United Continental Holdings Inc

Latest United Continental Holdings Inc News and Updates

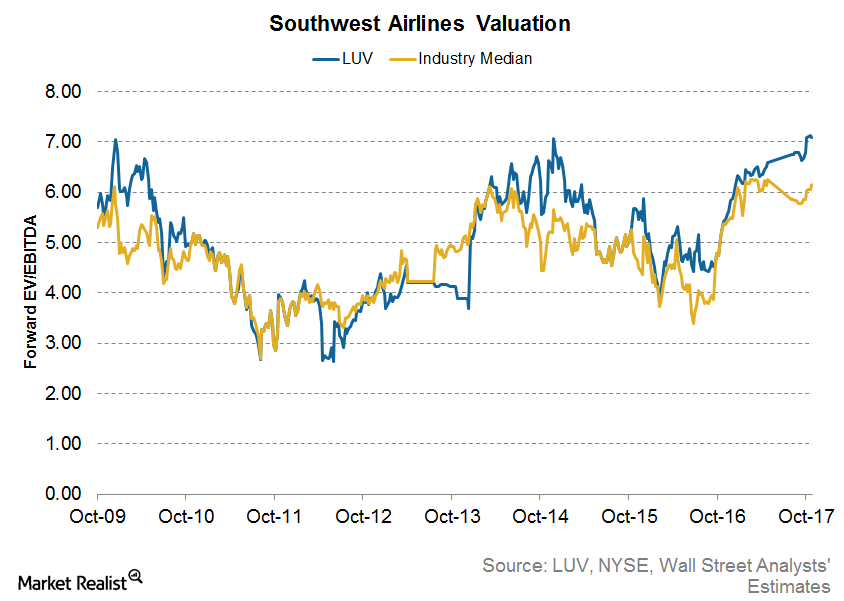

What Does Southwest Airlines’ Current Valuation Indicate?

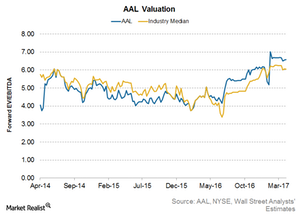

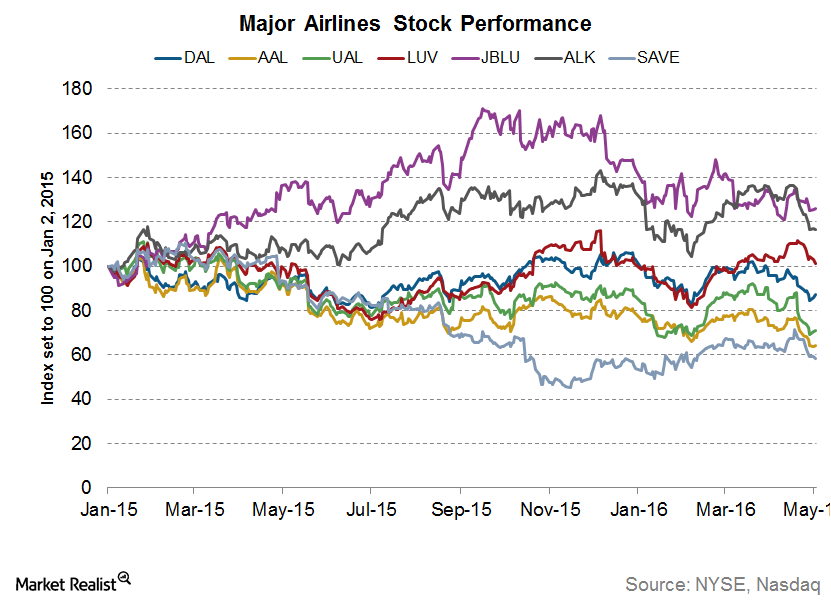

Current valuation Southwest Airlines (LUV) has a forward EV-to-EBITDA[1. enterprise value to earnings before interest, tax, depreciation, and amortization] multiple of 7.1x. This is the highest multiple among the major airline carriers and is higher than its average valuation of 6.3x since September 2008. Peer comparisons American Airlines (AAL) is trading at a similar valuation […]

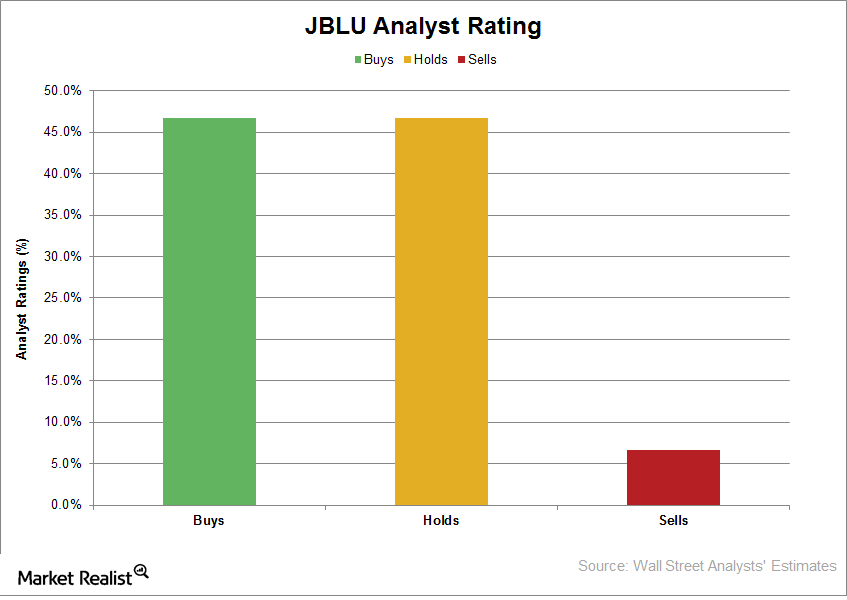

What Wall Street Analysts Recommend for JetBlue Airways

As of September 19, 2017, one analyst out of the 15 analysts tracking JetBlue Airways (JBLU) had a “strong buy” recommendation on the stock.

Could American Airlines’ Unit Revenues Decline in 2H17?

