Alexis Tate

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Alexis Tate

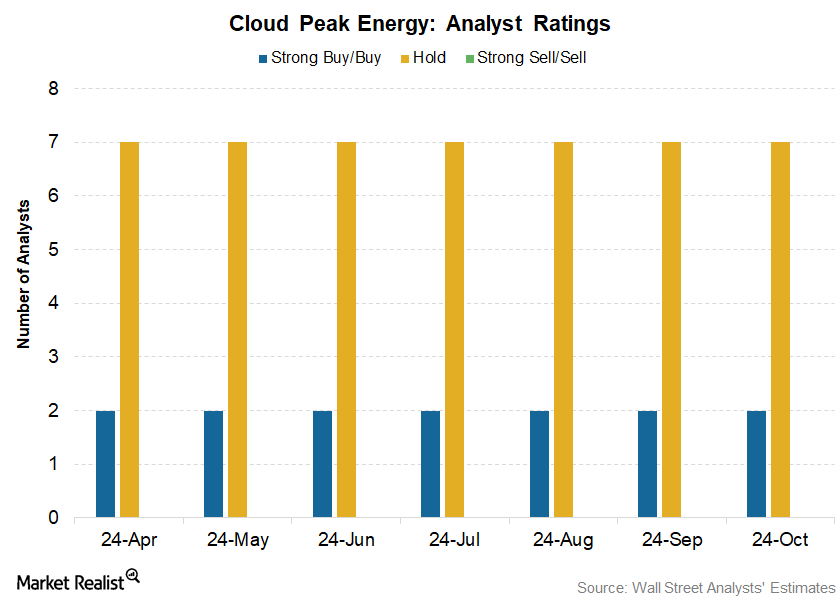

Why Most Analysts Recommend a ‘Hold’ for Cloud Peak Energy

Of the nine analysts covering Cloud Peak Energy (CLD), seven analysts rated its stock as a “hold,” and two gave CLD a “buy” or “strong buy” rating.

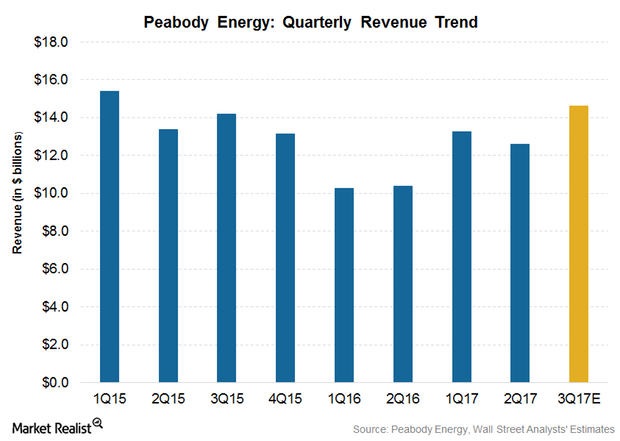

Analysts Expect Peabody Energy’s Revenues to Rise in 3Q17

In 3Q15, Peabody Energy (BTU) reported $1.42 billion in revenues. Analysts anticipate that it will post $1.46 billion in 3Q17 compared to $1.26 billion in 2Q17.

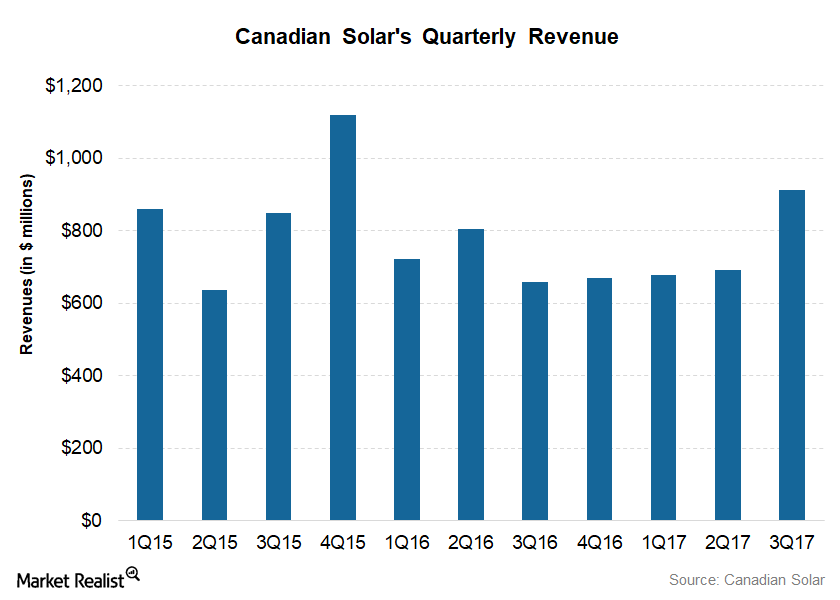

Canadian Solar Beat Analysts’ 3Q17 Revenue Estimates

Canadian Solar’s revenues from the sale of electricity in 3Q17 totaled $9.6 million, which was marginally lower than $9.8 million in 2Q17.

