United Continental Holdings Inc

Latest United Continental Holdings Inc News and Updates

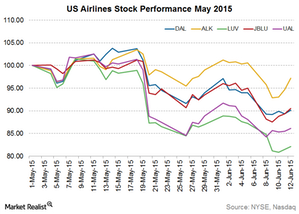

The Key Variables Impacting Airline Stocks

A strengthening dollar led to improved profitability for US airlines in 1Q15 while subduing profitability for non-US airlines. This further increased the industry’s performance gap across the globe.

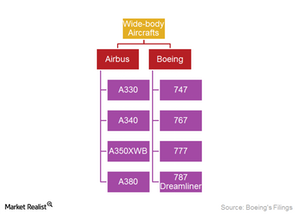

Boeing’s Fleet of Wide-Body Aircraft

Wide-body aircraft fly transoceanic routes, can accommodate 200–500 passengers, and often transport commercial cargo across the globe.

Boeing: A Wide Diversification Wingspan

When Boeing bought McDonnell Douglas in 1996, the acquisition helped Boeing overtake Lockheed Martin as the largest defense contractor.Industrials Why political and legal factors impact the airline industry

The airline industry is widely impacted by regulations and restrictions related to international trade, tax policy, and competition. It’s also impacted by issues like war, terrorism, and the outbreak of diseases—such as Ebola. These issues are political. As a result, they require government intervention.

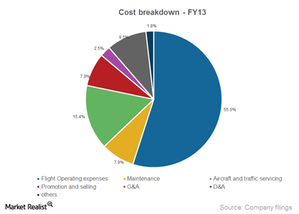

Rising operating expenses as a percentage of revenue

More than half of China Southern’s total operating expenses in FY13 were related to flight operating expenses.

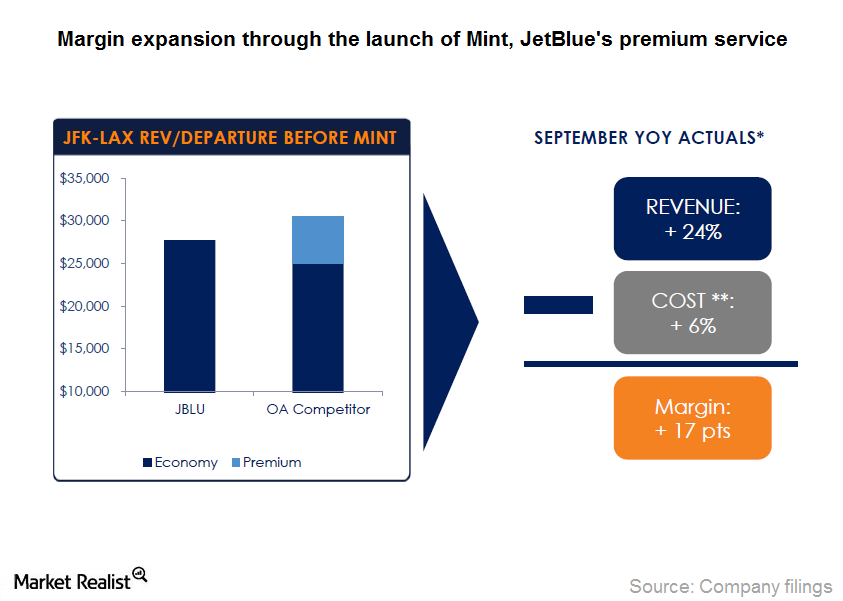

Even More drives JetBlue’s ancillary revenue

Revenue from JetBlues’ Even More Space grew at a five-year compounded annual growth rate of ~30% from $45 million in fiscal year 2008 to $170 million in fiscal year 2013.Macroeconomic Analysis Freight, passenger index values show rising transportation demand

Although trucking is the most widely used mode of transportation, the fastest growing mode of transport is by air.