TK

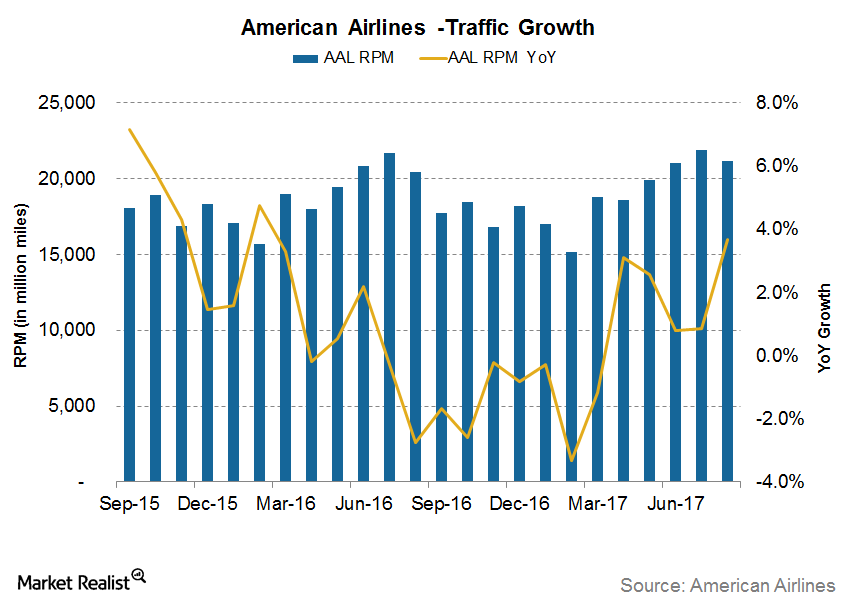

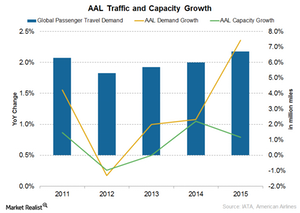

American Airlines’ Traffic Growth Exceeds Its Capacity Growth

For August 2017, AAL’s international traffic increased 6.9% year-over-year. Year-to-date, its international traffic has increased 5.5% YoY.

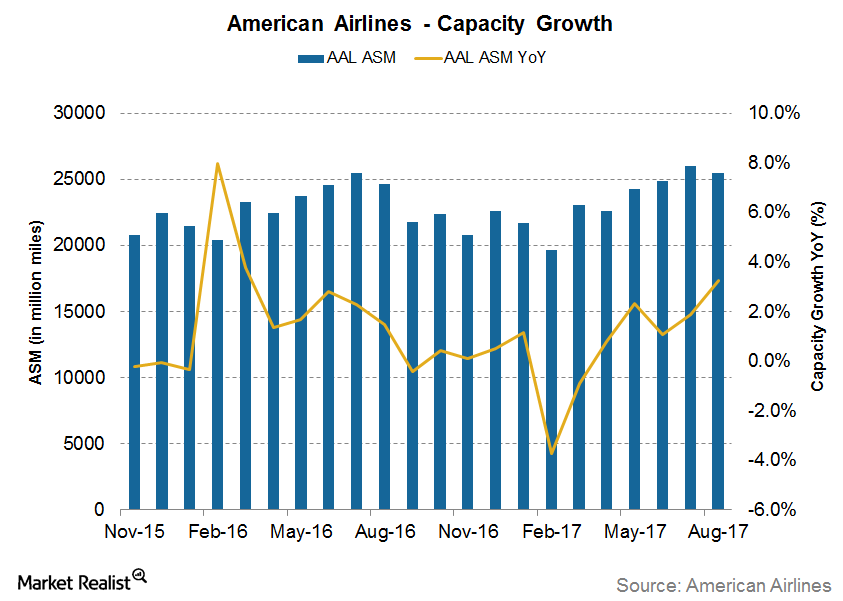

American Airlines’ Capacity Outpaced Its Legacy Peers in August

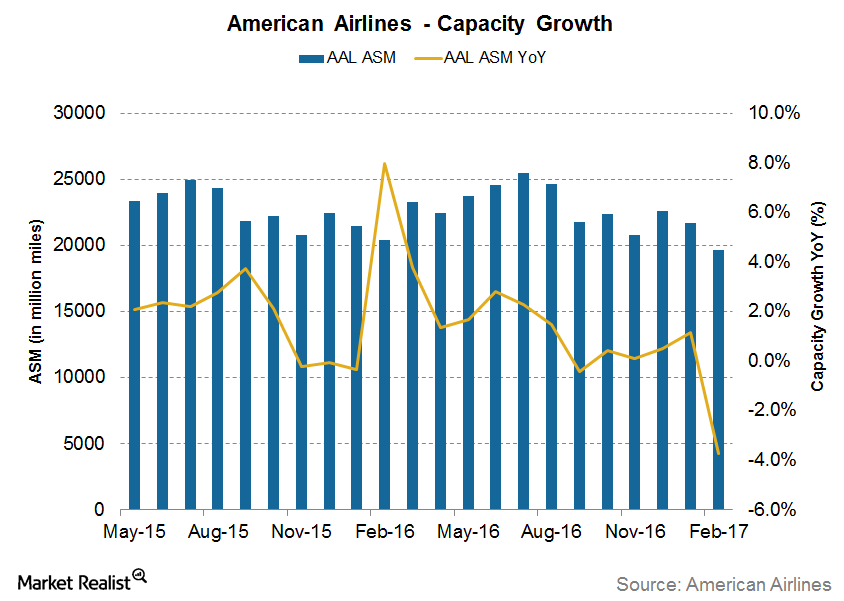

American Airlines’ (AAL) capacity grew 3.2% year-over-year in August, significantly higher than its 0.4% year-over-year growth reported in the previous seven months.

Can United Continental Improve Its Margins in 2017?

