PowerShares Dynamic Leisure & Entmnt ETF

Latest PowerShares Dynamic Leisure & Entmnt ETF News and Updates

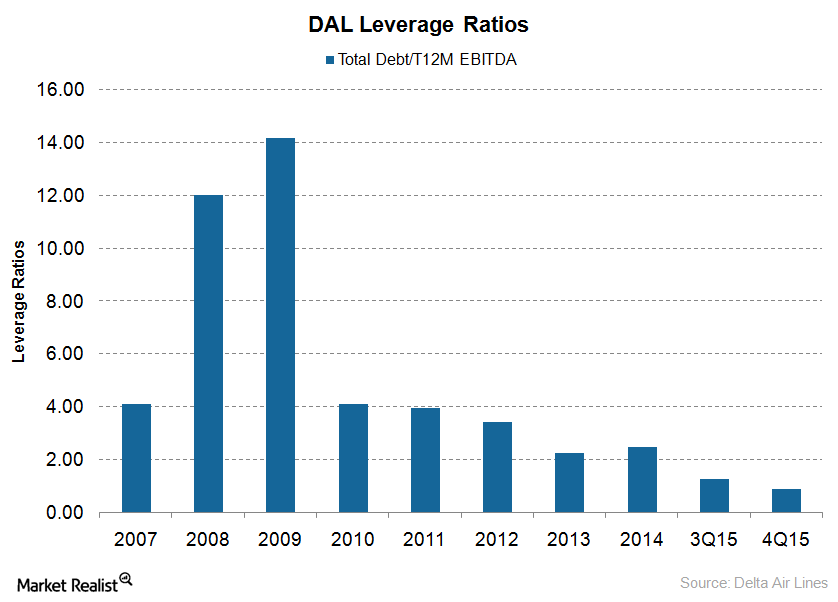

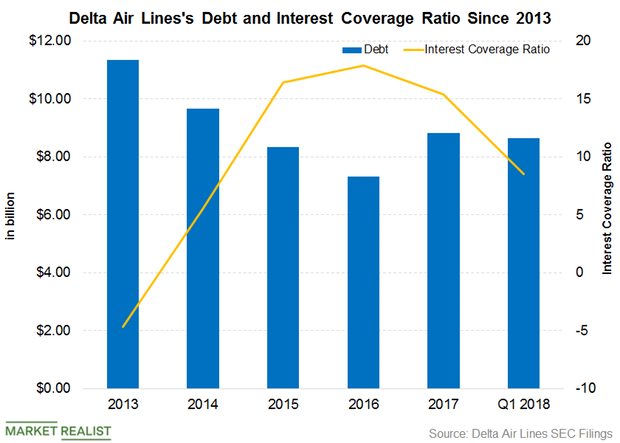

Can Delta Air Lines Continue to Reduce Its Debt in 2016?

Delta Air Lines (DAL) expects to generate more than $7 billion–$8 billion of operating cash flow and ~$4 billion–$5 billion of free cash flow. It plans to reduce its adjusted net debt to $4 billion by 2020.

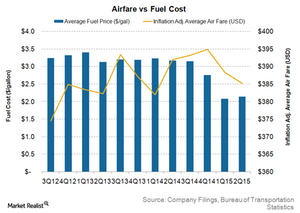

Will Airfares Continue to Decline in 2016?

According to a study by Expedia, airfares fell by about 5% in 2015. Despite this decline, passenger complaints are on the rise. Many consumer leaders also lobbied for airfare reductions.

McDonald’s Global Presence and the Three-Legged Stool

McDonald’s, the world’s largest fast food chain, has over 38,000 restaurants across 120 countries. In 2018, it had approximately $21.0 billion in sales.

Must-Know: McDonald’s Has Got Tough Competition

McDonald’s (MCD) competition includes large international and national food chains as well as regional and local retailers of food products.Consumer Key restaurant industry formats: The casual dining business

Contrary to fast food restaurants, casual dining restaurants have a relaxed and casual ambiance with a lot of seating. They offer full table service and may also have a wine menu or full bar service.

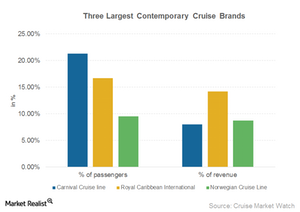

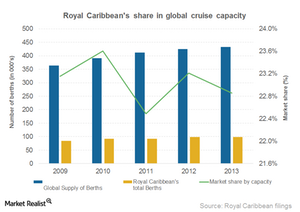

Royal Caribbean operates the world’s largest contemporary cruise brand

Royal Caribbean International is a global brand offered by Royal Caribbean (RCL). It’s one of the world’s three largest contemporary brands.