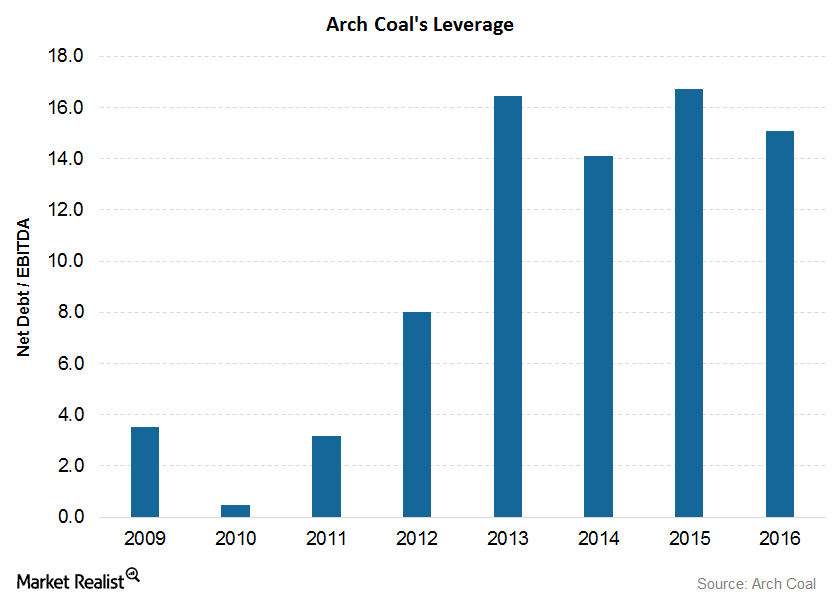

Understanding Arch Coal’s Financial Position

Arch Coal’s leverage On June 30, 2017, the book value of Arch Coal’s (ARCH) long-term debt was about $315.6 million, of which ~$297 million is due for payment in 2024. Arch Coal’s leverage, which is its net debt divided by EBITDA (earnings before interest, tax, depreciation, and amortization), has increased since the acquisition of International […]

More about KBR’s Major Clients

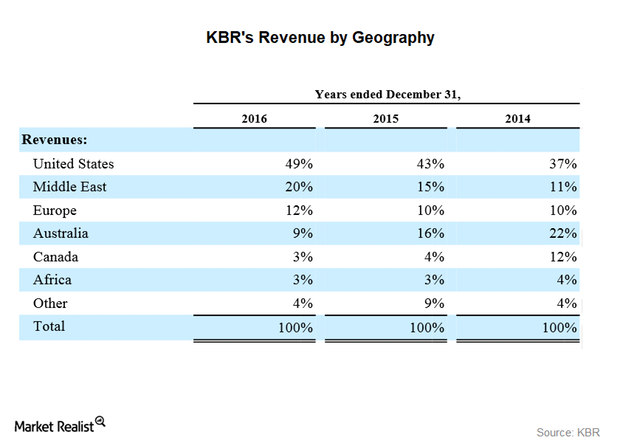

Clients and their sectors KBR (KBR) has a diverse customer base. According to KBR, its customers are “domestic and foreign governments, international and national oil and gas companies, independent refiners, petrochemical producers, fertilizer producers and manufacturers.” Revenue from overseas operations represented 63%, 57%, and 51% of KBR’s total revenue in 2014, 2015, and 2016, respectively. In this part, we’ll look at […]

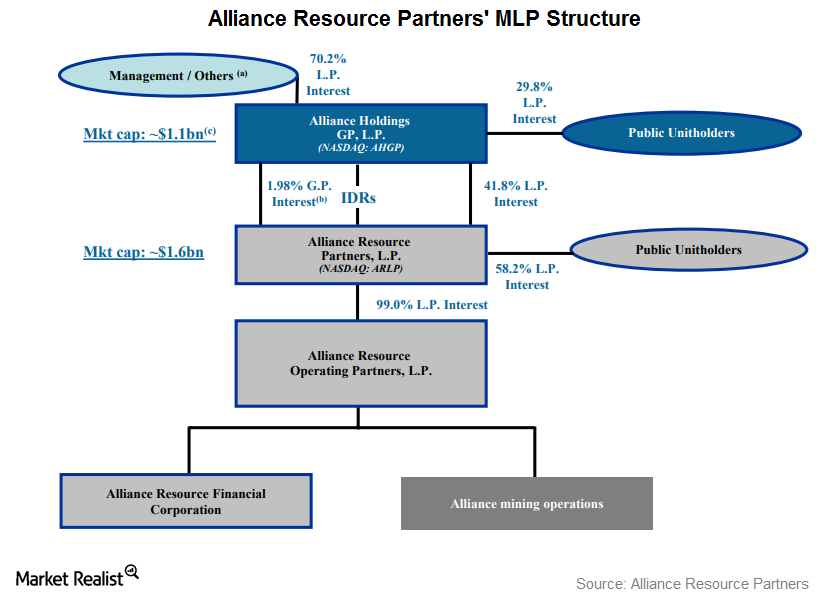

Understanding the Master Limited Partnership Structure of Alliance Resource Partners

As of December 31, 2016, Alliance Resource Partners was being managed by its MGP, which is 100% owned, directly and indirectly, by AGHP.

What Factors Could Drive Arch Coal Stock in 2H17?

