Steel Dynamics Inc

Latest Steel Dynamics Inc News and Updates

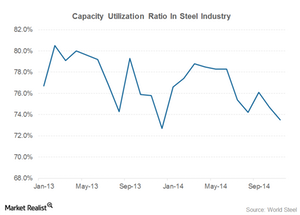

Why the capacity utilization rate came down at Steel Dynamics

One of the key metrics in the steel industry is the capacity utilization rate. It represents the actual production compared to the maximum possible production.

Analysts Still Hate Steel Stocks despite Bumper Earnings

Overall, it has been a mixed earnings season for steel companies.

What Should You Expect from U.S. Steel’s 1Q18 Earnings?

1Q18 earnings season is in full swing. So what should you expect for U.S. Steel?

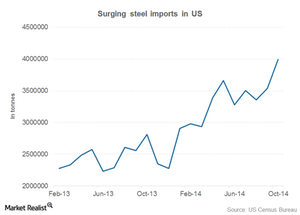

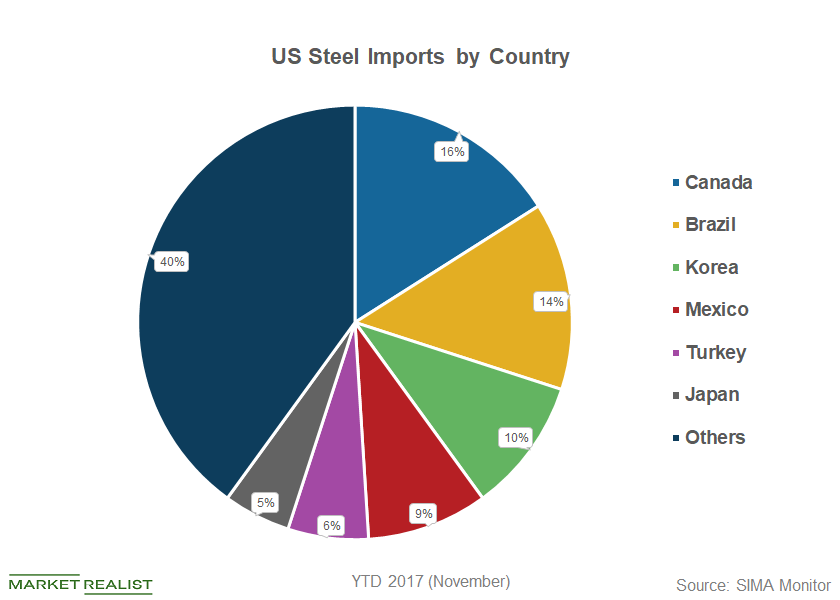

Steel Imports Reach Record Levels In October

Compared to the first ten months of last year, steel imports are up by more than 35%. This is an alarming situation.

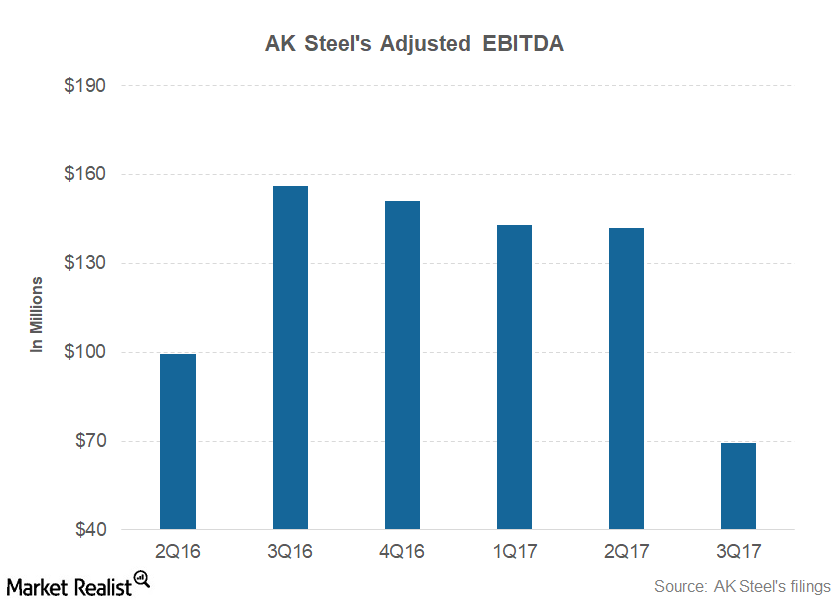

What Weighed down AK Steel’s 3Q17 Performance?

AK Steel (AKS) reported adjusted EBITDA of $69.2 million in 3Q17, compared with $142 million in 2Q17 and $157 million in 3Q16.

Why US Steelmakers’ Party Might Not Last Long

Due to trade cases, the US steel industry has turned into a virtual island largely immune to global steel prices—at least in the short term.

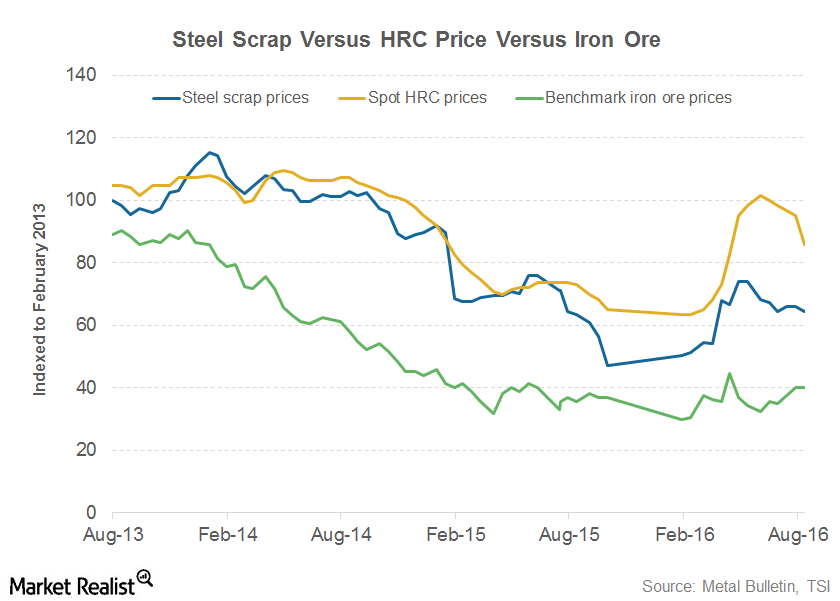

Iron Ore and Steel Scrap Prices Diverge after Section 232 Tariffs

Iron ore and steel scrap are the key steelmaking raw materials. In the United States, steel prices and scrap prices tend to move in tandem.

