Raymond Anderson

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Raymond Anderson

How Could a Trade War Impact Asset Managers?

After Trump announced that Chinese investments in US tech stocks would be restricted, the Dow Jones Industrial Average spiked downward.

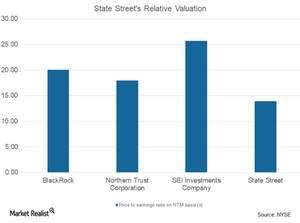

Can State Street Recover Its Discounted Valuations?

On a next 12-month basis, State Street Corporation (STT) has a PE (price-to-earnings) ratio of 13.9x. Its competitors’ average is 21.22x.

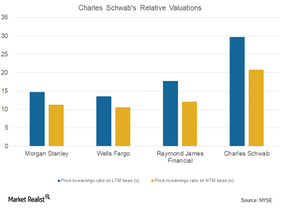

What’s Charles Schwab’s Valuation?

Charles Schwab (SCHW) has a price-to-earnings ratio of 20.80x on an NTM (next-12-month) basis.

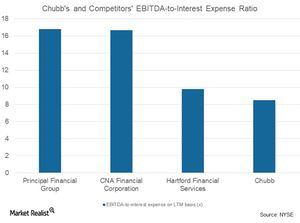

What to Expect from Chubb in 4Q17

Chubb Limited (CB) plans to release its 4Q17 earnings report on January 30. The average estimate from Wall Street analysts for earnings per share or EPS in 4Q17 is $2.33.

Brokerages in 2018: What to Expect

The final week of the second quarter might help brokerages, primarily because of higher client participation.

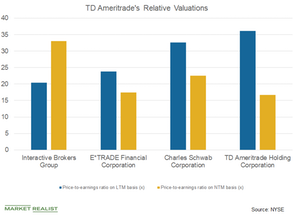

What Are TD Ameritrade’s Valuations?

TD Ameritrade’s (AMTD) PE ratio stood at 16.68x on a next 12-month basis, which implies discounted valuations.

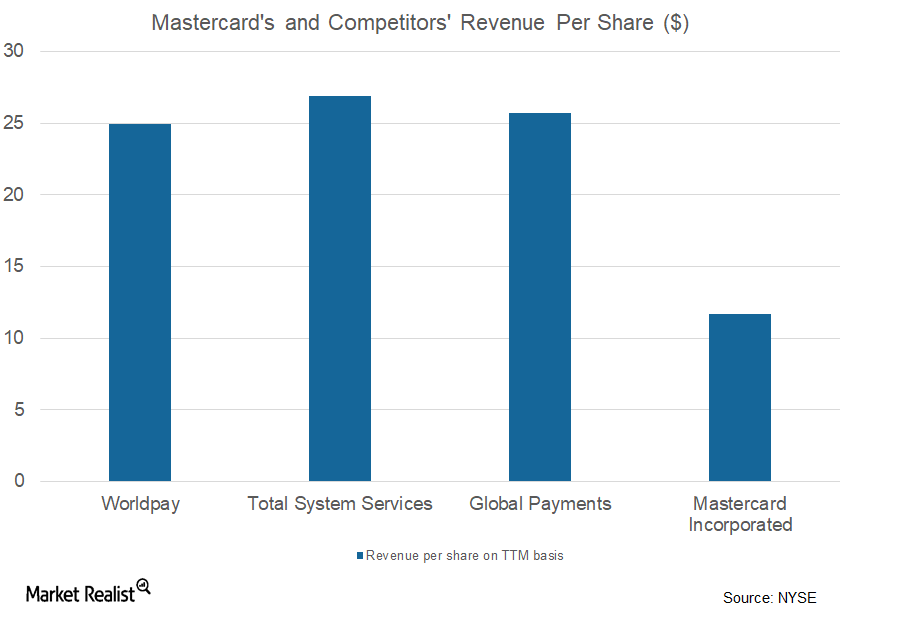

What Are Mastercard’s Growth Strategies?

Over the past few years, Mastercard’s (MA) revenues have remained consistent.

