Suncor Energy Inc

Latest Suncor Energy Inc News and Updates

What Are the Best Canadian Energy Stocks to Buy in September?

Energy prices are expected to rise more in 2021. What are the best Canadian energy stocks that you can buy in September?

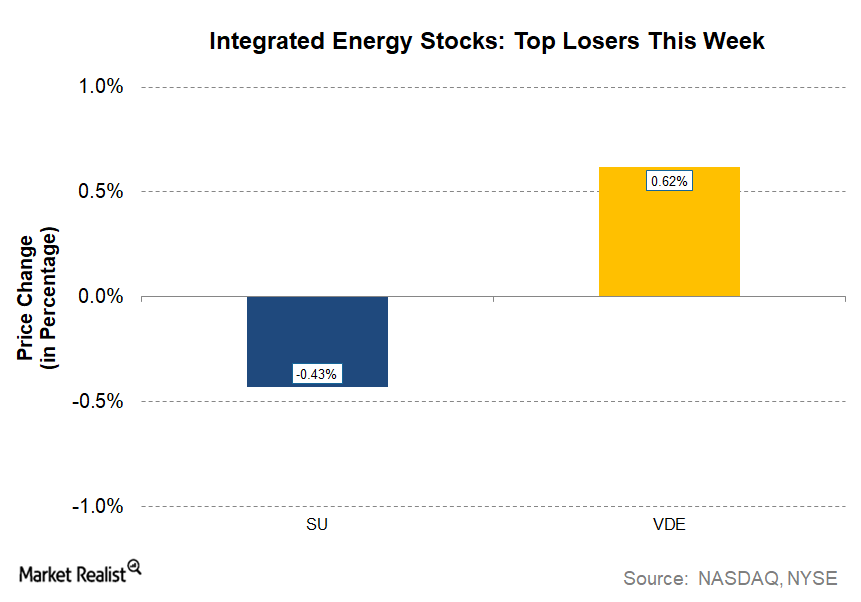

Suncor Energy: The Only Integrated Energy Loser This Week

Suncor Energy (SU) is the only losing stock in the current week from the integrated energy sector. It fell from last week’s close of $34.67 to $34.52 on October 11, 2017.

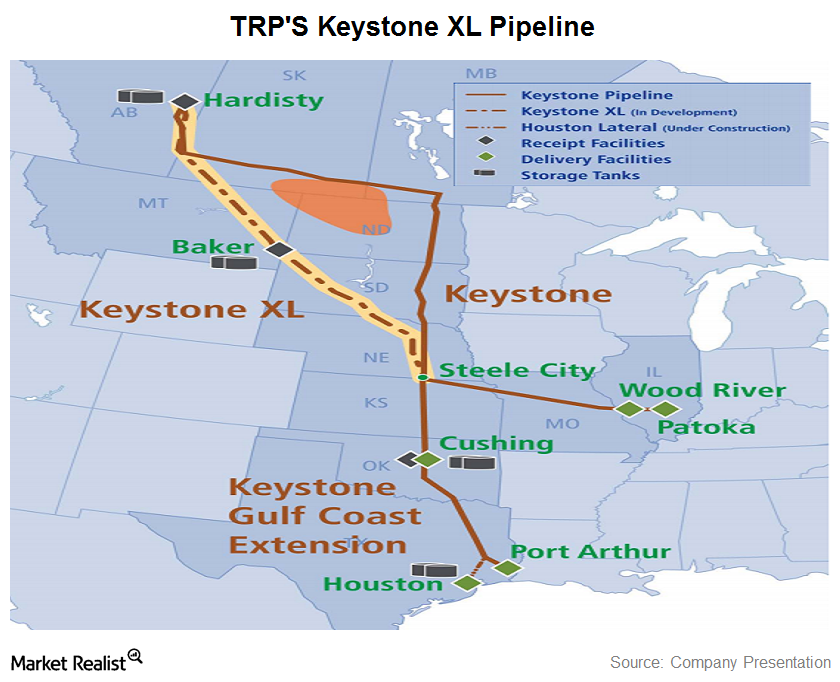

TransCanada’s controversial Keystone XL Pipeline project

The Keystone XL Pipeline project is a proposed 1,179-mile pipeline. It begins in Alberta, Canada and extends south to join the existing Keystone Pipeline in Steele City, Nebraska.