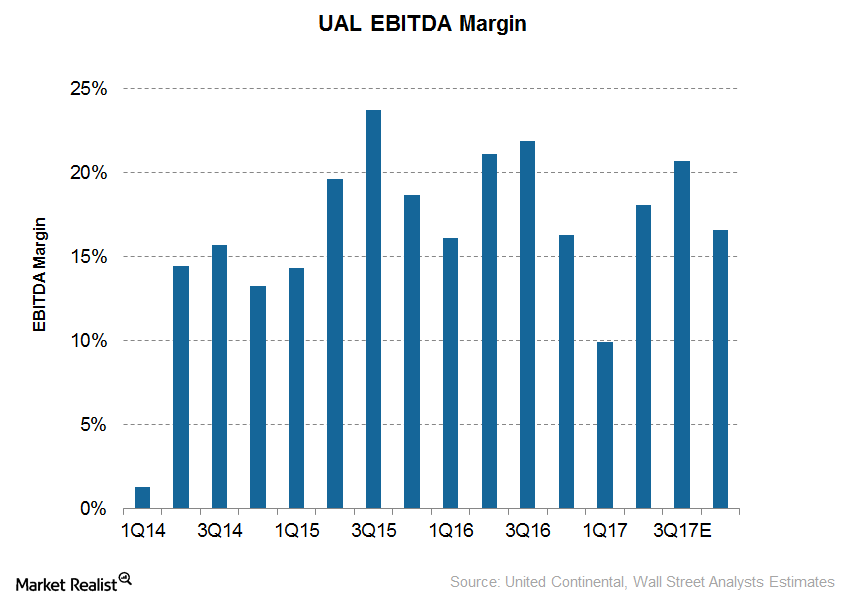

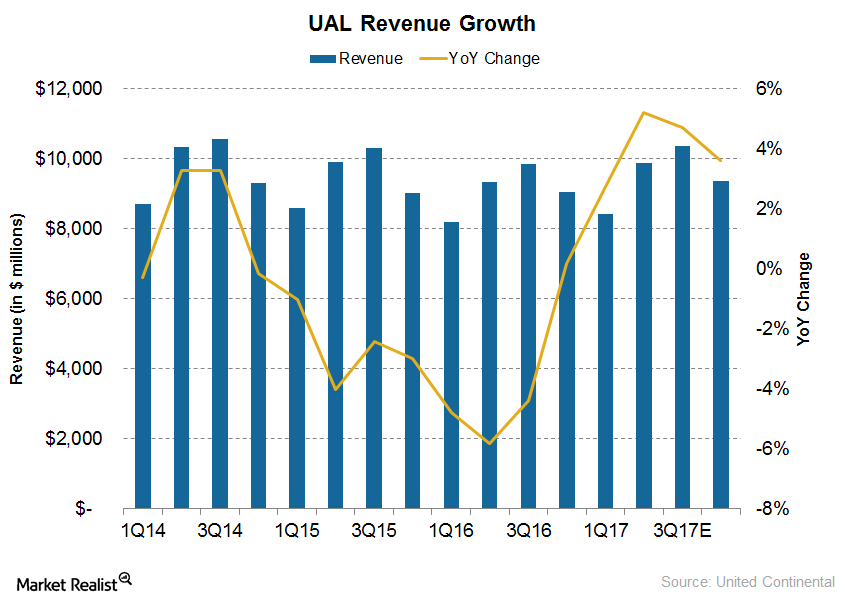

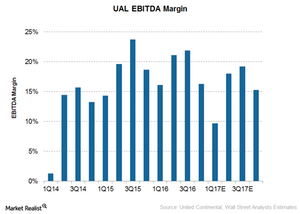

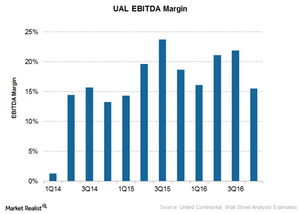

United Continental’s (UAL) EBITDA is expected to fall 10% to $1.8 billion.

Will United Continental Meet Increased Capacity Growth Guidance?

At the start of the year, United announced its plan to grow its capacity by 0%–1%, in line with GDP growth expectations.

Why Barclays Thinks UAL Earnings Could Improve

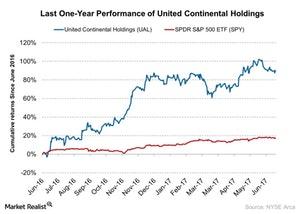

UAL is currently trading at $76. Its 52-week high is $83.04, and its 52-week low is $37.64.

Why American Airlines Improved Its Unit Revenue Guidance for 2Q17

AAL’s utilization rose 0.3% YoY (year-over-year) in February, then by 1.8% YoY in April and 0.2% YoY in May.

Will American Follow United Continental in High Capacity Growth?

For May 2017, American Airlines (AAL) reported a 2.3% YoY (year-over-year) growth in capacity—its highest growth so far in 2017.

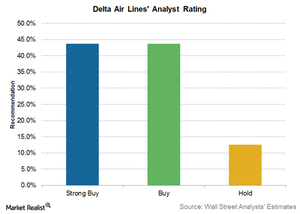

Analyst Ratings for Delta Air Lines after Traffic Release

Only one analyst has upgraded Delta Air Lines (DAL) since it released its traffic data on Friday, June 2, 2017.

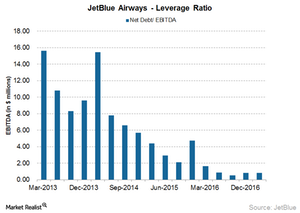

What Investors Should Know about JetBlue’s Debt

The airline industry is very capital-intensive, so airlines generally have huge debt numbers on their balance sheets.

American Airlines’ Valuation: What’s Priced In?

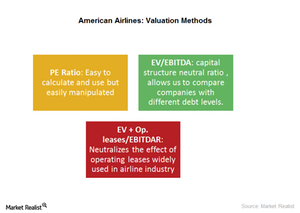

Currently, American Airlines (AAL) is valued at 6.6x its forward EV-to-EBITDA ratio (enterprise value to earnings before interest, tax, depreciation, and amortization).

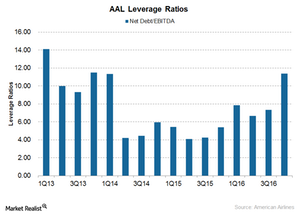

Why American Airlines Has Higher Debt Compared to Its Peers

As opposed to most other airlines that have been reducing their debts, American Airlines’ (AAL) debt has risen, partly due to its focus on completing its integration with US Airways.

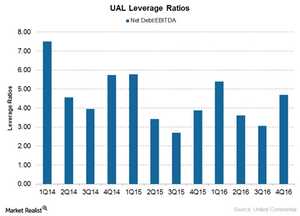

United Continental’s Debt: What You Need to Know

For 2016 overall, United Continental (UAL) has generated $5.5 billion in operating cash flow and $1.9 billion in free cash flow.

Can United Continental Improve Margins in 2017?

For 1Q17, analysts are now expecting United Continental’s (UAL) EBITDA to fall 39% to $0.81 billion.

United’s Increased Capacity Growth: Should Investors Worry?

Airlines have long been known as capital destroyers. In times of profitability (such as now), they increase capacity to an extent that can’t be filled.