How McDonald’s Wages and Major Costs Stack Up

McDonald’s performance is sensitive to any changes in price levels—be it food, labor, or rent. So how much does it cost for McDonald’s to generate revenue?

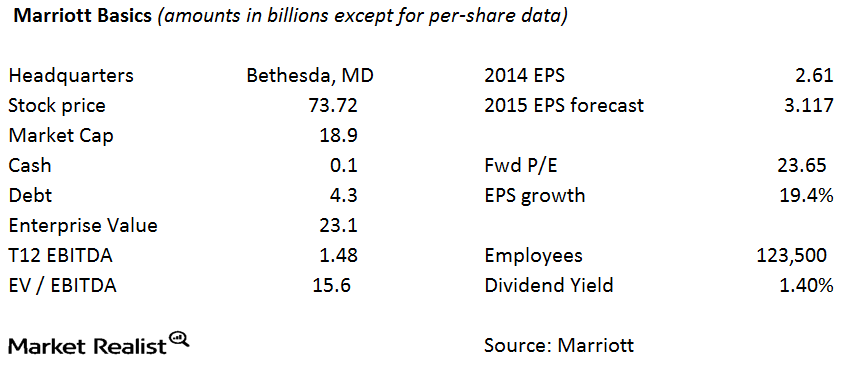

Rationale for the Starwood-Marriott Merger

With the Starwood-Marriott merger, the companies expect to generate at least $200 million in annual cost savings beginning in the second year after the deal closes.

Marketing contributes to Royal Caribbean’s growing customer base

Royal Caribbean (RCL) offers all cruise company services, including pre- and post-hotel stay arrangements and air transportation.

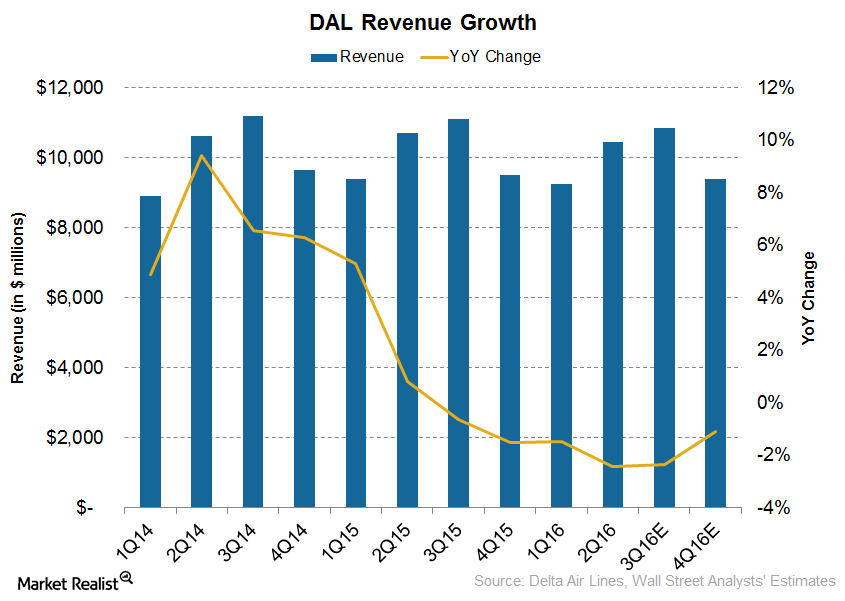

Why Is Delta Air Lines’s Revenue Expected to Fall in 2016?

Analysts are estimating an ~4.5% decline in Delta Air Lines’s (DAL) revenue to $10.6 billion for 3Q16.

McDonald’s Supply Chain: A Must-Know for Investors

With over 38,000 restaurants, McDonald’s doesn’t make any of its products. Instead, it contracts with suppliers to meet its massive requirements.