Is Suncor Energy Stock a ‘Buy’ amid Weak Energy Prices?

Suncor Energy (NYSE:SU) stock has fallen 47% year-to-date. Weak crude oil prices have taken a toll on energy companies’ stock prices.

How Does the Oil Price Crash Impact Warren Buffett?

For the first time, WTI crude prices fell into the negative zone during trade on Monday. Warren Buffett invested in Occidental Petroleum last year.

Chevron: Is It a Good Time to Invest in the Stock?

Currently, Chevron stock trades at 18.5x its 2019 forward EPS and at 17.2x its 2020 forward EPS. The stock is higher than most of its peers.

ExxonMobil Stock: JPMorgan Chase Cut Its Target Price

ExxonMobil’s (XOM) earnings fell in the second quarter. After the earnings, JPMorgan Chase cut its target price on ExxonMobil stock from $85 to $83.

BP’s Earnings Beat Analysts’ Expectations

BP (BP) reported its second-quarter results today. Its earnings per American depositary share of $0.84 beat analysts’ estimate by about 7%.

Suncor’s Earnings Rise but Miss Estimate in Q2

Suncor Energy (SU) posted its second-quarter earnings results on July 24. In the quarter, its revenue missed Wall Street’s estimate by 4%.

ExxonMobil Tops the Charts with Strong Financials

ExxonMobil (XOM) has the lowest percentage of debt in its capital structure compared to its peers. In the first quarter, ExxonMobil’s total debt-to-capital ratio stood at 17%.

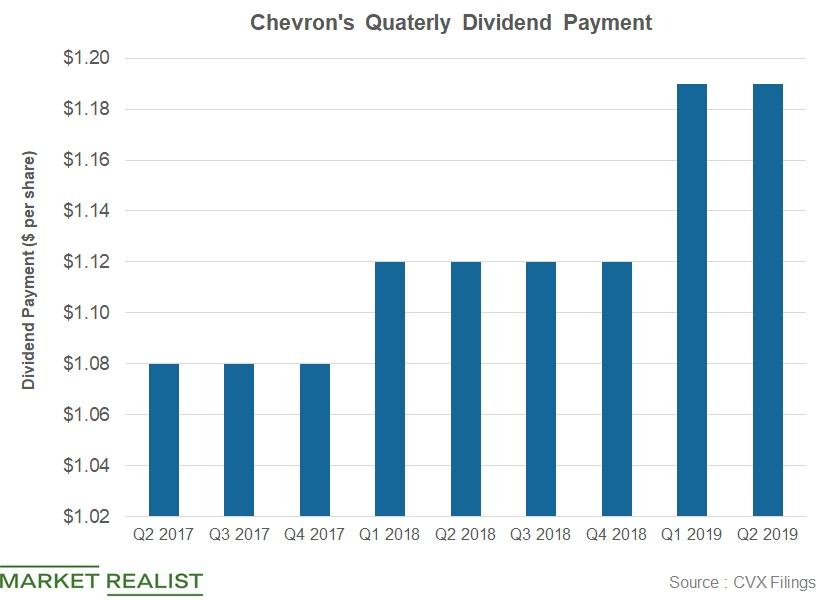

How Will Chevon’s Dividend Payment Trend in Q2?

Chevron (CVX) released its first-quarter earnings on April 26. The company paid $2.2 billion in dividends in the first quarter.

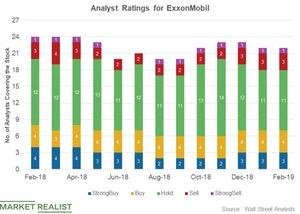

ExxonMobil: Analysts’ Recommendations

In the fourth quarter, ExxonMobil’s earnings rose and beat the estimates. ExxonMobil continued to take advantage of its integrated business model.

Chevron: Analysts Expect Higher Q3 Earnings

Chevron (CVX) is expected to post its third-quarter results on November 2. Chevron is expected to post an EPS of $2.1 in the third quarter.