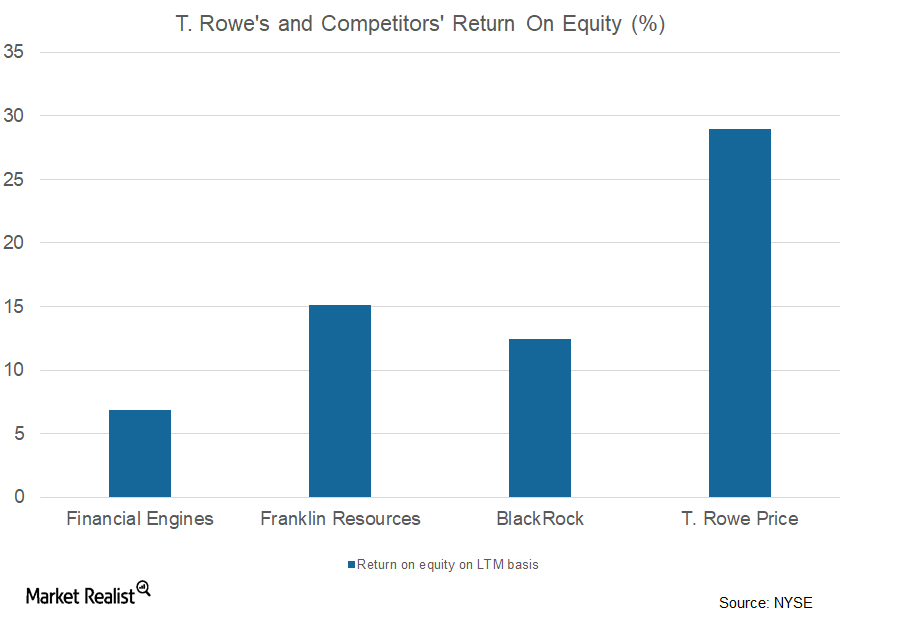

A Look at T. Rowe Price’s Assets under Management

Asset classes In its investor presentation on February 21, 2018, T. Rowe Price (TROW) stated that its core business is helped by the allocation of its AUM (assets under management) in different asset classes and its strong client base. However, the company also believes that targeting new opportunities is crucial for its core business. Of its total AUM, […]

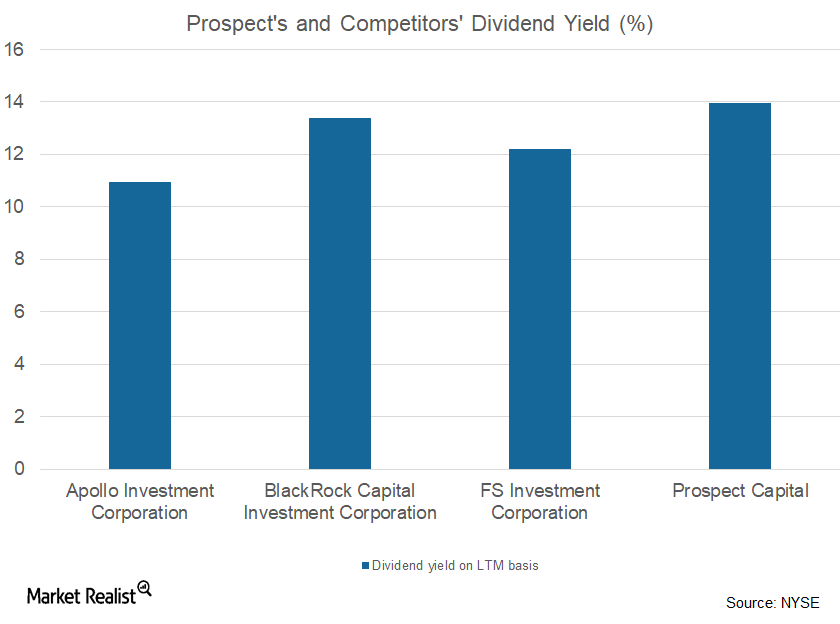

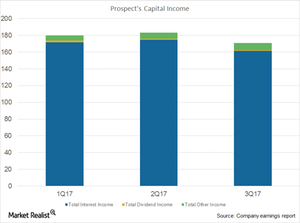

Why Prospect’s Investment Income Fell

In fiscal 2Q18, Prospect Capital’s (PSEC) total investment income was $162.4 million compared to $183.4 million a year earlier.