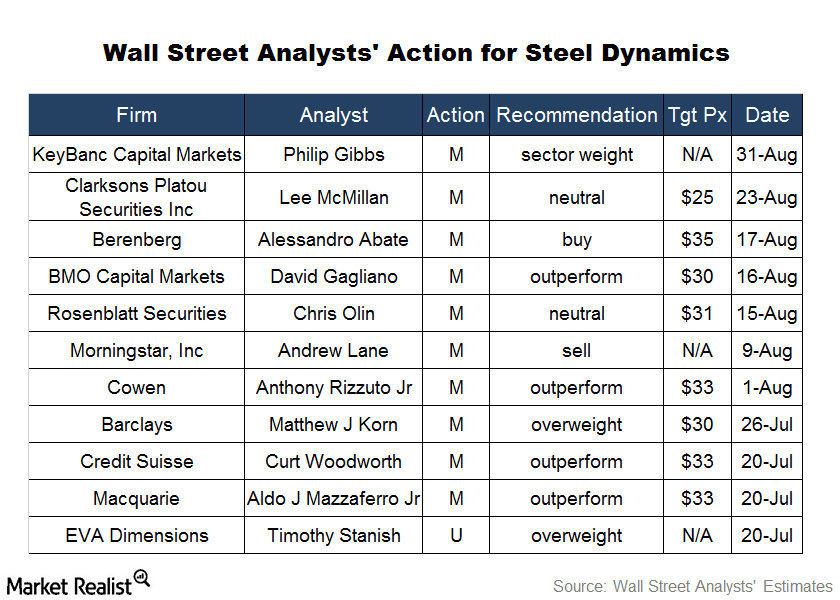

Why Most Analysts Have Rated Steel Dynamics as a ‘Buy’

Steel Dynamics has one of the most diversified end-market exposures compared to other steel companies.

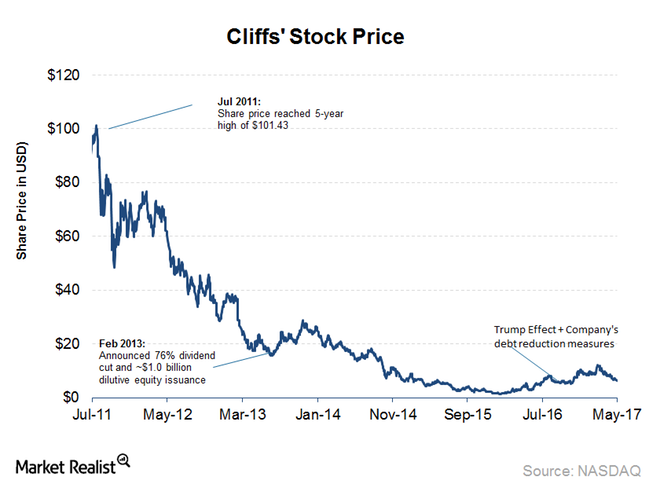

What to Expect from Cliffs Natural Resources’ 2Q17 Earnings

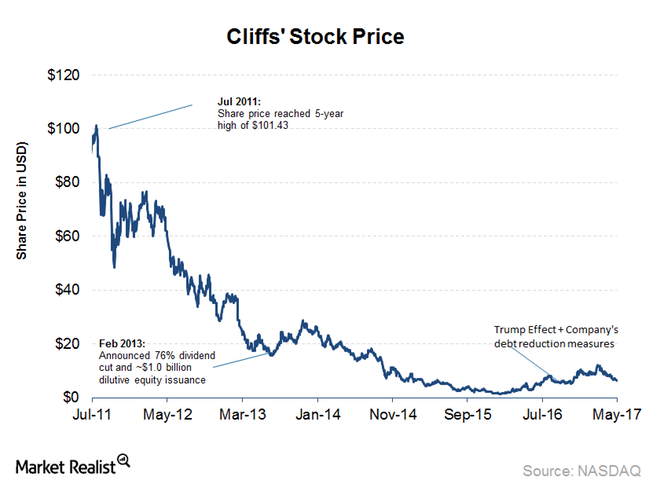

In this series, we’ll see what investors could expect from Cliffs Natural Resources’ (CLF) 2Q17 earnings report. CLF stock has gained 23% in the last 15 trading days.

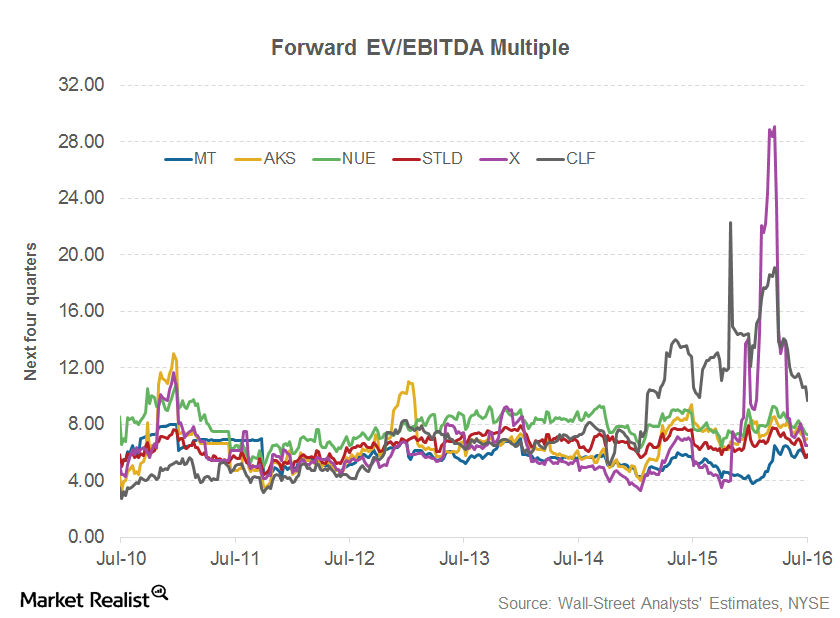

Could There Be More Upside to Cliffs Natural Resources’ Valuation?