Integrated Energy Stocks: The Top Eight Dividend Yielders

In this series, we’ll look at eight integrated energy stocks and rank them on dividend yields. Royal Dutch Shell (RDS.A) holds the top spot.

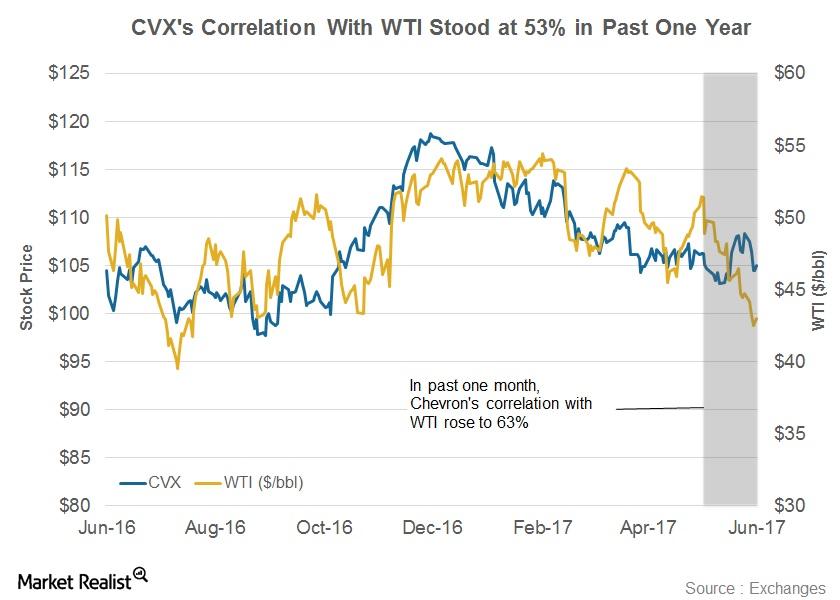

Correlation of Chevron Stock with WTI Crude Oil

The correlation coefficient of Chevron (CVX) versus WTI stood at 0.53 in the last one-year period.

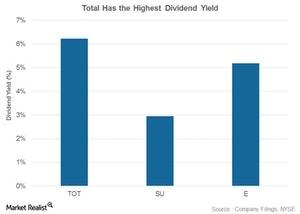

TOT, SU, E, and PBR: Comparing Their Dividend Yields

Total (TOT), Suncor Energy (SU), ENI (E), and Petrobras (PBR) have provided steady returns to their shareholders in the form of dividends.

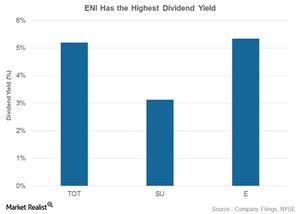

TOT, SU, E, PBR: Who Has Highest Dividend Yield?

Total (TOT), Suncor Energy (SU), ENI (E), and Petrobras (PBR) have consistently given returns to shareholders in the form of dividends.

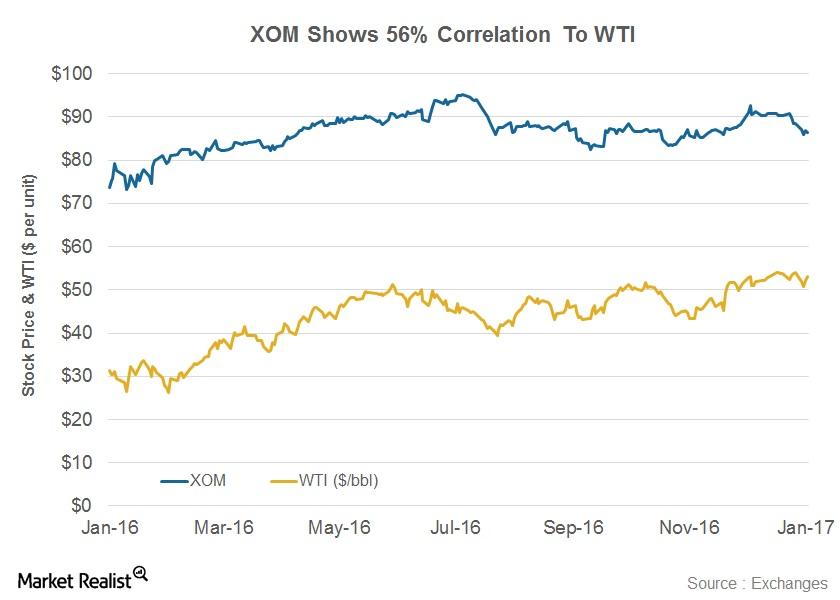

What’s the Correlation Between XOM and WTI?