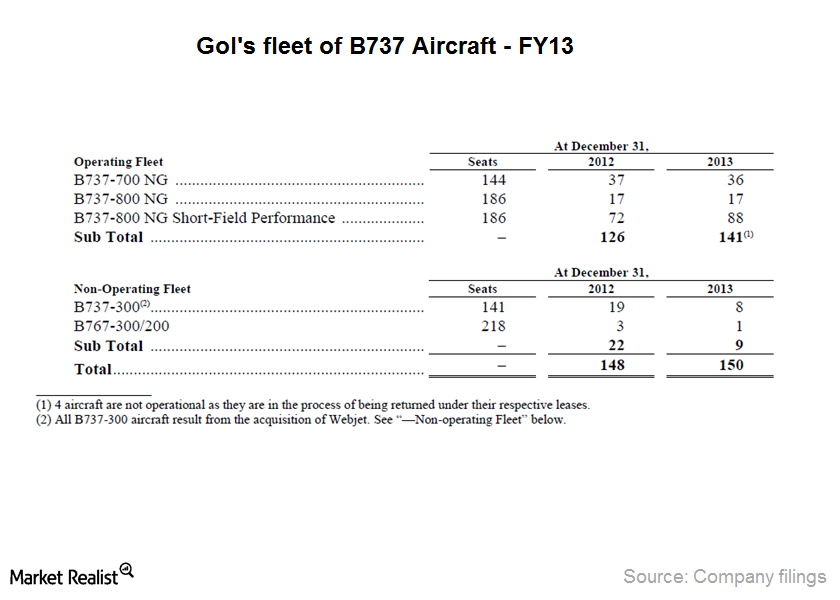

Gol maintains low-cost advantage with single fleet type

Using a single aircraft type reduces disruption of operations due to maintenance efficiencies. The airline reduces training costs with standardized pilot training and maintenance routines.

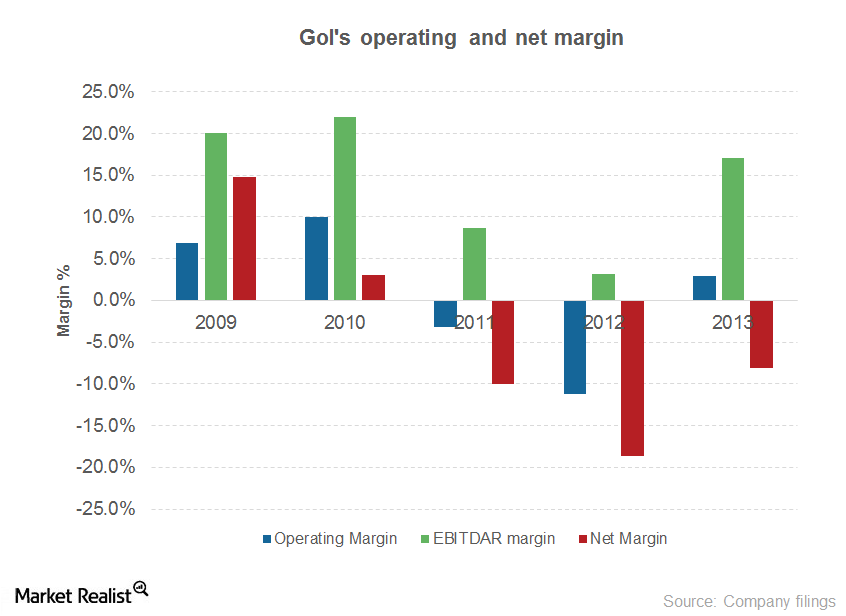

Non-operating expenses eclipse Gol’s operating profitability

Gol’s operating income turned positive in FY13 after reporting losses for two consecutive years.Industrials Must-know: SARS’ impact on the airline industry

SARS was another disease outbreak in 2003. SARS caused a panic similar to the current Ebola outbreak. SARS was a viral respiratory illness.Industrials The global airline market’s key revenue drivers and profitability

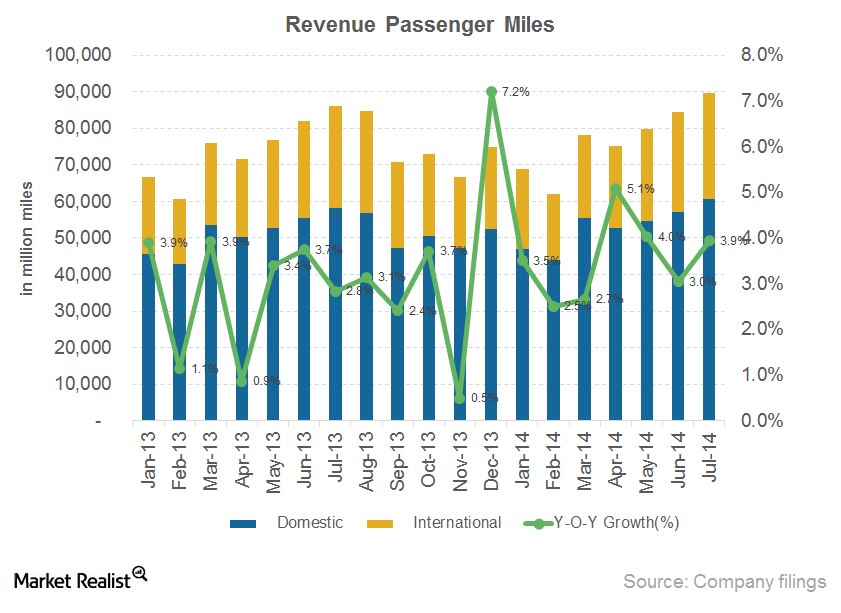

According to IATA (or the International Air Transport Association), the global airline industry passenger volume and capacity increased by 5.3% year-over-year in July 2014. Freight volume increased by 5.8%. In July load factor (or capacity utilization) for passengers was 82.3%, and for freight, it was 44.4%.Industrials Why investors should track labor costs in the airline industry

