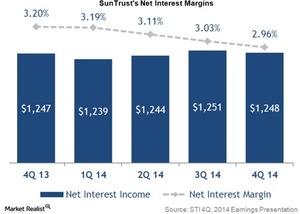

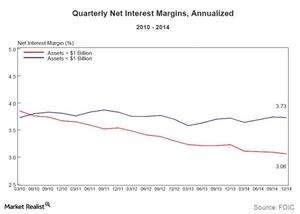

Why SunTrust Has Lower Net Interest Margins

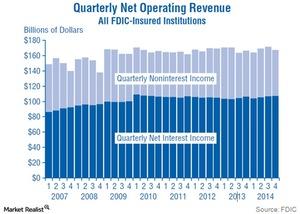

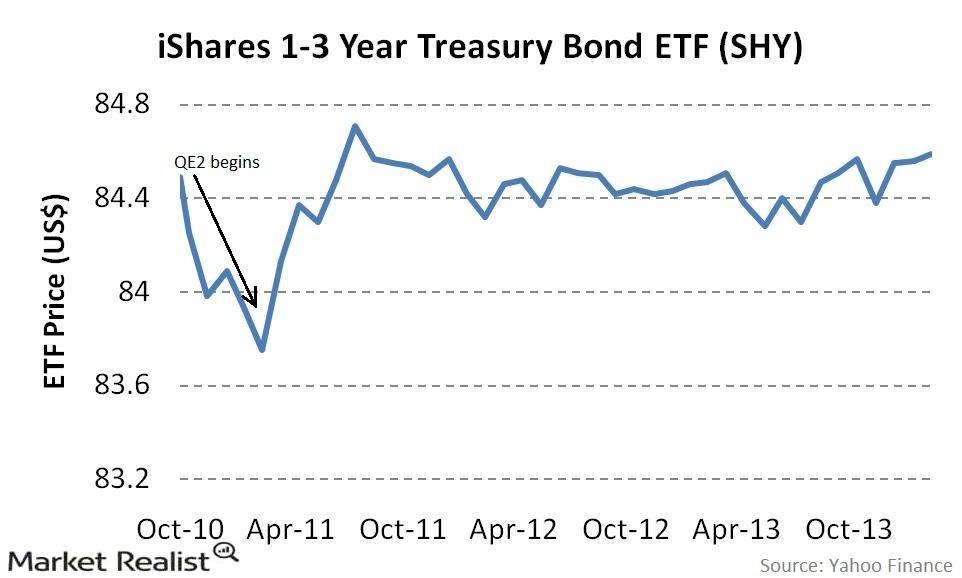

SunTrust Bank’s net interest income in 2014 remained stable compared to 2013 as strong loan growth offset the decline in net interest margin.

Market Realist has the latest news and updates on banking, U.S. banks, credit unions, and savings and loan associations.

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.