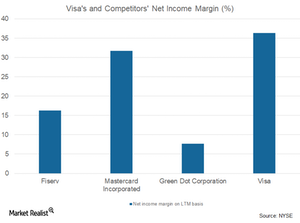

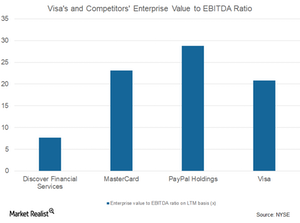

Inside Visa’s Operating Expenses

Visa (V) saw a rise of 13% in total operating expenses on a YoY (year-over-year) basis in fiscal 1Q18. It incurred $1.5 billion in expenses in fiscal 1Q18 compared to $1.4 billion a year earlier.

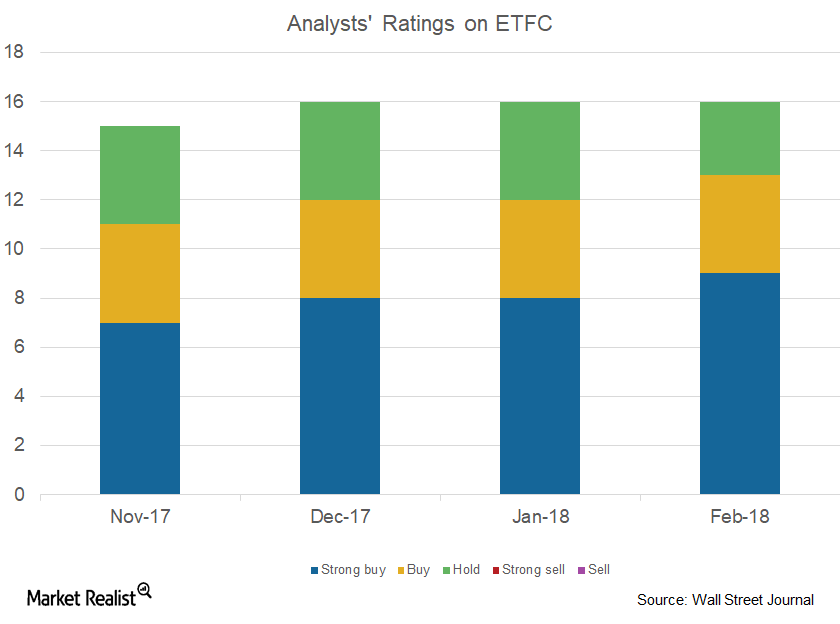

How Analysts View E*TRADE Financial in February 2018

E*TRADE Financial Corporation (ETFC) is covered by 16 analysts in February 2018. Of these analysts, nine suggested a “strong buy” and three gave “hold” ratings on ETFC.