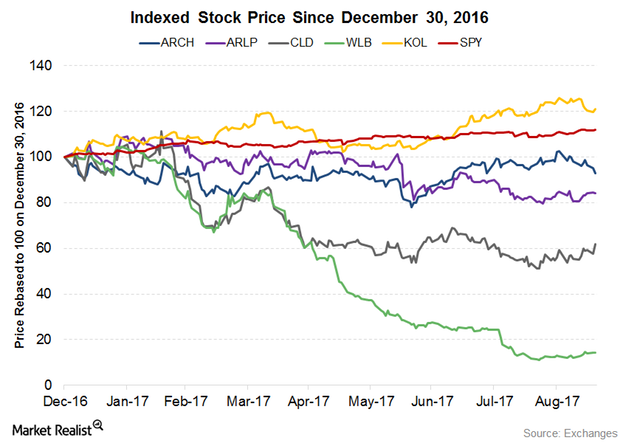

1H17 in review Majority of the coal (KOL) stocks began 2017 on a weak note. The stocks have not been able to recoup from the slump until now. They have been outperformed by the broader market and the VanEck Vectors Coal ETF so far in 2017. On September 19, 2017, Arch Coal (ARCH) has fallen […]

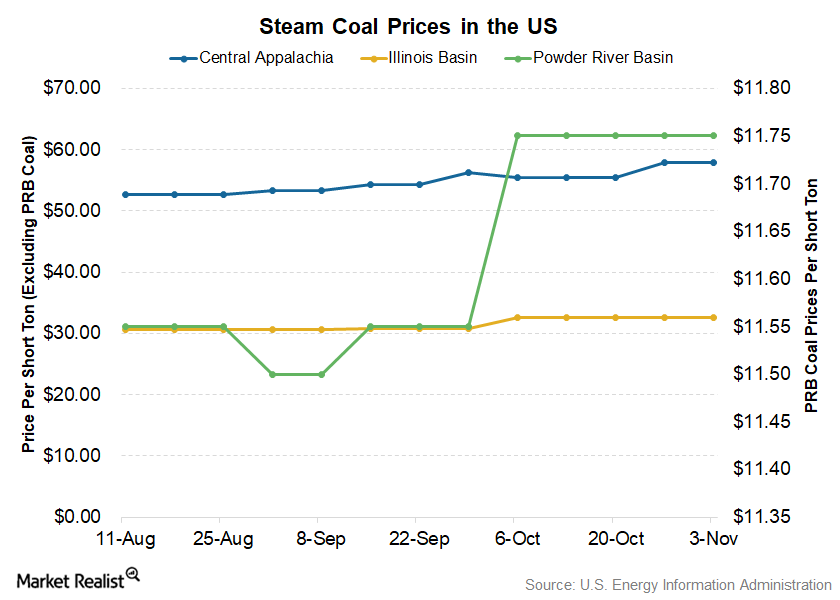

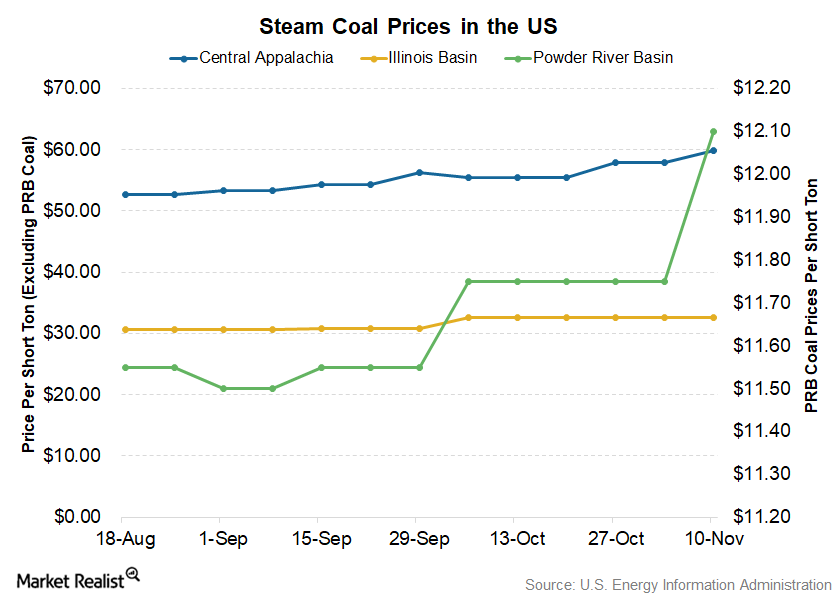

Spot Coal Prices Remained Flat in the Week Ending November 3

Powder River Basin coal settled at $11.75 per short ton, while Illinois Basin spot coal prices closed at $32.60 per short ton.

Westmoreland Coal’s Canadian Operations: An Overview

Westmoreland’s Canadian operations Westmoreland Coal (WLB) acquired seven surface mines in Alberta and Saskatchewan, a stake in an activated carbon plant, and a char plant in Canada from Sherritt International in 2014. As of January 1, 2016, WLB’s Canadian operations are grouped as one entity, Prairie Mines & Royalty ULC. Its Canadian operations hold total […]

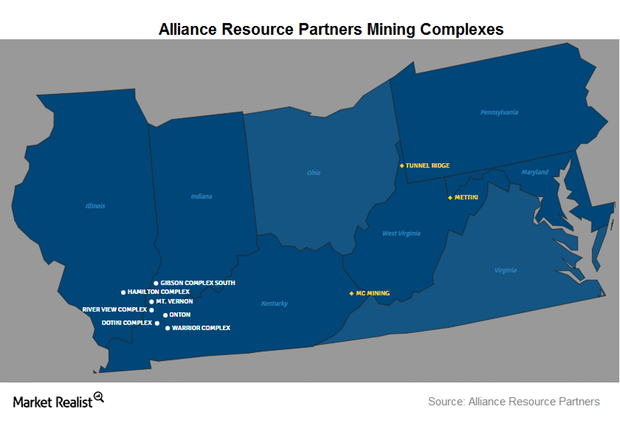

Inside Alliance Resource Partners’ Mining Operations

Alliance Resource Partners (ARLP) operates eight underground mining complexes in two regions: Illinois and Appalachia.