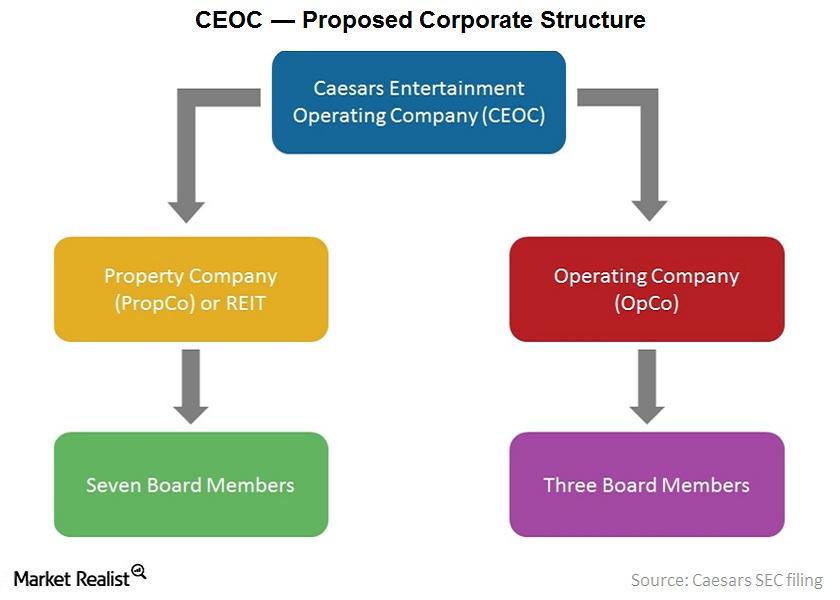

Caesars Entertainment’s New Corporate Structure and Governance

On December 22, 2014, CZR and Caesars Acquisition Company (CACQ) entered into a definitive agreement to merge in an all-stock transaction.

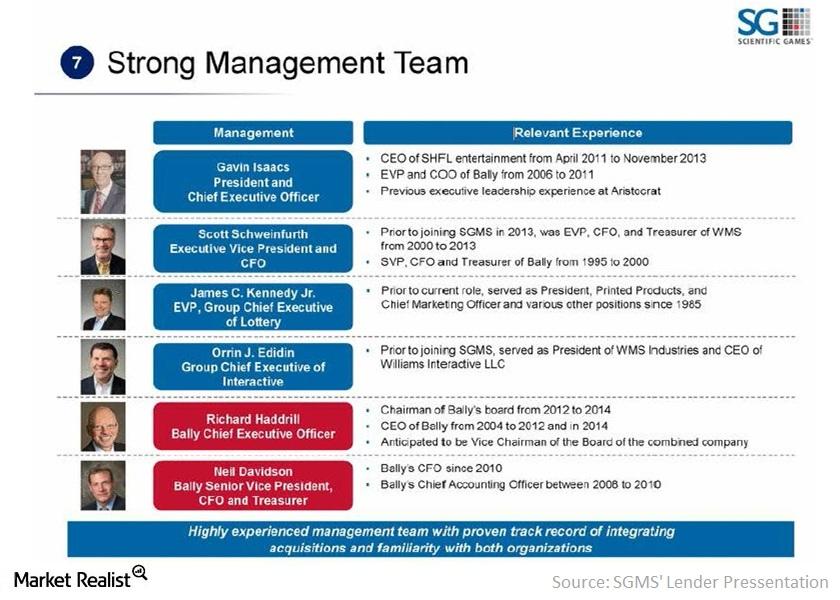

Consolidated Scientific Games: A Stronger Management Team

The executive management team of SGMS includes President and CEO Gavin Isaacs and Executive Vice President and CFO Scott Schweinfurth.

Why Noodles and Company has short and long-term goals

Noodles & Company (or NDLS) has a few initiatives and tactics to drive short-term traffic. It also drives longer-term brand and customer loyalty building.Consumer Why it’s important to understand Noodles and Co.

Noodles & Company (or NDLS) was founded in 1995. It’s a fast-casual restaurant chain that serves classic noodle and pasta dishes.

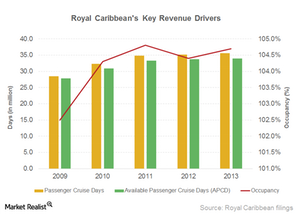

Key metrics to measure Royal Caribbean’s revenue performance

Now let’s look at certain key operating metrics used in the cruising industry to evaluate operational performance.

McDonald’s Menu Struggles to Shed Its Junk Food Rep

Despite health-related controversies, fast food companies such as McDonald’s maintain that they provide consumers with choice and convenience.

