Teresa Cederholm

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Teresa Cederholm

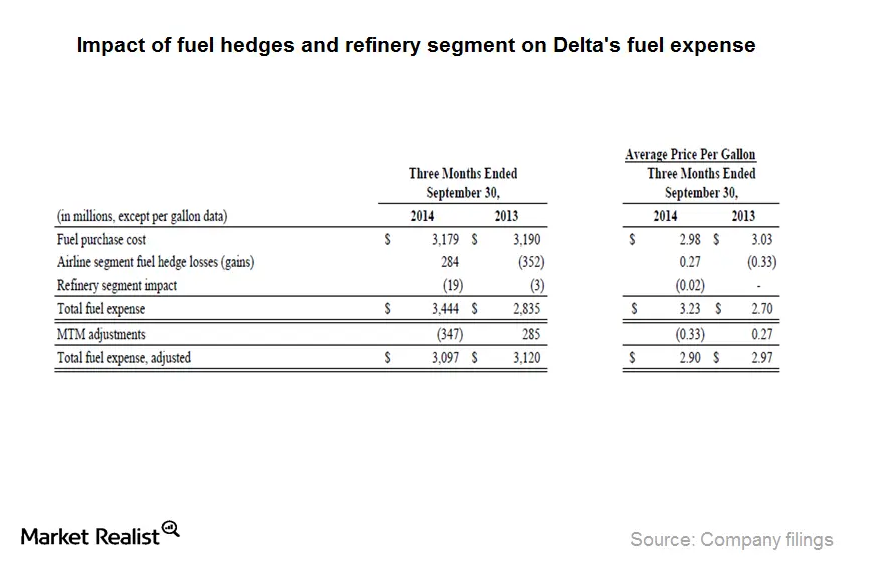

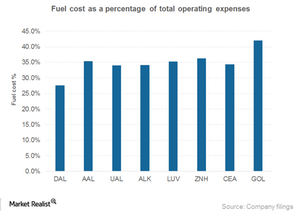

Why Delta’s 3Q14 fuel expense was impacted by fuel hedges

Fuel expense is Delta’s largest expense. It accounted for ~29% of the total operating expense in 3Q14. Fuel consumption per available seat mile decreased by 1.5% during the quarter.

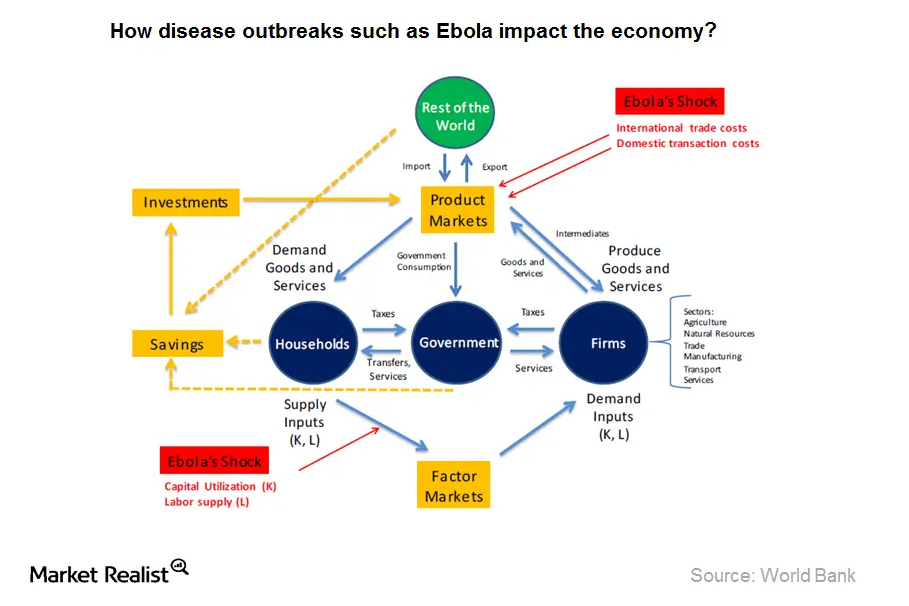

Why fatal disease outbreaks impact economic activity

The World Bank estimated Ebola’s impact by analyzing two scenarios—low Ebola and high Ebola. The scenarios are based on the probability of the disease spreading internationally.