Powder River Basin Coal Spot Prices Recovered Sharply

During the week ended November 10, 2017, PRB coal closed at $12.10 per short ton, which was ~3% higher than $11.75 per short ton that coal maintained for the past five weeks.

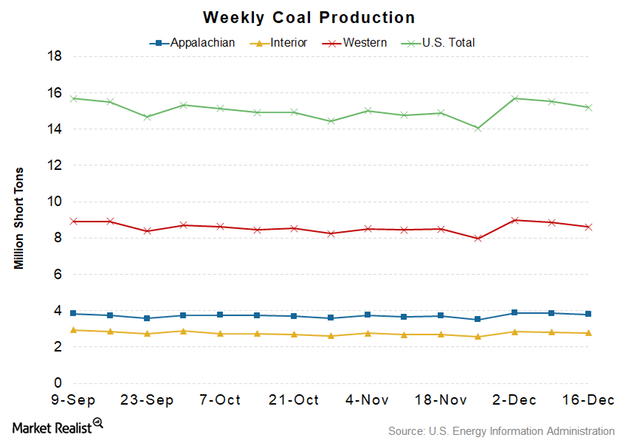

Coal Production Continues to Fall

On December 21, the EIA released the estimate of the coal volumes produced in the US for the week ending December 16.

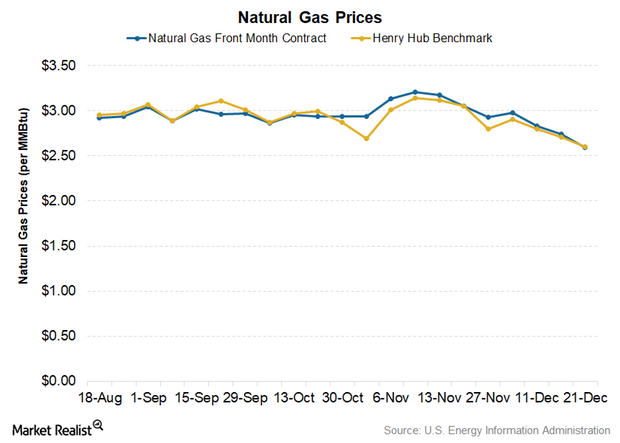

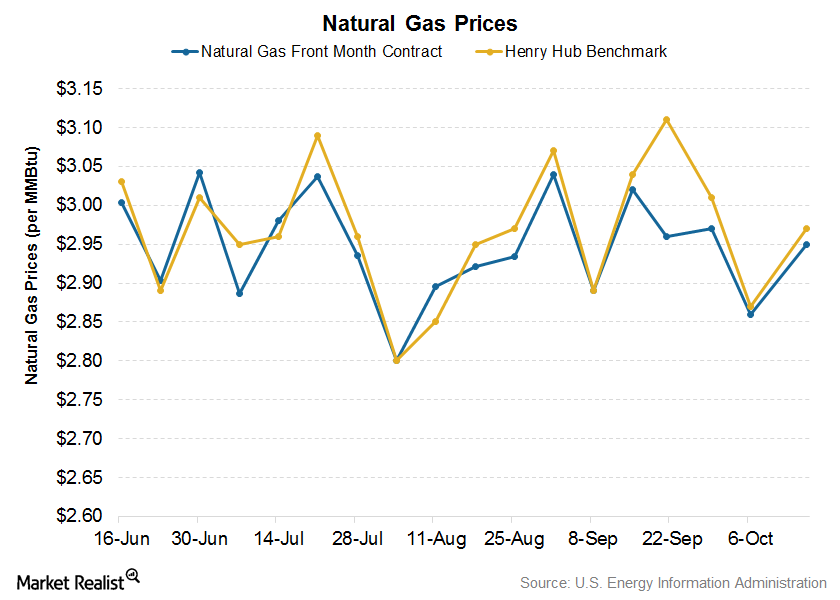

Natural Gas Prices Continue to Fall

In the EIA’s STEO report, it predicted that the Henry Hub natural gas benchmark price would average $3.12 per MMBtu in 2018.

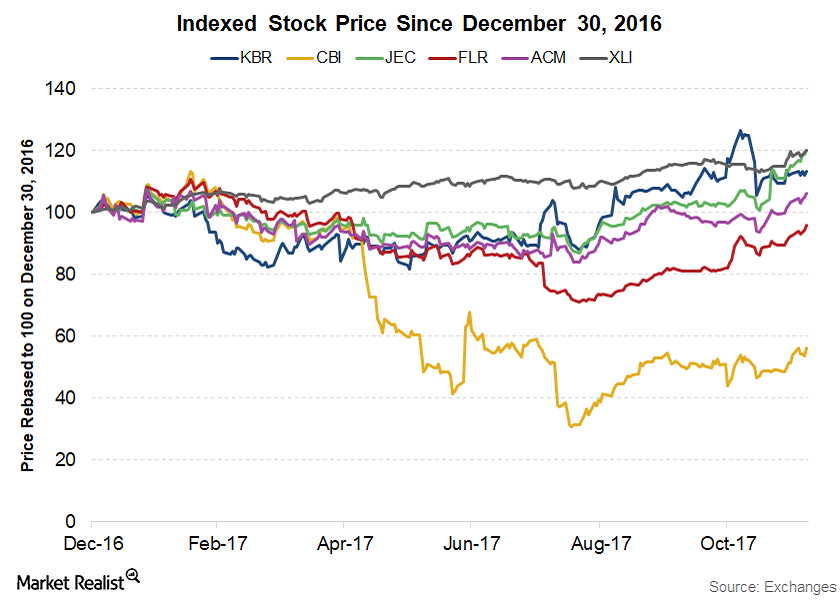

KBR Stock: Performance and Outlook

KBR has an assorted mix of business portfolios, which helps it combat cyclicality associated with any single market.