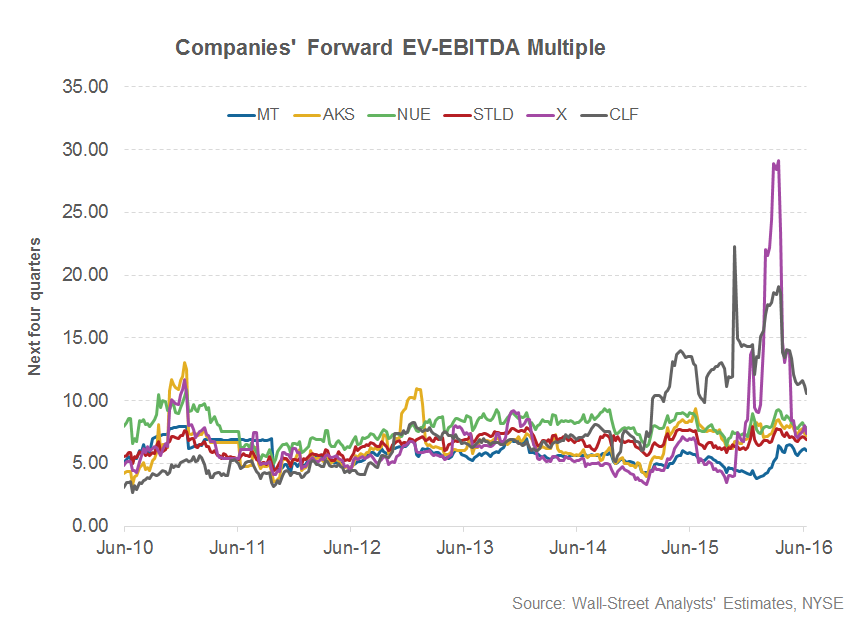

For companies in cyclical industries such as steel and mining, the EV-to-EBITDA multiple is the preferred valuation metric.

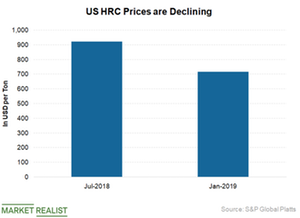

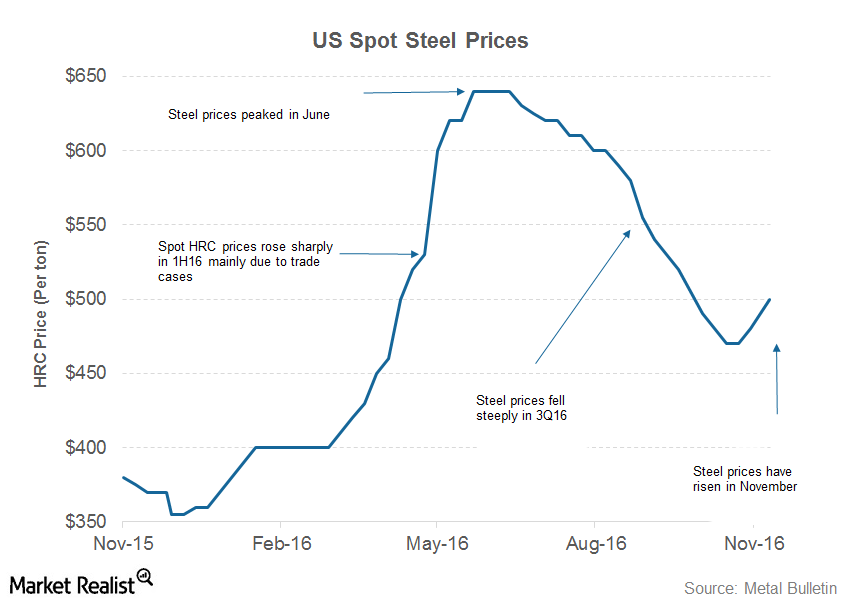

Could Steel Scrap Prices Follow Steel Prices Lower?

Steel scrap prices could follow steel prices lower. Steel mills might negotiate hard with scrap suppliers as steel prices pare some of their 2016 gains.

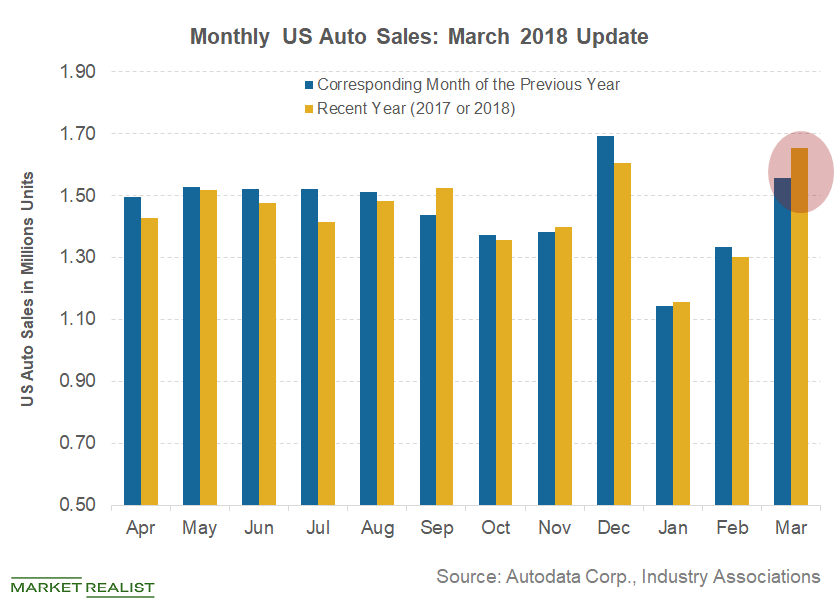

What Leading Indicators Tell Us about US Steel Demand

The construction sector is the largest steel user. In the residential construction sector, US housing starts rose to an 11-year high in May.

Despite Gloomy Outlook, It’s Not the End of Road for Steel Stocks

US steelmakers such as U.S. Steel Corporation (X), AK Steel (AKS), and Nucor (NUE) stand to gain from duties against imported steel products, as they help them protect their turf from foreign steelmakers.

Steel Industry’s Capacity Utilization Ratio Is At A 1-Year Low

The capacity utilization ratio is a key determinant of steel companies’ profitability. As a result, it’s a key metric that steel play investors should actively track.

