ~10.7x, and Carlyle Group’s (CG) forward PE ratio was 7.4x.

Valuation multiples

KKR’s trailing price-to-earnings ratio stands at ~10.7x. As far as the company’s distributions in the form of dividends are concerned, its trailing annual dividend yield stood at ~2.5% compared with the industry average of 3.6%. KKR’s competitors’ trailing annual dividend yields stand at:

Apollo Global Management (APO), Carlyle Group (CG), and Blackstone Group (BX) together constitute 4.1% of the PowerShares Global Listed Private Equity ETF (PSP).