What Higher Capacity Means for Airlines’ Utilization

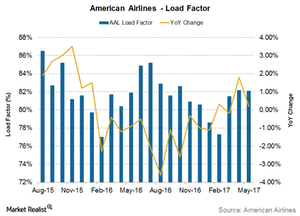

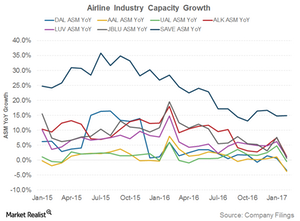

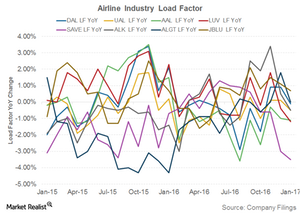

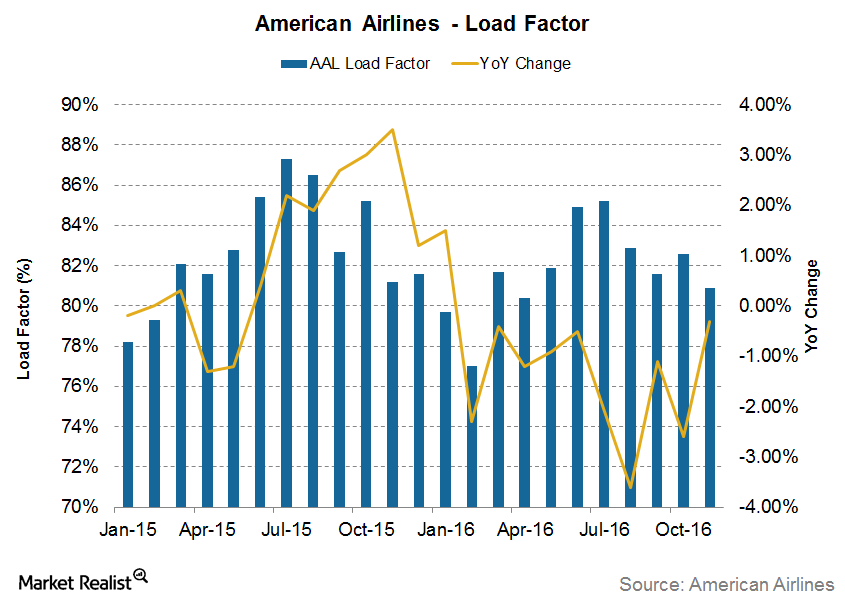

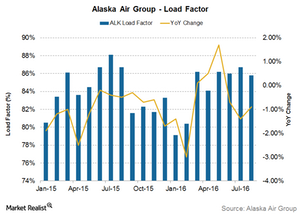

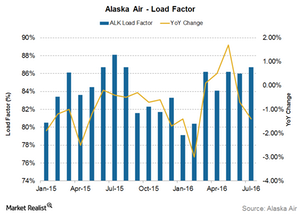

The load factor Airlines’ capacity utilization is measured using the passenger load factor, which is calculated by dividing traffic by capacity. Analyzing airlines’ load factors As discussed in the previous article, most airlines saw high capacity growth in January 2017. As a result, all airlines except JetBlue Airways witnessed a decline in their load factors. […]

Will Delta Air Lines’ Fuel Costs Keep Falling in 2017?

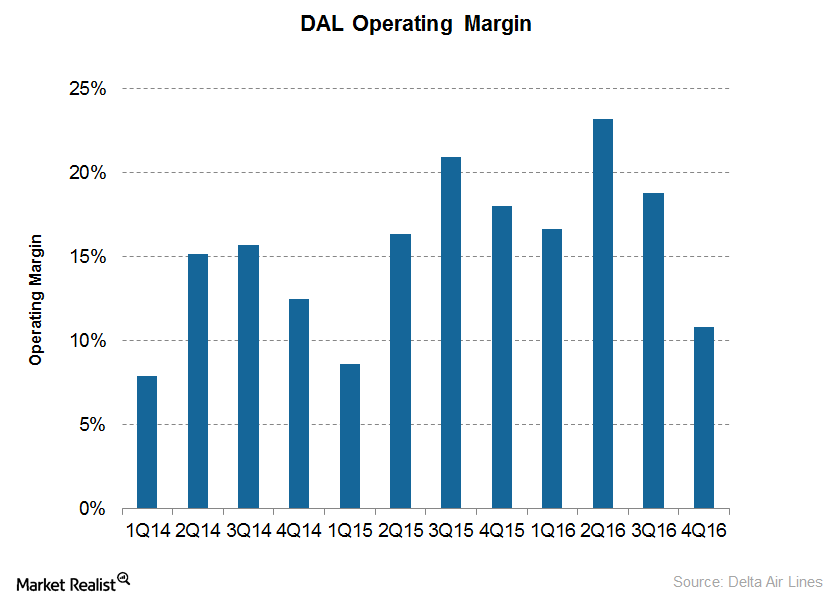

Until 3Q16, Delta Air Lines (DAL) had managed to keep its costs flat if not decreasing. However…

Will Delta Air Lines’ Strong Operational Performance Last?

Delta Air Lines (DAL) saw average traffic of about 50 million passenger miles for the quarter, a 0.8% year-over-year improvement

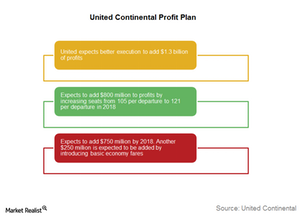

How Does United Continental Plan to Improve Margins?

United expects to add $800 million to profits by increasing seats from 105 per departure to 121 per departure in 2018.

Will United Continental’s Margins Improve in 2017?

For 4Q16, analysts are expecting United Continental’s (UAL) EBITDA to fall 26% to $1.4 billion.

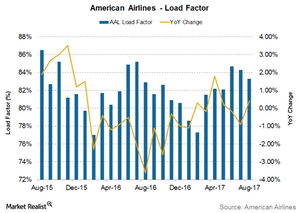

Will American Airlines’s Unit Revenues Continue to Decline?

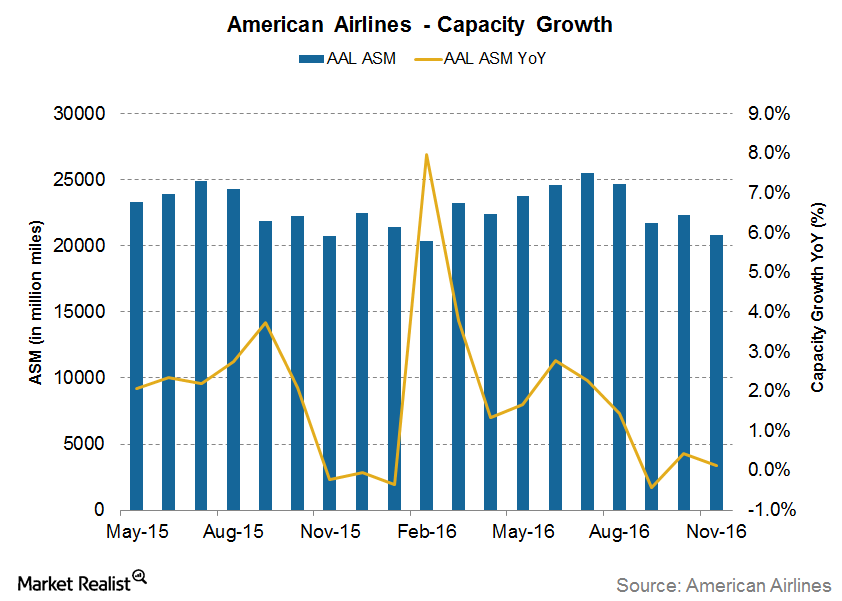

For November 2016, American Airlines’s (AAL) load factor fell 0.3% and year-to-date 2016, its load factor fell 1.3%.