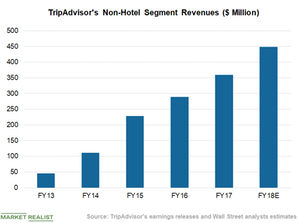

Non-Hotel Segment: TripAdvisor’s Key Revenue Growth Driver

For 2018, analysts expect TripAdvisor to report non-hotel revenues of $449 million—YoY (year-over-year) growth of ~25%.

Delta Air Lines: Is Higher Debt a Concern?

Delta Air Lines’ higher debt means a higher interest expense and a higher DE (debt-to-equity) ratio. Delta Air Lines’ current DE ratio is 0.69x.

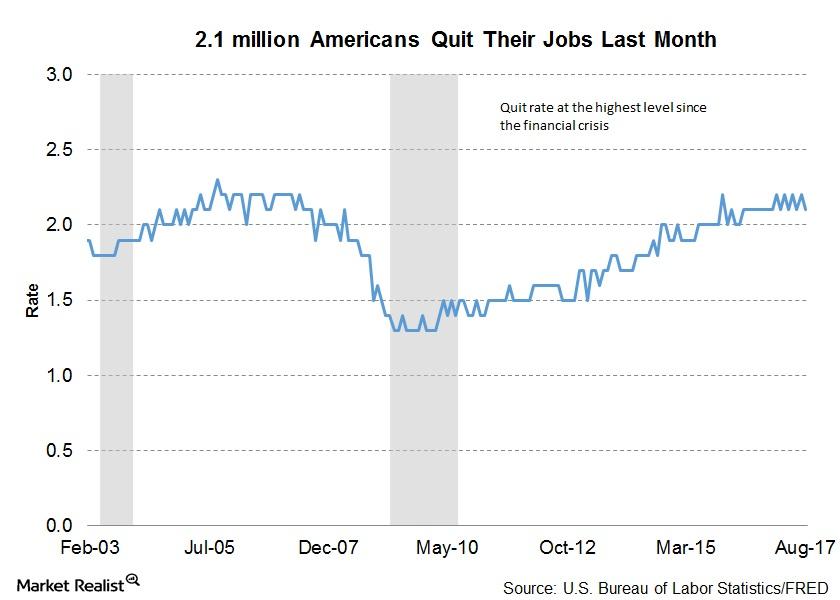

How Many Americans Quit Their Jobs in August?

As per the latest JOLTS report, about 2.1 million Americans quit their jobs voluntarily in August, which was a decrease of 70,000 from the previous reading.

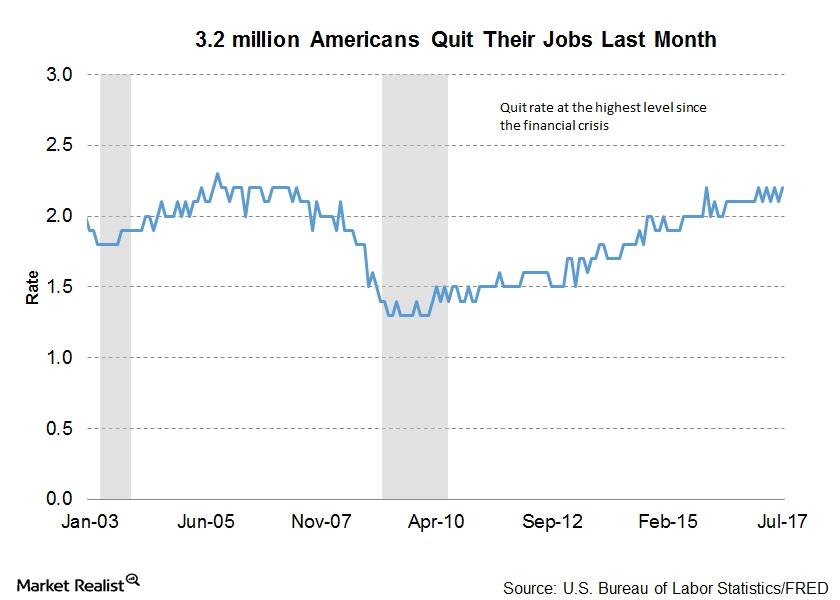

Why Are So Many Americans Quitting Their Jobs?

As per the latest JOLTS report, about 3.2 million Americans quit their jobs voluntarily last month. This is an increase of 0.1 million from the previous month.