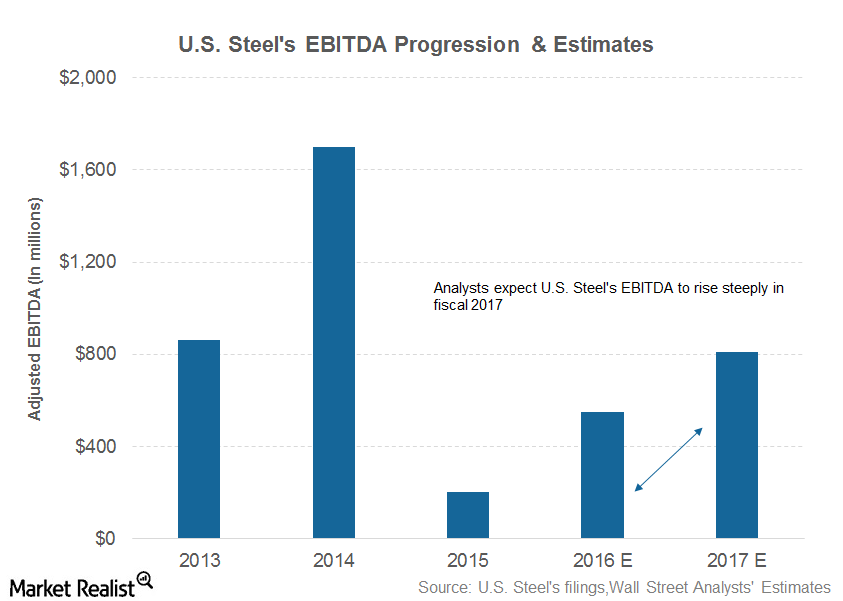

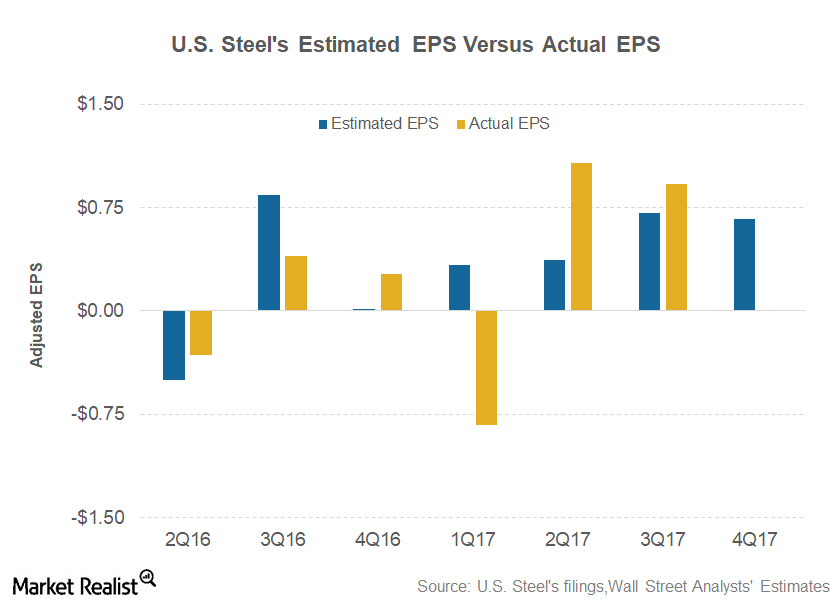

2Q16 Earnings Call: Will U.S. Steel Raise Its 2016 Guidance?

One would expect U.S. Steel to increase its 2016 guidance during its 2Q16 earnings call. However, U.S. Steel might be conservative.

US Steel Imports Fell: Don’t Celebrate Just Yet!

Preliminary data showed that US steel imports fell sharply in August after the spike in July. However, falling imports haven’t restored investor sentiments.

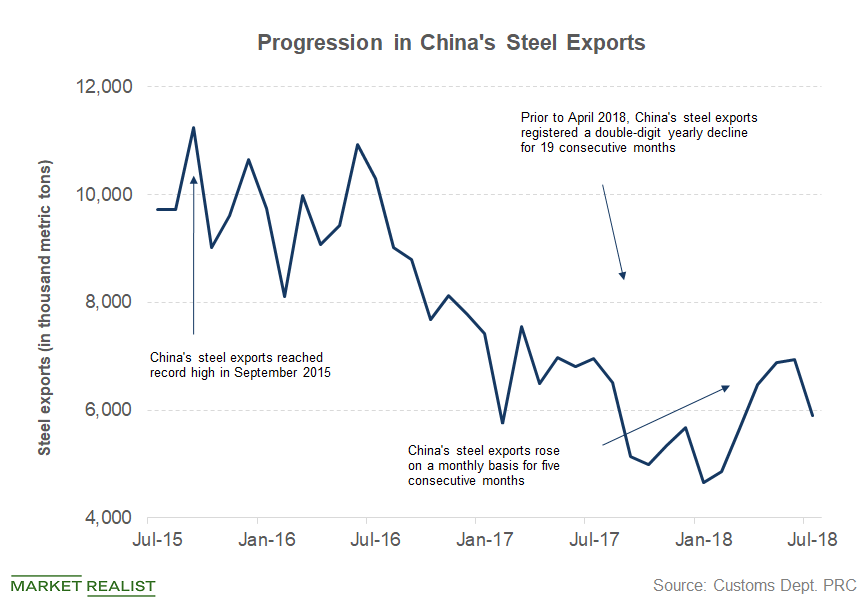

Are Global Macros Supportive of US Steel Stocks?

Although US steel producers have trade protections in the form of the Section 232 tariffs, the global steel pricing environment still affects US steel prices.

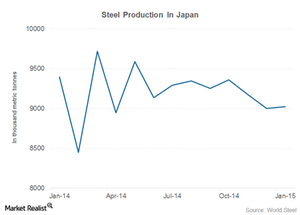

Can Abenomics Address The Japanese Steel Industry?

The Japanese steel industry also benefited from Abenomics. Steel production picked up as a result of the policies. A weaker yen also benefited Japan.

Should US Steel Mills Halt Production amid Coronavirus?

The AISI asked the Trump administration to classify the steel industry as “essential.” The industry wants to continue production despite the coronavirus.

Could US Steel Stocks Be a Contra Play in 2020?

Overall, 2019 was a mixed year for US steel stocks. However, due to the rally in the fourth quarter, most stocks managed to close the year with gains.

A Look at Analysts’ Top 5 US Steel Stocks

In this overview article, we’ll see how analysts are rating the leading steel stocks, and we’ll also compare performance from the top five steel companies.