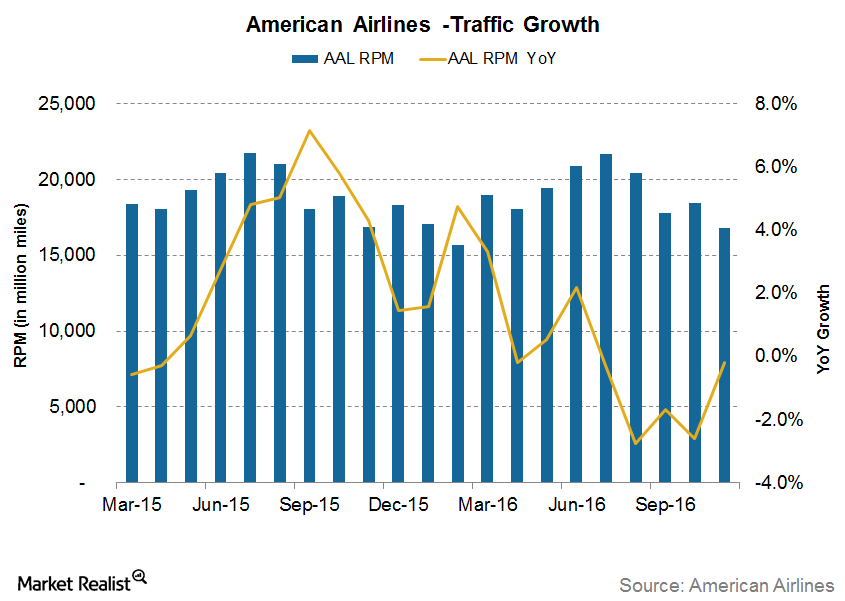

American Airlines’s Traffic Growth Lags Capacity Growth

In November 2016, American Airlines’s (AAL) traffic fell 0.2% year-over-year, slightly lagging its capacity growth in the same period. Year-to-date, AAL’s traffic has increased 0.3%.

Is American Airlines’s Capacity Growth Finally Slowing Down?

American Airlines’s (AAL) capacity grew 0.1% year-over-year in November 2016, similar to the growth seen during most of 2016. Year-to-date, AAL’s capacity has grown 1.9%.

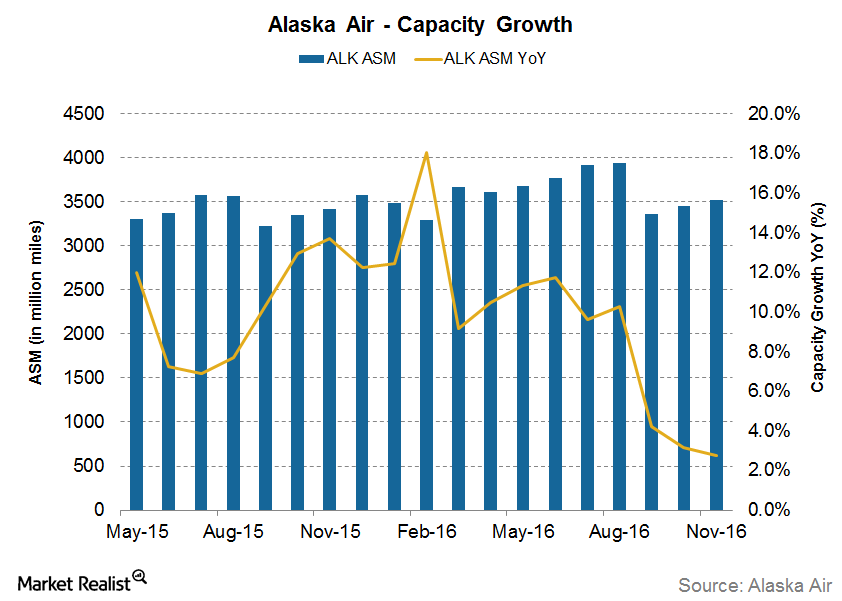

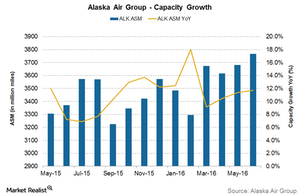

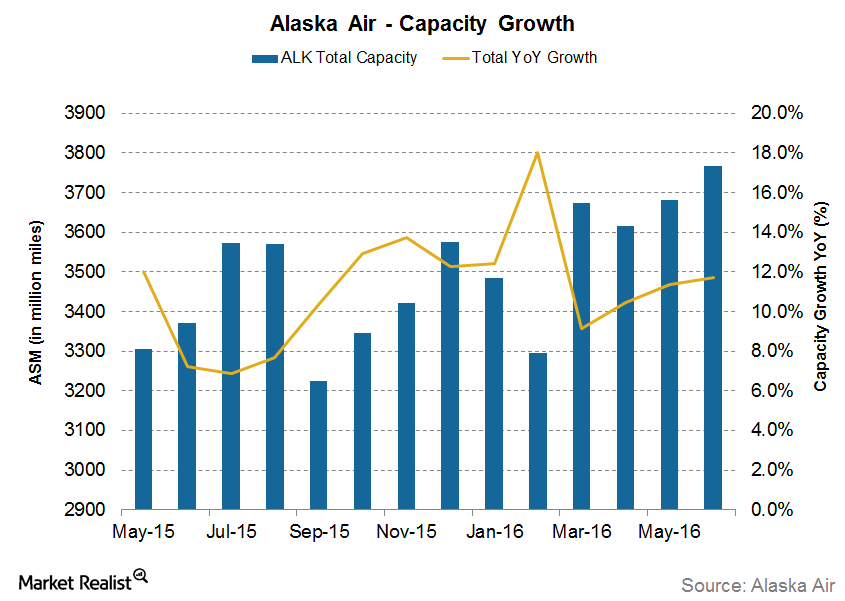

Capacity Growth: Is Alaska Air Group Reducing the Pace?

For November 2016, Alaska Air Group’s capacity rose 2.8% YoY (year-over-year). It’s the slowest growth in any month in 2016.

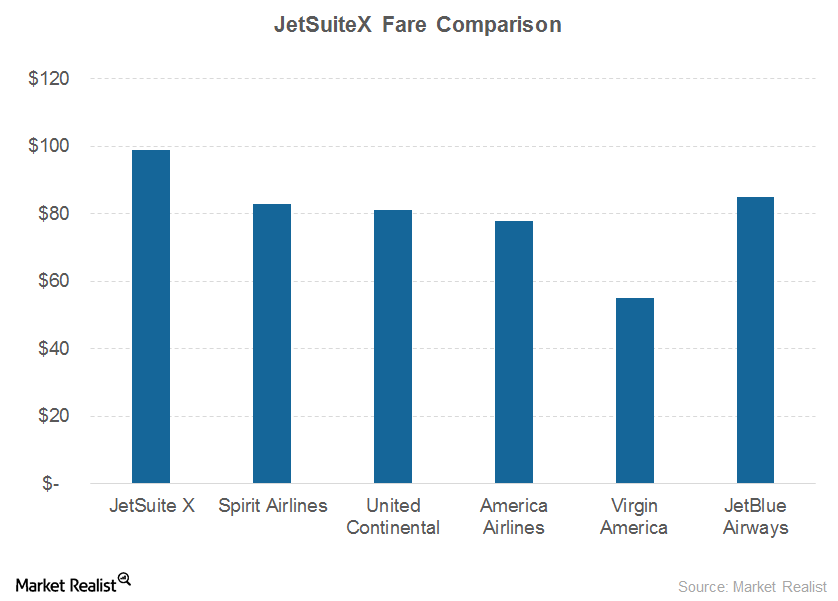

JetBlue’s New Investments: A Pioneer in Private Jet Services?