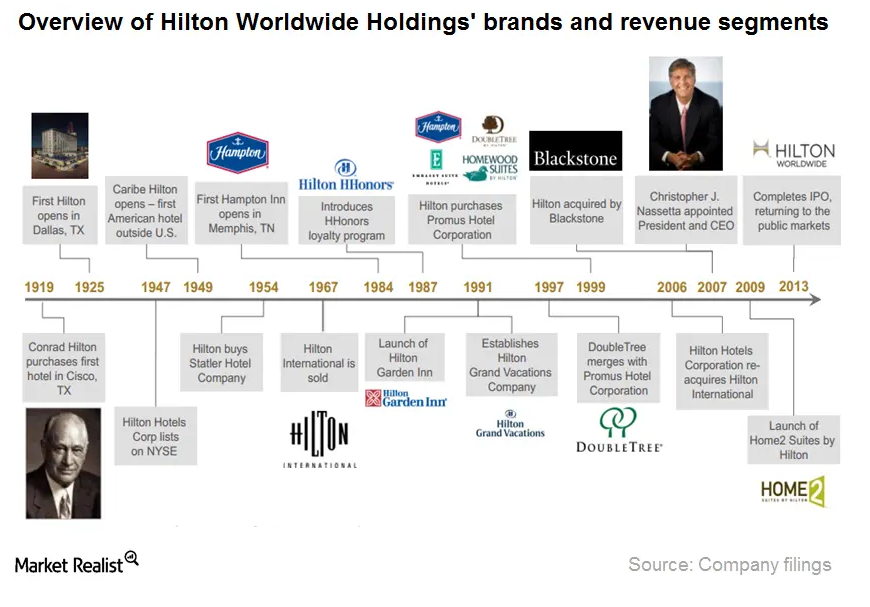

Overview: Hilton Worldwide Holdings Inc.

Hilton Worldwide Holdings is one of the largest hospitality companies in the world. It was founded in 1919 by Conrad Hilton. The company started when he bought his first hotel in Texas.

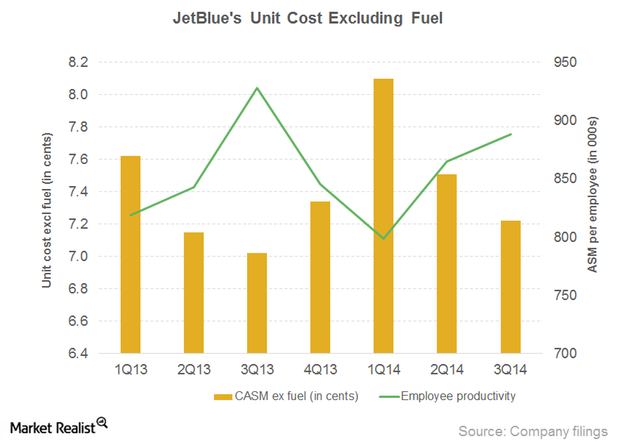

JetBlue’s unit cost growth: Employee costs up, lower productivity

Salary, wages, and benefits increased as a result of higher wage rates. Airlines have also had to increase headcount to adhere to the new Federal Aviation Administration (or FAA) regulations on flight, duty, and rest.Industrials Estimating American Airlines’ earnings growth

Apart from improved operational efficiencies, American has outperformed its peers in pre-tax margin (excluding special items) improvement in the first half of 2014 to 8.7% from 4.1% in the previous year.

Comparison of China Eastern’s fuel costs with competitors

Chinese airlines have an advantage of having lower employee costs compared to their counterparts in the US. Operational efficiency of US airlines are comparatively higher.Industrials Must-know: Alaska’s commitment to increase shareholder returns

Increases in share prices and dividends provide direct benefits to shareholders. The increases in share prices give better returns. Share repurchases and stock splits provide indirect benefits. Share repurchases lead to a reduction in outstanding shares. This results in increased EPS.Company & Industry Overviews Gol’s passenger revenue increases on higher yields

Brazil is the third largest domestic aviation market. With double-digit traffic growth, Brazil was one of the fastest-growing domestic markets in 2010 and 2011.Industrials Delta Air Lines’ key strategy to increase shareholder returns

Capital expenditure is generally high in the airline industry. Delta manages to keep it low through its strategy of buying used aircraft.Industrials Must-know: Delta Air Lines’ second quarter earnings

Today, Delta is one of the largest airlines in U.S. providing transportation services for passengers and cargo—it serves almost 165 million customers each year to 225 domestic and 97 international destinations.Consumer Why trend in fee income is an important source of revenue

Marriott increased its fee income at a ten-year compound annual growth rate (or CAGR) of 7.6% to $1,543 million in 2013—from $742 million in 2003.Industrials United sees major improvement in 3Q14 fuel cost efficiency

United achieved significant fuel cost savings during 3Q14 in the form of lower purchase costs and improved fuel efficiency.Industrials The must-know drivers of air cargo growth for US airlines

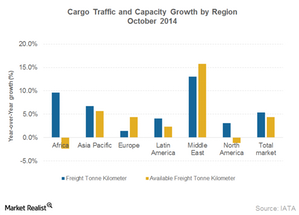

According to the IATA, global air freight volume has increased by 4.5%. Capacity, measured by available freight ton kilometers (or AFTK), increased by 3.5% year-over-year in August 2014.