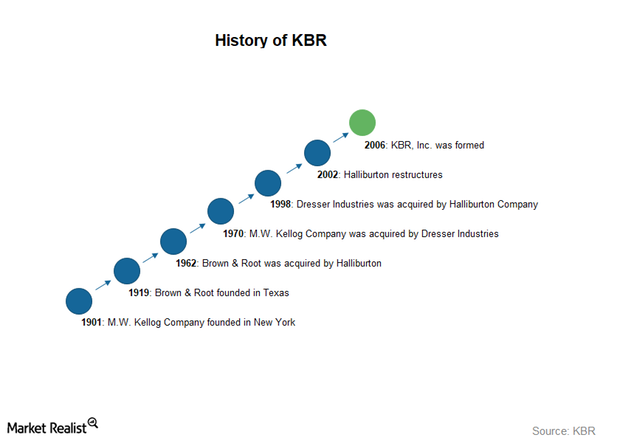

An Introduction to KBR

KBR (KBR), headquartered in Houston, Texas, is a comprehensive professional service and technology provider.

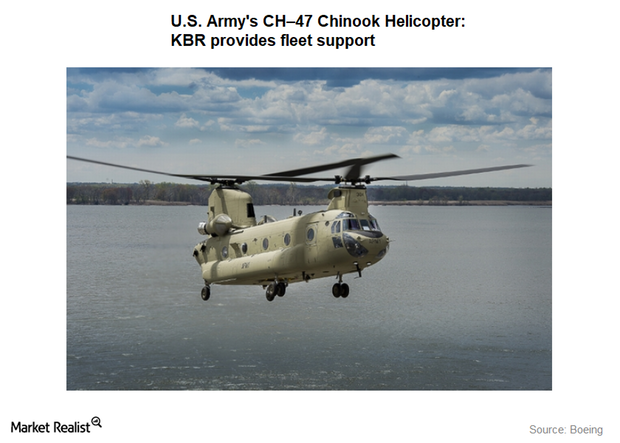

Understanding KBR’s Business Segments

Business segments KBR’s (KBR) business is classified into three core segments (government services, technology and consulting, and engineering and construction) and two non-core segments (non-strategic business and other business). Government services The government service segment’s primary focus is providing support solutions to US, UK, and Australian government agencies. According to KBR’s Form 10-K, the segment offers “full […]

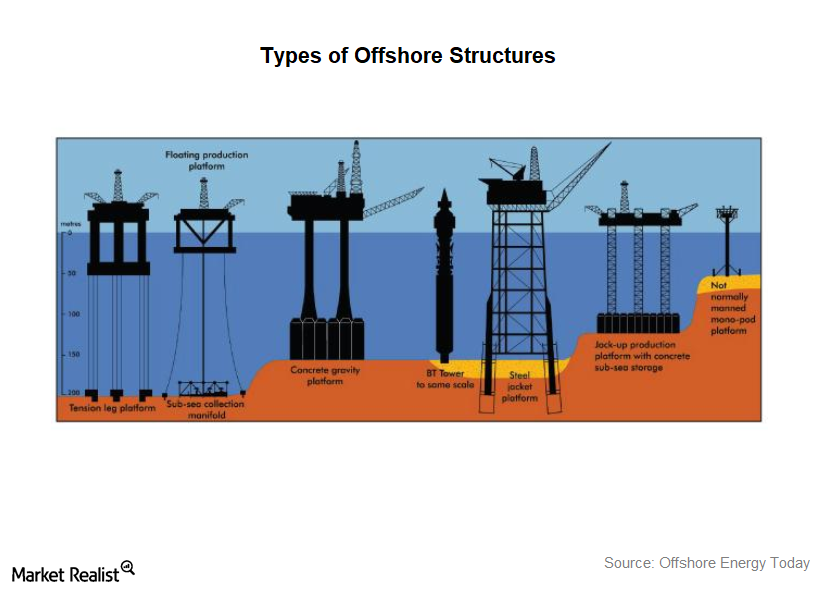

A Look at KBR’s Subsidiaries

Primary subsidiaries Previously, we discussed various acquisitions completed by KBR (KBR). Let’s now take a look at some of KBR’s subsidiaries and how they fit into the big picture for the company. Energy and construction Granherne, a KBR technology and engineering subsidiary, operates in the oil and gas industry. Granherne provides front-end engineering and design services […]