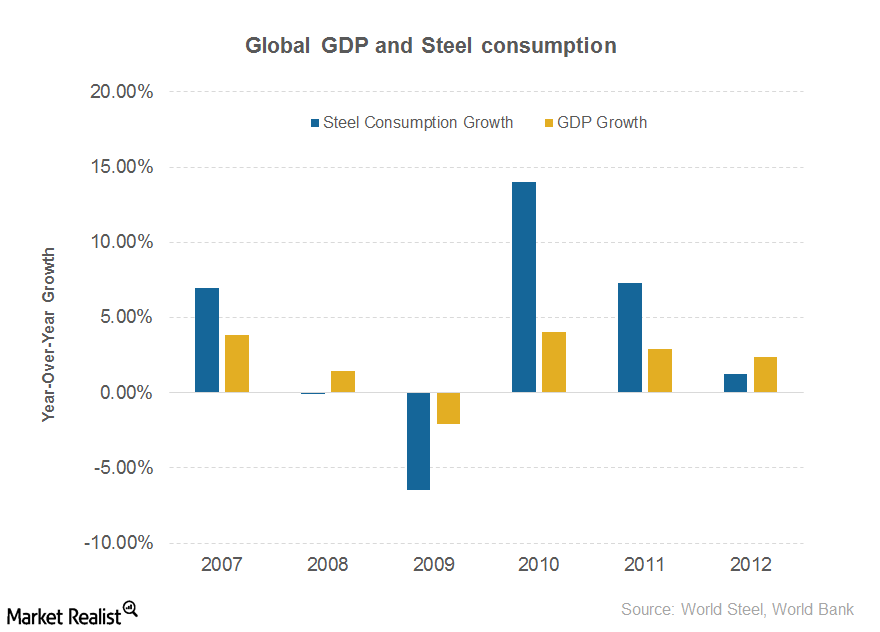

How Investors Can Play The Steel Industry

Steel is a cyclical industry and is dependent on the growth in economic activity. In this series, we’ll learn key facts related to the steel industry and how investors can play the steel industry.

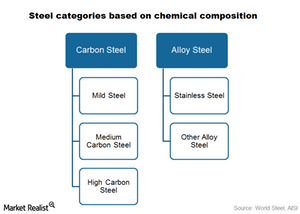

Key Facts Investors Need To Know About Steel

Steel can be classified into several categories. Various types of steel products are based on chemical composition. Types of steel are made by altering the chemical properties of steel.

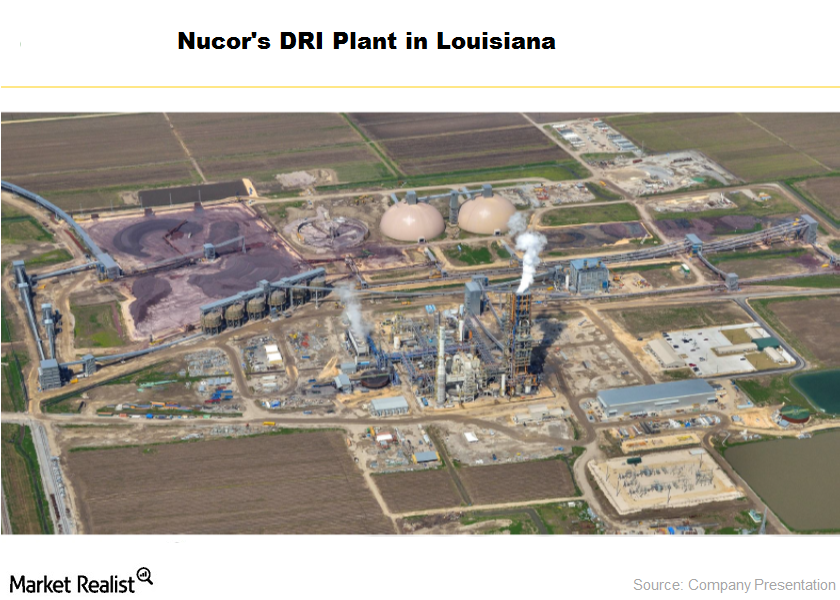

Why mini mills are changing their raw material strategy

Along with steel scrap, EAF can also produce steel through direct reduced iron (or DRI). DRI is produced by heating iron ore. STLD and NUE increased their focus on DRI.Materials Why Nucor’s Louisiana DRI plant could be a game changer

Nucor has produced 1.2 million tons of DRI this year at the Louisiana plant and expects to produce another 0.5 million tons in the next quarter.Materials Must-know: Understanding the major markets for AK Steel

AK Steel (AKS) gets most of its revenues from the U.S. For the past three years, more than 85% of its sales have come from the U.S. This makes AK Steel more exposed to the domestic market’s dynamics than global factors.

Trump Steel Tariffs: Will History Repeat Itself?

Will President Trump lift the steel tariffs like President Bush? President Trump’s steel tariffs will likely remain due to his support base.

US Steel Companies’ Guidance Opens a Can of Worms

This week, three leading US steel companies provided their third-quarter earnings guidances. All these guidances were lower than analysts were expecting.

Is Cleveland Cliffs’ HBI Plant an ‘Underappreciated’ Opportunity?

After Cleveland-Cliffs’s (CLF) debt repayment concerns were taken care of, it started refocusing on growth.

US Steel Companies Keep Fingers Crossed, Key Deadline Looms

U.S. Steel Corporation, AK Steel, Nucor, and Steel Dynamics will probably keep their fingers crossed as the “final” deadline approaches.

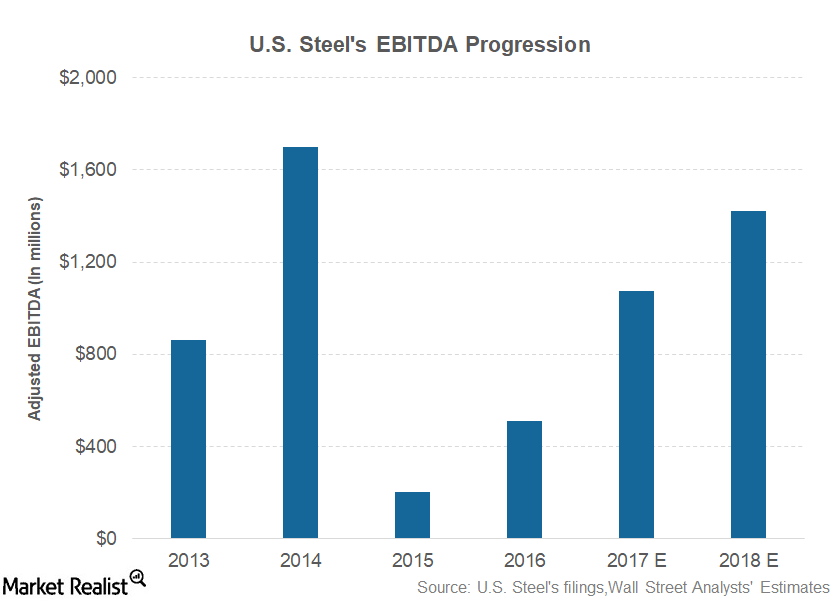

Analyzing U.S. Steel Corporation’s 4Q17 Earnings Call

During the 4Q17 earnings call, analysts will carefully watch U.S. Steel Corporation’s 2018 guidance.

Can U.S. Steel Corporation Continue to Fly High?

U.S. Steel Corporation (X) is scheduled to release its 4Q17 financial results on January 31, 2018. U.S. Steel Corporation closed 2017 with gains of 6.6%.