JetBlue announced that it had undertaken a small stake (the exact stake is unclear) in JetSuite, the fourth-biggest private jet operator in the United States.

Why Does JetBlue Expect Unit Costs to Rise in 4Q16?

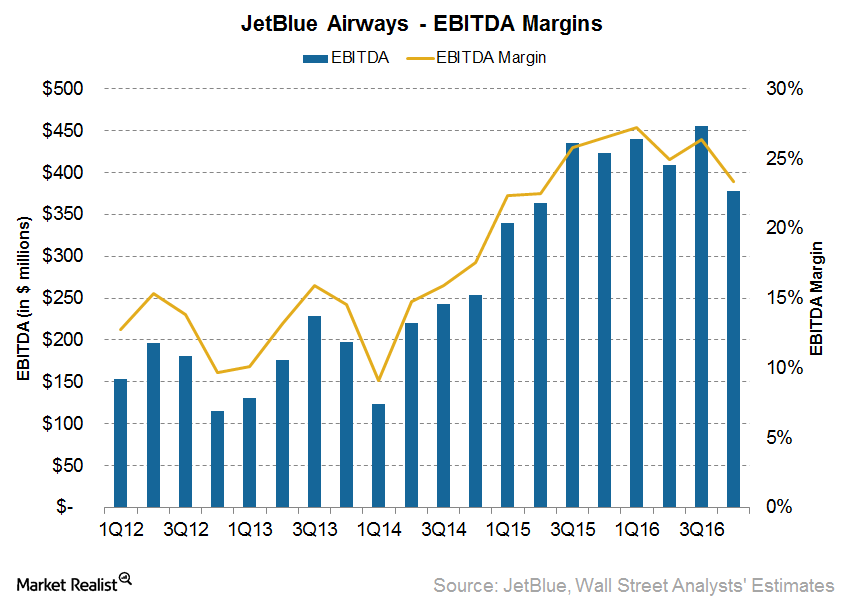

For the third quarter of the year, JetBlue Airways’ (JBLU) operating expenses—excluding fuel and profit sharing—rose 3.1% to 7.86 cents.

JetBlue’s: Can Investors Expect Improved Revenue in 4Q16?

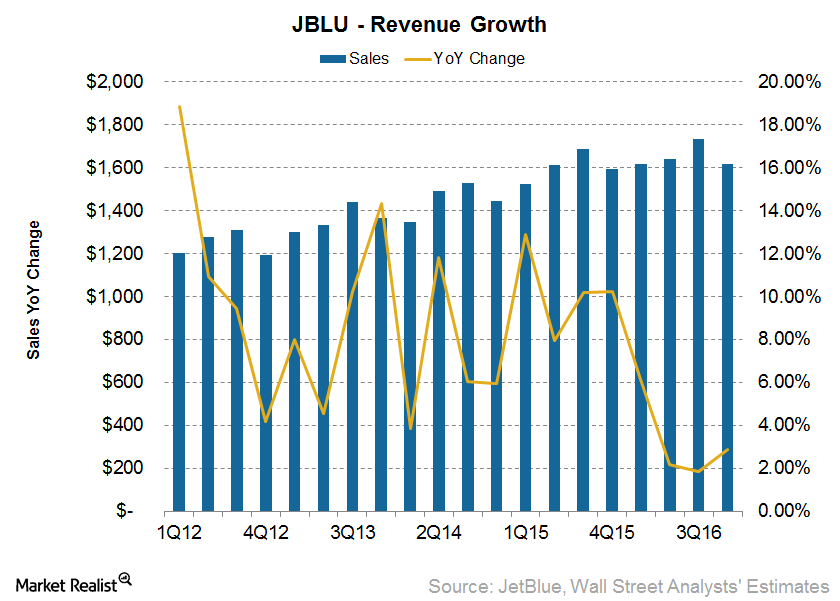

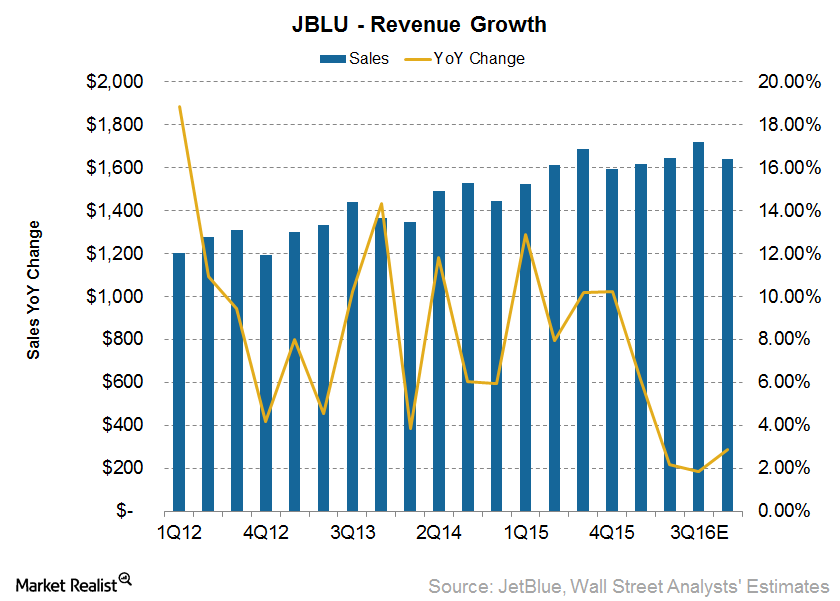

For 3Q16, JetBlue Airways’ (JBLU) revenues stood at $1.73 billion—a 2.6% year-over-year increase compared to revenue of $1.69 billion in 3Q15.

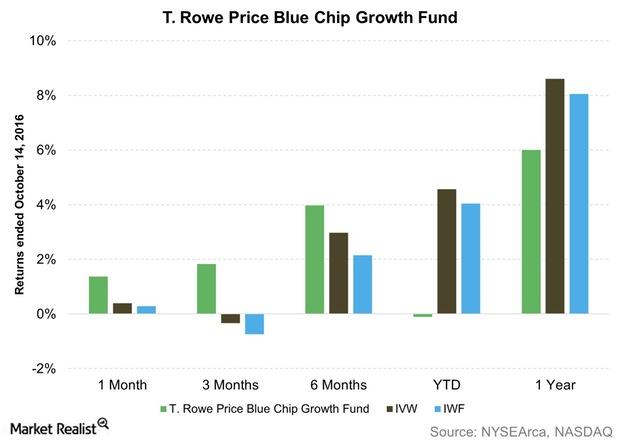

Why the T. Rowe Price Blue Chip Growth Fund Has Had a Rough 2016

TRBCX has had quite a poor run in 2016 so far. The fund places in the bottom three in the YTD period among the 12 funds in this review.