The second largest cost component for airlines is salaries, wages, and benefits. Employment in the U.S. airline industry has increased in the last couple of years when the U.S. economy recovered from the recession and demand for air travel picked up.Industrials Must-know: Why yield is another key driver for airline revenue

Yield is the average fare per passenger per mile. Passenger revenue is calculated by multiplying RPM (or revenue passenger miles) with yield. Yield varies based on demand and supply factors. Since demand for air travel is seasonal, yield is higher during peak seasons.Industrials Must-know: Why airlines should improve their load factor

Load factor is a measure of capacity utilization. It indicates the percentage of total capacity that is utilized by an airline. Since airlines are capital intensive and have high fixed costs, the efficiency with which they utilize their assets is key to generate adequate return on investment.Industrials Must-know: Why available seat miles affect airlines’ revenue

Available seat miles (or ASM) is the measure of airline capacity. It’s calculated as the total number of seats multiplied by the total distance travelled. While RPM (or revenue passenger miles) is a measure of demand, ASM is the measure of supply.Industrials Must-know: Trends in key economic indicators that impact airlines

The airline industry is an important contributor to the U.S. economy’s growth. According to Airlines for America (or A4A), the industry drives $1.5 trillion in U.S. economic activity and more than 11 million in U.S. jobs.

Must-know: Key indicators impacting airline industry performance

Cyclical industries follow the business cycle, so their revenues are higher during economic prosperity and lower during economic contraction. The airline industry is sensitive to changes in economic growth.Industrials Must-know: Environmental awareness in the airline industry

The global aviation industry consumes over 200 million tons of fuel per year. The rising demand for air transport and the rising crude oil prices could impact the industry’s carbon emissions. The environmental impact could also influence sustainability.Industrials Must-know: The role of technology in the airline industry

Technological advancement has been the driving factor for improving airlines’ operational efficiency. Airlines have been able to reduce costs and improve operations by using advanced aircraft engine technology, IT solutions, and mobile technology. The technology has created better connectivity and enhanced passengers’ travel experience.Industrials Travel preferences for millennials versus non-millennials

The Boston Consulting Group researched the millennial generation’s travel preferences in the business and leisure segment. This will provide a better understanding of how social and demographic factors influence air travel. It will also show how the factors influence company strategies to adopt to the changing trends.Industrials Why social and demographic factors influence air travel demand

Categorizing generations in the U.S. according to the year of birth provides insight into the changing trends in the travel and tourism industry. The demand for air travel has increased significantly over the years. Demographic factors also play an important role in forecasting demand.Industrials Why economic factors support airline industry growth

Like most industries, the airline industry is impacted by the economic cycle’s peaks and troughs. The current growth in developed economies—like U.S.—has resulted in a rise in business confidence, industrial production, and international trade.Industrials PESTEL framework analyzes the industry’s external environment

The Political, Economic, Social, Technological, Environmental, and Legal (or PESTEL) framework covers the six external factors that impact the airline industry. The framework provides a broad perspective on opportunities and threats that surround the industry. The factors can’t be controlled by the industry.

