Lynn Noah

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Lynn Noah

US Stock Indices Plunge after Oil Prices Rebound

The three US equity indices that we review in this weekly series fell from December 8 to December 15, 2015, after a rebound in oil prices.

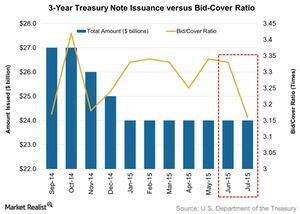

3-Year Treasury Notes’ Overall Demand Fell on July 7

The US Treasury holds monthly auctions of three-year Treasury notes. The latest auction was held on July 7.

10-Year Treasury Note Market Demand Barely Moved Last Week

On July 8, ten-year Treasury notes worth $21 billion were auctioned—the same as the previous week.

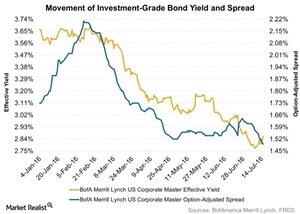

High-Grade Bond Yields Rose as Spreads Touched Their Lowest Level

Last week, high-grade bond yields rose after upbeat US inflation and retail sales data raised the possibility of a rate hike by the year’s end.

IMF Provides a Positive Assessment of China’s Economy

In a press conference on June 14 on its annual Article Four Staff Report, the IMF provided a positive assessment of China’s economy.

Analyzing China’s Leading Economic Index

China’s Leading Economic Index currently indicates that the country’s economy is facing a downturn. Its LEI remained unchanged at 98.71 points in July 2015.

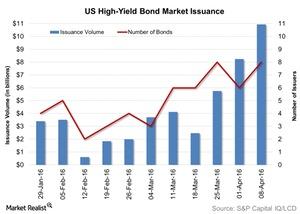

High Yield Bond Issuance Hit 2016 Record Last Week

High yield bond issuance surged last week and hit its highest level in 2016 yet due to continued growth in volume.

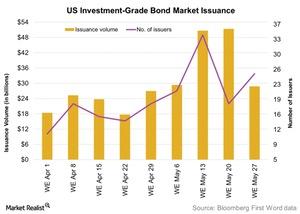

Investment-Grade Corporate Bonds’ Issuance Fell Last Week

Investment-grade corporate bonds worth $28.8 billion were issued in the primary market in the week to May 27, 2016.

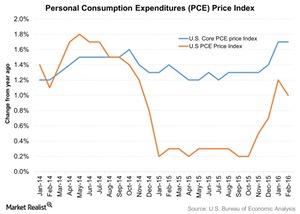

What Do the PCE Price Index and Break-Even Inflation Indicate?

The PCE price index is the Federal Reserve’s preferred measure of inflation because it covers the broadest set of goods and services.

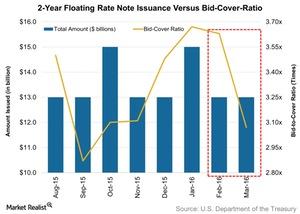

Why Overall Demand Tanked for 2-Year Floating-Rate Notes

Overall, $13 billion worth of floating-rate notes were auctioned, the same as in February’s auction.

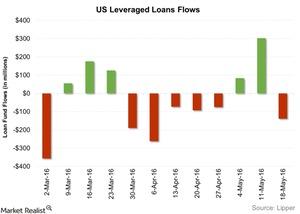

Why Leveraged Loan Funds Saw Outflows Last Week

According to S&P Capital IQ Leveraged Commentary & Data, three collateralized loan obligation deals worth $1.4 billion were priced last week.

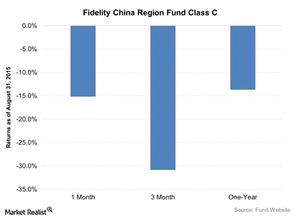

How Did the Fidelity China Region Fund Class C Perform in August?

The Fidelity China Region Fund Class C (FHKCX) aims to achieve long-term capital growth.

SSE Composite Index Falls despite China’s New IPO System

The SSE Composite Index fell by 1.8% from December 2 to December 9 and closed at 3,472.44 on December 9, 2015.