Must-know: Alaska’s increasing return on invested capital

Alaska’s capital expenditure (or capex) mainly includes investment on aircraft. It increased since 2010. In 2013, ~80% of the total cash used for investing activities was on capital expenditure. The total capital expenditure was $566 million. $487 million was on aircraft and aircraft purchase deposits. $79 million was on flight equipment and other property and equipment.Industrials Why it’s important for airlines to improve load factor

Load factor measures capacity utilization. It indicates the percentage of total capacity that an airline utilizes. Airlines are capital intensive. They have high fixed costs.Industrials Why United Continental’s high-cost structure affects its margins

In 2013, almost 57% of United’s (UAL) $37,030 million total operating costs comprised fuel costs (33%) and salaries (23%), compared to Delta’s 46%.

Low yield, utilization drive down air cargo profitability

Growing trade activity drove the recovery in cargo traffic in emerging markets in Asia, but it was slightly offset by the slowing European economy.

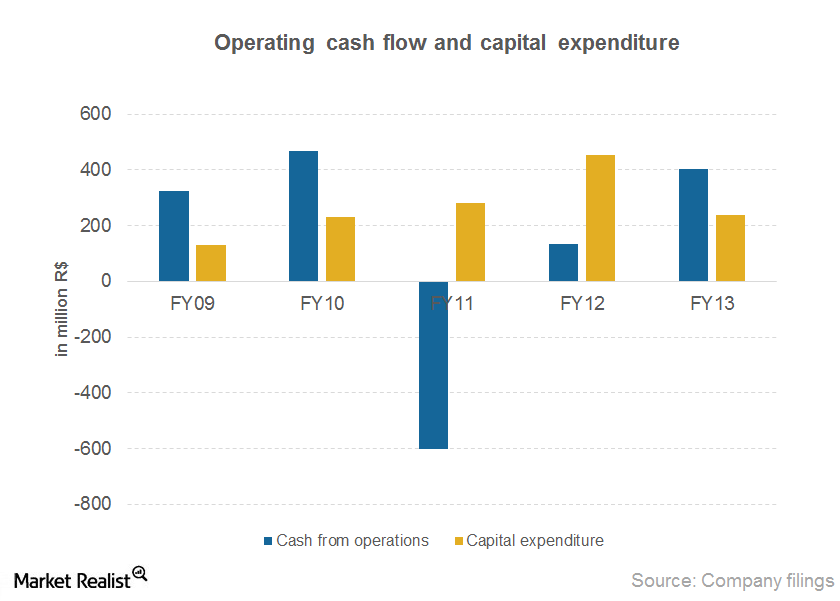

Gol’s increased operating cash flow boosts higher free cash flow

Gol’s financial assets decreased in 3Q14, but its cash balance increased to 1,942 million real from 1,636 million real in FY13.Industrials Why airlines adopt approaches to improve yield and revenue

Alaska Airlines (ALK) has the lowest yield of $0.148 among all its peers. Its peers include Delta (DAL) at $0.1689, United (UAL) at $0.1614, American (AAL) at $0.1622, and Southwest (LUV) at $0.1602. Revenue management is essential for the airline industry. The industry needs to maximize revenue by selling the most aircraft seats possible to customers at the best price.Industrials Changes in the US airline industry’s competitive landscape

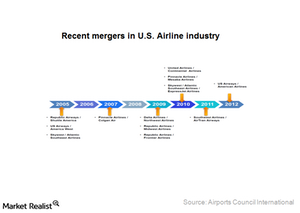

The Airline Deregulation Act of 1978 removed all regulations governing the airline routes, airfares, entry, and exit of commercial airlines. Earlier, this was controlled by the Civil Aeronautics Board (or CAB). Airfares and all other factors would be determined by demand and supply market forces.