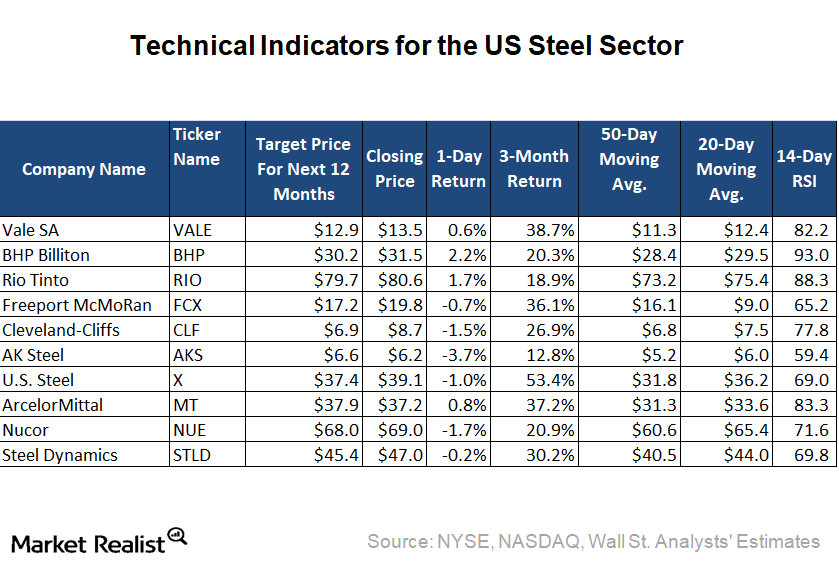

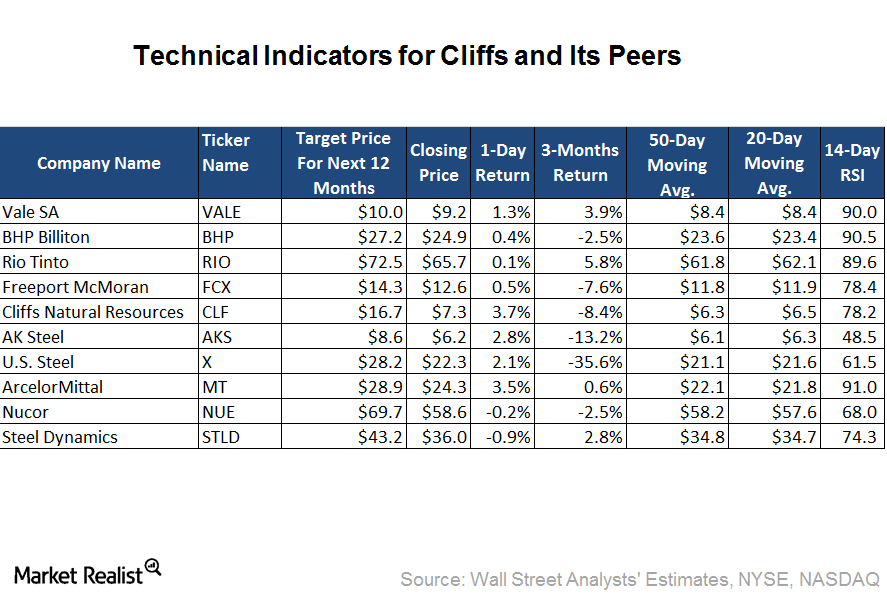

What Technical Indicators Say about Cliffs and Peers

Based on its January 12, 2018, closing price, Cleveland-Cliffs is trading ~28% above its 50-day moving average and 15.4% above its 20-day moving average.

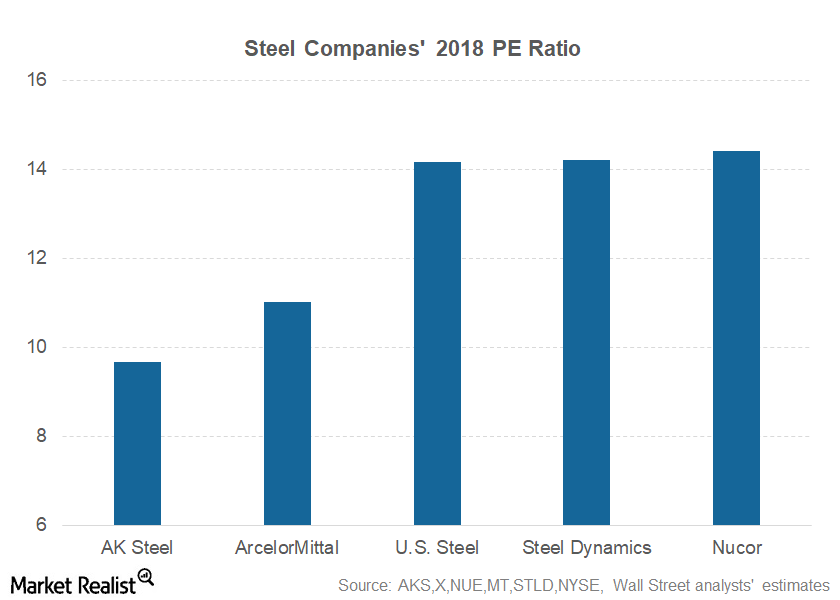

How Steel Companies’ PE Ratios Stack Up

AK Steel (AKS) has the lowest forward PE multiple of 9.7 among our select group of steel stocks.

After a Tough 2017, What Lies ahead for AK Steel in 2018?

While U.S. Steel shed ~26% of its market cap after its 1Q17 earnings miss, AK Steel investors were left poorer by 21% after AKS’s 3Q17 earnings miss.

A Look at Trends in US Steel Production

US steel production As US (DIA) (DOW) steel production is US steelmakers’ major revenue driver, it’s very important to track it. In this part, we’ll discuss domestic production and capacity utilization. According to the World Steel Association, the United States produced 7.1 million tons of steel in August 2017, an increase of 6.3% YoY (year-over-year). Production rose 5.6% in […]

These Variables Could Drive Cleveland-Cliffs Higher

After experiencing a great 2016, US steel stocks are having a tepid 2017.

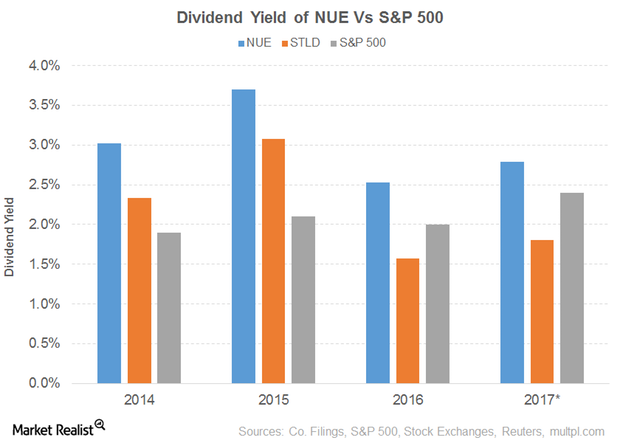

Dividend Yield of Nucor

Nucor’s (NUE) PE ratio of 21.8x is pitted against a sector average of 19.4x. The dividend yield of 1.5% is pitted against a sector average of 1.4%.