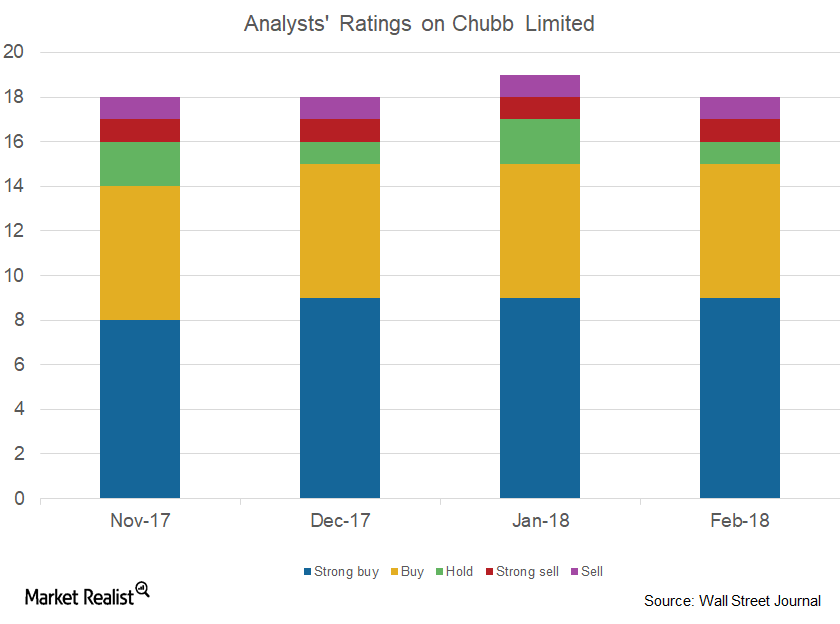

How Analysts Are Rating Chubb

Chubb (CB) is tracked by 18 analysts in February 2018. One analyst has recommended a “sell” for the stock, and one has recommended a “hold.”

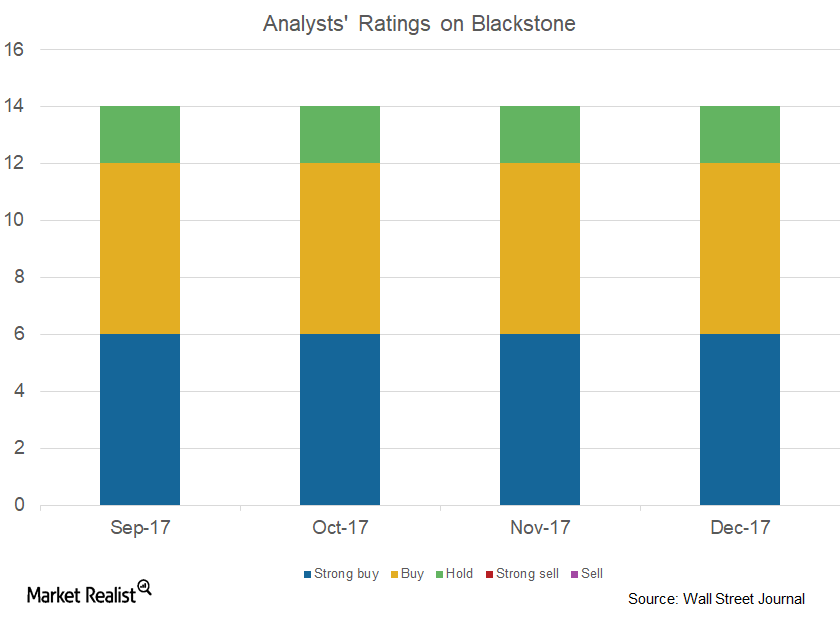

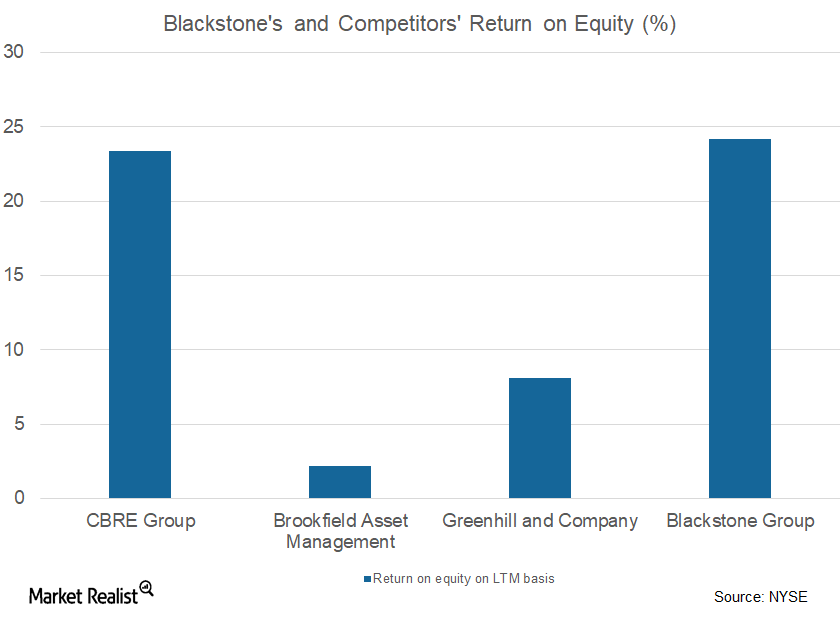

How Analysts View Blackstone

The Blackstone Group (BX) is being tracked by 14 analysts in December 2017. Six have given it “strong buy” ratings, two have suggested “hold” ratings, and six have recommended “buys.”