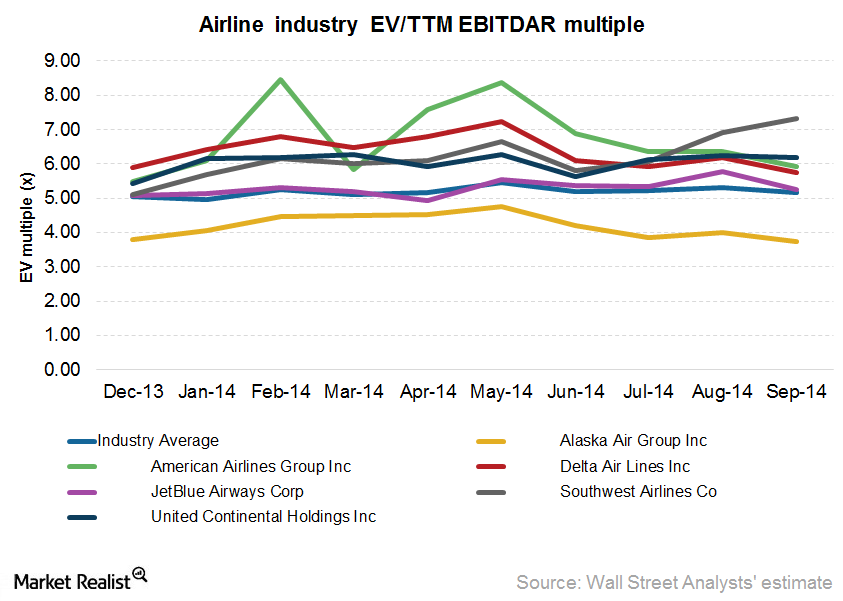

US airline industry: Summary of share prices and valuations

Southwest outperformed all its peers. Its share price increased 2.6% to $33.77 in September. That said, year-to-date results are positive overall.

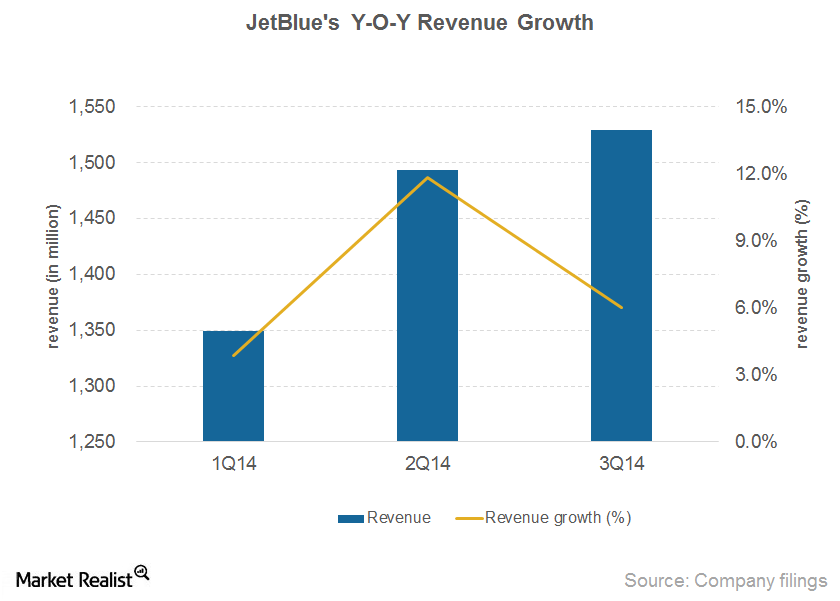

Higher passenger and ancillary revenue drive growth

JetBlue’s operating revenue increased by 6% to $1,529 million in 3Q14. The company states that its on-time performance was impacted by congestion in the air space.Industrials Key growth trends in airline passenger traffic by region