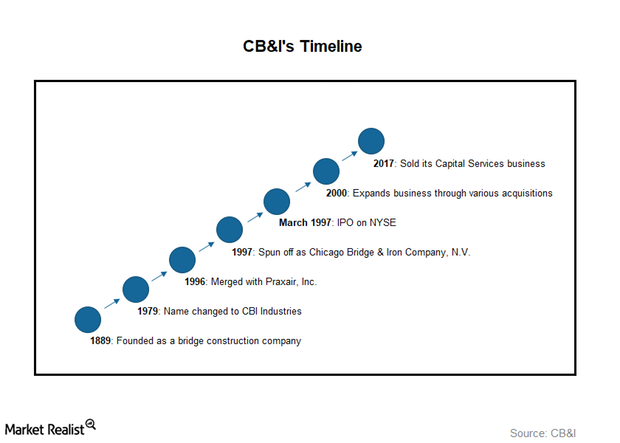

Chicago Bridge & Iron Company: An Introduction

In this series, we’ll analyze Chicago Bridge & Iron’s (CBI) business model. We’ll explore how it has expanded its business and evaluate its key operational metrics and financial position.

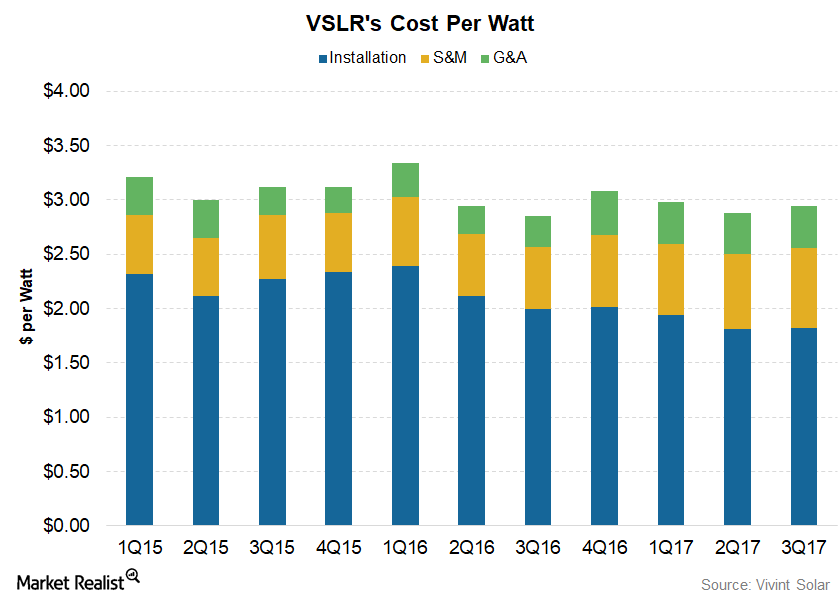

Vivint Solar Reported Rise in Estimated Retained Value in 3Q17

Vivint Solar (VSLR) reported a cost per watt of $2.94 for 3Q17, higher than the $2.88 it reported in 2Q17 and $3.85 in 3Q16.

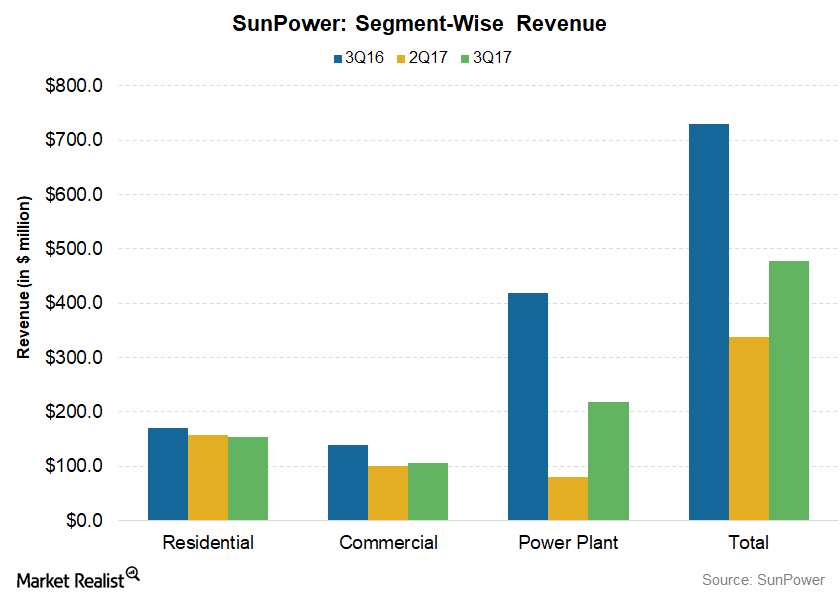

Why SunPower Reported Lower 3Q17 Revenues

SunPower (SPWR) reports its revenue under the power plant, residential, and commercial segments. The latter two segments are together called the distributed generation segments.