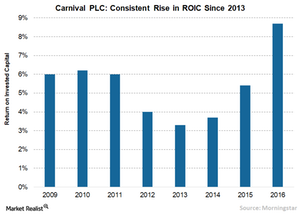

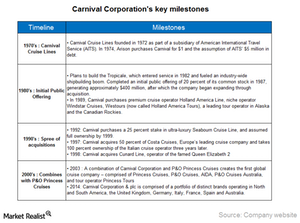

Carnival: Strong Brands Help Develop Market Niche

Carnival is among the most profitable and financially strong leisure travel companies in the world. It provides leisure travel to all major cruise destinations across the globe.

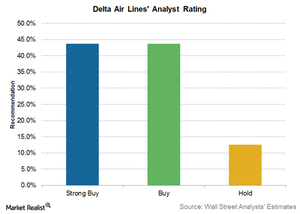

Analyst Ratings for Delta Air Lines after Traffic Release

Only one analyst has upgraded Delta Air Lines (DAL) since it released its traffic data on Friday, June 2, 2017.

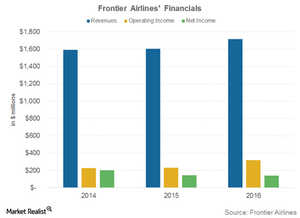

Frontier Airlines Cut Costs and Became Profitable

Frontier Airlines earned 42% of its revenue from ancillary fees or non-ticket revenue in 2016—a significant rise compared to 25% in 2015.

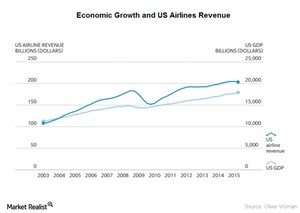

The Airline Industry’s Cyclical Nature Is a Mixed Blessing

The airline industry is cyclical, which means that its business depends on the country’s economic growth. Most analysts have revised their GDP estimates downward, resulting in a consensus estimate of 2.9% YoY growth.

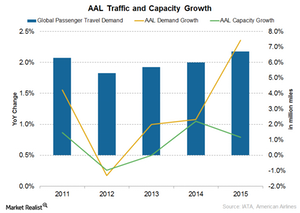

What Are American Airlines’ Major Revenue Drivers?

American Airlines’ (AAL) capacity growth is one of the slowest in the industry. However, it has the highest capacity among its peers.

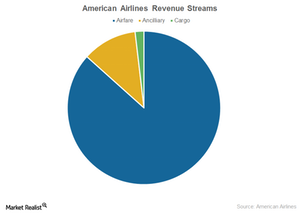

What Are American Airlines’ Key Revenue Streams?

In this part of the series, we’ll look at the main services and categories that add to American Airlines’ (AAL) revenues. The major component of revenues still comes from airfares.

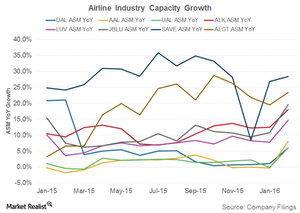

Is There Overcapacity in the Airline Industry?

In February 2016, the airline capacity of the eight major airlines exceeded their traffic growth by an average of 2%.

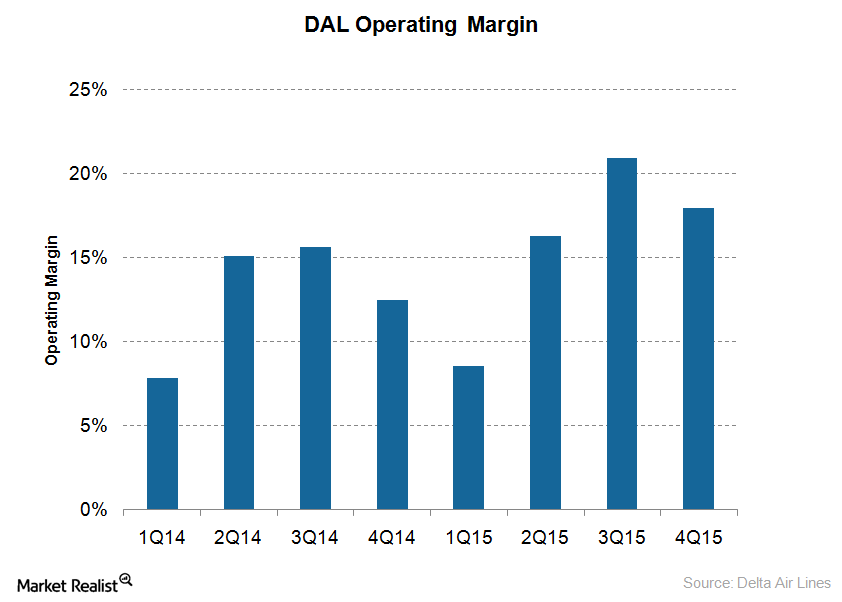

Can Delta Air Lines Continue to Reduce Its Costs in 2016?