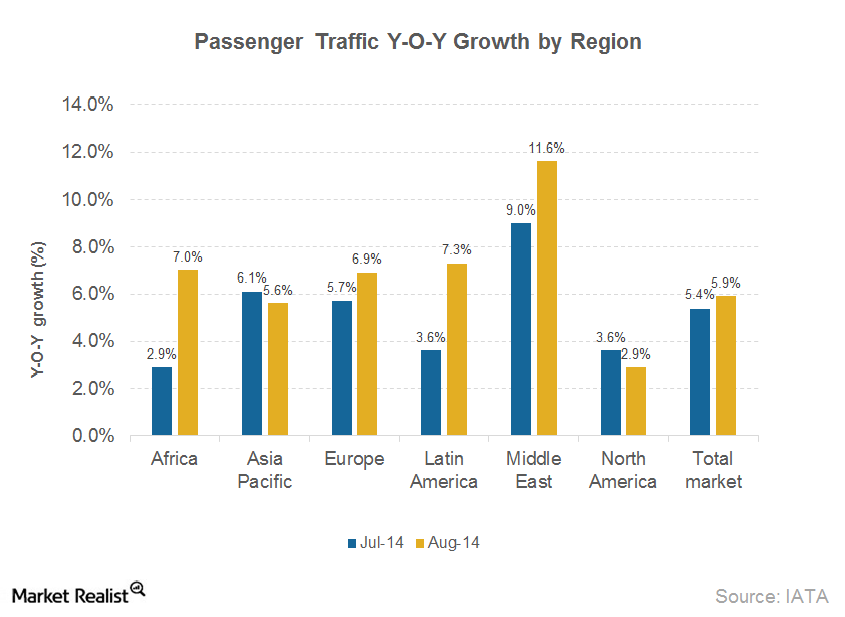

Global passenger traffic has increased by 5.8% year-over-year during the first eight months of 2014. Europe (29.7%), Asia-Pacifc (29.2%), and North America (25%) comprise ~85% of global market share by passenger traffic.

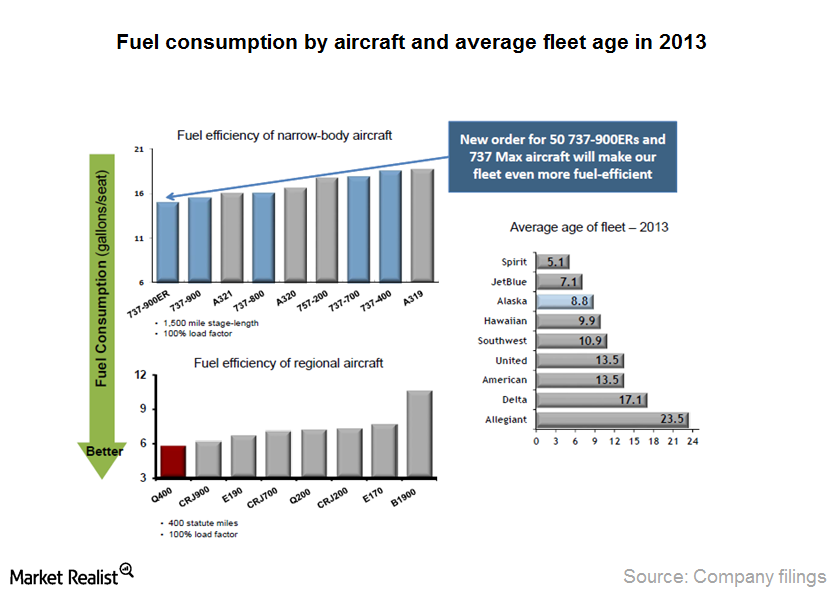

Must-know: Alaska Airlines’ aircraft and fuel efficiency

In 2013, Alaska operated a fleet of 131 Boeing 737 jet aircraft. It had contracts with Horizon, Sky West Airlines, and Peninsula Airways for regional capacity. Horizon operated 51 Bombardier Q400 turboprop aircraft. It sells all of its capacity to Alaska according to its capacity purchase agreements.Industrials Why Ebola impacted the airline industry

During fatal disease outbreaks, rules and restrictions are imposed—especially on air transportation. This includes canceling flights to the affected areas.Industrials Why the Ebola scare led to a 16% drop in the Airline Index

The share prices for major airline companies in the U.S. dropped substantially after the news of the first Ebola case in U.S. on September 30, 2014.Consumer Why Marriott is slowly expanding in international markets

Marriott has been expanding its presence in the international market. It added new brands in Europe, Asia Pacific, and the Middle East and African regions.

The global airline industry contributes to economic development

With 16,000 unique city pairs, connectivity by air is estimated to have doubled in the past two decades. Moreover, although demand continues to rise, the price of travel has fallen.

An operational summary of China Eastern Airlines

Established on April 14, 1995, based in Shanghai, China Eastern Corporation Limited is one of the three largest air carriers in China.Industrials Delta Air Line’s key operating segments and geographic segments

Delta Air Lines (DAL) derives 65.8% of its revenue from the passenger segment, 2.5% from the cargo segment, and 10.3% from other sources.

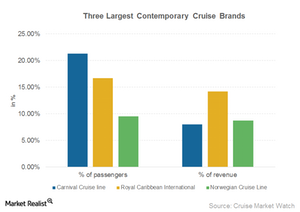

Royal Caribbean operates the world’s largest contemporary cruise brand

Royal Caribbean International is a global brand offered by Royal Caribbean (RCL). It’s one of the world’s three largest contemporary brands.

Marketing contributes to Royal Caribbean’s growing customer base

Royal Caribbean (RCL) offers all cruise company services, including pre- and post-hotel stay arrangements and air transportation.Must-know: Marriott International Inc.