Blackstone’s Private Equity Division Saw a Strong Performance

The Blackstone Group’s (BX) private equity division posted total revenue of $1.4 billion in the first nine months of 2017, compared to $895.3 million in the first nine months of 2016.

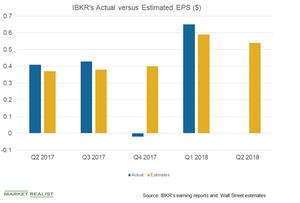

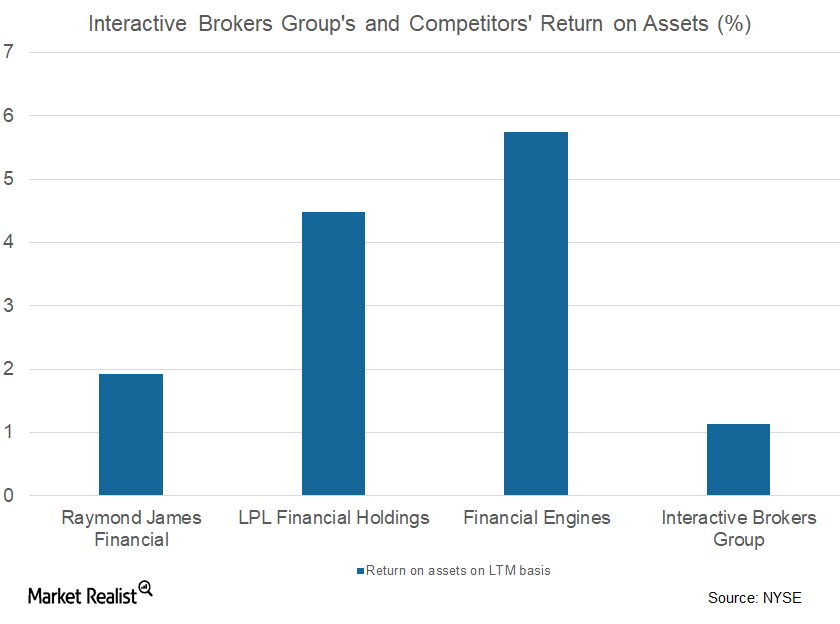

What Happened with Interactive Brokers’ Market-Making Business

Loss witnessed Interactive Brokers Group’s (IBKR) market-making business saw pre-tax income of -$35 million in the first three quarters of 2017, compared with $32 million in the same period of the prior year, primarily due to lower net revenue. Whereas the division’s trading gains fell from $124 million to $26 million, its other income rose to $14 […]