Integrated energy companies such as ExxonMobil are affected to varying degrees by volatility in crude oil prices. XOM’s correlation coefficient with WTI stands at 0.56.

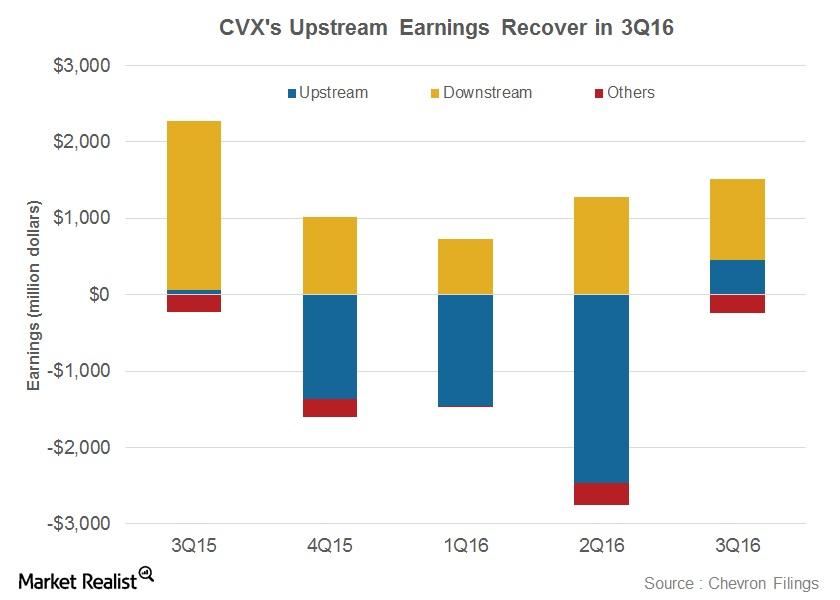

Chevron’s 4Q16 Segmental Outlook: Is It Positive?

Chevron’s (CVX) Downstream segment saw its earnings fall 52% YoY to ~$1.1 billion in 3Q16.

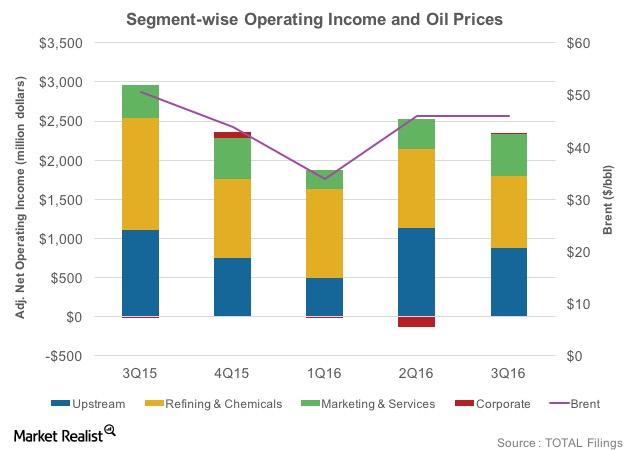

Analyzing Total’s Segmental Earnings in 3Q16

Total’s net adjusted operating earnings from the Upstream segment fell 21% from 3Q15 to $877 million in 3Q16 due to lower crude oil prices.