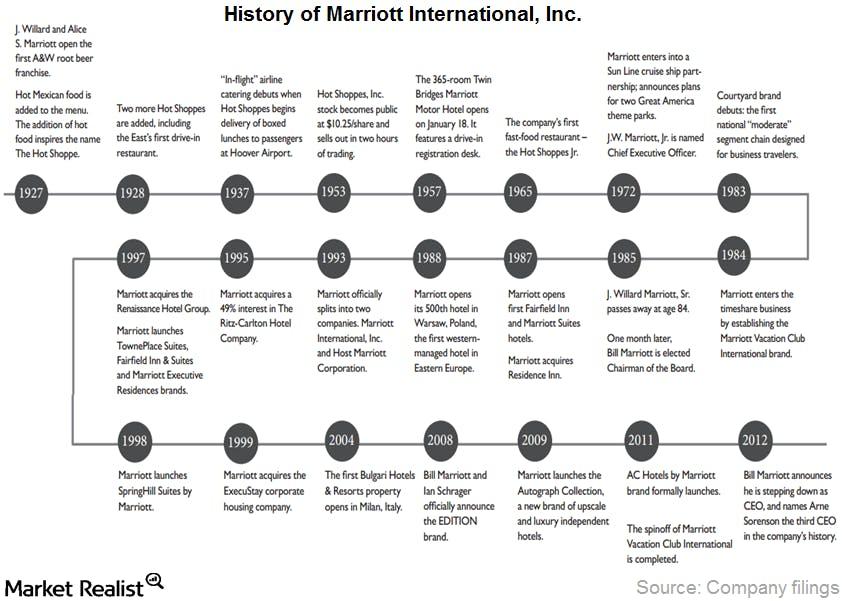

Marriott International’s headquarters are in Bethesda, Maryland. The company was founded in 1927 by J. Willard and Alice S. Marriott.Consumer Hilton’s diversified portfolio with 11 world-class brands

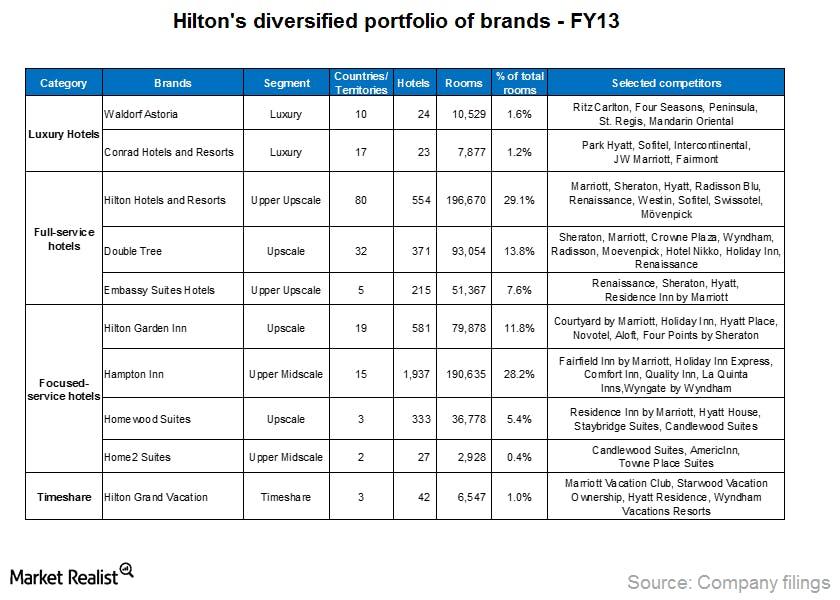

Hilton’s goal is to serve any customer, anywhere in the world, for any lodging need that they have. The company has a portfolio of 11 world-class brands. Hilton’s portfolio allows it to accomplish this goal.Hilton’s hotel room composition by brand and chain scale

