Even More drives JetBlue’s ancillary revenue

Revenue from JetBlues’ Even More Space grew at a five-year compounded annual growth rate of ~30% from $45 million in fiscal year 2008 to $170 million in fiscal year 2013.

Dec. 8 2014, Updated 12:00 p.m. ET

Ancillary revenue growth

In Part 2 of this series, we saw that the increase in JetBlue Airways Corporation’s (JBLU) revenue was driven by an increase in passenger revenue. Passenger revenue includes seat revenue and revenue from ancillary product offerings. Ancillary revenue increased by 12% year-over-year to $190 million in 3Q14 and is expected to increase by 10% to 15% year-over-year in fiscal year 2014.

Key ancillary offerings

In this article, we’ll look at how ancillary product offerings contributed to the company’s revenue growth.

Even More – The primary driver of ancillary revenue was JetBlue’s Even More offering, which contributed most to margins out of all ancillary products. Revenue from Even More Space grew at a five-year compounded annual growth rate of ~30% from $45 million in fiscal year 2008 to $170 million in fiscal year 2013. It’s expected to reach $190 million in fiscal year 2014. The company reports that Even More revenue per customer is up ~200% since 2008.

For more details on contributions to margins, read Why JetBlue’s ancillary products score high on Net Promoter Score.

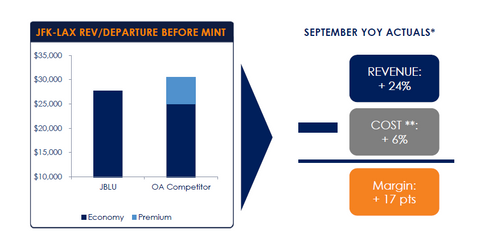

Mint – The Mint service was planned for routes between John F. Kennedy International Airport (or JFK) and Los Angeles, and JFK and San Francisco. Mint was launched with three fare products, $599, $799, and $999. The $599 and $799 products were non-refundable and $999 was refundable. Due to the strong demand for Mint services, the $999 was made non-refundable and the refundable fare was increased to $1,209. JetBlue plans to add seven daily frequencies from New York’s JFK airport to Los Angeles by the end of the year.

Fly-Fi – JetBlue is offering free access to in-flight Wi-Fi. The service will be installed in all Airbus A320 and A321 aircraft in the first half of 2015. Then, it will be installed in Embraer 190 aircraft.

Airlines all over the world, including major US airlines Delta Air Lines, Inc.(DAL), American Airlines Group Inc., (AAL), United Continental Holdings Inc. (UAL), Southwest Airlines Co. (LUV), and JetBlue (JBLU), are increasing ancillary revenue to achieve growth in yield. The alternative, increasing ticket fares, is difficult to do in competitive markets.

Investors can invest in US airlines through the SPDR S&P Transportation ETF (XTN) and the iShares Transportation Average ETF (IYT).