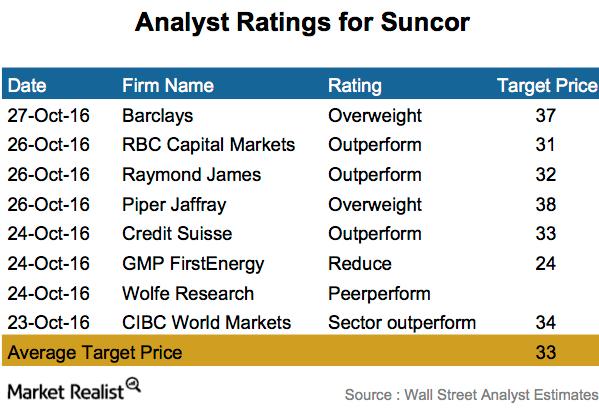

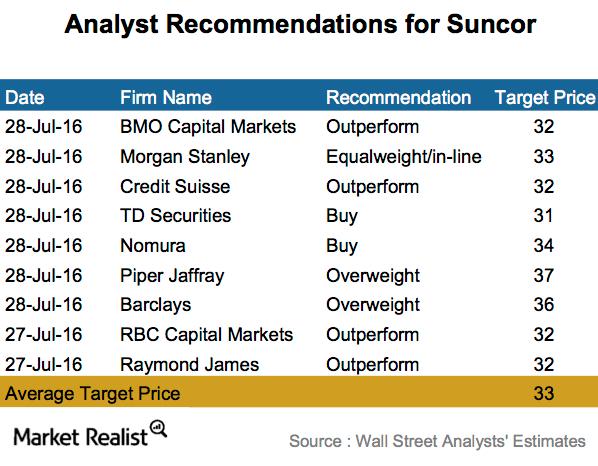

Suncor: How Analysts Are Rating the Stock after Earnings

An analyst survey shows that six out of eight companies surveyed rated Suncor Energy (SU) an “overweight” or “outperform.”

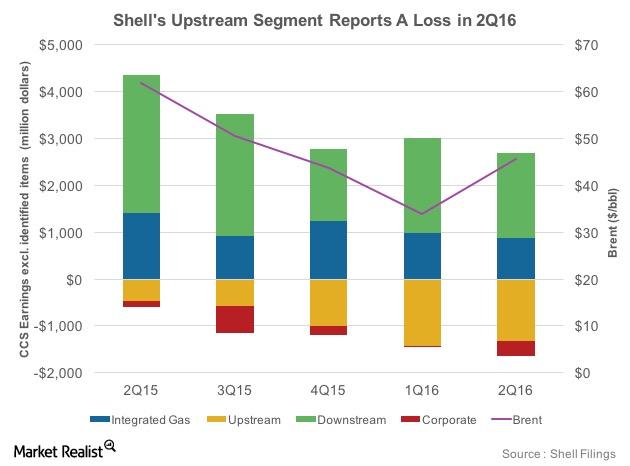

Shell’s Segments: Upstream Continues to Report Losses

Falling crude oil prices have changed the segmental dynamics within integrated energy companies such as Royal Dutch Shell (RDS.A).

Majority of Analysts Rate Suncor a ‘Buy’ after 2Q16 Earnings

Analyst surveys show that eight of the nine analysts surveyed rated Suncor (SU) a “buy,” “overweight,” or “outperform.”

What Does Suncor’s Short Interest Analysis Reveal?

Suncor Energy (SU) has witnessed a 34% rise in its short interest since April 2016.

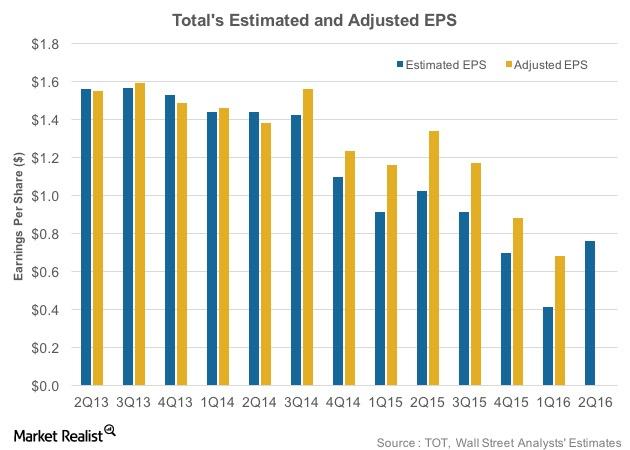

Total’s 2Q16 Earnings Outlook: Will It Beat Estimates?