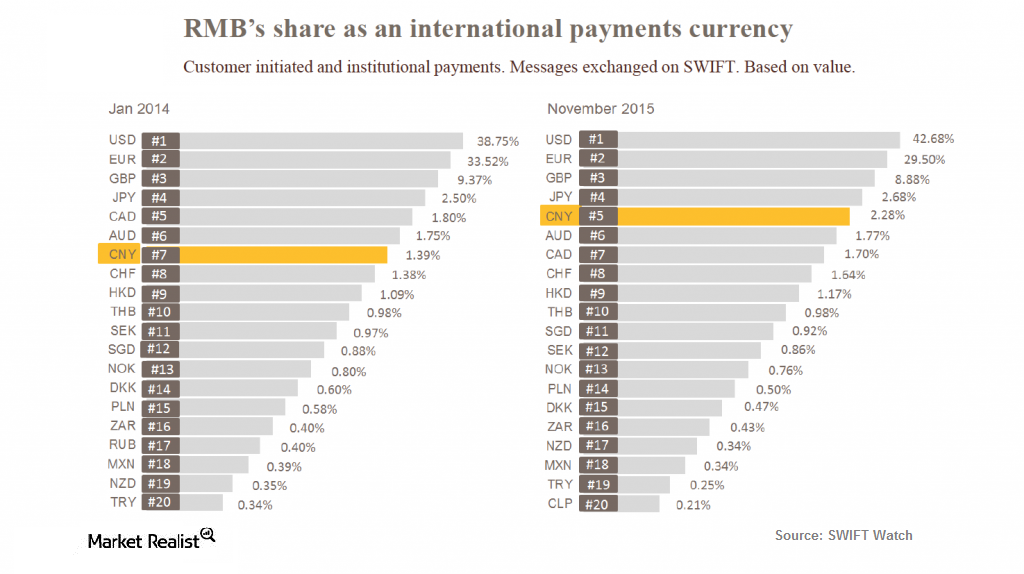

China’s Yuan Share Rose in Global Currency Payments

According to the latest SWIFT RMB Tracker, the yuan—also known as the “renminbi”—accounted for 2.3% of the global payments in November 2015.

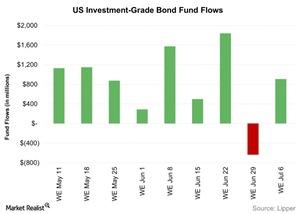

Investment-Grade Bond Funds Saw Inflows Last Week

Flows into investment-grade bond funds were positive last week. Investment-grade bond funds saw net inflows of $907.1 million during the week ending July 6.

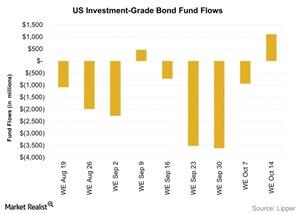

Investment-Grade Bond Funds Witness Inflows

Flows into investment-grade bond funds were positive for the week ending on October 14 after witnessing four consecutive weeks of outflows.

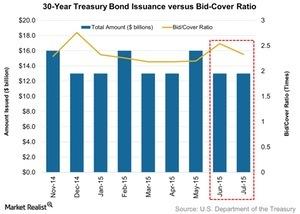

Brexit Vote: How Did US Treasury Auctions React?

The US Treasury auctioned 30-year TIPS (VIPSX)(LTPZ) worth $5 billion on June 22.

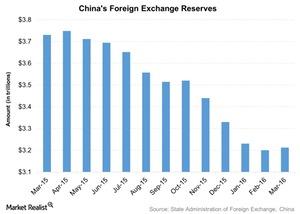

Did China End Its 4-Month Decline in Foreign Reserves in March?

China’s State Administration of Foreign Exchange, or SAFE, released foreign reserve data for March on April 7, 2016. China’s foreign reserves rose $10.3 billion to $3.2 trillion in March.

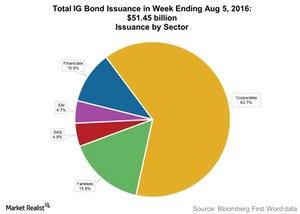

Microsoft Issued the Most High-Grade Bonds Last Week

Microsoft (MSFT) issued Aaa/AAA rated high-grade bonds worth $19.8 billion through seven parts on August 1, 2016.