For 1Q16, Delta Air Lines (DAL) expects to see its operating margins improve to 18%–20%, backed by solid cost savings and lower fuel prices.

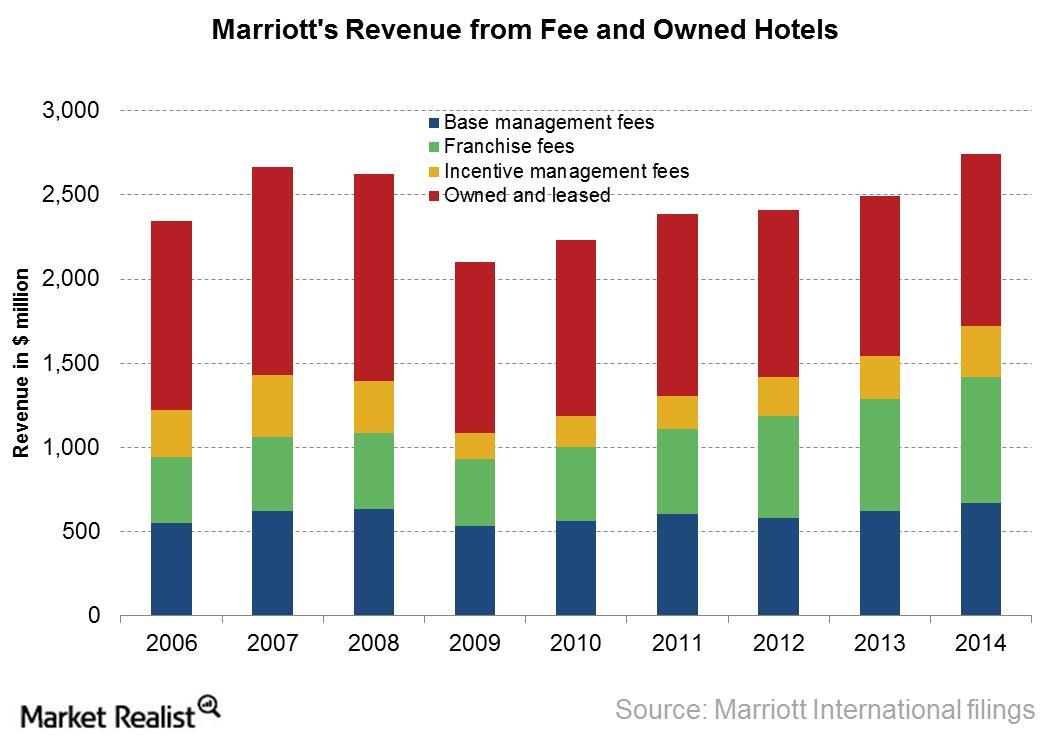

Why Marriott Relies Heavily on Its Franchise Model for Growth

Marriott now focuses on capital-light segments like franchised properties. Its fee incomes rose from $1.2 billion to $1.7 billion between 2006–2014.

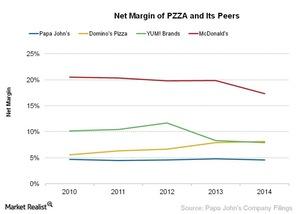

Comparing Papa John’s Net Margins with Other Quick-Service Big Guns

In 2014, Papa John’s net profits as a percentage of total sales decreased by 0.2% due to increases in interest levels.

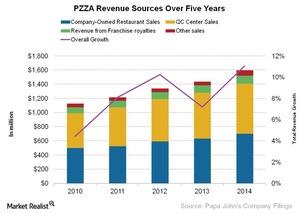

Papa John’s Franchising and Quality Centers—the Foremost Piece of Company Pie

To maintain the quality and consistency of products, Papa John’s has QC (quality control) centers that supply ingredients to its restaurants.

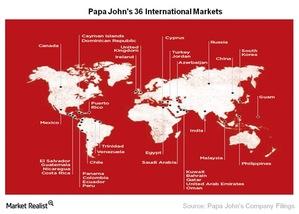

Sizing up the International Reach of Papa John’s Pizza

In 1998, Papa John’s decided to venture outside the US by opening outlets in Mexico and Puerto Rico. In 1999, it acquired the UK’s Perfect Pizza Holdings.