Total SA (TOT) is expected to post its 2Q16 results on July 28, 2016. In 1Q16, TOT’s revenues of $27.5 billion surpassed Wall Street estimates.

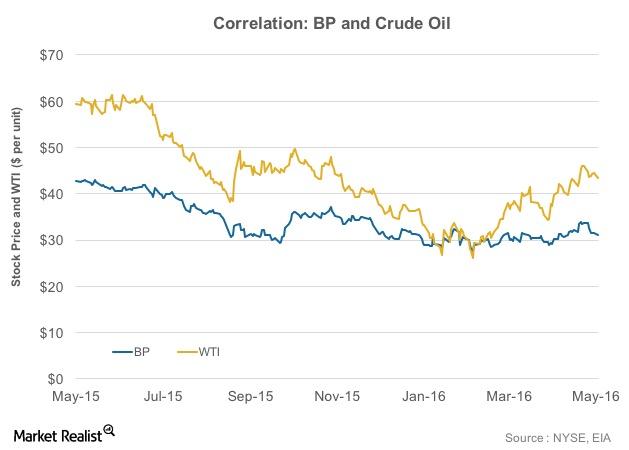

How Do BP’s Stock and Crude Oil Prices Correlate?

To what degree are integrated energy companies such as BP affected by volatility in crude oil prices? This varies from company to company.

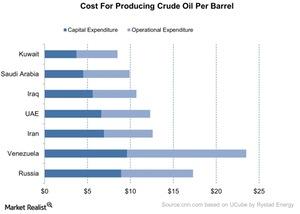

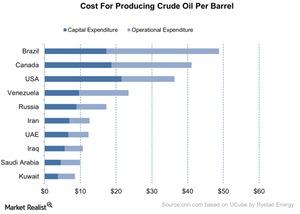

What’s the Break-Even Cost for the Top Oil Exporters?

Venezuela accounted for 17.5% of the world’s total proved crude oil reserves in 2014. BP (BP) conducted a study. It’s break-even cost is ~$23.50.

The Break-Even Costs of the World’s Top Oil Producers

Venezuela accounted for 17.5% of the world’s total proven crude oil reserve in 2014. According to a study by BP, Venezuela’s break-even cost is ~$23.5.

How Long Can the Price War Continue in Crude Oil?

According to data compiled by Rystad Energy, the cost of production per barrel of crude oil is $17.20 in Russia—compared to $9.90 in Saudi Arabia.

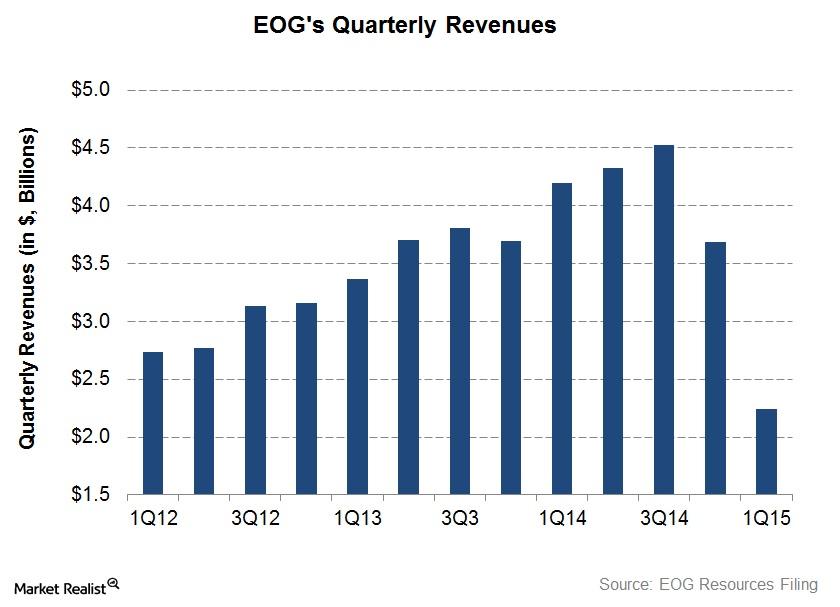

EOG Resources: Growing Revenue Is Battered by the Crude Oil Slump

EOG Resources’ 1Q15 adjusted revenue fell 39% quarter-over-quarter. This was mainly a result of the fall in crude oil and natural gas prices starting in 2H14.