Do Analysts Expect JetBlue’s Revenue to Rise in 3Q16?

Analysts expect JetBlue Airways’ (JBLU) 3Q16 revenue to come in at $1.7 billion, a year-over-year rise of 2.2%.

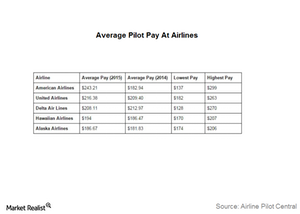

Why Is Delta’s Pilot Deal Important for the Airline Industry?

All airline pilots have their eyes on Delta Air Lines’ (DAL) final agreement with its pilots. This is because Delta’s deal will set a precedent in the industry.

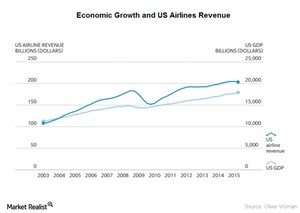

The Airline Industry’s Cyclical Nature Is a Mixed Blessing

The airline industry is cyclical, which means that its business depends on the country’s economic growth. Most analysts have revised their GDP estimates downward, resulting in a consensus estimate of 2.9% YoY growth.

Will Alaska Air’s Unit Revenues Continue to Fall in September?

Foreign currency fluctuations and lower fuel surcharges in the international market will have a negative impact on Alaska Air Group’s unit revenues.

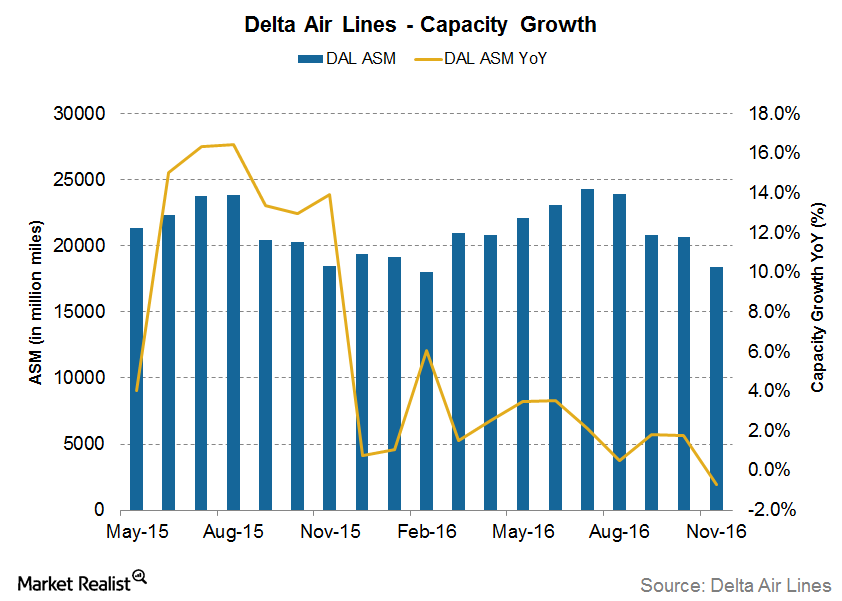

Will Alaska Air Group’s Capacity Expand More in 2016?

For August 2016, Alaska Air Group’s (ALK) capacity increased by 10.3% YoY. After average growth of 13% in 1Q16, its growth slowed down to 11% in 2Q16.

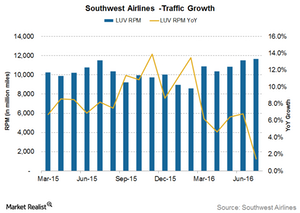

How Traffic Growth Lags behind Capacity at Southwest Airlines

In July 2016, Southwest Airlines’ (LUV) traffic grew by 1.4% YoY, which was slightly lower than its capacity growth of 2.3% YoY.

How Will Alaska Air Group’s Strategy Impact Unit Revenues?

Alaska Air Group (ALK) does not give any future unit revenue guidance. However, we can expect the PRASM’s decline to continue.

Can Alaska Air Group’s Capacity Growth Be Sustained for the Rest of 2016?

For July 2016, Alaska Air Group’s (ALK) capacity increased by 9.6% year-over-year. After an average growth of 13% in 1Q16, growth slowed to 11% in 2Q16 and is slowing further in the third quarter.

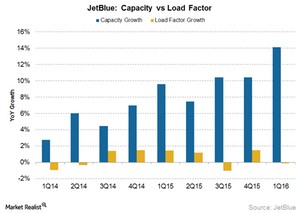

Does JetBlue Airways’s Capacity Growth Support Analyst Estimates?

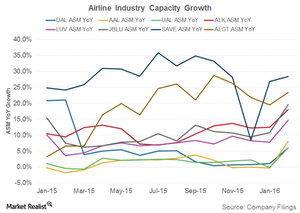

Capacity growth Like other airlines, JetBlue Airways (JBLU) has taken advantage of falling crude oil prices to expand its existing fleet. JetBlue’s double-digit revenue growth has been fueled by double-digit growth in its capacity. Historically, JetBlue Airways has seen the highest capacity growth among the seven major airlines. Spirit Airlines (SAVE) has seen the highest growth, followed by Alaska […]

What’s the Best Approach for Valuing American Airlines?

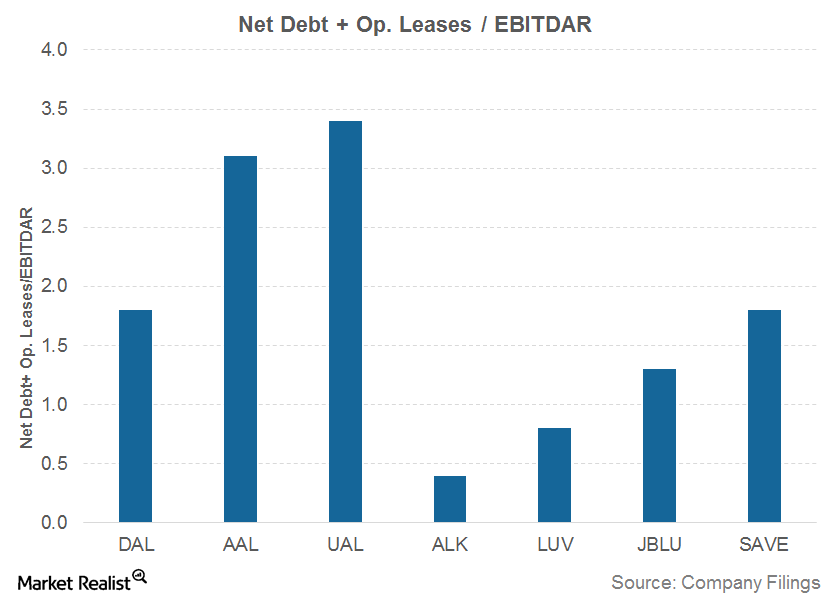

For airlines such as American Airlines (AAL), we go a step further and use an EV+ Op. leases-to-EBITDAR ratio.