What’s China’s Ranking in Index of Economic Freedom 2016?

China fell into the “mostly unfree” category, according to the Index of Economic Freedom for 2016. It was ranked 144th and scored 52.0 on the index.

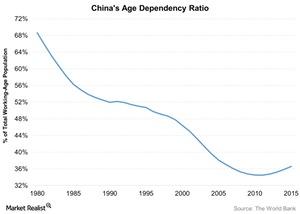

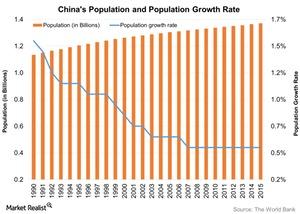

How China’s Population Control Created Social, Economic Problems

The one-child policy in China decreased population growth, but it produced social disadvantages such as gender imbalance and other social problems.

China’s Human Rights Violations and Population Control Policies

According to a recent Congressional report, 2015 was the worst year on record for human rights violations in China.

How Would an Interest Rate Hike Affect the Stock Market?

A hike in interest rates increases the cost of borrowing for companies. Most publicly traded companies carry at least some debt to fund their operations, and higher borrowing costs can cause their profit margins to contract.

SSE Composite Index Rose ahead of Long Weekend

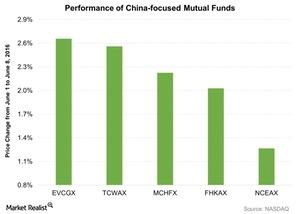

The SSE Composite Index rose slightly by 0.4% to 2,927.16 from June 1 to June 8, 2016, as the market prepared for the long weekend.

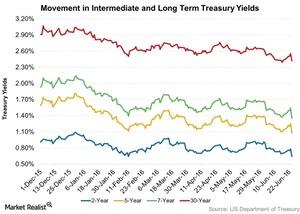

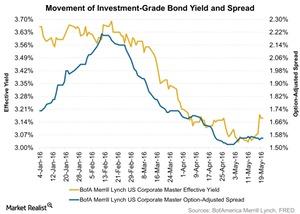

High-Grade Bond Yields Rise on Better Odds of a Rate Hike

Last week, investment-grade bond yields jumped 12 basis points and ended at 3.16%, the highest level since April 5, 2016.

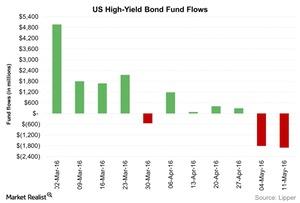

How Did High Yield Bond Fund Outflows Do Last Week?

Investor flows into high yield bond funds were negative last week for the second consecutive week. Net outflows from high yield bond funds totaled $1.9 billion.

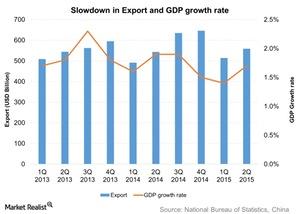

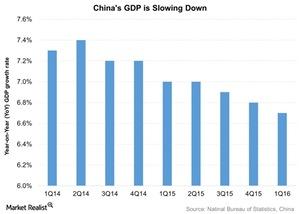

When China Sneezes, the World Catches a Cold!

China is the world’s second-largest economy. Its economy started going downhill due to sluggish global demand. This impacted its trading partners.

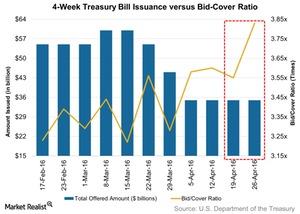

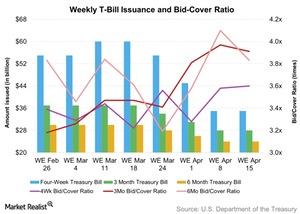

Fundamental Market Demand Rose for 4-Week Treasury Bills Auction

The US Department of the Treasury conducted the weekly auction of four-week Treasury bills (or T-bills) on April 26.

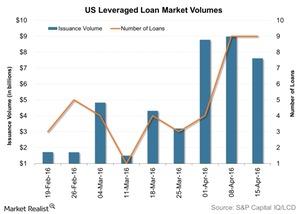

Why Did Leveraged Loans’ Issuance Fall?