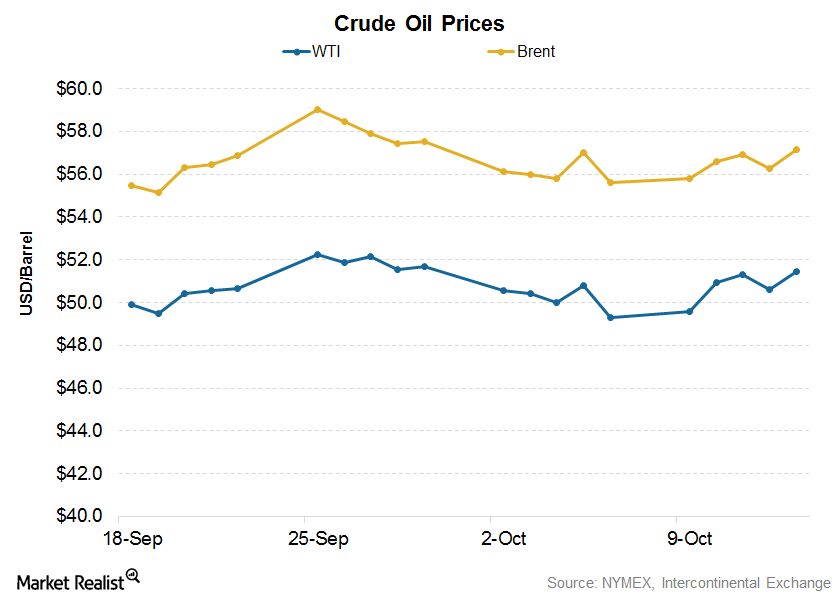

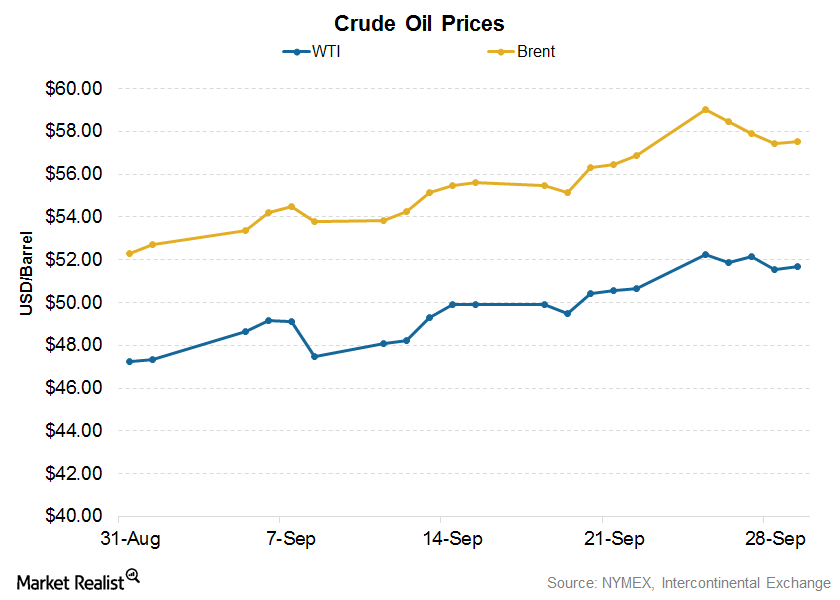

How Higher Crude Oil Prices Impact Coal Producers

On October 13, 2017, Brent crude oil prices settled at $57.17 per barrel, 3% higher than $55.60 reported during the previous week.

How Weather Affects Natural Gas Prices

On October 16, the November US natural gas futures contract price was reported as $2.95 per MMBtu.

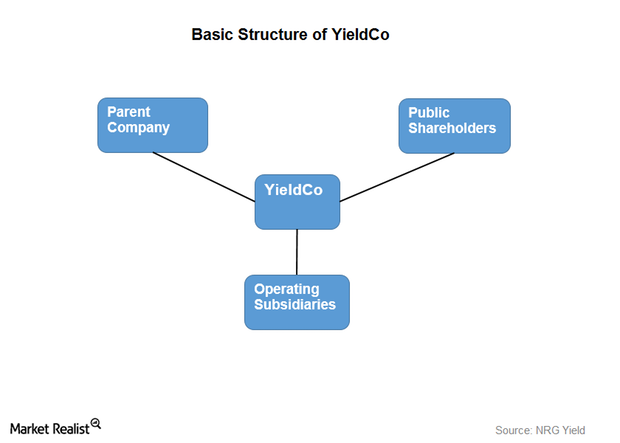

What Is a Yieldco?

A yieldco is an investment vehicle formed by a parent company to own operating assets. They’re expected to generate stable cash flows.

How Crude Oil Indirectly Impacts Coal Prices

On September 29, 2017, Brent crude oil prices closed at $57.54 per barrel compared to $56.86 the previous week.

First Solar: A Key Player in the Global Solar Power Industry

First Solar (FSLR) produces solar energy equipment. In this series, we’ll look at its performance and the outlook for the industry.

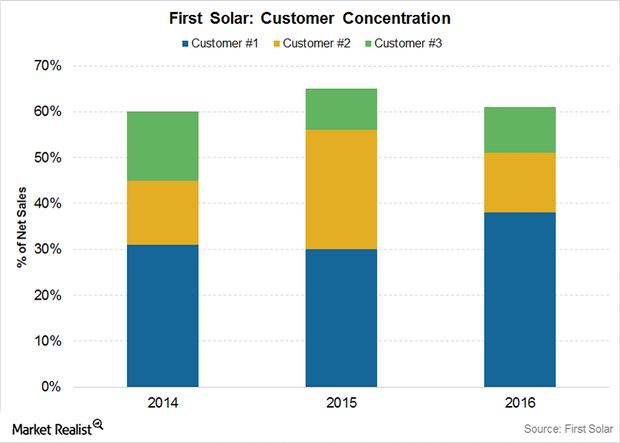

Southern and Nextera Energy: First Solar’s Key Customers

High customer concentration In 2016, First Solar (FSLR) sold solar modules to customers in the United States, India, and the United Arab Emirates. Approximately 23% of its total revenue was from third-party module sales. The majority of First Solar’s customer base is in the United States, which makes up to more than 80% of total […]

