ArcelorMittal’s Expected 4Q16 Revenues: The Word on Wall Street

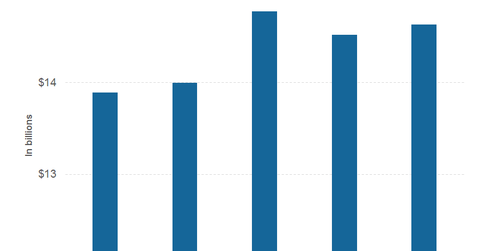

Analysts expect ArcelorMittal (MT) to post revenues of $14.6 billion in 4Q16. The company posted revenues of $14.5 billion in 3Q16 and $13.9 billion in 4Q15.

Feb. 6 2017, Updated 2:06 p.m. ET

ArcelorMittal’s expected 4Q16 revenues

According to data compiled by Thomson Reuters, analysts expect ArcelorMittal (MT) to post revenues of $14.6 billion in 4Q16. In contrast, the company posted revenues of $14.5 billion in 3Q16 and ~$13.9 billion in 4Q15. Analysts expect ArcelorMittal’s 4Q16 revenues to rise on a YoY (year-over-year) basis as well as a sequential quarterly basis.

It’s worth noting that steel companies’ revenues are basically a function of shipments and average selling prices. Shipments depend on end-user demand as well as import penetration.

Steel shipments

Together, Europe and NAFTA (North American Free Trade Agreement) account for ~75.0% of ArcelorMittal’s revenues. However, these two regions have opposing seasonalities in the fourth quarter. While shipments in the United States tend to fall in the fourth quarter, European shipments typically rise on a sequential basis in that quarter.

Primarily US-focused steel companies such as Nucor (NUE), Steel Dynamics (STLD), and AK Steel (AKS) reported sequential declines in their 4Q16 steel shipments. United States Steel’s (X) 4Q16 shipments were higher than 3Q16 on higher European shipments.

Average selling prices

According to data compiled by Metal Bulletin, in October 2016, US HRC (hot-rolled coil) prices fell to $470 per ton. However, we saw a significant recovery in prices in November 2016 after Donald Trump was elected. Spot HRC prices rose to $540 per ton that month. Steel prices continued their uptrend in December, and spot HRC prices ended 2016 at about $600 per ton.

While steel prices were volatile in the United States, European steel prices continued their uptrend in 4Q16. Higher steel prices in Europe should help MT offset lower pricing in its NAFTA segment.

In the next part of this series, we’ll take a look at analysts’ estimates for ArcelorMittal’s 4Q16 profitability.