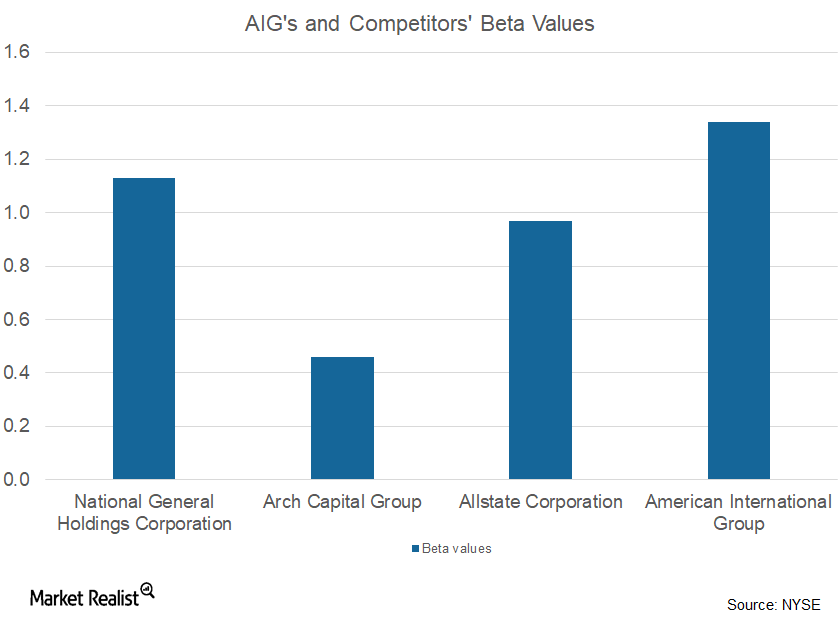

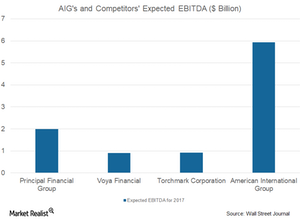

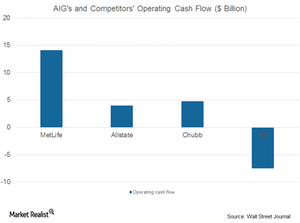

How AIG’s Consumer Insurance Division Performed in 3Q17

Marginal fall American International Group’s (AIG) consumer insurance division’s total operating revenue fell 1% from $6 billion in 3Q16 to $5.9 billion in 3Q17. The marginal fall was mainly due to lower net investment income and premiums. The division’s premiums fell 2% to $3.2 billion in 3Q17 from $3.3 billion in 3Q16. Whereas AIG has a beta of […]

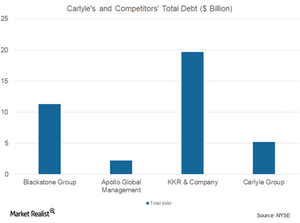

Carlyle Group’s Corporate Private Equity Division

In 3Q17, the Carlyle Group’s (CG) Corporate Private Equity division saw a marginal decline in distributable earnings, from $209 million in 3Q16 to $207 million in 3Q17.

What Could Drive AIG’s Performance in the Future?

According to Brian Duperreault, chief executive officer of American International Group (AIG), a company in any industry has to take the digitization path for long-term growth and success.

Analyzing Visa’s Assets and Liabilities

As of September 30, 2016, Visa (V) has reported a total asset balance of $64.03 billion. As of June 30, 2017, the company managed to report a total asset balance of $64.00 billion.

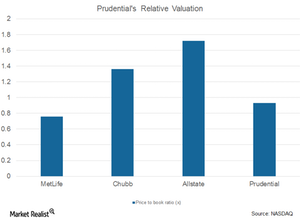

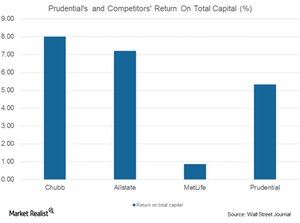

Prudential’s Discounted Valuations in 2Q17

Wall Street analysts recommended a one-year price target of $116.07 per share on Prudential Financial (PRU), reflecting an increase of ~14.1% from the current price.

Understanding Prudential’s Group Insurance and Individual Life Earnings

In 2Q17, on the basis of annualized new business premiums, sales in Prudential’s Individual Life business stood at $153 million, reflecting a marginal decline of ~3.8% year-over-year.

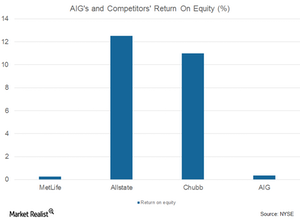

Analyzing AIG’s Life and Personal Insurance Business

AIG’s pretax operating income for personal insurance stood at $330 million in 2Q17. In 2Q16, it stood at $152 million.

Why AIG’s Net Income Fell on a Year-over-Year Basis

AIG is expected to post earnings per share of $1.22 in 3Q17, an ~20.3% decline from its 2Q17 earnings. AIG is expected to report revenues of ~$11.8 billion in 3Q17.

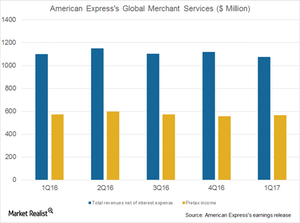

Inside American Express’s Global Merchant Services Segment

American Express’s (AXP) Global Merchant Services segment is expected to see a marginal increase in its net income in 2Q17.