What Could Drive Cliffs Natural Resources’ US Volumes in 2H17

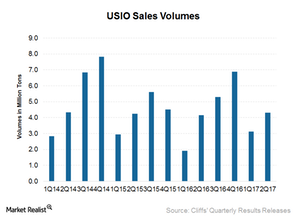

US iron ore (or USIO) is the main driver for Cliffs Natural Resources’ (CLF) top and bottom lines. The top line, in turn, is driven by volumes and realized prices.

CLF and Peers in Overbought Territory: What Triggered It?

Based on its June 12, 2017, closing price, Cliffs Natural Resources is trading 15.2% and 11.9% higher than its 50-day and 20-day moving averages, respectively.

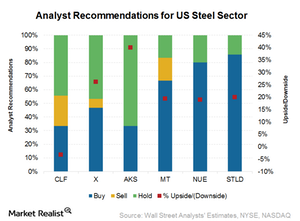

Jefferies Recommends a ‘Buy’ for CLF—What Do Other Analysts Think?

According to the consensus compiled by Thomson Reuters, 22% of the analysts covering Cliffs Natural Resources (CLF) recommended a “sell” for the stock, 33% recommend a “buy,” and 44% recommend a “hold” for the stock.

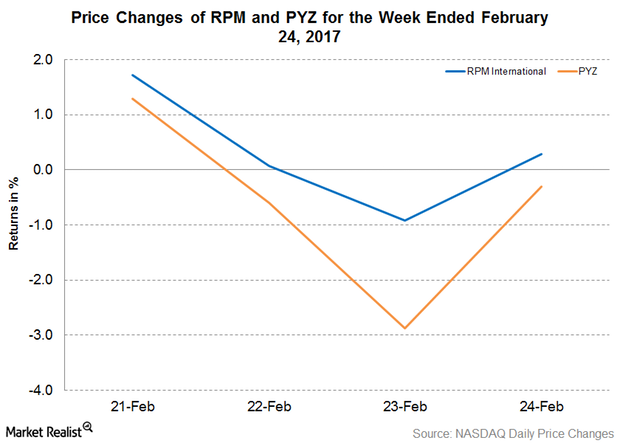

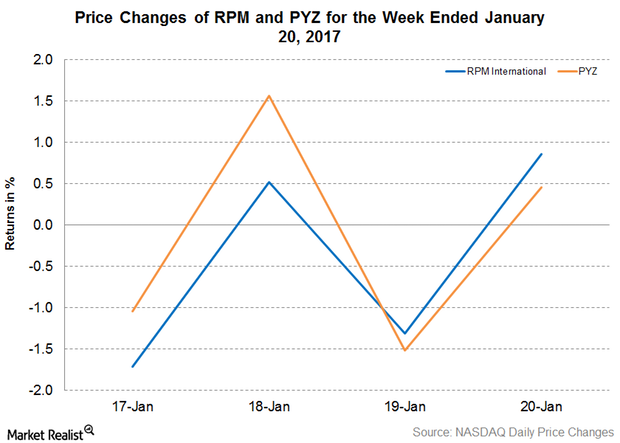

Ratner Leaves RPM International’s Board of Directors

On February 24, 2017, RPM International (RPM) announced that Charles Ratner would be retiring from RPM’s board of directors after serving the company for 12 years.

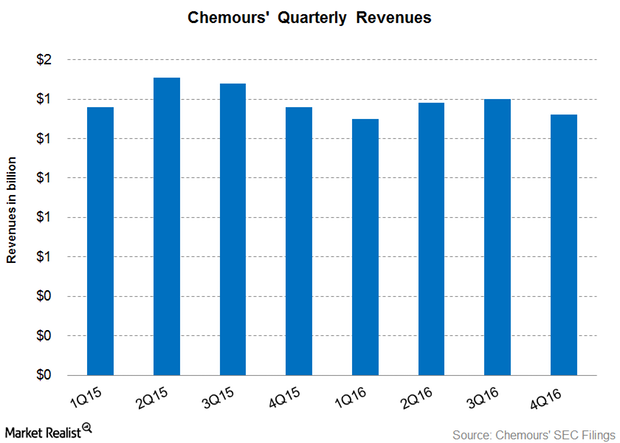

Chemours Beat Analysts’ 4Q16 Revenue Estimates

Chemours (CC) reported its 4Q16 results on February 15, 2017, after the markets closed. Chemours reported 4Q16 revenue of $1.32 billion.

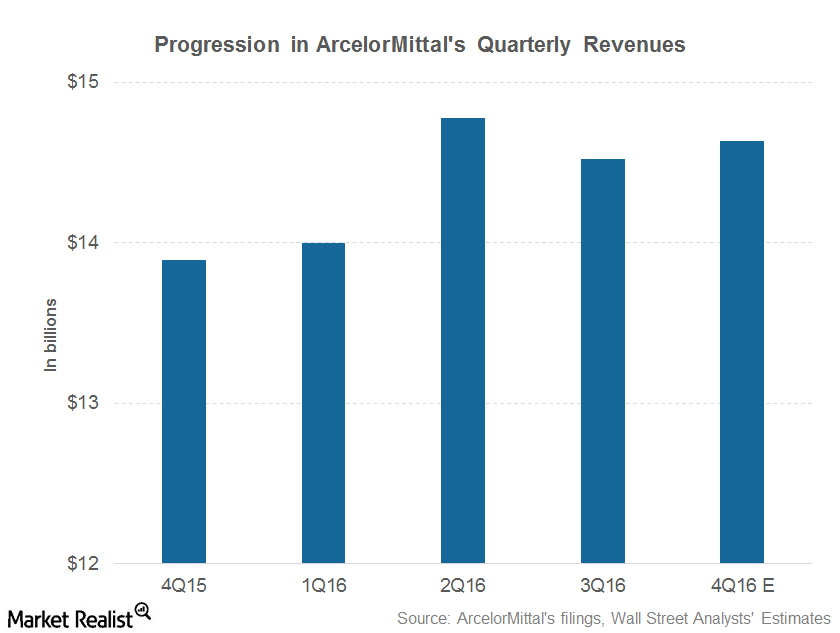

ArcelorMittal’s Expected 4Q16 Revenues: The Word on Wall Street

Analysts expect ArcelorMittal (MT) to post revenues of $14.6 billion in 4Q16. The company posted revenues of $14.5 billion in 3Q16 and $13.9 billion in 4Q15.

