Gol’s increased operating cash flow boosts higher free cash flow

Gol’s financial assets decreased in 3Q14, but its cash balance increased to 1,942 million real from 1,636 million real in FY13.

Nov. 20 2020, Updated 4:45 p.m. ET

Liquidity

A high amount of debt may result in a reduced cost of capital, but companies also require strong liquidity to manage the payment of fixed commitments. Gol has improved its liquidity over the years, as its cash and cash equivalents (including financial assets) increased from 1,423 million real in FY09 to 2,791 million real in FY13. This equates to a four-year compounded annual growth rate (or CAGR) of 18%.

However, Gol’s financial assets decreased in 3Q14, but its cash balance increased to 1,942 million real from 1,636 million real in FY13. Gol’s target is to maintain cash and cash equivalent as a percentage of revenue at 25%.

Increased operational cash flow

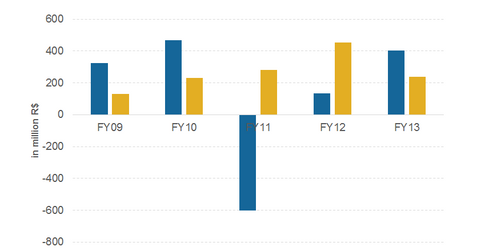

Higher cash flow from operations supported the increased cash balance. Cash from operations has increased to 403.9 million real in FY13 from 133.3 million real in FY12. Because Gol is cutting capacity to match the demand, capital expenditures decreased by ~48% to 238 million real in FY13 from 454 million real in FY12. Both of these factors led to an increase in free cash flow. Calculated as operating cash flow minus capital expenditure, free cash flow turned positive in FY13 to 166 million real, compared to -321 million real in FY12.

The Brazil Small-Cap ETF (BRF) holds 1.57% in Gol, the Brazil Consumer ETF (BRAQ) holds 1.20%, and the Guggenheim BRIC ETF (EEB) holds 0.05% in Gol. Plus, the Latin America Small Cap Index ETF (LATM) holds 0.56%, and Guggenheim MSCI Emerging Markets Equal Weight ETF (EWEM) holds 0.14%.

The iShares Transportation Average ETF (IYT) and the SPDR S&P Transportation ETF (XTN) hold stock in major US airlines, including Delta (DAL), American (AAL), United (UAL), Southwest (LUV), and JetBlue (JBLU).