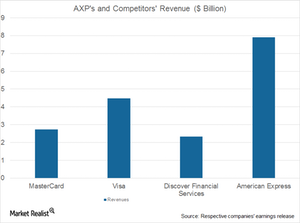

American Express to Ride on Partnerships, Digitization

American Express (or Amex) (AXP) has entered into digital partnerships with Airbnb, Facebook (FB), and Uber in order to offset the revenue loss from Costco (COST).

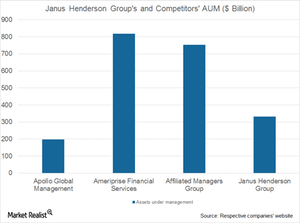

Janus-Henderson Merger: The Wait Is Over

The merger of Janus Capital Group (JNS) and Henderson Group (HGG), announced in late 2016, was finalized on May 30, 2017. It’s said to be a merger of equals.

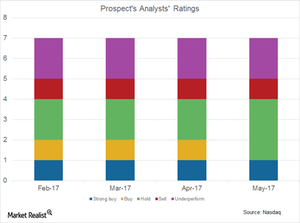

Prospect Capital’s Ratings: What Wall Street Analysts Have to Say

Although Prospect Capital (PSEC) has been delivering decent returns to investors, there has not been much change in the analysts’ ratings.

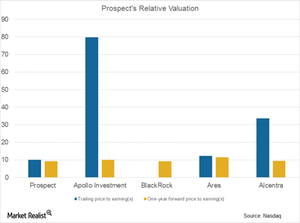

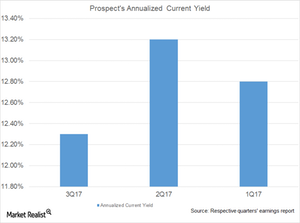

Prospect Capital’s Increasing Valuations in 2017

Analysts have given PSEC a one-year price target of $8.50 from the current price level, reflecting 0.7% growth.

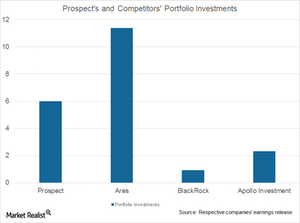

Prospect Capital’s Total Investments Increase in 2017

In fiscal 3Q17, Prospect Capital’s total value of investments stood at $6.0 billion in 125 companies, compared to $5.9 billion in fiscal 2Q17 in 123 companies.

Prospect Capital Prioritizes Secured Lending

About 70% of Prospect Capital’s portfolio is composed of first and second lien secured loans

Prospect Capital Adopts a Conservative Approach in Fiscal 3Q17

Prospect Capital’s (PSEC) originations decreased in fiscal 3Q17 to $449.6 million compared to $469.5 million in fiscal 2Q17.

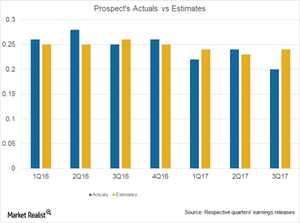

Prospect Capital’s Disappointing Performance in Fiscal 3Q17

Prospect Capital (PSEC) reported a decline in its net investment income in its fiscal 3Q17 earnings. Analysts expect PSEC’s fiscal 4Q17 EPS to reach $0.20, representing no change from fiscal 3Q17.

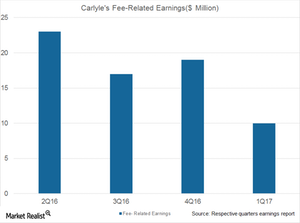

What’s Happening Now with Carlyle’s Investment Solutions Segment?

Carlyle Group (CG) raised new capital of $3 billion in 1Q17, which included $1.4 billion from its Investment Solutions segment and $1 billion from Real Assets.

Inside Carlyle’s Expected Performance in Real Estate Assets

Real estate experts have an optimistic view of the industry, backed by a rising number of allocations in core and opportunistic funds by investors.