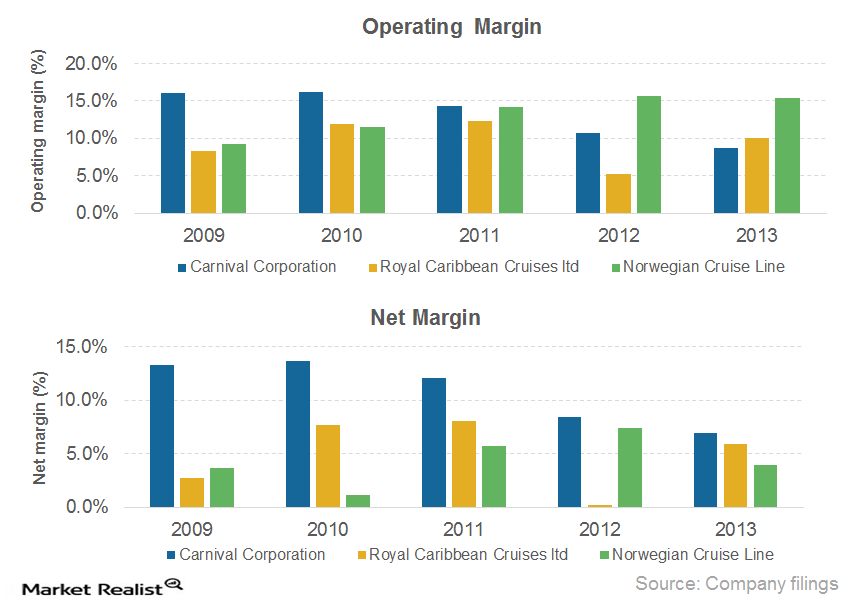

Comparing the major cruise lines’ operating and net margins

Among the three major competitors in the cruise industry, Royal Caribbean (RCL) had the highest operating margin in 2013.

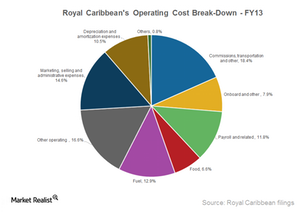

Breaking down Royal Caribbean’s operating costs

Costs directly related to operating a cruise ship comprise ~74% of Royal Caribbean’s (RCL) total operating costs.

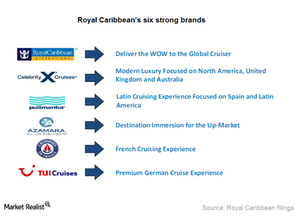

Royal Caribbean tailors brands for specific international markets

Apart from operating the largest contemporary global brand, Royal Caribbean offers five additional brands targeting specific markets.

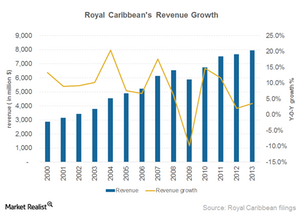

A closer look at Royal Caribbean’s revenue sources and growth

Royal Caribbean (RCL) derives revenue from two sources: passenger ticket revenue and onboard and other revenue.

Overview: Royal Caribbean Cruises, the 2nd largest cruise operator

Royal Caribbean Cruises, founded in 1968 and headquartered in Miami, Florida, is the world’s second largest cruise company.