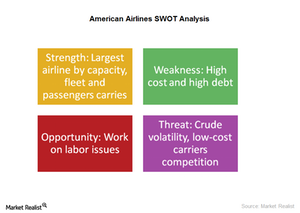

What Are American Airlines’ Key Strengths and Weaknesses?

Some key strengths keep American Airlines ahead of its competitors. It’s the largest airline in fleet, capacity, and number of passengers. It also has a strong hold on key hubs.

What Are American Airlines’ Major Revenue Drivers?

American Airlines’ (AAL) capacity growth is one of the slowest in the industry. However, it has the highest capacity among its peers.

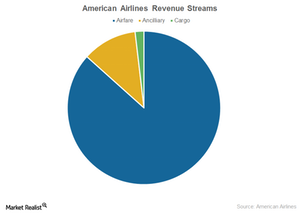

What Are American Airlines’ Key Revenue Streams?

In this part of the series, we’ll look at the main services and categories that add to American Airlines’ (AAL) revenues. The major component of revenues still comes from airfares.

American Airlines Stock: The Past, the Crisis, the Recovery

After the merger, American Airlines became the world’s leading airline in terms of fleet size, network, and finances. American Airlines stock has risen more than 270% since 2011.

Is There Overcapacity in the Airline Industry?

In February 2016, the airline capacity of the eight major airlines exceeded their traffic growth by an average of 2%.

Which Airline Has the Highest Leverage?

The airline industry is a capital-intensive industry with heavy investments required in building infrastructure, fleets, and their maintenance. As a result, airline stocks generally have high levels of debt on their balance sheets.

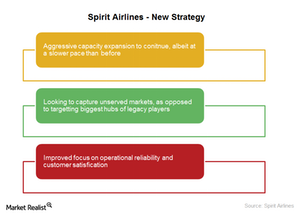

Spirit Airlines: New CEO, New Strategy

Spirit Airlines has historically followed a low-cost structure, and took numerous measures to keep its cost components the lowest in the industry.

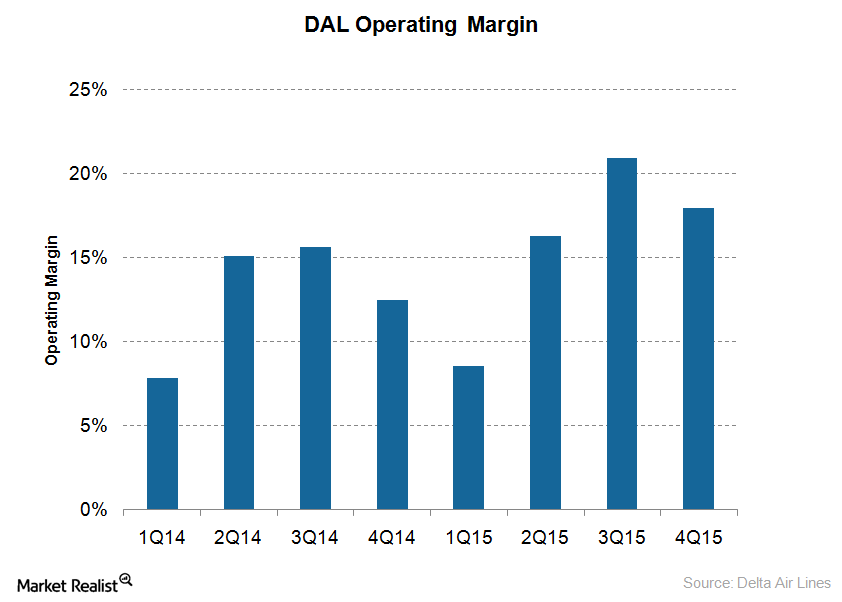

Can Delta Air Lines Continue to Reduce Its Costs in 2016?

For 1Q16, Delta Air Lines (DAL) expects to see its operating margins improve to 18%–20%, backed by solid cost savings and lower fuel prices.

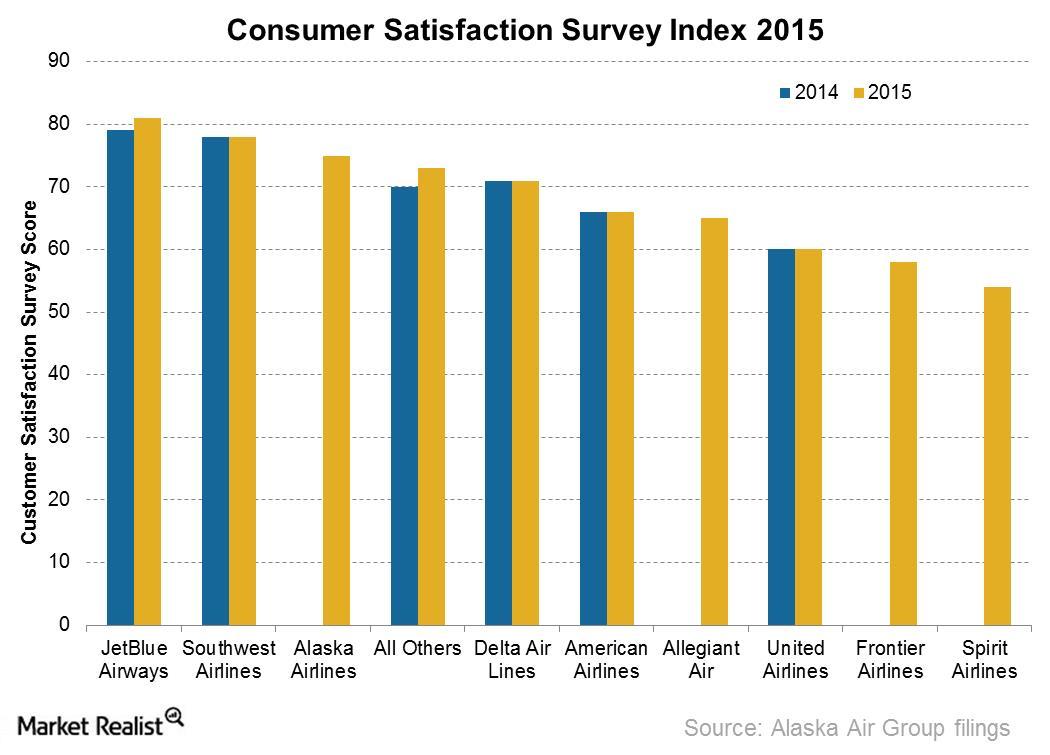

Alaska Airlines’ Keys to High Customer Satisfaction

For the seventh consecutive year, Alaska Airlines held the top spot in Customer Satisfaction among the Traditional Network Carriers survey conducted by J.D. Power.

Southwest’s Low Cost Strategy Helps Maintain a Competitive Edge

Southwest is known to be the pioneer of low cost travel in the industry. Its 42-year record of profitable operations is enough to prove the success of the company’s business model.