Understanding Carlyle’s Improved Performance despite Rate Hike Expectations

Carlyle Group has a number of credit strategies in place, and for its LPs (limited partnerships), the company is planning to invest in new credit strategies.

This Segment Is Driving Carlyle’s Numbers

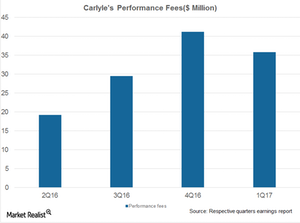

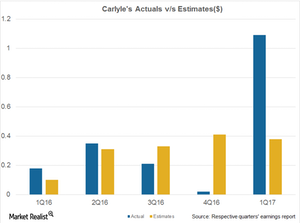

For 1Q17, Carlyle Group reported higher economic net income in its Corporate Private Equity segment, from $32 million in 1Q16 to $313 million in 1Q17.

Carlyle Saw Impressive 1Q17 Results, but Can It Sustain?

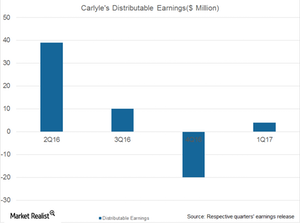

After a subdued performance in 4Q16 and heavy losses in its Global Market Strategies segment, Carlyle Group (CG) reported improved numbers in 1Q17.

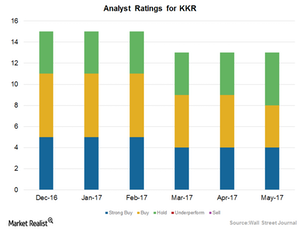

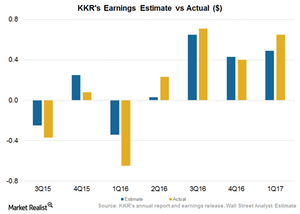

How Wall Street Analysts View KKR’s Performance in 2017

Analysts gave KKR an average target price of $21.42 from the current price, suggesting a rise of 14.3%.

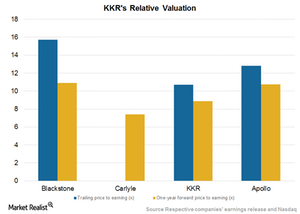

KKR’s Valuation amid Rising Equity Valuations in 2017

KKR & Co. (KKR) has posted earnings per share (or EPS) of $1.76 over the last four quarters.

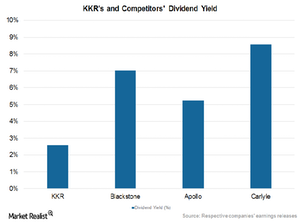

KKR’s Distribution Policy: A Reward for Unit Holders

KKR & Co. (KKR) paid a fixed dividend of $0.17 in May 2017 according to its policy announced in 2016.

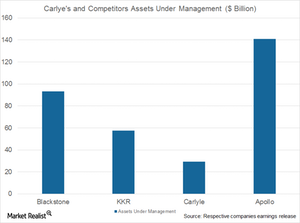

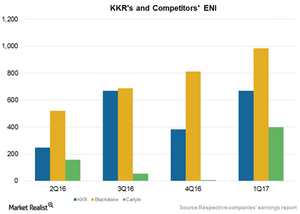

How KKR Is Performing in Relation to Alternative Managers

KKR & Co. (KKR) has reported an increase in its economic net income (or ENI) to $668.5 million in 1Q17 compared to $383.2 million in 4Q16.

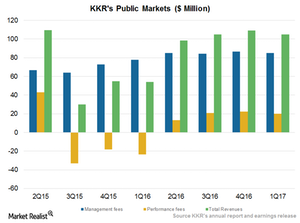

What Could Lead KKR’s Public Market Segment to Rise or Fall?

KKR has seen a decline in its base fees to $85.5 million in 1Q17 compared to $86.7 million in 4Q16.

KKR’s 2Q17 Performance on Deployments, Rise in Holdings

In 1Q17, KKR & Co. (KKR) deployed ~$5.4 billion in its Public Markets and Private Markets segments. KKR is expected to post EPS of $0.49 in 2Q17 and $2.15 in fiscal 2017, representing year-over-year growth of 113% and 216%, respectively.