RPM International Has Acquired Prime Resins

On January 17, 2017, RPM International (RPM) announced that it has acquired Prime Resins. The acquisition will be integrated into RPM’s USL Group.

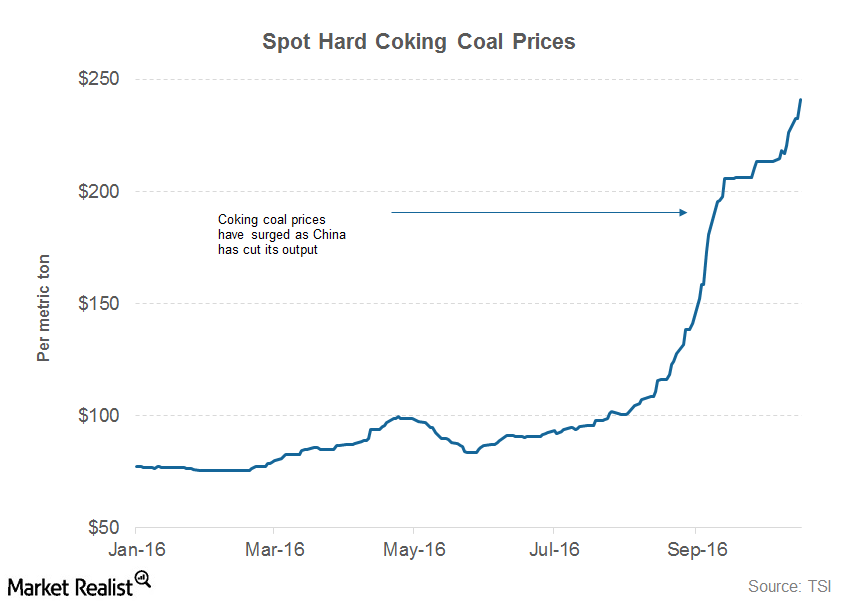

What Factors Are Supporting Steel Prices?

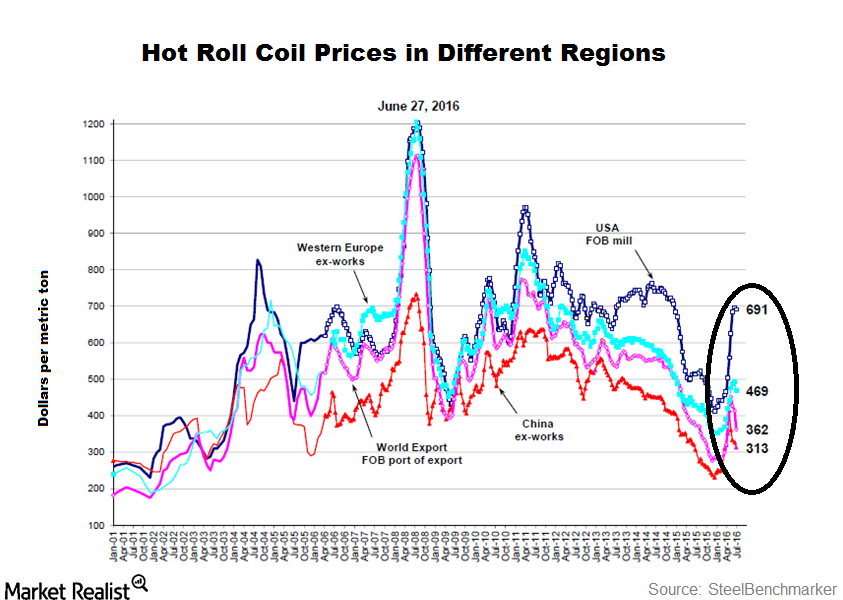

According to data compiled by Metal Bulletin, spot HRC (hot rolled coil) prices rose from $380 per short ton to $640 per short ton between January 2016 and June 2016.

Analyzing the Bullish Argument for U.S. Steel

The bulls and bears have their own sets of arguments about U.S. Steel. U.S. Steel (X) and AK Steel (AKS) mainly use iron ore as a raw material.

Why Janus Thinks Ignoring Inflation Is a Mistake

In this series, we’ll look at the Janus Asset Allocation team’s views on inflation, policy measures, and asset allocation (ITOT) (NEAR), given its assertion that inflation pressures are building.

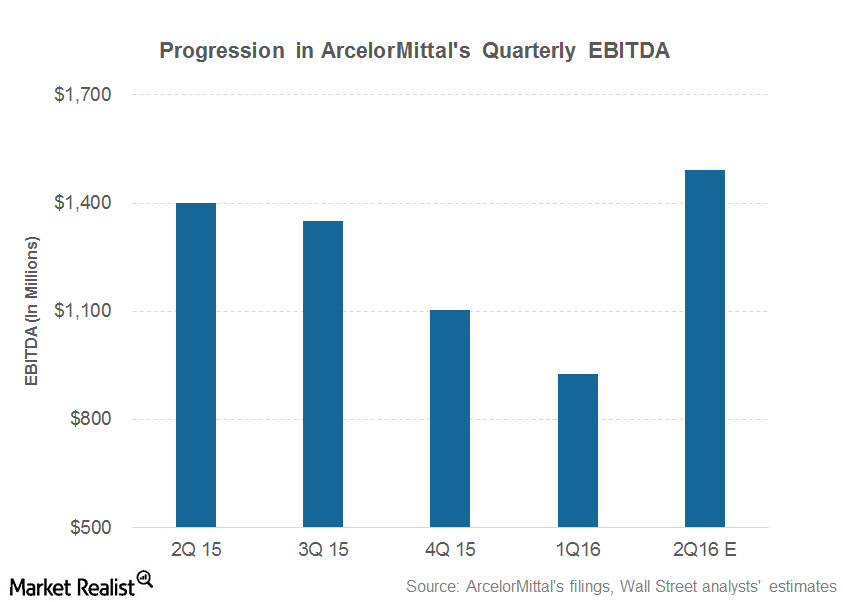

Are ArcelorMittal’s 2Q16 Earnings Estimates a Little Aggressive?

ArcelorMittal (MT) posted adjusted EBITDA of $927 million in 1Q16 and ~$1.4 million in 2Q15.

Is Cliffs’s Valuation Justified?

Cliffs Natural Resources (CLF) is trading at a forward EV/EBITDA multiple of 11.0x compared with its last five-year average of 8.0x.