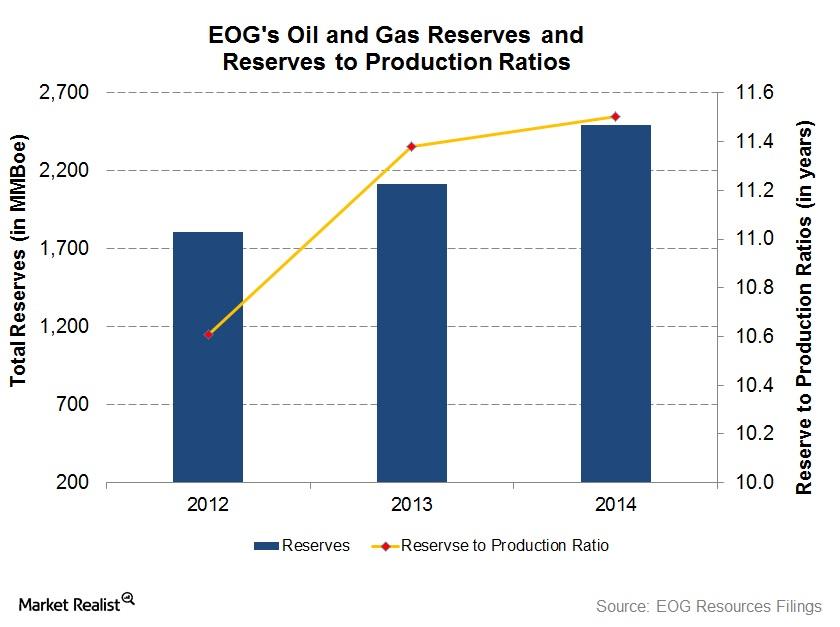

Growth in EOG Reserves Outpaces Production

EOG’s reserves-to-production ratio, or reserve life, increased from 10.6x in 2012 to 11.5x in 2014. It would take EOG 11.5 years to deplete its proved reserves at its 2014 production rate.

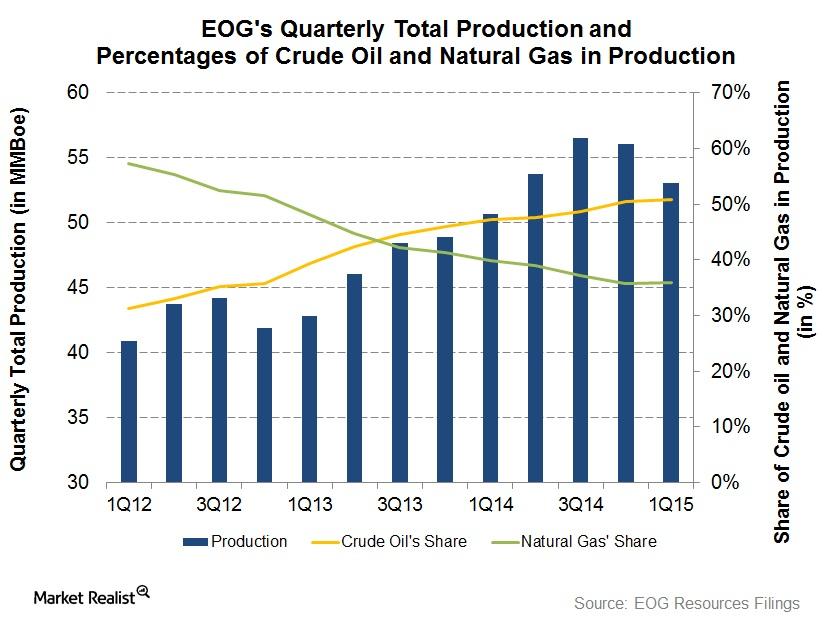

EOG Production Adjusts to Weak Energy Prices

On the heels of weak energy prices, EOG Resources wants to maintain steady production. This may result in flat production growth in 2015.

Key challenges facing the Canadian economy

One of the challenges facing the Canadian economy is a lack diversification. More than 70% of the TSX Composite Index is made up of only three sectors.