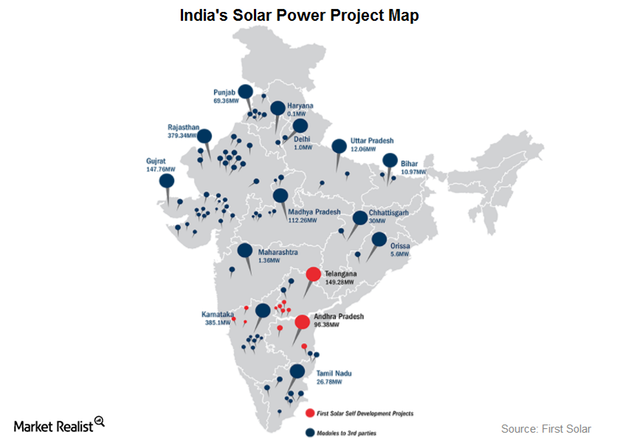

How India Became First Solar’s Second-Biggest Market

India’s rising electricity demand According to the EIA’s (U.S. Energy Information Administration) 2017 International Energy Outlook, India’s electricity generation is expected to increase by 3.2% per year through 2040, to meet increasing electricity demand in rural areas. Solar outlook Even though coal is the primary fuel used for electricity generation in India, the focus on renewable […]

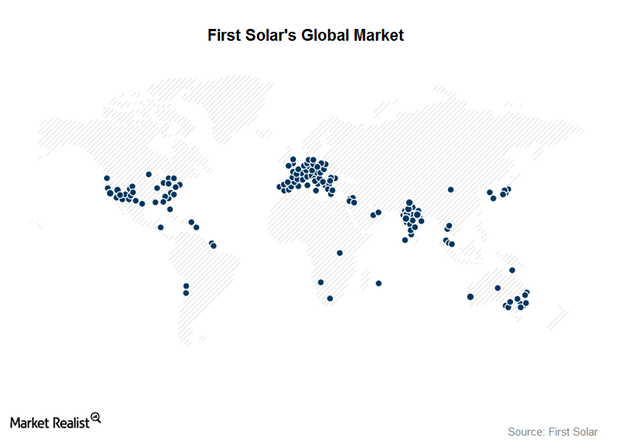

First Solar’s Global Market Strategy

The Americas The US PV (photovoltaic) market made up ~83% ($2.9 billion) of First Solar’s (FSLR) revenue. The United States has typically been First Solar’s largest market, and where many of its prominent projects and customers are located. First Solar has completed the construction of Del Sur, a 26 MW (megawatt) solar project in Honduras. It commenced […]

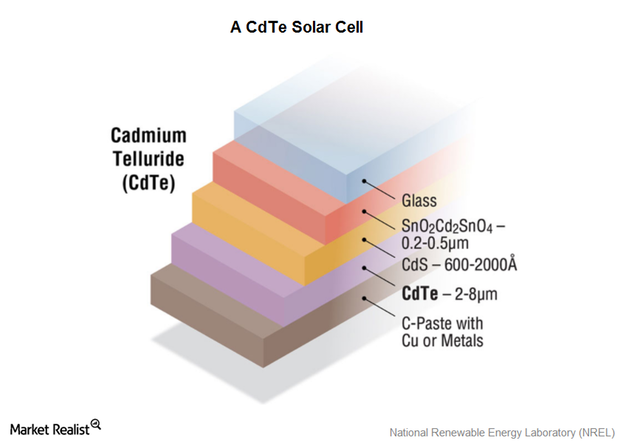

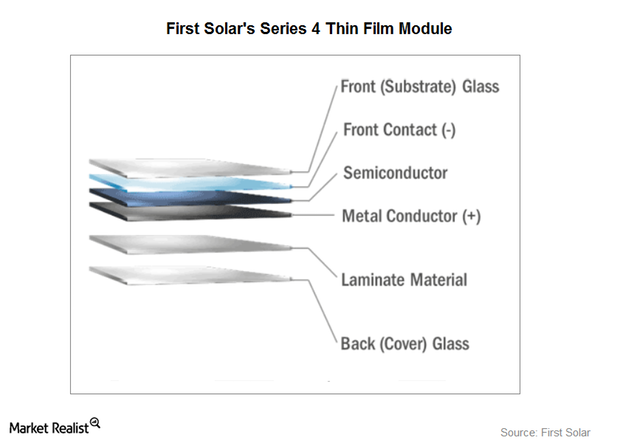

Behind First Solar’s Operations

Operating segments Previously, we looked at First Solar’s (FSLR) history. The photovoltaic module manufacturer operates two business segments: Components and Systems. The Components segment First Solar is a manufacturer of solar (TAN) photovoltaic (or PV) modules. First Solar also designs and sells these modules. They manufacture thin-film PVs, in which the semiconductor material used is […]

The Key Risks Involved in Arch Coal’s Business

Commodity price risk Arch Coal (ARCH) has long-term coal supply agreements for their non-trading, thermal coal sales, hence managing commodity risk for thermal coal and also to a limited extent, through the use of derivative instruments. However, sales commitments in the metallurgical coal market are typically not long-term in nature and are subject to fluctuations […]Company & Industry Overviews An Overview of Westmoreland Coal

In this series, we’ll analyze Westmoreland Coal’s (WLB) business model. We’ll explore how the company has expanded its business, and evaluate its key operational metrics and financial position.