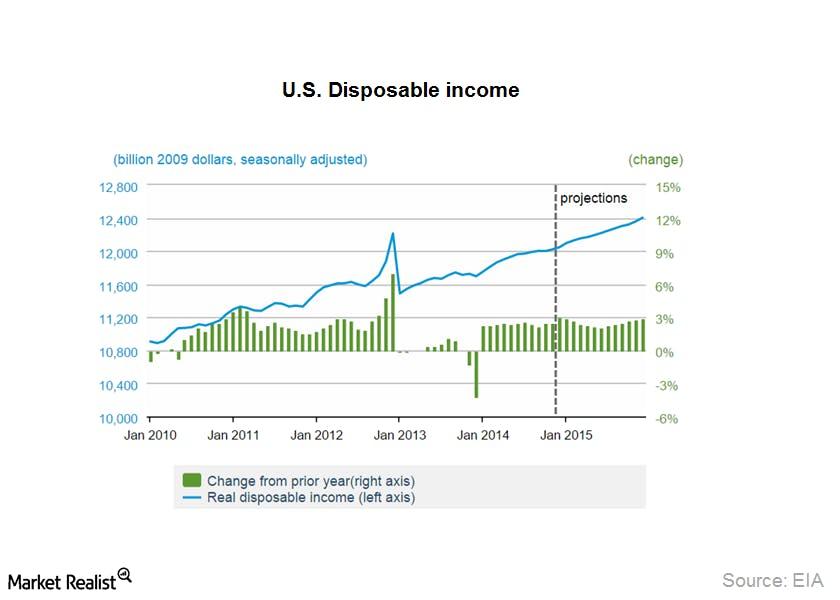

Hotel companies, like Hilton, expand their operations based on the demand for accommodations by location. They also expand based on customer preference for the level of service offerings.Why economic indicators influence travel and tourism demand

The airline industry contributes to U.S. economic growth. The industry drives $1.5 trillion in U.S. economic activity. It also generates more than 11 million jobs in the U.S.

Low-entry barriers intensify competition in airline industry

Short-term outlook above expectations The IATA (International Air Transport Association) has revised its forecast upwards on global airline profitability after the free fall of crude oil prices in the second half of 2014. Global net profit for 2014 is now estimated at $19.9 billion, higher than $18 billion projected in June. Profitability is expected to […]Industrials Assessing the key drivers of global airline industry growth

There was an overall increase in worldwide passenger traffic and capacity in August. Passenger capacity increase of 5.5% year-over-year and was driven by strong growth in the international market.Industrials Why are revenue passenger miles important?

Revenue passenger miles (or RPM) measures demand for air transport. It’s calculated as the number of revenue passengers multiplied by the total distance traveled.

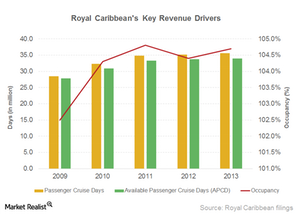

Key metrics to measure Royal Caribbean’s revenue performance

Now let’s look at certain key operating metrics used in the cruising industry to evaluate operational performance.Industrials Must-know: External factors that influence the airline industry

The airline industry has contributed to the globalization of the world economy. It connects buyers and sellers. It also transports goods across nations. It breaks the barrier of distance and time. The industry’s future looks bright. Travel expenditure in the U.S. is expected to grow by 4.3% in 2014 and 5.1% in 2015.Industrials Why political and legal factors impact the airline industry

The airline industry is widely impacted by regulations and restrictions related to international trade, tax policy, and competition. It’s also impacted by issues like war, terrorism, and the outbreak of diseases—such as Ebola. These issues are political. As a result, they require government intervention.

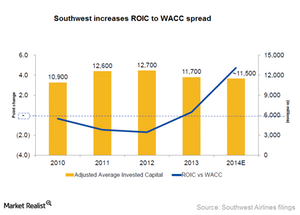

Southwest records highest return on invested capital since 1981

With the entry into international markets, Southwest’s growth prospects improved substantially, more than doubling its share price.

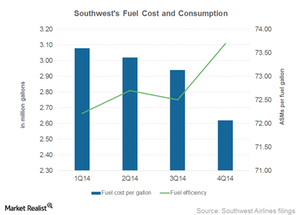

Efficiency, lower fuel costs reduce Southwest’s unit cost by 4%

Southwest Airlines enjoyed a decrease in its operating expenses from $4,042 million in 4Q13 to $4,007 million in 4Q14.