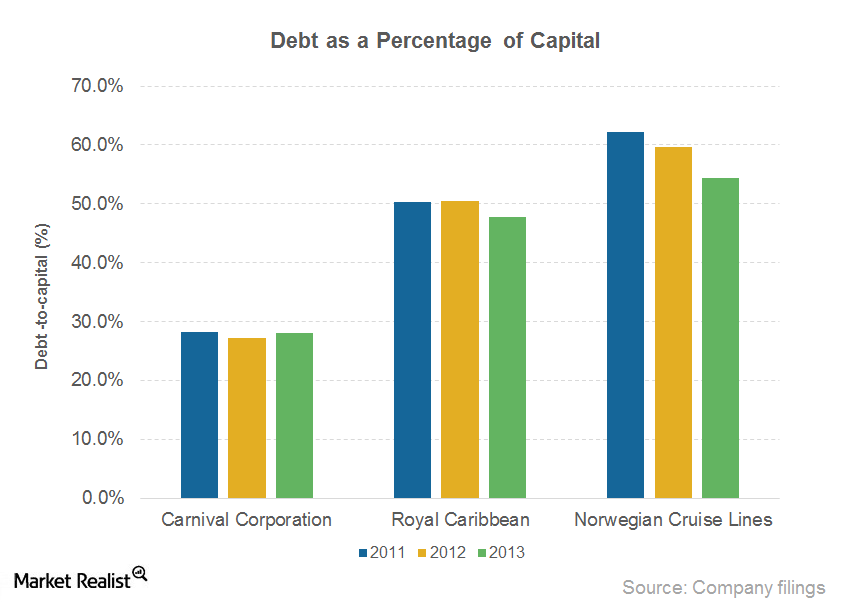

Carnival stays competitive with strong financial position

Carnival has a stronger financial position than its peers. It maintained a very low debt-to-capital ratio of 28% in 2013 and just 27% in 2014.

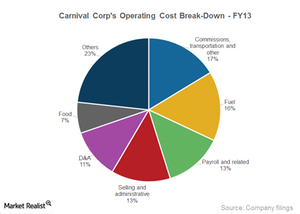

A key overview of Carnival’s costs and profitability

Carnival’s operating profit increased to $1,792 million in 2014, from $1,352 million in 2013. Its operating margin increased to 11.3%, from 8.7% in 2013.

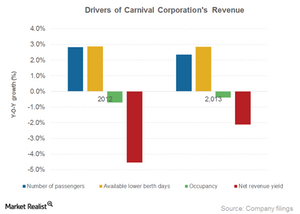

Key drivers of Carnival’s revenue growth

The growth of demand was the key driver of Carnival Corporation’s revenue growth in 2014. The number of passengers increased by 5% in 2014.

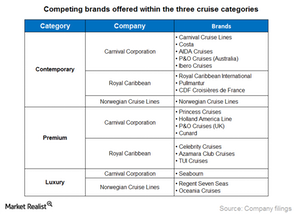

Carnival’s contemporary, premium, and luxury cruises

Cruise categories Cruise liners have been successfully providing a wide range of products and services at various price points to suit preferences of passengers from different age groups. Service levels and pricing differ by brand, category of the ship, cabins, season, duration, and itinerary. We can categorize cruise brands into these three categories: contemporary, premium, […]

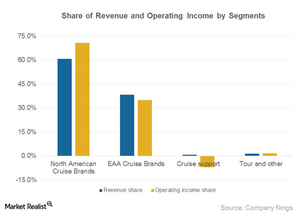

Two segments make up 98% of Carnival Corporation’s revenue

Two of Carnival Corporation’s (CCL) operating segments comprise almost 98% of the company’s revenue. Carnival also reports a Cruise Support segment and a Tour segment.

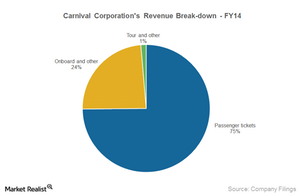

What are Carnival Corporation’s revenue sources?

Carnival Corporation (CCL) derives revenue from the following three sources: passenger tickets, onboard or other activities, and tours.

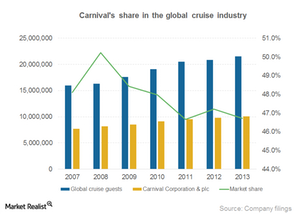

Carnival boasts largest market share of cruise passengers

The number of Carnival’s cruise passengers has increased at a six-year CAGR of 4.6%. It has the largest market share of cruise passengers at ~47%.

A key overview of Carnival, the world’s largest cruise company

Carnival Corporation (CCL), the largest cruise company in the world, operates 101 cruise ships and has a global market share of ~47%.Consumer Understanding Hilton’s operating cost

Hilton has operating expenses related to its owned and leased hotels and timeshare properties. This is separate from depreciation and amortization expenses.Consumer Key revenue drivers for the hotel industry

RevPAR is calculated by dividing hotel room revenue by the total available room nights. It’s used in the hotel industry to measure the company’s ability to generate greater revenue from each room.Consumer Must-know: Key metrics in McDonalds’ quarterly earnings

McDonald’s reported flat global comparable sales and negative comparable guest count for 2Q14, which is concerning from a long-term income growth perspective.Consumer Why marketing and advertising are so important for restaurants

Mainstream channels of marketing—like radio, TV, and print ads—are still common. But many restaurant chains have also used social media to increase their brand presence.