The US leveraged loans market saw an allocation of $7.6 billion worth of dollar-denominated senior loans in the week to April 15.

Indirect Bidders Participated in the 13-Week T-Bills Auction

The U.S. Department of the Treasury auctioned 13-week T-bills worth $28 billion on April 11. The offer amount of these bills was the same as the previous auction.

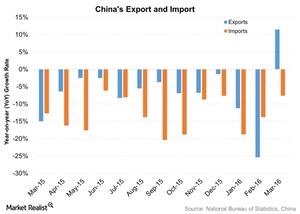

China’s Exports Jump: Can the Growth Be Maintained?

According to the General Administration of Customs, China’s exports, in US dollar terms, jumped 11.5% YoY (year-over-year) in March.

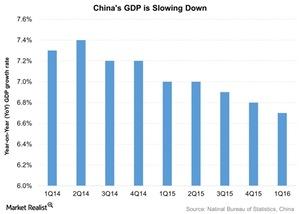

Why Did China’s GDP Grow in 1Q16?

According to the NBS (National Bureau of Statistics of China), China’s GDP grew 6.7% in 1Q16.

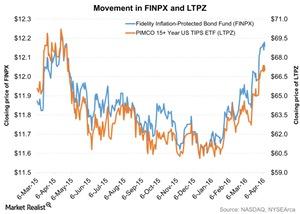

Why TIPS Are an Attractive Investment Option Right Now

Asset managers have warned that costs may rise. They recommend inflation-linked securities such as Treasury inflation-protected securities (or TIPS).

What Are TIPS and How Do They Benefit Investors?

Treasury inflation-protected securities (or TIPS) protect the value of debt securities from eroding due to a rise in inflation.Macroeconomic Analysis NCEAX: Robust 4Q15 but Dismal YTD Performance

The Neuberger Berman Greater China Equity Fund – Class A (NCEAX) adopts the value-bias strategy, and its objective is to seek long-term capital return in up and down markets.

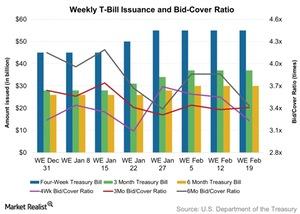

How Was Market Demand for the 13-Week Treasury Bill Auction?

The U.S. Department of the Treasury conducted the weekly auction of 13-week Treasury bills on February 16, 2016. The total issuance was worth $37 billion.

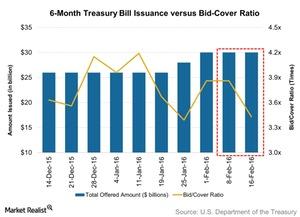

Bid-to-Cover Ratio Fell for 26-Week Treasury Bill Auction

The U.S. Department of the Treasury held the weekly 26-week Treasury bill auction on February 16, 2016. T-bills totaling $30 billion were on offer.

Macroeconomic Factors Affecting Investment-Grade Bond Yields

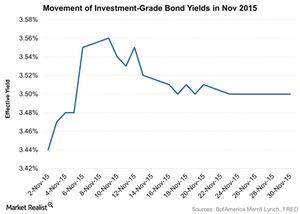

Investment-grade bond yields rose 8 basis points month-over-month and ended at 3.5% on November 30 due to high expectations of an interest rate hike in the December policy meeting.

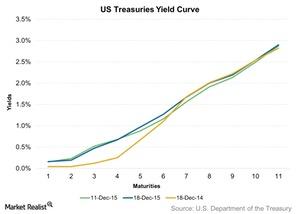

Treasury Yield Curve Flattened after US Interest Rate Hike

The US Treasury yield curve was flat for the week ended December 18, 2015, as short-term yields fell. Medium- to long-term yields rose after US interest rates rose by 25 basis points.