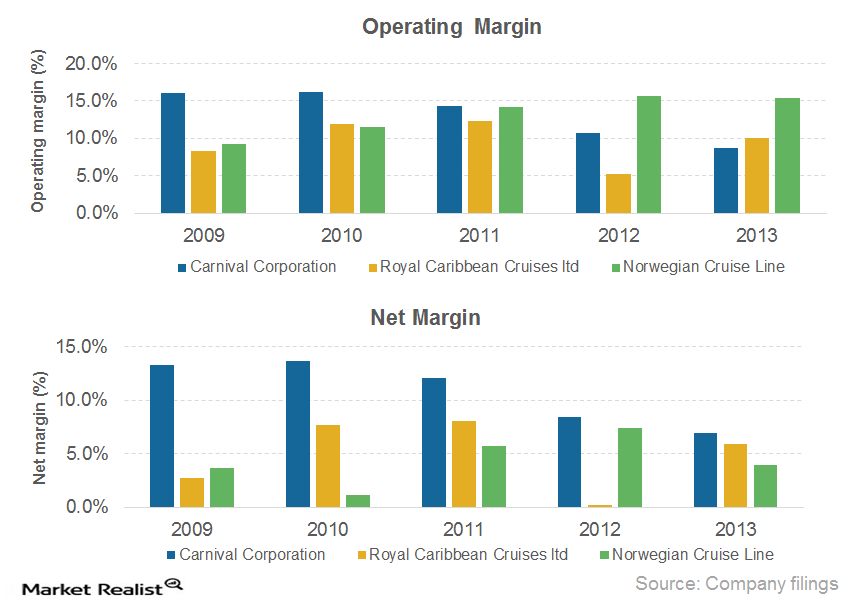

Comparing the major cruise lines’ operating and net margins

Among the three major competitors in the cruise industry, Royal Caribbean (RCL) had the highest operating margin in 2013.

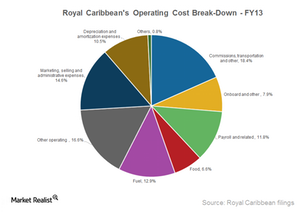

Breaking down Royal Caribbean’s operating costs

Costs directly related to operating a cruise ship comprise ~74% of Royal Caribbean’s (RCL) total operating costs.

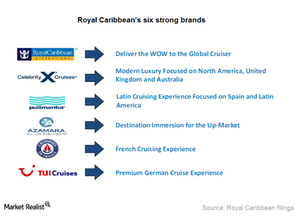

Royal Caribbean tailors brands for specific international markets

Apart from operating the largest contemporary global brand, Royal Caribbean offers five additional brands targeting specific markets.

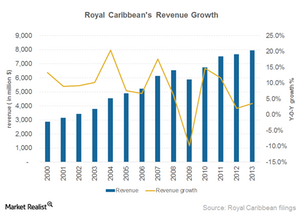

A closer look at Royal Caribbean’s revenue sources and growth

Royal Caribbean (RCL) derives revenue from two sources: passenger ticket revenue and onboard and other revenue.

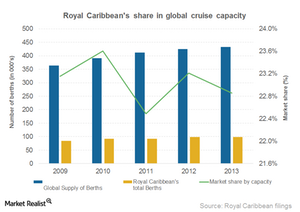

Overview: Royal Caribbean Cruises, the 2nd largest cruise operator

Royal Caribbean Cruises, founded in 1968 and headquartered in Miami, Florida, is the world’s second largest cruise company.

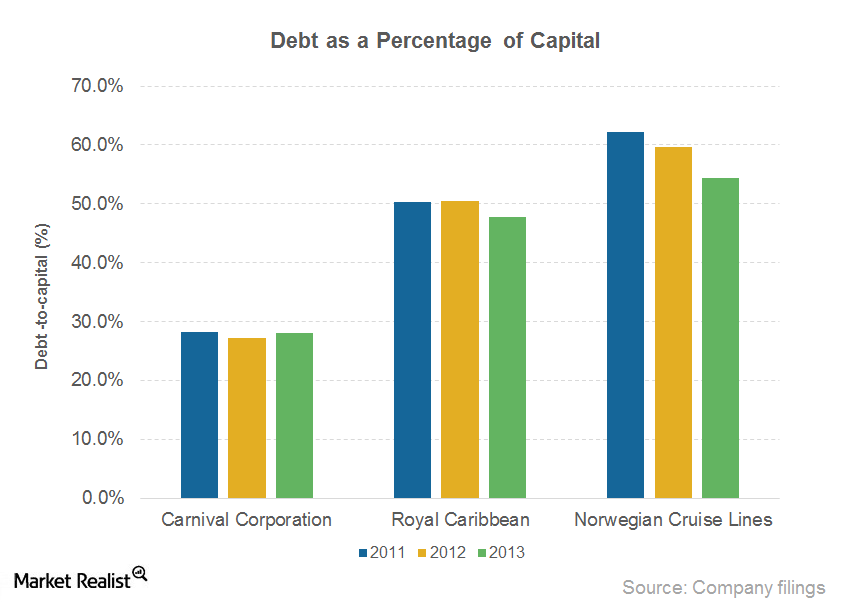

Carnival stays competitive with strong financial position

Carnival has a stronger financial position than its peers. It maintained a very low debt-to-capital ratio of 28% in 2013 and just 27% in 2014.