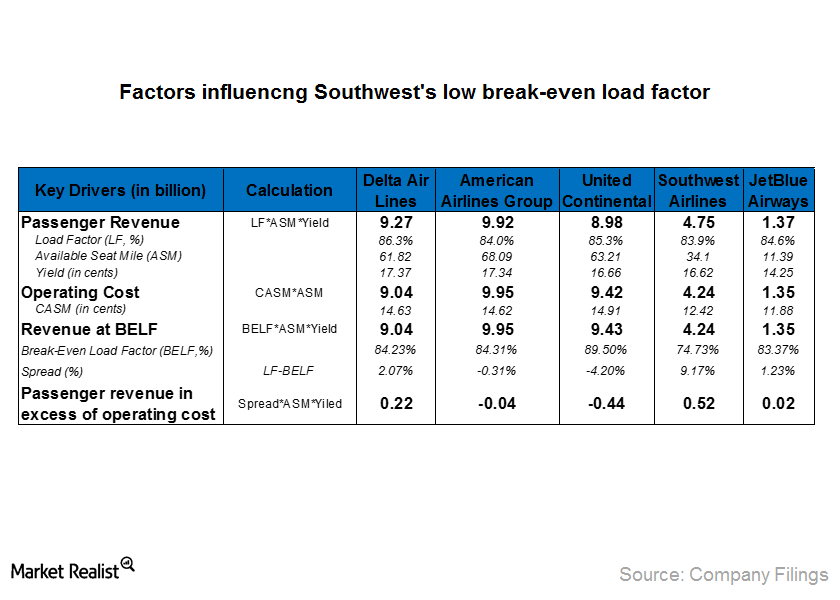

How Yield and Cost structure contribute to Southwest’s low break-even load factor?

As mentioned in the previous article, break-even load factor is calculated by dividing cost per available seat mile (or CASM) with yield per passenger mile and Southwest has the lowest break-even load factor compared to its peers. In this article we will analyze yield and cost structures of Southwest with its peers’ to determine how […]Industrials Must-know: Factors that affect aircraft utilization

Higher aircraft utilization will result in lower fixed costs per unit, as the costs spread across more air trips and passengers and results in lower cost per available seat mile.Industrials Must-know: Factors that influenced JetBlue’s top line growth

JetBlue Airways’ (JBLU) operating revenue has increased at a four-year compounded annual growth rate (or CAGR) of 13.4%, driven primarily by the growth in passenger revenue.Industrials Must-know: JetBlue’s position in key target markets

JetBlue has almost equal share in Florida, Latin America, and the transcontinental region which together accounted for about 87% of JetBlue’s total capacity.Industrials Must-know: JetBlue’s competitive airline positioning

JetBlue (JBLU) operates a hybrid business model that caters to the niche market comprising customers that it defines as “underserved customers.”Industrials An operational and financial overview of JetBlue Airways

JetBlue Airways Corporation is the fifth largest passenger carrier in the U.S. based on revenue passenger miles.Industrials Why low cost carriers influence the industry with low air fares

Over the last decade, with increasing mergers and consolidation in the U.S. airline industry and reduced competition, air fares were expected to increase dramatically.Industrials Low cost carrier strategies to maintain competitive advantage

LCCs don’t offer all services provided by a legacy carriers like free meals and drinks.Industrials Must-know: Airline business models

Southwest was instrumental in revolutionizing the industry with a differentiated business model.Industrials Overview: Southwest Airlines

As of December, 2013, the passenger segment comprised 94.5% of its revenues, cargo segment 0.9%, and ancillary revenues comprised 4.6%.Industrials Must-know: Merger synergies in the US airline industry

Network synergies accounted for almost 50%–85% of the total synergy benefits in the past airline mergers.Industrials Must-know: U.S. airline industry consolidation and restructuring

American’s number one position, in terms of revenue share as shown in the following chart, was replaced by United.Industrials Why winglets reduce aircraft drag and improve fuel efficiency

United has partnered with Aviation Partners Boeing (APB) to launch the Split Scimitar winglet. The new winglet is expected to save more than 45,000 gallons of fuel per aircraft per year.Industrials Evaluating United’s frequent-flyer program, MileagePlus

Under United’s MileagePlus program, members earn mileage credits for flights on United, United Express, airlines in Star Alliance, and other airlines that participate in the program.Industrials Why frequent-flyer programs are an effective marketing tool

Frequent-flyer programs are incentives given to customers by airlines to increase customer loyalty by awarding free miles on tickets purchased.Industrials Delta’s capacity: Current size and future purchase commitments

A comparison of the fleet sizes of Delta Air Lines with its competitors reveals that American Airlines group (AAL) has overtaken Delta (DAL) and United (UAL).Industrials Why Delta Air Lines’ margins are the highest among its peers

Delta (DAL) has outperformed its peers in terms of margins continuously for the past four years, followed by Southwest Airlines (LUV), American Airlines (AAL), and United Continental (UAL).Industrials Measuring Delta Air Lines’ performance with key operating metrics

Delta’s Operating revenue grew at a five-year CAGR (compound annual growth rate) of 6.1% from 2009 to 2013, mainly driven by a 6% growth in passenger mile yield, a 0.6% growth in RPM, and a load factor of more than 80%.Industrials Why Delta Air Lines scores highly on customer satisfaction surveys

Delta leads in many corporate surveys for customer satisfaction. These surveys help companies track their performance and take corrective steps when required.Industrials Delta’s unique strategy: Owning a refinery to contain fuel costs

Delta manages its fuel costs (about 33% of the company’s total operating expense) through purchase agreements, fuel hedging, and operating a refinery.