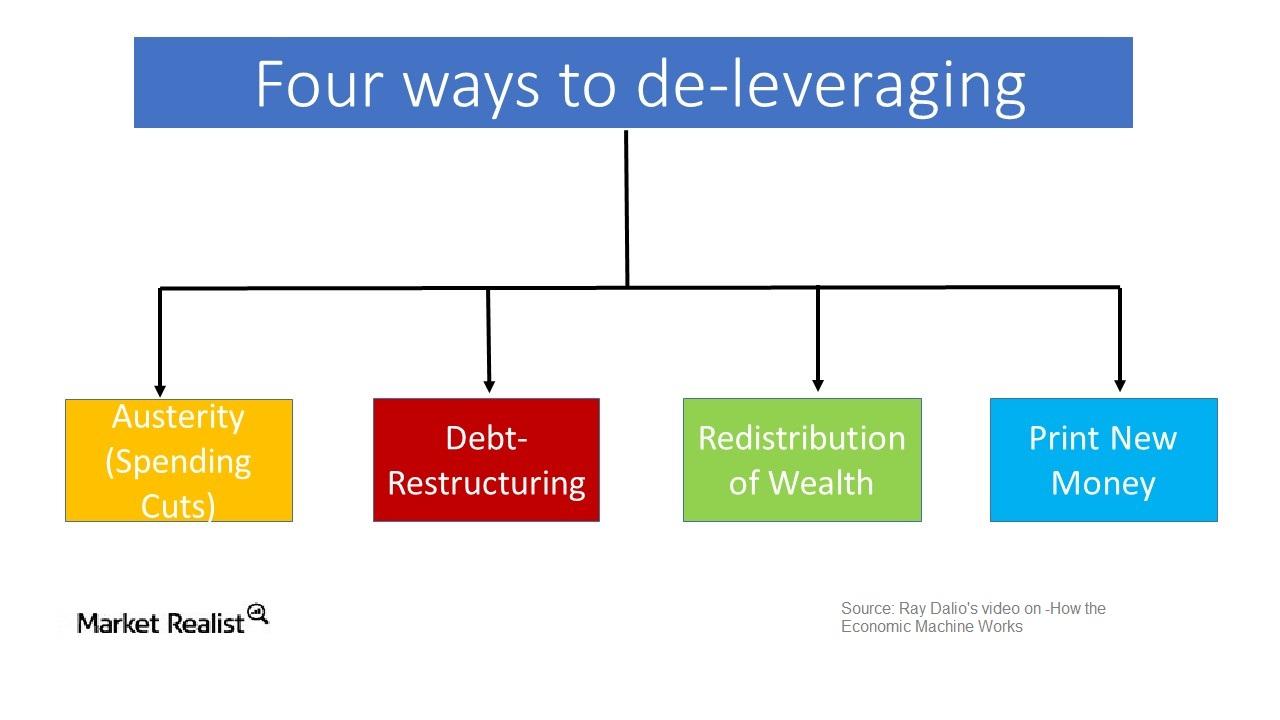

Analyzing China’s Leverage and Deleveraging Process

“Leverage” means borrowing funds for investment purposes. It creates short-term and long-term debt cycles. Short-term debt cycles typically last for 5–8 years.

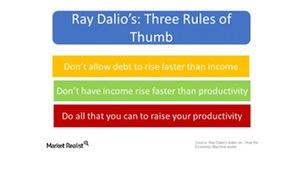

Ray Dalio’s 3 Rules of Thumb and the Road Ahead for China

Chinese policymakers should try to implement Ray Dalio’s three rules of thumb as closely as possible to get the country’s economic growth back on track.

Turbulence in China’s Stock Market

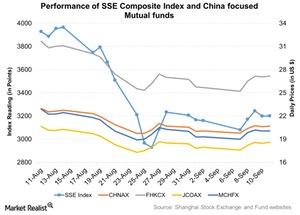

Due to recent stock market turbulence in China’s stock market, the SSE (Shanghai Stock Exchange) Composite Index was down 22.7% month-over-month and ended at 3,200.23 points on September 11.

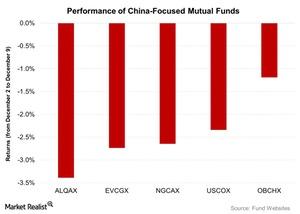

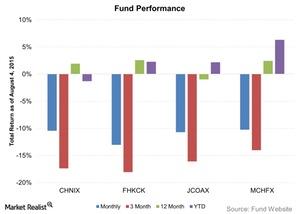

How Have China-Focused Mutual Funds Performed?

In the one-month period ended August 4, 2015, each of the four funds we’re covering in this series posted negative returns due to the stock market crash that spread from the end of June until July.